Accern supercharges Financial NLP and Sentiment Analysis, giving you an edge in finance. Gain unparalleled market insights and make smarter trading decisions. Ready to elevate your strategy?

Why Accern Is a Game-Changer in Financial NLP and Sentiment Analysis

You ever feel like you’re drowning in data?

Like the market moves faster than you can possibly keep up?

Every trader, every analyst, every fund manager faces this.

The sheer volume of news, reports, social media chatter – it’s overwhelming.

Trying to manually sift through it for actionable insights?

That’s a losing battle.

It’s like trying to catch a waterfall in a teacup.

But what if you could have an unfair advantage?

What if you could understand market sentiment before anyone else?

That’s where AI steps in, specifically for Finance and Trading.

And that’s where Accern changes the game.

This isn’t just another shiny new tool.

This is about getting real, quantifiable results.

This is about making smarter decisions, faster.

Forget guesswork; this is about precision.

So, if you’re tired of falling behind, keep reading.

Accern might just be the edge you’ve been looking for in the crazy world of Financial NLP and Sentiment Analysis.

It’s time to stop reacting and start predicting.

Table of Contents

- What is Accern?

- Key Features of Accern for Financial NLP and Sentiment Analysis

- Benefits of Using Accern for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Accern?

- How to Make Money Using Accern

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Accern?

Okay, so what exactly is Accern?

Think of it as your personal AI analyst, but on steroids.

Accern is an AI-powered platform designed specifically to extract real-time insights from unstructured data.

News articles, social media, press releases, regulatory filings – you name it.

It chews through all that text, identifies relevant events, and quantifies sentiment.

No human could process this volume and speed.

Its core function is to empower financial professionals.

That means hedge funds, asset managers, banks, and even individual traders.

They use it to gain a critical edge.

It’s about cutting through the noise.

Getting to the signal.

The platform excels at Financial NLP and Sentiment Analysis.

NLP stands for Natural Language Processing.

It’s how machines understand human language.

Sentiment analysis is about gauging the mood.

Is the market positive, negative, or neutral on a specific stock, sector, or event?

Accern does this at scale, in real-time, across millions of data points.

It’s not just about what happened, but what people are *saying* about what happened.

And how that might move prices.

It targets anyone who needs to make data-driven decisions in finance.

This means less gut feeling, more informed strategy.

It’s a powerful tool for those who demand precision and speed.

If you’re operating in Finance and Trading, you need this.

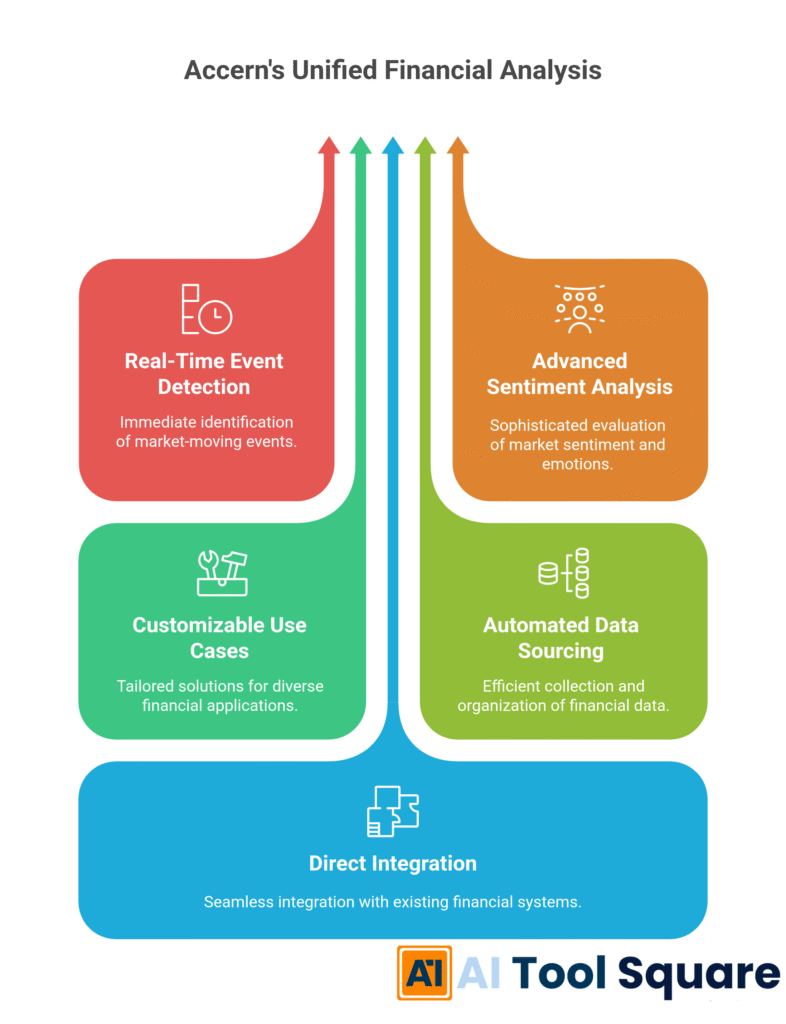

Key Features of Accern for Financial NLP and Sentiment Analysis

Accern isn’t just a fancy dashboard. It comes packed with features built for financial pros. These aren’t just buzzwords; they’re tools that deliver.

