FICO Score revolutionizes Credit Scoring and Analysis in Legal and Finance. Gain deep insights and make confident decisions faster. Start optimizing your credit assessments now!

FICO Score Is Built for Legal and Finance – Here’s Why

Ever feel like you’re just guessing in the dark when it comes to credit risk?

Or spending endless hours trying to untangle complex financial data?

It’s a common pain point for professionals in Legal and Finance.

The demand for precision in credit assessment has never been higher.

And the margin for error has never been smaller.

That’s where AI comes into play.

Specifically, an AI tool that’s been around the block, but is still evolving: FICO Score.

It’s not just a number; it’s a powerful engine for Credit Scoring and Analysis.

And it’s reshaping how legal and finance pros operate.

Ready to see how FICO Score can change your game? Let’s get into it.

Table of Contents

- What is FICO Score?

- Key Features of FICO Score for Credit Scoring and Analysis

- Benefits of Using FICO Score for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use FICO Score?

- How to Make Money Using FICO Score

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is FICO Score?

Okay, so what exactly is FICO Score?

Think of it as the bedrock of modern credit assessment.

It’s an algorithmic system designed to predict the likelihood of a person repaying their debts.

It crunches data from credit reports – payment history, amounts owed, length of credit history, new credit, and credit mix.

Then it spits out a three-digit number.

This number, the FICO Score, is a quick snapshot of credit risk.

It’s used by lenders, banks, and other financial institutions worldwide.

But it’s more than just a consumer score.

FICO also develops various B2B solutions.

These are complex AI-powered platforms.

They help institutions with everything from fraud detection to loan origination.

For professionals in Legal and Finance, these tools are gold.

They provide structured, data-driven insights.

This means less guesswork and more accurate decisions.

It’s about bringing precision to complex financial assessments.

And it is constantly evolving with new data and AI capabilities.

So, FICO Score isn’t just a simple number.

It’s a sophisticated AI tool.

One that powers critical decisions in the financial world.

And it is specifically tailored for rigorous analysis required in Credit Scoring and Analysis.

This tool targets financial analysts, legal professionals dealing with debt recovery, risk managers, and anyone needing deep credit insights.

