Vena Solutions redefines financial reporting for Legal and Finance pros. Automate complex tasks, gain real-time insights, and make smarter decisions. See how it transforms your workflow!

Experts in Legal and Finance Are Quietly Using Vena Solutions

Ever feel like you’re stuck in the mud?

Drowning in spreadsheets and manual data entry?

That’s the reality for many folks in Legal and Finance.

You’re dealing with high stakes, tight deadlines, and absolutely zero room for error when it comes to Financial Reporting.

The old ways? They’re just not cutting it anymore.

The world’s moved on.

AI isn’t just a buzzword anymore. It’s a tool. A serious one.

It’s here to make your life easier, faster, and more accurate.

And if you’re not using it, you’re leaving money and time on the table.

Specifically, Vena Solutions.

It’s the quiet disruptor.

The secret weapon for those who want to win.

This isn’t some generic software.

It’s built for you.

For your specific challenges in financial reporting.

We’re going to pull back the curtain on how Vena Solutions is changing the game.

How it helps you ditch the busywork.

How it helps you get more done, with less stress.

And how it ultimately helps you make more money.

Ready? Let’s do this.

Table of Contents

- What is Vena Solutions?

- Key Features of Vena Solutions for Financial Reporting

- Benefits of Using Vena Solutions for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Vena Solutions?

- How to Make Money Using Vena Solutions

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Vena Solutions?

Let’s cut to the chase.

What exactly is Vena Solutions?

It’s not just another piece of software.

Think of it as your intelligent co-pilot for financial processes.

Vena Solutions is a comprehensive Corporate Performance Management (CPM) platform.

What does that mean for you?

It means it unifies your planning, budgeting, forecasting, and, crucially, your financial reporting.

All in one place.

No more jumping between disconnected systems.

No more manual data reconciliation that eats your day.

It’s built to bring order to chaos.

Its core function is to automate and streamline complex financial processes.

It takes the guesswork and the grind out of reporting.

The target audience?

Primarily finance and accounting professionals.

But it’s especially powerful for those working in Legal and Finance, where precision and compliance are non-negotiable.

It helps them achieve greater accuracy.

It helps them boost efficiency.

And it helps them gain deeper insights from their financial data.

Imagine having real-time data at your fingertips.

Imagine generating complex reports in minutes, not days.

That’s what Vena promises. And delivers.

It works by integrating directly with your existing systems.

Your ERP, CRM, HRIS – you name it.

It pulls all your data into a centralised hub.

Then, it uses intelligent automation to help you transform that raw data into actionable insights.

It’s like having a team of experts working 24/7 on your financial data.

Without the payroll.

It’s designed to eliminate errors that creep in with manual processes.

It enforces data governance.

It provides audit trails.

All critical for regulatory compliance in Legal and Finance.

Ultimately, Vena Solutions lets you move from reactive number-crunching to proactive strategic planning.

It gives you the data, the reports, and the clarity to make confident decisions.

That’s a game-changer.

Key Features of Vena Solutions for Financial Reporting

So, what makes Vena Solutions special for Financial Reporting?

It’s the features.

They’re not just bells and whistles.

They’re engineered to solve real problems.

- Automated Data Collection and Integration:

This is huge.

Manual data collection is a time sink.

It’s prone to human error.

Vena automates this.

It connects directly to your existing GL, ERP, and other systems.

It pulls financial data, operational data, and even non-financial data seamlessly.

This means you’re working with current, accurate numbers. Always.

No more waiting for someone to manually export a report.

No more worrying if the data is out of date.

It ensures consistency across all your reports.

This builds trust in your numbers.

It frees up your team from mundane tasks.

Letting them focus on analysis, not data entry.

That’s value.

- Flexible Reporting and Dashboarding:

You need reports that actually mean something.

Not just static PDFs.

Vena provides highly flexible reporting capabilities.

You can create custom reports for different stakeholders.

Whether it’s the board, investors, or internal departments.

It’s not just about standard financial statements.

Think management reports, variance analysis, cash flow forecasts, and compliance reports.

All tailored to your specific needs.

The dashboards are intuitive.

They give you a visual overview of key performance indicators (KPIs).

You can drill down into the details with a click.

This helps you spot trends.

It helps you identify issues quickly.

It helps you make data-driven decisions on the fly.

This level of insight is priceless.

- Audit Trails and Version Control:

For Legal and Finance, compliance is everything.

You need to know where every number came from.

Who touched it.

When they touched it.

Vena bakes this in.