- Real-Time Event Detection:

This is huge. Accern constantly monitors millions of public and private data sources. It’s looking for specific events that impact markets. Think M&A announcements, executive changes, product recalls, earnings revisions. It doesn’t just find mentions; it understands the context. For Financial NLP and Sentiment Analysis, this means you get alerts on material news the moment it breaks. Not an hour later. This speed gives you a critical edge. You’re not waiting for a news aggregator; you’re getting deep, contextual understanding instantly. It’s about being first to know, with accuracy.

- Advanced Sentiment Analysis:

Sentiment isn’t just positive or negative. Accern goes deeper. It understands the nuances of financial language. It can differentiate between a neutral statement and a subtly negative one. It identifies sentiment across multiple dimensions: overall, specific entities, even specific topics within an article. This feature allows traders to gauge market mood with precision. It helps you understand how the market is *feeling* about a company, a sector, or a geopolitical event. This isn’t just keyword counting; it’s true linguistic understanding. For anyone in Finance and Trading, this insight is gold.

- Customizable Use Cases & Taxonomy:

You’re not getting a one-size-fits-all solution here. Accern allows users to build custom event models. Want to track a very specific type of regulatory change? You can define it. Need to monitor a unique set of ESG factors? You can set that up. This flexibility means the platform adapts to your specific investment strategy. It’s like having a bespoke AI system built just for your needs. This level of customization ensures that the insights you get are hyper-relevant. You’re not just swimming in data; you’re targeting exactly what matters to your alpha generation. This makes Accern incredibly powerful for specialized strategies.

- Automated Data Sourcing and Curation:

Forget spending hours finding and cleaning data. Accern handles that automatically. It aggregates data from a vast array of sources: news wires, financial publications, blogs, forums, social media, government filings. Then, it cleans, normalizes, and enriches this data. This means you’re working with reliable, high-quality information. No more worries about data integrity or missing sources. It’s all about providing a clean, consistent feed for your analysis. This saves immense time and resources, letting you focus on strategy, not data plumbing. It’s the silent workhorse that ensures your insights are solid.

- Direct Integration Capabilities:

Accern isn’t a standalone island. It’s designed to fit into your existing workflow. It offers APIs and various integration options. This means you can feed its insights directly into your trading algorithms, quantitative models, or internal dashboards. You don’t have to manually transfer data or switch between platforms. This seamless integration boosts operational efficiency. It ensures that the intelligence Accern generates is actionable. It flows right into where you make decisions. This connectivity is crucial for speed and automation in modern financial operations.

Benefits of Using Accern for Finance and Trading

Why bother with Accern? Because it solves real problems that cost real money.

First, let’s talk about time savings.

Manual research is slow, prone to error, and frankly, boring.

Accern automates the data crunching.

It reads faster than any human.

It processes more data than a team of analysts.

This frees up your team to focus on higher-value tasks.

Strategy development, complex modelling, client relations.

Not sifting through endless news feeds.

You get real-time insights, not yesterday’s news.

This speed is critical in fast-moving markets.

Second, there’s a massive improvement in insight quality.

Humans have biases.

We miss things.

We get tired.

Accern doesn’t.

It provides an objective, data-driven view of market sentiment and events.

It identifies subtle patterns and connections humans might overlook.

This leads to more robust, reliable analysis.

It helps overcome creative blocks, not in the artistic sense, but in the analytical sense.

When you’re stuck trying to understand why a stock moved, Accern gives you the data.

It provides clarity, cutting through market noise.

You’re no longer guessing; you’re acting on evidence.

Third, it’s about gaining an unfair advantage.

In Finance and Trading, information is power.

Early information is even more powerful.

Accern provides that early, accurate information.

It helps you identify opportunities before the wider market reacts.

It also flags risks that might be brewing under the surface.

This means better decision-making.

More profitable trades.

Reduced exposure to unforeseen events.

It’s not just about “keeping up.”

It’s about getting ahead.

Finally, consider the scalability.

