Personal Capital revolutionizes your Portfolio Optimization and Robo-Advisors strategy. Gain unparalleled insights and automate wealth management for peak financial performance. Discover the smarter way to invest now!

Personal Capital Unlocks New Potential in Portfolio Optimization and Robo-Advisors

Alright, let’s talk brass tacks.

The finance game? It’s changing.

AI isn’t some far-off sci-fi fantasy anymore.

It’s here, and it’s making waves in Finance and Trading.

Specifically, when it comes to managing money, optimising portfolios, and even automating investment decisions.

You’ve probably heard the whispers, seen the headlines.

Everyone’s looking for an edge.

A way to get more done, make smarter moves, and ultimately, grow their wealth without drowning in spreadsheets.

That’s where Personal Capital steps in.

This isn’t just another budgeting app.

It’s a serious tool for serious players.

It’s built for those who understand that in wealth management, efficiency isn’t a bonus; it’s the main event.

If you’re in the Finance and Trading world, especially if you’re wrestling with Portfolio Optimization and Robo-Advisors, then pay attention.

This could be the game-changer you’ve been looking for.

It’s about making your money work harder, smarter, and with a whole lot less headache.

Table of Contents

- What is Personal Capital?

- Key Features of Personal Capital for Portfolio Optimization and Robo-Advisors

- Benefits of Using Personal Capital for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Personal Capital?

- How to Make Money Using Personal Capital

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Personal Capital?

So, what exactly is Personal Capital?

Think of it as your financial command centre.

It’s an AI-powered platform designed to give you a complete, real-time picture of your finances.

We’re talking all your accounts, all in one place: bank accounts, investment portfolios, credit cards, mortgages – the lot.

Its core mission? To help you understand where your money is, where it’s going, and how it’s performing.

For those deep in Finance and Trading, it’s not just about seeing numbers.

It’s about gaining actionable insights.

It helps you spot opportunities and risks you might otherwise miss.

Personal Capital isn’t just for individual investors, though they certainly benefit.

It’s equally potent for financial advisors, wealth managers, and anyone else who needs to track and optimise multiple portfolios.

It simplifies what used to be a messy, time-consuming job.

No more logging into ten different sites.

No more guessing games.

It brings clarity to complexity, which is gold in the world of investments.

The tool aggregates data, analyses it, and then presents it in a way that makes sense.

It’s designed to give you the data you need to make quick, confident decisions.

Whether you’re trying to rebalance a portfolio, understand your net worth, or gauge your retirement readiness, Personal Capital is built for it.

It helps you stop reacting and start proactively managing your financial future.

It’s about putting you in control, with all the necessary information at your fingertips.

It provides a high-level view while also letting you drill down into the nitty-gritty details.

This means you can see the forest and the trees, making it invaluable for any serious financial strategy.

It makes the complex simple, allowing you to focus on growth rather than data wrangling.

Key Features of Personal Capital for Portfolio Optimization and Robo-Advisors

- Comprehensive Financial Dashboard:

This isn’t just a pretty screen. It’s your nerve centre. Personal Capital pulls all your financial accounts together: checking, savings, credit cards, mortgages, and most importantly, all your investment accounts.

You get a real-time snapshot of your entire net worth. This helps immensely with Portfolio Optimization and Robo-Advisors because you can see the big picture of your assets and liabilities, allowing for more holistic and informed decisions about asset allocation and risk.

It’s about making sure every piece of your financial puzzle fits together perfectly.

- Investment Checkup Tool:

Now, this is where it gets interesting for serious investors. The Investment Checkup tool analyses your current portfolio for diversification, risk tolerance, and fees.

It identifies areas where you might be over-concentrated or paying too much in hidden fees. This feature is crucial for Portfolio Optimization and Robo-Advisors.

It gives you specific, actionable recommendations to optimise your asset allocation. You can compare your portfolio against various benchmarks and see how it stacks up, helping you make data-driven adjustments to improve performance.

It’s like having a top-tier financial analyst constantly reviewing your holdings.

- Fee Analyzer:

Hidden fees eat into your returns. Period. Personal Capital’s Fee Analyzer goes deep, looking at the expense ratios on your mutual funds, ETFs, and even the fees charged by your advisors.

It calculates the long-term impact of these fees on your wealth. For Portfolio Optimization and Robo-Advisors, this is non-negotiable. Lowering fees directly translates to higher net returns over time.

