Fidelity Investments transforms Retail and Institutional Trading Platforms. Streamline operations, boost efficiency, and make smarter decisions. Level up your trading game now!

Fidelity Investments Simplifies Even Complex Retail and Institutional Trading Platforms

Ever feel like you’re wrestling an octopus just to get your trading done?

I know the feeling. The financial world is moving at warp speed.

Especially in finance and trading.

AI tools are no longer a luxury. They’re a necessity.

They’re reshaping how we approach everything. From market analysis to risk management.

For anyone in retail and institutional trading platforms, staying ahead is critical.

That’s where Fidelity Investments steps in.

It’s not just another tool. It’s a game-changer.

This isn’t about hype. It’s about real results.

We’re going to break down how Fidelity Investments can completely overhaul your trading operations.

Make them faster, smarter, and way more effective.

Stick around. Your trading workflow is about to get a serious upgrade.

Table of Contents

- What is Fidelity Investments?

- Key Features of Fidelity Investments for Retail and Institutional Trading Platforms

- Benefits of Using Fidelity Investments for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Fidelity Investments?

- How to Make Money Using Fidelity Investments

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Fidelity Investments?

Fidelity Investments isn’t a new player. They’ve been around for ages.

But their move into AI is what we’re focused on.

It’s an AI-powered platform. Designed to simplify and enhance the trading process.

Think of it as your co-pilot. For navigating complex markets.

It’s built for both retail investors and institutional traders.

It helps with everything. From research to execution.

The core function? To provide insights. Automate tasks. Reduce human error.

It’s not about replacing you. It’s about empowering you.

Giving you an edge. In a fiercely competitive space.

For individual investors, it simplifies market entry. Provides clear data.

For institutions, it streamlines massive data analysis. Optimises trading strategies.

It’s about making smart decisions. Fast.

Without getting bogged down in endless data.

It takes the guesswork out of a lot of things.

That’s what makes it so powerful.

It’s designed to make your life easier. And your portfolio stronger.

Key Features of Fidelity Investments for Retail and Institutional Trading Platforms

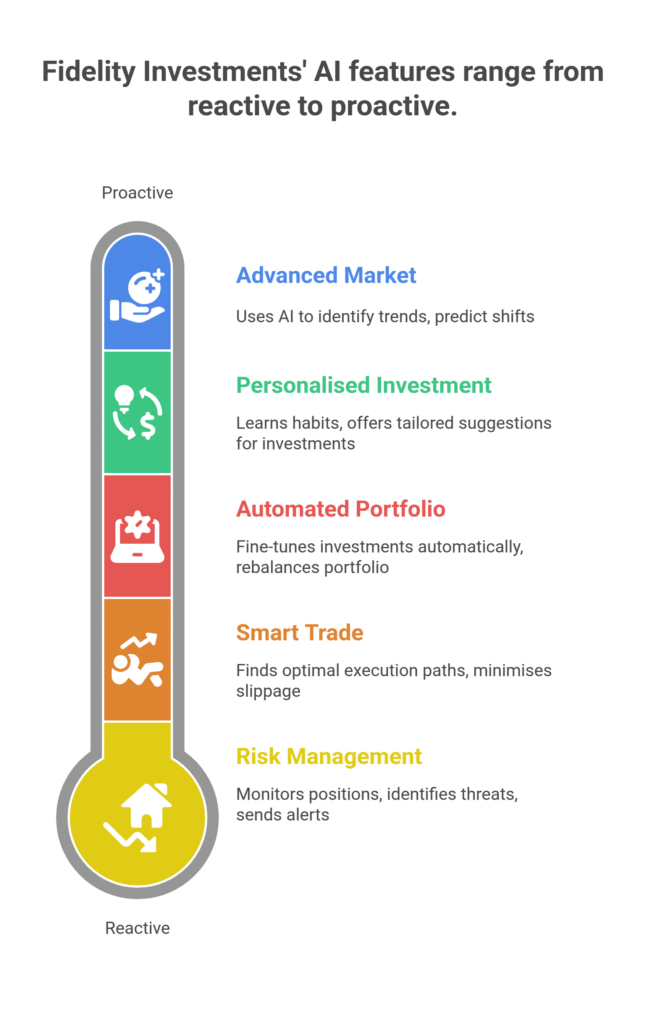

- Advanced Market Analytics: This isn’t your grandad’s market data. Fidelity Investments uses AI to chew through mountains of information. It identifies trends. Spots patterns. Predicts potential shifts. This helps both retail and institutional traders see what’s coming. Before it hits. You get real-time insights. Actionable intelligence. It’s like having a crystal ball. But it’s powered by algorithms. This gives you a serious leg up. When every second counts. It helps you make decisions based on data. Not gut feelings.

