TradeStation revolutionizes Algorithmic Trading and Strategy Development. Automate trades, backtest strategies, and gain an edge in financial markets. Ready to optimize your trading?

How TradeStation Is Reshaping Workflows in Finance and Trading

Ever feel like you’re constantly battling the clock in Finance and Trading?

Stuck in the weeds of manual processes?

The financial world, especially trading, moves at light speed.

If you’re not fast, you’re last.

AI isn’t just a buzzword anymore. It’s the engine driving efficiency.

It’s changing how we approach everything, especially in the high-stakes arena of Algorithmic Trading and Strategy Development.

Think about it: the human brain, powerful as it is, has limits.

Speed limits.

Analysis limits.

Emotion limits.

That’s where tools like TradeStation come in. They’re not just helping; they’re redefining the game.

This isn’t about replacing humans. It’s about empowering them to do more, faster, and smarter.

It’s about getting an edge when every millisecond counts.

So, if you’re serious about your game in finance and trading, you need to know this.

Table of Contents

- What is TradeStation?

- Key Features of TradeStation for Algorithmic Trading and Strategy Development

- Benefits of Using TradeStation for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use TradeStation?

- How to Make Money Using TradeStation

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is TradeStation?

Alright, let’s cut to the chase. What exactly is TradeStation?

It’s not just another trading platform. It’s a beast. A comprehensive AI-powered platform built specifically for serious traders and investors.

Think of it as your ultimate toolkit for navigating the markets.

Its core function? To give you the power to analyse, backtest, and automate your trading strategies.

We’re talking about real-time market data, advanced charting tools, and crucial for our discussion, powerful capabilities for Algorithmic Trading and Strategy Development.

Who’s it for? Anyone who’s tired of guesswork.

If you’re a professional trader, an institutional investor, or even an ambitious retail trader looking to level up your game, TradeStation is designed for you.

It helps you move from reactive trading to proactive, systematic trading.

It’s about making decisions based on data, not gut feelings.

It targets those who understand that in today’s markets, an edge comes from technology and precision.

It’s not for the faint of heart, but for those ready to commit to a rigorous, data-driven approach.

The platform isn’t just about executing trades. It’s about developing the intelligence behind those trades.

It’s about testing your hypotheses against historical data to see if they hold water.

And then, if they do, setting them loose in the market, automatically.

This is where the real leverage comes from. Automating what works.

It’s a complete solution. From idea generation to execution, all within one integrated system.

No more jumping between different software.

No more manual data entry.

Just pure, unadulterated trading power at your fingertips.

