Wealthfront transforms your portfolio optimization and robo-advisors workflow. Discover how this AI tool simplifies finance and trading. Get started today!

Wish I Knew About Wealthfront Sooner

You’re in finance and trading.

You’re looking at portfolios.

You’re thinking about optimizing.

Maybe you’re even dipping your toes into robo-advisors.

It’s a lot, right?

Lots of data.

Lots of decisions.

Lots of potential headaches.

Everyone’s talking about AI now.

How it’s changing everything.

Especially in finance.

But where do you even start?

Is there something that actually helps?

Something that doesn’t just add more complexity?

Something real?

Yeah.

It’s called Wealthfront.

And if you’re dealing with portfolio optimization or robo-advisors, you need to hear this.

Seriously.

Let’s break it down.

Table of Contents

- What is Wealthfront?

- Key Features of Wealthfront for Portfolio Optimization and Robo-Advisors

- Benefits of Using Wealthfront for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Wealthfront?

- How to Make Money Using Wealthfront

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Wealthfront?

Alright, straight talk.

What is Wealthfront?

Think of it as an AI-powered financial platform.

It’s not just some random app.

It’s built to handle serious financial stuff.

Specifically, it’s massive for things like investing, saving, and yes, managing your money smartly.

When we talk about Finance and Trading, Wealthfront is a major player.

It automates a lot of the boring, time-consuming work.

Stuff that used to take hours or even days.

It’s a robo-advisor at its core, but it does way more than just pick ETFs.

Its main goal?

To make sophisticated financial strategies accessible.

Not just for the Wall Street guys.

For anyone who wants to grow their wealth intelligently.

It uses algorithms – smart ones – to manage your investments.

This includes balancing risk.

Maximizing returns based on your goals.

And doing it all automatically.

So, if you’re thinking about Portfolio Optimization and Robo-Advisors, Wealthfront is designed specifically for that.

It’s for individuals and businesses who need a reliable, automated way to handle their money and investments.

No need for a personal financial guru charging crazy fees.

Wealthfront steps in.

It’s your AI partner in finance.

Taking the heavy lifting off your plate.

Freeing you up to focus on other things.

Like making more money to invest.

See how it works?

It’s a tool built for efficiency and results in the finance game.

And it’s changing how people approach their financial future.

Fast.

Key Features of Wealthfront for Portfolio Optimization and Robo-Advisors

Alright, let’s get specific.

What can Wealthfront actually *do* for you?

Especially when we’re talking Portfolio Optimization and Robo-Advisors?

It’s got a few killer features.

- Automated Investing:

This is the core.

Wealthfront builds you a diversified portfolio.

Based on your risk tolerance.

And your financial goals.

It uses algorithms to select low-cost ETFs.

It’s hands-off once you set it up.

Massive time saver for anyone serious about investing but short on time.

This is pure robo-advisor power.

- Tax-Loss Harvesting:

Okay, this is huge.

Wealthfront automatically looks for opportunities to sell investments at a loss.

To offset taxable gains.

Or even ordinary income.

Then it reinvests the money in a highly correlated asset.

This is sophisticated tax strategy.

Done automatically.

Without you lifting a finger.

It boosts after-tax returns.

Big benefit for portfolio performance.

- Risk Parity:

This is a more advanced strategy.

Wealthfront uses it in some portfolios.

It aims to spread risk evenly across different asset classes.

Not just allocating based on capital.

But based on how much risk each asset contributes.

It’s designed for potentially better returns with lower risk.

Part of that “optimization” piece we keep mentioning.

Leveraging algorithms to make smarter allocation decisions.

- Smart Beta:

Wealthfront offers Smart Beta portfolios.

These aren’t just market cap weighted.

They aim to capture specific investment factors.

Like value, momentum, or low volatility.

It’s a step beyond basic index investing.

Trying to capture potential excess returns.

Again, algorithms doing the heavy lifting.

Part of how it optimizes portfolios beyond the standard model.

- Automatic Rebalancing:

Portfolios drift over time.

Asset classes perform differently.

Wealthfront keeps your portfolio aligned with your target allocation.

Automatically.

It buys and sells fractions of ETFs.

Keeps you on track.

Reduces risk creep.

Another crucial piece of portfolio management.

Done by the AI.

- Integrated Financial Planning:

It’s not just investing.

Wealthfront connects the dots.

It links external accounts.

Bank accounts, credit cards, loans.

Gives you a full financial picture.

Its Path tool helps you project your financial future.

Based on your saving and spending habits.