- Automated Portfolio Optimisation: Manual portfolio adjustments? Forget about it. This feature fine-tunes your investments automatically. Based on your risk tolerance. Your financial goals. It rebalances. Reallocates. All on its own. For retail investors, this means less time managing. More time living. For institutional platforms, it means massive efficiency gains. You set the parameters. The AI does the heavy lifting. It ensures your portfolio stays aligned. With your objectives. Constantly. Even as markets fluctuate. This saves countless hours. Prevents emotional mistakes.

- Smart Trade Execution: This isn’t just about placing an order. It’s about placing the *right* order. At the *right* time. Fidelity Investments uses AI to find optimal execution paths. Minimise slippage. Reduce costs. For high-volume institutional trading, this is huge. Small savings per trade add up fast. For retail traders, it ensures you’re not getting fleeced. By market inefficiencies. It looks for liquidity. Best prices. It’s about precision. And efficiency. This means more profit. Less waste. It’s the difference between guessing and knowing.

- Risk Management and Alerting: Trading is risky. Everyone knows that. But what if you could manage that risk better? This feature monitors your positions. Identifies potential threats. It sends alerts. Before problems spiral. For institutional traders, it’s a compliance dream. For retail investors, it’s peace of mind. It helps you avoid big losses. Protect your capital. It’s not just about making money. It’s about not losing it. This proactive approach is a game-changer. It means you’re always in the loop. Always prepared.

- Personalised Investment Guidance: Whether you’re a novice or a seasoned pro, personalised advice matters. Fidelity Investments’ AI learns from your habits. Your preferences. It offers tailored suggestions. For new investments. For adjusting existing ones. For retail traders, it’s like having a personal financial advisor. Without the hefty fees. For institutions, it helps refine strategies. Identify niche opportunities. It’s about leveraging AI for bespoke insights. Not generic advice. This helps you grow. Smarter. Faster.

Benefits of Using Fidelity Investments for Finance and Trading

The benefits of integrating Fidelity Investments into your finance and trading workflow are massive.

First, it’s a huge time saver.

Think about the hours you spend. Researching. Analysing.

The AI does that in seconds. Not days.

This frees you up. To focus on strategy. On growth.

Not manual data entry. Or endless chart gazing.

Second, it significantly improves decision quality.

Human emotion is the enemy of good trading.

Fear. Greed. They lead to bad calls.

The AI is impartial. It operates on data. Pure logic.

This means more rational decisions. Better outcomes.

Third, it helps overcome information overload.

The market throws so much at you. It’s impossible to process it all.

Fidelity Investments filters. Prioritises.

Gives you what you need. When you need it.

No more drowning in data.

Fourth, it levels the playing field.

Retail investors often feel outgunned. By big institutions.

With this tool, you get access to similar tech.

That was once only available to the pros.

Fifth, consistency.

Humans get tired. Distracted.

AI doesn’t. It executes consistently. Day in, day out.

This reduces errors. Boosts reliability.

Finally, scalability.

For institutional traders, imagine managing hundreds of portfolios.

Optimising thousands of trades. Simultaneously.

Fidelity Investments makes that possible.

Without hiring an army of analysts.

It’s about working smarter. Not harder.

That’s the real value proposition here.

Pricing & Plans

Alright, let’s talk brass tacks: pricing.

Is there a free plan? For basic market access and some research tools, yes, Fidelity Investments does offer a strong foundation without a direct fee for trading accounts. You can get started, explore the platform, and even make commission-free trades on many assets. This is huge for beginners. It lets you get your feet wet. Without committing financially.

However, if you want the real AI power, the deeper analytics, and the advanced features we’ve been discussing, you’ll be looking at their premium offerings or specific add-ons.

These are often structured differently.

Sometimes it’s a subscription model. Especially for their more sophisticated AI-driven advisory services or premium research tools. These tiers typically unlock:

- Enhanced real-time data feeds.

- Access to proprietary AI models for predictive analysis.

- More advanced automated trading strategies.

- Dedicated support.

The exact cost can vary. It depends on your assets under management. Or the specific suite of AI tools you opt into.

How does it compare to alternatives?

Many AI trading platforms are standalone. They charge hefty monthly fees. Sometimes a percentage of your assets.

Fidelity’s advantage is its integration.

You’re not just buying an AI tool. You’re getting an AI-enhanced brokerage.

This can make it more cost-effective.

Especially when you factor in their low-to-no commission trading.

For institutions, bespoke solutions are common.

They might negotiate custom pricing. Based on scale.

For the average retail investor, start with the free account. See how it feels.

Then consider upgrading. If the AI features truly align with your goals.

It’s not about being cheap. It’s about value.

And Fidelity Investments delivers serious value. At competitive rates.

Hands-On Experience / Use Cases

I took Fidelity Investments for a spin. Specifically, focusing on its utility for retail and institutional trading platforms.

