FinBERT supercharges your Financial NLP and Sentiment Analysis. Understand market mood fast. Make smarter trading decisions. Try FinBERT today!

If You’re Not Using FinBERT, You’re Falling Behind

Alright, let’s talk about money.

Specifically, making money in finance and trading.

Things are changing fast.

AI isn’t just a buzzword anymore.

It’s real.

And it’s eating traditional workflows for breakfast.

Especially when it comes to making sense of text data.

Think news headlines, earnings calls, analyst reports.

That’s a mountain of information.

How do you process it all?

Fast?

Accurately?

That’s where FinBERT comes in.

This isn’t just another AI tool.

It’s built specifically for the finance world.

It’s designed to understand the jargon.

The nuances.

The subtle shifts in market mood that can make or break a trade.

If you’re still manually sifting through text, trying to gauge sentiment, you’re wasting time.

And time is money.

FinBERT is here to give you an edge.

A serious edge.

Let’s dig in and see how.

Table of Contents

- What is FinBERT?

- Key Features of FinBERT for Financial NLP and Sentiment Analysis

- Benefits of Using FinBERT for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use FinBERT?

- How to Make Money Using FinBERT

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is FinBERT?

Okay, let’s break this down simply.

FinBERT is an AI model.

Specifically, it’s a version of the famous BERT model.

But here’s the key difference: it was trained on financial text.

A massive dataset of financial news, reports, and documents.

Think of it like this: Regular AI models learn standard English.

FinBERT learned the language of money.

It understands terms like “earnings per share,” “volatility,” “bullish,” “bearish.”

It gets the context.

Why does this matter?

Because financial language is unique.

A word might mean one thing in general conversation but something totally different in finance.

Standard AI struggles with this.

FinBERT doesn’t.

Its main gig?

Financial NLP and Sentiment Analysis.

NLP stands for Natural Language Processing.

It’s how computers understand human language.

Sentiment analysis is figuring out the emotion or opinion expressed in text.

Is a news article positive, negative, or neutral about a specific company?

Is an analyst report optimistic or pessimistic?

FinBERT is built to tell you.

For who?

Anyone in Finance and Trading.

Traders, analysts, portfolio managers, researchers.

Anyone who needs to process large volumes of financial text to make decisions.

It takes the grunt work out of reading everything.

And it does it with accuracy tuned for finance.

That’s FinBERT at its core.

A specialized tool for a specialized job.

Getting straight to the point in financial text.

Understanding the market mood.

Fast.

And that’s valuable.

Key Features of FinBERT for Financial NLP and Sentiment Analysis

- Industry-Specific Training:

This is huge.

FinBERT wasn’t just trained on random internet text.

It learned from millions of financial sentences.

Think earnings call transcripts.

Financial news articles.

Analyst reports.

This training means it understands the specific language, jargon, and nuances of the finance world.

It knows that “volatile” in a financial report isn’t just describing someone’s temper.

It relates to price swings and risk.

This specialized understanding is what makes it so effective for Financial NLP and Sentiment Analysis.

Standard models would miss these subtleties.

FinBERT nails them.

- Accurate Sentiment Analysis:

This is FinBERT’s superpower for traders and analysts.

It can read a piece of financial text and classify the sentiment.

Usually into categories like Positive, Negative, and Neutral.

But because it’s trained on financial data, its sentiment scores are more reliable in this context.

It can differentiate between genuinely positive news (“Company X reported record profits”) and cautiously optimistic language (“Management is cautiously optimistic about future growth”).

This accuracy in interpreting financial mood swings is critical for making informed decisions.

Getting sentiment wrong can lead to bad trades.

FinBERT helps you get it right more often.

- Named Entity Recognition (NER):

Okay, slightly more technical term, but simple concept.

NER is about identifying and classifying key information in text.

For finance, this means pulling out company names, currency symbols, dates, specific financial metrics (like revenue, profit, debt), and even people’s names involved in a deal or report.

FinBERT’s financial training makes its NER highly effective for finance text.

