Signifyd empowers businesses with superior Fraud Detection, protecting revenue and boosting efficiency. Get instant clarity on risky transactions and confidently grow your business. See how Signifyd can transform your security strategy!

Human vs Signifyd: Who Handles Fraud Detection Better?

Alright, let’s talk brass tacks. You’re in security and moderation. You’re dealing with threats, with bad actors, with people trying to game the system. Specifically, you’re knee-deep in fraud detection. It’s a battle, right? Constant vigilance, ever-evolving tactics from the fraudsters.

The old way? It was slow. It was manual. It was a drain on resources. You were probably throwing bodies at the problem, hoping for the best. And still, fraud was slipping through. Chargebacks were eating into profits.

But here’s the kicker: the game changed. AI isn’t just a buzzword anymore. It’s a tool. A powerful one. And it’s reshaping how we approach security and moderation, especially when it comes to stopping fraud dead in its tracks.

We’re talking about AI tools built to handle what humans simply can’t at scale. One of those tools, making serious waves, is Signifyd. It promises to cut through the noise, give you answers, and protect your bottom line.

So, is it hype? Or is Signifyd the real deal, ready to take your fraud detection to levels you didn’t think possible? Let’s break it down.

Table of Contents

- What is Signifyd?

- Key Features of Signifyd for Fraud Detection

- Benefits of Using Signifyd for Security and Moderation

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Signifyd?

- How to Make Money Using Signifyd

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Signifyd?

Signifyd isn’t just another tech gadget. It’s an AI-powered fraud protection platform. Think of it as your elite, always-on fraud analyst team, but operating at lightning speed and scale. Its core function is to provide real-time fraud decisions for e-commerce transactions.

It was built from the ground up to solve a massive problem for online businesses: how to approve legitimate orders instantly while blocking fraudulent ones. And here’s the kicker: they back their decisions with a financial guarantee. If they approve an order and it turns out to be fraudulent, they cover the cost. That’s putting their money where their mouth is.

The target audience? Anyone running an online business. From burgeoning startups to enterprise-level giants. If you’re processing online payments, you’re a target for fraudsters. And Signifyd is designed to be your shield. They take on the risk, allowing businesses to focus on growth, not chargebacks.

Their technology leverages vast amounts of data, machine learning, and human intelligence to accurately assess the risk of every transaction. It’s about more than just flagging suspicious payments. It’s about boosting approval rates for good customers. That means more sales, less friction, and a better customer experience. They’re not just stopping fraud; they’re optimising revenue.

For anyone in security and moderation, this means a massive reduction in manual reviews. It frees up your team to focus on higher-value tasks, on more complex threats, or on improving other aspects of your security posture. It means fewer false positives, which translates to fewer disappointed legitimate customers. It’s a win-win: stop the bad guys, keep the good guys happy.

Key Features of Signifyd for Fraud Detection

- Guaranteed Fraud Protection: This isn’t just a promise; it’s a financial guarantee. Signifyd takes on the liability for fraudulent chargebacks on approved orders. If an order they approve turns out to be fraudulent, they reimburse you. This fundamentally shifts the risk away from your business. It means you can approve more orders with confidence, knowing your bottom line is protected. No more sleepless nights worrying about fraudulent transactions hitting your books. This is a game-changer for revenue protection.

- Advanced Machine Learning and AI: Signifyd’s backbone is its powerful AI and machine learning algorithms. It doesn’t rely on simple rules or static blacklists. Instead, it continuously learns from billions of data points across its global network. This allows it to identify complex fraud patterns that human eyes or traditional systems would miss. It analyses everything from device fingerprints and behavioural analytics to transaction history and geolocation. This predictive power means it can spot evolving fraud tactics in real-time. It provides accurate, instant decisions, drastically reducing false positives and maximising legitimate sales.

- Chargeback Management and Recovery: Fraud isn’t just about stopping a transaction before it ships. It’s also about what happens if a chargeback does occur. Signifyd doesn’t just guarantee against fraud; they also handle the chargeback dispute process for you. If a chargeback happens on a guaranteed order, they manage the entire dispute with the card networks. This saves your team countless hours and resources. It means you’re not just protected from the financial loss, but also from the administrative burden of fighting chargebacks. This streamlines your operations and ensures you reclaim revenue that might otherwise be lost.