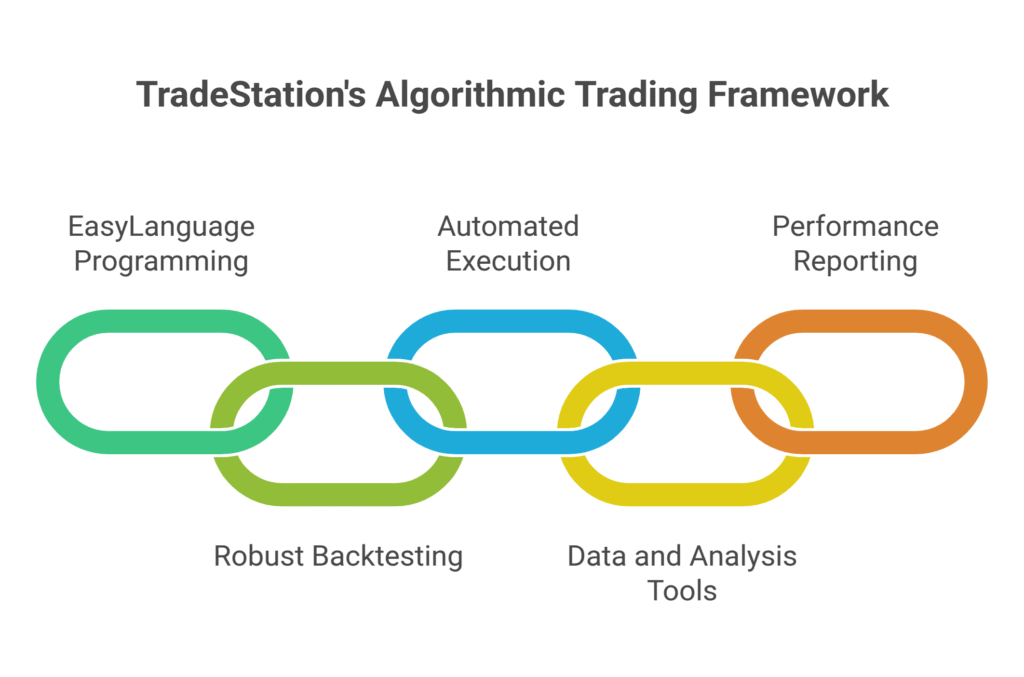

Key Features of TradeStation for Algorithmic Trading and Strategy Development

- EasyLanguage Programming: This isn’t just some fancy name. EasyLanguage is TradeStation’s proprietary programming language, designed specifically for traders. It’s intuitive. It’s powerful. You can code complex trading strategies without needing a computer science degree. Think about it: you have a trading idea, and with EasyLanguage, you can translate that idea into actionable code. This helps with Algorithmic Trading and Strategy Development by reducing the barrier to entry for strategy automation. It allows you to define your entry, exit, and money management rules with precision. This means you can create highly customized trading robots that do exactly what you want, consistently. It saves immense time compared to learning general-purpose programming languages like Python for trading.

- Robust Backtesting and Optimisation: You don’t just build a strategy and hope for the best. That’s amateur hour. TradeStation lets you backtest your strategies against decades of historical market data. We’re talking real historical data, not just theoretical models. This helps you see how your strategy would have performed in various market conditions. Even better, it offers optimisation tools. This allows you to fine-tune your strategy parameters to find the most profitable settings. It’s like stress-testing your plan under every possible scenario before you put real money on the line. This is crucial for Algorithmic Trading and Strategy Development because it gives you confidence in your approach. You can identify weaknesses and strengths before risking capital.

- Automated Trade Execution: This is where the rubber meets the road. Once your strategy is built, tested, and optimised, TradeStation can execute trades automatically. No manual intervention needed. This eliminates emotional trading decisions. It ensures your strategies are executed precisely when conditions are met, even when you’re not at your desk. This capability significantly boosts efficiency in Algorithmic Trading and Strategy Development. You set your rules, and the platform follows them to the letter. This means you can manage multiple strategies simultaneously, exploit fleeting opportunities, and maintain discipline around the clock. Imagine the peace of mind knowing your system is working for you, tirelessly.

- Market-Leading Data and Analysis Tools: TradeStation provides access to a huge amount of real-time and historical market data across various asset classes. Stocks, options, futures, forex—you name it. This data feeds directly into your analysis and backtesting. Beyond raw data, it offers advanced charting capabilities, technical indicators, and analytical tools. These are essential for identifying market trends, patterns, and potential trading opportunities. This level of data integration and analysis is a game-changer for Algorithmic Trading and Strategy Development. It means you’re always working with the freshest information and the most powerful analytical frameworks. You can spot anomalies, confirm signals, and build more robust strategies.

- Strategy Monitoring and Performance Reporting: It’s not enough to just launch a strategy. You need to know how it’s performing, in real-time. TradeStation gives you detailed performance reports. You can track metrics like profit and loss, drawdown, win rate, and much more. This monitoring helps you identify if your strategy is still effective or if market conditions have changed. It also helps you refine your approach over time. This continuous feedback loop is critical for successful Algorithmic Trading and Strategy Development. It allows for iterative improvements and ensures your strategies remain competitive and profitable in evolving markets. You’re always in the know, always in control, with clear data.

Benefits of Using TradeStation for Finance and Trading

So, why bother with TradeStation? What’s the real payoff?

First, time savings. Massive time savings.

Traditional trading means hours glued to screens, manually analysing charts, and waiting for opportunities.

TradeStation automates this. You set your rules, and it does the heavy lifting.

This frees you up to focus on higher-level strategy, research, or even, dare I say, life outside of trading.

Next, quality improvement.

Human emotions mess up trades. Fear, greed, impatience. They lead to bad decisions.

Algorithmic trading with TradeStation removes that. Your strategies are executed precisely, every single time, based on logic, not emotion.

This leads to more consistent, higher-quality trades.

It helps you overcome creative blocks too.

Stuck on a strategy idea? The backtesting and optimisation tools let you rapidly test countless variations.

It’s like having an army of data scientists working for you, validating or disproving your hypotheses in minutes, not days.

Think about the psychological edge this gives you.

You’re not guessing. You’re acting on statistically validated strategies.

This confidence reduces stress and burnout, which are huge problems in Finance and Trading.

It also allows for scalability.

One person can only manage so many manual trades or strategies.

With TradeStation, you can run multiple automated strategies across different markets simultaneously.

