Bloomberg API is a powerhouse for Data Feeds and Market Integration in finance. Streamline your workflows, get real-time insights, and make better trading decisions. See how it can boost your efficiency today!

Bloomberg API Helps Me Meet Deadlines Without Chaos

Let’s talk about chaos.

Specifically, the kind of chaos that hits you when you’re trying to keep up in finance and trading.

Data flying everywhere.

Markets moving at warp speed.

Integrating all of it feels like trying to drink from a firehose.

Meanwhile, AI is showing up everywhere else.

Picking stocks, analysing reports, even talking to customers.

So, where does the Bloomberg API fit in?

Does it actually cut through the noise?

Can it turn that firehose into a manageable stream?

I used it.

And things changed.

If you’re drowning in data and desperate for a better way, keep reading.

This is about getting stuff done, on time, without losing your mind.

Table of Contents

- What is Bloomberg API?

- Key Features of Bloomberg API for Data Feeds and Market Integration

- Benefits of Using Bloomberg API for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Bloomberg API?

- How to Make Money Using Bloomberg API

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Bloomberg API?

Alright, let’s cut to the chase.

What exactly is the Bloomberg API?

Think of it as the direct pipeline into the massive data lake that is Bloomberg.

It’s not the flashy terminal screen you might picture.

It’s the engine under the hood.

It lets your own applications, your own systems, talk directly to Bloomberg’s data sources.

We’re talking real-time market data.

Historical data stretching back years.

Reference data for stocks, bonds, currencies, everything.

News feeds.

Analytics.

All accessible programmatically.

No more manual downloads.

No more copy-pasting.

It’s built for professionals in Finance and Trading.

Quants, portfolio managers, risk analysts, developers building trading platforms.

Anyone who needs high-quality, reliable financial data integrated directly into their workflow.

It’s designed for serious use cases.

Building trading algorithms.

Populating internal risk models.

Creating custom reporting dashboards.

Automating processes that rely on market information.

It’s about getting the data you need, exactly when and where you need it.

Cleanly, consistently, and at speed.

If your work involves constantly needing accurate financial information, this is the tool that feeds your systems.

It’s not just data access.

It’s about integrating that data into the heart of your operations.

It’s the backbone for serious financial infrastructure.

That’s the Bloomberg API at its core.

A powerful data connector for financial pros.

