eToro helps Retail and Institutional Trading Platforms thrive with AI. Simplify workflows, boost efficiency, and make smarter decisions. Try eToro today!

Here’s What Happened When I Tried eToro for Retail and Institutional Trading Platforms

Alright, let’s talk about AI in finance.

It’s everywhere now, right?

Everyone’s trying to figure out how to use it.

Especially in trading.

Retail guys, big institutions – they’re all looking for an edge.

And honestly, it can feel overwhelming.

So, I looked into eToro.

Specifically, how it fits into the Finance and Trading space.

And more precisely, for Retail and Institutional Trading Platforms.

Because that’s where the real work happens, right?

Managing platforms, making decisions, trying not to screw it up.

Could eToro actually make a difference?

That’s what I wanted to find out.

Stick around, I’ll show you what I found.

Table of Contents

- What is eToro?

- Key Features of eToro for Retail and Institutional Trading Platforms

- Benefits of Using eToro for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use eToro?

- How to Make Money Using eToro

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is eToro?

Okay, first things first. What even is eToro?

At its core, eToro is a social trading and multi-asset brokerage company.

Think of it as a platform where you can trade various financial instruments.

We’re talking stocks, crypto, commodities, currencies, all that good stuff.

But it’s not just a place to buy and sell.

They built this whole social layer on top.

You can see what other traders are doing.

You can follow them.

You can even copy their trades automatically.

That’s where the “social” part comes in.

It’s designed for both people just starting out and those with more experience.

It aims to make trading more accessible and less intimidating.

Especially for retail traders who might not have years of experience.

They’ve been around for a while, building out their platform.

Adding more assets, more features.

And yes, they’re also leaning into technology, including AI concepts, to improve the trading experience.

Their goal?

To simplify trading and investing.

Make it something anyone can potentially get involved in.

And provide tools to help users make more informed choices.

It’s not strictly an “AI tool” in the same way some content generators are.

It’s a trading platform that uses technology, including algorithms and AI-driven features in certain areas, to enhance its offering.

The focus is on trading platforms, making them user-friendly and powerful.

Whether you’re trading a few stocks or managing a more complex portfolio.

They want to be your go-to.

That’s the basic rundown of what eToro is.

Now, let’s dig into what it actually does for trading platforms.

Key Features of eToro for Retail and Institutional Trading Platforms

Alright, let’s break down the features that actually matter for trading.

Especially for those managing platforms, big or small.

- CopyTrader Feature: This is probably eToro’s most famous feature. It lets you automatically copy the trades of successful investors on the platform. How does this help Retail and Institutional Trading Platforms? For retail users, it’s a way to get started without deep market knowledge. You can learn by observing and replicating. For institutions, while they won’t *copy* retail traders, the underlying technology and data analysis that identifies these “Popular Investors” uses sophisticated algorithms. Understanding this data can offer market insights or inform strategies, although institutions have their own complex systems. But for platforms serving retail clients, offering CopyTrader is a massive draw. It simplifies a core part of trading – deciding what to buy or sell. Instead of hours of research, you find a trader whose strategy you like and click copy. It’s a direct way to access diverse strategies.

This saves a ton of time.

Reduces the learning curve significantly.

And potentially boosts user engagement on a platform that offers this.

- Smart Portfolios: This is where eToro really starts leaning into more sophisticated, almost AI-driven strategies. Smart Portfolios are pre-made, thematic investment strategies. They are essentially collections of assets bundled together around a specific theme, like renewable energy, cryptocurrency, or even portfolios based on the collective wisdom of top traders. These portfolios are created and rebalanced by eToro’s investment committee using data and algorithms. For trading platforms, offering access to these can be a major value proposition. It provides users with diversified, professionally managed strategies without needing to build them from scratch.

This feature targets both retail investors looking for simpler diversification and potentially smaller institutions or wealth managers using the platform for clients.

It takes the guesswork out of asset allocation for specific market segments.

Think of it as a curated investment product.

It’s built on data-driven decisions.

And it’s designed to save users the effort of researching and constructing these portfolios themselves.

