MetricStream revolutionizes Risk Analysis and Management in Finance and Trading. Gain unprecedented clarity and make confident decisions. See how it boosts efficiency now!

Why More People in Finance and Trading Are Turning to MetricStream

Alright, let’s talk about something that’s probably been keeping you up at night.

Risk.

Specifically, Risk Analysis and Management in Finance and Trading.

It’s the foundation.

Mess it up, and you’re toast.

But honestly?

It’s also a mountain of work.

Data everywhere.

Regulations changing daily.

Trying to spot that tiny signal in a sea of noise.

Sounds familiar, right?

For years, it felt like we were just throwing more bodies at the problem.

More analysts, more spreadsheets, more late nights.

And still, things slipped through the cracks.

Because humans, bless our hearts, have limits.

We get tired.

We miss things.

We get overwhelmed by sheer volume.

Especially in Finance and Trading, where the stakes are sky-high.

Now, you’ve heard the buzz.

AI is showing up everywhere.

And yeah, some of it is just hype.

But some of it?

It’s the real deal.

It’s changing how we do things.

And when it comes to Risk Analysis and Management?

There’s one tool popping up more and more.

MetricStream.

People in Finance and Trading are quietly adopting it.

Not because it’s flashy.

But because it actually solves problems.

It tackles that massive workload.

It helps you see risks you’d otherwise miss.

It lets you make decisions faster.

More confidently.

It’s less about replacing you, and more about giving you superpowers.

So, why the sudden popularity?

Why are more people in Finance and Trading turning to MetricStream?

Let’s break it down.

We’re talking about real workflow changes.

Real efficiency gains.

And ultimately, better Risk Analysis and Management.

Which, let’s be honest, is everything.

Table of Contents

- What is MetricStream?

- Key Features of MetricStream for Risk Analysis and Management

- Benefits of Using MetricStream for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use MetricStream?