Key Features of Bloomberg API for Data Feeds and Market Integration

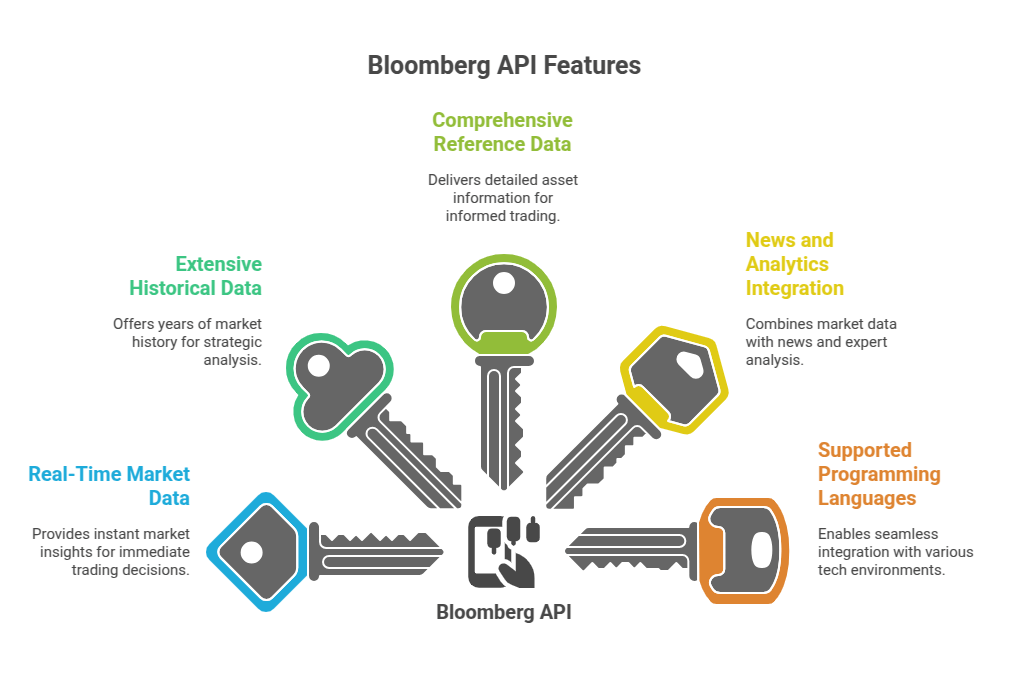

- Real-Time Market Data:

This is the lifeblood of trading.

Getting prices, volumes, and other market indicators milliseconds after they happen.

The Bloomberg API provides low-latency access to this.

You can stream data directly into your trading applications.

Build systems that react instantly to market moves.

This isn’t just getting a price snapshot.

It’s getting the tick data, the depth of market, everything you need for serious analysis and execution.

It helps with Data Feeds and Market Integration by ensuring your systems are always running on the freshest possible information.

No delays, no stale data.

Just the market, live.

- Extensive Historical Data:

Trading isn’t just about what’s happening now.

It’s about understanding what happened before.

The Bloomberg API gives you access to vast historical datasets.

Years, even decades, of price data.

Economic indicators, corporate fundamentals.

This is crucial for backtesting trading strategies.

Building predictive models.

Analysing long-term trends.

It helps you feed your research models with comprehensive historical context.

Ensuring your strategies are built on solid ground.

Not just recent noise.

- Comprehensive Reference Data:

What security is this?

What sector is it in?

Who are the key executives?

What’s the dividend history?

Reference data is the foundational layer.

The Bloomberg API provides detailed information on a massive range of asset classes.

Equities, fixed income, commodities, derivatives, funds.

This ensures you have the correct context for every piece of market data.

It’s essential for portfolio management systems.

Risk management frameworks.

Ensuring you’re trading the right instrument and understanding its characteristics.

- News and Analytics Integration:

Data isn’t just numbers.

News drives markets.

Economic releases, company announcements, geopolitical events.

The API lets you pull Bloomberg’s news feed directly into your systems.

Combine it with market data for event-driven trading.

Access Bloomberg’s proprietary analytics and calculations.

Yield curves, valuation models, risk metrics.

This provides a richer picture than just raw data.

It helps you integrate market sentiment and expert analysis into your decision-making process.

- Supported Programming Languages:

You need to connect from your own environment.

The Bloomberg API offers libraries and support for common programming languages.

Python, C++, Java, .NET, Excel.

This means you can build your applications in the language you’re comfortable with.

Integrate the data seamlessly into your existing tech stack.

It lowers the barrier to entry for development teams.

Lets you leverage existing coding expertise.

Making the integration process smoother.

Benefits of Using Bloomberg API for Finance and Trading

Okay, so why bother with the Bloomberg API?

What’s the actual win here for Finance and Trading?

First off, **efficiency goes through the roof**.

Seriously.

Stop wasting hours scraping data or waiting for batch files.

The API delivers data directly to your systems.

Automatically.

Real-time streams, instant historical pulls.

This frees up your team to do actual analysis and strategy.

Not data janitorial work.

Then there’s **data quality and reliability**.

Bloomberg’s data is considered gold standard.

Clean, accurate, verified.

When you’re making decisions with big money on the line, you need to trust your data source.

The API gives you that trust.

It significantly reduces errors introduced by manual data handling.

Another huge benefit? **Speed and timely decisions**.

Markets move fast.

Opportunities appear and disappear in seconds.

Getting real-time data integrated into your automated systems means you can react faster than humanly possible.

Identify arbitrage opportunities.

Execute trades based on breaking news.

It gives you a crucial edge in high-frequency or algorithmic trading.