Benefits of Using Signifyd for Security and Moderation

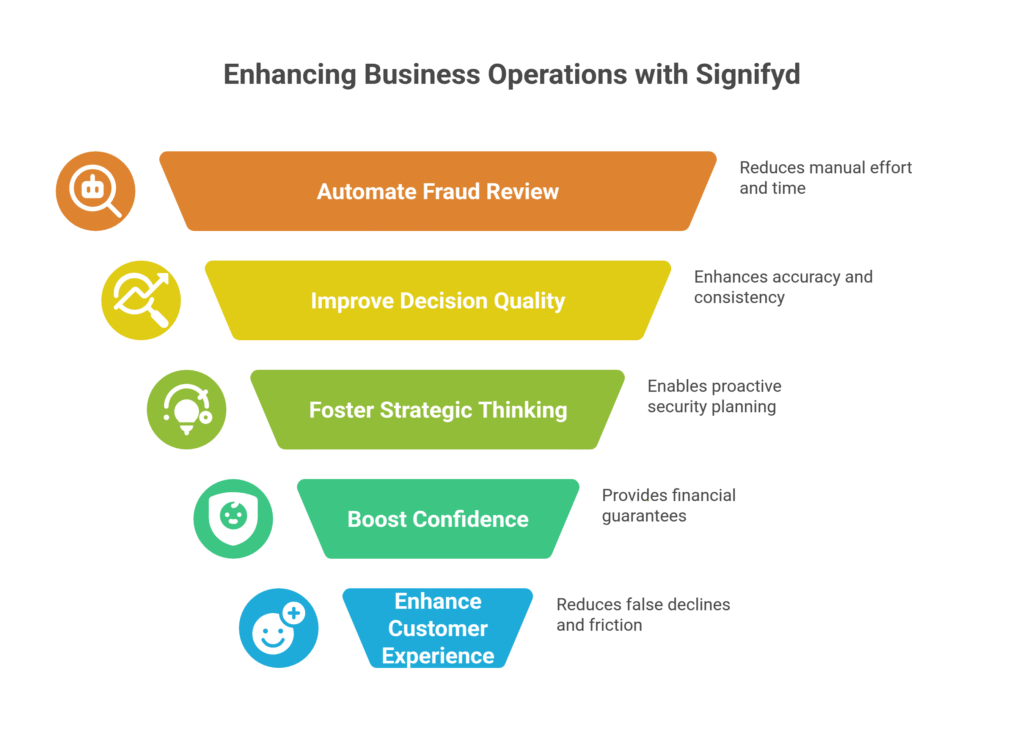

Look, your time is your most valuable asset. Manually reviewing transactions, chasing down suspicious orders, fighting chargebacks – it’s a time sink. Signifyd cuts through that. It automates the bulk of your fraud review process. This isn’t just about saving minutes; it’s about freeing up hours, days, even weeks of your team’s bandwidth. Imagine what else your security and moderation team could be doing if they weren’t bogged down in manual fraud checks. They could be focusing on proactive threat intelligence, enhancing other security protocols, or improving customer experience.

Quality improvement? Absolutely. Humans make mistakes. They get tired. They can be overwhelmed by data. Signifyd’s AI, on the other hand, operates with relentless consistency and precision. It analyses every transaction through a global lens of billions of data points. This means fewer errors, fewer legitimate orders declined, and significantly fewer fraudulent orders slipping through. The quality of your fraud decisions skyrockets. This leads directly to higher approval rates for good customers and a dramatic reduction in chargebacks, boosting your revenue.

Creative blocks in security? It sounds odd, but they exist. The constant pressure of preventing fraud can stifle innovation. When you’re spending all your energy putting out fires, you can’t think about building better fire prevention systems. Signifyd takes that heavy lifting off your plate. It lets your team move beyond reactive measures. They can start thinking strategically. They can brainstorm new ways to protect your assets, improve user trust, and scale your operations securely. It empowers a shift from firefighting to strategic security planning.

Beyond efficiency and accuracy, there’s the confidence factor. Running an online business, especially in areas prone to fraud, can be stressful. Every transaction feels like a gamble. Signifyd’s financial guarantee changes that equation entirely. You gain the confidence to approve more orders, knowing that if fraud does occur on an approved transaction, you’re not out of pocket. This confidence allows businesses to grow aggressively, expand into new markets, and test new products without the fear of being crippled by fraud. It’s about making bold business decisions without the inherent risk.

Finally, it’s about reducing friction for your legitimate customers. Nothing kills a sale faster than a false decline. When your fraud system flags a good customer as fraudulent, they get frustrated and often take their business elsewhere. Signifyd’s precision minimizes these false positives. It ensures that good customers have a smooth, frictionless checkout experience. This not only boosts immediate sales but also builds long-term customer loyalty and positive brand perception. It’s not just about fraud prevention; it’s about customer satisfaction.

