Thomson Reuters ONESOURCE revolutionises Tax Calculations and Audit. Streamline complex processes, ensure compliance, and boost efficiency in legal and finance. Get started today!

Human vs Thomson Reuters ONESOURCE: Who Handles Tax Calculations and Audit Better?

You’re probably here because the old way of doing things in legal and finance is killing you. Spreadsheets, manual data entry, the endless chase for accuracy. It’s a mess. Especially when it comes to tax calculations and audit. It’s not just busy work; it’s a high-stakes game. One mistake, and you’re looking at penalties, reputational damage, and a whole lot of stress.

The question isn’t if things need to change. It’s how. And more specifically, can AI tools like Thomson Reuters ONESOURCE really make a difference? Or is it just another piece of software that promises the world but delivers an empty box?

I get it. The AI hype train is moving fast. But in the trenches of legal and finance, where precision is paramount, it’s not about hype. It’s about results. It’s about freeing up your most valuable asset: time. It’s about making sure your numbers are rock solid, every single time.

So, let’s cut through the noise. We’re going to break down Thomson Reuters ONESOURCE. Is it the real deal for your tax calculations and audit workflows? Can it actually beat human effort in this crucial area? Or will it just add another layer of complexity? Let’s find out.

Table of Contents

- What is Thomson Reuters ONESOURCE?

- Key Features of Thomson Reuters ONESOURCE for Tax Calculations and Audit

- Benefits of Using Thomson Reuters ONESOURCE for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Thomson Reuters ONESOURCE?

- How to Make Money Using Thomson Reuters ONESOURCE

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Thomson Reuters ONESOURCE?

Thomson Reuters ONESOURCE isn’t just a piece of software. It’s an integrated suite of tax technology solutions. Think of it as your digital command centre for everything related to corporate tax. It’s built for large corporations, multinational enterprises, and the big players in accounting firms. Their goal is simple: automate, standardise, and streamline complex tax and accounting processes. This includes everything from direct and indirect tax compliance to transfer pricing and tax provision.

At its core, ONESOURCE tackles the monstrous complexity of global tax laws. It provides tools that help with everything from gathering financial data to filing returns. It’s about reducing manual effort and boosting accuracy. For anyone involved in tax calculations and audit, this is huge. It takes away the mind-numbing repetition and replaces it with structured, automated workflows. This means less time wasted and more time for strategic work.

The target audience here isn’t individual taxpayers. We’re talking about corporate tax departments, CFOs, tax directors, and professionals in large accounting firms. These are the people drowning in data, facing tight deadlines, and needing to ensure compliance across multiple jurisdictions. ONESOURCE aims to be the lifesaver in that storm. It centralises data, automates calculations, and helps with audit defence. This isn’t just about cutting costs; it’s about managing risk and making better, faster decisions. It’s built to handle the scale and complexity that human effort alone can’t reasonably manage anymore.

This tool acts as a single source of truth for all tax-related information. It integrates with existing ERP systems, which means data flows seamlessly. No more manual exports and imports. No more version control nightmares. This integration is crucial because it ensures data consistency across the organisation. It also reduces the chances of errors that arise from disparate data sources. So, if you’re looking to bring order to your tax chaos, ONESOURCE presents a compelling case.

It’s designed to manage the full tax lifecycle. From planning and compliance to reporting and audit management. This comprehensive approach is what sets it apart. It’s not a point solution; it’s an end-to-end system. This means fewer disparate systems to manage and a more cohesive workflow. It’s about bringing clarity to what can often be a very murky area of finance.

