MetaTrader 5 (MT5) transforms your Algorithmic Trading and Strategy Development workflow. Automate trades, test strategies fast, and boost efficiency. Get MT5 now!

How MetaTrader 5 (MT5) Transforms Your Algorithmic Trading and Strategy Development Workflow

Alright, listen up.

The game of Finance and Trading is changing.

It’s not about gut feelings and scribbled notes anymore.

It’s about systems.

It’s about automation.

It’s about letting machines do the heavy lifting.

Especially when you’re talking about Algorithmic Trading and Strategy Development.

You used to spend hours, maybe days, testing one idea.

Manually looking at charts.

Calculating potential outcomes.

It was slow.

It was painful.

And honestly, it was inefficient.

But AI? It’s here.

It’s already making waves in almost every industry.

And in Finance and Trading, tools powered by AI are becoming non-negotiable.

That’s where MetaTrader 5, or MT5 as the cool kids call it, steps in.

Think of it as your co-pilot in this automated trading race.

It’s designed to help you build, test, and deploy your trading strategies faster, smarter, and with less effort.

We’re talking about serious tools for serious traders.

If you’re in Finance and Trading and you’re not looking at MT5 for your Algorithmic Trading and Strategy Development, you’re already behind.

Simple as that.

Let’s break down what this thing actually is and why it matters.

No fluff.

Just the stuff that makes a difference.

Table of Contents

- What is MetaTrader 5 (MT5)?

- Key Features of MetaTrader 5 (MT5) for Algorithmic Trading and Strategy Development

- Benefits of Using MetaTrader 5 (MT5) for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use MetaTrader 5 (MT5)?

- How to Make Money Using MetaTrader 5 (MT5)

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is MetaTrader 5 (MT5)?

Okay, let’s get this straight.

MetaTrader 5, or MT5, isn’t just another charting tool.

It’s a multi-asset trading platform.

It lets you trade Forex, stocks, futures, and more.

But its real power, especially for those deep in Algorithmic Trading and Strategy Development, lies in its automated trading capabilities.

This platform was built by MetaQuotes Software.

It’s the follow-up to the hugely popular MetaTrader 4 (MT4).

Think of MT5 as MT4 on steroids, specifically designed for the modern, data-driven trader.

Who uses it?

Professional traders.

Hedge funds.

Institutional players.

Retail traders who are serious about their edge.

Anyone who understands that relying solely on manual execution is leaving money on the table.

The core idea?

Provide a robust environment for trading and analysis.

But beyond that, offer the tools to build and run automated trading systems.

These are often called Expert Advisors, or EAs.

They execute trades based on predefined rules.

Rules you set.

Rules you test.

This means you can trade 24/7 without staring at your screen.

It removes emotion from trading decisions.

And that, my friend, is huge.

It’s not just a trading platform.

It’s a platform for building your trading business.

For taking your Algorithmic Trading and Strategy Development from a hobby to a serious operation.

That’s what MT5 is at its core.

A serious tool for serious traders.

Key Features of MetaTrader 5 (MT5) for Algorithmic Trading and Strategy Development

Alright, let’s get into the nuts and bolts.

What makes MT5 special for Finance and Trading, specifically the automated side?

It’s not just one thing.

It’s a combination of powerful features.

- Integrated Development Environment (IDE): MQL5.

This is where the magic happens.

MT5 comes with its own programming language: MQL5.

It’s designed specifically for Algorithmic Trading and Strategy Development.

You can write your own trading robots (EAs).

You can create custom technical indicators.

You can build scripts to automate tasks.

The MQL5 IDE is powerful.

It has everything you need.

A code editor, a debugger, a compiler.

It’s built for traders, not just programmers.

If you have an idea for a trading strategy, MQL5 lets you turn it into code.

Fast.

- Strategy Tester.

Okay, you’ve coded your strategy.

How do you know if it works?

You backtest it.

The MT5 Strategy Tester is insane.

It lets you test your EAs on historical data.

We’re talking about years of price data.

You can simulate how your strategy would have performed.

It runs through the data at high speed.

You get detailed reports.

Profit factor.

Drawdown.

Winning trades vs. losing trades.

All the metrics that matter.

This is crucial for refining your strategy.

For finding weaknesses.

For optimising parameters.

It’s the difference between guessing and knowing.

- Market of Trading Robots and Indicators.

Maybe you’re not a coder.

Or maybe you want to see what others have built.

MT5 has a built-in marketplace.

The MQL5 Market.

Here, you can buy or rent EAs, indicators, and scripts.

Thousands of them.

You can find tools for almost any strategy.

Trend following.