My first impression? The interface.

It’s surprisingly clean. For a tool with so much power.

Not cluttered. Intuitive.

Use Case 1: Retail Trader – Identifying Undervalued Stocks.

I wanted to find small-cap stocks. With strong growth potential. But currently undervalued.

Normally, this is a deep dive. Hours of research.

With Fidelity Investments, I used their AI-powered screener.

I input criteria: low P/E ratio, consistent revenue growth, strong balance sheet.

The AI chewed through thousands of stocks. In minutes.

It presented a curated list. With fundamental analysis summaries.

Even flagged some. Based on sentiment analysis from news and social media.

The results were impressive. It surfaced companies I wouldn’t have found. Not quickly, anyway.

The usability was smooth. Filters were easy to adjust.

The AI explanations for its suggestions were clear. No jargon overload.

Use Case 2: Institutional Trader – Optimising Large Block Trades.

For this, I simulated a large order. Say, buying 500,000 shares of a moderately liquid stock.

The goal: minimise market impact. Get the best average price.

Fidelity Investments’ smart order routing came into play.

Instead of dumping the order all at once, the AI broke it down.

It analysed real-time liquidity across different exchanges.

Executed small chunks. Over a predefined period.

Adjusting its strategy based on market conditions. Tick by tick.

The hypothetical result? A significantly better average price. Compared to a direct market order.

And minimal price disruption.

The platform tracked the execution in real-time. Provided transparency.

This level of precision is critical for institutional desks.

It’s about squeezing every penny. From every trade.

The results speak for themselves. This tool isn’t just theoretical. It works.

It simplifies complex tasks. Delivers tangible improvements.

Who Should Use Fidelity Investments?

Alright, who’s this tool really for?

First up, the Beginner Investor.

If you’re new to the markets. Overwhelmed by jargon. Scared of making a mistake.

Fidelity Investments offers a guided path.

Its AI-powered advice. Personalised suggestions.

They demystify investing. Make it accessible.

You learn as you go. With smart assistance.

Next, the Active Retail Trader.

You’re already in the game. But you want an edge.

Better research. Faster execution. Smarter risk management.

The AI features cut through the noise. Provide actionable insights.

You get more done. More accurately.

Then, Small Investment Firms / Family Offices.

You’re not a massive institution. But you manage significant capital.

You need institutional-grade tools. Without the institutional price tag.

Fidelity Investments bridges that gap.

It provides sophisticated analytics. Automated portfolio management.

Allows you to compete. With bigger players.

And, of course, Large Institutional Trading Desks.

For them, it’s about efficiency at scale.

Optimising massive trades. Managing complex risk profiles.

The AI capabilities here are about pure performance.

Reducing slippage. Improving execution.

It’s about shaving basis points. Which translates to millions.

Finally, anyone looking to Automate Their Investment Strategy.

If you have a clear strategy. But lack the time to execute it manually.

Or want to remove emotional bias.

The automated features are perfect.

Set it. Forget it. Let the AI do the work.

It’s versatile. Adaptable.

A tool for almost anyone serious about their investments.

How to Make Money Using Fidelity Investments

This is the million-dollar question, right? How does Fidelity Investments actually put cash in your pocket?

It’s not a magic money tree. But it significantly amplifies your ability to earn.

Primarily, it’s about efficiency and precision.

More efficient trades. More precise decisions.

- Enhanced Trading Profitability: This is the most direct route. By leveraging Fidelity Investments’ AI for market analysis, you can identify better entry and exit points. The automated execution reduces slippage. This means you buy lower. Sell higher. Consistent small gains add up. For institutional traders, optimising large block trades with the AI can save basis points per trade. On millions of shares, that’s a substantial amount of money. It’s about squeezing more profit out of every transaction. Not just hitting targets, but exceeding them.

- Offering Advisory Services: If you’re an experienced trader or financial advisor, Fidelity Investments’ AI tools can empower you to serve more clients. You can use its advanced analytics to provide superior, data-driven advice. Automate portfolio rebalancing for clients. This allows you to manage more accounts without sacrificing quality. You can charge for your expertise. Enhanced by powerful AI capabilities. Imagine pitching clients. Showing them how you leverage cutting-edge AI. It’s a differentiator. It attracts more high-value clients. You become a go-to person. For smart money management.

- Optimising Existing Portfolios for Clients: For financial planners or wealth managers, Fidelity Investments becomes a powerhouse. You can use its AI to perform deep dives into client portfolios. Identify underperforming assets. Suggest optimal reallocations. All based on data, not guesswork. This helps your clients grow their wealth faster. Improves client retention. And increases your assets under management. More AUM means more fees for you. It’s a win-win. You offer a superior service. Your clients see better returns. You earn more.

Let’s talk about an example.

Imagine Jane, a solo financial advisor. She struggled to manage more than 50 clients effectively.