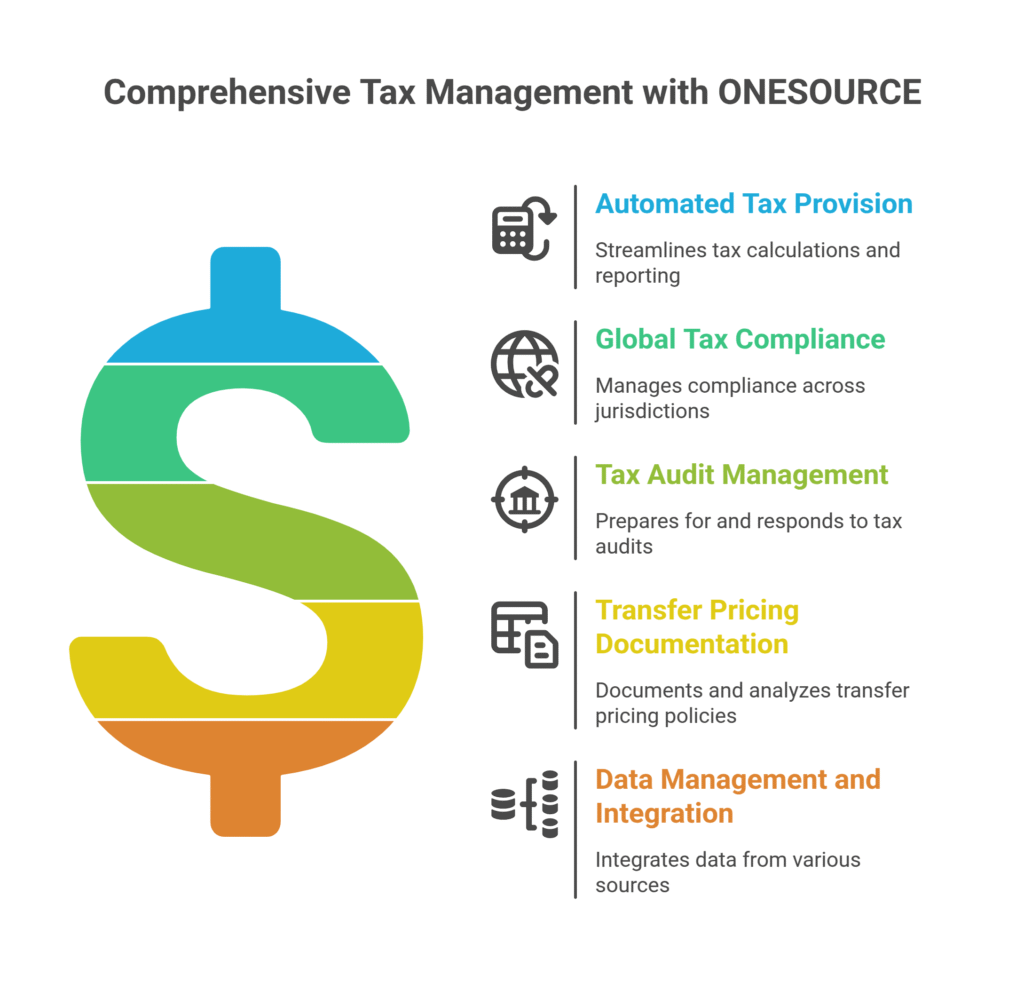

Key Features of Thomson Reuters ONESOURCE for Tax Calculations and Audit

- Automated Tax Provision: This is a game-changer. ONESOURCE automates the complex process of calculating current and deferred tax provisions. Think about all the manual adjustments, the reconciliations, the endless spreadsheets. ONESOURCE pulls data from your financial systems, applies relevant tax rules, and generates the necessary reports. This cuts down on the time spent by weeks, not just days. It ensures accuracy and consistency in your financial reporting. No more last-minute scrambles to close the books. It means your tax department can operate with greater predictability and confidence. This feature significantly reduces the risk of errors in your financial statements.

- Global Tax Compliance and Reporting: Navigating global tax laws is a minefield. Different countries, different rules, different filing deadlines. ONESOURCE provides a centralised platform for managing tax compliance across multiple jurisdictions. It includes updated tax content for various countries, helping you stay compliant with changing regulations. This isn’t just about filing forms; it’s about accurate calculations for VAT, GST, corporate income tax, and more. It ensures that your international operations are compliant and that you avoid penalties. This centralisation makes cross-border tax management manageable.

- Tax Audit Management and Defence: Audits are stressful. They demand precise data and quick responses. ONESOURCE helps you prepare for and respond to tax audits effectively. It stores all your tax data, calculations, and supporting documentation in one place. This means when an auditor comes knocking, you’re ready. You can easily retrieve historical data, demonstrate your methodologies, and defend your positions. This feature reduces audit risk and helps resolve disputes faster. It transforms audit preparation from a reactive nightmare into a proactive process. Having everything organised and accessible is half the battle won during an audit.

