DataRobot boosts Price Prediction and Forecasting in Finance and Trading. Get accurate insights, save time, and make smarter decisions fast. Try DataRobot today!

Why DataRobot Is a Game-Changer in Price Prediction and Forecasting

Let’s be real.

Finance and Trading?

It’s not for the faint of heart.

Especially when you’re trying to figure out where prices are heading.

Price Prediction and Forecasting… it’s the backbone of many trading strategies.

But it’s also a massive headache.

Hours spent sifting through data.

Building complex models that might not even work.

Or worse, missing opportunities because you’re stuck in analysis paralysis.

Meanwhile, AI tools are popping up everywhere.

Changing the game.

And in this world, DataRobot is making some serious waves.

Especially for anyone knee-deep in the markets.

It promises to take the pain out of prediction.

Give you an edge.

And maybe, just maybe, help you make more money.

Sounds good?

Keep reading.

Table of Contents

- What is DataRobot?

- Key Features of DataRobot for Price Prediction and Forecasting

- Benefits of Using DataRobot for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use DataRobot?

- How to Make Money Using DataRobot

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is DataRobot?

Okay, so what exactly is DataRobot?

Think of it like this: it’s an automated machine learning platform.

Built to make building AI models faster and easier.

Even if you’re not a data science guru.

It takes your data, understands what you’re trying to predict, and then automatically builds and tests a ton of different models.

Seriously, a *ton*.

It finds the best ones.

It ranks them.

And it explains why they work.

The core idea?

Democratise AI.

Make it accessible.

So businesses, big or small, can use the power of machine learning.

Without needing a massive team of PhDs.

It’s used across heaps of industries.

Healthcare, retail, manufacturing.

But it’s making a serious impact in finance.

Especially for folks who need to predict stuff.

Like, say, asset prices.

That’s where it gets interesting for us.

It takes complex data – historical prices, trading volumes, news sentiment, economic indicators.

Whatever you feed it.

And helps you build models to predict future movements.

Fast.

That’s the promise.

Cut through the noise.

Get to the signal.

And make decisions based on solid data, not just gut feeling.

It handles the heavy lifting.

Model selection, hyperparameter tuning, evaluation.

Stuff that normally takes ages.

This means you spend less time coding and more time thinking about strategy.

Which is where the real money is made, right?

So, in short: DataRobot is your shortcut to building powerful prediction models.

Especially for those juicy Price Prediction and Forecasting tasks.

It’s built for speed and accuracy.

And it’s designed so you don’t need to be a rocket scientist to use it.

That’s the core of it.

Automation.

Speed.

Accessibility.

For complex machine learning problems.

Like predicting stock prices.

Or forex movements.

Or crypto volatility.

You name it.

If you have data and need to predict a number, DataRobot is built to help.

And help fast.

Key Features of DataRobot for Price Prediction and Forecasting

- Automated Machine Learning (AutoML):

This is the big one.

You upload your data.

You tell DataRobot what you want to predict (like the closing price of a stock tomorrow).

DataRobot then goes to work.

It automatically prepares the data.

Explores thousands of different algorithms.

Trains models.

Evaluates them.

And presents you with a leaderboard of the best performers.

For Price Prediction and Forecasting, this is gold.

You don’t spend weeks trying different models yourself.

DataRobot does it in hours, sometimes minutes.

It tries everything from linear regression to complex neural networks.

Finding the model that best fits your specific data and prediction goal.

This isn’t just about speed.

It’s about finding models you might not have even considered.

Or models that require deep expertise to implement manually.

It’s like having a team of data scientists running experiments simultaneously.

But you only pay for one tool.

Huge time saver.

Huge potential for better accuracy.

Because it explores more options than a human possibly could in the same time frame.

This is the core engine driving DataRobot’s power.

Making machine learning practical and fast.

Especially for repetitive, complex tasks like predicting market prices.

It removes the manual guesswork from model building.

Letting you focus on the results and how to use them.

