Planful revolutionises Financial Reporting in Legal and Finance. Gain unparalleled accuracy and speed, transforming your workflow with AI. Ready to upgrade?

Planful Simplifies Even Complex Financial Reporting

Let’s talk about a problem.

You’re in Legal and Finance.

Your job involves numbers. Big numbers. Important numbers.

Specifically, financial reporting.

And if you’re like most, it’s a grind.

Manual data entry. Spreadsheet hell. Version control nightmares.

It’s slow. It’s error-prone. It eats up your valuable time.

Time you could be spending on actual strategic work.

Making money. Not just counting it.

AI is everywhere now. It’s changing everything.

And it’s finally coming for your financial reporting woes.

Enter Planful.

This isn’t just another tool. This is a weapon.

A weapon against inefficiency, inaccuracy, and wasted hours.

It’s designed to make your life easier, your reports better, and your results bigger.

If you’re still wrestling with spreadsheets for your financial reporting, you’re losing.

You’re leaving money on the table. You’re letting stress win.

It’s time to stop.

Let’s look at how Planful changes the game.

Table of Contents

- What is Planful?

- Key Features of Planful for Financial Reporting

- Benefits of Using Planful for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Planful?

- How to Make Money Using Planful

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

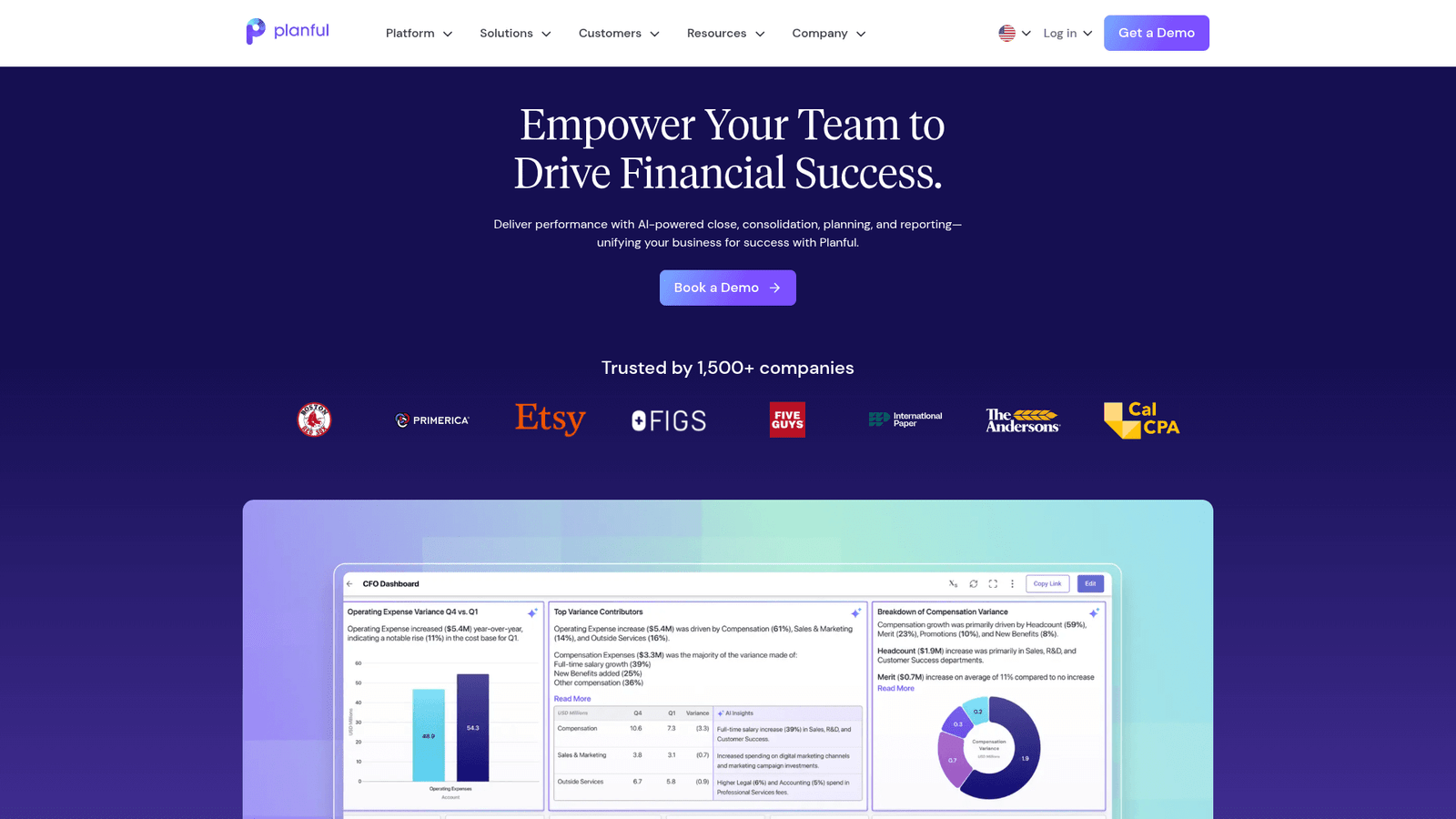

What is Planful?

Okay, so what exactly is Planful? Forget the marketing speak for a second.