- Transfer Pricing Documentation and Analysis: For multinational companies, transfer pricing is a major headache. Ensuring arm’s length transactions between related entities is critical but incredibly complex. ONESOURCE provides tools for documenting transfer pricing policies, conducting comparability analyses, and generating required reports. This ensures compliance with global transfer pricing regulations and helps mitigate audit exposure. It takes the guesswork out of intercompany transactions and provides a clear audit trail. This capability is essential for managing international tax liabilities and staying out of trouble with tax authorities worldwide.

- Data Management and Integration: The quality of your tax calculations depends entirely on the quality of your data. ONESOURCE excels here. It integrates with various ERP systems (SAP, Oracle, etc.) and other financial data sources. This means a seamless flow of data into the tax system, reducing manual data entry and improving data accuracy. It creates a single source of truth for all tax-related information. This centralised data management means less time spent reconciling discrepancies and more time focused on analysis. It provides the foundation for accurate and reliable tax outputs, which is non-negotiable in this field.

Benefits of Using Thomson Reuters ONESOURCE for Legal and Finance

Look, the benefits boil down to one thing: getting more done, better, with less pain. For professionals in legal and finance, especially those neck-deep in tax calculations and audit, ONESOURCE isn’t just a nice-to-have. It’s a competitive advantage. Think about all those hours you currently pour into mundane, repetitive tasks. Hours that could be spent on strategic planning, risk assessment, or even just getting home on time. That’s the first major win.

Time Savings: This is huge. Imagine cutting down the time spent on tax provision by 30%, 40%, even 50%. What would you do with that extra time? Instead of manually entering data, reconciling spreadsheets, and chasing down numbers, ONESOURCE automates it. This means your team can focus on higher-value activities. It frees up resources that can be redeployed to more complex advisory work or compliance initiatives. It’s not just about saving minutes; it’s about saving entire workdays across the quarter. This directly translates to increased productivity without needing to hire more staff.

Improved Accuracy and Reduced Risk: Manual processes are prone to human error. It’s just a fact. One wrong cell reference in a spreadsheet, and your entire tax calculation could be off. With ONESOURCE, the calculations are automated and based on pre-programmed tax rules and algorithms. This drastically reduces the likelihood of errors. More importantly, it helps ensure compliance with ever-changing tax regulations worldwide. Better accuracy means fewer audit flags, fewer penalties, and greater peace of mind. It’s about building confidence in your numbers, which is invaluable when dealing with tax authorities.

Enhanced Visibility and Control: How much visibility do you currently have into your global tax position? If it’s not real-time, it’s not enough. ONESOURCE provides a consolidated view of all your tax data across different entities and jurisdictions. This centralisation gives you unprecedented control over your tax function. You can track progress, identify bottlenecks, and monitor compliance status from a single dashboard. This enhanced visibility empowers you to make proactive decisions, rather than reactive ones. It’s about being in the driver’s seat, not just along for the ride.

Scalability and Adaptability: Your business isn’t static. It grows, it expands into new markets, and regulations change. Your tax solution needs to keep pace. ONESOURCE is designed to be scalable, meaning it can handle increasing volumes of data and complexity as your business evolves. It’s also regularly updated with the latest tax law changes, ensuring your compliance framework remains robust. This adaptability future-proofs your tax operations. It means you won’t outgrow your system, and you’ll always be prepared for whatever regulatory shifts come next. It’s an investment that pays dividends as your business expands.

Strategic Insights and Better Decision-Making: When you’re not drowning in manual tasks, you have the bandwidth for analysis. ONESOURCE provides robust reporting and analytics capabilities. You can generate detailed reports, identify trends, and model different tax scenarios. This data-driven approach empowers you to make more informed strategic decisions. It’s about moving beyond just compliance to tax planning and optimisation. You can identify opportunities for tax savings, assess the impact of business decisions on your tax position, and contribute more strategically to the business. This transforms the tax department from a cost centre into a value-added partner.

Pricing & Plans

Alright, let’s talk money. With Thomson Reuters ONESOURCE, you’re not looking at a “free plan” like you might find with some small SaaS tools. This isn’t a free trial for a basic content generator. This is enterprise-level software, built for serious corporate tax operations. They don’t typically publish their pricing on their website. Why? Because the cost is highly variable. It depends on a lot of factors. Think about the size of your organisation, the specific modules you need, the complexity of your tax structures, and the number of users.

