FactSet DataFeed revolutionizes Data Feeds and Market Integration, empowering Finance and Trading pros with accurate, real-time data. Stop manual struggle; gain a competitive edge. Try FactSet DataFeed today!

FactSet DataFeed Helps Me Meet Deadlines Without Chaos

Look, the world of Finance and Trading is moving at warp speed.

If you’re still sifting through data manually, you’re not just behind, you’re in a different race altogether.

AI isn’t just a buzzword anymore.

It’s the engine powering the top players.

And when it comes to raw, actionable market intelligence, one name keeps popping up: FactSet DataFeed.

It’s about streamlining your operations, getting the right data, right now, and making moves before the competition even knows what hit them.

Forget the chaos.

It’s time for clarity.

Table of Contents

- What is FactSet DataFeed?

- Key Features of FactSet DataFeed for Data Feeds and Market Integration

- Benefits of Using FactSet DataFeed for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use FactSet DataFeed?

- How to Make Money Using FactSet DataFeed

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is FactSet DataFeed?

So, what’s the deal with FactSet DataFeed?

Simply put, it’s an AI tool built to suck in, process, and spit out financial data at an insane speed.

Think of it as your personal data factory, running 24/7.

It’s not some fluffy content generator.

This thing is designed for the hardcore world of Finance and Trading.

Its core function is providing continuous, high-fidelity data feeds directly into your systems.

We’re talking real-time market data, historical archives, company financials, reference data – the whole shebang.

It’s for the big players.

Investment managers, hedge funds, quantitative analysts, fintech firms – anyone who lives and dies by precise data and lightning-fast execution.

Its target audience isn’t casual investors.

It’s for professionals who need to integrate vast amounts of information directly into their trading algorithms, risk models, and analytical applications.

No more waiting around for data updates.

No more manual data entry.

FactSet DataFeed automates that entire process, giving you an edge.

It means your models are always running on the freshest numbers available.

This is about getting ahead and staying there.

It’s about equipping traders and analysts with the raw material they need to make split-second decisions with confidence.

The level of detail and granularity it provides is staggering.

From individual stock ticks to macroeconomic indicators, it’s all there, ready for consumption.

It’s a data pipeline, robust and reliable.

This isn’t just about data; it’s about competitive advantage.

It’s about making sure your systems are fed with the exact information required, precisely when it’s needed.

That’s what FactSet DataFeed brings to the table.

Key Features of FactSet DataFeed for Data Feeds and Market Integration

- Comprehensive Data Coverage:

FactSet DataFeed isn’t messing around when it comes to data.

It covers everything.

We’re talking global real-time market data, deep historical archives going back decades, company fundamentals, supply chain details, ownership structures, and even alternative data sets like sentiment analysis.

This breadth means you don’t need multiple vendors for different data types.

It’s all in one place.

For Data Feeds and Market Integration, this is huge.

It simplifies the process, reducing the complexity of data sourcing.

You get a unified view, which is critical for accurate risk assessment and trading strategies.

No gaps, no missing pieces.

Just a complete picture of the financial universe, ready for your models.

It helps you build robust trading systems that rely on diverse data points, giving you a full scope of market dynamics.

- Flexible Delivery and API Integration:

How you get the data matters just as much as what data you get.

FactSet DataFeed offers serious flexibility.

You can get data via direct file delivery, robust APIs, or even cloud-based solutions.

This means it plugs right into your existing infrastructure.

No need to rebuild your whole system around it.

For market integration, this is a game-changer.

You can stream real-time prices directly into your algorithmic trading platforms.

Or pull historical data for backtesting models without breaking a sweat.

The API is well-documented, making integration smooth for developers.

This adaptability ensures that whether you’re a startup or a global bank, FactSet DataFeed fits your workflow.

It reduces integration time and costs, letting you focus on strategy, not setup.

- High Accuracy and Low Latency:

In Finance and Trading, outdated or inaccurate data is a death sentence.

FactSet DataFeed nails this.

It’s built for precision and speed.

Data goes through rigorous validation processes before it ever hits your system.

This means you’re working with clean, reliable numbers.

Low latency is crucial for real-time trading.

FactSet’s infrastructure minimizes delays, getting market updates to you virtually instantaneously.