Think of it as your new best mate in the world of corporate performance management (CPM).

It’s an AI-powered platform that takes the headache out of a whole bunch of finance tasks.

Budgeting. Forecasting. Consolidation. And, crucially for us, financial reporting.

It’s not just a fancy spreadsheet. It’s a complete system designed to bring all your financial data into one place.

No more hunting for files. No more emailing spreadsheets back and forth.

Its core function? To give you speed and accuracy.

It helps you make sense of complex financial information, fast.

It’s built for finance professionals who are tired of the old way of doing things.

If your current process involves more manual input than automated insight, Planful is for you.

It lets you spend less time gathering data and more time acting on it.

The target audience? Anyone from mid-market companies to large enterprises.

Specifically, finance teams, CFOs, controllers, and business analysts.

It centralises your data. It automates your processes. It gives you clear, actionable insights.

It’s about control. It’s about clarity. It’s about getting back your time.

Think of it as removing the friction from your financial operations.

It takes scattered data and turns it into a unified story.

That story? It’s your business’s financial health.

And with Planful, you get to write it with confidence.

Key Features of Planful for Financial Reporting

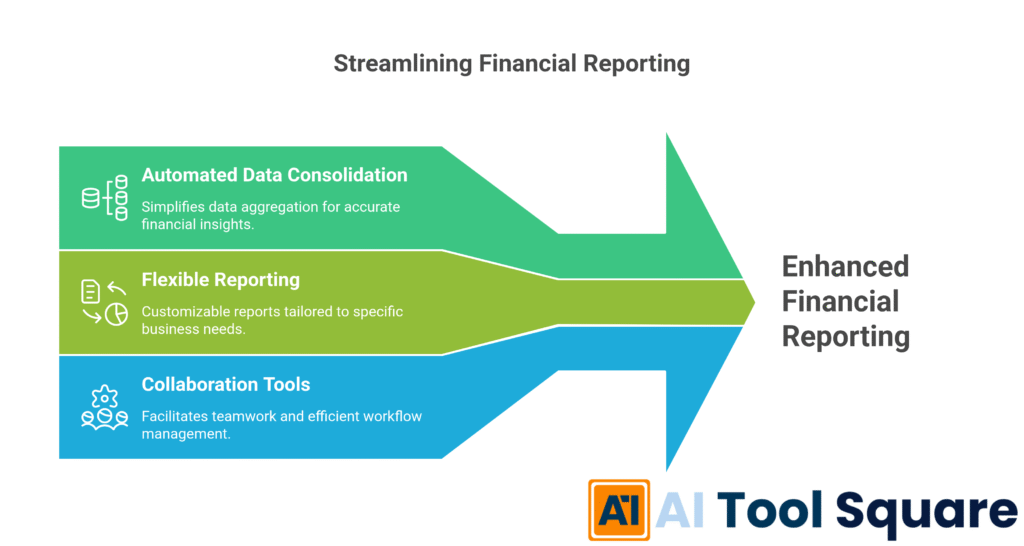

- Automated Data Consolidation:

This is a big one.