It’s a serious competitive advantage.

- Time Series Forecasting Capabilities:

Price data is time series data.

Prices today depend on prices yesterday, last week, last month.

DataRobot has specific tools built for this.

It understands the sequential nature of financial data.

Handles things like seasonality, trends, and lags automatically.

Standard machine learning models don’t always do well with time series.

You need specialised techniques.

DataRobot incorporates these.

It can build models that forecast future prices based on historical patterns.

You can specify things like forecast distance (how far into the future you want to predict).

It handles rolling forecasts.

Evaluates models based on metrics relevant to time series, like Mean Absolute Error (MAE) or Root Mean Squared Error (RMSE) over time.

This isn’t just about picking a good model.

It’s about picking a good model *for forecasting*.

Considering how past performance predicts future performance.

Crucial for trading.

It lets you factor in external data too.

Like economic releases, news sentiment scores, or data from related markets.

These can be powerful predictors if used correctly.

DataRobot helps you integrate this data into your forecasts.

Getting a richer, more accurate picture.

It specifically optimises for sequence-dependent data.

Which is exactly what financial price data is.

Without robust time series capabilities, generic AutoML isn’t enough for this job.

DataRobot has them built-in.

Making it a powerful tool for finance pros.

It’s not just predicting a point in time; it’s predicting a sequence of points over time.

That’s the nuance needed for price forecasting.

- Model Insights and Interpretability:

Okay, AI can feel like a black box.

It gives you a prediction, but why?

In Finance and Trading, knowing *why* a model predicts something is critical.

You need confidence in your decisions.

DataRobot provides detailed insights into its models.

Feature importance: Which factors in your data are most influencing the predictions?

Partial dependence plots: How does changing a specific factor (like trading volume) impact the predicted price, holding everything else constant?

Prediction explanations: For a single prediction, DataRobot can tell you exactly which features pushed the prediction up or down.

This isn’t just academic.

It helps you understand the market drivers.

Validate the model’s logic against your own market knowledge.

Spot potential issues (like a model relying too heavily on irrelevant data).

It builds trust in the AI’s recommendations.

You’re not blindly following a machine.

You’re using it as a powerful analyst that explains its reasoning.

This is key for regulatory compliance too.

Many financial institutions need to explain *how* a decision was made.

DataRobot’s interpretability tools help provide that audit trail.

It turns the black box into a grey box.

Still complex, but with windows you can look through.

Understanding *why* a price might move is as important as predicting *that* it will move.

DataRobot gives you that insight.

Empowering you to make more informed trading decisions.

Benefits of Using DataRobot for Finance and Trading

Alright, why should you care about using DataRobot if you’re in finance or trading?

Simple.

It makes you faster, smarter, and potentially richer.

Speed: Building accurate prediction models manually is a slog. Data cleaning, feature engineering, trying different algorithms, tuning parameters… it takes forever. DataRobot automates a massive chunk of this. You can go from raw data to a deployed model in hours, not weeks or months. This means you can react faster to market changes and test more strategies.

Accuracy: Because DataRobot explores a wider range of models and techniques than you could manually, it often finds more accurate models. Its time series capabilities are specifically tuned for financial data challenges. Better predictions mean better trading decisions.

Reduced Costs: You don’t need a huge team of expensive data scientists. DataRobot empowers existing analysts or traders to build sophisticated models. This slashes personnel costs associated with manual model development.

democratisation of AI: It puts powerful machine learning tools in the hands of domain experts – the traders and analysts who understand the markets best. They don’t need to become coding experts to build models.

Consistency: Automated processes are repeatable and consistent. You reduce the risk of human error in model building and deployment.

Scalability: As your data grows or you need to predict more assets, DataRobot scales with you. You can manage hundreds or thousands of models efficiently.

Better Risk Management: More accurate predictions help in assessing potential profits and losses more reliably. This is crucial for managing risk exposures in trading portfolios.