You’ll need to contact Thomson Reuters directly for a customised quote. They will assess your specific needs, your current setup, and what you’re trying to achieve. Then, they’ll put together a package. This isn’t a one-size-fits-all solution; it’s tailored. This means the investment can range from tens of thousands to hundreds of thousands of pounds annually, or even more, for massive multinational corporations. It’s a significant financial commitment, but it’s positioned as a strategic investment to mitigate risk, improve efficiency, and ensure compliance on a grand scale.

When you compare it to alternatives, you’re often looking at other enterprise resource planning (ERP) modules or specialised tax software providers. These include solutions from SAP, Oracle, or other dedicated tax technology firms. The key differentiators for ONESOURCE often come down to the breadth of its global tax content, its deep integration capabilities, and its comprehensive suite of modules that cover the entire tax lifecycle. While some ERP systems have tax functionalities, they often lack the depth and specialisation that ONESOURCE offers for complex corporate tax. This is where ONESOURCE shines. It’s built specifically for tax, by tax experts.

So, is it “worth it”? For a small business, absolutely not. It would be massive overkill and an unnecessary expense. But for large corporations, especially those with international operations and complex tax requirements, the cost of ONESOURCE is weighed against the potential cost of non-compliance, audit penalties, and the immense inefficiency of manual processes. The return on investment often comes from reduced risk, significant time savings, and the ability to redeploy highly paid tax professionals to more strategic tasks. It’s about preventing huge losses and optimising a critical business function. It’s a big investment, but it’s designed to solve big problems.

Hands-On Experience / Use Cases

Let’s talk about what actually happens when you put Thomson Reuters ONESOURCE into action. This isn’t just theoretical. Imagine a multi-national conglomerate, “Global Corp,” operating in 30 countries. Their tax team of 50 people used to dread quarter-end and year-end close. Tax provision was a six-week nightmare of spreadsheets, email chains, and frantic phone calls. Different entities used different systems, leading to data inconsistencies and endless reconciliation work. Audit season? Pure chaos. They knew they needed a better way to handle their tax calculations and audit procedures.

Use Case 1: Streamlining Global Tax Provision

Global Corp implemented the ONESOURCE Tax Provision module. The first major win was data integration. ONESOURCE connected directly to their various ERP systems (SAP in Europe, Oracle in North America, a custom system in Asia). This eliminated manual data extraction and upload. Instead of six weeks of data collection and reconciliation, the raw data flowed in seamlessly. The system then automatically applied the relevant tax rates and rules for each jurisdiction, calculating current and deferred taxes. Adjustments were made directly within the system, with a clear audit trail for every change.

The result? What used to take six weeks was compressed into two-and-a-half. Accuracy improved dramatically because human error from manual entry was almost eliminated. The tax team could now spend their time reviewing the provision for strategic implications, rather than wrestling with data integrity. This meant they could provide more timely and accurate forecasts to leadership, aiding in better financial planning.

Use Case 2: Mastering International Compliance

Global Corp also struggled with ensuring compliance across all 30 countries. Keeping up with changes in VAT, GST, and corporate income tax laws was a full-time job for several people. They often relied on external consultants for country-specific advice, which was costly and slow. With ONESOURCE Global Tax Compliance, they now had a centralised database of tax content. The system flagged upcoming deadlines and automatically generated country-specific forms and reports based on the integrated financial data.

For example, when a new VAT rule came into effect in Germany, ONESOURCE updated its logic, and the relevant forms were automatically adjusted. This meant Global Corp was always up-to-date and could file returns correctly and on time, significantly reducing the risk of penalties. The compliance burden shifted from manual tracking and external advice to system-driven automation and internal verification. This saved considerable consultant fees and internal staff time.

Use Case 3: Fortifying Audit Defence

When the tax authorities came knocking for an audit on Global Corp’s transfer pricing, it used to be a frantic scramble. Documents were scattered, calculations were on old spreadsheets, and explaining methodologies was a challenge. With ONESOURCE, all transfer pricing documentation, comparability analyses, and intercompany transaction data were stored centrally. During the audit, the team could instantly pull up any calculation, any supporting document, and demonstrate the arm’s length principle they applied.

This level of organisation and transparency meant the audit was smoother, shorter, and less contentious. Global Corp could respond to inquiries quickly and confidently. They avoided costly disputes and penalties because they had a clear, defensible position backed by robust data and documentation. The usability of ONESOURCE in this scenario was paramount; it allowed them to present a clear, unified front to auditors, making the process less adversarial and more collaborative. This direct access to historical, validated data is incredibly powerful during an audit.

