Resolver is the AI tool transforming Risk Analysis and Management in Finance and Trading. See how it cuts complexity, boosts efficiency, and drives better decisions. Get started today!

Why Resolver Is a Game-Changer in Risk Analysis and Management

Okay, listen up.

The world’s changing.

Fast.

Especially in finance.

And trading.

AI isn’t just a buzzword anymore.

It’s the engine.

It’s powering deals.

Managing portfolios.

And, yes, handling risk.

Risk. The thing that keeps everyone in this game up at night.

Miss a big one?

Game over.

Or at least, lights out for a while.

Historically, Risk Analysis and Management has been… well, manual.

Spreadsheets the size of small countries.

Data living everywhere.

Gut feelings mixed with complex models.

It worked. Kinda.

But it was slow.

Clunky.

Prone to human error.

What if you could ditch all that?

What if there was a tool?

One built for this crazy world.

One that helps you see risks coming.

Manage them proactively.

Make smarter moves.

That tool exists.

It’s called Resolver.

And it’s changing how people handle Risk Analysis and Management.

Especially if you’re in Finance and Trading.

Let’s talk about why.

And how it can change things for you.

Table of Contents

- What is Resolver?

- Key Features of Resolver for Risk Analysis and Management

- Benefits of Using Resolver for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Resolver?

- How to Make Money Using Resolver

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Resolver?

Alright, let’s break it down.

What exactly is this “Resolver” thing?

Think of it as an AI-powered platform.

But not just any AI platform.

It’s designed specifically for managing governance, risk, and compliance (GRC).

Yeah, I know. Sounds corporate.

But stick with me.

For the finance and trading world, GRC is everything.

It’s the framework.

It’s staying out of trouble.

It’s protecting your assets.

And your clients’.

Resolver brings all these messy, interconnected areas together.

It’s not just one tool.

It’s a suite.

Different modules talk to each other.

Sharing information.

Giving you a single view.

Instead of jumping between systems.

Or worse, spreadsheets.

The target audience?

Organizations. Big ones. Small ones.

Anyone who needs to seriously manage risk.

Protect against threats.

Ensure compliance with regulations.

And do it efficiently.

This is gold.

You’re dealing with market risk.

Credit risk.

Operational risk.

Compliance risk.

Cybersecurity threats.

It’s a minefield.

Resolver helps you navigate it.

Using AI to crunch data.

Spot patterns.

Predict potential issues.

Before they blow up.

Its core function?

To give you clarity.

Control.

And confidence.

In a world that thrives on chaos.

That’s what Resolver is built for.

Making the complex simple.

Making the invisible visible.

And ultimately, protecting your bottom line.

And your reputation.

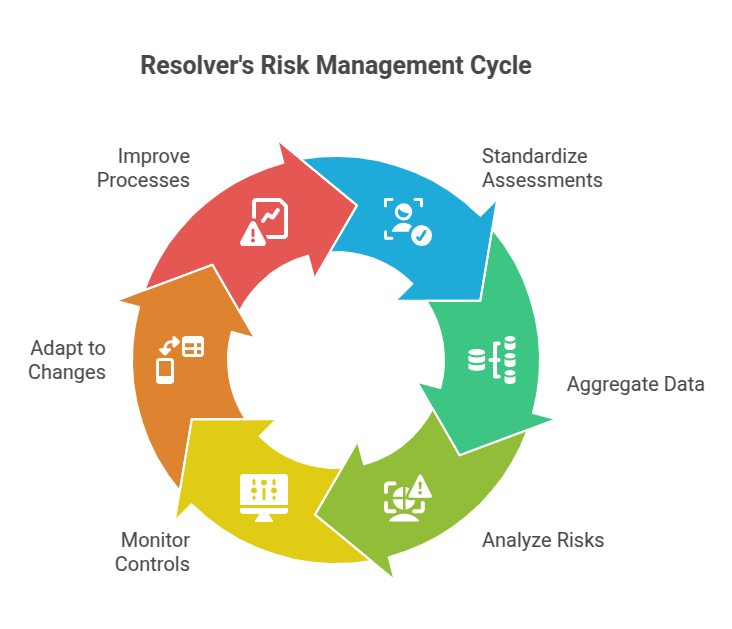

Key Features of Resolver for Risk Analysis and Management

Let’s get into the nuts and bolts.

