Interactive Brokers is an AI tool revolutionising Retail and Institutional Trading Platforms. Streamline your workflow and boost efficiency today!

Why Interactive Brokers Is a Game-Changer in Retail and Institutional Trading Platforms

You’re in Finance and Trading.

You see AI everywhere.

Everyone’s talking about it.

But how does it actually help *you*?

Especially when it comes to Retail and Institutional Trading Platforms?

Trading is complex.

It’s fast-paced.

It demands precision.

And it chews up time.

Finding edges, executing trades, managing risk.

It’s a grind.

Manual processes? Forget about it.

You need something smarter.

Something that gives you an edge.

Enter Interactive Brokers.

This isn’t just another platform.

It’s an AI-powered beast.

Built for people like you.

People serious about trading.

Whether you’re running a massive fund or trading from your home office.

Interactive Brokers aims to change how you operate.

It’s designed to make trading less about the busywork.

And more about the strategy.

Less stress, more results.

Stick around.

I’ll show you why this tool is a big deal.

And how it could seriously upgrade your trading game.

Table of Contents

- What is Interactive Brokers?

- Key Features of Interactive Brokers for Retail and Institutional Trading Platforms

- Benefits of Using Interactive Brokers for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Interactive Brokers?

- How to Make Money Using Interactive Brokers

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Interactive Brokers?

So, what exactly is Interactive Brokers?

Think of it as a super-brokerage platform.

It’s been around for a while, building a reputation.

But it’s not just a standard trading platform.

It incorporates advanced tools.

Stuff powered by artificial intelligence and sophisticated algorithms.

It serves a massive range of clients.

From individual traders like you.

To massive hedge funds and institutional players.

Its core function is to give you access.

Access to global markets.

Access to a huge range of assets.

And access to serious trading technology.

It’s not built for simple ‘buy and hold’ investors, although you can do that.

It’s for active traders.

People who need speed, data, and analysis.

People who need the tools to make split-second decisions.

And execute them efficiently.

The platform integrates market data.

Analysis tools.

And sophisticated order types.

It pulls all this together.

The AI part isn’t some separate chatbot.

It’s woven into the platform itself.

Helping with things like risk management suggestions.

Identifying potential trading opportunities.

And optimising trade execution.

It’s about providing intelligence.

Not just a place to click ‘buy’.

It aims to be a one-stop shop.

Connecting traders to exchanges worldwide.

And giving them the firepower to compete.

Whether you’re trading stocks, options, futures, forex, or bonds.

Interactive Brokers has the instruments.

And the tools to trade them seriously.

It’s built for volume.

It’s built for speed.

And increasingly, it’s built with smart tech.

That tech aims to make your trading smarter too.

It’s designed to handle the heavy lifting.

Leaving you to focus on strategy and execution.

Which is where the real money is made.

Not in clicking buttons or watching screens all day.

It’s about having the right insights.

At the right time.

And executing flawlessly.

That’s what Interactive Brokers tries to deliver.

For both the small-time trader and the big leagues.

It’s the tech layer behind your trading decisions.

A powerful engine for your trading strategies.

Simplifying complexity.

Boosting efficiency.

And aiming for better results.

That’s the promise.

And for many, it delivers.

Making it a go-to for serious players.

Key Features of Interactive Brokers for Retail and Institutional Trading Platforms

Alright, let’s get into the guts of it.

What does Interactive Brokers actually *do* for Retail and Institutional Trading Platforms?

It’s got a boatload of features.

But let’s focus on the ones that really matter.

The ones that leverage tech to make your trading life easier.

- Advanced Trading Platforms (TWS):

This is their main trading platform, the Trader Workstation (TWS).

It’s not some web browser toy.

It’s a professional-grade desktop application.

Packed with tools.

Real-time data.

Charting packages.

Scanning tools.

Order entry flexibility that’s insane.

For institutional traders, this is standard kit.

For retail traders, it gives you access to the same tools the pros use.

It helps with things like algorithmic trading setup.

Complex option strategy building.

And lightning-fast order execution.

It’s designed for performance and customisation.

You can set up your workspace exactly how you need it.

See the data you need.

And execute trades without messing around.

This significantly streamlines trading operations.

Reducing potential errors.

And freeing up time.

Time you can spend thinking, not clicking.

- AI-Powered Risk Management:

Trading is all about risk.

Manage it well, you survive.