This helps with setting realistic investment goals.

Making the portfolio optimization relevant to your real life.

See?

These aren’t just fluffy features.

They’re tangible tools.

Solving real problems in portfolio management and automated advising.

Making it smarter.

More efficient.

And potentially more profitable.

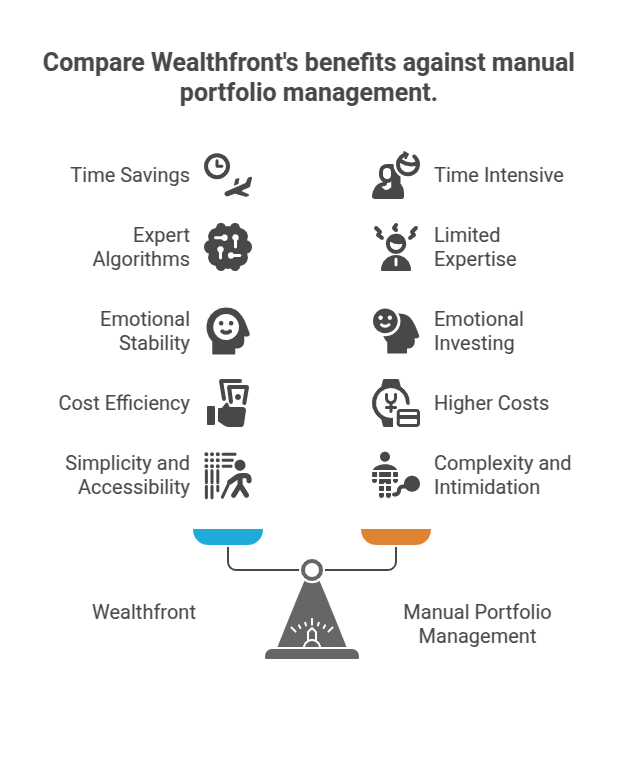

Benefits of Using Wealthfront for Finance and Trading

Okay, why bother?

What’s the payoff?

Using Wealthfront for Finance and Trading, especially for portfolio stuff, gives you some serious advantages.

First off: Time Savings.

Massive.

Building and managing a diversified portfolio manually?

Takes hours.

Researching ETFs, monitoring allocations, rebalancing, tax-loss harvesting…

It’s a second job.

Wealthfront automates pretty much all of it.

You set up your goals and risk tolerance.

The AI does the rest.

That’s time you can spend elsewhere.

On building your business.

On finding new opportunities.

Or just living your life.

Next: Quality Improvement.

Let’s be real.

Most people aren’t portfolio managers.

They don’t have deep expertise in asset allocation theory.

Or tax strategies for investing.

Wealthfront uses sophisticated algorithms.

Developed by experts.

Applying strategies that are proven to work over the long term.

Tax-loss harvesting alone can add significant value.

Often more than the fees you pay.

You get institutional-level portfolio management.

Without the institutional cost.

That’s better quality than most people can achieve on their own.

Also: Reduced Emotional Investing.

Markets go up.

Markets go down.

Humans react.

Often badly.

Panic selling during downturns.

Getting overly aggressive in bubbles.

The AI doesn’t have emotions.

It sticks to the plan.

It rebalances based on your target allocation, not market noise.

This disciplined approach is crucial for long-term success.

Helps you avoid costly mistakes driven by fear or greed.

Then there’s Cost Efficiency.

Compared to traditional financial advisors.

Who often charge 1% or more of assets under management.

Wealthfront’s fees are significantly lower.

We’ll cover pricing in a bit.

But the point is, you get professional management.

At a fraction of the cost.

Especially powerful as your portfolio grows.

Those fee savings compound over time.

Finally: Simplicity and Accessibility.

Financial planning and investing can feel intimidating.

Complex jargon.

Endless options.

Wealthfront simplifies it.

The interface is clean.

Setting up your account is straightforward.

The Path tool helps you visualize your future.

It makes sophisticated financial strategies accessible to everyone.

Not just finance pros.

Lowering the barrier to entry for smart financial management.

These benefits stack up.

They translate to better outcomes.

More peace of mind.

And a stronger financial position over time.

Pricing & Plans

Okay, let’s talk money.

How much does Wealthfront cost?

Is it going to break the bank?

The main deal with Wealthfront is a flat annual advisory fee.

It’s usually 0.25% of the assets they manage for you.

Pretty standard for robo-advisors.

And way lower than traditional financial advisors.

For example, if you have £100,000 invested.

That’s £250 per year.