Who Should Use Thomson Reuters ONESOURCE?

Let’s be clear: Thomson Reuters ONESOURCE isn’t for everyone. If you’re a freelance accountant handling local small businesses, this isn’t your tool. It would be like using a supercomputer to balance your chequebook. This beast is built for scale and complexity. So, who should actually be looking at ONESOURCE?

Large Corporations and Multinational Enterprises: If your company operates in multiple countries, deals with complex intercompany transactions, and has substantial revenue, ONESOURCE is designed for you. Managing global tax compliance, transfer pricing, and consolidating tax data across diverse jurisdictions is a monumental task. ONESOURCE provides the infrastructure to handle this efficiently, reducing risk and ensuring compliance on a global scale. It’s for businesses where tax is a significant operational and strategic concern.

Corporate Tax Departments: This is the primary user base. If you’re a tax director, VP of Tax, or part of a corporate tax team responsible for provision, compliance, and planning, ONESOURCE is a direct fit. It automates much of the grunt work, freeing up your skilled professionals to focus on analysis, strategy, and risk management. It gives them the tools to respond faster to regulatory changes and auditor inquiries.

Large Accounting Firms and Consulting Practices: Firms that provide tax services to large corporate clients will find ONESOURCE invaluable. It allows them to manage the tax affairs of multiple complex clients efficiently. They can leverage the same robust platform that their clients use, or offer advanced services based on the ONESOURCE capabilities. This improves service delivery, ensures consistency, and allows them to take on more complex engagements.

CFOs and Finance Leaders: While not direct users of the day-to-day functions, CFOs benefit immensely from the improved accuracy, reduced risk, and enhanced visibility ONESOURCE provides. It helps them ensure financial statement accuracy, manage cash flow more effectively, and make better strategic decisions based on reliable tax data. For any finance leader looking to optimise their tax function and mitigate financial risks, ONESOURCE is a key consideration.

Compliance and Risk Officers: In today’s regulatory environment, compliance is paramount. ONESOURCE helps these officers ensure that the company adheres to all tax laws and regulations across all operational jurisdictions. It provides the audit trails and documentation necessary to demonstrate compliance and defend against potential challenges. For anyone responsible for enterprise-wide risk management, the robust compliance features are a huge asset.

Essentially, if your tax challenges extend beyond simple domestic compliance, if you’re drowning in data, or if the consequences of a tax misstep are financially significant, then Thomson Reuters ONESOURCE is a solution worth exploring. It’s an investment in sophisticated automation and risk reduction for high-stakes environments.

How to Make Money Using Thomson Reuters ONESOURCE

Okay, you’ve got this powerful tool, Thomson Reuters ONESOURCE. How do you turn that into cold, hard cash? This isn’t about just saving money; it’s about creating new revenue streams or significantly boosting your existing profitability. For legal and finance professionals, especially those consulting or running their own firms, ONESOURCE can be a game-changer for revenue generation. It empowers you to offer premium services, handle more clients, and command higher fees because you deliver superior results. It’s about leveraging technology to scale your expertise.

- Service 1: Specialised Tax Compliance and Advisory for Multinationals: This is your bread and butter. Many mid-sized and even larger companies struggle with global tax compliance. They might have grown internationally but haven’t scaled their internal tax department. With ONESOURCE, you can offer them comprehensive tax compliance services. This includes preparing and filing corporate income tax returns, VAT/GST returns, and managing transfer pricing documentation for multiple jurisdictions. You become their outsourced global tax department, using ONESOURCE’s efficiency to handle the complexity. You charge premium fees for this specialist knowledge and the efficiency you bring. The value proposition is clear: you reduce their risk and free up their internal resources. This service alone can bring in substantial recurring revenue.

- Service 2: Tax Audit Defence and Support: Audits are terrifying for companies. They lack the internal expertise or the organised data to effectively respond to tax authorities. This is where you step in, armed with ONESOURCE. Because the tool keeps meticulous records, audit trails, and consistent data, you can offer a premium service helping clients prepare for, manage, and defend against tax audits. You can charge for your time in organising their data, generating reports from ONESOURCE, and assisting with direct communications with auditors. Your ability to quickly retrieve accurate historical data and present a coherent, defensible position makes you invaluable. Companies are willing to pay significant fees to avoid penalties and protracted disputes. This is a high-value, project-based service with excellent margins.