It can spot “AAPL” and know it’s Apple Inc.

It can see “$10 billion” and understand it’s a monetary value.

This feature helps automate the extraction of crucial data points from unstructured text.

Saving you the manual effort of reading and pulling these out yourself.

Making analysis faster and more scalable.

- Classification Capabilities:

Beyond just sentiment, FinBERT can classify financial text in other ways.

It can be fine-tuned to categorise documents.

Is this article about mergers and acquisitions?

Earnings reports?

Regulatory changes?

Economic indicators?

This helps in organizing vast amounts of information.

Allows you to quickly filter and focus on the text relevant to your specific interest.

Filtering out noise is key in finance.

FinBERT helps you do that effectively based on content type.

Benefits of Using FinBERT for Finance and Trading

Alright, why bother with FinBERT?

What’s the payoff?

First up: Speed.

Seriously, this thing processes text at lightning speed.

Try reading and analyzing sentiment on hundreds, maybe thousands, of news articles or reports manually.

Takes forever.

Your eyes glaze over.

Mistakes happen.

FinBERT does it in minutes.

Scanning, analysing, scoring sentiment.

This means you get market insights way faster than your competition.

Faster information equals faster decisions.

Which in trading? Is everything.

Next: Accuracy.

We talked about its financial training.

This isn’t generic sentiment analysis.

It understands the subtleties unique to finance.

The difference between “potential downside” (negative) and “limited upside” (also negative, but perhaps less so, depending on context).

Human analysts are good, sure.

But they are prone to bias and fatigue.

FinBERT applies its trained model consistently.

Giving you a more objective and reliable view of market sentiment across a large corpus of text.

Third: Scale.

You can’t manually process every single financial tweet, news article, and regulatory filing related to your portfolio.

It’s just not possible.

FinBERT allows you to scale your analysis.

Process data from thousands of sources simultaneously.

Track sentiment across an entire sector.

Monitor market mood for every stock you’re interested in.

This kind of broad, real-time coverage was previously only accessible to huge institutions with massive teams.

FinBERT levels the playing field.

Finally: Better Decision Making.

All this speed, accuracy, and scale boils down to one thing.

Making better decisions.

Accessing sentiment insights faster means you can react to market shifts sooner.

More accurate analysis means you’re trading on reliable information, not gut feeling or incomplete data.

Being able to monitor a wider range of information helps you spot trends or risks you might have missed.

It’s about having more data points, processed intelligently, to inform your trading and investment strategies.

That’s the real benefit.

Increased confidence and potentially better results in the market.

Pricing & Plans

Okay, let’s talk money.

Because that’s what this is all about, right?

How do you get your hands on FinBERT, and what does it cost?

Here’s the deal: FinBERT isn’t typically a standalone “tool” you just sign up for on a website like you might with a writing AI.

It’s more of a foundational AI model.

Think of it as the engine.

This means you’ll usually access it in one of a few ways.

First, through open-source libraries.

The original FinBERT model was released open-source.

This means the core technology is technically “free” to access and use.

But “free” here means you need technical skills.

You need to know how to set up a development environment, install libraries (like Hugging Face’s Transformers), load the FinBERT model, and write code (usually Python) to apply it to your data.

If you’re a developer, a data scientist, or have the technical chops, this is the most direct and potentially cheapest way to use it.

You’ll have infrastructure costs (servers, cloud computing) depending on how much data you process, but no direct licence fee for the model itself.

Second, through platforms or APIs.

Some companies and service providers build applications or APIs (Application Programming Interfaces) on top of FinBERT.

They handle the technical complexity.

You just send your text data to their API, and they send back the sentiment scores or extracted information.

These services typically have pricing plans.

Often based on usage – like the number of API calls you make or the volume of text you process.

This is easier than the open-source route if you’re not technical.

You pay for convenience and managed infrastructure.

Pricing varies wildly depending on the provider and scale.

Look for providers specializing in Financial NLP and Sentiment Analysis or AI in Finance and Trading.

Third, as part of a larger platform.