What does Resolver actually do?

How does it help with Risk Analysis and Management?

It’s got a stack of features.

Built specifically for this job.

Here are some of the big ones:

- Integrated Risk Assessments:

This isn’t your grandma’s checklist.

Resolver lets you run comprehensive risk assessments.

Across different business units.

Different types of risk.

Operational, financial, compliance, you name it.

It uses frameworks.

Standard ones. Custom ones.

It helps you identify potential risks.

Score them.

Based on likelihood and impact.

But here’s the AI bit.

It can pull data from other sources.

Incident reports. Audit findings. Control testing results.

To give you a clearer picture.

A more data-driven score.

Not just a guess.

This means you focus your energy where it matters most.

On the risks that could actually sink you.

- Real-time Risk Monitoring & Reporting:

Risk isn’t static.

It moves.

It changes.

Trying to keep track manually is impossible.

Resolver gives you dashboards.

In real-time.

Showing you your risk posture.

Across the business.

Or drilled down to specific areas.

It aggregates data.

From various sources.

Internal data. External feeds (news, market data).

It can alert you to changes.

When a key risk metric crosses a threshold.

When a new vulnerability is discovered.

When a regulation changes.

This isn’t looking in the rearview mirror.

It’s looking through the windscreen.

Seeing what’s coming.

Making proactive decisions.

Not reactive ones.

The reporting is key.

Generate reports for management.

For regulators.

Automatically.

With the latest data.

Saving you hours.

Days, even.

- Control Testing and Assurance:

Okay, you’ve identified risks.

You’ve put controls in place.

Do they work?

Are they effective?

Resolver helps you manage your control framework.

Map controls to risks.

Schedule testing.

Track results.

Assign actions for remediation.

It centralizes all this assurance work.

Internal audits. Compliance reviews.

It spots weaknesses.

Where controls are failing.

Or missing entirely.

Especially crucial in finance.

Where control failures can lead to massive losses.

Or regulatory fines.

Resolver makes sure your safety nets are actually there.

And that they’re strong.

This builds confidence.

For you.

For investors.

For the guys with the badges.

- Incident and Loss Event Tracking:

Stuff happens.

Incidents occur.

Loss events hit.

Cyberattacks. Trading errors. Fraud.

How do you track them?

Learn from them?

Prevent them happening again?

Resolver has dedicated modules for this.

Capture incident details.

Investigate root causes.

Track financial losses.

Manage remediation tasks.

Crucially, it links these back to your risks.

And controls.

An incident isn’t just an isolated event.

It’s a data point.

Showing you where your risk assessment was wrong.

Or where a control failed.

Resolver makes this connection automatically.

Turning painful events into learning opportunities.

Strengthening your defences.

That’s a glimpse.

There’s more.

Compliance management.

Audit management.

Third-party risk management.

Business continuity planning.

All tied together.

This integration is the AI bit.

It sees the connections.

Between an incident.

A control failure.

A specific risk.

A regulatory requirement.

And gives you insight.

Actionable insight.

That’s the power of Resolver for Risk Analysis and Management.

Benefits of Using Resolver for Finance and Trading

Okay, so it has features.

Big deal.

What does that mean for you?

The guy or gal in Finance and Trading?

Plenty.

Let’s talk benefits.

Massive Time Savings:

Seriously. How much time is wasted?

Hunting for data.

Consolidating spreadsheets.

Generating manual reports.

Sending emails back and forth.

Resolver automates so much of this.

Data collection.

Risk scoring.

Report generation.

Monitoring alerts.

It frees up your team.

To actually *do* risk management.

Not just admin.

Improved Accuracy and Consistency:

Manual processes?