- How to Make Money Using MetricStream

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

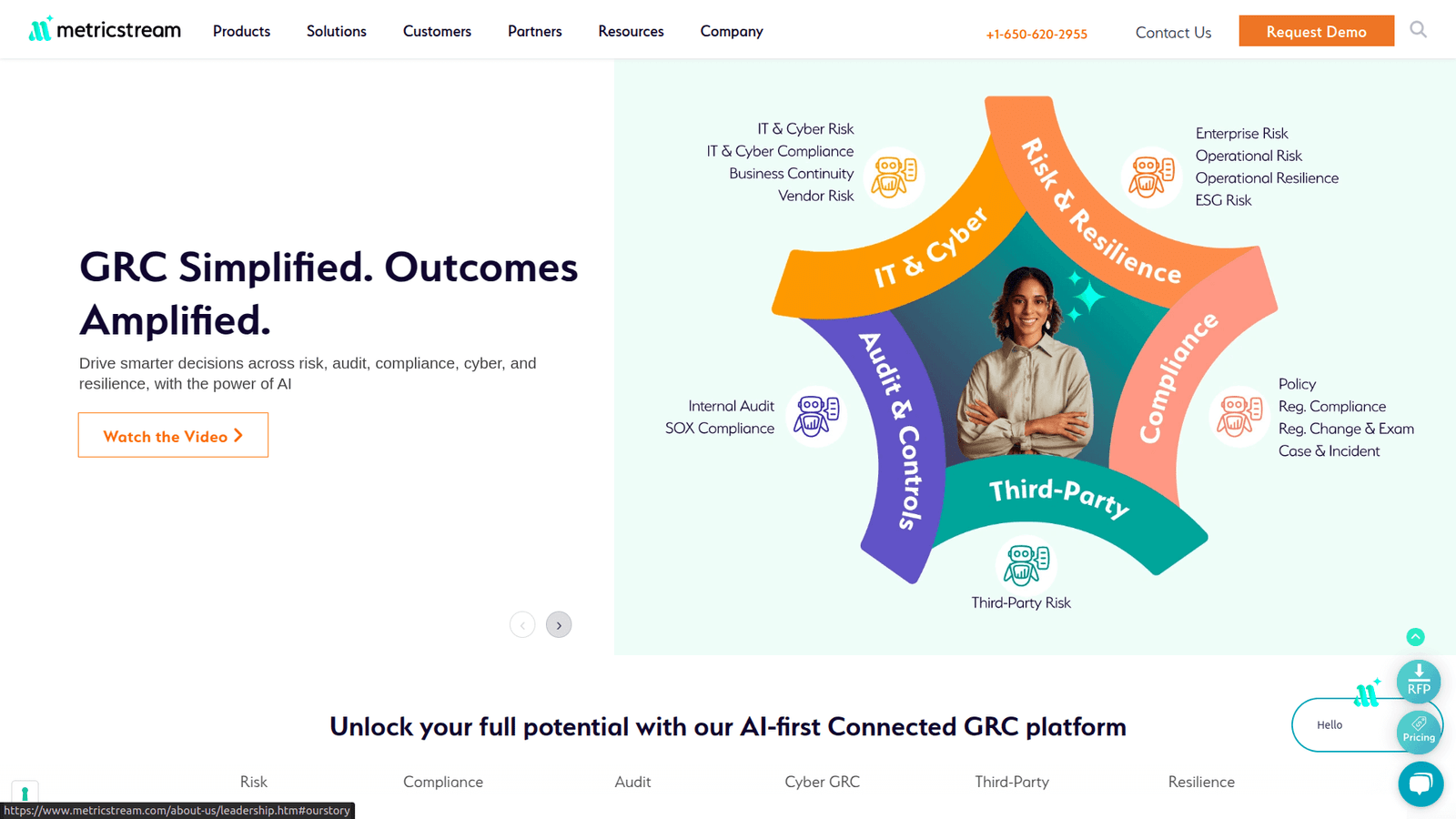

What is MetricStream?

Okay, first things first.

What exactly is MetricStream?

Think of it as a platform.

A big one.

It’s designed for something called GRC.

That stands for Governance, Risk, and Compliance.

Yeah, I know, corporate speak.

But stick with me.

What that means in plain English is it helps companies deal with all the rules, all the potential problems, and all the things they need to do to stay out of trouble and make smart choices.

It’s a big system for managing complex stuff.

MetricStream isn’t just one thing.

It’s a suite of applications.

Different tools for different jobs within GRC.

And yeah, AI is built into a lot of it now.

Not just tacked on.

It uses AI to automate things.

To spot patterns humans can’t easily see.

To predict potential issues.

It’s used by huge companies.

Across industries.

But it’s particularly relevant for Finance and Trading.

Why?

Because Finance and Trading is arguably one of the most complex, most regulated, and highest-risk industries out there.

You’re dealing with market volatility.

Credit risk.

Operational glitches.

Regulatory changes that hit like a train.

Cyber threats.

The list is endless.

Managing all that manually is a nightmare.

It’s prone to errors.

It’s slow.

And it costs a fortune.

MetricStream’s core function?

To bring structure to that chaos.

To connect the dots between different risks.

To automate monitoring.

To provide a single view of your risk Risk Analysis and Management.

Especially relevant for financial institutions dealing with things like Basel requirements, Dodd-Frank, MiFID II, you name it.

It helps you map risks to regulations.

Track controls.

Run assessments.

Report to regulators and the board without pulling your hair out.

So, it’s not just some simple AI content tool.

It’s an enterprise-level GRC platform.

With serious AI muscle built-in.

Focused on solving the kind of big, hairy problems that keep finance professionals up at night.

Especially around understanding and handling risk.

Key Features of MetricStream for Risk Analysis and Management

Alright, let’s get into the guts of it.

What does MetricStream actually *do* that makes it so useful for Risk Analysis and Management in Finance and Trading?

It’s got a bunch of features.

But let’s focus on the ones that directly hit that risk problem.

- Integrated Risk Management:

This is huge.

In a big financial firm, risk isn’t just one thing.

You have market risk.

Credit risk.

Operational risk.

Compliance risk.