Pricing & Plans

Alright, let’s talk money. Is Signifyd free? Short answer: no. This isn’t a freemium tool you tinker with. This is an enterprise-grade solution built to protect serious revenue. Think of it less as a monthly subscription and more as an insurance policy that pays for itself.

Their pricing model isn’t typically laid out on a public page with tiered plans like “Basic,” “Pro,” “Enterprise.” Instead, it’s generally based on a percentage of transactions they review, or a flat fee per decision, often combined with the value of the chargeback guarantee. It’s performance-based. They only make money if you do.

What does the premium version include? Essentially, all of it. You get the full suite: the AI-powered real-time fraud decisions, the financial guarantee that covers chargebacks on approved orders, and their expert chargeback management team fighting disputes on your behalf. There’s no “lite” version of fraud protection when you’re dealing with real money.

How does it compare with alternatives? Well, most alternatives fall into a few camps. You have traditional fraud detection systems that rely on rules engines. These often require significant manual intervention and come with high false positive rates. They don’t offer the financial guarantee that Signifyd does. You’re still on the hook for the fraud.

Then you have in-house teams. Building your own fraud prevention department is incredibly expensive. You need data scientists, analysts, developers. The infrastructure costs are immense. And even then, it’s hard to match the scale and breadth of data that Signifyd processes globally.

Signifyd’s unique selling proposition is that guarantee. It shifts the risk. This isn’t just about software; it’s about a service that takes on your biggest fraud headaches. For businesses losing significant revenue to chargebacks, the return on investment (ROI) can be substantial. It’s often cheaper than the losses they incur from fraud and false declines, not to mention the operational costs of manual reviews. You pay for peace of mind, and the ability to grow without fear.

Hands-On Experience / Use Cases

Let me paint a picture. Imagine you run an e-commerce store, selling high-value electronics. Orders are flying in. Suddenly, an order comes in for five top-of-the-line laptops, shipping to a residential address, paid with a card from a different country. Your gut screams “fraud!”

The old way? Your team would put it on hold. They’d spend 20 minutes (or more) digging. Checking IP addresses, cross-referencing names, maybe even trying to call the customer. In that time, the customer gets impatient, or the fraudster moves on. This order holds up your warehouse, too. It’s a bottleneck.

With Signifyd? The order hits your system. Within seconds, often milliseconds, Signifyd’s AI analyses thousands of data points. It looks at the customer’s purchase history globally, their device, their location, their social footprint, previous fraud attempts on similar profiles, and much more. It then provides an instant decision: Approve or Decline. And if it’s an “Approve,” it comes with that financial guarantee.

So, in this scenario, if Signifyd says “Approve,” you ship the laptops immediately, confidently. No manual review. No delay. Your team doesn’t even see it. And if, by some fluke, it later turns out to be fraudulent, Signifyd covers the chargeback. Your team’s workload just dropped significantly. Your legitimate customer got their order fast.

Let’s consider another use case: Account Takeover (ATO) attempts. Fraudsters try to log into existing customer accounts, change shipping addresses, and make purchases. This is subtle, often bypassing traditional fraud checks because it looks like a legitimate customer. Signifyd’s AI also monitors post-purchase activities and login attempts. It can detect unusual login patterns or rapid changes to account details, flagging them as suspicious. This helps prevent fraud even after the initial purchase, protecting your loyal customers and their accounts.

The usability is remarkably straightforward. Signifyd integrates seamlessly with major e-commerce platforms like Shopify, Magento, Salesforce Commerce Cloud, and many others. Implementation is usually quite simple, often an API integration or a plugin. Once it’s set up, it runs in the background, making decisions with minimal input from your team. The dashboard provides clear analytics and insights, allowing you to track performance and understand fraud trends. It doesn’t require a data scientist to operate it. It’s designed to be a plug-and-play solution that just works, delivering results from day one.

Who Should Use Signifyd?

If you’re processing online transactions, you should be looking at Signifyd. It’s that simple. But let’s break down the ideal user profiles.

First up: E-commerce Businesses of All Sizes. Whether you’re a small online boutique just starting out or a massive enterprise handling millions of transactions, fraud is a threat. Signifyd scales with you. Small businesses benefit from the peace of mind and automation without needing a dedicated fraud team. Larger businesses benefit from the efficiency, reduced chargebacks, and ability to scale operations globally without increasing fraud risk.

Next: Businesses with High Transaction Volumes. If you’re approving hundreds or thousands of orders a day, manual review is unsustainable. Signifyd automates that, allowing you to process more orders faster, without increasing your fraud exposure. It’s about maintaining speed and agility while staying secure.