Error-prone.

Different people, different ways.

Resolver provides a standard framework.

Consistent data.

Automated calculations.

Reduces the chance of mistakes.

Which can be incredibly costly in finance.

Better Decision Making:

This is the big one.

Resolver gives you a clear, integrated view of risk.

Across the business.

You see dependencies.

How one risk impacts another.

What controls are weakest.

Where incidents are clustering.

This data-driven insight.

Allows you to make *informed* decisions.

About allocating resources.

Investing in controls.

Hedging exposures.

It’s not a gut feeling anymore.

It’s based on real data.

Proactive Risk Management:

Stop playing catch-up.

Resolver’s monitoring and alerting capabilities.

Help you spot issues early.

Before they escalate.

Identify emerging risks.

Based on trends in the data.

You move from reactive incident response.

To proactive prevention.

Massive difference.

Simplified Compliance:

Regulations are complex.

They change.

Keeping track is a nightmare.

Resolver helps map regulations to risks and controls.

Track compliance status.

Demonstrate adherence to auditors.

Automated reporting helps here too.

Reduces the stress.

Reduces the risk of fines.

Enhanced Communication and Collaboration:

Risk isn’t just one department’s job.

It touches everyone.

Resolver provides a central platform.

For different teams to share information.

About risks, incidents, controls.

Workflow and task assignment features.

Ensure actions get taken.

Everyone is on the same page.

Break down silos.

Improve overall risk culture.

Scalability:

As your business grows.

As markets get more complex.

So does your risk.

Resolver is built to scale.

Handle more data.

More users.

More complex frameworks.

It grows with you.

These aren’t just fancy words.

These are real business benefits.

Translate to fewer losses.

More efficient operations.

Stronger investor confidence.

And less grey hair.

That’s the impact of using Resolver for Risk Analysis and Management.

Pricing & Plans

Alright, the question everyone asks.

What’s it cost?

Resolver isn’t like those free AI tools you play with online.

This is an enterprise-level platform.

Built for serious business needs.

Especially in a high-stakes environment like Finance and Trading.

So, no, there isn’t a free plan.

You don’t just sign up and start playing around.

It requires implementation.

Configuration.

Integration with your existing systems.

Their pricing is typically not listed publicly.

It’s usually based on factors like:

- The specific modules you need (Risk, Audit, Compliance, etc.).

- The size of your organization.

- The number of users.

- The complexity of your requirements.

You’ll need to contact their sales team.

Discuss your needs.

Get a custom quote.

This isn’t a one-size-fits-all solution.

It’s tailored.

How does it compare to alternatives?

There are other GRC platforms out there.

Some might be cheaper upfront.

But Resolver positions itself at the higher end.

Focusing on integration.

Advanced analytics.

And the ability to handle complex organizational structures.

Its AI capabilities are a key differentiator.

Especially for predictive risk insights.

Many basic tools are just databases with workflows.

Resolver is more.

It aims to be intelligent.

To help you uncover risks you didn’t even know existed.

Is it worth the cost?

For organizations where poor risk management.

Can cost millions.

In losses.

In fines.

In reputation damage.

Absolutely.

Think of it as insurance.

But insurance that also makes you more efficient.

And helps you make better strategic decisions.

The ROI comes from preventing losses.

Reducing compliance costs.

Freeing up valuable staff time.

So while the upfront cost might seem high.

Especially compared to a basic tool.

The potential return is significant.

For serious players in Finance and Trading.

This is an investment.

Not an expense.

Hands-On Experience / Use Cases

So, how does this play out in the real world?

Let’s walk through a scenario.

Imagine you’re the Head of Risk for a mid-sized investment firm.

Before Resolver?

Your team spends weeks every quarter.

Collecting risk assessments from department heads.

Trading desk.

Operations.

Compliance.

Legal.

They’re all in different formats.

Some spreadsheets.

Some Word docs.

Lots of emails.

You manually consolidate everything.

Try to spot trends.

Build a dashboard in Excel.