Manage it poorly, you blow up.

Interactive Brokers has built-in risk management tools.

Stuff that goes beyond just showing you your margin.

Their Probability Lab and Risk Navigator are serious tools.

They use quantitative analysis.

And yes, AI elements come into play here.

They help you understand the potential impact of market moves on your portfolio.

They can model different scenarios.

Show you stress tests.

And help you adjust positions proactively.

For institutional clients, integrated risk reporting is crucial.

IB delivers this.

For retail traders, it’s about getting alerts.

Understanding your exposure across different asset classes.

And making data-driven decisions about reducing risk.

This isn’t just some basic stop-loss.

It’s a holistic view of your portfolio risk.

Helping you avoid those nasty surprises.

It’s the platform watching your back.

Using data to highlight potential dangers.

Before they bite you.

- Algorithmic Trading and APIs:

This is where the real power for serious traders lies.

IB supports automated trading strategies.

You can build and test your own algorithms.

Or use their library of built-in algos.

Things like “Adaptive Algo” which aims for the best price and timing.

Or algos designed to work large orders without disrupting the market.

This is essential for institutional trading.

But increasingly accessible to retail traders with programming skills.

They offer APIs (Application Programming Interfaces).

This lets you connect your own trading software.

Your own models.

Your own AI strategies.

Directly to their execution system.

This opens up huge possibilities.

Building proprietary strategies.

Integrating market signals from other sources.

Automating complex order sequences.

It turns the platform into a launchpad for your own trading intelligence.

This level of automation saves massive amounts of time.

Removes emotional decision-making from execution.

And allows you to scale your trading activity.

It’s the engine for high-frequency trading.

And systematic strategies.

Making IB a serious tool for serious players.

This access to robust APIs is a huge differentiator.

It allows for a deep integration.

Making the platform truly programmable.

It’s the key to unlocking advanced trading techniques.

Techniques previously only available to the big boys.

Now accessible to anyone willing to learn and build.

This isn’t just a trading account.

It’s a development environment.

For your trading business.

Powerful stuff.

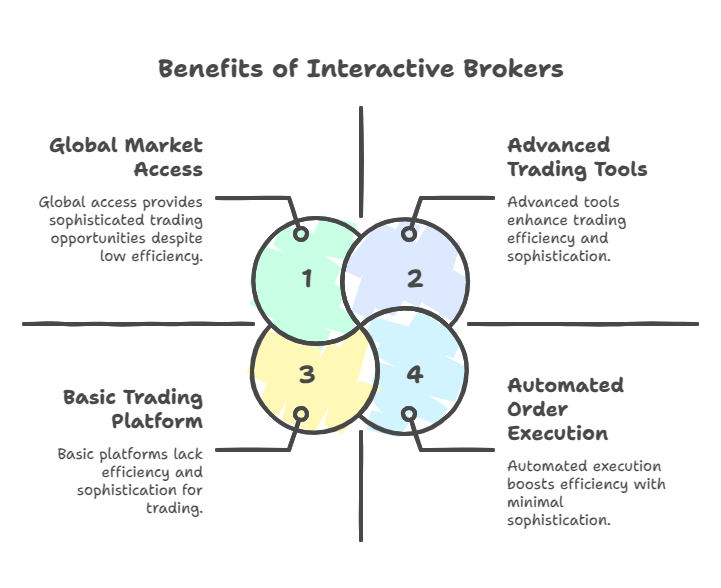

Benefits of Using Interactive Brokers for Finance and Trading

Okay, so what’s the payoff?

Why should you care about Interactive Brokers for Finance and Trading?

It boils down to a few key things.

Things that directly impact your bottom line and your sanity.

First off, **efficiency**.

Trading is time-sensitive.

A few seconds can mean missed opportunities or losses.

Interactive Brokers’ platform is built for speed.

Fast data feeds.

Quick order entry.

Reliable execution.

The automation features mean you’re not manually clicking buttons.

Your algos are working while you sleep (or think about your next move).

This saves you hours.

Hours you’d otherwise spend monitoring, calculating, and executing.

It frees you up to do higher-value tasks.

Like research, strategy development, and analysis.

Next, **access**.

IB gives you access to global markets from a single account.

Stocks in the US, UK, Europe, Asia.

Options, futures, forex, bonds, funds.

Trading across different asset classes and geographies diversifies your opportunities.

It lets you follow the money wherever it goes.