Remember pulling data from five different systems, then trying to stitch it all together in Excel?

Planful kills that pain. It automatically pulls data from your GL, ERP, HR systems, and more.

It’s like having a super-smart assistant who goes and fetches all the info for you.

Then, it cleans it up and organises it.

This means your financial reporting starts with a single source of truth.

No more discrepancies. No more “which version is correct?” arguments.

Just accurate data, ready for analysis, ready for reporting.

It cuts down hours, even days, of manual work.

That’s real time back in your pocket.

- Flexible Reporting and Analytics:

Once your data is in, what do you do with it?

Planful gives you incredible power here.

It’s not just about standard reports. You can build custom reports for almost anything.

Think P&L statements, balance sheets, cash flow statements.

But also, highly specific reports for your business – by department, by project, by region.

You can slice and dice data in ways that would make your old spreadsheets weep.

Dashboards? Visualisations? All there.

It means you don’t just see numbers; you understand the story behind them.

You can identify trends, spot anomalies, and drill down into details instantly.

This leads to faster, more informed decision-making.

- Collaboration and Workflow Management:

Financial reporting is rarely a solo act.

It involves multiple stakeholders. Different departments. Different approvals.

Planful is built for teams. It has features that let multiple users work on the same report.

You can set up workflows, assign tasks, and track progress.

No more confusing email chains or endless meetings to coordinate.

Everyone sees the latest version. Everyone knows their responsibilities.

It brings clarity and accountability to the entire reporting cycle.

This means faster closes, fewer bottlenecks, and a smoother process overall.

Your team works together, not in silos, to get those critical reports out the door.

Benefits of Using Planful for Legal and Finance

Alright, so you get the features. But what does it actually *do* for you?

Specifically, for someone in Legal and Finance, what’s the payoff?

First, time savings. This is massive.

Think about the hours you currently spend on data collection, validation, and report generation.

Planful slashes that. By automating consolidation and report creation, you’re not just saving minutes, you’re saving days.

This frees you up for higher-value work. Strategic analysis. Business partnering.

Instead of being a data monkey, you become a strategic advisor.

Next, unparalleled accuracy.

Manual processes are riddled with human error. Typos, formula mistakes, forgotten updates.

Planful minimises these. With a single source of truth and automated calculations, your numbers are reliable.

This means more trustworthy reports. More confident decisions. Less risk.

It improves the quality of your entire financial reporting output.

You’ll sleep better knowing your figures are spot on.

Then there’s speed and agility.

In today’s fast-paced world, waiting weeks for a report is a death sentence.

Planful lets you generate reports quickly. Need to reforecast based on new data? No problem.

Want to see the impact of a new legal case on your budget? Instantly available.

This agility allows you to react faster, adapt quicker, and outmanoeuvre competitors.

You can respond to market changes or internal shifts without missing a beat.

Finally, enhanced insights and better decision-making.

When you have clean, consolidated data and powerful analytics tools, you see things you never could before.

You can spot trends, forecast future performance with greater precision, and understand the drivers of your business.

This isn’t just about reporting; it’s about understanding.

It empowers you to make smarter, data-driven decisions that impact the bottom line.

You move from reactive reporting to proactive strategy. That’s how you win.

Pricing & Plans

Alright, let’s talk brass tacks: what’s this going to cost you?

With Planful, you won’t find a “free” tier like some basic AI tools.

This isn’t a toy. It’s an enterprise-grade solution.

So, expect pricing that reflects that level of capability and the value it delivers.

The exact cost isn’t usually listed transparently on their website with a simple monthly fee.

Why? Because it’s tailored.