Strategic risk.

They’re all connected.

But traditionally, they’re managed in silos.

Different teams.

Different spreadsheets.

Different systems.

MetricStream pulls it all together.

It gives you a central place to identify, assess, manage, and monitor all these different types of risks.

It shows you how one risk event in one area might impact another.

Like, how a cyber attack (IT risk) could trigger operational failures (operational risk) leading to financial losses (market/credit risk) and regulatory penalties (compliance risk).

Seeing these connections is critical.

It’s not just managing individual risks.

It’s understanding the complex web of risk.

This integration is powered partly by AI, helping map those relationships automatically.

- AI-Powered Risk Identification & Assessment:

This is where the AI really earns its keep.

Identifying risks manually is slow.

And you often miss emerging threats.

MetricStream uses AI to scan vast amounts of data.

Internal data like incident reports, audit findings, trading data.

External data like news feeds, regulatory updates, social media sentiment (yes, even that can be a risk signal).

It looks for patterns.

Anomalies.

Things that look out of the ordinary.

It can flag potential risks automatically.

Before they become major problems.

For example, the AI might spot unusual trading patterns that could indicate fraud.

Or identify a cluster of minor operational failures that signal a bigger system issue.

It also helps with risk assessment.

Instead of just qualitative assessments (“High,” “Medium,” “Low”), the AI can help quantify potential impact based on historical data and predictive models.

This gives you a much clearer picture of your exposure.

- Automated Monitoring and Alerts:

Risk isn’t static.

It changes constantly.

New threats emerge.

Market conditions shift.

Keeping an eye on everything 24/7 is impossible for humans.

MetricStream automates this monitoring.

You set up key risk indicators (KRIs).

Performance indicators (KPIs).

Control effectiveness metrics.

The platform continuously tracks these.

And crucially, the AI can enhance this by learning what “normal” looks like and alerting you to deviations that matter.

When a KRI breaches a threshold?

Or when the AI detects something suspicious?

You get an alert.

Instantly.

This means you’re not finding out about a problem days or weeks later in a report.

You’re notified in near real-time.

Allowing you to react quickly.

This is essential in fast-moving environments like trading.

Faster reaction time means less potential damage.

Less loss.

Less regulatory heat.

Benefits of Using MetricStream for Finance and Trading

Okay, so those are some of the core features.

But what’s the payoff?

Why should anyone in Finance and Trading even care about MetricStream?

It boils down to a few critical things.

Things that directly impact the bottom line and your ability to sleep at night.

Massive Time Savings:

Let’s be real.

Risk Analysis and Management involves a ton of manual work.

Gathering data from disparate systems.

Putting it into spreadsheets.

Running calculations.

Writing reports.

Chasing people for sign-offs.

MetricStream automates large chunks of this.

Data collection.

Analysis.

Reporting.

Compliance mapping.

The AI features, in particular, cut down the time spent on sifting through data to find risks.

This isn’t just about saving hours.

It’s about freeing up highly-paid risk professionals.

So they can do actual Risk Analysis and Management.

Not just data entry and report formatting.

Improved Accuracy and Consistency:

Humans make mistakes.

Especially when dealing with complex, repetitive tasks involving huge datasets.

Typos in formulas.

Missed data points.

Inconsistent methodologies across teams.

MetricStream provides a standardized platform.

Data is centralised.

Calculations are automated and consistent.

Risk assessments follow defined workflows.

The AI reduces the chances of human error in identification and analysis.

This leads to more accurate risk data.

More reliable reporting.

And more confident decisions based on trustworthy information.

Enhanced Risk Visibility:

Can you see all your key risks in one place right now?

Across all departments?

Mapped against your strategic objectives?

Probably not easily.

MetricStream provides dashboards and reporting tools that give you a holistic view.

From a high-level overview for the board to detailed breakdowns for specific teams.

You can see concentrations of risk.

Emerging trends.

The effectiveness of your controls.

This visibility is powered by the integrated data and the AI’s ability to synthesise information.

It moves you from a reactive “firefighting” mode to a proactive, strategic risk management approach.