It’s outdated the minute you finish it.

Incidents?

Logged in one system.

Losses in another.

Audit findings in a third.

Trying to link them up?

A Herculean effort.

Now, with Resolver.

The assessment process is standardized.

Built into the platform.

Departments input directly.

Resolver aggregates the data instantly.

Scores risks automatically.

Based on pre-defined criteria.

Your dashboard?

Real-time.

Shows you the top risks.

Trending risks.

Risks with the weakest controls.

Incidents are logged in the same system.

Resolver links them to the relevant risks and controls.

Shows you which controls are failing.

Highlights areas with repeated incidents.

A sudden increase in trading errors in a specific team?

Resolver flags it.

Links it to operational risk.

Suggests reviewing training.

Or controls on trading limits.

Another use case: Regulatory change.

A new rule drops from the FCA or SEC.

Before?

Legal sends an email.

Compliance tries to figure out which controls are impacted.

Which policies need updating.

Takes forever.

With Resolver?

You can map regulations.

Link them to controls and processes.

A new rule comes in.

You update the regulatory library in Resolver.

It shows you exactly which controls are now inadequate.

Which assessments need review.

Assign tasks to update policies and controls.

Track progress.

You adapt quickly.

Stay compliant.

Avoid the scramble.

Usability?

It’s a professional platform.

So there’s a learning curve.

It’s not like using a simple app.

But it’s designed for clarity.

Visual dashboards.

Intuitive workflows.

Compared to wrestling with disparate systems and spreadsheets?

It’s a massive upgrade.

The initial setup takes effort.

Defining your risks.

Building your control library.

But once it’s running?

The day-to-day is far smoother.

The results?

A clearer risk picture.

Faster identification of issues.

More efficient use of resources.

Ultimately, a stronger defense against the unexpected.

Which, in Finance and Trading, is everything.

That’s the practical impact of Resolver for Risk Analysis and Management.

Who Should Use Resolver?

Okay, who is this tool actually for?

Is it for everyone in Finance and Trading?

Probably not the individual day trader.

Or the solo financial advisor.

Unless they’re managing significant scale and complexity.

Resolver is built for organizations.

For companies.

Here’s a breakdown of the ideal users:

Investment Firms and Asset Managers:

Managing billions? Millions?

Dealing with diverse portfolios?

Operating in multiple jurisdictions?

Risk is inherent.

Market risk, credit risk, operational risk, compliance risk.

Resolver centralizes it all.

Gives portfolio managers better insights.

Helps compliance officers sleep at night.

Banks and Financial Institutions:

From large global banks to regional ones.

The regulatory burden is immense.

Operational complexity is high.

Fraud, cyber threats, liquidity risk.

Resolver helps manage GRC across the entire institution.

Connecting disparate risk types.

Improving control effectiveness.

Simplifying regulatory reporting.

FinTech Companies:

Fast-growing?

Innovating rapidly?

You might think GRC is slow and clunky.

But ignoring it is suicide.

FinTechs need to build trust.

Prove security.

Navigate regulations quickly.

Resolver provides the framework.

Scales with your growth.

Helps you professionalize your operations.

Attract institutional partners.

Corporate Finance Departments (Large Enterprises):

Even outside traditional finance firms.

Large companies have significant financial risks.

Treasury risk.

Investment risk (pensions, etc.).

Fraud risk.

Ensuring controls are effective.

Managing compliance around financial reporting.

Resolver fits here too.

Part of a broader GRC program.

Internal Audit and Compliance Teams:

These teams are directly responsible for assurance.

Testing controls.

Monitoring compliance.

Investigating issues.

Resolver is their core workbench.

Streamlining their workflows.

Providing the data they need.

Generating audit reports.

Basically, if you’re part of an organization.

In the financial sector.

Or a large company with significant financial operations.

And you care about managing risk properly.

Not just ticking boxes.

If you’re currently struggling with spreadsheets.

Disconnected systems.

Lack of visibility.

Resolver is designed for you.

It’s for the serious players.