This allows for faster execution of trades based on current market conditions.

It means your trading models are reacting to events as they happen, not minutes later.

Accuracy prevents costly errors.

Low latency creates opportunities.

Together, they give you a significant competitive edge in fast-moving markets.

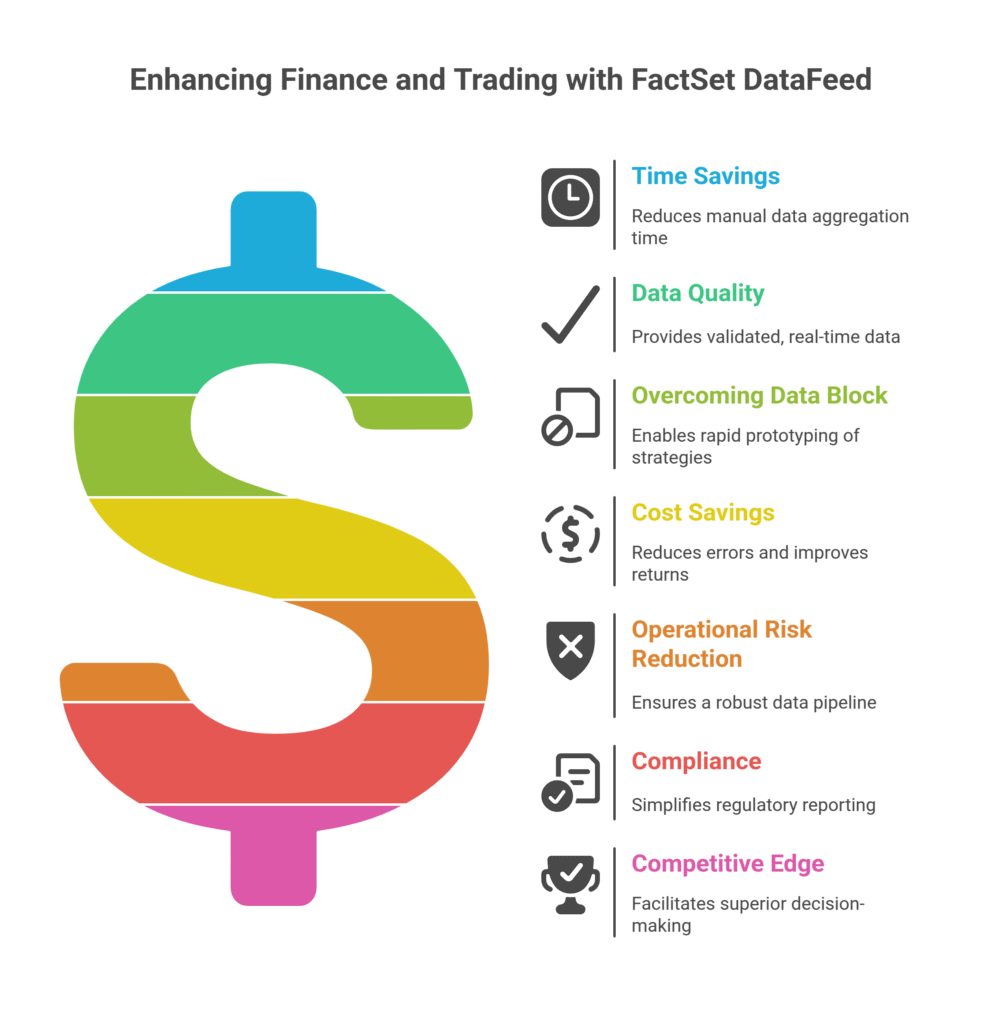

Benefits of Using FactSet DataFeed for Finance and Trading

Alright, let’s talk brass tacks.

Why should you even bother with FactSet DataFeed?

Simple: time and money.

First, you’re going to save a massive amount of time.

Imagine cutting out hours, days even, of manual data aggregation and cleansing.

That’s what this tool does.

Your analysts aren’t spending time downloading spreadsheets and fixing errors.

They’re focused on what matters: finding alpha.

Second, the quality of your data goes through the roof.

Garbage in, garbage out, right?

With FactSet DataFeed, you’re getting validated, real-time data directly into your systems.

This means more accurate models, better backtesting, and ultimately, smarter trading decisions.