You can anticipate problems rather than just reacting to them.

Better Regulatory Compliance:

This is non-negotiable in Finance and Trading.

Fines for non-compliance are brutal.

Reputational damage can be even worse.

MetricStream is built with compliance in mind.

It helps you map risks and controls directly to specific regulatory requirements (like Basel III, SOX, GDPR, etc.).

It automates compliance monitoring.

It simplifies audits and reporting.

The AI can even help track changes in regulations and assess their impact on your risk posture.

This doesn’t just save you from fines.

It builds trust with regulators.

And your clients.

It’s a strong signal that you take risk and compliance seriously.

Improved Decision Making:

Ultimately, better Risk Analysis and Management leads to better decisions.

With accurate, real-time information.

With a clear view of potential risks and rewards.

You can make strategic choices with more confidence.

Whether it’s entering a new market.

Launching a new product.

Or adjusting your trading strategy.

MetricStream provides the data and insights to support these decisions.

Reducing uncertainty.

And increasing the likelihood of success.

The AI’s predictive capabilities add another layer, helping you foresee potential outcomes.

Pricing & Plans

Alright, let’s talk money.

How much does this thing cost?

This is where it gets a little less straightforward than your average AI content tool.

MetricStream isn’t a one-size-fits-all product with three simple pricing tiers on a website.

It’s an enterprise-level platform.

It’s modular.

Meaning companies pick and choose the specific applications they need.

Like Risk Management, Compliance Management, Audit Management, etc.

And the pricing is typically customized.

Based on the size of the organisation.

The specific modules implemented.

The number of users.

The level of support required.

The complexity of the implementation.

So, you won’t find a “Free Plan” or a “Pro Plan for $99/month” here.

This is a significant investment.

We’re talking potentially six or even seven figures annually for large financial institutions.

It’s not something a solo trader or a small advisory firm is going to pick up off the shelf.

Their target market is large banks, investment firms, insurance companies, and other major players in Finance and Trading.

For these companies, the cost is weighed against the immense cost of getting risk wrong.

Fines.

Losses.

Reputational damage.

Operational disruption.

Those costs can dwarf the price tag of a platform like MetricStream.

The ROI comes from reducing those potential losses.

Improving efficiency.

Enabling growth by managing risk effectively.

They typically offer trials or demos.

You’d talk to their sales team.

Go through a detailed needs assessment.

And they’d build a custom proposal.

Comparing it to alternatives?

Its main competitors are other enterprise GRC platforms.

Like ServiceNow GRC, RSA Archer, etc.

Each has its strengths and focuses.

MetricStream has been a leader in this space for a long time.

Their AI capabilities are a key differentiator they are pushing.

Especially how AI integrates across various risk types.

The pricing reflects the scale and complexity of the problems it solves.

It’s an investment in the core infrastructure of Risk Analysis and Management for serious players.

Hands-On Experience / Use Cases

Alright, enough with the features and benefits list.

What does this actually look like in the real world?

How do firms in Finance and Trading actually *use* MetricStream for Risk Analysis and Management?

Let’s run through a couple of scenarios.

Imagine a large investment bank.

They have trading desks all over the world.

Dealing in every asset class imaginable.

Managing market risk here is insane.

Volatility spikes.

Liquidity dries up.

Correlation models break down.

Traditionally, this involves complex value-at-risk (VaR) models, stress testing, scenario analysis.

All crunching massive amounts of historical and real-time data.

MetricStream comes in by integrating data feeds from all trading systems.

Market data providers.

Its AI capabilities can then analyse this data in real-time.

Spotting unusual trading activity that might signal a rogue trader.

Identifying potential concentrations of risk across different portfolios that might not be obvious.

Running faster, more dynamic stress tests based on predictive AI models.

It could alert the risk team instantly if a specific desk or portfolio is hitting exposure limits.

Or if market conditions suggest a sudden, sharp move is likely.

The AI can even suggest potential hedging strategies based on current risk levels and market outlook.

This isn’t just reporting risk.