Then there are Businesses Selling High-Value Goods or Services. Electronics, luxury items, digital goods, tickets – these are prime targets for fraudsters because the payout for them is significant. The cost of a single fraudulent transaction can wipe out profits from many legitimate sales. Signifyd’s guarantee is particularly valuable here, protecting those large-ticket items.

Consider Businesses Experiencing High Chargeback Rates. If you’re constantly fighting chargebacks, it’s a symptom of a weak fraud prevention system. Signifyd directly addresses this by stopping fraud upfront and by managing chargeback disputes on guaranteed orders. It turns a significant cost centre into a protected revenue stream.

Also, Businesses Expanding Globally. Fraud patterns vary significantly by region. What’s suspicious in one country might be normal in another. Signifyd’s global data network makes it adept at detecting fraud across diverse geographies, making international expansion less risky and more profitable.

Finally, Businesses Looking to Optimise Approval Rates. It’s not just about stopping fraud; it’s also about approving legitimate orders that might otherwise be incorrectly declined by overly aggressive rules-based systems. Signifyd’s precision means fewer false positives, leading to higher approval rates and a better customer experience. This translates directly into more sales.

How to Make Money Using Signifyd

This might sound counterintuitive. “How do I make money with a fraud prevention tool?” But it’s simple: you make money by *not losing it* and by *optimising your operations* to unlock more revenue.

First, the obvious: Stopping Fraudulent Chargebacks. This is direct profit preservation. Every dollar of fraud you prevent or get reimbursed for is a dollar saved. If you’re currently losing thousands, tens of thousands, or even hundreds of thousands to fraud and chargebacks, Signifyd is literally putting that money back into your pocket. It’s not a soft saving; it’s hard cash.

Then, Maximising Legitimate Orders. This is where many businesses leave money on the table. Overly cautious fraud systems decline good customers, fearing fraud. Signifyd’s precision allows you to approve more legitimate orders that would otherwise be rejected. This means higher approval rates, more sales, and better customer lifetime value. It’s directly impacting your top line.

Consider Reducing Operational Costs. Think about the labour costs of your fraud review team. The hours spent manually reviewing transactions, disputing chargebacks, contacting customers. Signifyd automates much of this. This frees up your team’s time, allowing them to focus on revenue-generating activities, or it simply means you need fewer resources dedicated to fraud, which is a direct saving on your payroll.

- Service 1: E-commerce Consultancy Specialising in Risk Management: If you’re a consultant, you can leverage your expertise with Signifyd to offer high-value services to e-commerce clients. You can help them integrate Signifyd, analyse their current fraud loss, project ROI, and train their teams on how to best utilise the platform. You become the go-to expert for reducing fraud and boosting revenue. This means you can charge premium rates for your strategic advice and implementation services. It’s about selling solutions, not just software.

- Service 2: Managed Fraud Prevention Services: For smaller e-commerce businesses that don’t want to deal with fraud at all, you could offer a managed service. You integrate Signifyd into their store, monitor their dashboard, provide regular reports, and manage any edge cases or specific fraud challenges they might face. Essentially, you become their outsourced fraud department, powered by Signifyd. This creates a recurring revenue stream for your business, offering peace of mind to your clients.

- Service 3: Chargeback Dispute & Recovery Specialist: Focus specifically on helping businesses recover revenue lost to chargebacks, using Signifyd’s capabilities. While Signifyd handles guaranteed orders, there might be other chargebacks (e.g., service not delivered, technical issues) where your expertise can help. You can use insights from Signifyd’s data to improve overall chargeback prevention strategies for clients, and for those guaranteed orders, you can highlight how Signifyd’s guarantee protects them. Position yourself as the expert in navigating the complex world of chargeback disputes and recovery, demonstrating how Signifyd makes a significant difference.

**Case Study Example:** “How Jane, an e-commerce consultant, makes $10k/month helping businesses secure their revenue using Signifyd for Fraud Detection.” Jane works with 5-7 medium-sized e-commerce clients per month. She charges them a retainer of $1,500-$2,000 to manage their Signifyd integration, monitor their fraud performance, and provide strategic recommendations for reducing their overall fraud footprint. She presents compelling ROI figures to prospective clients, showing how Signifyd’s guarantee alone often covers the cost of her services and the platform itself, turning a cost center into a profit generator. She highlights how her guidance, combined with Signifyd, leads to a 5-10% increase in approved orders and a significant reduction in chargeback rates for her clients.

Limitations and Considerations

No tool is a silver bullet, and Signifyd is no exception. While powerful, it’s important to understand its limitations and what to consider before diving in.