No more guessing games.

Third, you overcome “data block.”

Ever had a great trading idea but couldn’t get the data fast enough to test it?

Or the right kind of data?

FactSet DataFeed removes that barrier.

You have access to a vast ocean of information at your fingertips, ready to be plugged into your research.

It means more rapid prototyping of new strategies.

You can react faster to market shifts.

The cost savings are indirect but very real.

Less manual work means fewer errors, which means less time spent fixing those errors.

Better data means potentially better returns, which is the ultimate goal.

It helps reduce operational risk because you’re relying on a proven, robust data pipeline.

This also extends to compliance.

Having auditable, consistent data feeds simplifies regulatory reporting.

It’s not just about speed; it’s about building a more resilient and profitable operation.

You gain a competitive edge by making decisions based on superior information, delivered reliably and quickly.

That’s the core benefit.

Pricing & Plans

Alright, let’s talk about the money piece.

FactSet DataFeed isn’t a one-size-fits-all, off-the-shelf product you just add to your cart.

This isn’t some free AI tool you play with on a Sunday afternoon.

It’s a serious institutional-grade solution.

Therefore, you won’t find transparent pricing tiers listed on their website like you would for a consumer product.

Their pricing is typically customised.

It depends on several factors: the specific data sets you need, the volume of data, the frequency of updates (real-time vs. delayed), and how you integrate it (API calls, direct file delivery, etc.).

They work with clients to build a solution that fits their exact requirements.

This means you’ll need to contact FactSet directly, talk to their sales team, and explain your use case.

They’ll then put together a quote for you.

Compared to alternatives, FactSet DataFeed is positioned at the premium end of the market.

You’re paying for unparalleled data quality, breadth, and reliability.

Competitors might offer cheaper rates, but often, that comes with trade-offs in data coverage, accuracy, or latency.

The value here is in the reduction of operational risk and the increased accuracy of your financial models.

Think of it as an investment in your core infrastructure, not an expense.

For firms where every millisecond and every data point counts, the cost is justified by the competitive advantage it provides.

It’s about what you gain, not just what you pay.

It’s about having a data backbone that won’t crumble under pressure.

So, while there’s no “free plan,” the investment is designed to pay for itself through improved decision-making and operational efficiency.

Hands-On Experience / Use Cases

Alright, let’s get real.

How does FactSet DataFeed actually play out in the trenches?

I’ve seen it transform operations.

Take a quantitative hedge fund, for instance.

They used to spend hours every morning downloading disparate data files from various sources.

Market data from one provider, company financials from another, news sentiment from a third.

Then, they’d have to manually align timestamps, clean up formatting issues, and run validation scripts.

It was a bottleneck.

Their traders were waiting for data, not acting on it.

After integrating FactSet DataFeed, everything changed.

They set up direct feeds for real-time equity prices, bond yields, and FX rates, streaming directly into their algorithmic trading platform.

Historical data for backtesting was delivered nightly, pre-cleaned and formatted.

The usability was surprisingly smooth, considering the complexity of the data.

Their developers found the APIs well-structured and the documentation clear.

Integration wasn’t immediate, of course; it took some dedicated effort from their tech team, but the payoff was huge.

The results?

Their trading desk saw a noticeable improvement in execution speed.

Their research team could spin up new strategies much faster because the data was readily available and reliable.

They reduced their data management team by 20% because the automated feeds eliminated so much manual work.

Another use case: a major investment bank using it for risk management.

They needed to aggregate exposure across various asset classes and geographies in real time.

FactSet DataFeed provided the underlying data streams for all their portfolio holdings, derivatives, and counterparty information.

This allowed them to calculate real-time value-at-risk (VaR) and stress tests, identifying potential risks before they became problems.

The confidence in their risk models went up significantly because the data input was so robust.

It’s about going from reactive to proactive.

These aren’t hypotheticals; these are real shifts in operational capability that FactSet DataFeed delivers.

Who Should Use FactSet DataFeed?

So, who exactly needs FactSet DataFeed?

It’s not for everyone, and let’s be clear about that.

This isn’t your personal budgeting app.

First up, if you’re running a hedge fund or an asset management firm, you’re probably already considering it, or you should be.