It’s actively assisting in managing it.

Another use case: Operational risk.

Think about all the processes in a bank.

Account opening.

Transaction processing.

Customer service.

IT systems.

Each is a potential point of failure.

A breakdown can cause huge losses.

Or regulatory issues.

MetricStream helps map these processes.

Identify the risks associated with each step.

Implement and track controls (like requiring dual authorization for high-value transfers).

The AI can monitor internal systems.

Spot patterns in failed transactions.

Employee errors.

System outages.

It can predict which processes are most likely to experience issues based on historical data and current conditions.

This allows the bank to focus its resources on strengthening controls in the riskiest areas.

Preventing problems before they occur.

Not just reacting after a major operational failure.

Usability wise, it’s a complex platform.

It requires significant configuration and training.

It’s not plug-and-play.

But once implemented and tailored to a firm’s specific needs, users generally find it provides a unified, structured way to manage risk data and workflows.

The results?

Firms report faster risk assessments.

Reduced time spent on compliance reporting.

Improved ability to identify emerging risks.

And a clearer, more objective view of their overall risk posture.

Leading to fewer surprises.

And better protection against potential financial and reputational damage.

Who Should Use MetricStream?

So, is MetricStream for everyone?

Absolutely not.

Based on what we’ve covered, its target audience is pretty specific.

It’s built for organisations that face significant, complex, and interconnected risks.

And that need a robust, enterprise-wide system to manage those risks.

Specifically within Finance and Trading, here are the ideal user profiles:

Large Banks and Financial Institutions:

This is ground zero for MetricStream.

Global banks, national banks, regional banks.

They deal with every type of risk imaginable on a massive scale.

Market risk, credit risk, operational risk, liquidity risk, compliance risk, strategic risk, reputational risk, cyber risk.

They operate under intense regulatory scrutiny (Basel III, Dodd-Frank, etc.).

They need an integrated platform to manage all this.

MetricStream provides that central nervous system for Risk Analysis and Management.

Investment Firms and Asset Managers:

Firms managing large portfolios need sophisticated tools for market risk, credit risk, and liquidity risk.

They also face operational risks related to trading systems and custody.

And compliance risks related to client suitability, reporting, and market abuse.

MetricStream helps them monitor portfolios for risk breaches.

Ensure compliance with investment mandates and regulations.

And report risk exposures to investors and regulators.

Insurance Companies:

Insurers manage underwriting risk, investment risk, operational risk, and complex regulatory environments (like Solvency II).

MetricStream helps them model and manage these risks.

Ensure solvency.

And meet stringent reporting requirements.

Broker-Dealers:

Firms involved in trading securities face market risk, credit risk (counterparty risk), operational risk, and extensive regulatory obligations (FINRA rules, etc.).

MetricStream can help them monitor trading activity for potential misconduct.

Manage counterparty exposures.

And automate compliance checks.

Large Corporate Finance Departments (in non-financial companies):

Even large corporations in other sectors have significant financial risks (currency risk, interest rate risk, credit risk from customers).

They also have operational and compliance risks related to financial reporting (SOX).

MetricStream can be used to manage these financial and operational risks enterprise-wide.

Basically, if you’re a large organisation in Finance and Trading (or a large non-financial company with complex financial operations) where risk is intertwined across different functions, highly regulated, and poses a material threat to your existence if not managed properly, MetricStream is built for you.

If you’re a small firm or an individual trader?

This is overkill.

You need different tools.

MetricStream is for the heavyweights dealing with systemic risk and regulatory mountains.

How to Make Money Using MetricStream

This is a bit different for an enterprise platform like MetricStream.

You don’t typically “make money *using*” it in the same way you would with an AI content tool where you generate articles and sell them.

MetricStream is an internal system.

A core piece of infrastructure for managing operations and risks.

So, how do organisations using it “make money” or benefit financially?

It’s about enabling and protecting revenue, not directly generating it from the tool itself.

- Reducing Losses from Risk Events:

This is the most direct financial impact.

Better Risk Analysis and Management means fewer bad things happen.