- Service 3: Tax Technology Implementation and Optimisation Consulting: Many companies own ONESOURCE but aren’t fully leveraging its capabilities. Or they are considering implementing it and need expert guidance. If you become proficient with ONESOURCE, you can offer consulting services on its implementation, customisation, and ongoing optimisation. This involves helping clients integrate ONESOURCE with their ERP systems, configure specific modules, train their internal teams, and establish best practices for using the platform. This isn’t just about technical setup; it’s about re-engineering their entire tax process to maximise efficiency and compliance. You charge for your expertise in system implementation and process improvement. This is a consulting service with high hourly rates, and it positions you as a leading authority in tax technology.

Case Study Example: How “TaxGenius Consultants” Doubled Revenue with ONESOURCE

TaxGenius Consultants, a boutique firm specialising in corporate tax, saw their revenue plateau. They were limited by how many clients their small team could handle manually. After investing in Thomson Reuters ONESOURCE, they pivoted. They started offering “Global Tax Command Centre” packages, leveraging ONESOURCE for automated provision, compliance, and transfer pricing. Their first new client was a rapidly expanding tech firm with operations in 10 countries. TaxGenius used ONESOURCE to centralise all their tax data, automate their quarterly provisions, and manage all international filings.

The tech firm saw a 40% reduction in time spent on compliance and audit preparation within the first year. TaxGenius, by delivering such clear, quantifiable value through ONESOURCE, was able to secure a long-term, high-value contract. This success story led to more referrals. Within 18 months, TaxGenius Consultants doubled their annual revenue from £500,000 to over £1 million, without significantly increasing their team size. They could take on more complex clients and charge higher fees because their efficiency, powered by ONESOURCE, was unmatched.

Limitations and Considerations

Look, no tool is perfect. And Thomson Reuters ONESOURCE, while powerful, has its own set of considerations. Knowing these upfront is crucial before you dive in. It’s about setting realistic expectations and understanding where the tool excels and where it might present challenges. This isn’t a magic wand; it’s a sophisticated piece of machinery that requires thoughtful operation.

High Implementation Cost and Time: This isn’t a plug-and-play solution you download and start using in an hour. Implementing ONESOURCE requires a significant upfront investment in terms of both capital and time. There’s the cost of the software itself, plus potential costs for customisation, integration with existing ERP systems, data migration, and training. The implementation process can take months, depending on the size and complexity of your organisation. It requires dedicated resources, a clear project plan, and commitment from leadership. Don’t underestimate this phase; it’s critical for success.

Complexity and Learning Curve: ONESOURCE is designed for complex tax scenarios. As such, it’s a sophisticated system with numerous features and modules. This means there’s a considerable learning curve for users. Your tax professionals will need comprehensive training to fully leverage the system’s capabilities. While the automation simplifies workflows, understanding how to configure the system, troubleshoot issues, and interpret its outputs requires a deep understanding of both tax law and the software itself. It’s not intuitive for beginners, and proper training is non-negotiable.

Dependence on Data Quality: “Garbage in, garbage out” applies absolutely here. While ONESOURCE excels at processing and automating, it relies entirely on the quality of the data fed into it. If your source data from ERP systems is messy, inconsistent, or incomplete, ONESOURCE will reflect those inaccuracies. It won’t magically fix bad data. Organisations need robust data governance processes in place to ensure clean and accurate information flows into ONESOURCE. This is a prerequisite for getting reliable results and avoiding headaches during tax calculations and audits.

Customisation Challenges: While ONESOURCE is highly configurable, extensive customisation can lead to its own set of problems. Too much customisation can make upgrades more difficult, increase maintenance costs, and potentially introduce unforeseen errors. While tailoring the system to your specific needs is important, striking the right balance between customisation and leveraging out-of-the-box functionality is key. It’s about adapting your processes to the tool where it makes sense, rather than forcing the tool to bend to every legacy process.

Vendor Lock-in and Support: Once you’re deeply integrated with a system like ONESOURCE, switching to an alternative can be a massive undertaking. This creates a degree of vendor lock-in. It’s important to assess Thomson Reuters’ ongoing support, update policies, and responsiveness. While they are a reputable vendor, relying on a single major platform means you’re tied to their ecosystem. Ensure their service level agreements (SLAs) align with your business critical needs and that their support system is robust enough to handle any issues that arise.