Some financial data and analytics platforms might integrate FinBERT or similar specialized models into their service offerings.

You won’t see “FinBERT” explicitly.

It’s just part of their “AI-powered sentiment analysis” feature.

Pricing for these platforms is usually subscription-based.

Often tiered based on features, data access, and user count.

This is the most “done-for-you” option but also potentially the most expensive overall, as you’re paying for the entire platform, not just the AI analysis.

Is there a free plan?

Not in the sense of a free web interface to use FinBERT directly.

But the open-source nature means the model itself is free if you can deploy it.

Some API providers might offer a small free tier for testing.

Premium versions come via these API providers or integrated platforms.

They offer higher usage limits, better performance, more features, and support.

Compared to alternatives (like building your own model from scratch, which is incredibly hard, or using generic sentiment models that perform poorly on financial text), FinBERT is cost-effective if you need specialized financial analysis.

Your cost depends heavily on your technical ability and the volume of data you need to process.

But the potential ROI from better decisions can easily outweigh the cost.

Hands-On Experience / Use Cases

Let’s get real.

How do people actually use FinBERT?

Forget the theory for a sec.

Here are some practical examples.

Imagine you’re a quantitative trader.

You rely on data and algorithms.

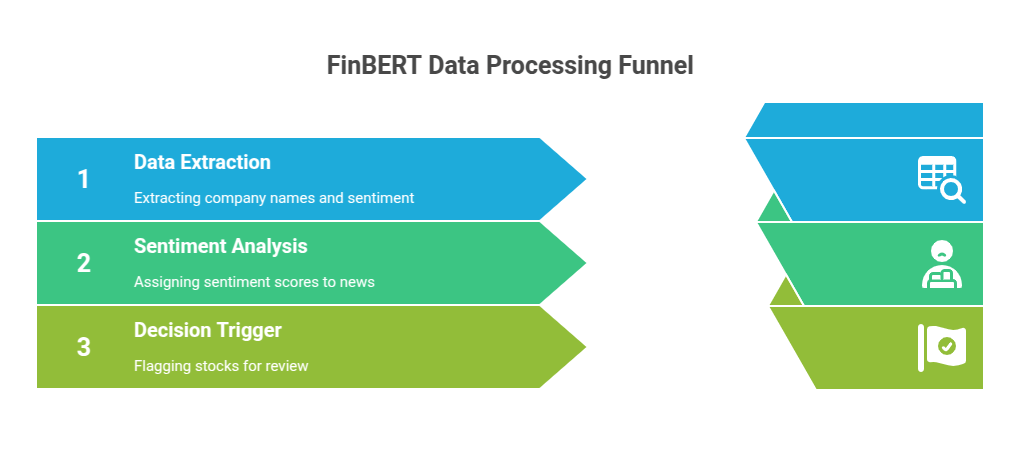

You could set up a system that uses FinBERT to monitor real-time financial news feeds.

Every time a news article drops about stocks in your watchlist, FinBERT analyses it.

It extracts the company name (NER) and assigns a sentiment score (Sentiment Analysis).

If there’s a sudden cluster of highly negative sentiment articles about a stock, your algorithm gets a signal.

Maybe it flags the stock for review.

Or even triggers a small protective trade.

You’re integrating unstructured text data – previously hard to use in quant models – directly into your trading signals.

Another use case: a portfolio manager.

You have positions in various sectors.

How do you gauge the overall market mood for, say, the renewable energy sector?

You could feed FinBERT all the analyst reports, industry news, and regulatory updates related to renewable energy companies over the past month.

FinBERT processes it, calculates the average sentiment, identifies key topics (Classification), and extracts specific financial mentions (NER).

You get a dashboard showing sentiment trends for the sector, individual companies within it, and common positive or negative themes being discussed.

This helps you understand if the general feeling is bullish or bearish, informing your allocation decisions.

Think about compliance teams.

They need to monitor communications.

Internal emails, chat logs, public statements.

Looking for potential red flags.