Planful’s pricing is typically custom. It depends on several factors.

Things like the size of your organisation, the number of users you need, and the specific modules or features you want to implement.

Are you just after financial reporting? Or do you need the full suite: budgeting, forecasting, consolidation, and reporting?

All these factors play into the final quote.

You’ll need to contact their sales team directly for a personalised demonstration and a bespoke quote.

They want to understand your exact needs before they give you a number.

This isn’t a bad thing. It means you only pay for what you truly need.

Compared to alternatives in the CPM space – think Adaptive Planning by Workday, Anaplan, or Oracle EPM Cloud – Planful is highly competitive.

It often offers a strong balance of features, ease of use, and cost-effectiveness.

The premium version, which would include everything we’ve discussed for financial reporting, provides comprehensive capabilities.

You get the automated data integration, advanced analytics, robust reporting, and full collaboration tools.

Think about it as an investment.

The cost of NOT having a tool like Planful can be far higher.

Lost time, errors, missed opportunities due to slow reporting. Those add up.

So, while there’s no free trial, the value proposition is strong for organisations ready to commit to serious financial transformation.

Hands-On Experience / Use Cases

Okay, enough theory. Let’s talk about what it feels like to actually use Planful for financial reporting.

Imagine this scenario: you’re the Financial Controller at a growing legal firm.

Every month-end close is a frantic dash.

You’re pulling billing data from one system, payroll from another, general ledger entries from a third.

Then, you manually map it all into a series of interconnected spreadsheets.

One wrong cell reference, one missed update, and the whole edifice collapses.

The board meeting is in two days, and you’re still chasing departmental budget holders for their final figures.

Sound familiar?

With Planful, this process changes dramatically.

From day one, I found the data integration setup surprisingly straightforward.

Connecting to our various source systems was guided, almost intuitive.

Once connected, data flows automatically.

No more manual exports and imports. That alone was a game-changer.

For reporting, the pre-built templates were a solid starting point for our standard P&L and balance sheets.

But the real power was in customisation.

We needed specific reports showing revenue by legal practice area, cross-referenced with lawyer utilisation rates.

Building these reports felt more like dragging and dropping than writing complex formulas.

The dashboards? Visually clean, easy to configure.

I could see our firm’s financial health at a glance, then drill down into specific client profitability or departmental spend with a few clicks.

Collaboration was also smooth.

Department heads could log in, review their specific budget vs. actuals, and add comments directly within the platform.

No more endless email threads or shared drives with conflicting versions.

Everything was centralised, with an audit trail for every change.

The results?

Our month-end close time reduced by 30%. Seriously.

Accuracy improved dramatically. We caught errors before they became problems.

And the board meetings? We presented dynamic reports, answering questions on the fly, instead of promising to “look into it.”

It transformed our financial reporting from a chore into a strategic advantage.

The usability is strong, but like any robust system, there’s a learning curve.

However, the initial setup and ongoing use felt logical.

The payoff in terms of efficiency and insight was quick and undeniable.

Who Should Use Planful?

So, who exactly benefits from bringing Planful into their operation?

This isn’t for everyone. If you’re a sole trader with a simple spreadsheet, it’s overkill.

But if you’re beyond that, and dealing with complexity, listen up.

Mid-sized to Large Enterprises: This is Planful’s sweet spot.

Organisations with multiple departments, complex cost centres, and diverse revenue streams will see the biggest gains.

If your current financial processes are straining under the weight of growth, Planful offers the scalability you need.

Finance Teams and CFOs: This one’s obvious.

If you’re responsible for the financial health of your organisation, including budgeting, forecasting, and especially financial reporting, Planful is built for you.

It gives you the tools to move from reactive number crunching to proactive strategic planning.

Legal and Accounting Firms: This is a specific niche where Planful shines.

These firms often have unique billing structures, project-based profitability analysis needs, and strict compliance requirements.

Planful can handle the complexity of legal case costing, attorney utilisation rates, and client profitability.

It provides granular insights that generic tools simply can’t.