**Customisation and flexibility** are key too.

You’re not limited by a pre-built interface.

You pull the specific data points you need.

Structure them how your internal systems require.

Build dashboards, models, and applications exactly tailored to your firm’s specific strategies and workflows.

It supports sophisticated quantitative analysis.

Building complex risk models.

Developing proprietary indicators.

The data is there for you to use however you need.

Finally, it **scales with your needs**.

Whether you’re a small quantitative fund or a large investment bank.

The API can handle varying data volumes and request frequencies.

It’s built for enterprise-level performance and reliability.

These benefits aren’t just nice-to-haves.

They translate directly into better performance, reduced operational risk, and competitive advantage.

Pricing & Plans

Alright, let’s talk money.

How much does this Bloomberg API thing cost?

Here’s the deal: Bloomberg doesn’t publish standard, off-the-shelf pricing for the API.

It’s not like subscribing to Netflix or a typical SaaS tool.

The pricing is **custom and based on usage and your specific requirements**.

Are you pulling real-time data for thousands of securities?

Accessing decades of historical data?

Using specific analytics?

The cost depends on factors like:

- Which data sets you need access to (real-time, historical, reference, news).

- The volume of data you’re pulling.

- The frequency of your requests (e.g., streaming real-time vs. batch historical pulls).

- The number of users or applications accessing the API.

- Any specific licensing or integration support needed.

This isn’t a free tool.

There’s no “free plan” to just test it out casually.

It requires a professional relationship with Bloomberg.

Typically, you need to be a Bloomberg Terminal subscriber or negotiate a specific API data license.

The cost can range significantly.

For a smaller firm with limited data needs, it might be less.

For a large institution running high-frequency trading, it will be substantial.

How does it compare to alternatives?

Other financial data providers like Refinitiv (now part of LSE), FactSet, or ICE Data Services also offer APIs.

Pricing models are similar – custom quotes based on usage.

Bloomberg is generally perceived as being premium-priced, but also offering premium data quality and breadth.

You’re paying for the reliability, the depth of data, and the infrastructure behind it.

To get a real quote, you need to talk directly to Bloomberg sales.

They’ll assess your needs and provide a proposal.

So, don’t expect a simple monthly fee like a consumer product.

Factor this into your budget as a significant operational cost if you need top-tier financial data integration.

Hands-On Experience / Use Cases

Alright, let’s get concrete.

How does this actually look in practice?

Forget the brochures.

Here’s how firms actually use the Bloomberg API for Data Feeds and Market Integration.

**Use Case 1: Algorithmic Trading**

This is a classic.

A quant trading firm needs real-time price feeds for thousands of stocks across multiple exchanges.

Their algorithms need to react in milliseconds.

They use the Bloomberg API’s real-time streaming data feature.

Their custom-built execution system connects to the API.

As soon as a price updates on Bloomberg, the API pushes it to their system.

Their algorithms process the new price, generate trade signals, and potentially send orders.

Usability? Once the initial connection is set up (which requires expertise), the data flow is automated.

Results? Reduced latency, faster signal generation, and the ability to implement strategies that require high-speed market access.

**Use Case 2: Risk Management System**

An asset management firm needs to calculate portfolio risk daily.

This requires market data like volatilities, correlations, and prices for all their holdings.

They use the Bloomberg API to pull end-of-day data.

Their internal risk engine makes calls to the API requesting specific fields for each security in their portfolio.

They also pull historical data for calculating metrics like Value at Risk (VaR).

Usability? Developers integrate API calls into their scheduled batch jobs.

Results? Automated, consistent risk calculations using trusted data. No manual data entry or validation needed for this input.

**Use Case 3: Custom Dashboard and Reporting**

A portfolio manager wants a custom dashboard that shows their specific performance metrics alongside key market benchmarks and news headlines relevant to their sector.

The internal tech team builds a web application.

This app uses the Bloomberg API to pull:

- Real-time index prices.