FinBERT, or models like it fine-tuned for specific compliance language, can scan this text.

Identify mentions of restricted activities, conflicts of interest, or potentially sensitive information.

This isn’t sentiment analysis exactly, but it uses the core NLP power of FinBERT to classify text based on rules or patterns relevant to compliance.

Saving countless hours of manual review.

Reducing risk.

What about research analysts?

They spend hours reading earnings call transcripts.

Looking for management commentary on specific issues.

Growth outlook, supply chain issues, new market entry.

FinBERT can help here too.

Use its classification and NER features to quickly pull out sentences or paragraphs that mention specific topics or financial metrics.

Then, run sentiment analysis on those specific sections.

How did the CEO sound when talking about supply chains?

Optimistic?

Concerned?

This speeds up the research process dramatically.

Allows analysts to cover more companies or dig deeper into specific themes.

These are just a few examples.

The usability depends on how FinBERT is implemented.

If you’re using the open-source version, usability depends on your coding skills.

If you’re using an API or a platform, it’s as easy as integrating with that service.

The results?

Faster analysis, ability to process more data, and potentially more informed decisions.

It’s about moving from reading to understanding, at scale.

Who Should Use FinBERT?

Okay, so who is this actually for?

Is it for everyone in finance?

Probably not *everyone*.

But a lot of people can benefit.

Quantitative Traders, absolutely.

If your strategy involves incorporating alternative data sources like news or social media, FinBERT is a must-have for processing the text component accurately.

It turns unstructured text into structured sentiment signals you can feed into your models.

Discretionary Traders and Portfolio Managers, yes.

You still read reports and news, but how do you quickly get the pulse of the market or a sector?

FinBERT-powered tools give you a bird’s-eye view of sentiment across vast amounts of text.

It helps you quickly identify shifts in mood that manual reading might miss or take too long to spot.

It augments your own analysis, doesn’t replace it.

Financial Analysts and Researchers, big time.

Your job involves deep dives into company fundamentals and market trends.

Reading is a huge part of that.

FinBERT automates the initial pass.

It can quickly summarize sentiment from earnings calls, highlight key phrases in reports, or aggregate opinions from analyst notes.

This frees you up to focus on the higher-level analysis and interpretation, not just the data gathering.

Data Scientists working in Finance and Trading, definitely.

If you’re building models that use text data, FinBERT is the perfect starting point.

It’s pre-trained on financial text, giving you a massive head start compared to using generic language models.

You can fine-tune it for even more specific tasks within your organization.

It’s the foundation for building powerful Financial NLP and Sentiment Analysis applications.

Financial News and Data Providers, potentially.

Companies that aggregate and distribute financial information can use FinBERT to add value.

They can offer sentiment scores alongside news articles.

Provide sentiment indices for sectors or markets.

This enhances their data offerings and provides clients with actionable insights.

Basically, anyone who deals with large volumes of financial text and needs to extract meaning, sentiment, or specific information efficiently and accurately should look into FinBERT.

If you’re making decisions based on financial reports, news, or commentary, FinBERT can likely improve your process.

It’s about leveraging AI to do the heavy lifting of text processing so you can focus on strategy and decision-making.

How to Make Money Using FinBERT

Okay, bottom line.

Can you actually make money with FinBERT?

Yeah, you absolutely can.

It’s not a money-printing machine on its own.

But it’s a tool that creates leverage.

Leverage that translates into profit, directly or indirectly.

Here’s how:

- Develop and Sell Sentiment Data Feeds:

This is a direct play if you have the technical skills.

Use FinBERT to process vast amounts of financial text – news, social media (with caution and proper filtering), blogs, forums.

Generate sentiment scores or indices for specific stocks, sectors, or keywords in real-time or near real-time.

Package this data into a feed.

Sell subscriptions to traders, hedge funds, or other financial institutions.

Your value proposition is providing timely, FinBERT-powered sentiment insights they can’t easily generate themselves.

This requires infrastructure and a solid data pipeline, but the demand for alternative data like sentiment is high.

