IBM Watson empowers precise Price Prediction and Forecasting in Finance & Trading. Gain a competitive edge with advanced AI insights, boosting your decision-making. Ready to transform your financial strategy?

If You’re Not Using IBM Watson, You’re Falling Behind

Ever feel like you’re playing catch-up in the world of finance and trading?

It’s a fast-paced game, right?

Traditional methods for price prediction and forecasting? They just aren’t cutting it anymore.

The market moves too fast.

The data deluge is real.

And if you’re still relying on gut feelings or outdated spreadsheets, you’re leaving money on the table.

Big time.

AI isn’t some futuristic concept.

It’s here.

It’s changing everything.

Especially in Finance and Trading.

And when we talk about AI in this space, one name keeps popping up: IBM Watson.

This isn’t just another tech fad.

It’s a serious tool.

A tool designed to give you an unfair advantage.

Specifically, when it comes to predicting prices and forecasting market trends.

Think about it.

What if you could see the market’s next move before anyone else?

What if you could make decisions with a level of confidence you’ve never had?

That’s the promise of IBM Watson for price prediction and forecasting.

It’s about working smarter, not harder.

It’s about getting real results.

So, if you’re serious about your trading game, listen up.

Because not knowing about this could be costing you.

Big time.

Table of Contents

- What is IBM Watson?

- Key Features of IBM Watson for Price Prediction and Forecasting

- Benefits of Using IBM Watson for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use IBM Watson?

- How to Make Money Using IBM Watson

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is IBM Watson?

Alright, let’s get straight to it. What exactly is IBM Watson?

Forget the sci-fi movie stuff for a second.

IBM Watson is a suite of AI services, built by IBM, designed to help businesses make sense of massive amounts of data.

It’s not just a single tool; it’s a collection of powerful AI capabilities.

Think of it like a highly intelligent analyst, but one that can process millions of data points in seconds.

Its core function is to understand, reason, learn, and interact.

This means it can read text, analyse images, interpret speech, and even understand complex financial reports.

The goal? To provide insights that humans simply can’t uncover alone or as quickly.

It’s built for enterprise-level challenges.

So, if you’re a financial institution, a hedge fund, a trading firm, or even an individual trader aiming for serious scale, this is your play.

It’s about bringing machine learning, natural language processing (NLP), and deep learning to your toughest problems.

For us, in the world of finance, its power truly shines when you need to crunch numbers, analyse market sentiment, and, crucially, forecast future prices.

It takes all that messy, unstructured data – news articles, social media feeds, analyst reports – and turns it into actionable intelligence.

This isn’t about guessing.

It’s about making highly informed decisions based on patterns you didn’t even know existed.

That’s IBM Watson for you.