It’s about stripping away the dead weight and making sure more of your money stays in your pocket, working for you. This tool can uncover thousands, even tens of thousands, of dollars you might be losing to unnecessary costs.

- Retirement Planner:

Future planning is a huge part of Portfolio Optimization and Robo-Advisors. The Retirement Planner isn’t just a calculator; it’s a projection engine.

It considers your current savings, spending habits, and future goals to forecast your retirement readiness. It even runs Monte Carlo simulations to show you the probability of meeting your goals under various market conditions.

This helps you adjust your investment strategy today to ensure you’re on track for tomorrow. It provides peace of mind, knowing whether you’re saving enough or if you need to tweak your approach.

- Cash Flow Analyzer & Budgeting Tools:

You can’t optimise a portfolio if you don’t control your cash flow. Personal Capital tracks your income and expenses, categorising them automatically.

This helps you understand where your money is going and identify areas for savings. Better cash flow means more capital available for investment, which directly fuels your Portfolio Optimization and Robo-Advisors efforts.

It’s about making your money work harder for you, starting with how you manage what comes in and what goes out. This foundational feature ensures your investment strategy isn’t undermined by poor spending habits.

- Robo-Advisory Services (Wealth Management):

For those with over $100,000 in investable assets, Personal Capital offers actual human financial advisors combined with their AI-driven platform.

This hybrid approach is where the “Robo-Advisors” part really shines. You get personalised advice, tax-loss harvesting, and rebalancing, all managed by professionals who leverage the platform’s insights.

It’s a powerful combination for serious Portfolio Optimization and Robo-Advisors, giving you both the high-tech analysis and the human touch.

They help you stay disciplined and make the right moves, especially during volatile market periods.