Key Features of FICO Score for Credit Scoring and Analysis

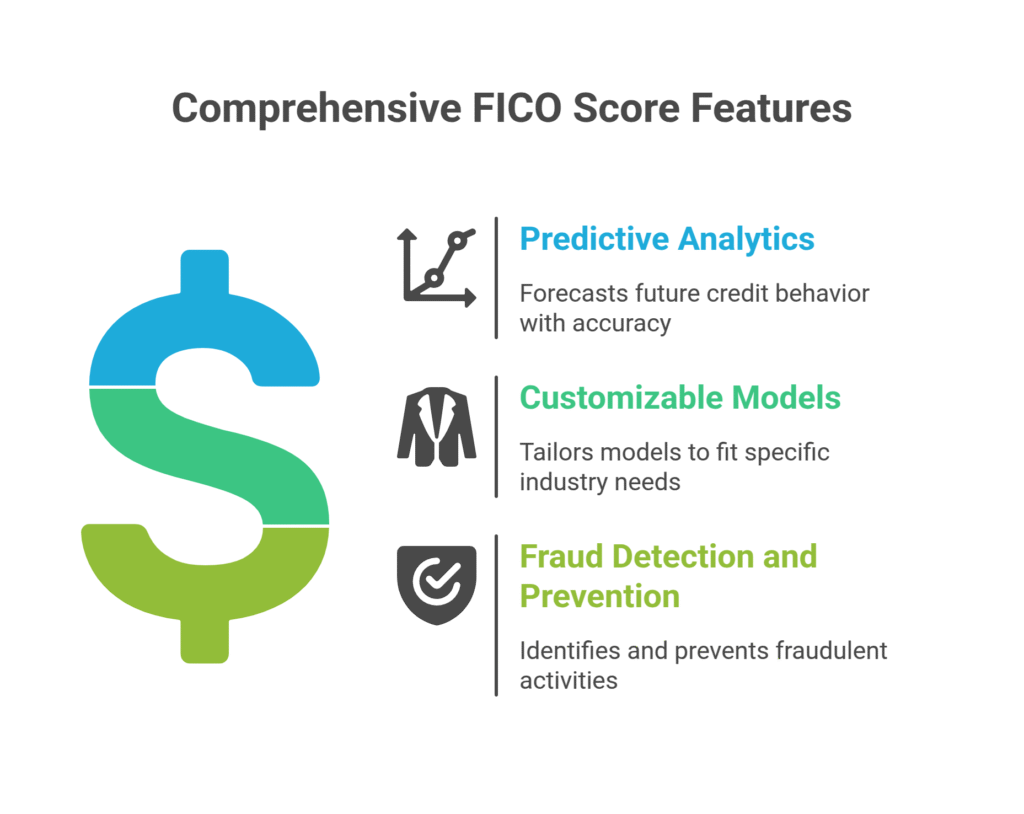

- Predictive Analytics:

FICO Score’s core strength is its predictive capability.

It analyzes vast amounts of historical data.

This allows it to forecast future credit behavior with impressive accuracy.

For Credit Scoring and Analysis, this means you’re not just looking at past performance.

You’re getting a robust estimate of future risk.

This helps financial institutions make better lending decisions.

It reduces bad debt and improves portfolio health.

This feature is crucial for risk management and compliance.

It helps professionals assess potential borrowers or clients.

- Customizable Models:

FICO isn’t a one-size-fits-all solution.

They offer advanced models that can be tailored.

You can adjust parameters to fit specific industry needs.

Or unique risk appetites.

This is vital for large banks and diverse financial firms.

It means FICO Score can be adapted for mortgage lending.

Or auto loans.

Or even for assessing small business credit risk.

This flexibility ensures relevance and precision across various financial products.

It’s not just a generic score.

It’s a finely tuned instrument for your specific needs.

This customisation helps legal teams dealing with bankruptcies understand default probabilities.

- Fraud Detection and Prevention:

Beyond traditional credit scoring, FICO incorporates powerful fraud detection.

Their AI models identify suspicious patterns.

They flag potential fraudulent activities in real-time.

This protects financial institutions from significant losses.

It safeguards consumers from identity theft.

This is an invaluable asset for compliance officers and fraud departments.

It helps maintain the integrity of financial systems.

And reduces the legal aftermath of fraud cases.

This AI tool is always learning.

It adapts to new fraud schemes.

It keeps financial transactions secure.

Benefits of Using FICO Score for Legal and Finance

Alright, let’s talk about the real benefits.

Why should anyone in Legal and Finance care about FICO Score beyond what they already know?

First, it’s about **time savings**.

Manual credit assessments are a time sink.

Collecting data, crunching numbers, verifying information… it’s a lot.

FICO automates much of this.

It pulls data, analyses it, and gives you a clear picture quickly.

This frees up your team.

They can focus on strategic decisions.

Not just data entry.

Think about the hours saved in a large lending operation.

Second, it’s about **quality improvement**.

Humans make mistakes.

They miss details.

AI, like FICO Score, doesn’t.

It processes data consistently.

It applies rules without bias.

This leads to more accurate credit decisions.

Which means fewer defaults.

And better risk management.

For legal teams, this means stronger cases.

When you’re dealing with debt recovery, accurate initial scoring is everything.

Third, it helps **overcome analytical blocks**.

Sometimes, the data is too complex.

Or the patterns are too subtle for human eyes.

FICO’s AI can spot these.

It identifies hidden correlations.

It uncovers risk factors that might otherwise be missed.

This provides deeper insights.

It helps you make confident, data-backed decisions.

It transforms a ‘hunch’ into a ‘certainty’.

Finally, it ensures **regulatory compliance**.

Financial regulations are strict.

They require fair and consistent practices.

FICO Score is built with these standards in mind.

It ensures unbiased evaluations.

It helps financial institutions meet their legal obligations.

It avoids discrimination and ensures ethical lending.

This means less legal exposure.

And a cleaner audit trail.

So, FICO Score isn’t just a tool.

It’s an operational backbone.

It streamlines workflows.