- User-Friendly Interface and Tools: Okay, this might sound basic, but it’s huge for trading platforms. A clunky, confusing platform kills engagement. eToro puts a lot of effort into making its interface intuitive. This includes simple navigation, clear charts, accessible research tools, and easy execution of trades. For platform management, this means lower support costs, happier users, and a smoother overall experience. They also offer tools like ProCharts for advanced analysis, news feeds, and analyst ratings. While not strictly “AI,” these tools are essential for any serious trading platform and eToro integrates them well.

Good usability is often overlooked.

But try trading on a platform that looks like it’s from the 90s.

You won’t stick around long.

eToro gets this.

They make it easy to find what you need, analyze assets, and place trades.

This benefits both individual traders and larger entities managing client accounts on the platform.

These features combine to create a powerful offering.

They address common pain points in trading.

From deciding what to trade to managing diversified portfolios.

And they make the process simpler and more accessible.

Benefits of Using eToro for Finance and Trading

So, why would someone in Finance and Trading actually *use* eToro, especially for platform management?

Let’s break down the advantages.

Time Savings: This is a big one. The CopyTrader feature means you don’t need to spend hours researching individual stocks or cryptos if you choose to follow a successful trader. Smart Portfolios save you the effort of building and rebalancing a diversified portfolio from scratch. For wealth managers or smaller funds using the platform, this can free up time for client interaction or more complex strategy development elsewhere.

Less time spent on repetitive analysis.

More time for other important tasks.

Efficiency boost, plain and simple.

Accessibility and Ease of Use: Trading can be intimidating. eToro makes it much less so. The user-friendly interface means beginners can get started without a steep learning curve. This expands the potential user base for platforms built on or using eToro’s infrastructure. It lowers the barrier to entry for retail investors.

You don’t need a finance degree to figure it out.

That opens it up to a lot more people.

Which is good for business.

Learning Opportunities: The social aspect is more than just copying. You can interact with other traders, see their discussions, and learn from their analysis and strategies. This creates a community feel and a continuous learning environment. It’s like having a network of traders at your fingertips.

You’re not trading in a vacuum.

You can see what others are thinking.

And maybe pick up some new ideas.

Diversification Made Simpler: Smart Portfolios offer easy access to diversified investments across various themes and asset classes. This helps users manage risk without needing deep expertise in each sector. It simplifies portfolio construction significantly.

Get exposure to different markets easily.

Without buying every single stock or coin yourself.

Just pick a portfolio theme you like.

Access to Multiple Assets: eToro offers a wide range of assets on a single platform. Stocks, ETFs, crypto, commodities, forex – it’s all there. This convenience is huge. You don’t need accounts on multiple platforms to trade different things.

One platform for everything.

Keeps things simple and organized.

Less hassle managing multiple accounts.

Potential for Passive Income (via CopyTrader): For retail users, the CopyTrader feature offers a way to potentially generate returns by simply copying successful traders. While returns are not guaranteed and involve risk, it’s a compelling proposition for those who don’t have the time or expertise to actively trade themselves.

Find someone good, copy them.

Let them do the heavy lifting.

Again, still involves risk. Never forget that.

Enhanced Decision Making (via tools and data): While not pure AI advice, the platform provides tools like ProCharts, news feeds, analysis, and the data from Popular Investors and Smart Portfolios. This information helps users make more informed decisions than just guessing or following hype.

Data at your fingertips.

Analysis tools available.

Helps you think through your trades.

These benefits make a strong case for using eToro.

It simplifies trading, makes it more accessible, and provides tools that can help users achieve their financial goals.

Pricing & Plans

Alright, let’s talk money. How much does this thing cost?

eToro operates on a commission-based model, but they also offer commission-free stock and ETF trading in certain markets (like the US).

This is a big draw, especially for retail traders.

No commission means more of your money goes into the actual investment.

For other assets like cryptocurrencies or CFDs, they charge spreads.

A spread is the difference between the buy price and the sell price.

This is how they make money on those trades.

Spreads vary depending on the asset and market conditions.

They also have withdrawal fees.

And an inactivity fee if you don’t log in for a while.

So, while commission-free trading is a headline feature, it’s not entirely free.

You need to look at the spreads and other fees.

There isn’t a traditional “free plan” or “premium plan” like a SaaS tool.

You open an account, deposit funds, and trade.

The “cost” is in the spreads and fees you pay on transactions.