Without needing multiple accounts with different brokers.

This simplifies your operations massively.

Especially for institutional players or active retail traders with broad strategies.

Then there’s **sophistication**.

The tools aren’t basic.

They’re professional-grade.

The risk management suite is top-tier.

The analytical tools are deep.

The AI elements provide intelligent prompts and insights.

It helps you make more **informed decisions**.

Based on data and analysis, not just gut feeling.

This leads to potentially **better results**.

By reducing emotional mistakes.

Improving execution quality.

And giving you a clearer picture of market conditions and risk.

For retail traders, it’s about levelling the playing field.

Getting access to tools the pros use.

For institutional traders, it’s about having a robust, reliable, and powerful platform.

One that can handle massive volume and complex strategies.

And let’s not forget **cost efficiency**.

Interactive Brokers is known for its low commissions.

Especially for active traders.

Lower trading costs mean more of your profits stay with you.

Over time, this adds up big time.

The technology also reduces the need for manual processes.

Which can save on operational costs for funds and institutions.

It’s about getting more done.

With less effort.

And at a lower cost per trade.

That’s a win-win.

Ultimately, the benefit is about having a serious tool.

A tool that supports serious trading goals.

It removes friction.

Adds intelligence.

And provides the firepower you need to compete.

Whether you’re trading a few thousand or a few billion.

It scales with you.

And provides the infrastructure for consistent trading performance.

That’s a powerful benefit.

One that translates directly to your potential success.

Pricing & Plans

Alright, let’s talk money.

How much does this powerful thing cost?

Interactive Brokers isn’t like some free trading apps you see advertised everywhere.

It’s a professional-grade platform.

And the pricing reflects that.

But here’s the kicker: for what you get, it’s often very competitive.

Especially for active traders.

They have a couple of main pricing structures for commissions: Tiered and Fixed.

**Tiered** pricing decreases as your trading volume increases.

This is where serious traders save money.

The more you trade, the lower your per-share or per-contract cost.

This includes exchange, regulatory, and clearing fees passed through.

**Fixed** pricing is a set, low commission per share or contract.

It’s simpler and predictable.

Good for those who trade less frequently or want simplicity.

You choose the plan that fits your trading style and volume.

For **retail traders**, the commission structure is generally low.

Often cheaper than many mainstream brokers, especially for options and futures.

There’s no minimum account balance required for a Lite account, but Pro accounts have minimums to unlock lower commission tiers and advanced features.

Data subscriptions cost extra.

If you need real-time, level II data from specific exchanges, you pay for it.

This is standard for professional data feeds.

For **institutional clients**, pricing is tailored.

Based on volume, services needed, and custom setups.

They deal with things like prime brokerage services.

Fund administration tools.

And custom API integrations.

The cost scales significantly depending on the size and complexity of the institution.

Compared to other institutional platforms, IB is often seen as cost-effective.

They also have platform fees.

For certain platforms or low activity, there might be fees.

But these are often waived if you maintain a certain account balance or generate enough commissions.

They are transparent about these fees.

You need to check their site for specifics.

Because it varies based on account type, assets, and trading volume.

Is there a “free” plan?

Not in the sense of zero commissions on everything like some apps.

The Lite account offers commission-free trading on US stocks and ETFs.

But the real power of IB, the advanced features and AI tools, comes with the Pro account.

Which has its tiered commission structure.

So, you’re paying for the speed, the access, the data, and the tools.

Think of it as paying for performance infrastructure.

If you’re serious about trading, the cost is an investment.

An investment in a platform that gives you an edge.

Instead of being squeezed by high commissions elsewhere.

Or limited by basic tools.

You need to do the maths based on your trading volume and style.

But for active participants in the market, IB’s pricing is often a significant advantage.

It’s built to reward active trading.

Which is exactly who the platform is designed for.

You’re paying for serious capability.

Not just a pretty interface.

And that’s worth considering.

Hands-On Experience / Use Cases

Okay, enough theory.

How does this actually work in practice?

Let’s talk about using Interactive Brokers for Retail and Institutional Trading Platforms.

Imagine you’re a retail options trader.

You use TWS (Trader Workstation).

You pull up an option chain.

It’s showing real-time Greeks, implied volatility, and market depth.

You can model multi-leg strategies visually.

The Probability Lab helps you see the statistical chances of your strategy being profitable at expiry.