If your assets under management grow, your research needs grow.

Hiring more analysts for manual work gets expensive, fast.

Accern scales with you.

It handles increasing data volumes without a proportionate increase in cost.

This efficiency translates directly to your bottom line.

It makes advanced Financial NLP and Sentiment Analysis accessible.

No matter your size, it levels the playing field.

It’s an investment that pays dividends in speed, accuracy, and profitability.

Pricing & Plans

Alright, let’s talk money. Is Accern going to break the bank?

The short answer is: it depends.

Accern operates on an enterprise model.

This isn’t a tool with a public “sign up now for $X/month” button.

It’s a serious platform for serious financial institutions.

Think large hedge funds, asset managers, banks, and big trading firms.

Therefore, you won’t find specific pricing tiers openly advertised on their website.

Pricing is typically customized based on several factors.

These include the scope of data sources you need, the number of users, the complexity of your use cases, and the level of support required.

They work directly with clients to tailor a solution.

So, no, there isn’t a free plan for Accern.

This isn’t a freemium tool for individual hobbyists.

It’s a professional-grade solution.

The premium version, or rather, the standard offering, includes the full suite of features.

Real-time event detection, advanced sentiment analysis, custom models, and comprehensive data sourcing.

It’s built for high-stakes environments where precision and speed are paramount.

How does it compare to alternatives?

Well, direct competitors in this specific niche are few.

Most other AI tools for Finance and Trading might offer parts of what Accern does.

Some might do NLP, others sentiment, some just data aggregation.

Accern aims to be an end-to-end solution.

It integrates these capabilities seamlessly.

Therefore, a direct price comparison is hard without knowing your exact needs.

However, consider the return on investment.

The cost of missed opportunities or delayed information in finance can be astronomical.

The gains from early, accurate insights can be substantial.

So, while it’s an investment, the value proposition is clear for those who can leverage its power.

If you’re considering Accern, expect a consultative sales process.

They’ll assess your needs and provide a tailored quote.

It’s about solving your specific problems, not just selling a subscription.

It’s for serious players looking for a serious edge in Financial NLP and Sentiment Analysis.

Hands-On Experience / Use Cases

Alright, enough theory. How does this thing actually work in the trenches?

Imagine you’re a portfolio manager.

You’re constantly looking for an edge.

One day, you get an alert from Accern.

It flags a significant increase in negative sentiment around a specific biotech company, BioGenX.

This isn’t just a general negative sentiment.

Accern identifies discussions across various sources – niche medical forums, specialist financial blogs, even early news wires – about a specific drug trial.

The tone indicates unexpected adverse effects.

Most public news aggregators are still reporting positive or neutral sentiment, focusing on older, positive news.

But Accern, with its deep Financial NLP and Sentiment Analysis, has picked up on the subtle, evolving narrative.

It’s detected a shift.

Within minutes, you can drill down.

You see the specific articles, the keywords, the sentiment scores.

You can even trace the spread of the information.

You then have a choice.

Do you wait for the official press release, which could be hours or days away?

Or do you act on this early, AI-generated insight?

In this simulated example, you decide to trim your position in BioGenX.

You might even take a short position if your strategy allows.

A day later, the company officially announces delays and safety concerns with their drug trial.

The stock plummets.

While others are scrambling, you’ve already de-risked or even profited.

That’s the real impact.

Another use case: a quantitative hedge fund.

They integrate Accern’s event data directly into their trading algorithms.

Accern identifies thousands of micro-events daily.

Everything from supply chain disruptions affecting a specific industry to executive comments at industry conferences.

These aren’t always front-page news.

But aggregated, and with sentiment assigned, they provide powerful signals.

The algorithms then use these signals to adjust portfolio weightings.

They might increase exposure to companies with strong, positive momentum.

They might reduce exposure to those showing early signs of trouble.

The usability of Accern is streamlined.

Its dashboard provides a clear overview of detected events and sentiment trends.

Customizable alerts mean you only get notified about what matters to your specific investments.

The API allows for seamless integration into existing systems.

The results?

Potentially significant outperformance.

Reduced downside risk.

And a much more efficient research process for analysts.

It moves you from reactive to proactive in Finance and Trading.

This isn’t magic; it’s advanced AI putting crucial information at your fingertips, before the crowd.

Who Should Use Accern?

So, who’s actually going to get the most bang for their buck with Accern?

It’s definitely not for everyone.

This tool is for serious players in the financial arena.

First up, Hedge Funds and Asset Managers.

These are the core users.

They operate with massive amounts of capital.

Even a slight edge in information can translate to millions in profits or avoided losses.