Organisations Facing Regulatory Scrutiny: If you operate in an industry with heavy regulations or need robust audit trails for compliance, Planful delivers.

Its data integrity and version control features are crucial for satisfying auditors and meeting regulatory standards.

Companies with Distributed Teams: If your finance team or business units are spread across different locations, collaboration can be a nightmare.

Planful’s cloud-based platform and workflow capabilities ensure everyone is working from the same, up-to-date information.

This makes multi-entity consolidations and reporting seamless.

Businesses Seeking to Modernise Their Finance Function: If you’re still relying heavily on manual spreadsheets and disparate systems, Planful is your pathway to a more efficient, accurate, and insightful finance operation.

It’s about leaving the past behind and embracing a more intelligent way to manage your finances.

Ultimately, if you’re feeling the pinch of complex financial processes and want to empower your team to be more strategic, Planful is a serious contender.

How to Make Money Using Planful

Making money with Planful isn’t about using it to generate content for sale, like some AI writing tools.

It’s about driving profit by making your business, or your clients’ businesses, more efficient, accurate, and strategically sound.

Here’s how you can leverage Planful to fatten the bottom line:

- Service 1: Financial Reporting Consulting and Optimisation:

If you’re an independent consultant or part of a consulting firm, Planful opens up new service offerings.

Many companies are still stuck in the dark ages with their financial reporting.

They need help migrating from old systems (read: Excel hell) to modern platforms.

You can specialise in implementing Planful for clients.

This involves setting up data integrations, configuring reporting templates, and training their teams.

Charge for implementation projects, ongoing support, and custom report development.

Your value proposition? Drastically improved efficiency, accuracy, and strategic insight for their finance function.

You’re selling them time, reduced risk, and better decision-making capabilities.

- Service 2: Enhanced Internal Strategic Decision-Making:

If you’re using Planful within your own business, the money-making aspect is indirect but very real.

By having access to faster, more accurate financial reporting, you make smarter business decisions.

This could mean identifying underperforming product lines or services more quickly.

It could mean allocating resources to the most profitable areas with greater precision.

You can optimise pricing strategies based on real-time cost data.

You can spot cash flow issues before they become crises.

The efficiency gains from automated reporting free up your finance team to focus on strategic analysis rather than data entry.

This translates directly into improved profitability and growth for your own company.

- Service 3: Offering Fractional CFO or Finance-as-a-Service:

For smaller to mid-sized businesses that can’t afford a full-time, experienced CFO, a fractional CFO service is a goldmine.

With Planful in your toolkit, you can offer sophisticated finance management to multiple clients.

You can provide monthly or quarterly financial reporting, forecasting, and budgeting services.

Planful allows you to manage multiple client accounts efficiently, generating high-quality reports for each.

Example: Meet Sarah, a freelance finance professional.

Before Planful, she could realistically handle 3-4 fractional CFO clients due to the manual reporting burden.

After integrating Planful for automated data consolidation and report generation, she now manages 8-10 clients.

She charges each client an average of £2,000 per month.

That’s an additional £8,000 to £12,000 a month in revenue, purely from the efficiency gains Planful offers.

She delivers better, faster insights, making her an indispensable asset to her clients, while significantly boosting her own income.

Limitations and Considerations

Okay, let’s be real. No tool is perfect.

Planful is powerful, but it’s not a magic bullet that solves everything without effort.

You need to be aware of a few things before jumping in.

First, the learning curve.

While Planful is designed for usability, it’s a comprehensive enterprise system.

It’s not as simple as opening a new spreadsheet.

Your team will need training. They’ll need time to adapt to the new workflows and features.

Expect an initial ramp-up period where productivity might dip slightly before it skyrockets.

Budget for training and allow your team to truly get to grips with it.

Next, initial setup complexity.

Integrating Planful with all your existing systems – your ERP, CRM, HR software – takes effort.

It requires planning, data mapping, and testing.

This isn’t an overnight flick-of-a-switch deployment.