You can input potential price movements and see the impact on your P&L and Greeks in real-time.

That AI-powered risk analysis?

It’s running in the background.

If you’re about to put on a position that exposes you to too much delta or gamma risk based on your portfolio size, the platform can warn you.

It’s not just saying “high risk”.

It’s showing you *why* and *how much*.

It might suggest hedges or alternative strategies.

When you place the trade, you can use an algorithmic order type.

Say, a “Limit If Touched” order combined with a “Scale” algo.

This automatically breaks up a large order.

Executes chunks at improving prices as the market moves.

Minimising market impact.

And aiming for a better average price.

You set it up once.

The algo handles the complex execution.

Saving you from watching the screen constantly and manually placing multiple orders.

For an **institutional fund manager**, the use case scales up.

They might use the IB API to connect their proprietary quantitative models.

Their models generate trade signals.

The API sends these signals directly to the IB execution engine.

Trades are placed automatically.

Using IB’s sophisticated routing technology to find the best price across multiple exchanges globally.

The fund needs to trade a massive block of shares without moving the market.

They use a complex algo like the “VWAP” (Volume Weighted Average Price) algo.

You tell the system how many shares to trade and over what time period.

The algo automatically releases small chunks of the order throughout the day.

Following the historical volume profile of the stock.

Minimising footprint.

And aiming to execute near the day’s VWAP.

This is heavy-duty automation.

Impossible to do manually.

IB also provides consolidated reporting across all positions and asset classes.

Essential for institutional compliance and portfolio monitoring.

The risk tools aggregate exposure across different strategies and markets.

Giving a birds-eye view of total portfolio risk.

This automated risk reporting is critical for fund operations.

In both cases – the retail options trader and the institutional fund – the platform is doing the heavy lifting.

Providing sophisticated analysis.

Automating complex tasks.

And offering intelligent insights.

The usability of TWS can seem daunting at first.

It’s not the prettiest interface.

It’s built for function and speed.

There’s a learning curve.

But once you figure it out, it’s incredibly powerful and customisable.

The results?

For active traders, it means tighter spreads, better execution prices, and the ability to implement strategies that require speed and complexity.

For institutions, it’s the infrastructure to run sophisticated strategies at scale.

Efficiently and reliably.

That’s the real-world impact.

It’s about enabling advanced trading.

And automating the process.

So you can focus on finding those profitable opportunities.

And letting the platform handle the rest.

It’s a significant upgrade from basic trading setups.

Whether you’re trading £10k or £10 million.

Who Should Use Interactive Brokers?

Is Interactive Brokers for everyone?

Probably not.

If you just want to buy shares of Apple and hold them for 20 years, it might be overkill.

Or slightly cheaper elsewhere with a simpler app.

But if you’re serious about trading, this is for you.

Here’s who really benefits:

**Active Retail Traders:** People who trade frequently. Daily, weekly, or multiple times a week.

You’re trading more than just US stocks.

You use options, futures, forex, or trade globally.

You need serious tools for charting, analysis, and order entry.

You want low commissions because they eat into your profits fast with volume.

You value speed and reliability.

You are willing to learn a powerful platform.

**Professional Traders:** Individuals trading their own capital full-time.

This is your business.

You need the best possible execution.

Access to advanced order types and algos.

Robust risk management.

And detailed reporting.

You might be using quantitative strategies.

Or needing direct market access (DMA).

IB provides the infrastructure for this.

**Hedge Funds and Asset Managers:** This is a core target market for IB.

They need to manage large pools of capital.

Trade a wide variety of instruments globally.

Implement complex strategies, often algorithmic.

Require prime brokerage services (financing, clearing, reporting).

Need reliable, scalable technology that integrates with their systems via APIs.

Rigorous compliance and risk management are non-negotiable.

IB is built to handle this institutional scale and complexity.

**Financial Advisors and Wealth Managers:** Professionals managing client portfolios.

They need a platform that can handle multiple accounts.

Provide sophisticated portfolio management tools.

Offer a wide range of investment products.

And handle rebalancing and reporting efficiently.

IB’s Advisor platform is specifically designed for this.

Allowing them to manage client money effectively and compliantly.

**Developers and Quants:** People building automated trading systems.

If you’re writing code to trade.

Building AI models for market prediction.

Or backtesting strategies with historical data.

The IB API is a key piece of infrastructure.

It lets you connect your code to live market data and execution.