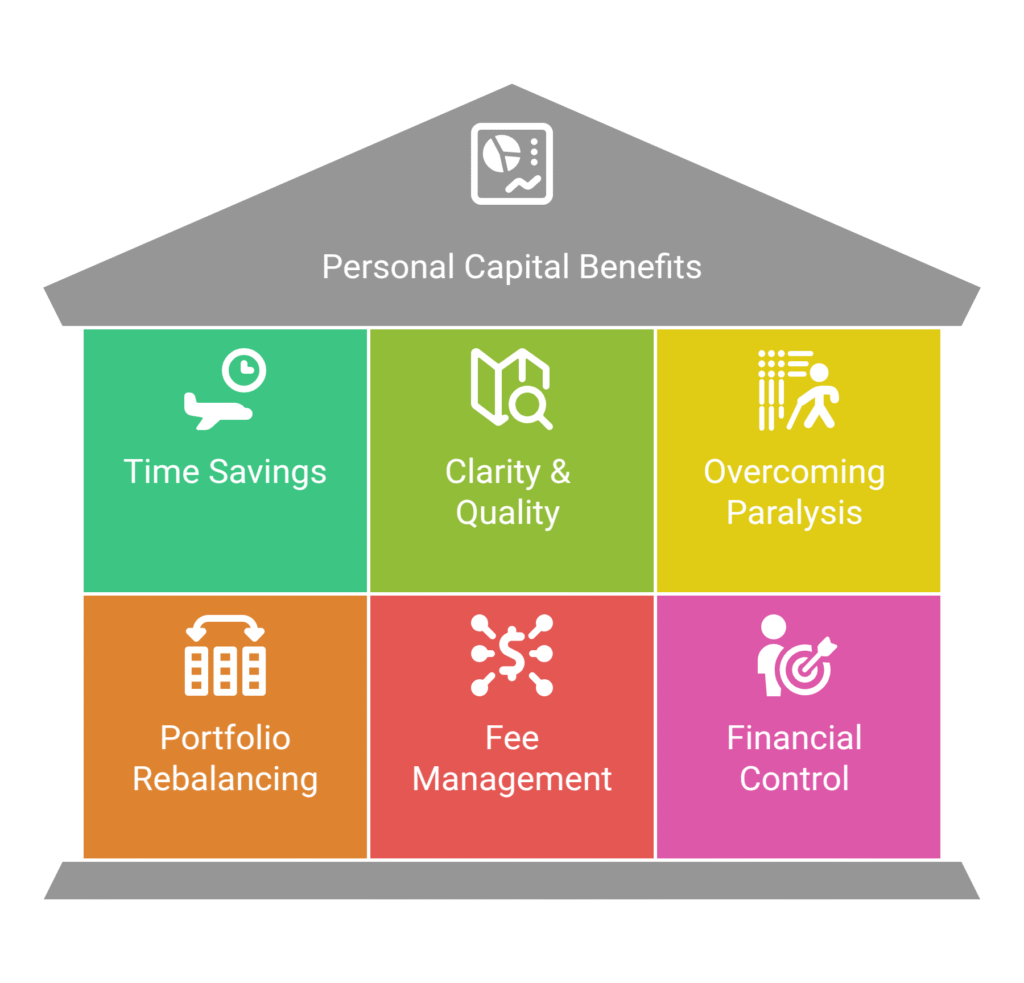

Benefits of Using Personal Capital for Finance and Trading

Alright, let’s cut to the chase. Why should you care about Personal Capital if you’re in Finance and Trading?

It boils down to a few core benefits that hit where it hurts, or rather, where it helps.

First, time savings.

Seriously, how much time do you currently spend logging into different accounts, downloading statements, and trying to piece together a coherent financial picture?

Hours, right? Maybe even days over the course of a month.

Personal Capital automates that.

It consolidates everything into one dashboard.

This means less busywork for you and more time to focus on strategy, research, or, you know, actually living your life.

Second, unbeatable clarity and quality improvement.

When all your data is aggregated and analysed by a smart system, you get insights you simply can’t pull together manually.

It highlights hidden fees, diversification gaps, and potential tax efficiencies.

This isn’t just about ‘better’ decisions; it’s about making *optimised* decisions based on comprehensive, real-time data.

It’s the difference between guessing and knowing.

Third, overcoming analysis paralysis.

Ever stare at a dozen spreadsheets, unsure which move to make next?

Personal Capital cuts through that noise.

Its tools, especially the Investment Checkup and Retirement Planner, provide clear recommendations and simulations.

They give you the confidence to act, because the AI has done the heavy lifting of crunching the numbers and stress-testing scenarios.

Fourth, strategic portfolio rebalancing.

This is huge for Portfolio Optimization and Robo-Advisors.

The platform helps you understand when your asset allocation drifts from your target.

It doesn’t just tell you there’s a problem; it shows you exactly where and suggests adjustments.

This proactive approach helps maintain your desired risk profile and keeps you on track to meet your financial goals.

No more waiting for quarterly statements to realise you’re off course.

Fifth, better fee management.

Those small fees? They compound over decades and can cost you a fortune.

Personal Capital brings these often-invisible costs to light.

Knowing exactly how much you’re paying and where allows you to make informed choices about your investments.

It empowers you to negotiate with advisors or switch to lower-cost alternatives, directly boosting your net returns.

Finally, enhanced financial control and discipline.

When you have a clear, real-time view of your entire financial situation, you gain an immense sense of control.

This transparency fosters better financial habits, encourages consistent savings, and helps you stick to your long-term investment strategy.

It’s about moving from reactive money management to proactive wealth building.

These aren’t just features; they’re accelerants for your financial growth.

They help you work smarter, not just harder, in the complex world of Finance and Trading.

Pricing & Plans

Alright, let’s talk money, because that’s what this is all about, right?

Personal Capital has a unique pricing structure that sets it apart from many other financial tools.

Here’s the deal: The core suite of financial planning tools, the ones we just talked about—the comprehensive dashboard, net worth tracker, cash flow analyser, budgeting tools, Investment Checkup, Retirement Planner, and Fee Analyzer—these are completely free.

No hidden fees, no credit card required.

This free access is a massive value proposition, especially for individual investors and those just starting to get serious about their finances.

You get robust analytics and aggregation capabilities without paying a dime.

So, what do you pay for?

You pay if you opt for their professional Wealth Management services.

This is where Personal Capital acts more like a traditional financial advisor, but with a tech-forward approach (hence the ‘Robo-Advisors’ part).

These services are available to clients with at least $100,000 in investable assets.

The fee structure is a tiered AUM (Assets Under Management) model, meaning you pay a percentage of the assets they manage for you.

For accounts between $100,000 and $1 million, the advisory fee is typically around 0.89% per year.

As your assets grow, the percentage decreases.

For example, for assets between $1 million and $3 million, it might drop to 0.79%, and it continues to scale down for higher tiers.

This fee covers personalized financial advice from a dedicated human advisor, tax-loss harvesting, rebalancing, and estate planning guidance, among other things.

