H2O.ai boosts your Price Prediction and Forecasting. Get actionable insights fast. See how this AI tool simplifies finance tasks. Try it now!

If You’re Not Using H2O.ai, You’re Falling Behind

Let’s be real.

The game in finance and trading is changing fast.

AI isn’t just a buzzword anymore.

It’s the engine driving serious results.

Especially when we talk about Price Prediction and Forecasting.

Getting those numbers right, predicting market moves… that’s the difference between winning big and just hoping for the best.

For a long time, this felt like trying to read tea leaves.

Complex models, endless data crunching, guesswork.

It ate up time.

It ate up resources.

And frankly, it often left you scratching your head.

But what if there was a tool that could cut through all that noise?

Something built for the job.

Something that understands the data, finds the patterns, and spits out predictions you can actually trust.

That’s where H2O.ai comes in.

I’ve seen what this thing can do.

It’s not just another piece of software.

It’s a fundamental shift in how you approach one of the toughest challenges in the market.

If your Price Prediction and Forecasting workflow feels stuck in the past, this is for you.

Let’s break down why H2O.ai might just be the upgrade you desperately need.

Table of Contents

- What is H2O.ai?

- Key Features of H2O.ai for Price Prediction and Forecasting

- Benefits of Using H2O.ai for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use H2O.ai?

- How to Make Money Using H2O.ai

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is H2O.ai?

Okay, let’s get straight to it.

What is H2O.ai?

Think of it as a powerful platform for building and deploying AI models.

But not just any AI.

We’re talking serious machine learning power, designed for real-world problems.

It’s built to handle complex data and turn it into actionable insights.

It’s not some flimsy tool built overnight.

H2O.ai has been around, constantly improving, used by massive companies and data science pros.

It’s specifically designed to make the tough stuff easy.

For guys in Finance and Trading, this means less time wrestling with algorithms and more time acting on predictions.

It automates a ton of the grunt work involved in machine learning.

Things like data preparation, model selection, hyperparameter tuning – the stuff that takes forever manually.

H2O.ai handles it.

Its core strength lies in its ability to build highly accurate models quickly.

Whether you’re predicting stock prices, forecasting demand, or assessing risk, it gives you the tools to do it better.

It’s not just for PhDs in data science either.

While data scientists love it for its depth, it’s also built to be accessible.

They have tools that simplify the process, making AI accessible to business analysts and domain experts.

The goal is to democratize AI.

To put powerful machine learning capabilities into the hands of people who can use it to solve real business problems.

For anyone serious about leveraging data for better decisions in finance, understanding H2O.ai is step one.

It’s a platform built for results.

It’s designed to turn data into predictive power.

That predictive power is exactly what you need for Price Prediction and Forecasting.

It takes the guesswork out and brings data-driven certainty in.

That’s the H2O.ai difference.

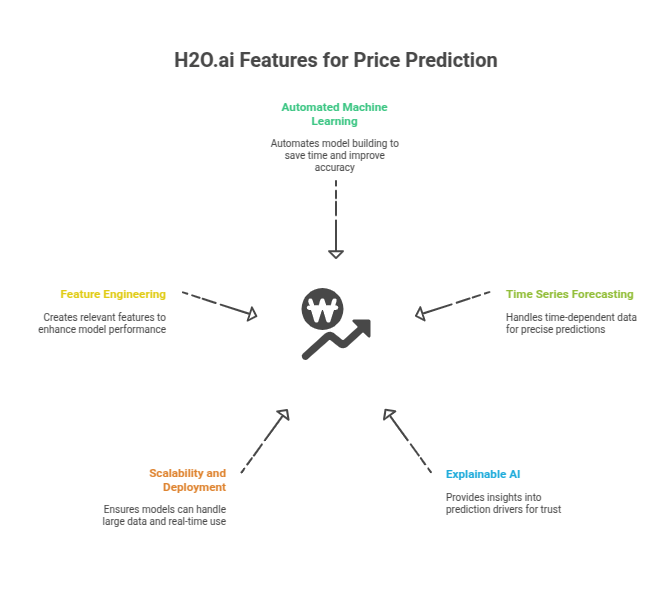

Key Features of H2O.ai for Price Prediction and Forecasting

Alright, let’s talk specifics.

What does H2O.ai actually *do* that makes it so effective for Price Prediction and Forecasting?

It’s got a stack of features built for this exact challenge.

- Automated Machine Learning (AutoML):

This is a game-changer.

Manual model building is a beast.