Who need a robust, integrated solution.

For Risk Analysis and Management.

How to Make Money Using Resolver

Now, this isn’t a tool for individuals to directly make money.

Like a content generator.

Or a trading bot.

Resolver is a B2B GRC platform.

The money-making potential comes from the efficiency and effectiveness.

It brings to an organization.

Think about it this way:

Reducing Losses:

The primary goal of Risk Analysis and Management.

Preventing bad things from happening.

Operational failures.

Fraud.

Cyber breaches.

Compliance fines.

Trading errors.

Each prevented incident.

Each avoided fine.

Is money saved.

Money that stays in the business.

Directly impacts the bottom line.

Resolver helps you identify and mitigate these risks more effectively.

That’s making money by not losing it.

Improving Operational Efficiency:

Remember the time savings we talked about?

Automating manual tasks.

Streamlining workflows.

Freeing up employees.

Those employees can now focus on higher-value activities.

Developing new products.

Improving services.

Growing the business.

That efficiency gain translates directly to profit.

Lower operating costs.

Increased capacity.

Enabling Growth and New Ventures:

Want to launch a new trading strategy?

Expand into a new market?

Offer a new financial product?

Proper risk management is essential.

Regulators demand it.

Investors expect it.

Resolver provides the framework.

To assess the risks of new initiatives.

Build controls.

Monitor their effectiveness.

It gives you the confidence.

And the ability.

To pursue growth opportunities.

While managing the associated risks.

Enabling growth is making money.

Building Trust and Reputation:

In finance, reputation is everything.

Clients and partners need to trust you.

That you’re secure.

That you’re compliant.

That you manage risk responsibly.

A robust GRC program, powered by a tool like Resolver.

Demonstrates this commitment.

It can be a competitive advantage.

Helping you attract and retain clients.

Attract better talent.

This indirectly but significantly impacts revenue.

Think of it as a sales tool.

Proving you’re a safe pair of hands.

Consulting Services:

While you might not make money directly with the tool as an individual.

Expertise in using GRC platforms like Resolver.

Is valuable.

Consultants specializing in GRC.

Or implementing Resolver solutions.

Can offer services to organizations.

Helping them set up Resolver.

Develop risk frameworks.

Train staff.

Optimize their GRC processes.

This is a direct way for individuals or consulting firms.

To make money.

Leveraging their knowledge of the tool.

And the GRC domain.

So, Resolver doesn’t print cash directly.

But it’s a powerful engine for the organization.

Driving efficiency.

Preventing losses.

Enabling safe growth.

Building trust.

All of which translate into a healthier, more profitable business.

That’s how Resolver helps make money in Finance and Trading.

Limitations and Considerations

Nothing is perfect.

Not even a powerful AI tool like Resolver.

While it’s a game-changer for many.

There are things to consider.

Limitations.

Implementation Effort:

This isn’t a simple plug-and-play tool.

Especially for large organizations.

Getting it set up takes time.

Planning.

Resource allocation.

You need to define your risk taxonomy.

Map your controls.

Configure workflows.

Integrate data sources.

This requires internal effort.

And potentially external help.

It’s a project.

Learning Curve:

Resolver is a sophisticated platform.

It has depth.

Users need training.

To understand the modules.

How to perform assessments.

How to log incidents.

How to use the dashboards.

While the interface is designed for usability.

It’s still a professional tool.

Expect a period where users get up to speed.

Data Quality is Crucial:

Resolver relies on data.

Data from your business.

Incident logs.

Audit results.

Assessment inputs.

If the data going in is bad?

The insights coming out won’t be great either.

“Garbage in, garbage out.”

You need processes to ensure data quality.

Users need to understand why accurate input is important.

The AI is only as good as the information it processes.

Cost:

As mentioned, it’s not cheap.

It’s an enterprise investment.

Requires budget.

It’s a significant expense.

Especially for smaller firms.

You need to build a strong business case.

Demonstrate the ROI.

Ensure the potential benefits outweigh the cost.