Key Features of IBM Watson for Price Prediction and Forecasting

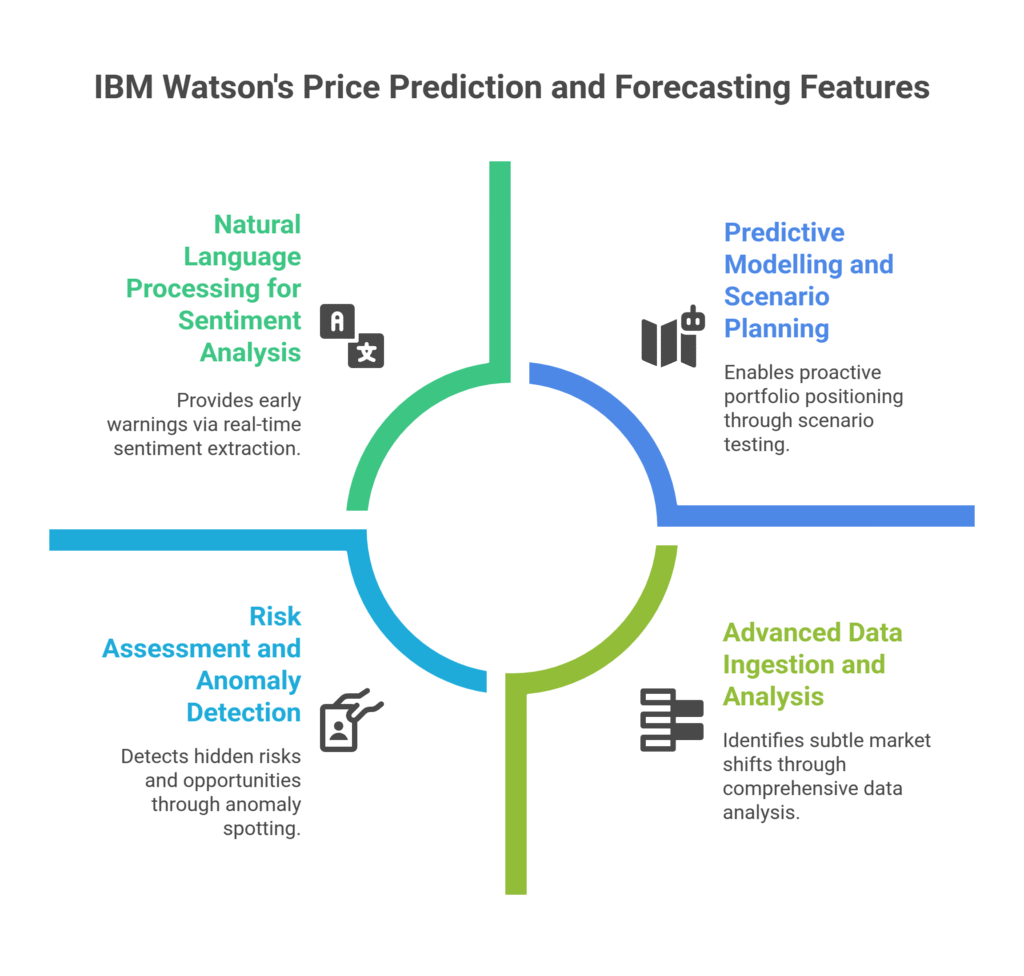

- Advanced Data Ingestion and Analysis: This is where IBM Watson starts to flex. It doesn’t just look at numbers. It sucks in everything: historical price data, economic indicators, corporate earnings reports, global news, social media sentiment, even central bank statements. Then, it uses its powerful machine learning algorithms to identify patterns that are invisible to the human eye. This means you’re getting insights from a much broader and deeper data set than anyone relying on traditional methods. It’s about catching subtle shifts that precede major market moves.

- Natural Language Processing (NLP) for Sentiment Analysis: Price movements aren’t just about hard numbers. They’re heavily influenced by sentiment. Think about how a sudden news announcement or a trending topic on social media can swing a stock. IBM Watson’s NLP capabilities are insane here. It can read and understand millions of news articles, tweets, and analyst reports in real-time. It then extracts sentiment – positive, negative, neutral – towards specific assets, industries, or even geopolitical events. This gives you an early warning system for sentiment shifts, which are often leading indicators for price changes. This is a game-changer for Price Prediction and Forecasting.

- Predictive Modelling and Scenario Planning: This isn’t just about telling you what happened. It’s about predicting what WILL happen. IBM Watson allows you to build sophisticated predictive models based on all the data it’s ingested and analysed. You can test different scenarios, adjusting variables like interest rates, oil prices, or political stability, and see how they might impact asset prices. This foresight helps you position your portfolio proactively, rather than reactively. It’s like having a crystal ball, but one powered by data and AI. This capability is key for robust price prediction and forecasting strategies.

- Risk Assessment and Anomaly Detection: In trading, managing risk is just as important as generating returns. IBM Watson is brilliant at spotting anomalies – unusual patterns or outliers in data that could indicate a hidden risk or an emerging opportunity. Maybe a correlation between two seemingly unrelated assets suddenly appears, or a trading volume spike isn’t matching news flow. Watson flags these deviations, allowing you to investigate and adjust your strategy before it’s too late. It’s an extra layer of protection, helping you avoid unexpected losses and capitalize on overlooked opportunities.

Benefits of Using IBM Watson for Finance and Trading

Alright, let’s talk brass tacks. Why should you even bother with IBM Watson for price prediction and forecasting?

It boils down to a few core advantages that directly impact your bottom line.

First, unparalleled speed and scale.

Try sifting through a decade of financial reports, every major news headline, and millions of social media posts by hand.

Impossible, right?

Watson does it in a fraction of the time.

This means you’re getting insights not in days or hours, but in minutes.

Imagine how much faster you can react to market shifts.

Next, superior accuracy and depth of insight.

Humans have biases. We miss things.

Watson doesn’t.

It processes objective data, finding correlations and patterns that are simply too complex for human cognition.

This leads to more precise price predictions.

It means fewer missed opportunities and fewer costly mistakes.

You’re operating with a clearer picture of the market.

Then there’s the reduction in human error and bias.

Emotional trading is a killer.

Fear, greed, FOMO – they cloud judgment.

Watson operates purely on data.

It removes the emotional rollercoaster from your decision-making.

This leads to more disciplined, systematic trading.

You’re making moves based on what the data says, not how you feel.

Another massive benefit is the ability to handle unstructured data.

Most financial analysis focuses on neat, tidy numbers.