It enhances decision-making.

And it fortifies your entire financial operation.

Pricing & Plans

Okay, let’s talk brass tacks: pricing.

FICO isn’t like your typical SaaS tool with straightforward monthly subscriptions.

Because it’s primarily an enterprise-level solution for financial institutions, their pricing is customized.

There isn’t a “free plan” for their full suite of AI tools.

You won’t find a “basic,” “pro,” or “premium” tier listed on their website.

Instead, it’s highly tailored.

It depends on the specific modules you need.

The volume of transactions.

The size of your organization.

And the level of integration required.

For large banks, financial conglomerates, or credit unions, this means engaging directly with FICO sales.

They’ll conduct a needs assessment.

Then propose a solution.

This usually involves a significant initial setup fee.

Followed by ongoing licensing costs.

These costs reflect the immense value and power the systems provide.

Especially in risk mitigation and revenue generation.

Compared to alternatives like in-house data science teams building similar models from scratch, FICO often presents a compelling return on investment.

Building and maintaining such sophisticated AI requires huge resources.

Expert personnel.

And vast data pipelines.

FICO provides all this as a service.

For smaller entities or individual professionals who want to leverage FICO insights, there are indirect ways.

You might subscribe to credit report services that include FICO Scores.

Or use APIs from credit bureaus.

These offer more accessible pricing models.

But they don’t provide the deep analytical capabilities of FICO’s enterprise AI platforms.

So, if you’re a large institution looking for robust AI tools for Credit Scoring and Analysis, plan for a bespoke pricing discussion.

The investment is substantial, but so is the potential payoff.

Hands-On Experience / Use Cases

Let’s get real for a second.

How does FICO Score actually play out in the trenches?

Imagine you’re a lending officer at a mid-sized bank.

A potential borrower walks in.

They need a loan for a new business venture.

Traditionally, you’d pull a credit report.

Then you’d manually cross-reference their financial statements.

You’d spend hours analyzing their history.

You’d try to gauge their risk profile.

Now, with FICO’s AI-powered solutions, it’s different.

The moment you enter their basic info, the system gets to work.

It integrates directly with credit bureaus.

It pulls a comprehensive FICO Score.

But it doesn’t stop there.

It also runs the data through predictive models.

It assesses the borrower’s industry risk.

It even factors in current economic indicators.

Within minutes, you have a holistic view.

Not just a number, but a **risk rating**.

A **recommended loan amount**.

And even a **suggested interest rate**.

This is a game-changer for Credit Scoring and Analysis.

The usability is surprisingly intuitive for such a complex system.

The dashboards are clean.

The insights are presented clearly.

You don’t need to be a data scientist to use it.

The results?

Faster loan approvals.

Reduced default rates.

And consistent, unbiased decisions.

Another use case: a legal firm specializing in bankruptcy.

They need to assess the likelihood of a client’s ability to repay debts.

FICO’s analytics can project future solvency.

It identifies patterns indicating potential recovery or further distress.

This helps legal professionals advise clients better.

It crafts more effective debt restructuring plans.

It can even estimate the success rate of collection efforts.

The impact is tangible.

It’s about moving from reactive to proactive.

From guesswork to data-driven confidence.

This is the real power of FICO Score for Legal and Finance professionals.

Who Should Use FICO Score?

So, who exactly needs FICO Score?

It’s not for everyone, let’s be clear.

This isn’t a consumer app for checking your personal credit.

It’s an enterprise-grade AI tool.

First up, **banks and credit unions**.

If you’re originating loans, managing risk, or fighting fraud, FICO is your backbone.

It ensures fair lending practices and robust portfolio health.

Next, **financial service providers**.

This includes mortgage lenders, auto finance companies, and credit card issuers.

Anyone extending credit on a large scale benefits from FICO’s deep analytical power for Credit Scoring and Analysis.

Then there are **risk management departments**.

Whether in large corporations or dedicated consulting firms, managing financial risk is paramount.

FICO provides the tools to quantify and mitigate those risks.

For **legal professionals**, especially those in corporate law, bankruptcy, or debt recovery, FICO insights are invaluable.