- Offer Financial NLP and Sentiment Analysis as a Service:

Not everyone wants to run their own FinBERT models.

Many businesses or individuals in Finance and Trading need the insights but lack the technical expertise.

You can offer a service where clients send you financial documents (reports, transcripts, articles), and you return a detailed sentiment analysis report powered by FinBERT.

You could specialize.

Maybe focus on M&A sentiment.

Or analyzing management tone in earnings calls.

Or tracking public sentiment around specific financial regulations.

Charge per document, per report, or on a retainer basis.

- Build and License Financial AI Applications:

If you’re a developer, you can build specific applications that use FinBERT under the hood.

An application that screens stocks based on sentiment changes.

A tool that summarizes the key sentiment points from a batch of analyst reports.

A dashboard visualizing sentiment trends across different asset classes.

You build the software, integrate FinBERT, and then license it to users or institutions.

This is a higher-effort approach but can lead to scalable revenue if the application solves a real problem.

Consider someone like a freelance data analyst.

They can use FinBERT to offer advanced text analysis services to small hedge funds or investment advisors who don’t have in-house AI teams.

Instead of manually reading hundreds of pages for a client project, they use FinBERT to quickly process the text.

Extracting key themes, sentiment, and data points.

They charge a premium for faster, more comprehensive analysis enabled by the tool.

Their efficiency gains directly translate into higher earnings or the ability to take on more projects.

Another angle: Improve your own trading.

If you’re a trader, using FinBERT for better sentiment analysis on news and social media can give you timely signals.

Spotting negative sentiment early might help you exit a position before a big drop.

Identifying strong positive sentiment might validate a long position.

Better information leads to potentially better trading performance.

Increased profits from trading are a direct way FinBERT can make you money.

This requires developing and backtesting strategies based on the sentiment data, but the tool provides the crucial data point you need.

In short, FinBERT is a powerful engine for processing financial text.

You can make money by selling the data it generates, selling services powered by it, building products around it, or using it to directly improve your own financial activities.

It’s about finding a need in the market for deep, scalable financial text analysis and filling it using FinBERT.

Limitations and Considerations

Okay, let’s be real.

No tool is perfect.

FinBERT is powerful, especially for Finance and Trading text.

But it has limits.

First, accuracy isn’t 100%.

While FinBERT is trained on financial data, language is complex.

Sarcasm, irony, and highly nuanced language can still trip it up.

A sentence might be technically positive but in a cynical context.

“The company *finally* achieved profitability after years of losses.”

“Achieved profitability” is positive language.

But the word “*finally*” adds a layer of historical underperformance or sarcasm.

FinBERT might just see “profitability” and score it positively.

Context matters, and sometimes deep human understanding is still needed.

Sentiment scores should be used as indicators, not gospel.

Second, it’s only as good as the data it’s trained on.

The original FinBERT is trained on a specific corpus.

If you’re analyzing text that is very different from its training data – say, informal social media posts with lots of slang, or highly specialized niche financial documents – its performance might drop.

Fine-tuning the model on your specific type of data might be necessary for optimal results.

This requires additional effort and expertise.

Third, technical requirements.

As discussed under pricing, directly using the open-source FinBERT requires technical know-how.

You need skills in programming (Python), machine learning libraries, and potentially cloud computing.

Setting up the infrastructure, running the model, and integrating it into your workflow isn’t a plug-and-play operation.

If you’re not technical, you’ll rely on platforms or APIs, which adds cost and dependence on external providers.

Fourth, data privacy and security.

If you’re processing sensitive financial documents internally, you need to ensure that running the model on your own infrastructure is secure.

If you’re using a third-party API service, you need to trust that provider with your data and ensure they meet compliance standards relevant to Financial NLP and Sentiment Analysis.

This isn’t unique to FinBERT, but it’s a critical consideration when dealing with financial information.

Fifth, interpreting the results.

FinBERT gives you scores or categories.

Understanding what a sentiment score of, say, 0.7 really means in the context of a specific document or a collection of documents requires interpretation.