This multiplies your potential opportunities without multiplying your workload.

Ultimately, it’s about efficiency.

More trades, better trades, less manual work, less emotional baggage.

That’s a formula for serious competitive advantage.

You stop being a glorified button-pusher and start becoming a true architect of your financial destiny.

Pricing & Plans

Alright, let’s talk brass tacks: what’s the damage?

TradeStation’s pricing structure isn’t a simple monthly subscription like your Netflix. It’s built for traders, which means it’s more about commissions and data fees.

They operate on a commission-based model for trades. This means for stock and options trades, you might pay a few cents per share or per contract. Futures have their own per-contract commission.

The exact rates can vary based on your account size and trading volume. High-volume traders often get lower per-trade rates.

Is there a free plan? Not exactly in the way you might think for an AI tool.

You need to open and fund a brokerage account to use the full platform. There isn’t a “free tier” where you get full access to the AI tools without any trading.

However, they often have promotions for new accounts, sometimes offering commission-free trading on certain products for a limited period or if you meet specific criteria.

What does the premium version include? The “premium” here is simply having a funded account that gives you access to the TradeStation platform itself.

All the powerful features we talked about – EasyLanguage, backtesting, automated execution, real-time data – are included once you’re a client.

Where alternatives come in, it’s usually about other brokers offering algorithmic trading capabilities.

Some might have lower commissions, but perhaps less robust tools for strategy development.

Think about platforms like Interactive Brokers or tastytrade. They offer powerful APIs for programmatic trading, but TradeStation’s integrated EasyLanguage environment for strategy creation is a significant differentiator.

Interactive Brokers is known for low commissions and global market access but can be more complex for beginners in algo trading. You often need to code in Python or Java to leverage their API.

TradeStation packages it all into one environment, making it more accessible for traders who are not expert programmers but want powerful automation.

So, while it’s not “free,” the cost is tied to your trading activity. If you’re actively trading and developing strategies, the value derived from its advanced features often outweighs the commission costs.

Hands-On Experience / Use Cases

Let me tell you, getting hands-on with TradeStation feels like stepping into a cockpit.

It’s powerful. It’s got a lot of buttons. But once you know what they do, you’re flying.

Let’s simulate a real example: say I had a simple idea. “I want to buy shares of Apple every time its stock price crosses above its 50-day moving average, and sell when it crosses below.”

Sounds basic, right? But how do you test that over decades of data? And how do you make sure you execute it perfectly every time?

This is where TradeStation shines.

First, I’d open the EasyLanguage development environment. It’s like a smart notepad.

I’d write a few lines of code: `If Close crosses over Average(Close, 50) Then Buy next bar at market; If Close crosses under Average(Close, 50) Then Sell next bar at market;`

That’s literally it for the core logic. Simple, right?

Then, I’d hit “verify” to check for errors. TradeStation’s compiler is quick.

Next, the magic happens: backtesting.

I apply this strategy to Apple’s historical data, going back 20 years.

TradeStation processes this in minutes, sometimes seconds.

It gives me a detailed performance report: total profit, max drawdown, number of trades, average profit per trade, even the profit factor.

I might see, for instance, that this simple strategy, while profitable in some periods, might have had a huge drawdown during the 2008 financial crisis.

This instant feedback is priceless. I now know this strategy isn’t robust enough.

So, I iterate. Maybe I add a stop loss: `SetStopLoss(1.5 * AverageTrueRange(14));`

Backtest again. See the new results.

The usability here is that the feedback loop is incredibly tight. You have an idea, you code it, you test it, you refine it. Repeat. Fast.

The results? For this simple example, I might discover that while the strategy gained X%, the drawdown was too high for my comfort.

Or maybe I find a hidden gem, a combination of indicators that yielded a surprisingly consistent profit with low risk.

Another use case: say you’re a discretionary trader, but you want to automate your order entry.

You see a pattern, and you want to place a complex order with multiple targets and stops in milliseconds.

You can pre-program those order sets in TradeStation, attach them to a hotkey, and execute them instantly.

This isn’t just about full automation; it’s about augmenting human decision-making with machine speed and precision.

It gives you an edge in execution that manual traders simply can’t match.

Who Should Use TradeStation?

So, who exactly needs this beast of a platform?

TradeStation isn’t for everyone. It’s for people who are serious about their trading game.

First up: Active Traders and Day Traders.

If you’re in the market constantly, making multiple trades a day or week, the automation features alone are a game-changer.