You try different algorithms, tweak settings, validate… it takes forever.

AutoML automates this entire process.

You feed it your data, tell it what you want to predict (like a price), and it goes to work.

It explores thousands of possible models and finds the best ones automatically.

This saves you weeks, sometimes months, of work.

It means you can build highly accurate predictive models much faster.

More models tested means a higher chance of finding the one that nails your Price Prediction and Forecasting needs.

- Time Series Forecasting Capabilities:

Price data isn’t just random numbers.

It’s time series data – values that change over time.

Predicting future prices requires specialized techniques.

H2O.ai has powerful, built-in tools specifically for time series forecasting.

It can handle seasonality, trends, and other patterns specific to time data.

This isn’t just generic forecasting; it’s designed for the nuances of financial data.

Accurate time series models are absolutely crucial for reliable Price Prediction and Forecasting in trading.

It gives you confidence that the model understands the *flow* of prices over time.

- Explainable AI (XAI):

AI models can feel like black boxes.

They give you a prediction, but you don’t always know *why*.

In finance, knowing *why* a price is predicted to move is critical.

Explainable AI features in H2O.ai help you understand the drivers behind a prediction.

It shows you which factors the model is weighing most heavily.

Is it historical price trends? News sentiment? Macro economic indicators?

XAI helps you peek inside the model.

This builds trust in the predictions and helps you refine your understanding of market dynamics.

You’re not just blindly following an AI; you’re learning from it.

This is vital for making informed trading decisions based on AI predictions.

- Scalability and Deployment:

Building a model is one thing.

Putting it to work, making predictions in real-time or on large datasets, is another.

H2O.ai is built for scale.

It can handle massive amounts of data without breaking a sweat.

It also makes it easy to deploy your models.

You can integrate the predictions into your existing trading platforms or workflows.

This means you can get real-time price predictions flowing where you need them.

Operationalizing your models is just as important as building them.

H2O.ai nails this, making sure your predictions aren’t just theoretical but are actually driving actions.

- Feature Engineering:

The data you feed into a model matters.

Sometimes the raw data isn’t enough.

You need to create new features from existing data – like moving averages, volatility measures, or time-based features.

H2O.ai has tools to automate and simplify feature engineering.

This process can dramatically improve model accuracy.

Creating relevant features is key to capturing the nuances of financial markets.

H2O.ai helps you do this effectively, boosting your Price Prediction and Forecasting performance.

These aren’t just random features.

They’re specifically designed to tackle the complexities of financial data and prediction.

They make the entire process of building and using predictive models for prices faster, more accurate, and more understandable.

That’s the power H2O.ai brings to the table.

Benefits of Using H2O.ai for Finance and Trading

Okay, so H2O.ai has cool features.

But what does that actually *mean* for someone working in Finance and Trading?

What are the tangible benefits you get from using this tool for Price Prediction and Forecasting?

Let’s break it down.

Significant Time Savings:

Manual model building is slow.

Data cleaning, feature engineering, model selection, tuning… it’s a grind.

H2O.ai’s AutoML slashes this time.

You can literally go from raw data to a working model in a fraction of the time it would take manually.

Time is money in finance.

Saving this much time means you can test more strategies, react faster to market changes, and free up your valuable human capital for higher-level tasks.

Improved Prediction Accuracy:

Better models lead to better predictions.

H2O.ai’s algorithms are cutting-edge.

Its ability to automatically test numerous model architectures and tune hyperparameters means it finds highly optimized solutions.

More accurate price predictions mean better trading decisions.

This directly impacts your bottom line.

Slight improvements in accuracy can translate to significant gains in trading performance.

Reduced Need for Deep AI Expertise:

Building sophisticated AI models traditionally required expert data scientists.

H2O.ai lowers this barrier.

While experts can leverage its full power, features like AutoML allow analysts with less deep machine learning knowledge to build effective models.

You don’t need a PhD to get started with powerful Price Prediction and Forecasting.

This democratizes AI within your organization.

More people can contribute to building predictive capabilities.

Better Understanding with Explainable AI:

We touched on XAI earlier.

The benefit is crucial.

Knowing *why* a model predicts a certain price movement builds confidence.

It helps you understand the market factors the AI is highlighting.

This isn’t just about trusting the AI; it’s about enhancing your own market intuition.

You can validate the model’s logic against your own domain knowledge.

This leads to more robust and reliable trading strategies.

Ability to Handle Complex Data:

Financial data is messy.

It’s high-frequency, noisy, and comes from multiple sources.