For institutional clients or partners using eToro’s infrastructure (if applicable), pricing structures would likely be different and more tailored.

For the average user, the pricing is transparent on the platform itself.

You can see the spread before you execute a trade.

How does this compare to others?

Many traditional brokers charge commissions per trade.

The move to commission-free trading for stocks was a major disruptor, led by companies like Robinhood and followed by others including eToro.

eToro’s spreads on crypto can sometimes be higher than dedicated crypto exchanges.

But you get the convenience of trading multiple asset classes in one place.

So, it’s a trade-off.

Is there a premium version?

eToro has a “Popular Investor” program for traders who allow others to copy them.

This program offers various tiers and benefits based on assets under copy and risk score.

It’s more of a partnership program than a premium user tier.

They also have a VIP program for high-volume traders or those with large account balances, offering benefits like a dedicated account manager and lower withdrawal fees.

So, the core platform is accessible without monthly fees, but costs are incurred through trading activity and inactivity.

For platforms using eToro’s services in a more integrated way, the pricing model would be negotiated directly.

But for individual traders or small firms using the standard platform, the costs are primarily transaction-based.

Understand the spreads and fees for the assets you plan to trade.

That’s the key takeaway on pricing.

Hands-On Experience / Use Cases

Alright, let’s get into the nitty-gritty. What’s it actually like to use eToro for managing trading activities?

Let’s look at a couple of scenarios.

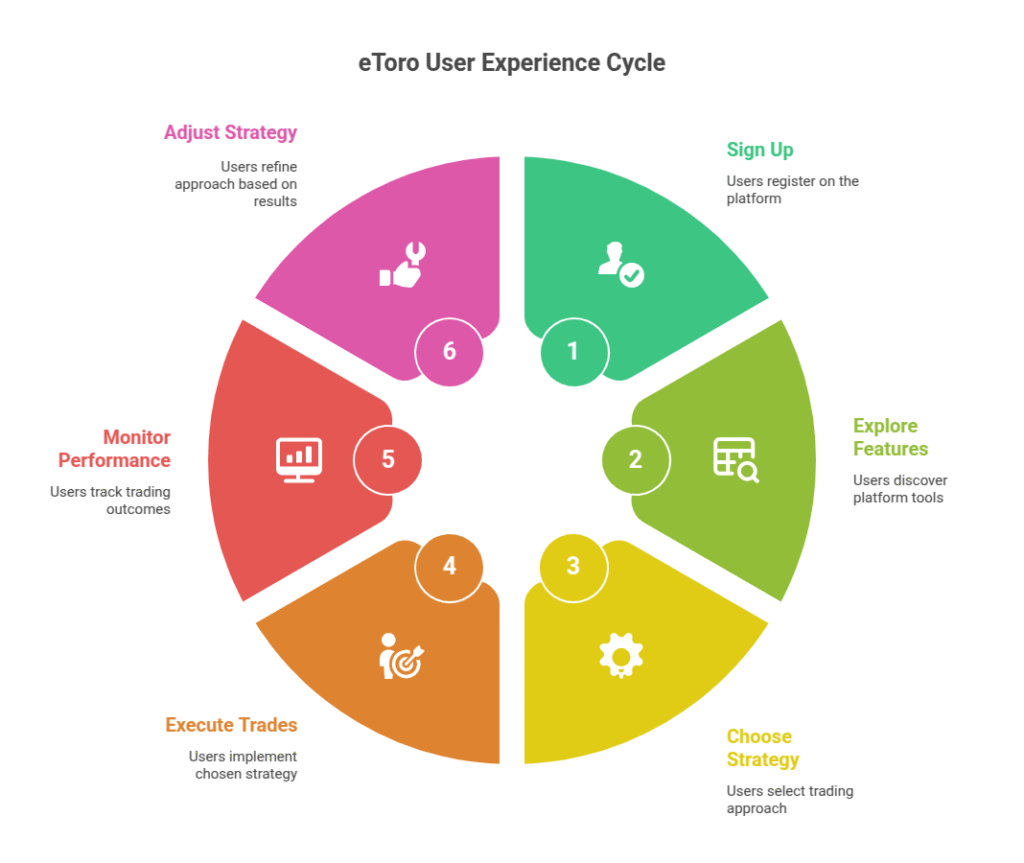

Use Case 1: A Retail Investor Starting Out.