These aren’t necessarily deal-breakers, but they are important considerations that need to be factored into any decision to implement ONESOURCE. It’s a powerful tool, but like any powerful tool, it demands careful planning and execution.

Final Thoughts

So, where does this leave us with Thomson Reuters ONESOURCE for your tax calculations and audit needs? The answer is clear: for large enterprises and sophisticated accounting firms, ONESOURCE isn’t just an option; it’s rapidly becoming a necessity. The manual way of handling global tax is simply unsustainable. It’s too slow, too prone to error, and frankly, too risky.

Human vs. ONESOURCE? It’s not a competition. It’s a partnership. Humans provide the strategic insight, the critical thinking, the complex problem-solving. ONESOURCE provides the automation, the accuracy, the vast data processing power that no human team, no matter how skilled, could replicate at scale. It allows your best people to do their best work, rather than getting bogged down in repetitive data entry and reconciliation.

The value proposition is compelling: reduced risk of non-compliance, significant time savings in tax provision and compliance cycles, enhanced visibility into your global tax position, and the ability to defend your tax positions with robust, auditable data. These aren’t minor improvements; these are fundamental shifts that impact your bottom line and your ability to operate globally without constant anxiety over tax issues.

While the investment is substantial and the implementation requires commitment, the long-term benefits far outweigh the initial hurdles for organisations that genuinely need this level of sophistication. It’s about moving from reactive crisis management to proactive strategic planning in your tax department.

My recommendation? If your organisation fits the profile—complex tax structures, multi-jurisdictional operations, high volume of transactions—then you need to seriously evaluate Thomson Reuters ONESOURCE. Don’t just look at the price tag. Look at the cost of doing nothing, the cost of errors, the cost of inefficiency, and the cost of missed strategic opportunities. The numbers will likely speak for themselves.

Your next step? Don’t guess. Reach out to Thomson Reuters. Get a demo. Discuss your specific challenges. Get a tailored quote. See how this tool can transform your tax operations from a cost centre to a strategic advantage. It’s time to stop fighting fires and start building a compliant, efficient, and future-ready tax function.

Visit the official Thomson Reuters ONESOURCE website

Frequently Asked Questions

1. What is Thomson Reuters ONESOURCE used for?

Thomson Reuters ONESOURCE is primarily used by large corporations and accounting firms to automate and manage complex corporate tax processes. This includes tax provision, global compliance, transfer pricing, and audit management. It helps ensure accuracy, reduce risk, and improve efficiency in all aspects of corporate tax.

2. Is Thomson Reuters ONESOURCE free?

No, Thomson Reuters ONESOURCE is not free. It is an enterprise-level software solution with a significant investment. Pricing is customised based on the specific modules needed, the size and complexity of the organisation, and the number of users. You need to contact Thomson Reuters directly for a detailed quote.

3. How does Thomson Reuters ONESOURCE compare to other AI tools?

Thomson Reuters ONESOURCE is a specialised AI-powered tax technology solution. It compares with other enterprise tax software providers and financial modules within ERP systems (like SAP or Oracle). Its key differentiator is its deep focus on end-to-end corporate tax, extensive global tax content, and robust integration capabilities, offering more specialisation than general ERP tax functionalities.

4. Can beginners use Thomson Reuters ONESOURCE?

Thomson Reuters ONESOURCE is designed for experienced tax professionals in complex corporate environments. While it automates many tasks, it has a significant learning curve due to its sophistication and the complexity of the tax regulations it handles. Proper training is essential for new users to maximise its benefits.

5. Does the content created by Thomson Reuters ONESOURCE meet quality and optimization standards?

Thomson Reuters ONESOURCE doesn’t “create content” in the typical sense of generating articles or marketing copy. Instead, it generates highly accurate and compliant tax calculations, reports, and documentation. These outputs meet stringent quality and regulatory standards required for tax filings and audit defence. Its “optimization” comes from streamlining processes and reducing human error.

6. Can I make money with Thomson Reuters ONESOURCE?

Yes, if you’re a tax professional or a consulting firm, you can absolutely make money using Thomson Reuters ONESOURCE. You can offer specialised services like outsourced global tax compliance, expert tax audit defence and support, or even consulting on ONESOURCE implementation and optimisation for other companies. Its efficiency allows you to serve more clients and charge premium rates.