Spot Hidden Patterns: The automated exploration might uncover relationships in your data that manual analysis would miss. Complex interactions between features can be identified by sophisticated models DataRobot builds.

Increased Productivity: Free up your team from repetitive model building tasks. They can focus on higher-value activities like strategy development, backtesting, and market research.

Finance and Trading is competitive.

An edge is everything.

DataRobot provides that edge by making advanced prediction accessible, fast, and effective.

It turns complex data science into a usable tool for everyday financial operations.

That’s a serious win.

Pricing & Plans

Okay, let’s talk money.

How much does this AI magic cost?

DataRobot isn’t typically a cheap, off-the-shelf SaaS tool like some consumer AI apps.

It’s an enterprise-grade platform.

Built for serious business use.

Their pricing isn’t usually listed publicly on their website in neat tiers.

It’s more of a “contact us for a custom quote” situation.

Why?

Because the pricing depends heavily on your needs.

Factors include:

How much data you’ll be processing.

How many users need access.

Whether you need on-premises deployment or cloud.

The specific modules or features you require (like the time series add-ons).

The level of support you need.

So, there’s no simple “free plan” or “$99/month” option you just sign up for.

They offer a free trial or a demo, for sure.

This lets you kick the tires and see if it fits your needs.

But for actual usage, you’ll need to talk to their sales team.

Compared to building an in-house data science team and infrastructure from scratch?

DataRobot can often be more cost-effective.

You get access to cutting-edge techniques and constant updates without hiring dozens of expensive experts.

Compared to other enterprise AutoML platforms?

The pricing is competitive, but again, it’s tailored.

Alternatives exist from companies like H2O.ai, Google Cloud AI Platform, AWS SageMaker Autopilot, etc.

Each has its strengths and pricing models.

DataRobot positions itself on ease of use, breadth of algorithms, and specific industry solutions (like their finance accelerators).

So, while you won’t find a simple price tag here.

Expect it to be a significant investment.

But an investment intended to deliver significant returns through improved prediction accuracy and efficiency.

The value proposition is saving time, reducing hiring costs, and making better, data-driven decisions faster.

For a serious trading operation, the potential gains from better predictions can quickly outweigh the platform cost.

The key is to evaluate the ROI for your specific use case.

Does the accuracy boost and speed-up translate into more profitable trades or better risk management?

That’s the calculation you need to make.

Contacting DataRobot for a demo and custom quote is the necessary first step to understanding the cost for *you*.

Hands-On Experience / Use Cases

Let’s talk about how this actually looks in action.

Imagine you’re a quantitative analyst at a hedge fund.

Your job is to build models that predict asset prices.

Specifically, let’s say you want to predict the 5-day ahead price movement for a basket of tech stocks.

Your data includes historical prices, trading volumes, relevant economic indicators (like interest rates, inflation), and maybe some alternative data like news sentiment scores for each company.

Manually, you’d spend days cleaning and formatting this data.

Then you’d choose a few algorithms you think might work – maybe ARIMA, or a Prophet model, or a LSTM neural network.

You’d code them up.

Train them.

Tune parameters.

Evaluate results.

Compare them.

It’s a lengthy, iterative process.