H2O.ai is built to handle this complexity.

It can process large volumes of data and work with various data types.

This allows you to build models that incorporate a wider range of relevant information.

The more comprehensive your data input, the potentially better your Price Prediction and Forecasting output.

Competitive Advantage:

Let’s face it.

The firms winning are the ones leveraging technology effectively.

Using a powerful AI platform like H2O.ai for core tasks like Price Prediction and Forecasting gives you an edge.

You can react faster, predict better, and automate processes that your competitors are still doing manually.

This isn’t just about staying in the game; it’s about getting ahead.

These benefits compound.

Saving time, getting better predictions, making AI accessible, understanding your models, and handling complex data all contribute to a stronger, more agile trading operation.

That’s the real value H2O.ai delivers.

Pricing & Plans

Alright, the features sound good, the benefits are clear.

But what does this thing cost?

Pricing for a platform like H2O.ai isn’t usually like buying a standard SaaS tool with simple tiers.

It’s often more enterprise-focused.

H2O.ai offers a range of products and services, from open-source options to full enterprise AI platforms.

Let’s start with the good news for tinkerers and smaller operations.

They have an open-source core platform called H2O-3.

This is a powerful, distributed in-memory machine learning platform.

It’s free to download and use.

If you have the technical expertise to set it up and work with it programmatically, you can build serious models without licensing costs.

This is a great entry point to experiment with H2O.ai’s capabilities, especially for Price Prediction and Forecasting on your own data.

Then there’s the enterprise side.

This is where the more user-friendly interfaces, AutoML capabilities, security features, and dedicated support come in.

Their flagship enterprise offering is H2O AI Cloud.

This is a comprehensive platform covering the entire AI lifecycle.

Pricing for H2O AI Cloud is typically not listed publicly.

It’s based on factors like usage, the specific products needed (like their Driverless AI for AutoML), the scale of deployment, and support requirements.

You’ll likely need to contact their sales team for a custom quote tailored to your organization’s needs.

Compared to alternatives?

The competitive landscape for enterprise AI platforms includes players like DataRobot, Google Cloud AI Platform, Amazon SageMaker, and Microsoft Azure Machine Learning.

Each has its own pricing model, often consumption-based or tiered by features and support.

H2O.ai is generally considered a premium enterprise solution.

Its pricing reflects its power, features, and suitability for complex, mission-critical applications like high-stakes Price Prediction and Forecasting in finance.

Is it right for a solo trader or small firm?

The open-source version is certainly accessible if you have the technical chops.

For the full enterprise experience, it’s probably more suited for larger financial institutions, hedge funds, or trading desks with significant data science resources and requirements.

However, their platform is modular, so specific components or solutions might be accessible for smaller operations depending on their needs and budget.

The best approach is to explore the open-source version first if you’re technically inclined.

If you need the full enterprise power, the next step is a direct conversation with H2O.ai to understand their specific pricing models and how they fit your requirements for Price Prediction and Forecasting.

Don’t expect off-the-shelf pricing; think custom solution costing.

Hands-On Experience / Use Cases

Reading about features is one thing.

Seeing how it works in practice is another.

Let’s simulate or describe a real-world scenario for Price Prediction and Forecasting using H2O.ai.

Imagine you’re a portfolio manager or a quantitative trader.

Your goal is to predict the price movement of a basket of stocks over the next week.

You have historical price data, trading volume, relevant economic indicators, and maybe even some alternative data like social media sentiment or news headlines.

Manually, this would involve:

Pulling data from various sources.

Cleaning and merging it (a huge pain).

Calculating technical indicators (moving averages, RSI, MACD, etc.).

Trying different forecasting models (ARIMA, GARCH, etc.).

Maybe dabbling with machine learning models (Linear Regression, Random Forests, etc.).

Coding all of this up.

Tuning parameters.

Validating the models.

It’s a ton of work, highly iterative, and requires significant coding and statistical expertise.

Using H2O.ai, specifically H2O AI Cloud and its Driverless AI component, the process changes dramatically.

You start by connecting H2O.ai to your data sources.

H2O.ai handles data connectors, pulling in the disparate datasets.

You define your target variable: the price you want to predict (e.g., closing price in 7 days).

You specify the columns that contain time series information (date/time).

You then leverage Driverless AI.

You point it to your data, specify the target, and set parameters like the prediction horizon (7 days) and the desired accuracy level.

Driverless AI then takes over.

It automatically performs feature engineering. It creates new, relevant features from your raw data, including sophisticated time series features.