They need real-time, deep insights into market sentiment and emerging events.

Accern helps them build more robust trading strategies.

Next, Investment Banks and Proprietary Trading Desks.

These institutions need to make lightning-fast decisions.

Whether it’s for M&A advisory, underwriting, or proprietary trading.

Understanding the market narrative and sentiment around companies is critical.

Accern provides that intelligence, often ahead of traditional news channels.

Then there are Quantitative Funds.

For quant funds, Accern is a data goldmine.

Its structured event data and sentiment scores can be fed directly into algorithmic models.

This allows for the creation of new alpha-generating strategies.

It also refines existing ones.

It’s about leveraging unstructured data at scale for systematic trading.

Don’t forget Corporate Strategy and Investor Relations Teams.

While not directly Finance and Trading, these teams benefit too.

They need to monitor how their company, competitors, and industry are perceived.

Accern provides a comprehensive view of public sentiment.

This helps them manage reputation and understand market expectations.

Finally, Risk Management Departments.

Identifying early warning signs of reputational damage, operational failures, or legal issues is crucial.

Accern can flag these emerging risks from a multitude of textual sources.

This allows for proactive mitigation.

It enhances the overall risk intelligence of an organization.

So, if you’re an individual day trader with a small account, Accern is likely overkill.

But if you’re managing significant capital, needing a decisive edge, and your decisions hinge on understanding market narrative and Financial NLP and Sentiment Analysis, then Accern is built for you.

It’s a high-performance tool for high-stakes environments.

How to Make Money Using Accern

You want to make money? Good. Accern helps you do just that, but not in the way you might think of a side hustle. This isn’t about selling services to small businesses. This is about generating alpha.

- Identifying Alpha-Generating Trading Signals:

This is the primary way to make money. Accern gives you early access to information. Think about it: if you know about a critical event or a shift in sentiment before the rest of the market, you can trade on that information. It could be buying a stock showing early positive sentiment shifts, or shorting one with accumulating negative news. The speed and depth of Accern’s Financial NLP and Sentiment Analysis translate directly into actionable trading signals. This means more profitable entries and exits. It’s about being ahead of the curve, consistently.

- Optimising Risk Management and Hedging Strategies:

Making money isn’t just about big wins; it’s about avoiding big losses. Accern helps you identify brewing risks. Are there early signs of supply chain disruptions? Negative regulatory talk? Reputational issues for a key holding? By detecting these risks early, you can adjust your portfolio. You can hedge against potential downturns or reduce exposure. This protects your capital. It turns potential losses into sustained profitability by smart, proactive risk management. It’s not always about making a new buck, sometimes it’s about not losing the old ones.

- Developing Unique Investment Strategies:

Accern allows you to go beyond traditional financial metrics. With its customisable event models, you can build entirely new strategies. For example, you could track all mentions of “carbon footprint reduction” combined with “executive hiring” in the renewable energy sector. This allows you to identify ESG leaders early. Or perhaps, track specific competitor product launch sentiment. These unique data points can form the basis of a differentiated investment strategy, giving you a competitive edge and thus, better returns in Finance and Trading.

Let’s consider a real-world scenario (anonymised for privacy, of course).

A boutique asset management firm was struggling with market volatility.

Their traditional models were good, but they kept getting caught off guard by sudden news events.

They integrated Accern.

One specific example: Accern started flagging unusual, geographically isolated news about a certain commodity.

It was about unforeseen weather patterns impacting harvests in a niche agricultural region.

This information wasn’t yet picked up by major commodity reports.

But Accern’s event detection, combined with local news sentiment analysis, caught it.

The firm used this insight to adjust their commodity futures positions.

They locked in profits before the broader market caught on to the supply shortage.

This single, early insight from Accern helped them generate an additional 1.5% alpha on that portfolio for the quarter.

That’s significant money.

It’s not just about what Accern does; it’s about what you *do* with the intelligence it provides.

It empowers you to make highly informed, timely decisions.

Those decisions are what drive profits in the financial markets.

Accern isn’t a get-rich-quick scheme.

It’s a sophisticated tool that gives skilled financial professionals a powerful advantage.

It helps you work smarter, not just harder, to extract value from information.

Limitations and Considerations

Nothing is perfect, right? Accern is powerful, but it’s not without its nuances and things you need to keep in mind.

First, let’s talk about accuracy and false positives.

While Accern’s AI is cutting-edge, it’s still AI.

No machine can perfectly interpret human language 100% of the time.

Sometimes, it might flag an event that, upon human review, turns out to be less significant.

Or the sentiment might be slightly misinterpreted due to sarcasm or highly nuanced language.