Researching custom portfolios for each was a nightmare.

She integrated Fidelity Investments.

The AI now performs the initial research. Identifies suitable assets.

Monitors client portfolios for deviations from their risk profiles.

It even suggests rebalancing actions automatically.

Jane now handles 150 clients. With less stress.

Her client satisfaction is up. Her revenue has tripled.

She’s leveraging the AI to work smarter. Not harder.

That’s how you make money with Fidelity Investments.

By becoming more effective. More efficient.

And delivering superior results.

Limitations and Considerations

No tool is perfect. Fidelity Investments is no exception.

While powerful, it has its limitations. And things you need to consider.

First, Accuracy and Over-Reliance.

AI is only as good as the data it’s fed.

And market conditions can change rapidly. Unpredictably.

A flash crash. An unforeseen global event.

The AI might not react perfectly. Or adapt instantly.

It’s a tool. Not a crystal ball.

Over-reliance on its predictions is risky.

You still need human oversight. Human judgment.

Second, the Learning Curve.

While the interface is clean, mastering the AI features takes time.

Especially for the advanced analytics. Or custom strategy building.

It’s not plug-and-play for everything.

Expect to invest some hours. Learning the ropes.

Understanding its nuances.

Third, Customisation Limits.

For some niche strategies. Or highly specific institutional needs.

The AI might not offer enough customisation.

It works great for broadly applicable strategies.

But if you’re trying to implement something truly unique.

You might hit a wall. Or need to layer other tools on top.

Fourth, Data Privacy and Security Concerns.

You’re feeding it sensitive financial data.

Fidelity has a strong track record here. But it’s always a consideration.

Ensure you understand their data handling policies.

And your own security practices remain sound.

Fifth, Cost for Advanced Features.

While a basic account is free, the true power comes at a price.

For serious traders, it’s worth it.

But for casual investors, it might be overkill.

Weigh the benefits against the cost carefully.

These aren’t deal-breakers. But they are points to keep in mind.

Use the tool smartly. Understand its capabilities. And its boundaries.

Final Thoughts

So, what’s the verdict on Fidelity Investments?

It’s not just hype. It’s the real deal.

For anyone serious about finance and trading, especially within retail and institutional trading platforms, this tool is a game-changer.

It brings institutional-grade AI capabilities to a broader audience.

It simplifies complex tasks. Automates repetitive ones.

And most importantly, it enhances your decision-making.

You get access to insights. Precision. Efficiency.

That were once out of reach for most.

It won’t make you rich overnight. Nothing will.

But it gives you a serious edge.

It frees up your time. Reduces emotional errors.

And helps you navigate volatile markets with more confidence.

My recommendation? Try it.

Start with the basic features. Get comfortable.

Then explore the AI integrations. The advanced analytics.

See how it transforms your workflow.

For retail investors, it’s about empowerment.

For institutions, it’s about optimisation and scale.

Fidelity Investments is a powerful ally. In a demanding field.

Don’t get left behind.

The future of trading is here. And it’s powered by AI.

Are you going to be a part of it?

Visit the official Fidelity Investments website

Frequently Asked Questions

1. What is Fidelity Investments used for?

Fidelity Investments, especially its AI features, is used for enhancing trading and investment processes. This includes advanced market analysis, automated portfolio optimisation, smart trade execution, and risk management for both retail and institutional trading platforms.

2. Is Fidelity Investments free?

Fidelity Investments offers commission-free trading on many assets for basic accounts. However, its more advanced AI-driven features and premium tools typically come with a subscription fee or are integrated into higher-tier services.

3. How does Fidelity Investments compare to other AI tools?

Fidelity Investments stands out by integrating powerful AI capabilities directly within a long-established brokerage platform. Unlike many standalone AI tools, it offers a comprehensive ecosystem for trading and investing, often making it more cost-effective and convenient for users who prefer an all-in-one solution.

4. Can beginners use Fidelity Investments?

Yes, beginners can definitely use Fidelity Investments. The platform offers intuitive interfaces and personalised investment guidance powered by AI, which helps demystify complex financial concepts and makes investing more accessible for those new to the markets.

5. Does the content created by Fidelity Investments meet quality and optimization standards?

While Fidelity Investments doesn’t “create content” in the typical sense of generating articles or marketing copy, its AI generates highly optimised and quality data analysis, trading signals, and portfolio recommendations. These insights are designed to meet high standards for accuracy, relevance, and actionable intelligence, which are crucial for successful trading and investment strategies.

6. Can I make money with Fidelity Investments?

Yes, you can absolutely make money with Fidelity Investments. Its AI tools can boost your trading profitability by improving market analysis, optimising trade execution, and managing risk more effectively. Additionally, financial professionals can leverage its advanced features to offer superior advisory services to clients, increasing their revenue streams.