It offers robust audit trails.

Every change, every entry, every approval is logged.

This creates an indisputable record.

It ensures accountability.

And it significantly simplifies internal and external audits.

No more scrambling to piece together information.

Version control is also critical.

You can track different iterations of reports, budgets, and forecasts.

This means you never lose work.

You can compare versions side-by-side.

Understand how plans evolved.

This level of transparency and control builds confidence.

It reduces risk.

It means you can stand by your numbers, every single time.

Benefits of Using Vena Solutions for Legal and Finance

Okay, so what’s the real payoff?

Beyond the fancy features, how does Vena Solutions actually change your day-to-day?

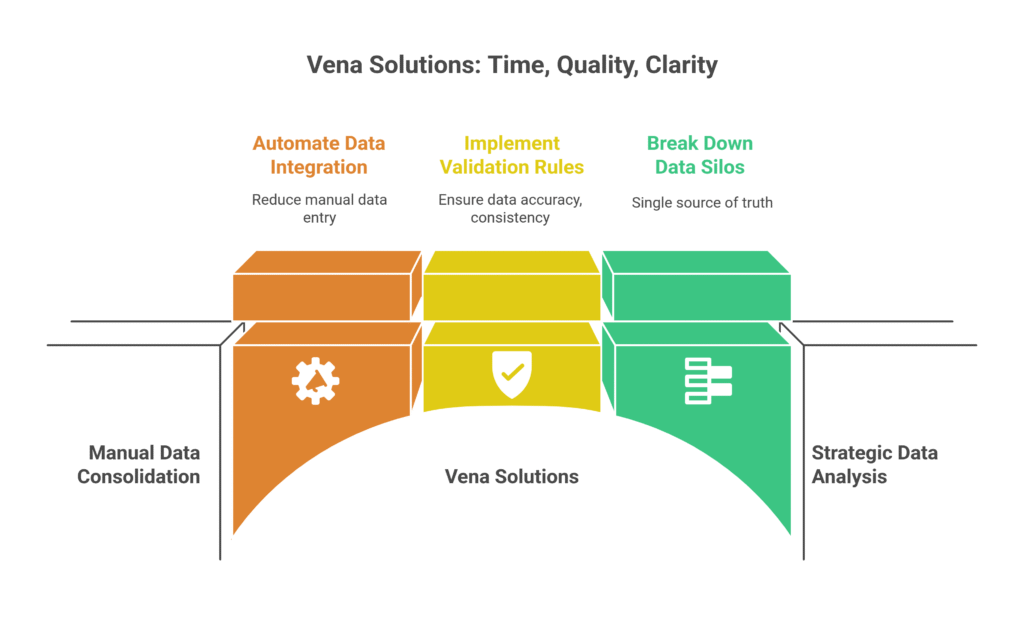

It comes down to three things: time, quality, and clarity.

First, massive time savings.

Think about the hours you currently spend on manual data consolidation.

On chasing down numbers from different departments.

On formatting spreadsheets.

Vena automates most of that.

This frees up your most valuable resource: your people.

They can shift from being data janitors to strategic analysts.

Imagine closing your books faster.

Imagine generating weekly or even daily reports, not just monthly.

This isn’t about working harder; it’s about working smarter.

Second, unparalleled quality improvement.

Manual processes are riddled with errors. It’s human nature.

One wrong cell reference. One misplaced digit. And your entire report is flawed.

Vena minimises these risks.

Its automated data integration reduces the chances of errors.

The built-in validation rules ensure data integrity.

This means your financial reports are accurate.

They’re consistent.

They’re reliable.

For Legal and Finance, this is critical for compliance and trust.

Poor data quality leads to poor decisions.

Vena ensures you’re making decisions based on solid ground.

Third, overcoming information silos and gaining clarity.

Many organisations operate with information trapped in different departments.

Finance has its data. Legal has theirs. Operations have another set.

Vena breaks down these silos.

It provides a single source of truth for all your financial data.

This means everyone is working from the same accurate numbers.

It fosters better collaboration across departments.

When you have a consolidated view, you see the bigger picture.

You can identify trends.

You can assess risks more effectively.

You can pinpoint areas for growth or cost reduction.

This clarity empowers you to make strategic decisions with confidence.

It’s not just about reporting what happened.

It’s about understanding why it happened, and what you can do about it.

That’s a competitive advantage.

It means you’re not just reporting history; you’re shaping the future.

Pricing & Plans

Alright, let’s talk numbers.

How much does Vena Solutions cost?