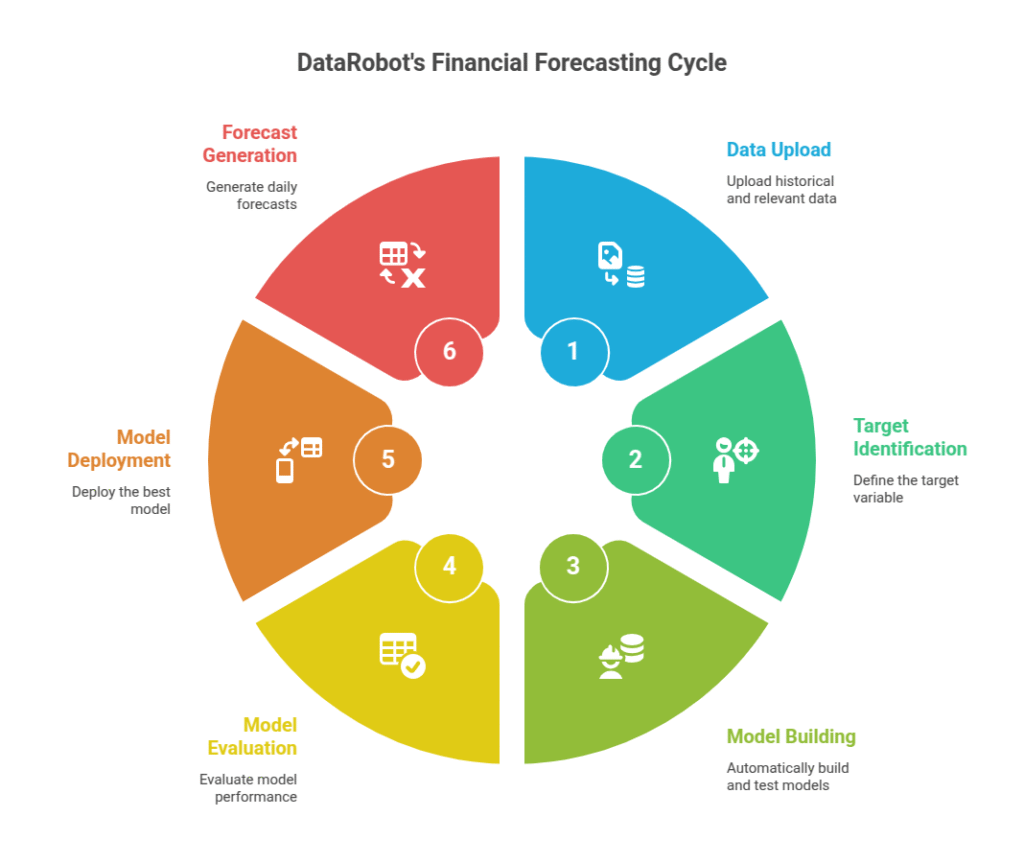

With DataRobot, the workflow changes dramatically.

You upload your historical data (cleaned, but DataRobot can help with some prep too).

You identify the target variable: the price movement (or the price itself) you want to predict in 5 days.

You specify it’s a time series problem and define the time steps.

You hit ‘Go’.

DataRobot automatically does feature engineering relevant to time series (like creating lagged variables, moving averages, etc.).

It then spins up hundreds, maybe thousands, of models simultaneously.

Testing different algorithms and configurations.

For Price Prediction and Forecasting in this context, it tries various time series models, regression models, tree-based models, and even deep learning approaches if applicable.

Within a few hours (depending on data size and complexity), you have a leaderboard.

Ranked by accuracy metrics relevant to forecasting (like RMSE, MAE, etc.).

You can inspect the top models.

See which features are driving their predictions.

Look at backtest results to see how they performed historically.

DataRobot provides visualisations showing the forecast vs. actuals.

You select the best model based on performance, interpretability, and business sense.

Then, deploying the model for live predictions is often just a few clicks.

You feed in new data daily, and the model generates forecasts.

The usability is high, even for non-coders.

The interface is designed for business users and analysts, not just data scientists.

Results?

Faster model development cycles.

Potentially more accurate models due to broader exploration.

More time for analysts to focus on interpreting results and trading strategy.

Consider another case: a risk management team needing to forecast volatility.

Volatility is harder to predict than price, but it’s a time series problem.

They can feed historical volatility data, trading volumes, macroeconomic factors, etc., into DataRobot.

Build models to forecast future volatility levels or ranges.

This helps in setting risk limits, valuing options, and hedging strategies.

Or maybe a bank wanting to predict loan defaults based on economic forecasts.

Not strictly price prediction, but relies heavily on economic forecasting which DataRobot can handle.

They can incorporate macroeconomic predictions generated by DataRobot’s time series models into their credit risk models.