Mean reversion.

Arbitrage.

Whatever your style, there’s likely something here.

You can also sell your own creations.

Turn your Algorithmic Trading and Strategy Development skills into a revenue stream.

This market fuels innovation.

It gives you access to strategies you might not have thought of.

It’s a massive resource for any serious trader.

These features aren’t just nice-to-haves.

They are essential for anyone serious about automating their trading.

They provide the infrastructure to go from idea to execution.

Efficiently.

Effectively.

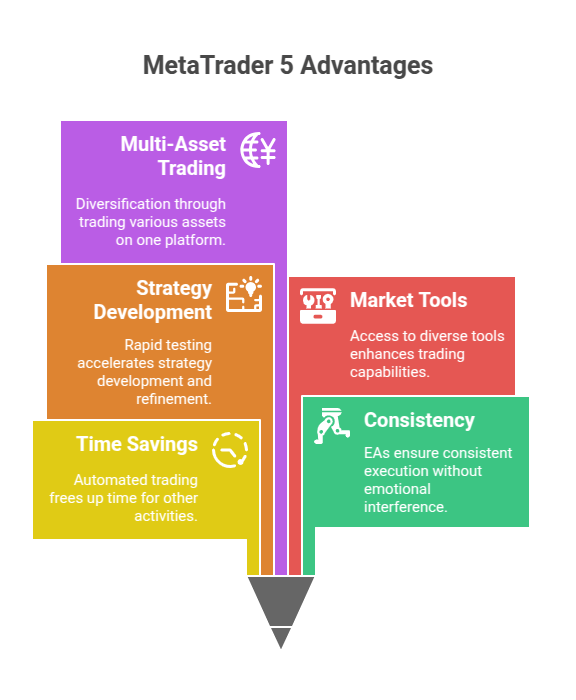

Benefits of Using MetaTrader 5 (MT5) for Finance and Trading

Why bother with MT5?

What’s the real upside for someone in Finance and Trading?

It boils down to a few key advantages.

Time Savings: This is huge.

Manual trading is time-consuming.

Staring at charts for hours.

Waiting for setups.

Executing trades manually.

With automated trading via MT5 EAs, the platform does the work.

Once your strategy is coded and running, it monitors the market.

It identifies opportunities.

It executes trades.

All while you’re doing other things.

Sleeping, working, living life.

This frees up your time for strategy development, analysis, or just enjoying your profits.

Improved Consistency: Humans are emotional.

Fear and greed mess with trading decisions.

You might hesitate on a good trade.

Or hold onto a losing trade for too long.

EAs don’t have emotions.

They follow the rules you set.

Every single time.

This ensures consistent execution of your strategy.

No deviation.

No impulsive decisions.

Just the strategy playing out.

Faster Strategy Development and Testing: We talked about the Strategy Tester.

This tool is a game-changer for Algorithmic Trading and Strategy Development.

You can test strategies on historical data in minutes.

Not days or weeks.

You can quickly iterate on ideas.

Tweak parameters.

See the impact instantly.

This rapid feedback loop accelerates the development process.

You can test more ideas.

Find robust strategies faster.

It’s an efficiency booster on a massive scale.

Access to a Wide Market of Tools: The MQL5 Market is a goldmine.

You don’t have to build everything from scratch.

You can leverage the work of other developers.

Find EAs that fit your trading style.

Get custom indicators that provide the exact analysis you need.

This saves you development time.

And gives you access to powerful tools immediately.

It lowers the barrier to entry for sophisticated trading.

Multi-Asset Trading: MT5 isn’t limited to Forex.

You can trade stocks, futures, commodities, and more.

All from one platform.

With your automated strategies.

This allows for diversification.

You’re not stuck in one market.

You can apply your Algorithmic Trading and Strategy Development skills across different instruments.

More opportunities.

Potentially better returns.

These benefits aren’t theoretical.

They translate directly into better trading performance.

And for businesses in Finance and Trading, they mean increased efficiency and profitability.

Pricing & Plans

Alright, let’s talk money.

Is MetaTrader 5 going to empty your bank account?

Here’s the good news.

The MetaTrader 5 platform itself?

It’s generally **free** for traders.

You download it from your broker.

Most Forex and CFD brokers offer MT5 to their clients at no cost.

This is a huge advantage.

You get access to a professional-grade platform.

With all the advanced charting and analysis tools.

Plus the MQL5 IDE and Strategy Tester.

All for free.

So, where do costs come in?

Mainly, the costs are related to what you add to the platform.

Brokerage Fees: You’ll pay your broker their usual fees for trading.

Commissions, spreads, swap fees.