And is it worth it?

Unlike many consumer AI tools, Vena Solutions doesn’t typically publish its pricing online.

Why? Because it’s not a one-size-fits-all product.

Vena is an enterprise-level Corporate Performance Management (CPM) platform.

Its pricing is highly customised.

It depends on several factors:

The size of your organisation.

The complexity of your financial reporting needs.

The number of users who will access the system.

The specific modules and features you require (e.g., budgeting, forecasting, compliance, integration with specific ERPs).

So, there’s no free plan in the traditional sense like you might find with a simple word generator.

However, Vena typically offers detailed demonstrations and tailored proposals.

This lets you see the platform in action.

You can discuss your specific challenges.

And they can then provide an accurate quote based on your unique requirements.

What does the premium version include?

The full Vena platform is the “premium version.”

It includes the core financial reporting capabilities we discussed.

Plus modules for budgeting, planning, forecasting, financial close, and operational planning.

It also comes with robust security features, extensive audit trails, and dedicated customer support.

Comparison with alternatives?

Vena competes with other leading CPM solutions like Anaplan, Workday Adaptive Planning, and OneStream.

Each has its strengths.

Vena’s key differentiators often include its native integration with Excel.

This is a huge benefit for finance professionals.

They already know Excel inside out.

It reduces the learning curve significantly.

It makes the transition smoother.

It also offers deep industry-specific solutions.

Especially for Legal and Finance, which can be critical for compliance and reporting nuances.

While the upfront investment might seem significant compared to basic software, the ROI comes from efficiency gains.

It comes from reduced errors.

It comes from better decision-making.

It’s an investment in your financial future.

Not just another expense.

It’s about scaling your operations without scaling your headcount.

It’s about moving faster, with more precision.

That’s hard to put a price on.

Hands-On Experience / Use Cases

Let’s get real.

What does Vena Solutions look like when you actually use it?

Imagine a financial controller, Sarah, at a mid-sized law firm.

Before Vena, her life was a spreadsheet nightmare.

Month-end close took five grueling days.

Pulling data from the practice management system.

From the HR system.

From the general ledger.

Then manually consolidating everything in Excel.

Reconciling discrepancies.

Creating different versions of reports for partners, for bank covenants, for tax filings.

One small error could snowball into hours of rework.

Stress levels were through the roof.

Enter Vena Solutions.

The usability is surprisingly good.

Because Vena leverages the familiar Excel interface, Sarah’s team didn’t have a steep learning curve.

They were already Excel wizards.

Vena just supercharged their existing skills.

Now, here’s how it changed things:

Use Case 1: Automating Monthly Financial Reporting

Instead of manual exports, Vena integrates directly with the firm’s accounting software.

At month-end, Sarah simply logs into Vena.

The system automatically pulls the latest trial balance, revenue figures, and expense data.

She has pre-built templates for her income statement, balance sheet, and cash flow statement.

These templates automatically populate with the fresh data.

Variance analysis reports? Done in minutes.

She can drill down from a high-level summary to the underlying transaction details with a click.

No more hunting for source documents.

Result: Month-end close went from five days to one and a half.

Accuracy shot up.

The firm now has real-time insights into their financial health, not just historical data.

Use Case 2: Preparing for Compliance Audits

Legal and Finance means constant audits.

Before, preparing for an audit was a monumental task.

Gathering documents.

Proving data lineage.

With Vena’s built-in audit trails, this is simplified.

Every data point, every adjustment, every user action is logged.

Auditors can see the full history of any number.

From its source system entry to its appearance in the final report.

Result: Audit preparation time reduced by 60%.

The audit process became smoother, less stressful, and the firm demonstrated impeccable data governance.

Sarah reported a huge reduction in stress.

More time for strategic planning.

Less time for grunt work.

That’s the kind of practical impact Vena delivers.

Who Should Use Vena Solutions?

Okay, so it’s powerful. But is it for everyone?

No. Not really.

Vena Solutions is not for your solo blogger writing articles.

It’s not for a small startup with two employees and a simple spreadsheet.

Vena is a serious tool for serious financial operations.

Here’s the ideal user profile:

Mid-sized to Large Enterprises: If your company has complex financial reporting requirements.

If you have multiple departments, business units, or legal entities.

If you’re struggling with manual consolidation.

Vena is built for this scale.

It shines when it brings together data from disparate sources.

Finance Teams in Growing Companies: Are you outgrowing your current spreadsheet-based processes?

Are your current systems buckling under the weight of increased data and reporting demands?