Speed and precision in execution are paramount for them, and TradeStation delivers.

Next, Algorithmic Traders and Quants.

This is the sweet spot. If you’re building, testing, and deploying automated strategies, TradeStation’s EasyLanguage and robust backtesting engine are exactly what you need.

It’s built for developing systematic approaches to the market.

Then, Strategy Developers and Researchers.

Even if you’re not actively trading your own capital, but you consult for others, or research market behaviour, TradeStation offers the tools to validate trading hypotheses.

You can backtest strategies for clients, provide data-driven insights, and develop proprietary models.

Consider Small Hedge Funds and Proprietary Trading Firms.

They might not have the budget for custom-built institutional software, but they need powerful, reliable tools.

TradeStation provides enterprise-level capabilities at a more accessible price point, letting them compete with larger players.

Finally, Serious Retail Traders Looking to Scale.

Maybe you’ve been discretionary trading for a while, seen some success, and now you want to take it to the next level.

You want to remove emotion, increase efficiency, and potentially manage more capital.

TradeStation offers the tools to transition from manual trading to a more systematic, professional approach.

It’s not for casual investors looking to buy and hold. It’s for those who see trading as a business, a science, and a path to consistent, data-driven profits.

If you value automation, precision, and rigorous testing in your financial activities, then TradeStation is definitely worth a look.

How to Make Money Using TradeStation

Alright, this is where it gets interesting. How do you actually cash in on this thing?

It’s not just about saving time; it’s about creating new revenue streams or amplifying existing ones.

The most obvious way is through optimised trading performance.

By developing and backtesting robust strategies, you increase your win rate, manage risk better, and ultimately, make more consistent profits from your own trading.

That’s direct, right?

But there’s more to it than just trading your own account.

- Offer Algorithmic Trading as a Service: Think about it. Many individuals and even small funds want to dabble in algorithmic trading but lack the technical know-how or the time to build strategies. You can use TradeStation to develop and manage custom trading strategies for clients. This could involve creating a unique strategy based on their risk profile, backtesting it rigorously, and then managing the execution through your TradeStation platform. You could charge a setup fee, a monthly management fee, or a performance fee (a percentage of the profits generated). This leverages your expertise and TradeStation’s power.

- Sell Custom EasyLanguage Indicators & Strategies: The TradeStation ecosystem has a marketplace. If you’re skilled with EasyLanguage, you can develop proprietary indicators, studies, or fully automated strategies and sell them to other TradeStation users. Think of it like an app store for trading tools. Traders are always looking for an edge, and if you can provide a unique, profitable tool that’s easy to use, there’s a market for it. You create it once, and sell it repeatedly.

- Provide Trading Education & Coaching: With your mastery of TradeStation, you become an expert. You can teach others how to use the platform, how to code in EasyLanguage, and how to develop and backtest their own strategies. This could be through online courses, one-on-one coaching, webinars, or even a membership site. People pay good money to learn from those who truly understand these powerful tools. It’s about sharing your knowledge and helping others become better traders.

Let’s look at an example: Imagine a hypothetical trader, let’s call her Sarah.

Sarah started by using TradeStation to improve her own trading in Futures. She used EasyLanguage to build a trend-following strategy and rigorously backtested it.

After consistent profits for a year, she noticed friends and colleagues asking how she did it.

She then began offering a service: “Algorithmic Strategy Development and Management.”

She takes on a few high-net-worth clients, builds custom strategies for them on TradeStation, and automates their trades.

She charges a 2% management fee on assets and 15% of the profits.

With just five clients, each with £100,000 to manage, that’s £10,000 annually in management fees, plus a cut of the profits.

On top of that, Sarah launched a small online course showing others how to replicate her strategy building process using EasyLanguage.

She sells the course for £497. Even with just 20 sales a month, that’s almost £10,000 in passive income.

This isn’t just theory; this is how professionals use these tools to build multiple income streams.

TradeStation provides the infrastructure. Your expertise and creativity provide the profit.

Limitations and Considerations

Look, nothing’s perfect. Even TradeStation, powerful as it is, has its quirks.

First, the learning curve. It’s a professional-grade tool.

This isn’t a point-and-click solution for instant riches.

You need to invest time learning the platform, especially EasyLanguage.

It’s not Python, but it’s still a programming language. You’ll need to understand syntax, variables, and logic.

If you’re completely new to coding or systematic trading, expect a ramp-up period.

Next, over-optimisation risk.

TradeStation’s optimisation features are incredibly powerful.