Seems reasonable for automated management and tax optimization.

Are there other costs?

Yes, but they aren’t from Wealthfront directly.

You’ll pay the underlying expense ratios of the ETFs in your portfolio.

Wealthfront tends to use low-cost ETFs.

So these fees are usually very small.

Think maybe 0.05% to 0.15% range annually.

Add that to the 0.25% advisory fee.

Total cost is still very competitive.

Especially when you consider the tax-loss harvesting benefits.

Which can often *add* more than the fees cost.

Is there a minimum to open an investment account?

Yeah, it’s typically £500.

Pretty low barrier to entry.

What about other services?

Wealthfront also offers a high-yield cash account.

They call it their Cash Account.

No management fee for that.

Just earn interest on your savings.

They also have loans against your portfolio value.

Details and rates for that are separate.

Compared to alternatives?

Other robo-advisors like Betterment have similar fee structures.

Some might have slightly different minimums or premium tiers with human advisor access.

Wealthfront focuses heavily on the automated side.

Their AI and specific features like tax-loss harvesting on accounts over £500 are key differentiators.

Traditional brokers often have higher trading fees.

Or push their own mutual funds with higher expense ratios.

And again, financial advisors are way more expensive.

So, Wealthfront’s pricing is transparent.

Competitive.

And designed to be cost-effective for long-term investors.

It fits the model of using AI to reduce costs while maintaining quality.

Hands-On Experience / Use Cases

Okay, let’s talk about using Wealthfront.

What’s it like in practice?

Imagine this: You’re a busy professional.

Maybe you work in Finance and Trading already, but you don’t have time to manage your own portfolio.

Or you run a small business.

Or you’re just trying to get your personal finances sorted.

You sign up for Wealthfront.

The onboarding is smooth.

They ask you questions.

About your age.

Income.

Goals (like retirement, buying a house).

Risk tolerance.

They use this to build a recommended portfolio allocation.

Stocks, bonds, etc.

Mostly through diversified, low-cost ETFs.

This is where the AI and the Portfolio Optimization comes in immediately.

It’s not a generic portfolio.

It’s tailored based on your input.

Let’s say you have £50,000 to invest.

You link your bank account.

Transfer the funds.

Wealthfront takes it from there.

It buys the ETFs based on your selected portfolio.

Then, over time, it monitors everything.

Markets move.

Your asset allocation starts to drift.

The AI notices this.

It automatically rebalances your portfolio.

Selling some assets that have grown.

Buying others that have lagged.

Keeps you aligned with your target risk level.

Another scenario: Tax season.

Tax-loss harvesting is running in the background.

The AI identifies opportunities to sell assets at a loss.

Even fractions of shares.

It executes the trades.

Generates a tax report for you.

You get the tax benefit.

Without any manual tracking or complex calculations.

This is a massive win for efficiency.

A real-world example of the AI providing tangible value.

The Path tool is also a key part of the experience.

You link all your accounts.

Bank, credit card, mortgage, student loans, etc.

Wealthfront crunches the numbers.

Based on your income, spending, and investments.

It projects your financial future.

Can you retire by age 60?

Can you afford that house?

You can model different scenarios.

“What if I save an extra £500 a month?”

“What if the market returns are lower?”

It gives you data-driven insights.

Helps you make smarter decisions about your finances.

It ties your daily financial habits into your long-term investment plan.

Making the Portfolio Optimization part of a bigger picture.

The usability is high.

The results are clear.

It automates complex tasks.

Provides valuable insights.

Feels like having a super-smart financial assistant.

Who Should Use Wealthfront?

Alright, is Wealthfront for everyone?

Probably not *everyone*.

But it’s a great fit for a lot of people.

Who benefits most from Wealthfront, especially for that Portfolio Optimization and Robo-Advisors capability?

Busy Professionals: If you have a demanding job and limited free time.

You know you *should* be investing.

But the thought of managing it yourself feels overwhelming.

Wealthfront automates it.

Lets you focus on your career or business.

Your money works for you in the background.

People New to Investing: If you’re just starting out.

The investment world can feel like a minefield.

Wealthfront simplifies it.

Sets you up with a diversified, low-cost portfolio.

Teaches you the basics through its platform.

Provides a guided approach to building wealth.

Individuals Seeking Tax Efficiency: If you have taxable investment accounts.

Tax-loss harvesting can be a significant benefit.

Especially in volatile markets.

Wealthfront automates this complex strategy.

Helping boost your after-tax returns.

This is a killer feature for those focused on maximizing net gains.