First, Accuracy isn’t 100% perfect. Yes, Signifyd boasts incredibly high accuracy rates and that financial guarantee is robust. But no AI system can prevent every single fraud attempt, especially as fraudsters constantly evolve their tactics. There will always be edge cases, new types of fraud, or highly sophisticated attacks that might slip through. The guarantee protects you financially, but it’s crucial to understand it’s about risk mitigation, not absolute elimination.

Next, Integration and Learning Curve. While Signifyd strives for seamless integration, every business’s tech stack is unique. There might be some initial setup time, API work, or adjustments required to get it fully integrated with your specific e-commerce platform, order management system, and payment gateway. It’s generally straightforward for popular platforms, but custom setups might require more developer time. And while the daily use is simple, understanding the metrics, optimising your settings (if needed), and leveraging all insights can take a bit of a learning curve for your team.

Consider the Cost. As mentioned, Signifyd isn’t free. For very small businesses with extremely low transaction volumes and minimal fraud risk, the cost might not justify the immediate benefits. However, for businesses seeing even moderate fraud losses, the ROI quickly becomes clear. It’s an investment, and like any investment, you need to weigh the cost against the potential returns and losses. Don’t expect a free ride.

Then there’s Reliance on Third-Party. You’re effectively outsourcing a critical security function. While this is a massive benefit for most, it means a degree of reliance on Signifyd’s infrastructure, uptime, and expertise. If their systems go down, or if there’s an issue on their side, it could impact your transaction processing. This is true for any third-party service, but it’s worth acknowledging.

Finally, Data Privacy and Compliance. Signifyd processes sensitive transaction data. Businesses need to ensure that their use of Signifyd complies with all relevant data privacy regulations (like GDPR, CCPA, etc.) in the regions they operate. Signifyd is built with compliance in mind, but the responsibility ultimately lies with the business to ensure their overall operations are compliant.

Final Thoughts

So, what’s the verdict? Is Signifyd worth it for your fraud detection needs, especially in the security and moderation space? Absolutely.

Its value proposition is clear and compelling: it shifts the financial risk of fraud from your business to Signifyd, automates a significant portion of your fraud review process, and optimises your approval rates for legitimate customers. This isn’t just about preventing losses; it’s about unlocking revenue and freeing up your team to focus on growth and more strategic security initiatives.

If you’re tired of manual reviews, fighting chargebacks, or losing good customers to false declines, Signifyd offers a robust, AI-powered solution. It allows you to make confident decisions, scale your operations without fear, and ultimately, grow your business more profitably.

My recommendation is straightforward: if you process online transactions and are serious about protecting your revenue while optimising customer experience, you need to explore Signifyd. It’s a fundamental upgrade to how modern businesses handle fraud.

Next step? Don’t just take my word for it. Reach out to them. Get a demo. Understand how their guarantee can specifically impact your bottom line. See for yourself how Signifyd can transform your fraud detection strategy.

Visit the official Signifyd website

Frequently Asked Questions

1. What is Signifyd used for?

Signifyd is primarily used for AI-powered fraud detection and prevention in e-commerce. It helps online businesses automatically approve legitimate orders and decline fraudulent ones, backed by a financial guarantee against chargebacks.

2. Is Signifyd free?

No, Signifyd is not free. It is a premium, enterprise-grade solution typically priced based on transaction volume or a flat fee per decision, often including a chargeback guarantee. It’s an investment designed to deliver significant ROI by preventing fraud losses and increasing legitimate sales.

3. How does Signifyd compare to other AI tools?

Signifyd stands out from many other AI tools because it offers a financial guarantee against fraud on approved orders. While other AI tools might identify fraud, Signifyd takes on the financial liability, effectively insuring your transactions. It also processes a vast global network of data, giving it a unique edge in detecting evolving fraud patterns compared to simpler rule-based systems.

4. Can beginners use Signifyd?

Yes, beginners can use Signifyd. While the underlying technology is complex, the user interface and integration are designed to be straightforward. Once set up, it largely operates in the background, making automated decisions. It doesn’t require deep fraud expertise to manage daily operations.

5. Does the content created by Signifyd meet quality and optimization standards?

Signifyd does not “create content” in the traditional sense like text generators. Instead, it creates highly accurate fraud decisions. These decisions meet the highest standards for quality and optimisation because they are driven by advanced AI, vast datasets, and a financial guarantee, ensuring maximum approval rates for legitimate customers and minimal fraud losses.

6. Can I make money with Signifyd?

Yes, you can make money with Signifyd by significantly reducing fraud losses, increasing your legitimate sales by approving more good orders, and lowering operational costs associated with manual fraud review and chargeback management. For consultants, it opens up opportunities to offer high-value risk management and e-commerce optimisation services to clients.