It automatically selects and tunes models. It explores various algorithms suitable for time series forecasting and identifies the best performing ones.

It builds pipelines. It combines data processing steps, feature engineering, and modeling into a single, robust workflow.

Within minutes, or perhaps a few hours depending on data size and complexity, H2O.ai presents you with a leaderboard of models.

You can see which models performed best based on your chosen evaluation metric (like RMSE or MAE for forecasting).

Crucially, you can then delve into the Explainable AI insights.

You can see which features were most important for the prediction.

For a stock price prediction, maybe it shows that recent trading volume and the 50-day moving average were the biggest drivers in the model’s prediction for a particular stock.

You can see partial dependence plots showing how changing a specific input feature affects the predicted price.

Once you select the best model, deploying it is straightforward within the platform.

You can generate scoring pipelines to get predictions on new, incoming data.

You can integrate these predictions into your trading algorithms or decision support systems.

The usability here is the key.

While the underlying AI is complex, the interface in H2O AI Cloud makes the process manageable.

It’s guided, visual, and automates the hardest parts.

The results?

Faster model iteration, potentially more accurate predictions due to exploring a wider range of models and features, and the ability to understand *why* the model is predicting what it is.

This isn’t just theoretical; financial institutions globally use H2O.ai for everything from credit risk scoring to fraud detection and yes, significant Price Prediction and Forecasting tasks.

The platform’s strength lies in its ability to make advanced AI practical for complex financial problems.

Who Should Use H2O.ai?

Alright, so who’s this H2O.ai thing actually for?

Is it for everyone in finance?

Probably not *everyone*, but it fits a few key profiles perfectly, especially for tackling Price Prediction and Forecasting.

Quantitative Trading Firms / Hedge Funds:

This is almost a no-brainer.

These organizations live and die by their models and predictions.

They have the data volume and the need for highly accurate, often real-time, predictions.

H2O.ai’s speed, scalability, and AutoML capabilities are ideal for developing and deploying complex trading strategies.

They have the technical teams who can leverage the platform’s full power.

Large Financial Institutions (Banks, Investment Firms):

Beyond just trading, banks and large firms need predictive analytics for tons of use cases.

Risk assessment, fraud detection, customer churn prediction, and yes, forecasting financial markets and asset prices.

H2O.ai provides a centralized platform for these diverse AI initiatives.

It helps standardize AI development and deployment across different departments.

Data Science Teams in Finance:

If your company already has a dedicated data science team, H2O.ai can significantly boost their productivity.

It automates tedious tasks, allows them to test more ideas faster, and provides powerful tools for model management and deployment.

It frees them up to work on harder, more strategic problems rather than getting bogged down in boilerplate coding and tuning.

Financial Analysts and Domain Experts (with some technical inclination):

Here’s where H2O.ai’s push for democratization comes in.

Tools like Driverless AI are designed to be used by people who understand the business problem (like predicting stock prices) but might not be expert Python programmers.

If you’re an analyst with a strong understanding of market data and some familiarity with analytical tools, you can potentially use H2O.ai to build predictive models without needing a full data science background.

This empowers domain experts to build their own forecasting tools.

Companies Requiring Scalable Predictions:

Any business in the finance space that needs to make predictions on large, constantly updating datasets needs a scalable platform.

Whether it’s forecasting prices for thousands of assets, predicting loan defaults across millions of customers, or detecting fraudulent transactions in real-time, H2O.ai is built to handle that scale.

Who might it *not* be for?

Probably solo retail traders working with limited data and basic spreadsheets.

The open-source version requires technical setup, and the enterprise platform is an investment.

If your predictive needs are simple or low-volume, there might be simpler tools.

But if you’re serious about leveraging advanced AI for significant Price Prediction and Forecasting or other complex financial tasks, and you operate at a certain scale or have the technical resources, H2O.ai is definitely on the list of tools you should evaluate.

How to Make Money Using H2O.ai

Okay, let’s talk brass tacks.

How can you actually turn H2O.ai into cash, especially focusing on Price Prediction and Forecasting?

It’s not a magic money machine, but it gives you powerful capabilities you can monetize.

1. Offer Predictive Analytics as a Service:

Many businesses, especially smaller ones or those in related fields like financial planning or real estate, need Price Prediction and Forecasting but lack the internal expertise or tools.

- Service 1: Custom Price Forecasting Reports.

Use H2O.ai to build custom prediction models for clients.

Maybe a real estate developer wants to forecast property values in specific areas.