The key is the platform’s ability to quickly turn data into reliable forecasts or predictions, especially for time-dependent data common in finance.

It’s about accelerating the process and improving the quality of the models used for critical financial decisions.

Who Should Use DataRobot?

So, is DataRobot for everyone dabbling in trading?

Probably not your casual retail investor.

As we touched on with pricing, it’s an enterprise-level tool.

The ideal users are typically:

Quantitative Trading Firms and Hedge Funds: These firms live and die by their models. DataRobot accelerates model development and testing, a direct competitive advantage. They have the data volume and the need for advanced, custom predictions.

Asset Management Firms: For portfolio management, risk management, and generating alpha through predictive insights. They need robust, explainable models for internal use and possibly for reporting to clients.

Banks and Financial Institutions: Beyond trading, banks need forecasting for loan default risk, credit scoring, fraud detection, and economic scenario planning. DataRobot’s platform can standardise and accelerate these processes across departments.

Corporate Finance Departments: Predicting revenue, expenses, cash flow, or commodity prices impacting their business. These internal forecasting needs are critical for planning and strategy.

Experienced Analysts and Data Scientists: Even if a company has a data science team, DataRobot makes them more productive. It handles the repetitive stuff, letting the experts focus on complex problems, feature engineering, and model interpretation.

FinTech Companies: Building predictive features into their products, whether it’s robo-advisory, credit scoring, or market analysis tools. Speed to market is crucial for FinTech, and DataRobot helps deliver predictive features faster.

Academics and Researchers in Computational Finance: For building and testing research models quickly.

Essentially, if you or your organisation deals with large volumes of financial data, needs to make predictions or forecasts regularly, and wants to leverage advanced machine learning without building an entire data science infrastructure from scratch (or wants to make their existing team hyper-efficient), DataRobot is likely a good fit.

It’s for those who understand the value of data-driven decision making in finance and are willing to invest in a powerful platform to achieve it.

It’s for teams who are tired of manual model building taking forever.

Or who struggle to deploy models into production quickly.

It’s for businesses that recognise the predictive power of AI but need a guided, automated way to harness it.

If you’re just trading off charts and news headlines with a small personal account, DataRobot is likely overkill.

If you’re managing significant capital, trading systematically, or building financial products that rely on predictions, DataRobot is built for you.

How to Make Money Using DataRobot

Okay, the ultimate question.

Can you actually make money using DataRobot?

Yes, absolutely. But not just by owning the tool.

It’s an enabler.

It helps you build the systems that make money.

Here’s how users in Finance and Trading typically monetise DataRobot:

- Enhanced Trading Strategies:

This is the most direct route for many.

Use DataRobot to build more accurate Price Prediction and Forecasting models.

These models can form the basis of automated trading signals or inform discretionary trading decisions.

Predicting future price movements with even slightly better accuracy than the competition can lead to significant profits on large trading volumes.

You can build models to predict:

Directional moves (up/down).

Volatility.

Correlation between assets.

Optimal entry and exit points.

The faster model development cycle lets you test and deploy new strategies quickly.

Adapting to changing market conditions.

This translates directly to potential alpha generation.

If your predictions are right more often than wrong, you make money.

- Offering Predictive Analytics Services:

If you’re a consultant or run a small firm, you can use DataRobot to offer predictive analytics services to other businesses.

Maybe a company needs to forecast demand for their products based on economic indicators.

Or a property developer wants to predict future property values in different areas.

A logistics company needs to forecast fuel prices.

DataRobot lets you build these custom forecasting models for clients much faster than doing it manually.

You sell the insights and the models.

Your efficiency (thanks to DataRobot) means you can take on more clients or charge competitive rates while maintaining profitability.

You become the expert providing high-value predictive insights.

Powered by an advanced AI platform.

It’s like being a top chef using the best ovens and ingredients – you can produce gourmet meals efficiently.

