QuantConnect supercharges Algorithmic Trading and Strategy Development. Build, backtest, and deploy strategies faster than ever. Ready to build your trading empire? Check it out now!

Why QuantConnect Is a Game-Changer in Algorithmic Trading and Strategy Development

Okay, let’s talk money.

Specifically, making money in markets.

The old ways?

Manual trading.

Staring at charts, hoping for a signal.

Slow.

Stressful.

Hard to scale.

Then came algorithmic trading.

Writing code to trade for you.

Smarter, faster, less emotional.

But building these systems?

A beast.

You need data.

LOTS of data.

Clean data.

You need backtesting engines.

Reliable ones.

You need execution platforms.

That actually work.

And connecting all these pieces?

A headache.

Most folks give up before they even start.

Or they build something janky that breaks constantly.

This is where QuantConnect walks in.

It’s an AI tool that changes the game for Algorithmic Trading and Strategy Development.

Think of it as your unfair advantage.

It removes the biggest roadblocks.

Gives you the tools pros use.

Without the ridiculous price tag or complexity.

If you’re serious about Finance and Trading, specifically building trading robots, you NEED to hear about this.

Table of Contents

- What is QuantConnect?

- Key Features of QuantConnect for Algorithmic Trading and Strategy Development

- Benefits of Using QuantConnect for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use QuantConnect?

- How to Make Money Using QuantConnect

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is QuantConnect?

Alright, straight talk.

What IS QuantConnect?

It’s an open-source algorithmic trading platform.

Built for quants, developers, and anyone who wants to automate their trading.

Forget cobbling together random pieces of software.

QuantConnect is the whole stack.

From data access to backtesting to live trading.

It gives you a research environment.

A place to explore ideas.

Test hypotheses.

It gives you historical data.

Massive amounts.

Stocks, options, futures, forex, crypto.

Cleaned and ready to go.

No more messy data downloads and parsing.

It has a backtesting engine.

Simulates how your strategy would have performed historically.

Fast and accurate.

Crucial for validating your ideas.

Then, there’s live trading.

Connect to various brokers.

Deploy your strategy.

Let the code do the work.

The cool part?

It’s built on C#, Python, and F#.

Popular languages.

Meaning you can get started quickly if you know how to code.

If you don’t?

Well, you might need to learn.

But the payoff is huge.

It’s used by individuals.

Hedge funds.

Universities.

Anyone serious about algorithmic trading.

It levels the playing field.

Gives the little guy powerful tools.

Tools that used to cost millions.

That’s QuantConnect.

A complete platform for building your trading robots.

Simple as that.

Key Features of QuantConnect for Algorithmic Trading and Strategy Development

Okay, let’s drill down.

What makes QuantConnect special for Algorithmic Trading and Strategy Development?

It’s the features.

They cover the whole lifecycle.

From idea to execution.

- Comprehensive Data Library:

This is HUGE.

Data is the fuel for algorithmic trading.

Without good data, your strategy is blind.

QuantConnect provides mountains of historical data.

Equities, options, futures, forex, crypto.

Tick data, minute data, daily data.

Cleaned, organised, and ready to use.

No more spending weeks scraping and cleaning data.

It’s all there.

Access it directly within the platform.

Saves you massive amounts of time and headache.

Lets you focus on building, not gathering.

- Powerful Backtesting Engine:

Got a trading idea?

You need to test it.

See how it would have performed in the past.

QuantConnect’s backtester is solid.

It simulates market conditions accurately.

Accounts for things like slippage and transaction costs.

Gives you detailed performance metrics.

Sharpe ratio, maximum drawdown, alpha, beta.

Everything you need to evaluate a strategy.

Fast backtesting means you can iterate quickly.

Test variations of your strategy.

Find what works.

Discard what doesn’t.

Essential for building robust strategies.

- Research Environment:

Before you build a full strategy, you explore.

You look at data.

Test small ideas.

QuantConnect has a research notebook environment.

Like a Jupyter notebook, but integrated.

Access the same data library.

Use popular libraries like pandas and numpy.

Visualise data.

Develop indicators.

Prototype strategy logic.

It’s your sandbox for innovation.

Crucial for refining your edge.

- Algorithm Lab & Cloud Platform:

This is where the coding happens.

You write your strategy code here.

Use C#, Python, or F#.

The cloud platform handles the heavy lifting.

Compilation, backtesting, live deployment.

No need for powerful local machines.

Scale your backtests.

Run multiple experiments at once.

The platform is built for performance.

Reliable and scalable.

- Live Trading Integrations:

Found a profitable strategy?

Time to put it to work.