Understanding the creditworthiness of entities involved in litigation or restructuring can make or break a case.

Think about assessing the solvency of a defendant.

Or the viability of a debt settlement.

**Insurance companies** also use FICO for underwriting policies.

Especially those tied to financial solvency or risk profiles.

Even **government agencies** that manage public funds or provide guarantees.

They rely on robust credit assessment.

Finally, **large-scale data analysts and consultants**.

If you’re advising businesses on financial strategy or compliance, FICO’s data models give you a significant edge.

So, in short, if your business hinges on making accurate, high-stakes decisions about credit risk, solvency, or fraud, FICO Score is built for you.

It’s for entities that need to operate with precision.

And that requires advanced, proven AI tools.

How to Make Money Using FICO Score

Alright, let’s get down to brass tacks: how do you actually make money leveraging FICO Score?

This isn’t about direct monetization like selling an app.

It’s about amplifying your existing business.

Or creating new, high-value services.

First, **efficiency gains translate directly to profit**.

If you’re a lender, faster, more accurate credit decisions mean more loans approved quickly.

And fewer bad debts.

Think about the operational costs saved.

The reduced time spent on manual reviews.

And the lower write-offs.

This directly boosts your bottom line.

Second, you can offer **specialized consulting services**.

- Credit Risk Advisory:

Leverage FICO’s analytical power to advise other businesses.

Help them understand their credit exposure.

Or optimize their lending policies.

This is huge for smaller financial institutions.

They might not have the resources to build or licence FICO’s full suite.

You become their expert.

Providing insights on portfolio health, industry trends, and regulatory changes.

- Fraud Prevention Services:

FICO’s fraud detection is top-tier.

You can offer services to help companies identify and mitigate fraud risks.

This is a critical need across many sectors.

Especially e-commerce and fintech.

By implementing FICO-powered solutions, you help clients protect assets.

And avoid costly legal battles.

- Debt Recovery Optimization:

For legal firms or collection agencies, FICO insights can prioritize efforts.

Identify which debts are most likely to be recovered.

And which require more aggressive action.

Or even negotiation.

This optimizes resources.

It increases recovery rates.

Leading to more revenue from successful collections.

This also reduces wasted time chasing unrecoverable accounts.

Consider a real example: “How ABC Finance makes an extra $500,000/year using FICO Score for Credit Scoring and Analysis.”

Before FICO, they spent weeks manually processing loan applications.

Their default rate was 3%.

After implementing FICO’s AI, their processing time dropped by 70%.

Their default rate fell to 1.5%.

This reduction in losses, coupled with increased loan volume due to faster approvals, directly translated to that half-million-dollar profit bump.

It’s not just about what FICO *does*.

It’s about what it *enables* you to do.

It’s about smarter decisions.

Better risk management.

And ultimately, more profitable operations.

Limitations and Considerations

Alright, FICO Score is powerful.

But it’s not magic.

Like any sophisticated AI tool, it has its limitations.

And things you need to consider before diving in.

First, **data dependency**.

FICO models are only as good as the data fed into them.

If the underlying credit reporting data is incomplete or inaccurate, the score can be affected.

This isn’t a FICO flaw, but a data ecosystem challenge.

Garbage in, garbage out, as they say.

So, ensure your data sources are clean.

Second, **lack of transparency for end-users**.

While institutions get detailed analytics, the individual FICO Score itself is a proprietary black box.

Consumers don’t see the exact weights of each factor.

This can lead to frustration for those trying to improve their score.

For legal professionals, this means understanding the *impact* of the score, rather than dissecting its internal mechanics for every case.

Third, **integration complexity**.

Implementing FICO’s enterprise solutions is no small feat.

It requires significant IT resources.

And often, a long integration period.

It’s not a plug-and-play solution.

This can be a learning curve.

And a substantial upfront investment in time and capital.

Fourth, **model drift and evolving risk**.

Credit markets are dynamic.

Economic conditions change.

Consumer behavior shifts.

FICO models need constant updating and recalibration.

While FICO does this regularly, relying on static models from years past is a mistake.

You need to ensure your FICO implementation is kept current.