- Improving Internal Operations:

Even if you don’t trade directly, financial firms can use DataRobot to make money by saving money or improving efficiency.

Predicting customer churn: Reduces marketing costs.

Predicting credit risk: Reduces loan losses.

Predicting operational failures: Reduces downtime and costs.

Automating repetitive analysis tasks: Frees up expensive employee time for more strategic work.

Predicting resource needs: Optimises staffing and infrastructure.

These might not seem like direct “make money” examples like trading, but they improve the bottom line significantly.

Think of it as stopping the leaks in the bucket.

The money saved is money earned.

By using DataRobot to build models that optimise various internal processes, businesses become leaner and more profitable.

Predictive maintenance on trading infrastructure, forecasting customer support ticket volume, optimising trading desk staffing based on predicted volatility – these all contribute to a healthier financial state.

DataRobot is the tool that makes building these predictive models practical and fast.

Case Study Snippet (Simulated):

Meet “QuantX Capital”.

A boutique hedge fund.

They used to have two data scientists who spent 80% of their time cleaning data and manually trying out different quantitative models for equity Price Prediction and Forecasting.

Model updates took weeks.

Testing new data sources was a major project.

They adopted DataRobot.

Suddenly, their two data scientists could build and test dozens of models simultaneously.

Integrating new data sources became much simpler.

Model deployment time dropped from weeks to days.

They discovered that incorporating news sentiment data (processed by DataRobot) significantly improved the accuracy of their short-term predictions for certain sectors.

This improved accuracy translated directly into more profitable trades.

They were able to deploy a new trading strategy based on these improved predictions.

Leading to a significant percentage increase in their annual returns (e.g., 5-10% extra alpha) in the first year using the platform.

The cost of DataRobot was easily justified by the increased profitability from their trading activities.

Their data scientists shifted focus from repetitive tasks to finding *new* data sources and refining the *strategy* around the predictions DataRobot provided.

They used DataRobot to work smarter, not just harder.

That’s the power play.

Limitations and Considerations

Okay, DataRobot isn’t a magic bullet.

Nothing is.

While powerful, it has limitations and things you need to consider.

Data Quality is Still Key: DataRobot is great at building models from data. But if your input data is garbage, the predictions will be garbage. It can help with some data prep, but you still need clean, relevant, and reliable data to start with. It won’t fix fundamentally flawed data sources.

Understanding the Output: While DataRobot provides interpretability tools, you still need someone with domain knowledge (finance/trading) to understand what the model insights mean in a market context. Feature importance is useful, but you need to know *why* that feature matters in the real world.

Not a Strategy Generator: DataRobot builds prediction models. It doesn’t tell you *how* to trade based on those predictions. You still need trading expertise to develop a strategy, manage risk, and execute trades using the model’s outputs. It’s a tool for the strategy, not the strategy itself.

Cost: As discussed, it’s an enterprise platform. The cost can be prohibitive for small teams or individual traders. You need to have a use case with significant potential return to justify the investment.

Complexity for Some Users: While designed for ease of use, it’s still a sophisticated platform. Users need some level of analytical understanding. It’s not like clicking a button and getting a guaranteed winning trade. You need to understand the modelling process, evaluation metrics, and model deployment.

Generalisation Risk: A model might perform perfectly on historical data (backtesting) but fail in live trading conditions. Markets change. New factors emerge. DataRobot helps build models fast, but you still need rigorous testing and monitoring to ensure they perform well out-of-sample and in live trading.

Reliance on Historical Data: Like all predictive models, DataRobot’s models are trained on past data. They can struggle with unprecedented events or regime changes in the market that have no historical precedent.

Overfitting Potential: AutoML can sometimes find models that fit the training data too well but don’t generalise. DataRobot has safeguards and validation techniques, but the user needs to understand these and interpret the results correctly to avoid overfitting.

Integration Needs: Deploying models requires integration with your existing trading platforms, data feeds, or internal systems. While DataRobot offers APIs and deployment options, this step still requires technical work.