Imagine Sarah. She’s heard about trading, maybe wants to invest some savings, but has zero clue where to start. Researching stocks is overwhelming. Understanding technical charts? Forget about it.

Sarah signs up for eToro.

The onboarding is pretty straightforward.

She sees the main feed, like a social media platform but for traders.

She starts browsing Popular Investors.

She can see their profiles, their risk scores, how much they’ve gained or lost over different periods.

This data helps her pick someone whose style and performance she likes.

She allocates a portion of her funds to copy “TraderX”.

Now, every trade TraderX makes, Sarah’s account makes automatically, proportionally to the amount she allocated.

She can monitor the performance from her dashboard.

She still sees all the individual assets being traded in her portfolio.

This is incredibly simple for a beginner.

It takes the stress out of initial decision-making.

It’s like having a mentor, but automated.

Use Case 2: A Small Investment Club Using Smart Portfolios.

Let’s say a group of friends wants to invest together, maybe focusing on future trends. They don’t have a dedicated analyst. They want to invest in things like renewable energy or specific tech sectors.

Instead of researching dozens of individual companies or ETFs in that sector…

They look at eToro’s Smart Portfolios.

They find one focused on clean energy.

They can see exactly which assets are in the portfolio.

They can see the historical performance (past performance is not an indicator of future results, obviously, but it gives context).

They decide to allocate a portion of their club’s funds into this Smart Portfolio.

eToro manages the rebalancing.

If the portfolio manager decides to adjust the holdings based on their strategy and data analysis, it happens automatically for the club.

This saves the club members a massive amount of research time.

It gives them a diversified position in a specific theme with one click.

It simplifies portfolio management for their specific goal.

Overall Usability:

The platform itself is clean.

Finding assets to trade is easy.

The charts are good enough for most retail analysis.

Placing trades is intuitive.

The social feed can be a bit noisy sometimes, but you can filter it.

Withdrawals and deposits are standard processes, depending on your region and method.

Compared to some old-school brokerage platforms, it feels modern and easy to navigate.

It’s designed for a user who wants simplicity and access to community knowledge.

These examples show how eToro’s features translate into real-world benefits.

Making trading less complex.

Saving time.

Providing avenues for diversification.

That’s the practical impact.

Who Should Use eToro?

Okay, so who is eToro actually for?

Who gets the most out of its features, especially in the context of Retail and Institutional Trading Platforms?

Beginner Retail Traders: This is a major target audience. If you’re new to trading and don’t know where to start, the CopyTrader feature is a huge draw. It allows you to participate in the market by following experienced traders. The simple interface also makes it less intimidating than complex professional platforms.

Just starting out?

Want to dip your toes in?

eToro makes it relatively easy.

Retail Traders Interested in Social Trading: Even if you have some experience, the ability to interact with other traders, share ideas, and see what the community is doing can be valuable. It adds a layer of insight you don’t get on isolated platforms.

Like seeing what your peers are up to.

Getting a pulse on market sentiment from the retail side.

Investors Looking for Thematic Portfolios: If you want to invest in specific sectors or trends without picking individual assets, Smart Portfolios are a good fit. It’s a simple way to get diversified exposure to themes like tech, crypto, or specific industries.

Want to invest in the future of AI?

Or clean energy?

There’s likely a Smart Portfolio for that.

Retail Investors Who Trade Multiple Asset Types: If you trade stocks, crypto, and maybe some commodities or forex, having it all on one platform like eToro is very convenient. It simplifies account management.

Tired of logging into three different apps?

eToro puts it all in one spot.

Small Investment Clubs or Groups: As mentioned before, for groups pooling money, features like Smart Portfolios offer a simple way to invest collectively in specific strategies without needing a dedicated expert among them.

Investing with friends or family?

Simplifies the decision-making and execution.

Financial Educators or Content Creators: If you teach others about trading or create content around it, eToro’s platform is visually intuitive and easy to explain. Its social features can also be interesting to discuss.

Showing people how trading works?

eToro’s interface is easy to screen record and explain.

Institutions (in a limited capacity): While major institutions have their own sophisticated systems, eToro’s underlying technology, market data access, and features like Smart Portfolios (potentially custom-built for partners) could be relevant. For institutions serving retail clients, using eToro’s B2B solutions or white-label platforms could be an option to quickly offer social trading or thematic investments.