But so much valuable information is buried in news articles, analyst reports, regulatory filings, and even social media chatter.

Watson’s NLP chops extract value from this “messy” data, giving you insights your competitors might be missing entirely.

Finally, improved risk management.

By identifying anomalies and potential risks early, Watson helps you protect your capital.

It’s like having an always-on guardian angel for your portfolio.

You’re not just aiming for bigger wins; you’re also mitigating bigger losses.

Ultimately, IBM Watson empowers you to make more confident, data-driven decisions in a world that thrives on uncertainty.

That’s the real win.

Pricing & Plans

Alright, let’s talk about the money part.

Is IBM Watson free? Short answer: no.

This isn’t some freemium app you download for fun.

IBM Watson is an enterprise-grade AI platform.

It’s built for serious businesses with serious data needs.

Think about it. The kind of computational power, data handling, and sophisticated algorithms required for something like precise price prediction and forecasting?

That’s not cheap to build, maintain, or scale.

IBM Watson’s pricing structure is typically consumption-based.

This means you pay for what you use.

It’s broken down by individual services.

For example, you might pay per API call for Natural Language Understanding, or per gigabyte of data processed by Watson Discovery.

They do offer a “Lite” plan for some services, which provides a limited free tier.

This is usually enough for developers to experiment, build proof-of-concepts, or for very small, non-intensive use cases.

But for full-scale price prediction and forecasting in a trading environment?

You’ll be looking at their standard or premium tiers.

These tiers typically offer higher usage limits, more advanced features, dedicated support, and better performance.

The exact cost can vary widely depending on the specific Watson services you integrate (e.g., Watson Discovery for data ingestion, Watson Machine Learning for model building, Watson Natural Language Understanding for sentiment analysis) and the volume of data you’re processing.

It’s not a one-size-fits-all subscription fee like Netflix.

Instead, you’d typically engage with IBM sales to get a tailored quote based on your specific use case, data volume, and required integrations.

Compared to alternatives?

Other enterprise AI platforms like Google Cloud AI or Amazon Web Services (AWS) AI/ML services also operate on a consumption model.

The core difference often comes down to the specific pre-trained models, ease of integration with other IBM products, and the level of industry-specific solutions available.

IBM Watson often shines in areas like deep industry expertise and ready-to-deploy solutions for sectors like finance.

So, while it’s not free, the investment reflects the power and potential ROI it brings to the table for serious financial operations.

Hands-On Experience / Use Cases

Alright, enough theory. Let’s talk about how this actually plays out.

Imagine you’re a quant analyst at a medium-sized hedge fund.

Your job? To find edges, predict market moves, and make money.

You’re looking at a specific commodity, say, crude oil.

Historically, you’ve used economic indicators, supply-demand reports, and geopolitical news.

Good stuff, but limited.

Now, you decide to integrate IBM Watson.

First step: Data Ingestion.

You feed Watson historical oil price data, yes.

But you also feed it millions of news articles from Reuters, Bloomberg, and local news outlets in oil-producing nations.

You throw in social media data from key geopolitical analysts, satellite imagery data on oil rig activity, and transcripts of OPEC meetings.

Stuff you’d never process manually.

Watson Discovery and Watson Natural Language Understanding start churning.

They extract entities, concepts, and sentiment.

They identify shifts in tone around specific countries, oil companies, or supply chain disruptions.

Next, Predictive Model Building.

Using Watson Machine Learning, you build a model that takes all these diverse data points – structured and unstructured – and correlates them with past oil price movements.

The AI starts to learn.

It identifies subtle leading indicators.

For example, a slight increase in negative sentiment from obscure news sources about a particular pipeline in Africa, combined with a dip in satellite-detected refinery activity, might predict a price increase before official reports even hit.

Then, Real-time Forecasting and Alerting.

Your model is live.

Watson continuously monitors the incoming data streams.

If it detects a pattern that historically led to a price movement, it triggers an alert.

Maybe it forecasts a 3% dip in crude oil within the next 48 hours due to a unique combination of sentiment, logistical bottlenecks, and an unexpected inventory build-up that no human analyst could have connected so quickly.

The usability of Watson, for someone with a data science or developer background, is robust.

It’s not a drag-and-drop tool for absolute beginners, but it’s designed to accelerate complex AI projects.

The APIs are well-documented.

The dashboards provide visualizations of the data flow and model performance.

The results?

Potentially, a significant edge.

You’re getting predictive signals that are more accurate, more timely, and based on a richer data tapestry than anything your competition is likely using.

This translates directly into more profitable trades and better risk management.