A commodity trader needs predictions on future prices.

You use H2O.ai to build the model, generate the forecasts, and provide detailed reports, including the Explainable AI insights so they understand the drivers.

Charge a fee per report or on a subscription basis.

- Service 2: Embed Predictions into Client Workflows.

If a client has their own platform or internal system (like a real estate CRM or a trading dashboard), you can use H2O.ai’s deployment capabilities to feed predictions directly into their system via APIs.

You’re essentially providing an automated prediction engine.

This is a higher-value service, charging for the ongoing access to the prediction API.

2. Enhance Your Own Trading Performance:

This is the most direct way if you are a trader or fund manager.

Use H2O.ai to build more accurate and faster Price Prediction and Forecasting models for the assets you trade.

Better predictions lead to more profitable trading decisions.

The efficiency gains mean you can analyze more assets or iterate on strategies faster.

If your models give you a consistent edge, that translates directly into trading profits.

3. Sell or License Your Models/Strategies:

If you build particularly effective prediction models or develop trading strategies based on H2O.ai predictions, you might be able to package and sell them.

- Service 3: License Model Predictions.

Build a superior Price Prediction and Forecasting model for a specific market (e.g., cryptocurrency, specific stock sectors).

Instead of trading it yourself, license the predictions generated by your model to other traders or firms.

You charge a fee for access to your forecast data feed.

Consider the story of someone like a quantitative analyst who used H2O.ai’s AutoML. They were able to build and test forecasting models for obscure commodities markets in a fraction of the time it used to take. This allowed them to identify profitable trading opportunities that others missed because they were still manually building models. This efficiency and speed translated directly into increased trading volume and profitability for their desk. They weren’t selling a service; they were boosting internal performance, which is another form of making money.

4. Consult on AI/ML in Finance:

Become an expert in using H2O.ai for financial applications, including Price Prediction and Forecasting.

Offer consulting services to firms looking to adopt AI but needing guidance on tools and implementation.

Your knowledge of H2O.ai’s capabilities makes you a valuable advisor.

5. Develop AI-Powered Products:

Use H2O.ai as the back-end for developing your own financial products.

Maybe a dashboard that provides predictive insights for specific assets.

An alert system based on predicted price movements.

A tool that helps users build simple forecasting models using a friendly interface, powered by H2O.ai behind the scenes.

You sell access to this product.

Making money with H2O.ai isn’t about the tool magically generating cash.

It’s about leveraging its power to build valuable assets or services:

Highly accurate prediction models.

Efficient prediction workflows.

Expertise in advanced financial AI.

The tool gives you the horsepower; you need to apply it strategically in the market or as a service provider.

Limitations and Considerations

No tool is perfect.

H2O.ai is incredibly powerful, especially for Price Prediction and Forecasting, but it’s important to be realistic.

There are limitations and things you need to consider.

Data Quality is Paramount:

This is true for any AI tool, but it bears repeating.

H2O.ai builds models based on the data you give it.

If your historical price data is incomplete, inaccurate, or poorly formatted, the models will be flawed.

Garbage in, garbage out.

While H2O.ai has data preparation capabilities, you still need clean, relevant data to start with.

Don’t expect it to work miracles on messy spreadsheets pulled from dodgy sources.

Requires Technical Understanding (Even with AutoML):

While H2O.ai democratizes AI, it’s not a magic button.

To get the best results, you need to understand the fundamentals of machine learning, data types, and how to frame your prediction problem correctly.

You need to know how to evaluate model performance (what does an RMSE of X actually mean for your price predictions?).

You need to understand the financial domain you’re working in.

AutoML helps, but it doesn’t replace the need for skilled analysts or data scientists to guide the process and interpret the results.

Computational Resources:

Building and training complex AI models on large financial datasets is computationally intensive.

The open-source version might require significant local hardware.

The enterprise cloud platform requires paying for the compute power used.

This isn’t a tool you run on a dusty old laptop and expect instant, high-accuracy results on a million data points.

Be prepared for the need for adequate computing resources, which comes with a cost.

Not a Trading Robot Out of the Box:

H2O.ai builds prediction models.

It predicts prices.

It does *not* execute trades for you directly.

You need to integrate the predictions from H2O.ai into your own trading strategy or platform.

The prediction is an input into your decision-making process, not the final trade execution itself.

Building the actual trading system around the predictions is a separate task.

Market Volatility and Unpredictability:

AI is great at finding patterns in historical data.

However, financial markets can be subject to Black Swan events – unpredictable, rare events that historical data might not adequately prepare the model for.