Fewer operational failures that halt trading or processing.

Fewer instances of fraud or misconduct.

Better management of market and credit exposures reduces unexpected losses.

Preventing a single major risk event (like a trading blow-up or a massive cyber attack) can save a company tens or hundreds of millions, or even billions.

That’s money kept in the bank.

Which is just as good as making it.

- Avoiding Regulatory Fines and Penalties:

Regulatory bodies hit financial firms HARD for non-compliance.

Fines run into the millions regularly.

Sometimes billions.

MetricStream helps ensure compliance processes are robust and traceable.

It provides the audit trails regulators demand.

By preventing regulatory breaches, MetricStream saves the company huge sums in potential fines.

And avoids the associated legal costs and management distraction.

- Improving Operational Efficiency:

Automating Risk Analysis and Management tasks saves time and resources.

Risk teams spend less time on manual data collection and reporting.

Compliance teams can manage more regulations with the same staff.

Audit cycles can be faster and more effective.

This leads to lower operational costs.

Those cost savings directly contribute to the company’s profitability.

Essentially, you do more with less.

- Enabling Strategic Growth:

Effective Risk Analysis and Management isn’t just about preventing bad things.

It’s also about taking smart risks.

MetricStream gives management the confidence to pursue new opportunities.

Enter new markets.

Develop new products.

Because they have a clear understanding of the risks involved and the controls in place to manage them.

This ability to confidently pursue growth initiatives directly drives revenue and profit.

You can move faster than competitors who are bogged down by uncertainty or manual processes.

So, while you don’t sell a service “powered by MetricStream” in the same way you might sell articles generated by a language model, the financial benefits come from increased resilience, reduced costs, and the ability to pursue profitable opportunities with a clear view of the associated risks.

It’s about protecting and growing the core business.

Not a side hustle.

Limitations and Considerations

Okay, let’s pump the brakes a little.

No tool is perfect.

MetricStream is powerful, sure.

But it has limitations.

Especially in the context of using AI for Risk Analysis and Management.

Here’s what you need to keep in mind:

Implementation Complexity:

This isn’t a simple download and install.

Deploying an enterprise GRC platform like MetricStream is a major project.

It requires significant planning.

Integration with existing systems (trading platforms, HR systems, IT systems, etc.).

Configuration to match your specific risk frameworks, policies, and workflows.

Training for staff across different departments.

It can take months, sometimes over a year, to get it fully up and running and delivering value.

It’s a heavy lift.

Data Quality is Paramount:

MetricStream, and especially its AI features, are only as good as the data you feed them.

Garbage in, garbage out.

If your source systems have inconsistent or inaccurate data, the risk insights and AI predictions will be flawed.

Cleaning and standardising data from disparate sources is often the biggest challenge in these projects.

Don’t expect miracles if your underlying data infrastructure is a mess.

Requires Expert Oversight:

The AI capabilities can identify patterns and anomalies.

But they don’t replace human expertise.

Risk professionals are still needed to interpret the findings.

Validate the AI’s output.

Apply judgement based on context that the AI might miss.

Define the risk appetite.

Design effective controls.

The tool supports decision-making.

It doesn’t make the decisions for you.

You still need skilled analysts and managers.

Cost:

As discussed, this is not cheap.

The initial implementation costs are high.

Ongoing licensing fees are substantial.

You also need to factor in the cost of internal resources to manage the platform and external consultants for implementation and support.

It’s an investment suitable only for organisations with the budget and the scale of risk to justify it.

Integration Challenges:

While MetricStream is designed for integration, actually connecting it to legacy systems in a large financial institution can be tricky.

Older systems may not have modern APIs.

Data formats may be incompatible.

This requires significant effort and technical expertise.

AI “Black Box” Concerns:

Some AI models can be difficult to interpret.

They might flag a risk, but it’s not always easy to understand *why* the AI made that assessment.

In a regulated environment like Finance and Trading, being able to explain *why* a decision was made or a risk was flagged is crucial.

Regulators demand explainability.