QuantConnect connects to major brokers.

Interactive Brokers, FXCM, OANDA, Binance, etc.

Deploy your algorithm with a few clicks.

Monitor its performance in real-time.

Manage your positions.

Withdraw profits (the goal, right?).

The transition from backtesting to live trading is smooth.

Minimises the chance of errors.

- Community and Documentation:

Algorithmic trading can be lonely.

QuantConnect has a strong community.

Forums, GitHub repos, tutorials.

Lots of examples and shared knowledge.

Excellent documentation too.

Clear explanations of the platform and API.

If you get stuck, help is usually available.

Speeds up the learning curve.

Makes the process less frustrating.

These features together create a powerful ecosystem.

They remove the tedious parts of algorithmic trading.

Let you focus on the high-value stuff.

Finding your edge.

Building the logic.

Testing rigorously.

Deploying with confidence.

That’s how QuantConnect helps you win.

Benefits of Using QuantConnect for Finance and Trading

Okay, so we know WHAT it is and the bells and whistles.

But what’s in it for YOU?

Why use QuantConnect for your Finance and Trading efforts?

The benefits are significant.

They translate directly into better results and less pain.

- Saves HUGE amounts of Time:

Seriously, this is the biggest one.

Setting up an algorithmic trading environment from scratch is a nightmare.

Data sourcing, cleaning, database management.

Building a backtesting engine.

Connecting to brokers.

It takes months, if not years.

And constant maintenance.

QuantConnect provides all of this off-the-shelf.

You log in, start coding.

Flip a switch to backtest.

Another switch to go live.

This saved time?

You spend it on strategy development.

The actual income-generating part.

- Increases Strategy Quality and Robustness:

Better tools lead to better strategies.

With reliable data and a strong backtester, you can trust your results more.

You can test across different market conditions.

Check for overfitting.

Validate performance over long periods.

This rigor makes your strategies more robust.

More likely to perform well in live trading.

It’s the difference between a flimsy paper airplane and a fighter jet.

- Lowers the Barrier to Entry:

Algorithmic trading used to be just for big institutions.

Hedge funds with massive budgets and teams of engineers.

QuantConnect changes that.

It provides institutional-grade tools to individuals and small teams.

You don’t need to build infrastructure.

You don’t need to negotiate expensive data feeds.

You just need to know how to code and have trading ideas.

Opens up opportunities for talented individuals.

- Reduces Technical Headaches:

Maintaining trading systems is a pain.

Servers crashing, data feeds breaking, software updates.

QuantConnect is a cloud platform.

They handle the infrastructure.

The data updates.

The platform maintenance.

You focus on your core job: trading.

Less time fixing tech problems.

More time making money.

Simple math.

- Facilitates Iteration and Improvement:

Trading isn’t static.

Markets change.

Strategies need to evolve.

QuantConnect’s platform makes this easy.

Tweak your code, backtest instantly.

Compare performance of different versions.

Deploy updates seamlessly.

This rapid iteration cycle is crucial for staying ahead.

Continuously improving your edge.

These are real, tangible benefits.

They make algorithmic trading accessible.

More efficient.

More effective.

If you’re serious about automating your trading, QuantConnect gives you the tools to do it right.

Pricing & Plans

Okay, the big question.

How much does this cost?

QuantConnect has a few different plans.

They try to cater to different levels of users.

From hobbyists to professional funds.

There is a free tier.

Yes, FREE.

The Community plan.

It gives you access to the platform.

Access to data (with some limitations).

Limited backtesting time.

No live trading on this plan.

But it’s perfect for learning.

Experimenting.

Building your first few strategies.

Testing the waters without spending a penny.

Then there are paid plans.

Starter, Pro, Institutional.

As you go up, you get more resources.

More backtesting compute power.

More research hours.

More data access (higher resolution, more history).

Live trading access.

Dedicated support.

The pricing scales with your needs.

If you’re just starting, the free plan is plenty.

If you’re serious and want to trade live, you’ll need a paid plan.

Compare this to building your own system.

Data feeds alone can cost thousands per month.

Server costs.

Developer time.

QuantConnect’s paid plans are competitive.

Especially considering the value you get.

Access to institutional-grade infrastructure.

Reliable data.

A robust platform.

It’s an investment in your trading.

Not just a cost.

They also have a marketplace.

You can buy or sell algorithms and data.

Another potential revenue stream.

Overall, the pricing feels fair.

Starts free to get you hooked.

Scales as you grow.

Makes sense for serious traders.

Hands-On Experience / Use Cases

Okay, enough theory.

What’s it like to actually USE QuantConnect for Algorithmic Trading and Strategy Development?