No model, no matter how sophisticated or how well-built with H2O.ai, can perfectly predict the future, especially in highly volatile conditions.

Predictions are probabilistic.

They indicate likelihoods and potential movements, not certainties.

You still need risk management and human judgment in your trading strategy.

Cost of Enterprise Features:

As discussed in pricing, the full-featured enterprise H2O.ai platform is an investment.

It’s not a cheap monthly subscription for casual use.

The cost needs to be justified by the value you gain from better predictions and increased efficiency.

Make sure you have a clear use case and a realistic expectation of ROI before committing to an enterprise deployment.

Understanding these points is crucial.

H2O.ai is a powerful tool, but it’s a tool that requires skill, good data, resources, and a realistic understanding of what AI can and cannot do in dynamic markets.

Final Thoughts

Alright, wrapping this up.

We’ve covered what H2O.ai is, its killer features for Finance and Trading, specifically for Price Prediction and Forecasting, the benefits, who should use it, how you can potentially make money with it, and the important limitations.

Here’s the deal.

The finance world is moving.

Fast.

AI isn’t a side project anymore; it’s becoming core infrastructure.

Especially for tasks like predicting market movements.

Relying solely on manual methods or basic tools for Price Prediction and Forecasting is like trying to win a Formula 1 race in a go-kart.

You’re just not equipped for the speed and complexity.

H2O.ai is not just another AI tool.

It’s a mature, powerful platform designed for serious data science and real-world applications.

Its strength lies in automating the hard parts, handling complex data, and providing insights you can trust through Explainable AI.

For anyone in Finance and Trading who needs to make faster, more accurate, and more reliable predictions about prices, H2O.ai offers a significant leap forward.

It saves time.

It boosts accuracy.

It makes advanced AI more accessible.

It helps you understand *why* things are predicted to move.

That’s powerful stuff.

Yes, it requires good data.

Yes, the enterprise version is an investment.

Yes, you still need human expertise and risk management.

But the competitive advantage it offers is undeniable.

If your current Price Prediction and Forecasting methods feel slow, inaccurate, or opaque, you owe it to yourself to look at H2O.ai.

It’s built for this exact challenge.

It delivers the tools you need to stop guessing and start making data-driven forecasts.

My recommendation?

If you’re operating in the finance space, especially where predictive accuracy is key, explore H2O.ai.

Start with the open-source version if you have the technical capability, or reach out to their team to understand their enterprise offerings if you need the full power and ease of use.

The future of Price Prediction and Forecasting in finance is AI-driven.

H2O.ai is one of the key players building that future.

Don’t get left behind.

Visit the official H2O.ai website

Frequently Asked Questions

1. What is H2O.ai used for?

H2O.ai is a platform for building and deploying AI and machine learning models.

It’s used across many industries for tasks like fraud detection, risk management, customer analytics, and specifically in Finance and Trading for Price Prediction and Forecasting, algorithmic trading, and portfolio management.

2. Is H2O.ai free?

H2O.ai offers an open-source version called H2O-3, which is free to use but requires technical setup.

Their full-featured enterprise platform, H2O AI Cloud, is a commercial product with pricing based on usage and specific requirements, typically requiring a direct quote.

3. How does H2O.ai compare to other AI tools?

H2O.ai is known for its powerful AutoML capabilities, robust time series forecasting tools, and enterprise-grade scalability.

It competes with other enterprise AI platforms like DataRobot, AWS SageMaker, and Azure ML, often distinguishing itself with a strong focus on regulated industries like finance and a deep feature set for complex data problems.

4. Can beginners use H2O.ai?

The open-source H2O-3 requires coding knowledge.

The enterprise H2O AI Cloud, particularly features like Driverless AI, is designed to be more accessible to users who understand their data and business problems but might not have deep machine learning coding expertise.

However, some understanding of data and analytics is still beneficial.

5. Does the content created by H2O.ai meet quality and optimization standards?

H2O.ai doesn’t “create content” in the way a writing AI does.

It creates predictive models and generates forecasts based on data.

The “quality” is measured by the accuracy and reliability of its predictions and the insights it provides.

These models are built to meet the rigorous standards required for critical financial applications.

6. Can I make money with H2O.ai?

Yes, you can make money with H2O.ai by leveraging its capabilities for Price Prediction and Forecasting.

This can involve using it to improve your own trading performance, offering predictive analytics as a service to clients, licensing models or predictions, consulting on AI implementation, or developing AI-powered financial products.