Potential for Over-Reliance:

Resolver provides powerful insights.

Automates processes.

But Risk Analysis and Management still requires human judgment.

Context.

Experience.

You can’t just plug Resolver in and walk away.

Blindly trust every AI output.

It’s a tool to augment human expertise.

Not replace it entirely.

Users need to understand the data.

The models.

Apply critical thinking.

These aren’t reasons to avoid Resolver.

They’re realities of implementing complex systems.

Especially in a critical area like Finance and Trading.

Be prepared for the implementation effort.

Invest in training.

Focus on data quality.

Build a solid business case.

And remember that the AI is a partner.

Not the sole decision-maker.

Manage these considerations.

And you’ll unlock Resolver’s full potential.

Final Thoughts

So, what’s the bottom line on Resolver?

Especially for Finance and Trading?

It’s not just another software tool.

It’s a strategic platform.

For managing something absolutely critical: Risk.

In a world that’s faster.

More interconnected.

And more unpredictable than ever.

Manual Risk Analysis and Management doesn’t cut it anymore.

Spreadsheets are roadblocks.

Siloed systems are blind spots.

Resolver pulls it all together.

Using AI to make sense of the chaos.

Giving you visibility.

Predictive insights.

Automated workflows.

It transforms how you identify, assess, monitor, and mitigate risk.

For organizations operating in finance.

Where the stakes are sky-high.

And regulatory pressure is constant.

Resolver isn’t just a nice-to-have.

It’s becoming essential infrastructure.

It saves time.

Improves accuracy.

Leads to better, faster decisions.

Protects against losses.

Enables safer growth.

Yes, there’s an investment involved.

In cost.

In implementation effort.

But the potential returns.

In saved money.

In increased efficiency.

In peace of mind.

Are substantial.

If you’re serious about Risk Analysis and Management.

If your current processes are holding you back.

If you need a single source of truth for GRC.

Resolver is definitely worth exploring.

It’s designed for the complexity of modern finance.

It’s a tool built for the future.

Operating right now.

Don’t get left behind.

Take a look.

Visit the official Resolver website

Frequently Asked Questions

1. What is Resolver used for?

Resolver is a comprehensive GRC (Governance, Risk, and Compliance) platform.

It helps organizations manage various types of risk.

Track compliance requirements.

Handle incidents.

Manage audits.

It’s used to get a holistic view of an organization’s risk posture.

Improve decision making.

And protect against threats.

2. Is Resolver free?

No, Resolver is an enterprise-level software platform.

There is no free plan.

Pricing is custom.

Based on the specific modules needed.

Organization size.

And other factors.

You need to contact their sales team for a quote.

3. How does Resolver compare to other AI tools?

Resolver is focused specifically on GRC and Risk Analysis and Management.

Unlike general AI tools.

Its AI is tailored for GRC tasks.

Like risk scoring.

Identifying patterns in incident data.

Providing predictive insights.

It’s a specialized platform.

Integrated across GRC functions.

Other AI tools might focus on content.

Marketing.

Or other domains.

4. Can beginners use Resolver?

Resolver is a professional, sophisticated platform.

It’s not designed for absolute beginners in GRC.

Users need training.

And some understanding of risk management principles.

However, once trained, the interface is designed to be intuitive.

Much easier than managing GRC manually.

5. Does the content created by Resolver meet quality and optimization standards?

Resolver doesn’t create content in the traditional sense.

Like marketing copy or articles.

It generates reports.

Dashboards.

Insights based on your GRC data.

The quality of these outputs depends heavily on the quality of the input data.

And how the system is configured.

For Finance and Trading.

Accuracy and relevant insights are key.

Which Resolver is built to provide.

6. Can I make money with Resolver?

As an individual user, you don’t directly make money with Resolver.

It’s a business tool.

Organizations use Resolver to make money by reducing losses.

Improving efficiency.

Enabling safer growth.

And building trust.

Expertise in Resolver implementation or GRC consulting using the tool.

Is a way for professionals to offer services.

And earn income.