Let’s run through a simple case.

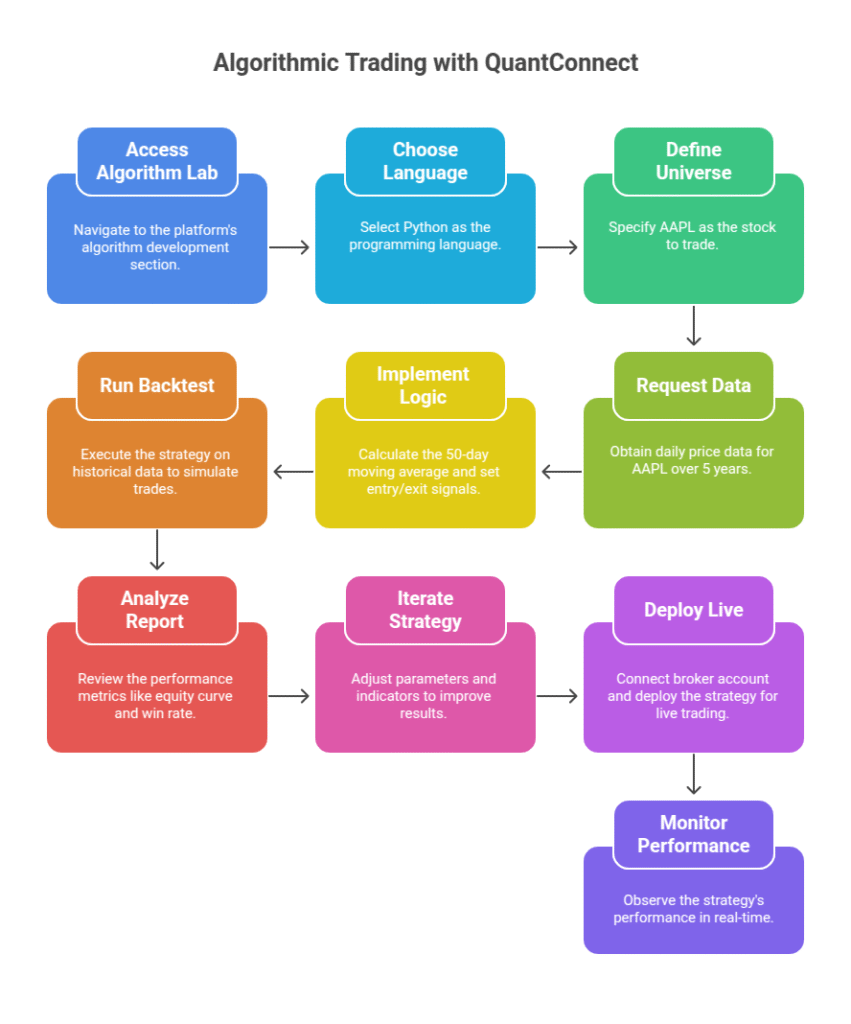

Say you have an idea: Buy Apple stock when it crosses its 50-day moving average from below. Sell when it crosses from above.

Simple moving average crossover.

In QuantConnect, you’d go to the Algorithm Lab.

Choose your language (Python is popular).

The platform gives you a template.

You fill in the blanks.

First, define your universe.

Which stocks to trade?

Add AAPL.

Then, request your data.

Daily price data for AAPL.

Specify the start and end dates for your backtest.

Maybe 5 years of data.

Next, implement the logic.

Calculate the 50-day moving average.

This is easy with built-in indicators.

Write the code for your entry and exit signals.

If Close crosses above MA50, buy.

If Close crosses below MA50, sell.

Specify your position sizing.

Maybe invest a fixed percentage of capital.

Add stop losses or take profits if you want.

Write maybe 50-100 lines of code.

Doesn’t take long if you know Python.

Hit “Run Backtest”.

The cloud platform fires up.

Downloads the data.

Runs your code bar by bar.

Simulates trades.

Generates a detailed report.

Equity curve, drawdowns, number of trades, win rate, CAGR.

All the stats you need.

Takes a few minutes, maybe less.

You see the performance.

Looks good? Great.

Not so good?

Go back to the code.

Tweak the parameters (maybe 100-day MA?).

Add another indicator.

Change the universe to tech stocks.

Run another backtest.

Iterate. Iterate. Iterate.

This process is fast and smooth on QuantConnect.

Once you’re happy with the backtest…

Connect your broker account (on a paid plan).

Hit “Deploy Live”.

Your strategy runs automatically on the cloud.

Executes trades through your broker.

You monitor the performance.

This hands-on experience is key.