So, while DataRobot is powerful for Price Prediction and Forecasting and other financial modelling, it’s not a magic wand. It’s a sophisticated tool that requires skilled users, good data, and a solid understanding of both the technology and the financial markets. It accelerates the process and boosts potential, but doesn’t eliminate the need for human expertise and careful strategy.

Final Thoughts

Alright, wrapping this up.

DataRobot is a beast of a tool.

Especially if you’re neck-deep in Finance and Trading and need to nail Price Prediction and Forecasting.

It takes the grind out of building complex machine learning models.

Gives you speed, scale, and access to techniques that would normally require an army of data scientists.

For firms serious about using data to get an edge in the markets, it’s a game-changer.

It democratises powerful AI, putting it in the hands of analysts and traders who understand the domain best.

The automated machine learning and specific time series capabilities are spot on for financial data challenges.

Plus, the model interpretability helps build confidence and meet compliance needs.

Is it cheap? No.

Is it simple enough for everyone? Not quite.

But for the right user – typically larger firms, quants, or dedicated FinTechs – the ROI can be massive.

Faster model deployment, more accurate predictions, better efficiency, and potentially significant increases in profitability.

It doesn’t replace human intelligence or market expertise.

It augments it.

It’s a tool that lets humans focus on strategy and insight, while the AI handles the heavy lifting of model building and iteration.

If your business relies on accurate financial forecasting, and you’re struggling with the speed or complexity of traditional methods, DataRobot is definitely worth investigating.

It could be the difference between falling behind and staying ahead in a fiercely competitive market.

Go get a demo. See how it handles your data.

That’s the real test.

Visit the official DataRobot website

Frequently Asked Questions

1. What is DataRobot used for?

DataRobot is primarily used for automated machine learning (AutoML).

It helps businesses quickly build, deploy, and manage AI models to make predictions from data.

This includes things like predicting customer churn, forecasting sales, detecting fraud, and in our case, Price Prediction and Forecasting in finance.

It automates many steps of the data science workflow.

2. Is DataRobot free?

No, DataRobot is not a free tool.

It’s an enterprise-level platform with custom pricing based on specific business needs and usage.

They do offer demos and free trials for potential customers to evaluate the platform.

You need to contact their sales team for pricing details relevant to your organisation.

3. How does DataRobot compare to other AI tools?

DataRobot competes with other AutoML platforms and cloud-based AI services (like Google Cloud AI, AWS SageMaker, H2O.ai).

Its strengths often cited are its ease of use, breadth of algorithms explored automatically, specific features for time series, and model interpretability tools.

It focuses heavily on automating the end-to-end model building and deployment process for business users and analysts, not just expert data scientists.

4. Can beginners use DataRobot?

While DataRobot simplifies machine learning, it’s designed for users with analytical needs, typically in a business context.

A complete beginner with no data or financial knowledge might find it challenging.

However, a financial analyst or trader with a solid understanding of data and forecasting concepts can use DataRobot much more effectively than traditional coding methods, even without deep data science expertise.

Its interface guides you through the process.

5. Does the content created by DataRobot meet quality and optimization standards?

DataRobot doesn’t “create content” in the writing sense.

It builds predictive models from data.

The “quality and optimisation” here refer to the accuracy and robustness of the models it builds for tasks like Price Prediction and Forecasting.

It aims to build high-quality, accurate models automatically.

Model quality is measured by statistical metrics (like RMSE, MAE).

Optimisation refers to finding the best model configuration.

It performs these tasks to high standards, but requires quality data input.

6. Can I make money with DataRobot?

Yes, you can make money using DataRobot, but it’s an indirect tool for that purpose.

You use it to build better predictive models for trading strategies, improve operational efficiency in a financial business (saving costs), or offer predictive analytics services to clients.

The money comes from leveraging the accurate predictions and efficiencies DataRobot enables, not from DataRobot itself paying you or generating income directly without your strategic application.