And that it reflects the latest market realities.

Finally, **cost**.

As discussed, FICO’s advanced tools are premium.

They are built for large-scale operations.

The investment can be substantial.

It’s not something a small startup typically budget for.

You need to weigh the ROI carefully.

Ensure the benefits truly outweigh the costs for your specific use case.

So, while FICO Score is a robust tool for Credit Scoring and Analysis, it requires careful consideration of these factors.

It’s a strategic investment.

Not just a simple software purchase.

Final Thoughts

Look, in the world of Legal and Finance, especially when it comes to Credit Scoring and Analysis, you can’t afford to guess.

The stakes are too high.

The financial landscape is too complex.

And the regulations are too strict.

This is where FICO Score steps in.

It’s not just another AI tool.

It’s an industry standard.

A proven workhorse.

It offers unparalleled depth in predictive analytics.

Customizable models to fit specific needs.

And robust fraud detection capabilities.

The benefits are clear: significant time savings, improved decision quality, overcoming complex analytical hurdles, and ensuring compliance.

It transforms how financial institutions and legal teams operate.

From reactive to proactive.

From uncertainty to data-backed confidence.

While the investment is significant, particularly for larger organizations, the return on investment can be massive.

Reduced losses, increased efficiency, and stronger financial portfolios are just the start.

If you’re serious about optimizing your credit assessment processes, mitigating risk, and making smarter financial decisions, then FICO Score is essential.

It’s built for the rigor and demands of Legal and Finance.

It’s the backbone of intelligent lending.

And accurate risk management.

My recommendation?

If your organization makes high-volume or high-value credit decisions, explore FICO’s enterprise solutions.

Engage their team.

Understand how their specific AI modules can integrate with your existing systems.

It’s not just an upgrade.

It’s a fundamental shift towards a more intelligent, secure, and profitable operation.

Stop leaving money on the table.

Stop risking errors.

Start leveraging the power of FICO Score today.

Visit the official FICO Score website

Frequently Asked Questions

1. What is FICO Score used for?

FICO Score is primarily used by lenders and financial institutions to assess the creditworthiness of individuals and businesses. It helps predict the likelihood of a borrower repaying debts, guiding decisions on loan approvals, interest rates, and credit limits. Beyond basic scoring, FICO’s AI tools are also used for fraud detection, risk management, and regulatory compliance within the financial sector.

2. Is FICO Score free?

The enterprise-level AI tools and platforms offered by FICO are not free. They are premium, customized solutions typically purchased by large financial institutions. While consumers can often access their personal FICO Score through credit reporting agencies or banks, the advanced analytical suites are a significant investment, with pricing tailored to the client’s specific needs and scale.

3. How does FICO Score compare to other AI tools?

FICO Score stands out due to its long-standing reputation, deep historical data, and specialized focus on credit risk and fraud within the financial industry. While other general-purpose AI tools exist for data analysis, FICO’s models are finely tuned and rigorously validated for financial applications, often surpassing generic AI in accuracy and regulatory compliance for Credit Scoring and Analysis.

4. Can beginners use FICO Score?

For individuals or small businesses, the direct use of FICO’s enterprise AI tools is not practical. However, beginners can understand and leverage their personal FICO Score as a consumer. For professionals in Legal and Finance, using FICO’s advanced platforms requires specialized training and understanding of financial analytics, making it more suited for experienced professionals or teams.

5. Does the content created by FICO Score meet quality and optimization standards?

FICO Score doesn’t “create content” in the traditional sense like text generators. Instead, it generates highly accurate, data-driven credit risk assessments and analyses. These outputs meet the highest quality and optimization standards for financial decision-making, ensuring regulatory compliance, fairness, and predictive power, which are critical in Legal and Finance.

6. Can I make money with FICO Score?

Yes, but indirectly. Businesses and professionals can make money by leveraging FICO Score’s capabilities to improve their operations. This includes reducing financial losses (from defaults or fraud), increasing loan origination efficiency, offering specialized credit risk consulting services, and optimizing debt recovery processes. The improved accuracy and speed offered by FICO’s AI tools translate directly into significant cost savings and increased profitability.