It’s not just a theoretical platform.

It’s built for action.

From idea to live trading, it streamlines the whole thing.

Who Should Use QuantConnect?

Is QuantConnect for everyone?

Probably not.

If you just want to click buy and sell buttons, no.

If you’re looking for guaranteed profits with zero effort, definitely no.

But if you fit certain profiles, it’s a game-changer.

Who should use QuantConnect?

- Aspiring Algorithmic Traders:

You know manual trading isn’t scalable.

You want to automate.

You’re willing to learn code (Python is a good start).

QuantConnect gives you the environment to learn and practice.

Without the infrastructure headaches.

The free tier is perfect for this.

It’s a serious platform, not a toy.

- Quantitative Analysts & Developers:

You already have coding skills.

You understand financial concepts.

You might be working in finance or want to.

QuantConnect is your playground.

Build complex strategies.

Test cutting-edge ideas.

Leverage your technical skills directly in the market.

It’s designed for people like you.

- Fund Managers and Institutions:

Yes, even the big boys use it.

Or parts of it.

The platform scales.

Provides enterprise-level data access and compute.

Can be a cost-effective way to build out algorithmic capabilities.

Compared to building everything in-house.

They have institutional-grade plans.

Built for serious volume and complex needs.

- Academics and Researchers:

QuantConnect’s data and research environment are great for academia.

Testing financial models.

Simulating market events.

Teaching students algorithmic trading.

Access to clean data and a replicable environment is key for research.

They often have programs for universities.

Basically, if you want to use code and data to make trading decisions, QuantConnect is probably for you.

You don’t need to be a math genius.

You don’t need to be a Wall Street veteran.

But you do need patience, a willingness to learn, and realistic expectations.

It’s a tool to BUILD with.

Not a magic money machine.

How to Make Money Using QuantConnect

Alright, let’s cut to the chase.

How do you actually use QuantConnect to make cash?

It’s a tool.

You use the tool to build things that make money.

The most direct way is obvious:

- Build and Deploy Profitable Trading Strategies:

This is the core purpose.

You develop an algorithmic trading strategy using QuantConnect.

Backtest it rigorously.

Optimise it.

And if it shows promise, you deploy it for live trading.

The algorithm trades automatically.

Buys and sells based on your code.

If your strategy has a positive edge, you make money from trading profits.

This requires skill, research, and managing risk.

But QuantConnect provides the necessary platform.

For Algorithmic Trading and Strategy Development, it’s a direct path.

- Offer Algorithmic Trading Strategy Development Services:

Maybe you’re a skilled coder and strategy developer.

But you don’t want to manage your own trading capital.

Or you want additional income streams.

You can use your skills on QuantConnect to build strategies FOR others.

Individuals, small funds, family offices.

They have capital but lack the technical expertise.

You use QuantConnect’s data, backtesting, and development environment.

Charge a fee for your services.

Develop and test strategies based on their requirements or ideas.

Deliver the algorithm code or help them deploy it.

This leverages the platform’s capabilities to offer valuable technical services.

- Sell Strategies or Data on the QuantConnect Marketplace:

QuantConnect has a marketplace.

You can package your successful trading strategies.

Offer them for sale.

Other users can subscribe to your strategy.

Or license it.

You earn a royalty or fee.

This requires a proven, profitable strategy.

It’s a way to monetize your development work beyond your own trading.

You can also sell access to custom data feeds you’ve built or curated.

If you find unique data sources and integrate them.

Offers another avenue for income within the ecosystem.

- Improve Efficiency in Existing Finance Roles:

If you already work in Finance and Trading, QuantConnect can make you better at your job.

Faster research.

More rigorous testing of investment ideas.

Automating parts of your workflow.

This increased efficiency and capability makes you more valuable.

Can lead to promotions, raises, or new opportunities.

Indirect, but a real way to boost your earning potential.

It’s important to manage expectations.

Making money from trading algorithms is hard work.

Requires skill, patience, and risk management.

QuantConnect provides the tools to make it possible.

But it doesn’t guarantee success.

The platform empowers you.

What you build with it determines your results.

Limitations and Considerations

No tool is perfect.

QuantConnect is powerful, but it has limitations.

Things you need to know before diving in.

- Requires Coding Knowledge:

This is the big one.

QuantConnect is not a drag-and-drop strategy builder.

You need to write code.

C#, Python, or F#.

If you’ve never coded before, there’s a learning curve.

It’s manageable, especially with Python and their documentation.

But it’s a necessary skill.

If you’re code-averse, this isn’t for you.

- Complexity of Algorithmic Trading Itself:

QuantConnect simplifies the infrastructure.