Anyone Who Prefers Automated Management: If you like the idea of setting a plan and letting technology execute it.

You trust algorithms to make rational decisions.

Free from human emotion.

Wealthfront is built for exactly that.

It’s a hands-off approach to sophisticated investing.

People with Moderate to High Account Balances: While the minimum is low (£500).

The benefits, especially tax-loss harvesting, become more substantial with larger portfolios.

The 0.25% fee is very competitive as your assets grow.

For very small amounts, the impact of fees is minimal anyway.

But the relative value of the automated services increases with account size.

Finance and Trading Professionals (for personal use): Even if you work in the industry.

Managing your personal portfolio can be time-consuming.

Or emotionally challenging.

Using Wealthfront for your personal investments can be a smart move.

Leveraging the AI for efficiency.

Practicing what you preach with automated portfolio management.

Who might *not* be the best fit?

Active traders who want to pick individual stocks.

People who want a deep, personal relationship with a human advisor.

Those with extremely complex financial situations needing bespoke advice.

But for solid, automated, low-cost investing and financial planning, Wealthfront is a strong contender.

How to Make Money Using Wealthfront

Hold up.

Make money *using* Wealthfront?

Isn’t it for investing your *own* money?

Yes, primarily.

The main way you “make money” is through investment returns and tax savings.

The AI optimizes your portfolio to potentially grow over time.

And features like tax-loss harvesting put more money back in your pocket.

That’s the direct path.

But can you leverage Wealthfront in other ways related to making money, especially if you’re in the Finance and Trading space or provide financial services?

Yeah, indirectly.

- Efficiency Gains for Professionals:

If you’re a financial advisor or planner yourself.

Or you run a firm.

Understanding and potentially recommending robo-advisors like Wealthfront is key.

You can use it as a case study for clients.

Explain how AI can handle core portfolio management.

Freeing you up for higher-value services.

Like complex financial planning, estate planning, or tax strategy beyond investing.

Position yourself as someone who uses modern tools.

Shows you’re forward-thinking.

This can attract certain types of clients.

- Client Education and Content:

If you create content around finance (blog, YouTube, social media).

Wealthfront is a great topic.

You can review it.

Compare it to others.

Explain its features like tax-loss harvesting or Path.

Use it as an example of AI in finance.

This builds your authority.

Attracts an audience interested in modern finance tools.

Monetize this audience through ads, affiliate links (if available and appropriate), or by offering your own related services.

- Offering Complementary Services:

Wealthfront handles the automated investing piece.

But it doesn’t replace all financial advice.

You could position yourself as someone who helps clients set up their Wealthfront account.

Integrate it into their broader financial picture.

Advise on things Wealthfront *doesn’t* do.

Like insurance needs, advanced estate planning, business finance integration.

Become the human layer on top of the AI layer.

This allows you to serve clients who want both the efficiency of a robo-advisor and personalized advice.

Think of it less about Wealthfront *paying* you directly for these services.

And more about Wealthfront being a tool or a subject matter.

That you can use to build your own financial brand or service.

By being knowledgeable about leading Portfolio Optimization and Robo-Advisors platforms.

You demonstrate expertise.

Attract clients or an audience interested in modern finance.

And build your own revenue streams around that.

So, while you’re making money *with* your investments on Wealthfront.

You can also make money *around* Wealthfront.

By leveraging its existence and your knowledge of it.

Limitations and Considerations

Okay, let’s keep it real.

No tool is perfect.

Wealthfront is powerful, especially for Portfolio Optimization and Robo-Advisors.

But it has limits.

First limitation: Limited Customization.

Wealthfront offers curated portfolios.

Based on modern portfolio theory and their own strategies.

You can adjust your risk tolerance.

But you can’t pick individual stocks.

You can’t exclude specific industries (unless it’s a Socially Responsible Investing option).

If you’re a hands-on investor who wants complete control over every holding.

Or you have strong opinions about specific companies or sectors.

Wealthfront isn’t built for that.

It’s automated, not DIY stock picking.

Second: Lack of Human Financial Advisor.

Wealthfront is a robo-advisor.

Meaning the advice and management come from algorithms.

They have customer support.

And access to CFP professionals for specific questions if you have enough assets (usually £500k+).

But you don’t get a dedicated financial advisor.

Someone you build a long-term personal relationship with.

Who knows your entire family’s situation inside out.

For complex life events or truly bespoke financial planning needs.

A human advisor might be necessary.

Third: Algorithm Reliance.

The performance relies on the algorithms.