This is standard for any trading.

MT5 is just the tool you use to place those trades.

Expert Advisors (EAs) and Indicators from the MQL5 Market: This is where you might spend money.

Some EAs and indicators on the MQL5 Market are free.

Others are paid products.

Prices vary widely.

From a few dollars to hundreds, even thousands, for complex or high-performance EAs.

You can usually rent them monthly or buy them outright.

Think of this like buying software.

You’re paying for the development work behind the strategy or tool.

Before buying, you can often test EAs on demo accounts.

This is crucial.

Never buy an EA without testing it yourself first.

Hiring a Developer: If you want a custom EA built specifically for your strategy.

And you don’t want to code it yourself.

You can hire an MQL5 developer.

There’s a large community of developers on the MQL5 website.

They offer freelance services.

Costs depend on the complexity of your strategy.

Hourly rates or fixed project fees are common.

So, the platform itself is free.

The costs come from third-party tools or custom development.

Compared to some institutional trading platforms that cost tens of thousands per month, MT5 is incredibly accessible.

It puts powerful Algorithmic Trading and Strategy Development tools within reach of almost anyone.

That’s a major win.

Hands-On Experience / Use Cases

Forget the theory.

How does this actually work in practice?

Let’s say you have a trading idea.

Maybe it’s simple.

“Buy EUR/USD when the 50-period moving average crosses above the 200-period moving average, and the RSI is below 30.”

“Sell when the opposite happens, or after a 100-pip gain or 50-pip loss.”

Manually trading this means monitoring charts constantly.

Waiting for the stars to align.

Executing the trade perfectly.

Managing the stop loss and take profit.

It’s prone to errors.

And you’ll miss trades when you’re not watching.

With MetaTrader 5, you’d translate those rules into MQL5 code.

You’d write an Expert Advisor.

It might take a few hours if you’re new to coding.

Or minutes if you’re experienced.

Once coded, you take it to the Strategy Tester.

Load up historical data for EUR/USD.

Run the test over the last 5 years.

The tester simulates every tick of price movement.

It applies your EA’s rules.

Places virtual trades.

Tracks performance.

In less than an hour, maybe much less depending on your computer, you get a full report.

Was the strategy profitable?

What was the maximum drawdown?

Which specific trades won or lost?

The tester even shows you the trades visually on a chart replay.

You see exactly where your EA would have entered and exited.

Now you can iterate.

Maybe add another filter.

Change the moving average periods.

Adjust the stop loss.

Run the test again.

Compare the reports.

This rapid iteration is key to robust Algorithmic Trading and Strategy Development.

You can test dozens of variations in a day.

Find the parameters that performed best historically.

Once you’re satisfied with the backtest results, you deploy the EA on a live or demo account.

The EA takes over.

Monitoring.

Trading.

Based on your rules.

This isn’t magic.

Past performance doesn’t guarantee future results.

But systematic testing gives you an edge.

It removes guesswork.

It’s a data-driven approach to Finance and Trading.

Other use cases?

Building indicators that combine multiple signals into one.

Creating scripts for one-click order management.

Setting up complex conditional orders that your broker’s platform might not support natively.

MetaTrader 5 provides the framework for all of it.

It transforms trading from an art to a science.

Or at least, makes the art much more scientific.

Who Should Use MetaTrader 5 (MT5)?

Is MT5 for everyone?

Probably not.

If you’re just dipping your toes into trading with a few hundred quid.

And you only plan to buy and hold a couple of stocks.

MetaTrader 5 might be overkill.

But if you’re serious about Finance and Trading, especially the active side…

If you’re looking for an edge…

If you want to trade systematically…

Then MT5 is likely for you.

Here are some profiles that benefit the most:

Serious Retail Traders: You’re trading your own money.

You see trading as more than a hobby.

You understand the need for a plan.

You want to backtest your ideas rigorously.

You’re open to automation to improve consistency and save time.

MetaTrader 5 gives you institutional-level tools without the institutional price tag.

Quantitative Traders: You love data.

You build strategies based on mathematical models.

You need powerful backtesting and optimisation capabilities.

The MT5 Strategy Tester is built for this.

The ability to code your own models in MQL5 is essential.

Fund Managers and Proprietary Trading Firms: For smaller firms or individual fund managers.

MetaTrader 5 can be a cost-effective platform.

It allows them to deploy multiple automated strategies.

Manage various accounts.

Maintain control over their trading systems.

The reporting features are also valuable for tracking performance.

Developers and Coders: If you have programming skills.

MQL5 provides a platform to apply those skills to Finance and Trading.

You can build tools for yourself.