That’s the power of IBM Watson in action for price prediction and forecasting.

Who Should Use IBM Watson?

So, who exactly is IBM Watson for when it comes to price prediction and forecasting?

It’s not for everyone, let’s be clear.

If you’re a casual day trader or just dabbling with a small portfolio, this might be overkill.

But if you’re serious, if you’re looking for an institutional-grade advantage, then listen up.

First off, Hedge Funds and Investment Banks.

These are the big players. They have massive amounts of capital at stake and need every edge they can get.

Watson’s ability to process vast, complex, and unstructured data streams makes it perfect for their sophisticated quantitative strategies.

They use it for everything from high-frequency trading insights to long-term macroeconomic forecasting.

Next, Proprietary Trading Firms.

These firms trade with their own money, and their profitability depends directly on superior market intelligence.

Watson helps them identify fleeting opportunities and mitigate risks faster than humanly possible.

They can develop highly specialized models for specific asset classes.

Then, Financial Data and Analytics Providers.

Companies that sell market data, research, or analytical tools to others in the finance industry.

They can leverage Watson to enrich their own offerings, providing deeper insights or new data products to their clients.

Think of them building their own AI-powered tools on top of Watson.

Also, Corporate Treasury Departments.

Not just trading, but managing a company’s own cash, foreign exchange exposure, and commodity risk.

Accurate price prediction and forecasting here can save or make a company millions by optimizing hedging strategies and investment decisions.

Finally, Advanced Individual Traders and Quant Enthusiasts.

If you’re a highly skilled individual with a strong background in programming, data science, and a significant trading capital, you *could* leverage Watson.

It requires technical know-how to integrate and build your own models, but the potential upside for market outperformance is huge.

In essence, if your livelihood depends on making highly accurate, data-driven financial predictions at scale, and you have the technical resources to implement an enterprise-grade AI solution, then IBM Watson is absolutely worth considering.

How to Make Money Using IBM Watson

Alright, let’s talk about the real reason you’re here: how do you turn this powerful AI into actual profit?

IBM Watson isn’t a direct money-making machine in itself, but it’s a massive accelerator and enhancer for existing financial strategies.

It’s about leverage.

Here’s how people are doing it:

- Optimized Trading Strategies: This is the most direct route. By using Watson for precise price prediction and forecasting, you’re making more informed trades. This means higher win rates, better entry and exit points, and potentially larger position sizes due to increased confidence. Imagine an arbitrage opportunity that only Watson can spot due to its ability to process multiple data feeds simultaneously and identify tiny, fleeting discrepancies. Or predicting a commodity price swing minutes before the market reacts. That’s pure profit.

- Risk Mitigation as a Profit Driver: Losing less money is the same as making more money. Watson excels at anomaly detection and flagging potential risks – geopolitical instability affecting a currency, a sudden shift in corporate bond sentiment, or an impending supply chain disruption. By getting early warnings, you can adjust your positions, hedge more effectively, or avoid catastrophic losses. This preservation of capital is a massive profit contributor.

- Consulting and Advisory Services: If you’re a financial analyst or consultant, IBM Watson gives you an incredible edge. You can offer cutting-edge AI-powered insights to clients who don’t have the internal capabilities or resources. Think about providing bespoke market forecasts, sentiment analysis reports for specific industries, or even building custom predictive models for their investment portfolios. You become the expert with the advanced tools, commanding higher fees for superior advice.

Let me give you a quick, simplified example.

There’s this fictional firm, “AlphaGen Capital.”

They were struggling with predicting the highly volatile crypto market.

Their manual analysis and basic models were inconsistent.

They integrated IBM Watson.

They used Watson Discovery to ingest every relevant news article, social media post, and blockchain transaction data point they could find, in real-time.

Watson Natural Language Understanding analysed the sentiment of crypto influencers, developer activity on GitHub, and global regulatory news.

Watson Machine Learning then built a predictive model for Bitcoin price movements.

The result?

Within six months, AlphaGen Capital reported a 15% increase in their average monthly trading profits, directly attributing a significant portion to the enhanced accuracy of their price predictions and risk alerts from their Watson-powered system.

They weren’t just guessing anymore.

They were making moves based on data-driven foresight.

That’s how you make money with IBM Watson in finance and trading.

Limitations and Considerations

Look, nothing’s perfect.

While IBM Watson is a beast for price prediction and forecasting, it’s not a magic bullet.

There are some real-world considerations you need to be aware of before diving in.

First, data quality is paramount.

Garbage in, garbage out.

Watson is incredibly powerful at finding patterns in data, but if your source data is incomplete, inaccurate, or biased, your predictions will be too.