Making it a playground for algorithmic trading development.

In short, if you see trading as more than a hobby.

If you need serious tools, speed, and access.

If you trade actively or manage significant capital.

Interactive Brokers is likely a strong fit.

It requires some effort to learn.

But the payoff in capability is significant.

It’s for those who are serious about getting an edge in the market.

Using technology to trade smarter.

Not just harder.

How to Make Money Using Interactive Brokers

Okay, the big question.

How does Interactive Brokers help you actually *make money*?

It’s not a magic money machine.

You still need a trading strategy that works.

But it gives you the tools to execute that strategy effectively.

And in some cases, unlock new ways to generate income.

Here’s how:

- Improved Trading Performance:

This is the most direct way.

The platform’s speed and execution quality mean you get filled at better prices.

Over hundreds or thousands of trades, this adds up.

Lower commissions directly reduce your costs.

Leaving more profit on the table.

The advanced tools like charting, scanning, and analytics help you identify better trading opportunities.

The AI risk management helps you avoid big losses.

Protecting your capital is just as important as making gains.

These factors combined contribute to potentially higher profitability over time.

It helps you trade your strategy more effectively.

- Algorithmic Trading and Automation:

If you can develop or acquire profitable trading algorithms.

IB provides the platform to deploy them.

Automated strategies can trade 24/7 in global markets.

Reacting to market conditions faster than any human.

They can execute complex strategies that would be impossible manually.

This allows you to scale your trading volume and potentially generate income from multiple strategies simultaneously.

This requires skill in programming or quant finance.

But the infrastructure is there.

**Example:** A quantitative trader develops an algorithm that exploits tiny price discrepancies between related assets (arbitrage). They connect it to IB via the API. The algo identifies opportunities and executes trades in milliseconds across different exchanges, generating small profits on each trade, which add up due to high volume.

- Providing Services Based on IB:

If you master the platform, you can offer services to others.

**Service 1: Algorithmic Trading Development:** You can build custom trading algorithms for other traders or small funds using the IB API.

Your expertise in connecting strategies to the platform is valuable.

Clients pay you for the development and implementation of their ideas or strategies.

**Service 2: Managed Accounts:** If you have a track record of profitable trading.

You can become a money manager on the IB platform.

Using their Advisor platform.

Clients can grant you power of attorney to trade their accounts.

You earn management fees (a percentage of assets) and potentially performance fees (a percentage of profits).

This leverages your trading skill into a business.

**Service 3: Trading Education and Consulting:** Teach others how to use the advanced features of TWS.

Explain the risk tools, the algos, the charting package.

Many retail traders struggle with the platform’s complexity.

You can offer courses, webinars, or one-on-one coaching.

Showing them how to unlock the power of IB.

Your expertise becomes a valuable product.

**Client Acquisition Opportunities:**

Using a reputable, institutional-grade platform like IB can give you credibility.

If you’re running a small fund or managing client money.

Being on IB shows you are using serious infrastructure.

This can make it easier to attract sophisticated clients.

They trust the technology behind the operations.

Making money with IB is about using its power.

Either to enhance your own trading profits.

Or to build a business around the services it enables.

It provides the foundation.

You build the structure on top.

Limitations and Considerations

Nothing is perfect, right?

Interactive Brokers is powerful, but it has its quirks and potential downsides.

You need to know these before you jump in.

**Complexity:** This is probably the biggest hurdle for retail traders.

The Trader Workstation (TWS) is feature-rich.

It’s also dense.

It can feel overwhelming when you first open it.

There’s a definite learning curve to navigate all the menus, windows, and settings.

It’s not as intuitive as some beginner-focused mobile trading apps.

You’ll need to invest time to learn how to use its full potential.

**Not Ideal for Casual Investors:** If you just want to buy a few stocks and hold them for years.

And you don’t plan on trading options, futures, or foreign markets.

Interactive Brokers might be more platform than you need.

Simpler brokers with user-friendly apps might be a better fit.

The commission structure, while low for active traders, might not be the absolute lowest for infrequent stock trading (though their Lite plan addresses this partly).

**Data Fees:** Real-time market data costs money.

While Interactive Brokers commissions are low, the monthly fees for comprehensive data packages can add up.

Especially if you need data from multiple exchanges globally.

You need to factor this into your overall trading costs.

Free delayed data is available, but serious traders need real-time feeds.