It’s a project. A worthwhile project, but a project nonetheless.

You might need support from Planful’s professional services or a dedicated implementation partner.

Then there’s the cost.

As discussed, Planful is an investment. It’s not free, and it’s not cheap, especially for smaller businesses.

You need to have a clear ROI in mind.

The cost should be weighed against the significant time savings, increased accuracy, and improved decision-making it offers.

If your current manual processes are costing you more in terms of time, errors, and missed opportunities, then the cost is justified.

Consider feature overload for simpler needs.

If your financial reporting requirements are very basic, with only a few accounts and simple statements, Planful might be more than you need.

You could potentially be paying for features you’ll never use.

It’s designed for organisations with a certain level of complexity.

Finally, data accuracy depends on source data quality.

Planful is excellent at consolidating and reporting data, but it won’t fix bad data at the source.

“Garbage in, garbage out” still applies.

If your GL entries are messy, or your billing system has inconsistencies, Planful will faithfully report those inconsistencies.

It highlights them, but it doesn’t magically cleanse them for you.

You still need good data hygiene practices upstream.

These aren’t deal-breakers, but they are things to keep in mind when you’re evaluating if Planful is the right fit for your organisation.

Final Thoughts

So, what’s the verdict on Planful?

Look, if you’re in Legal and Finance, and financial reporting is eating your soul, Planful is not just an option. It’s a necessity.

It solves real problems: manual data hell, endless spreadsheets, inaccurate figures, and slow reporting cycles.

It replaces them with automation, precision, speed, and real insight.

This tool helps you move from being a historian of numbers to a strategic driver of your business.

It streamlines your entire workflow, frees up your team’s time, and gives you the confidence that your numbers are correct.

The benefits – reduced errors, faster closes, better decisions, and significant time savings – are undeniable.

Is it an investment? Absolutely.

Does it require some effort for implementation and training? Yes.

But the payoff for any mid-to-large organisation grappling with complex financial reporting is huge.

It’s about getting back control. It’s about empowering your finance team.

It’s about having the right numbers, at the right time, to make the right calls.

If you’re serious about taking your financial reporting to the next level, then you need to explore Planful.

Stop doing things the hard way. There’s a smarter way.

Take the step.

Visit the official Planful website

Frequently Asked Questions

1. What is Planful used for?

Planful is a comprehensive corporate performance management (CPM) platform.

It’s primarily used for financial planning, budgeting, forecasting, consolidation, and, crucially, financial reporting.

It helps organisations automate and streamline complex financial processes to gain better insights and make data-driven decisions.

2. Is Planful free?

No, Planful is not a free tool.

It’s an enterprise-grade solution with custom pricing that depends on the size of the organisation, the number of users, and the specific modules required.

You’ll need to contact their sales team for a personalised quote.

3. How does Planful compare to other AI tools?

Planful stands out from general AI tools by offering a specialised, integrated platform for finance.

It directly competes with other CPM software like Workday Adaptive Planning, Anaplan, and Oracle EPM Cloud.

Its strength lies in its balance of robust features, strong data integration capabilities, and user-friendly interface tailored specifically for financial professionals.

4. Can beginners use Planful?

While Planful has an intuitive design, it’s a sophisticated system.

A complete beginner to finance software might find an initial learning curve.

However, with proper training and onboarding, finance professionals can quickly become proficient and leverage its power effectively.

5. Does the content created by Planful meet quality and optimization standards?

Planful doesn’t “create content” in the typical sense of generating text or images.

Instead, it produces financial reports, dashboards, and analytical insights.

These outputs are designed for high accuracy, clarity, and relevance, meeting the stringent quality and optimisation standards required for financial decision-making and regulatory compliance.

6. Can I make money with Planful?

Yes, you can make money with Planful, though not directly by selling its output like some AI content tools.

You can generate revenue by offering financial reporting, planning, and analysis consulting services to other businesses.

Internally, it boosts profitability by increasing efficiency, reducing errors, and enabling smarter, faster strategic decisions for your own organisation.