- Historical performance data for benchmarks.

- News articles tagged with relevant keywords or company names.

- Reference data for their holdings (e.g., industry, market cap).

Usability? The end user (the portfolio manager) interacts with a simple, tailored interface. The complexity of data retrieval is hidden.

Results? Managers get a consolidated view of the information they need, updated frequently, within a tool designed for their specific workflow. Better insights, faster reporting.

**Use Case 4: Populating Internal Databases**

A large bank maintains extensive internal databases for research and compliance.

They need to populate these databases with fundamental data (earnings, balance sheets), corporate actions, and economic indicators.

They use the Bloomberg API to retrieve this data programmatically.

Automated scripts run daily or hourly, querying the API for updates on thousands of companies and economic series.

The retrieved data is then loaded into their data warehouse.

Usability? This is mostly behind-the-scenes infrastructure work by data engineers.

Results? A consistently updated, reliable internal data source feeding multiple downstream systems (analytics, reporting, compliance). Reduced reliance on manual data collection.

These examples show that the Bloomberg API isn’t just one tool.

It’s a building block.

It provides the critical Data Feeds and Market Integration capability that powers many different applications within a financial firm.

It takes expertise to set up and manage, but the result is integrated, automated data flow.

Who Should Use Bloomberg API?

Okay, so who is this thing actually for?

Is it for everyone in Finance and Trading?

Not really.

It’s a specialised tool for specific needs.

Here’s who typically benefits most:

**Quantitative Analysts (Quants):**

If you’re building complex trading models, backtesting strategies, or running statistical analysis on financial markets, you need clean, extensive data.

The API gives you programmatic access to exactly that.

It’s essential for developing and deploying quantitative strategies.

**Algorithmic Trading Firms:**

Any firm focused on automated trading needs direct, low-latency access to market data.

The API is a core component of their technology stack.

It provides the necessary speed and volume of data to power automated execution systems.

**Portfolio Managers (with technical support):**

While a PM might not directly code against the API, their custom tools and dashboards likely rely on it.

Firms that want to build tailored reporting or analysis tools for their portfolio managers use the API to feed those tools with data.

**Risk Management Professionals:**

Calculating exposure, VaR, stress tests, and other risk metrics requires vast amounts of market and reference data.

The API provides the automated data flow needed to feed internal risk systems consistently and reliably.

**Financial Software Developers/Engineers:**

If your job is building internal systems for trading, risk, research, or compliance within a financial institution, you’ll likely be working with the Bloomberg API.

It’s a fundamental data source for many internal financial applications.

**Research Teams (requiring large datasets):**

Academic or institutional research teams needing to analyse large historical datasets for financial studies.

The API allows them to programmatically pull the specific data ranges and fields they need for their analysis.

**Financial Data Vendors:**

Some firms that specialise in providing specific types of financial data or derived analytics might use the Bloomberg API as one of their underlying data sources (subject to licensing agreements).

Who shouldn’t necessarily use it?

Individual retail traders, casual investors, or small businesses who don’t require real-time, high-volume, or programmatically integrated data.

The cost and technical complexity are too high for casual use.

It’s a tool for institutions and sophisticated professional users who need to integrate premium financial data into their operational systems.

How to Make Money Using Bloomberg API

Making money with the Bloomberg API isn’t about using the API itself to generate revenue directly, like selling access to the data (that’s Bloomberg’s business).

It’s about **leveraging the capabilities the API provides to create value**.

Here’s how firms and professionals use it to make money:

**1. Powering Profitable Trading Strategies:**

This is the most direct way.

Algorithmic trading firms use the low-latency data feeds from the API.

They feed this data into proprietary trading algorithms.

These algorithms identify trading opportunities faster and execute trades more efficiently than manual processes.

The ability to consume vast amounts of real-time and historical data allows for the development and execution of strategies like statistical arbitrage, market making, or event-driven trading that rely on speed and data volume.

The profit comes from the trading gains generated by these strategies, which are powered by the API data.