Or build them for others and sell them on the MQL5 Market.

It’s a whole ecosystem for trading automation.

Those Interested in Algorithmic Trading but New to Coding: Learning MQL5 isn’t rocket science.

There are tons of resources online.

Tutorials, forums, documentation.

MT5 provides the environment to learn and experiment.

You can start with simple EAs and build up your skills.

It’s an accessible entry point into Algorithmic Trading and Strategy Development.

Basically, if you want to move beyond manual point-and-click trading.

If you want to trade smarter, not harder.

If you value consistency and systematic execution.

MetaTrader 5 is a tool you need to consider seriously.

How to Make Money Using MetaTrader 5 (MT5)

Okay, let’s talk about the bottom line.

How do you actually turn MT5 into income?

It’s not just about trading your own account.

Though that’s the most direct way.

Algorithmic Trading and Strategy Development skills open up other avenues.

- Automated Trading Your Own Capital: This is the obvious one.

Develop and test your own EAs.

Deploy them on your trading account.

The goal is for your automated strategies to generate profits consistently.

This requires solid strategy development, rigorous testing, and good risk management.

MetaTrader 5 gives you the tools to do this effectively.

- Selling Expert Advisors and Indicators on the MQL5 Market: Remember the market we discussed?

If you can build effective trading tools, you can sell them there.

Write EAs that implement popular strategies.

Create unique indicators that give traders an edge.

Package them up and list them for sale.

The MQL5 Market has a massive user base.

Your tools could generate passive income.

You keep most of the sales revenue.

It’s a direct way to monetize your Algorithmic Trading and Strategy Development skills.

- Offering Freelance Development Services: Many traders have strategy ideas but can’t code.

They need someone to turn their rules into an EA or custom indicator.

If you know MQL5, you can offer your services as a freelance developer.

The MQL5 website has a dedicated ‘Freelance’ section.

Clients post projects.

Developers bid on them.

You get paid to build custom trading tools for others.

Rates depend on your skill level and the project complexity.

This is a reliable way to make money using your MetaTrader 5 knowledge, even if you’re not trading your own funds.

- Creating Educational Content (Courses, Tutorials): As MT5 and algo trading grow, so does the demand for learning resources.

If you master MQL5 and the MetaTrader 5 platform.

You can create courses, video tutorials, or write guides.

Teach others how to code EAs.

Show them how to use the Strategy Tester effectively.

Share your strategy development process.

Platforms like Udemy, Skillshare, or even YouTube allow you to reach a wide audience and monetize your expertise.

- Managing Funds (Proprietary Trading): If you build a track record with your automated strategies.

You might attract investors.

Or get hired by a proprietary trading firm.

Your skills in Algorithmic Trading and Strategy Development become your resume.

Firms are always looking for profitable trading systems.

MT5 is a common platform in smaller prop shops.

You can manage their capital using your EAs.

This is a higher-level goal, but achievable with the right skills and performance.

Making money with MetaTrader 5 isn’t just about hitting ‘buy’ or ‘sell’.

It’s about leveraging the platform’s capabilities.

Building valuable trading systems.

And potentially providing those systems or the knowledge to build them to others.

It’s a skill set that has real market value in Finance and Trading.

Limitations and Considerations

Nothing is perfect.

MT5 is powerful, yes.

But it has its limits.

And you need to be aware of them.

Learning Curve: While MetaTrader 5 itself is user-friendly for basic trading.

Mastering MQL5 and the Strategy Tester takes time.

If you’re new to programming, MQL5 will be a new language to learn.

The Strategy Tester has many settings.

Understanding how to use it correctly, avoid pitfalls like over-optimisation, requires effort.

It’s not a plug-and-play solution for automated millions.

Broker Dependency: You access MT5 through a broker.

The quality of your experience can depend heavily on that broker.

Execution speed.

Available instruments.

Data feed quality for backtesting.

All of these are provided by the broker.

Choose your broker wisely.

Ensure they offer MetaTrader 5 with good conditions.

Backtesting Limitations: The MT5 Strategy Tester is excellent.

But it’s not perfect.

The accuracy of backtest results depends on the quality of historical data.

Tick data is best, but not always readily available or accurate from all brokers.

Modelling methods in the tester can impact results.

You need to understand the difference between ‘Every tick based on real ticks’ and ‘1 Minute OHLC’.

Slippage and commission modelling also need careful setup.

Backtesting shows past performance, not future guarantees.

Markets change.

Strategies can stop working.

Over-Optimisation Risk: The Strategy Tester has powerful optimisation features.

You can test thousands of parameter combinations.

This is great for finding robust settings.