It’s a comprehensive package for serious investors who want professional management combined with cutting-edge technology.

Compared to traditional financial advisors who might charge 1% or more, Personal Capital’s fees are competitive, especially considering the advanced technology they bring to the table.

Alternatives like Vanguard Personal Advisor Services or Schwab Intelligent Portfolios also offer competitive AUM fees, but Personal Capital’s free tools provide a significant advantage for users who prefer to self-manage with powerful insights.

Essentially, Personal Capital gives you the choice: use their powerful analytical tools for free, or pay for a comprehensive, tech-driven wealth management service with human advisors.

It’s a model that caters to a broad spectrum of financial needs, from the DIY investor to the high-net-worth individual seeking sophisticated guidance.

They’ve built a powerful funnel.

Hands-On Experience / Use Cases

Alright, let’s get real. How does Personal Capital actually perform when the rubber meets the road?

I’ve been using it for a while now, and I can tell you, it simplifies things dramatically.

My previous setup? A messy collection of spreadsheets, bank logins, and investment platform dashboards.

Each month, pulling it all together felt like a chore.

With Personal Capital, it’s different.

Connecting all my accounts was straightforward.

Once linked, the dashboard lit up with a clear, real-time view of my net worth.

No more manual updates.

Case Study: Portfolio Rebalancing

Let’s say I set my target asset allocation at 70% equities, 30% bonds.

Over time, due to market movements, my equities might surge, pushing my allocation to 75%.

Before Personal Capital, I’d have to manually calculate this across different brokerage accounts.

Now, the Investment Checkup tool immediately flags this drift.

It shows me exactly which holdings are out of whack and recommends trades to bring me back to my target allocation.

It even visualises the impact of potential changes.

This isn’t just theory; it’s practical guidance that saves hours of calculation and helps maintain risk control.

Use Case: Identifying Hidden Fees

I thought I was pretty savvy about fees.

Turns out, I was wrong.

The Fee Analyzer went through my 401(k) and IRA accounts and highlighted expense ratios I was totally blind to.

It projected how much these seemingly small percentages would cost me over decades – it was staggering.

Armed with that data, I was able to switch a couple of high-fee funds to lower-cost index funds within my 401(k), directly boosting my long-term returns.

This information is genuinely invaluable, and it’s something I wouldn’t have caught without the tool.

Usability:

The interface is clean and intuitive.

Navigation is simple.

You don’t need a finance degree to use it, though those with financial expertise will appreciate the depth of the insights.

Graphs and charts are easy to read, making complex financial data accessible.

The mobile app is just as good, allowing you to check in on your portfolio on the go.

Results:

The results are tangible.

I’ve significantly improved my portfolio’s diversification, reduced my overall investment fees, and gained a much clearer picture of my retirement readiness.

The peace of mind that comes from knowing exactly where you stand financially, at any given moment, is a huge win.

For anyone serious about wealth building, whether managing your own money or client funds, Personal Capital delivers real, measurable value.

It’s not just reporting; it’s empowering you to make better financial decisions.

Who Should Use Personal Capital?

Let’s break down who really benefits from Personal Capital.

This isn’t a one-size-fits-all tool, but its applications are surprisingly broad, especially for those in or adjacent to the world of Finance and Trading.

First up: Individual Investors with Multiple Accounts.

If you’ve got a checking account, a savings account, a couple of brokerage accounts, a 401(k), an IRA, maybe some crypto holdings, and a mortgage, then Personal Capital is practically a requirement.

It brings all that disparate data into one cohesive view, making it easy to track your net worth and overall financial health.

Next: DIY Investors Focused on Portfolio Optimization.

If you prefer to manage your own investments but want professional-grade tools to help you with asset allocation, risk assessment, and fee analysis, the free tools alone are worth their weight in gold.

They give you the insights to optimise your portfolio without paying advisory fees.

Then we have Financial Advisors and Wealth Managers.

While Personal Capital offers its own advisory services, the free dashboard and analytical tools can be incredibly useful for professionals to get a holistic view of a client’s finances quickly, identify problem areas, and demonstrate value.

It can serve as a powerful data aggregation and initial analysis tool.

Also, Retirement Planners.

The Retirement Planner is robust. If your primary goal is to ensure you’re on track for retirement, this tool provides sophisticated projections, including Monte Carlo simulations, to help you understand your probability of success and make adjustments.