This isn’t a criticism specific to Accern; it’s a limitation of current NLP technology.

So, while it provides powerful signals, human oversight is still important.

Don’t blindly trust every alert without any verification.

Second, the learning curve and setup time.

Accern isn’t a plug-and-play tool for beginners.

It’s designed for sophisticated users.

Setting up custom event models, integrating with existing systems, and fine-tuning the taxonomy requires expertise.

There’s a learning curve involved in fully leveraging its capabilities.

You need to understand your data, your strategy, and how to configure the platform to serve those needs.

It’s not like downloading a simple app.

Expect an onboarding process and a commitment to understanding the system.

Third, data volume and relevance.

Accern processes a massive amount of data.

While this is a strength, it can also be a challenge if not managed properly.

Without carefully configured filters and custom models, you could still be overwhelmed.

It’s crucial to define what truly matters to your strategy.

Otherwise, you risk trading one type of noise for another.

You need to be specific about what you want to track for effective Financial NLP and Sentiment Analysis.

Finally, cost implications.

As discussed, Accern is an enterprise solution.

It comes with an enterprise price tag.

For smaller firms or individual traders, the investment might be prohibitive.

You need to have significant assets under management or be operating in a high-volume trading environment to justify the cost.

The return on investment needs to be carefully calculated.

It’s an investment in infrastructure, not a casual subscription.

It’s about whether the edge it provides truly outweighs the capital outlay for your specific scale of operations in Finance and Trading.

So, while Accern offers incredible advantages, remember it’s a powerful tool that requires thoughtful implementation and continued human expertise.

Final Thoughts

Let’s wrap this up.

Accern is not just another AI tool.

It’s a serious piece of technology for serious financial professionals.

Its core value lies in its ability to transform unstructured data into actionable intelligence.

It does this at a speed and scale impossible for humans.

If you’re in Finance and Trading, battling for an edge, Accern offers a potent weapon.

It elevates your Financial NLP and Sentiment Analysis beyond keyword searches and basic sentiment.

It gets you to contextual understanding, in real-time.

This means you can detect market-moving events earlier.

You can gauge sentiment with greater precision.

And you can make more informed, data-driven decisions.

Is it for everyone? No.

It requires investment, both financially and in terms of learning.

But for those who operate where milliseconds and nuanced information equate to massive gains or losses, it’s a game-changer.

It can significantly boost your operational efficiency.

It can help you identify alpha opportunities.

And it can provide a critical layer of risk management.

My recommendation?

If you’re an institutional player and you’re not exploring this, you’re potentially leaving money on the table.

You’re operating with one hand tied behind your back.

The market isn’t waiting for you.

It’s moving fast.

Accern helps you move faster.

Take the next step.

At least investigate what it can do for your specific needs.

Visit the official Accern website

Frequently Asked Questions

1. What is Accern used for?

Accern is primarily used by financial professionals in Finance and Trading. It leverages AI-powered Natural Language Processing (NLP) and sentiment analysis to extract real-time insights from vast amounts of unstructured text data. This helps users make data-driven decisions, identify trading opportunities, and manage risk more effectively.

2. Is Accern free?

No, Accern is not a free tool. It is an enterprise-grade solution designed for institutional clients like hedge funds, asset managers, and banks. Pricing is custom and based on specific client needs and usage, reflecting its powerful capabilities and target market.

3. How does Accern compare to other AI tools?

Accern stands out by offering a comprehensive, end-to-end solution specifically tailored for Financial NLP and Sentiment Analysis. While other AI tools might offer individual components like basic sentiment analysis or data aggregation, Accern integrates real-time event detection, advanced contextual sentiment, and customizable use cases across a massive data universe, all within a financial context. It’s built for precision in high-stakes environments.

4. Can beginners use Accern?

Accern is designed for sophisticated financial professionals. While the interface aims for clarity, fully leveraging its advanced features, like building custom event models and integrating APIs, requires a strong understanding of financial markets and data analytics. It’s not typically recommended for absolute beginners without institutional support or extensive training.

5. Does the content created by Accern meet quality and optimization standards?

Accern doesn’t “create content” in the typical sense of generating articles or marketing copy. Instead, it extracts and structures information, providing data points and insights. The quality of these insights is very high, driven by advanced AI. For optimization standards, it excels at providing the critical, timely information needed to optimize trading and investment strategies, which is its primary function.

6. Can I make money with Accern?

Yes, users can make money with Accern by gaining an informational edge. It helps identify alpha-generating trading signals earlier than the broader market, optimize risk management by flagging emerging threats, and develop unique investment strategies based on deep, nuanced insights from unstructured data. It’s a tool for enhancing profitability in professional financial operations.