Vena provides the scalability you need.

It helps you grow without adding proportional headcount to your finance team.

Organisations with Strict Compliance Needs (especially Legal and Finance):

Law firms, financial services institutions, real estate investment trusts, insurance companies.

Any business where regulatory compliance, audit trails, and data accuracy are paramount.

Vena’s robust governance features are a lifesaver here.

It helps you meet standards like SOX, GAAP, IFRS, and internal controls.

Companies Seeking Enhanced Business Intelligence:

If you’re tired of looking backwards.

If you want to understand *why* numbers are what they are.

If you want to forecast with greater accuracy.

Vena’s analytics and dashboarding capabilities provide this foresight.

It helps decision-makers.

Businesses Frustrated with Disconnected Systems:

Are your ERP, CRM, payroll, and other systems not talking to each other?

Leading to endless manual reconciliation?

Vena acts as a central hub.

It integrates and harmonises data.

Creating a single, unified version of financial truth.

In short, if you’re still wrestling with spreadsheets for complex financial reporting, budgeting, and planning, and you’re looking to scale, improve accuracy, and gain serious insights, Vena Solutions is likely for you.

It’s for those who want to move beyond just reporting numbers to truly understanding and influencing them.

How to Make Money Using Vena Solutions

This is the part everyone cares about.

How does Vena Solutions put more money in your pocket?

It’s not direct, like selling a product.

It’s about efficiency, accuracy, and strategic advantage.

Which all translate to profit.

- Service 1: Streamline Client Financial Reporting (for Consultancy Firms):

If you run a financial consultancy or accounting firm that serves multiple clients, Vena is a goldmine.

You can leverage Vena to offer premium financial reporting services.

Instead of spending hours manually compiling reports for each client, you set up their data integration within Vena.

Then, you automate the generation of their monthly, quarterly, and annual reports.

This means you can onboard more clients without increasing your team size proportionally.

You deliver faster, more accurate reports.

This builds client trust and allows you to command higher fees for your enhanced service.

Your efficiency gains become your profit margin.

- Service 2: Optimise Internal Financial Operations (for Businesses):

For businesses using Vena internally, the money-making comes from cost savings and better decisions.

Think about the reduction in audit fees.

When your data is clean, traceable, and accurate in Vena, your audits go smoother and faster.

This directly saves you money on professional services.

Then there’s the opportunity cost of bad decisions.

With Vena’s real-time dashboards and forecasting, you make smarter investment choices.

You identify unprofitable segments faster.

You can react quicker to market changes.

This translates into avoiding losses and seizing opportunities, directly boosting your bottom line.

For instance, a real estate firm used Vena to quickly identify underperforming properties across their portfolio.

This led them to divest assets proactively, avoiding significant future losses.

They literally made money by avoiding losing it.

- Service 3: Enhanced Valuation and Due Diligence for M&A (for Legal & Finance):

In the world of mergers and acquisitions, time is money.

And accuracy is king.

Legal and Finance teams involved in M&A can use Vena to dramatically speed up due diligence.

By integrating target company financials into Vena, you can quickly standardise, analyse, and model their performance.

This allows for faster, more reliable valuations.

It helps you spot red flags or hidden opportunities early on.

Being able to close deals faster or identify deal breakers quicker means better resource allocation.

It means avoiding costly mistakes.

And ultimately, it means more successful transactions.

A private equity firm used Vena to analyse acquisition targets.

They cut their due diligence period by 30%.

This enabled them to outmaneuver competitors and secure more lucrative deals.

That’s direct revenue generation from efficiency.

How a Financial Analyst, Mark, Boosted His Career and Income with Vena Solutions:

Mark was a financial analyst for a major legal practice.

He was drowning in manual consolidation work.

After implementing Vena, he became the internal expert.

He used its capabilities to build advanced forecasting models.

He created dynamic dashboards for the partners.

These tools provided insights they never had before.

The firm started making data-driven decisions that led to increased profitability.

Mark’s efficiency and strategic contributions led to a rapid promotion to Senior Financial Manager.

And a significant salary increase.

He didn’t just save the company money; he became indispensable, increasing his own value.

Limitations and Considerations

Nothing is perfect.

Vena Solutions is powerful, but it’s important to go in with eyes wide open.

There are a few things to consider.

First, implementation time and effort.

Vena isn’t an off-the-shelf app you download and use in an hour.

It’s an enterprise-grade system.

Implementing it requires planning, data migration, and configuration.