**2. Building and Selling Financial Software:**

Software companies that build applications for financial professionals often integrate with the Bloomberg API.

They don’t resell the raw data.

Instead, they build analytical tools, reporting systems, portfolio management platforms, or risk analysis software.

These tools consume data via the API (the end client needs their own Bloomberg license).

The value is in the software’s functionality, analytics, and user interface.

They charge clients for the software license or service, which is enhanced by the seamless integration with Bloomberg data.

Example: A company creates a specialised bond valuation tool that pulls bond data and analytics from Bloomberg via the API. They sell this tool subscription to fixed income desks.

**3. Providing Data Integration and Consulting Services:**

Implementing and managing the Bloomberg API requires technical expertise.

Firms or individual consultants who specialise in financial technology can offer services to help financial institutions integrate the API into their existing systems.

This includes setting up connections, developing custom applications that use the data, building data pipelines, and maintaining the infrastructure.

They charge for their expertise and time.

Example: A consulting firm helps an asset manager replace their manual data collection process with an automated system powered by the Bloomberg API, charging a project fee for the implementation.

**4. Enhancing Research and Analysis:**

Investment banks and research firms use the API to power their research teams.

By giving analysts programmatic access to data, they can perform deeper, more sophisticated analysis faster.

This leads to higher-quality research reports, better investment recommendations, and more informed decisions for their clients.

While not a direct money-making feature of the API itself, it contributes significantly to the value proposition the firm offers its clients, ultimately supporting revenue generation through fees or trading commissions.

**5. Improving Operational Efficiency (Saving Money):**

“A penny saved is a penny earned.”

Automating Data Feeds and Market Integration via the API significantly reduces the labour cost and time associated with manual data handling.

It reduces errors, which can be costly in finance.

The efficiency gains free up expensive human capital to focus on higher-value activities.

The money “made” here is in the form of reduced operational costs and increased productivity, which improves the bottom line.

In essence, the Bloomberg API is an enabler.

It provides the essential data backbone that allows financial firms to build proprietary systems, execute advanced strategies, offer specialised services, and operate more efficiently.

The money is made through the business activities that are powered by the reliable, integrated data flow from the API.

Limitations and Considerations

Nothing is perfect, right?

The Bloomberg API is powerful, but it’s not without its challenges and things you need to think about.

Here are the main limitations and considerations:

**1. Cost:**

We already touched on this, but it bears repeating.

This is a significant investment.

It’s priced for professional institutions.

The custom pricing model means you need to engage with Bloomberg directly to understand the expense.

It’s not a cheap, easy-to-access tool.

**2. Technical Complexity:**

Using the API requires technical expertise.

You need developers who can work with programming languages like Python, C++, or Java.

Understanding the API structure, data entitlements, and error handling takes time and skill.

It’s not a plug-and-play solution for non-technical users.

Implementing and maintaining the integration requires ongoing technical resources.

**3. Data Entitlements:**

You only get access to the data you’re licensed for.

Just having API access doesn’t mean you can pull *any* data from Bloomberg.

Your data subscription determines which securities, data fields, and types of data (real-time, historical) you can access via the API.

Managing these entitlements and ensuring your applications only request what they’re allowed to is important.

**4. Vendor Lock-in:**

Integrating your core systems deeply with the Bloomberg API creates a dependency.

Switching to another data provider would be a major undertaking.

It would require re-architecting your data pipelines and applications.

This is common with enterprise-level data providers, but it’s a significant consideration.

**5. Learning Curve:**

Even for experienced developers, understanding the full breadth of the Bloomberg API and its specific methods and data structures takes time.

Bloomberg provides documentation and support, but it’s a complex system reflecting the complexity of financial markets.

**6. Support Structure:**

While Bloomberg offers support, it’s structured for institutional clients.

You won’t get instant chat support like a consumer product.

Support processes are more formal and may involve dedicated account managers and technical teams.

**7. Not a Trading Platform:**

The API provides data feeds.