Big players might use pieces of eToro’s tech.

Or partner with them to offer specific services.

They’re not likely to be copying retail traders, obviously.

In short, eToro is primarily geared towards the retail market, making trading accessible and adding a social layer.

But its technology and features have relevance for the institutional side, either as a tool for managing retail clients or through potential B2B partnerships.

If you value simplicity, community, and curated investment options, eToro is probably worth looking at.

How to Make Money Using eToro

Okay, the big question. Can you actually make money with eToro?

Yes, but not in the way you might think of a typical “AI tool” that generates content you can sell.

eToro is a trading platform.

So the primary way to potentially make money is through successful trading and investing.

Buy low, sell high. That’s the basic idea.

However, eToro offers specific features that can help you pursue this goal or even create unique opportunities.

- Trading and Investing: This is the most direct way. Use the platform to trade stocks, crypto, commodities, etc. Leverage the research tools, charts, and news feed to make informed decisions. If your trades are profitable, you make money. Simple concept, requires skill and market understanding.

Mastering trading basics is key here.

Research. Strategy. Risk management.

It’s not a guaranteed income source. Markets are volatile.

- Becoming a Popular Investor: If you are a successful trader on eToro and meet certain criteria (risk score, assets under copy, etc.), you can join the Popular Investor program. This program allows other users to copy your trades. In return, eToro pays you a commission based on your assets under copy. This is a direct way to make money based on your trading skill, beyond just your own portfolio gains.

This is where the AI/social layer creates a unique opportunity.

If you’re good, others pay to follow you (indirectly, through eToro’s program).

It’s like being a fund manager, but on a social platform.

Requires consistent performance and attracting copiers.

- Leveraging Smart Portfolios: While not “making money” from eToro directly, investing in Smart Portfolios can be a way to potentially grow your capital over time through diversified, thematic investments. You’re relying on the strategy curated by eToro based on data.

Instead of building your own portfolio, you invest in a pre-built one.

If the assets in the portfolio increase in value, your investment grows.

It’s passive investing in specific themes.

Case Study Example (Simulated):

Let’s look at “CryptoKing21” on eToro. He started trading crypto in 2018. He developed a strategy that consistently generated positive returns with a moderate risk score. He shared his insights on the eToro feed, built a following. Eventually, he qualified for the Popular Investor program.

Over time, “CryptoKing21” attracted thousands of copiers, who collectively allocated over $1 million to copy his trades.

Because of the volume of assets under copy and his performance tier in the program, eToro paid him a monthly commission.

This commission, in addition to the gains on his own trading capital, became a significant income stream.

He effectively monetized his trading skill using eToro’s Popular Investor framework.

He didn’t just trade for himself; he built a business around his trading performance.

This is a real possibility on eToro if you have strong trading results.

Other potential, less direct ways could involve creating content around your eToro experience (blogging, videos) and using affiliate marketing, although this requires building an audience off-platform.

But the core “make money *with* eToro” features are successful trading, becoming a Popular Investor, and potentially benefiting from Smart Portfolio growth.

It’s all tied to market performance and your (or the copied trader’s) skill.

Limitations and Considerations

No tool is perfect. eToro is powerful, especially for its target audience, but it has limitations and things you need to be aware of.

Risk of Loss: This is the biggest one, and it applies to all trading. Trading CFDs and leveraged products carries a high risk of losing money quickly. Even copying successful traders isn’t a guarantee of profit. Markets can be unpredictable. You can lose your entire investment.

Never invest money you can’t afford to lose.

Past performance is not an indicator of future results.

This isn’t just eToro; it’s the nature of trading.

Fees and Spreads: While commission-free stock trading is great, spreads on other assets can add up. Withdrawal fees and inactivity fees also need to be factored into your costs. They can eat into potential profits.

Always read the fee structure carefully.

Understand how costs impact your overall returns.

Limited Advanced Trading Tools: Compared to platforms built specifically for professional day traders or institutional firms, eToro’s charting and analysis tools, while good for retail, might lack some of the deep customisation or sophisticated order types that pros require.

If you need ultra-advanced charting or complex algorithmic trading capabilities…

eToro might not be sufficient on its own.