Anyone involved in quantitative analysis or algorithmic trading will find it indispensable.

You need high-volume, low-latency, and accurate data to feed your models, and FactSet DataFeed delivers that in spades.

Investment banks and large financial institutions are also prime candidates.

They need comprehensive data for risk management, regulatory compliance, and cross-asset analytics.

The ability to integrate vast, diverse datasets into their internal systems is critical.

Fintech startups that are building innovative financial applications and platforms can benefit too.

Instead of spending years building their own data infrastructure, they can leverage FactSet DataFeed as a plug-and-play solution for their data needs, allowing them to focus on their core product.

Even academic institutions or research departments at universities might use it for advanced financial modelling and economic research, where access to granular, historical data is paramount.

Essentially, if your business operations heavily rely on accurate, timely, and extensive financial data feeds, and if you have the technical capability to integrate such a robust system, then FactSet DataFeed is built for you.

It’s for those who understand that data is the new oil, and they need a world-class refinery.

If you’re a small individual trader, this is overkill.

But for serious players looking for a competitive edge through superior data, it’s a must-have.

How to Make Money Using FactSet DataFeed

Alright, let’s talk about the real reason you’re here: how do you turn FactSet DataFeed into cold, hard cash?

It’s not direct, like selling a product you made with it.

It’s about leveraging its power to do things faster, better, and with more precision, which directly translates to profit.

Here’s how it breaks down:

- Enhanced Algorithmic Trading Strategies:

This is probably the most direct route to profit.

With FactSet DataFeed’s low-latency, high-accuracy data, your algorithmic trading systems get a massive upgrade.

Think about it: you’re receiving market data, news, and sentiment signals faster and cleaner than your competitors.

This allows your algorithms to identify and act on opportunities microseconds before others.

It means better entry and exit points, reduced slippage, and the ability to execute high-frequency strategies with confidence.

The efficiency gains here aren’t just about saving time; they’re about generating alpha that simply wasn’t possible with slower, less reliable data feeds.

More efficient trades equal more profit.

- Superior Investment Research and Portfolio Management:

FactSet DataFeed gives your research team a superpower.

They can access vast historical datasets, company fundamentals, and alternative data with ease.

This means they can conduct deeper, more robust analyses to identify undervalued assets or emerging trends.

For portfolio managers, having this integrated data means they can build more diversified, risk-adjusted portfolios.

They can monitor performance against precise benchmarks and adjust allocations based on real-time market shifts and company specific events.

The result?

Better performing portfolios that attract more client assets and generate higher management fees.

It’s about making data-driven decisions that consistently outperform the market.

- Client Acquisition and Service Enhancement for Financial Firms:

If you’re a financial advisory firm, wealth manager, or even a fintech platform, the ability to leverage FactSet DataFeed can be a huge differentiator.

You can offer clients more sophisticated insights, more precise risk assessments, and more tailored investment advice.

Imagine being able to show a prospective client real-time, granular data supporting your investment thesis, or providing them with highly customized portfolio analytics.

This enhanced capability allows you to attract higher-net-worth clients who demand top-tier service and data-backed strategies.

It positions you as a cutting-edge firm, capable of delivering superior value.

This leads to increased client acquisition, higher client retention, and ultimately, more revenue.

It’s about building trust and demonstrating expertise through superior data access.

Here’s a quick example.

I know a small quant shop in London.

Before FactSet DataFeed, they spent roughly 30% of their research time on data sourcing and cleaning.

That’s valuable time not spent on strategy.

After integrating FactSet, that dropped to under 5%.

They repurposed that time into refining their models, exploring new data points, and iterating faster.

This led to them discovering new alpha signals that boosted their monthly returns by an average of 0.5% (which is massive in their world).

That 0.5% translates to millions in AUM over a year.

It’s not just about saving money; it’s about making significantly more.

FactSet DataFeed is an enabler of higher performance and higher profitability.

Limitations and Considerations

Alright, let’s be real.

No tool is perfect, and FactSet DataFeed is no exception.

While it’s a beast for data, it has its considerations.

First off, it’s not cheap.

We touched on pricing, but it bears repeating.

This is an enterprise-level solution.

If you’re a small individual trader, the cost alone will be a non-starter.

It’s an investment, not a quick buy.