It’s a must-have for long-term strategic financial planning.

Small Business Owners and Entrepreneurs.

Often, personal and business finances can get intertwined.

Personal Capital helps you maintain a clear picture of your overall financial standing, allowing you to make better decisions about personal investments and how they relate to your business capital.

Finally, anyone who feels overwhelmed by their finances and wants a clear, intuitive way to understand their money.

It demystifies complex financial concepts and presents them in an actionable format.

If you’re ready to move beyond basic budgeting and start actively optimising your wealth, Personal Capital is built for you.

How to Make Money Using Personal Capital

Okay, let’s talk about the bottom line: making money.

While Personal Capital isn’t a direct revenue-generating tool in the same way a trading platform is, it’s a powerful enabler.

It helps you make smarter financial decisions that lead to increased wealth, directly or indirectly.

Think of it as a force multiplier for your financial efforts.

- Optimising Personal Investments for Higher Returns:

This is the most straightforward way. By using Personal Capital’s Investment Checkup, Fee Analyzer, and Retirement Planner, you can make informed decisions to optimise your personal portfolio.

Reducing fees directly increases your net returns.

Rebalancing to maintain your target allocation can prevent significant losses during market shifts and capture growth more effectively.

A conservative estimate of saving 0.5% in fees per year on a £500,000 portfolio translates to £2,500 annually. Over decades, compounding makes that figure enormous.

That’s money staying in your pocket, growing.

- Offering Enhanced Financial Advisory Services:

If you’re a financial advisor, planner, or wealth manager, Personal Capital can significantly boost your efficiency and client value.

You can use its robust aggregation and analysis tools to quickly get a comprehensive view of a client’s entire financial situation.

This allows you to spend less time on data collection and more time on high-value advice.

You can use the Fee Analyzer to show clients how much they could save, or the Retirement Planner to visually demonstrate their progress and potential shortfalls.

This advanced analytical capability can attract more clients and justify higher fees for your services.

It’s about offering a superior service.

- Identifying Lucrative Investment Opportunities:

While Personal Capital doesn’t directly pick stocks, its comprehensive overview helps you spot imbalances and opportunities within your overall financial picture.

For instance, if your cash flow analyser shows significant surplus, you know you have more capital available for investment.

If the Investment Checkup reveals an underperforming asset class relative to your goals, it prompts you to research and allocate funds more effectively.

This indirect insight can lead to better capital deployment and, consequently, better returns.

Case Study Example: The £10,000 Fee Saver

Let’s take Sarah, a self-employed consultant.

She had multiple old 401(k)s, an IRA, and a personal brokerage account, totalling about £750,000.

She used Personal Capital’s free tools.

The Fee Analyzer immediately flagged her old 401(k) for having funds with expense ratios averaging 1.2%.

It projected that over the next 20 years, these fees would cost her over £70,000 in lost returns compared to similar funds with a 0.2% expense ratio.

Sarah rolled over the old 401(k) into a lower-cost IRA and invested in broad market index funds with minimal fees.

Within the first year, her portfolio’s overall expense ratio dropped from an average of 0.9% to 0.25%.

On her £750,000 portfolio, this reduction of 0.65% meant saving roughly £4,875 in fees in just that year.

Compounded over her remaining working years, this decision, facilitated by Personal Capital’s insights, will likely save her tens of thousands, if not hundreds of thousands, of pounds.

She didn’t ‘make’ money in the traditional sense, but she saved a substantial amount, which is just as good, if not better.

Limitations and Considerations

Look, nothing’s perfect.

While Personal Capital is a powerful tool, it’s got its quirks and things to keep in mind.

Knowing these upfront helps set realistic expectations.

First, data accuracy and synchronisation.

For the most part, it’s excellent, but occasionally, an account might disconnect or struggle to pull the latest data.

This usually resolves itself, but it can be annoying when you’re trying to get a real-time snapshot.

You’ll need to manually re-link accounts sometimes.

It’s not a deal-breaker, but it’s a minor hiccup worth noting.

Second, the sales pitch for wealth management.

Remember how the core tools are free?

Personal Capital makes its money from its paid wealth management services.

This means you’ll likely receive calls or emails encouraging you to sign up for their advisory services if you have a significant investable net worth.

While the calls are generally informative and not overly aggressive, if you’re strictly a DIY investor and don’t want an advisor, it can feel like a constant push.

You can politely decline, but be prepared for it.