It’s designed for accessibility, not maximum complexity.

Focus on Retail and Social Trading: While relevant for institutions serving retail, eToro’s core focus and platform design are heavily oriented towards individual investors and the social aspect. It’s not a Bloomberg terminal or a prime brokerage platform.

Institutional needs are often very different.

Different execution requirements, reporting, etc.

eToro might not meet all those specific needs out-of-the-box for major players.

“AI” is More Algorithmic/Data-Driven: When we talk about AI in eToro, it’s primarily behind the scenes – identifying Popular Investors, curating Smart Portfolios, potentially market trend analysis feeding into features. It’s not an AI advisor giving you personalized trading advice based on your portfolio alone.

Don’t expect a robot telling you exactly when to buy and sell your specific holdings.

It’s more about smart aggregation, selection, and automation.

Reliance on Copied Traders: If you use CopyTrader, your success is tied to the performance of the trader you copy. Their strategies might change, they might have a bad run, or they might leave the platform. You need to monitor their performance and be prepared to switch if needed.

You’re putting faith in another person’s trading ability.

Do your diligence on who you copy.

Regulatory Differences: eToro operates under various regulations globally. The specific assets available and features might differ based on where you live. Ensure the platform is properly regulated in your jurisdiction.

Check the fine print for your country.

What’s available in the UK might be different from the US or Australia.

These are not reasons *not* to use eToro, but they are important considerations.

Understand the risks, be aware of the costs, and manage your expectations regarding advanced features and the nature of the “AI” involved.

Final Thoughts

So, is eToro a game-changer for Retail and Institutional Trading Platforms?

For retail, absolutely.

It drastically simplifies the barrier to entry.

The CopyTrader and Smart Portfolios are powerful features for beginners and those looking for curated strategies.

The social aspect adds a unique dimension.

It makes trading less isolating.

For institutions, it’s less about using the standard eToro platform for their core operations.

It’s more about the underlying technology and model.

The concept of social trading, data-driven portfolio curation, and user-friendly interfaces are lessons major platforms can and do learn from.

eToro excels at packaging complex financial activities into an accessible, almost consumer-friendly product.

This is highly valuable for any platform targeting retail investors.

It removes a lot of the friction associated with traditional trading.

If you’re managing a retail trading platform, studying eToro’s approach to usability, social features, and simplified investment products (like Smart Portfolios) is a smart move.

If you’re a retail investor looking for a user-friendly platform with unique features…

eToro is definitely one to consider.

Just remember the risks involved in trading and do your own research.

The platform provides tools and accessibility.

But success still depends on market conditions and decision-making.

My experience is that it lives up to its promise of making trading more accessible.

The social features are genuinely interesting.

And the Smart Portfolios are a neat way to invest thematically.

Ready to see it for yourself?

Visit the official eToro website

Frequently Asked Questions

1. What is eToro used for?

eToro is primarily used for online trading and investing in various financial assets like stocks, cryptocurrencies, commodities, and currencies. It also features social trading capabilities like copying other investors and exploring curated Smart Portfolios.

2. Is eToro free?

Opening an eToro account is free. They offer commission-free trading for stocks and ETFs in certain markets. However, they charge spreads on other assets, and there are fees for withdrawals and inactivity.

3. How does eToro compare to other AI tools?

eToro is fundamentally a trading platform, not a typical AI content or marketing tool. While it uses algorithms and data analysis (AI concepts) to power features like CopyTrader and Smart Portfolios, its core function is brokerage and social trading, not generating text or images.

4. Can beginners use eToro?

Yes, eToro is designed with beginners in mind. Its user-friendly interface, educational resources, and the CopyTrader feature make it very accessible for those new to trading.

5. Does the content created by eToro meet quality and optimization standards?

eToro doesn’t “create content” in the traditional sense like writing articles. Its platform provides data, charts, news feeds, and the social feed shows user posts and analysis. The quality of information depends on the source (e.g., market data providers, users). Trading decisions require independent analysis and risk assessment.

6. Can I make money with eToro?

Yes, you can potentially make money through successful trading and investing on the platform. Additionally, experienced and successful traders can earn income by joining the Popular Investor program, where they get paid commissions for allowing others to copy their trades.