But it’s easy to over-optimise.

Finding settings that look amazing on historical data but fail in live trading.

Because they are curve-fitted to past noise, not underlying market behaviour.

It requires discipline and understanding to avoid this trap.

Requires VPS for 24/7 Trading: If you want your EA to trade around the clock.

Your MetaTrader 5 terminal needs to be running constantly.

With a stable internet connection.

Most serious algo traders use a Virtual Private Server (VPS).

This is a remote computer running 24/7.

It adds a small monthly cost.

MetaTrader 5 is a tool.

A very good tool for Finance and Trading.

Especially for Algorithmic Trading and Strategy Development.

But it doesn’t remove the need for skill.

For market understanding.

For risk management.

It automates the execution and testing.

The strategy still comes from you.

Final Thoughts

So, what’s the verdict on MetaTrader 5?

If you’re serious about Finance and Trading.

If you’re looking to trade systematically.

If you want to leverage the power of automation.

MetaTrader 5 is essential.

It’s arguably the most accessible platform for professional-level Algorithmic Trading and Strategy Development.

You get a powerful IDE.

A robust Strategy Tester.

Access to a massive market of tools.

All potentially for free through your broker.

It allows you to turn your trading ideas into testable, automated systems.

To refine your strategies based on data, not intuition.

To trade with consistency.

It’s not a magic button.

It requires effort to learn MQL5.

To understand backtesting best practices.

To develop sound strategies.

But the potential upside?

Significant time savings.

Reduced emotional trading errors.

The ability to trade multiple markets 24/7.

And opportunities to monetize your skills beyond trading your own account.

If you’re still doing everything manually.

If your strategy testing is limited to eyeballing charts.

You’re leaving an edge on the table.

MetaTrader 5 provides the tools to compete in the modern trading landscape.

My recommendation?

Download it through a reputable broker.

Start experimenting with the Strategy Tester.

Dabble in MQL5.

Explore the MQL5 Market.

See how it fits into your trading workflow.

For anyone serious about automating their trading or building systematic strategies, MetaTrader 5 is a necessary piece of kit.

It delivers on its promise: transforming your approach to Algorithmic Trading and Strategy Development.

Visit the official MetaTrader 5 (MT5) website

Frequently Asked Questions

1. What is MetaTrader 5 (MT5) used for?

MetaTrader 5 (MT5) is a multi-asset trading platform used for trading Forex, stocks, futures, and other financial instruments. Its primary strength for advanced traders is its comprehensive tools for Algorithmic Trading and Strategy Development, allowing users to automate trades using Expert Advisors (EAs), create custom indicators, and backtest strategies rigorously on historical data.

2. Is MetaTrader 5 (MT5) free?

Yes, the MetaTrader 5 (MT5) platform itself is typically offered for free to traders by Forex and CFD brokers. Costs arise from brokerage fees for trading, purchasing or renting Expert Advisors and indicators from the MQL5 Market, or hiring freelance MQL5 developers for custom work.

3. How does MetaTrader 5 (MT5) compare to other AI tools?

MetaTrader 5 isn’t an “AI tool” in the sense of generating content or images using large language models. It’s a platform for building and deploying trading algorithms. It provides the environment (MQL5 IDE) and testing facilities (Strategy Tester) that are crucial for Algorithmic Trading and Strategy Development, which is a form of applying computational methods to Finance and Trading. It competes more directly with platforms like cTrader, TradingView (for charting/some automation), and institutional platforms, focusing on powerful automated trading capabilities.

4. Can beginners use MetaTrader 5 (MT5)?

Yes, beginners can use MetaTrader 5 for manual trading as its interface is relatively standard for trading platforms. However, leveraging its full power for Algorithmic Trading and Strategy Development requires learning MQL5 and understanding the Strategy Tester, which involves a steeper learning curve than basic manual trading.

5. Does the content created by MetaTrader 5 (MT5) meet quality and optimization standards?

MetaTrader 5 doesn’t “create content” like text or images. It creates trading algorithms (Expert Advisors, indicators) through coding in MQL5. The “quality” and “optimization” of these algorithms depend entirely on the skill of the developer who writes the code and tests the strategy using MT5’s built-in tools. A well-coded and properly tested EA can be highly “optimized” for trading performance based on historical data.

6. Can I make money with MetaTrader 5 (MT5)?

Absolutely. The primary way is by using MetaTrader 5 to develop and run profitable automated trading strategies on your own capital. Additionally, you can make money by selling Expert Advisors and custom indicators you develop on the MQL5 Market, offering freelance MQL5 development services to other traders, or creating educational content about the platform and MQL5 programming.