While they are sophisticated and based on sound financial principles.

Algorithms can’t predict black swan events.

Or react to unforeseen market conditions in novel ways like a human *might* attempt (though often with poor results).

You are trusting the code.

For most people, this is a good thing (less emotion).

But it’s a reliance on a programmed strategy.

Fourth: Fees for Managed Accounts.

While lower than traditional advisors, the 0.25% fee adds up over time.

Especially on large balances.

If you are a DIY investor willing to manage your own portfolio of low-cost ETFs on a zero-commission platform.

You could potentially invest for even lower costs.

However, you wouldn’t get the automated tax-loss harvesting or rebalancing.

You have to weigh the fee against the value of the automated services.

Fifth: Tax-Loss Harvesting Limitations.

This feature is amazing.

But it requires a taxable account.

It’s less relevant for accounts like ISAs or pensions where capital gains aren’t taxed annually.

Also, the wash-sale rule is complex, and while Wealthfront handles it, relying solely on automated tax strategies without understanding the basics isn’t ideal.

These aren’t dealbreakers for most users.

But it’s important to know what Wealthfront does and doesn’t do.

It’s a powerful tool for automated investment management and financial planning.

It’s not a bespoke, human-led comprehensive financial service.

Manage expectations.

Understand its strengths and weaknesses.

Final Thoughts

So, what’s the verdict on Wealthfront?

Especially for Portfolio Optimization and Robo-Advisors in the world of Finance and Trading?

Look, it’s a serious tool.

It’s not just hype.

It actually delivers on its promise of automated, intelligent investing.

If you’re someone who needs a smart, low-cost way to manage your investments.

You appreciate the power of algorithms for things like diversification, rebalancing, and tax efficiency.

And you don’t have the time or desire to manage everything manually.

Wealthfront is probably a really good fit.

It takes complex financial strategies.

Like tax-loss harvesting and risk parity.

And puts them on autopilot.

That’s valuable.

The Path tool helps you see the bigger picture.

Connect your investing to your real-life goals.

Is it perfect? No.

If you’re a stock-picking enthusiast.

Or need hand-holding from a personal advisor.

Look elsewhere.

But for the vast majority of people who just need a solid, reliable, and efficient way to grow their long-term wealth through investing.

Wealthfront is a strong contender.

It’s a smart choice.

It leverages AI where AI makes sense in finance.

Automating the repeatable, data-driven tasks.

Leaving you to focus on earning and saving.

My recommendation?

If you fit the profile – busy, looking for automated efficiency, value tax savings – check it out.

Do your own digging on their site.

See if their portfolios match your philosophy.

Run some scenarios with their tools.

It might just be the financial tool you’ve been missing.

The one that makes managing your money less of a chore.

And more of a confident path forward.

Visit the official Wealthfront website

Frequently Asked Questions

1. What is Wealthfront used for?

Wealthfront is primarily used for automated investment management, known as robo-advising. It builds and manages diversified portfolios based on your financial goals and risk tolerance, using algorithms for tasks like rebalancing and tax-loss harvesting. It also offers financial planning tools and cash management.

2. Is Wealthfront free?

No, Wealthfront is not free for investment management. They charge an annual advisory fee, typically 0.25% of the assets under management. There may also be underlying ETF fees. They do offer a Cash Account with no management fee.

3. How does Wealthfront compare to other AI tools?

Wealthfront is an AI-powered tool specifically for personal finance and investing, focusing on automated portfolio management and planning. Other AI tools might focus on generating content, analyzing data for businesses, or providing different types of financial analysis. Its AI is tailored for optimizing investment portfolios and automating related financial tasks.

4. Can beginners use Wealthfront?

Yes, Wealthfront is designed to be user-friendly for beginners. The onboarding process guides you through setting up goals and risk tolerance, and the platform automates the investing process. You don’t need prior investment knowledge to get started.

5. Does the content created by Wealthfront meet quality and optimization standards?

Wealthfront doesn’t “create content” in the sense of writing articles or marketing copy. It creates and manages investment portfolios. The quality and optimization standards apply to its financial strategies – aiming for diversified, low-cost, tax-efficient portfolios optimized for long-term growth based on your profile.

6. Can I make money with Wealthfront?

You make money with Wealthfront through the returns on your investments as the portfolio grows over time. The automated features like tax-loss harvesting are designed to help you keep more of those returns. You can also potentially leverage knowledge of Wealthfront to offer related services if you are a finance professional, but the platform itself doesn’t directly pay you for using it in that way.