You can tweak a strategy to look perfect on historical data.

But this can lead to strategies that perform fantastically in the past, but fail spectacularly in the future.

It’s like designing a car for a specific track, only to find it useless on a normal road.

You need discipline and a deep understanding of what backtesting truly means to avoid curve-fitting.

Data limitations. While TradeStation offers extensive data, it’s still historical data.

The market is dynamic. Past performance is not indicative of future results.

Unexpected events, black swans, or fundamental shifts in market structure can render even well-tested strategies useless.

Your strategies need constant monitoring and adaptation.

Also, consider the cost structure.

While the platform itself is accessed via a funded account, the commissions can add up, especially for very high-frequency or low-capital strategies.

Make sure your expected profits outweigh the trading costs.

Finally, technical glitches. No software is immune.

Internet outages, platform freezes, or unexpected errors can disrupt automated trades.

You need robust contingency plans. What happens if your internet goes down when a trade is supposed to execute?

It’s not just set-it-and-forget-it. It requires supervision, even if it’s automated.

TradeStation is a powerful tool. But it’s a tool for professionals.

It demands a commitment to learning, a nuanced understanding of market dynamics, and a disciplined approach to strategy development.

Don’t expect it to be a magic money tree. It’s an axe. You still need to swing it right.

Final Thoughts

So, here’s the bottom line.

TradeStation isn’t just a trading platform; it’s a force multiplier for anyone serious about Algorithmic Trading and Strategy Development.

It takes the guesswork out of trading, replacing gut feelings with data-driven decisions.

Its value is clear: it automates the tedious, optimises the profitable, and gives you back valuable time.

If you’re still manually crunching numbers, executing trades by hand, or letting emotions dictate your financial decisions, you’re leaving money on the table.

You’re playing checkers in a chess game.

TradeStation empowers you to build, test, and deploy sophisticated strategies that run 24/7, without emotional interference.

It’s the closest thing to having a tireless, hyper-efficient trading assistant that never sleeps.

My recommendation? If you’re committed to serious trading, if you want an edge in the fast-paced world of finance, you need to explore this.

It’s an investment in your trading future.

The learning curve is real, but the payoff for mastering it can be monumental.

Don’t just observe the market. Shape your participation in it.

Take the next step. Dig in. See how TradeStation can transform your approach to trading.

Visit the official TradeStation website

Frequently Asked Questions

1. What is TradeStation used for?

TradeStation is primarily used for online brokerage services, allowing traders to buy and sell various financial instruments like stocks, options, futures, and cryptocurrencies. Its advanced features are particularly popular for algorithmic trading, strategy development, backtesting, and market analysis. It provides powerful tools for automated trading and detailed performance reporting.

2. Is TradeStation free?

TradeStation is not entirely free. While there might not be explicit monthly subscription fees for the platform itself, users need to open and fund a brokerage account. Trading activities incur commissions on a per-trade or per-contract basis. There might be some data fees for premium real-time market data.

3. How does TradeStation compare to other AI tools?

TradeStation stands out from many general AI tools because it’s purpose-built for finance and trading. Unlike general-purpose AI platforms, TradeStation integrates directly with brokerage services and provides specific features like EasyLanguage for strategy coding, robust backtesting engines, and automated execution. It competes more directly with other advanced trading platforms like Interactive Brokers or NinjaTrader, often excelling in its integrated strategy development environment.

4. Can beginners use TradeStation?

While TradeStation is a powerful, professional-grade platform, beginners can use it with a willingness to learn. It has a steeper learning curve than simpler trading apps, especially if you want to use its advanced algorithmic trading and strategy development features like EasyLanguage. TradeStation provides educational resources, but new users should expect to invest time in understanding its functionalities before diving into complex strategies.

5. Does the content created by TradeStation meet quality and optimisation standards?

TradeStation doesn’t create “content” in the traditional sense like articles or marketing copy. Instead, it helps users create and optimise trading strategies and algorithms. These strategies, when developed and backtested correctly within TradeStation, are designed to meet high standards of logical soundness, risk management, and profitability based on historical market data. The quality and optimisation depend heavily on the user’s expertise in strategy development and their interpretation of the market.

6. Can I make money with TradeStation?

Yes, you can potentially make money with TradeStation by directly trading financial instruments and, more significantly, by developing and deploying profitable algorithmic trading strategies. Beyond personal trading, you can also generate income by offering algorithmic trading as a service, selling custom EasyLanguage indicators or strategies to other traders, or providing education and coaching on how to effectively use the platform for trading.