**Customer Service:** While Interactive Brokers has improved over the years, some users still report mixed experiences with customer support.

Given the complexity of trading issues, getting timely and knowledgeable help is crucial.

This can be a point of frustration for some.

Especially compared to brokers known for their hand-holding support.

**Account Minimums (for Pro Features):** To access the full power of the Pro platform, including margin rates and lower commission tiers, there might be account minimum requirements.

This can be a barrier for traders starting with very small capital.

Though the Lite account is an entry point.

**Focus on Active Trading:** The platform is optimised for active traders.

Features like research reports and educational content are available.

But the core strength and focus are on execution, tools, and data for active market participation.

If you need extensive hand-holding research and educational materials, other brokers might be more aligned.

**Not Always the Absolute Cheapest for *Every* Asset:** While known for low costs, especially on options and futures, it’s always worth comparing specific asset class commissions with other brokers, particularly local ones if you trade specific regional markets heavily.

These aren’t dealbreakers for the right user.

But they are important considerations.

You need to assess if the power and features outweigh the complexity and potential costs for your specific trading needs.

It’s a tool built for a specific purpose.

And it excels at that purpose.

But Interactive Brokers demands a certain level of commitment from the user.

To learn it and use it effectively.

Final Thoughts

So, wrapping this up.

Interactive Brokers is a serious player in the Finance and Trading world.

Especially when it comes to powering Retail and Institutional Trading Platforms.

It’s not just another broker.

It’s a technology platform.

Loaded with tools, data, and capabilities.

The integration of advanced features, including elements of AI-powered analysis and automated execution, sets it apart.

It gives active retail traders access to the kind of tools traditionally reserved for institutions.

And it provides institutions with the robust, scalable infrastructure they need to operate globally.

The benefits are clear: improved efficiency, better access to global markets, sophisticated risk management, and the potential for enhanced trading performance.

The low commission structure for active traders is a significant draw.

But it’s not without its challenges.

The complexity of the platform requires dedication to learn.

And you need to factor in data fees.

However, for anyone serious about trading.

Whether you’re managing your own capital actively or running a fund.

The capabilities of Interactive Brokers are tough to beat.

It’s the infrastructure that enables advanced strategies.

Automates the mundane tasks.

And provides the data and analysis needed for intelligent decision-making.

If you’re currently using a simpler platform and feeling constrained.

Or if you’re looking to scale your trading operations.

Interactive Brokers is definitely worth a serious look.

It’s an investment in your trading future.

Providing the engine to drive your trading success.

Is it the right tool for you?

If you value power, speed, broad market access, and sophisticated tools over simplicity and hand-holding.

Then yes.

It’s a game-changer.

Ready to see it for yourself?

Visit the official Interactive Brokers website

Frequently Asked Questions

1. What is Interactive Brokers used for?

Interactive Brokers is used for trading a wide range of financial instruments globally, including stocks, options, futures, forex, bonds, and funds. It’s designed for active traders and institutions needing advanced tools, low commissions, and global market access.

2. Is Interactive Brokers free?

Interactive Brokers is not entirely free. They offer competitive, low commissions, especially for active traders, under tiered or fixed plans. There might be fees for data subscriptions or inactivity, but costs are often lower than competitors for frequent trading.

3. How does Interactive Brokers compare to other AI tools?

Interactive Brokers isn’t an AI content generator or marketing tool. It’s a trading platform that incorporates AI elements for tasks like risk analysis, optimal order execution, and identifying trading opportunities. It compares to other brokerage platforms by offering more advanced tools and global access, often at lower costs for active trading.

4. Can beginners use Interactive Brokers?

Beginners *can* use Interactive Brokers, especially with their Lite account for US stocks. However, the full Trader Workstation (TWS) platform is complex and designed for experienced traders. Beginners should be prepared for a significant learning curve to use its advanced features effectively.

5. Does the content created by Interactive Brokers meet quality and optimization standards?

Interactive Brokers doesn’t “create content” like text or articles. It provides market data, analysis, and trading tools. The quality and optimisation of trading results depend on the user’s strategy, risk management, and skill in using the platform’s capabilities.

6. Can I make money with Interactive Brokers?

Yes, you can make money using Interactive Brokers by successfully trading financial markets. The platform’s low costs, fast execution, and advanced tools can help improve trading performance. You can also potentially earn money by developing automated strategies or offering services like money management or trading education based on the platform.