It does NOT simplify the art and science of algorithmic trading.

Finding a profitable edge is hard.

Managing risk is crucial.

Understanding market dynamics.

Dealing with real-world issues like slippage and unexpected events.

These challenges remain.

QuantConnect is a tool to help you navigate them.

It doesn’t solve them for you.

- Backtesting vs. Live Trading Performance:

A strategy might look amazing in backtesting.

Perfect equity curve.

High Sharpe ratio.

But live trading is different.

Real-time data feeds.

Broker execution quirks.

Market impact.

Slippage can be worse than simulated.

Strategies often perform worse live than in backtests.

QuantConnect aims for accurate backtesting, but this gap always exists.

You need to be aware of it.

Start with small amounts live.

- Data Limitations on Free/Lower Tiers:

The free plan gives you data.

But it might not be the highest resolution or the longest history.

If you need tick data for microsecond strategies…

Or decades of history for low-frequency ones…

You’ll likely need a paid plan.

Understand the data limits of your chosen tier.

- Platform Specifics and Updates:

Like any platform, there’s a learning curve for QuantConnect itself.

Their API, how things are structured.

They update the platform periodically.

Code might need minor adjustments.

You’re working within their ecosystem.

You need to adapt to how they do things.

These aren’t dealbreakers.

But they are realities.

Manage your expectations.

Understand what the tool does and doesn’t do.

It provides the highway and the car.

You still need to learn how to drive and where you’re going.

Final Thoughts

So, wrapping this up.

QuantConnect is a serious platform.

Built for serious people in Finance and Trading.

Specifically, those focused on Algorithmic Trading and Strategy Development.

It solves massive problems.

Data, infrastructure, backtesting, deployment.

It gives you the tools to compete.

Even if you’re not a big institution.

The fact there’s a free tier?

Amazing.

Lets you learn, experiment, build skills.

The paid plans scale as you grow.

Providing the power and reliability needed for live trading.

Yes, you need to code.

Yes, building profitable strategies is hard work.

QuantConnect doesn’t eliminate the challenge of trading.

It eliminates the technical barriers to entry for algorithmic trading.

If you have trading ideas and are willing to code…

Or if you’re a developer looking to apply your skills to markets…

QuantConnect is arguably the best platform out there right now.

It provides the foundation.

The framework.

The data.

It streamlines the entire Algorithmic Trading and Strategy Development process.

Saves you time, money, and countless headaches.

It’s not magic.

It’s engineering.

Applied to trading.

And it works.

My recommendation?

If you’re even remotely interested in algorithmic trading…

Sign up for the free plan.

Play around in the research environment.

Try building a simple moving average strategy like the one we discussed.

Run a backtest.

See the power for yourself.

It might just change how you approach trading forever.

It did for me.

Visit the official QuantConnect website

Frequently Asked Questions

1. What is QuantConnect used for?

QuantConnect is used for developing, backtesting, and deploying algorithmic trading strategies.

It provides a platform with access to financial data, a research environment, and live trading integrations.

It helps automate trading decisions based on predefined rules coded into an algorithm.

2. Is QuantConnect free?

Yes, QuantConnect offers a free “Community” plan.

This plan allows users to develop and backtest strategies with some limitations on data access and compute time.

Paid plans are available for more resources and live trading capabilities.

3. How does QuantConnect compare to other AI tools?

QuantConnect is specifically designed for Algorithmic Trading and Strategy Development in Finance and Trading.

Unlike general AI tools for writing or image generation, QuantConnect provides financial data, backtesting engines, and live trading infrastructure.

Its focus is on building and deploying trading algorithms using code, differentiating it from no-code or low-code financial tools.

4. Can beginners use QuantConnect?

Beginners can use QuantConnect, but it requires learning to code (Python is recommended).

The platform provides documentation and a community forum to help beginners get started.

The free tier is ideal for beginners to learn and experiment without financial risk.

5. Does the content created by QuantConnect meet quality and optimization standards?

QuantConnect doesn’t create “content” in the traditional sense like articles or images.

It helps users create trading strategies (algorithms).

The quality and performance (“optimization”) of these strategies depend entirely on the user’s code, logic, and trading edge.

The platform provides the tools for rigorous testing to help users develop high-quality, potentially profitable strategies.

6. Can I make money with QuantConnect?

Yes, you can potentially make money with QuantConnect.

The primary way is by building and deploying profitable algorithmic trading strategies using the platform’s live trading capabilities.

You can also potentially make money by offering strategy development services to others or selling strategies/data on the QuantConnect marketplace.

Success depends on your trading skill, coding ability, and market conditions.