It typically does *not* provide direct order execution capabilities.

You use the data to inform your trading decisions or power your own execution systems, but you usually don’t send trades *through* the Bloomberg API itself.

That requires integration with execution management systems (EMS) or trading venues.

These considerations highlight that the Bloomberg API is a serious tool for serious users.

It requires budget, technical resources, and a clear use case where reliable, integrated financial data is critical to your operation.

It’s not a casual download.

Final Thoughts

So, where does that leave us with the Bloomberg API?

Look, if you’re deep in Finance and Trading, constantly battling with getting clean, timely data into your systems, the Bloomberg API is probably on your radar already.

Or it should be.

It’s not magic AI that does the trading for you.

It’s the plumbing.

But it’s premium plumbing for your data feeds and market integration.

It cuts through the noise.

It eliminates the grunt work of data collection.

It provides the reliable data foundation you need for everything from risk management to lightning-fast algorithmic trading.

Is it cheap? No.

Is it simple? Not from a technical standpoint.

Does it require commitment? Absolutely.

But for firms where data accuracy, speed, and integration are competitive advantages, the Bloomberg API delivers.

It allows you to automate critical workflows.

Build sophisticated proprietary systems.

Make decisions based on trusted information, updated in real-time.

It helps you meet those crazy deadlines because the data you need is just… there.

Integrated.

Reliable.

If you’re spending too much time wrestling with data and not enough time acting on it, the Bloomberg API is a solution worth exploring.

It’s a tool for serious players who need a robust, scalable, and trustworthy data backbone.

It empowers you to work smarter, not harder, in a data-intensive field.

My recommendation?

If your firm’s operations rely heavily on integrated financial data and you have the technical resources, investigate it properly.

Talk to Bloomberg.

Understand the costs and integration requirements for your specific needs.

It could be the key to unlocking significant efficiency and analytical power.

Visit the official Bloomberg API website

Frequently Asked Questions

1. What is Bloomberg API used for?

Bloomberg API is primarily used in Finance and Trading.

It provides programmatic access to Bloomberg’s extensive financial data.

This includes real-time and historical market data, reference data, news, and analytics.

It’s used to feed this data directly into a firm’s internal applications.

Common uses are powering algorithmic trading systems, risk management platforms, custom dashboards, and research databases.

2. Is Bloomberg API free?

No, Bloomberg API is not free.

It’s a premium service for financial professionals.

Pricing is custom and depends on the specific data access and usage volume required.

It typically requires a professional relationship and licensing agreement with Bloomberg.

3. How does Bloomberg API compare to other AI tools?

Bloomberg API is not an AI tool in the same way as a natural language processor or a predictive model generator.

It’s a data delivery and integration tool.

It provides the high-quality data feeds that AI tools used in finance (like those for sentiment analysis or price prediction) would consume.

It’s a data infrastructure component, not an AI application itself.

Other financial data APIs exist (e.g., Refinitiv, FactSet), offering similar data access but with potentially different data coverage, quality, and pricing models.

4. Can beginners use Bloomberg API?

Generally, no, beginners cannot easily use the Bloomberg API.

It requires technical skills to integrate and work with.

You need programming knowledge (like Python or C++) and an understanding of API concepts.

It’s designed for developers and quantitative professionals within financial institutions, not casual users.

5. Does the content created by Bloomberg API meet quality and optimization standards?

Bloomberg API doesn’t create content like articles or reports.

It provides raw or processed financial data.

The data itself is held to Bloomberg’s high standards for quality, accuracy, and timeliness, which are critical for financial markets.

Optimization standards would apply to how efficiently your applications retrieve and process the data from the API.

6. Can I make money with Bloomberg API?

You can’t make money selling access to the raw Bloomberg data itself through the API (that’s prohibited).

However, you can make money by using the API to power profitable activities.

This includes developing and running profitable trading strategies, building financial software that uses the data, providing data integration consulting services, or increasing operational efficiency within a firm.

The API is an enabler for revenue-generating activities in finance.