This can take weeks, or even months, depending on your organisation’s size and complexity.

You’ll need dedicated resources.

You’ll need involvement from IT and finance teams.

It’s a project, not a quick fix.

Second, the learning curve for advanced features.

While the Excel interface makes it familiar for finance professionals, mastering all of Vena’s capabilities takes time.

Building complex models, custom reports, and integrating niche data sources will require training.

And ongoing learning.

It’s not a tool you “set and forget.”

You need someone internally who can champion its use and really dig into its depths.

Third, cost of ownership.

As discussed, Vena isn’t cheap.

Beyond the initial licence fee, there are ongoing subscription costs.

There might be professional services fees for implementation and customisation.

And potential costs for additional training.

You need to be sure the ROI justifies the investment.

For smaller businesses, these costs might simply be prohibitive.

Fourth, data cleanliness is still key.

Vena can automate data collection.

It can validate some data.

But it won’t magically fix fundamentally messy or inconsistent source data.

“Garbage in, garbage out” still applies.

You need robust data governance in your source systems (ERP, CRM, etc.) for Vena to deliver its full potential.

It’s not a substitute for good data hygiene.

It amplifies it.

Finally, reliance on external support for complex issues.

While Vena has good support, highly complex or bespoke integrations might require bringing in Vena’s professional services.

Or a certified partner.

This is common with enterprise software.

But it’s a consideration for budgeting and project planning.

These aren’t deal-breakers.

But they are points to consider before you jump in.

Know what you’re getting into.

Plan for it.

And you’ll maximise your chances of success.

Final Thoughts

Here’s the deal.

If you’re in Legal and Finance, especially dealing with Financial Reporting, you know the grind.

The spreadsheets.

The endless reconciliation.

The nagging fear of an error.

Vena Solutions is built to kill that grind.

It’s not just an AI tool; it’s a strategic asset.

It bridges the gap between your raw data and actionable intelligence.

The value isn’t just in automating tasks.

It’s in the increased accuracy.

It’s in the real-time insights.

It’s in the ability to make confident decisions, faster.

It lets your finance team shift from data entry to strategic analysis.

That’s a move up the value chain.

It’s an investment, yes. A significant one for many.

But the ROI comes from reduced operational costs, avoided risks, and better business outcomes.

My recommendation?

If your organisation is grappling with complex financial reporting.

If you’re spending too much time on manual processes.

If you need better data governance and audit trails.

And you’re ready to embrace a more intelligent way of working.

Then Vena Solutions is absolutely worth exploring.

It’s not just about staying competitive.

It’s about pulling ahead.

It’s about building a finance function that’s proactive, precise, and powerful.

So, what’s your next step?

Go check it out.

See if it fits your specific needs.

Visit the official Vena Solutions website

Frequently Asked Questions

1. What is Vena Solutions used for?

Vena Solutions is used for Corporate Performance Management (CPM).

This includes automating and streamlining processes like financial reporting, budgeting, planning, forecasting, and financial close for businesses of all sizes.

It’s particularly strong in industries with complex data needs.

2. Is Vena Solutions free?

No, Vena Solutions is not free.

It is an enterprise-level software platform.

Pricing is customised based on organisation size, features required, and number of users.

You’ll need to contact them for a tailored quote.

3. How does Vena Solutions compare to other AI tools?

Vena Solutions differs from many consumer-grade AI tools because it’s a comprehensive, industry-specific platform.

It focuses on integrating and automating complex financial processes, leveraging AI and automation for data collection, validation, and reporting.

It competes with other CPM software like Anaplan and Workday Adaptive Planning.

4. Can beginners use Vena Solutions?

While Vena has a user-friendly interface, especially with its Excel integration, it’s designed for finance professionals.

Beginners to financial reporting concepts might find it complex initially.

However, for those with a finance background, the learning curve is manageable due to its familiar environment.

5. Does the content created by Vena Solutions meet quality and optimization standards?

Yes, Vena Solutions helps generate high-quality, accurate financial reports.

It ensures data integrity and consistency.

The optimisation comes from its ability to present complex data clearly, provide detailed audit trails, and support compliance.

It’s not about creating “content” in the marketing sense, but reliable, auditable financial statements.

6. Can I make money with Vena Solutions?

You can make money with Vena Solutions indirectly.

It boosts efficiency, reduces errors, and enables better strategic decisions.

This leads to cost savings, increased profitability, and faster deal closures.

Consultancy firms can also leverage Vena to offer premium, efficient financial reporting services to their clients.