Third, limited direct trading capabilities.

Personal Capital is an analysis and aggregation tool, not a brokerage platform.

You can see your investments, but you can’t execute trades directly through the platform (unless you’re a paying wealth management client whose accounts they manage).

You’ll still need to go to your individual brokerage accounts to make purchases or sales.

This isn’t a flaw, just a functional difference compared to platforms that offer both.

Fourth, the human element in Robo-Advisors.

While the platform offers AI-driven insights, the ‘Robo-Advisor’ aspect often refers to their hybrid model where AI informs human advisors.

If you’re expecting purely algorithmic trading without human involvement, you might be looking for something different, especially if your assets are below the threshold for their paid service.

Fifth, categorisation quirks.

The automatic transaction categorisation is pretty good, but it’s not perfect.

You’ll occasionally find transactions miscategorised, requiring manual adjustment.

This impacts the accuracy of your budgeting and cash flow analysis if not regularly reviewed.

It’s a minor edit, but one to be aware of.

Finally, learning curve for deeper features.

The dashboard is intuitive, but to really extract maximum value from features like the Retirement Planner’s advanced simulations or the in-depth tax analysis, you’ll need to spend some time understanding how they work and inputting accurate data.

It’s not steep, but it’s there.

So, while Personal Capital is a powerhouse, it’s important to go in with eyes open to these nuances.

They don’t detract from its overall value, but they’re part of the real-world experience.

Final Thoughts

Alright, let’s wrap this up.

Here’s the deal: Personal Capital isn’t just another budgeting app or a shiny new toy in the AI finance space.

It’s a genuine tool for serious players.

For anyone in Finance and Trading, especially if you’re neck-deep in Portfolio Optimization and Robo-Advisors, this platform is a game-changer.

The free tools alone – the net worth tracker, cash flow analysis, Investment Checkup, and Fee Analyzer – provide value that most paid services struggle to match.

They give you unparalleled clarity on your financial situation, highlight hidden costs, and empower you to make data-driven decisions that genuinely impact your wealth.

It saves you time, reduces stress, and, most importantly, helps you keep more of your hard-earned money.

If you’re managing multiple accounts, trying to reduce fees, or planning for retirement, Personal Capital simplifies the complex.

It provides the insights you need to take control and optimise your financial future.

The paid wealth management service, while not for everyone, offers a compelling hybrid model for those with larger portfolios seeking professional guidance combined with cutting-edge tech.

My recommendation?

Don’t just read about it.

Go try it.

The core features are free, so you’ve got nothing to lose and a whole lot of financial clarity to gain.

See for yourself how it can transform your approach to wealth management and investing.

It’s about working smarter, not harder, with your money.

Visit the official Personal Capital website

Frequently Asked Questions

1. What is Personal Capital used for?

Personal Capital is primarily used for aggregating all your financial accounts in one place, tracking your net worth, analysing investment portfolios for fees and diversification, and planning for retirement. It provides a holistic view of your financial health.

2. Is Personal Capital free?

Yes, the core suite of financial tools and features, including the net worth tracker, budgeting tools, investment analysis, and retirement planning, are completely free to use. They make money if you choose to use their paid wealth management advisory services.

3. How does Personal Capital compare to other AI tools?

Personal Capital stands out due to its comprehensive aggregation capabilities and sophisticated investment analysis tools (like the Fee Analyzer and Investment Checkup) which are often more advanced than basic budgeting apps. Unlike pure robo-advisors, it also offers a hybrid model with human financial advisors for clients meeting asset thresholds.

4. Can beginners use Personal Capital?

Yes, beginners can definitely use Personal Capital. Its user-friendly interface and intuitive dashboard make complex financial data easy to understand. While some features are advanced, the core functionality is accessible to anyone wanting to get a better handle on their finances.

5. Does the content created by Personal Capital meet quality and optimization standards?

Personal Capital doesn’t “create content” in the traditional sense of writing articles or marketing copy. Instead, it generates highly optimised financial insights, reports, and projections based on your linked data. These insights are of high quality, accurate, and optimised for decision-making in finance and trading.

6. Can I make money with Personal Capital?

Yes, indirectly. By using Personal Capital to identify and reduce hidden investment fees, optimise your portfolio for better returns, and plan effectively for retirement, you can significantly increase your net wealth over time. For financial professionals, it can also enhance service offerings, potentially leading to more clients and revenue.