You still need robust data pipelines and cleansing processes.

Don’t expect Watson to fix bad data; it’ll just process it faster.

Next, the learning curve and implementation complexity.

This isn’t a plug-and-play tool for beginners.

You need data scientists, AI engineers, and financial domain experts to properly configure, train, and maintain Watson’s models for complex tasks like price prediction.

Integrating it with your existing trading systems and data sources takes significant technical expertise and resources.

It’s an enterprise-level commitment.

Then there’s the cost.

As discussed, it’s not cheap.

The consumption-based model means costs can scale rapidly with usage.

For smaller firms or individual traders, the upfront and ongoing investment might simply be too high to justify, unless the potential returns are truly massive.

Also, market irrationality and black swan events.

AI thrives on patterns.

But financial markets are sometimes driven by pure human emotion, geopolitical shocks, or unforeseen “black swan” events that have no historical precedent.

Watson can process news and sentiment, but it still relies on historical data to learn.

It might struggle to predict the unpredictable.

It’s a tool for probability, not certainty.

Finally, explainability and “black box” concerns.

Sometimes, complex AI models, especially deep learning ones, can be difficult to interpret.

They give you an answer, but understanding *why* they gave that answer can be challenging.

In finance, where regulatory compliance and accountability are crucial, this “black box” nature can be a hurdle.

IBM is working on explainable AI, but it’s an ongoing challenge across the industry.

So, while Watson offers incredible power, it requires significant investment in terms of data, technical talent, and budget.

It’s a strategic asset, not a simple software purchase.

Final Thoughts

Look, the game of finance and trading has changed.

It’s no longer just about who has the best instincts or the most experience.

It’s about who has the best information, processed the fastest, and turned into actionable insights.

That’s where IBM Watson steps in.

For price prediction and forecasting, it’s not just an improvement; it’s a paradigm shift.

It takes the overwhelming chaos of market data – structured, unstructured, qualitative, quantitative – and brings order to it.

It spots trends, sentiment shifts, and hidden correlations that are simply beyond human capacity.

Are there challenges? Absolutely.

It demands a commitment to data quality, a technical team to implement it, and a budget that reflects its enterprise-grade capabilities.

This isn’t for the faint of heart, or for those just dipping their toes in the water.

But for serious financial institutions, hedge funds, or even advanced individual traders who are ready to invest in an unfair advantage?

IBM Watson is a no-brainer.

It equips you to make more confident decisions.

It helps you identify opportunities others miss.

And crucially, it helps you mitigate risks before they blow up your portfolio.

If you’re still relying solely on manual analysis, you’re not just falling behind, you’re actively leaving money on the table.

The market isn’t waiting.

The future of finance is data-driven, and IBM Watson is a key driver of that future.

It’s time to stop chasing and start leading.

Visit the official IBM Watson website

Frequently Asked Questions

1. What is IBM Watson used for?

IBM Watson is a suite of AI services used to process and analyse large volumes of data, extract insights, automate processes, and enhance decision-making. In finance and trading, its primary use is for advanced price prediction and forecasting, risk management, and market sentiment analysis.

2. Is IBM Watson free?

No, IBM Watson is not free. It is an enterprise-grade AI platform with a consumption-based pricing model, meaning you pay for the specific services and volume of data you use. Some services may offer limited free “Lite” tiers for testing and development.

3. How does IBM Watson compare to other AI tools?

IBM Watson stands out with its robust Natural Language Processing (NLP) capabilities, deep industry-specific solutions (especially in finance and healthcare), and integration with other IBM enterprise products. While competitors like AWS AI/ML and Google Cloud AI offer similar core AI services, Watson often provides more pre-trained models and solutions for complex industry challenges, particularly for Price Prediction and Forecasting.

4. Can beginners use IBM Watson?

Using IBM Watson for complex tasks like price prediction and forecasting generally requires a strong background in data science, programming, and financial markets. It’s designed for enterprise applications and professional developers, rather than casual beginners seeking a simple plug-and-play solution.

5. Does the content created by IBM Watson meet quality and optimization standards?

IBM Watson doesn’t “create content” in the typical sense of writing articles. Instead, it generates data-driven insights, predictions, and analyses. The quality and optimization of these outputs are high, provided the input data is clean and the models are properly trained. Its strength lies in precision and identifying patterns for financial decisions.

6. Can I make money with IBM Watson?

Yes, you can make money using IBM Watson by leveraging its capabilities for enhanced price prediction and forecasting, leading to more profitable trading strategies and improved risk management. Financial professionals and firms can also offer AI-powered consulting and advisory services to clients, generating revenue from superior market insights derived from Watson.