Second, the learning curve.

While the APIs are well-documented, integrating FactSet DataFeed into your existing systems isn’t a five-minute job.

It requires skilled developers and a solid understanding of data architecture.

If your team isn’t technically proficient or lacks experience with complex data integrations, you might struggle initially.

It’s not a point-and-click interface for basic users.

Third, while the data accuracy is incredibly high, it’s still data.

Markets are chaotic, and models can only be as good as their assumptions.

FactSet provides the raw ingredients, but you still need to be a top-tier chef to create a winning dish.

You need robust validation processes on your end to ensure the data is being used correctly and that your models are interpreting it accurately.

It’s not a magic bullet that guarantees profit.

Another consideration: vendor lock-in.

Once you’ve deeply integrated FactSet DataFeed into your core systems, switching to another provider can be a significant undertaking.

This isn’t necessarily a bad thing if you’re happy with the service, but it’s something to be aware of when making such a foundational decision.

Finally, customisation requests might take time.

While they offer a vast array of data sets, if you have very niche or proprietary data needs, getting those specifically tailored might require lead time and additional costs.

So, while it excels at its core mission, remember these factors before committing.

It’s a powerful tool, but like any powerful tool, it demands careful handling and a clear understanding of its place in your overall strategy.

Final Thoughts

Look, in the world of Finance and Trading, data isn’t just important; it’s the oxygen.

And if your oxygen supply is slow, dirty, or unreliable, you’re going to suffocate.

FactSet DataFeed solves that problem.

It’s a robust, highly accurate, and incredibly comprehensive solution for Data Feeds and Market Integration.

For firms that live and die by real-time decisions and complex analytical models, it’s not just a nice-to-have; it’s a necessity.

Yes, it’s an investment.

It demands technical expertise for integration.

But the payoff in terms of efficiency, accuracy, and ultimately, competitive advantage, is huge.

You’re saving valuable human hours, reducing operational risk, and empowering your team to focus on strategy, not data wrangling.

It’s about getting the right information at the right time, every single time.

If you’re serious about optimising your data infrastructure and gaining an edge in fast-moving markets, FactSet DataFeed deserves a hard look.

It delivers on its promise.

It streamlines operations, reduces chaos, and helps you meet those deadlines with confidence.

Don’t just take my word for it.

Visit the official FactSet DataFeed website

Frequently Asked Questions

1. What is FactSet DataFeed used for?

FactSet DataFeed is used to deliver real-time and historical financial market data, company fundamentals, and various alternative datasets directly into financial institutions’ systems.

Its main use is for powering algorithmic trading, risk management, portfolio analysis, and quantitative research.

It helps professionals in Finance and Trading make data-driven decisions.

2. Is FactSet DataFeed free?

No, FactSet DataFeed is not free.

It is an enterprise-level data solution with customised pricing based on data volume, specific datasets needed, and integration requirements.

You need to contact FactSet directly for a tailored quote.

3. How does FactSet DataFeed compare to other AI tools?

FactSet DataFeed isn’t a general-purpose AI tool.

It specialises specifically in high-quality, comprehensive financial data delivery and integration.

While other AI tools might focus on content generation or broad analytics, FactSet DataFeed excels in providing the foundational data that other financial AI models rely on for their computations and predictions.

4. Can beginners use FactSet DataFeed?

FactSet DataFeed is not designed for beginners or individual users.

It requires technical expertise for integration, typically involving developers and data engineers to connect it with existing financial systems and analytical models.

It’s built for institutional clients with sophisticated data needs.

5. Does the content created by FactSet DataFeed meet quality and optimization standards?

FactSet DataFeed does not “create content” in the typical sense of generating articles or marketing copy.

Instead, it provides highly structured, validated, and comprehensive financial data.

This data meets the highest industry standards for accuracy, timeliness, and reliability, which are crucial for the quality and optimisation of financial models and trading strategies.

6. Can I make money with FactSet DataFeed?

Yes, you can make money with FactSet DataFeed, but indirectly.

By providing superior, real-time data, it enables financial professionals to build more profitable algorithmic trading strategies, conduct deeper investment research, manage portfolios more effectively, and enhance client services.

These capabilities lead to improved financial performance and increased revenue for firms.