You need to understand how the model was trained, what its scores represent, and how to combine AI insights with other data points.

It’s a tool for analysis, not a crystal ball.

Human oversight and domain expertise are still essential.

So, while FinBERT is powerful, don’t treat it as magic.

Understand its strengths (financial text) and weaknesses (nuance, requiring technical setup).

Use it to augment your existing processes, not blindly replace them.

Be aware of the technical hurdles or costs associated with deployment.

And always validate the results, especially for critical decisions.

Final Thoughts

Look, the world of Finance and Trading is getting faster.

Information is everywhere.

Making sense of it all is the real challenge.

FinBERT is a serious piece of tech built specifically for this challenge.

It takes the messy, complex world of financial text and makes it understandable, quantifiable.

Especially when it comes to sentiment.

If you’re spending hours reading reports, news, or transcripts just to get a feel for the market mood or extract key info, you’re working too hard.

FinBERT can automate a huge chunk of that grunt work.

It gives you speed, accuracy (within its domain), and the ability to process data at scale you couldn’t manage manually.

This translates to potentially spotting trends faster, making more informed decisions, and ultimately, having an edge.

Is it easy?

Depends on your technical skills or whether you use a third-party platform.

Is it perfect?

No AI is. You still need your brain to interpret and apply the results.

But if you’re serious about leveraging technology in finance.

If you understand the value of extracting insights from text data.

FinBERT is something you need to look at.

It’s not just a tool.

It’s an enabler.

It allows you to do things that were previously too time-consuming or expensive.

My recommendation?

If you have the technical team, explore deploying the open-source model and fine-tuning it for your specific needs.

If you don’t, start looking into service providers or platforms that offer FinBERT-powered Financial NLP and Sentiment Analysis.

Figure out how you can integrate these sentiment insights into your workflow.

Don’t get left behind.

Leverage AI like FinBERT to work smarter, make better decisions, and stay ahead in a competitive market.

The tools are here.

It’s up to you to use them.

Visit the official FinBERT website

Frequently Asked Questions

1. What is FinBERT used for?

FinBERT is primarily used for natural language processing (NLP) tasks specifically within the finance domain.

Its main application is sentiment analysis of financial text, such as news articles, reports, and earnings calls.

It helps users understand the overall mood or opinion expressed in this text (positive, negative, neutral) with accuracy tuned for financial language.

2. Is FinBERT free?

The original FinBERT model is available as open-source, meaning the core technology is free to download and use.

However, using it requires technical skills for setup and deployment.

If you access FinBERT through third-party platforms or APIs, those services will have associated costs, often based on usage or subscription tiers.

3. How does FinBERT compare to other AI tools?

FinBERT is specifically trained on financial text, which gives it a significant advantage over general-purpose AI language models when analyzing financial documents.

Other tools might struggle with financial jargon or nuances, leading to less accurate sentiment analysis or information extraction in this specific domain.

FinBERT’s specialized training makes it better suited for Financial NLP and Sentiment Analysis tasks.

4. Can beginners use FinBERT?

Using the open-source version of FinBERT requires technical skills in programming and machine learning.

Beginners without a technical background would find it challenging to use directly.

However, many third-party platforms and services are built on top of FinBERT, offering user-friendly interfaces or APIs that beginners can use without needing deep technical knowledge of the model itself.

5. Does the content created by FinBERT meet quality and optimization standards?

FinBERT doesn’t “create” content in the way a generative AI like GPT does.

It analyzes existing financial text to provide insights like sentiment scores or extracted information.

The “quality” is in the accuracy of its analysis for financial text, which is considered high due to its specialized training.

It helps optimize workflows by quickly processing text that a human would take much longer to analyze.

6. Can I make money with FinBERT?

Yes, FinBERT can be used to make money.

You can use it to improve your own trading and investment performance by gaining faster and more accurate sentiment insights.

You can also offer services like financial sentiment analysis to clients, develop and sell data feeds powered by FinBERT, or build and license applications that integrate FinBERT’s capabilities.