While MetricStream is working on explainable AI features, it’s a general challenge with complex AI models.

So, it’s a powerful tool, but it requires significant commitment, investment, and internal expertise to implement and use effectively.

It won’t magically solve your risk problems overnight.

Final Thoughts

So, where do we land on MetricStream for Risk Analysis and Management in Finance and Trading?

Look, the world of Finance and Trading is getting faster, more complex, and riskier.

Regulation isn’t easing up.

Threats are constantly evolving.

Trying to manage all this with old-school methods – spreadsheets, manual processes, siloed systems – is a losing game.

You’ll miss things.

You’ll be slow to react.

You’ll burn out your best people.

And eventually, you’ll get hit.

Hard.

MetricStream represents the shift towards a more intelligent, integrated, and automated approach to GRC, particularly Risk Analysis and Management.

It’s an enterprise-grade solution designed for the heavy lifting required in highly regulated industries.

Its strength lies in bringing all your risk data into one place.

Automating monitoring and analysis.

And using AI to spot risks that humans might overlook.

It’s not a cheap fix.

It’s a significant investment.

It requires commitment and effort to implement.

But for large financial institutions drowning in risk data and regulatory requirements?

It offers a lifeline.

The potential benefits – reduced losses, avoided fines, improved efficiency, and enabling strategic growth – are substantial.

It allows risk professionals to move from being data processors to strategic advisors.

Using the AI-powered insights to make better decisions.

To be proactive rather than reactive.

My recommendation?

If you’re part of a large financial organisation struggling with fragmented risk management processes, drowning in manual tasks, and worried about missing critical threats or failing audits…

You need to look at platforms like MetricStream.

It’s not just an AI tool.

It’s a fundamental shift in how you approach Risk Analysis and Management.

It’s complex, yes.

It’s expensive, yes.

But the cost of *not* managing risk effectively in Finance and Trading is simply too high.

MetricStream is built to help you tackle that head-on.

It’s why more big players are turning to it.

It’s the smart move for serious Risk Analysis and Management in 2024 and beyond.

Visit the official MetricStream website

Frequently Asked Questions

1. What is MetricStream used for?

MetricStream is primarily used for Governance, Risk, and Compliance (GRC) management in large organisations.

In Finance and Trading, its key use is for integrated Risk Analysis and Management, helping firms identify, assess, monitor, and mitigate various types of risks (market, credit, operational, compliance, etc.) using a unified platform and AI capabilities.

2. Is MetricStream free?

No, MetricStream is not free.

It is an enterprise-level software platform with custom pricing based on the size of the organisation, the modules needed, and implementation complexity.

It’s a significant investment suitable for large companies, not individuals or small businesses.

3. How does MetricStream compare to other AI tools?

MetricStream isn’t a simple AI tool like a content generator or image creator.

It’s a comprehensive GRC platform that *incorporates* AI within its risk management workflows.

It competes with other enterprise GRC suites like ServiceNow GRC or RSA Archer, differentiated by its deep focus on integrated risk management and specific AI applications for risk analysis and monitoring.

4. Can beginners use MetricStream?

MetricStream is not designed for beginners in the general sense.

It is a complex enterprise platform requiring significant configuration and training.

Users typically need to be professionals within risk, compliance, audit, or IT departments of large organisations, receiving specific training on the platform.

5. Does the content created by MetricStream meet quality and optimization standards?

MetricStream doesn’t “create content” in the way a large language model does (like writing articles). Its “output” is primarily risk data analysis, reports, dashboards, and alerts.

The quality and accuracy of its output depend heavily on the quality of the data fed into it and the configuration of the system.

When properly implemented and maintained with good data, it provides high-quality, accurate risk analysis that meets regulatory and internal standards.

6. Can I make money with MetricStream?

You don’t directly “make money” by using MetricStream as an individual service provider selling output.

For organisations, the financial benefit comes from cost savings (avoiding fines, improving efficiency) and revenue protection (reducing losses from risk events, enabling confident strategic growth).

It helps the business make money by managing risks effectively, not as a direct revenue-generating tool itself.