AlphaSense transforms your approach to Financial NLP and Sentiment Analysis. Gain deeper insights, faster. Start making smarter trading decisions now.

Using AlphaSense to Boost Your Financial NLP and Sentiment Analysis Efficiency

Let’s talk about the game.

The game of Finance and Trading.

It’s fast. It’s brutal.

Information is everything.

And finding the right info, fast?

That’s the edge.

For years, we’ve been sifting.

Reading reports. Skimming news. Trying to catch the whisper that moves the market.

Trying to figure out what people *really* think about a company or a sector.

This is where AI comes in.

It’s not magic. It’s leverage.

And in the world of Financial NLP and Sentiment Analysis, there’s a tool that’s making waves.

AlphaSense.

Maybe you’ve heard of it.

Maybe you’re wondering if it’s worth the hype.

Stick with me.

I’m going to break down exactly what it is.

How it helps in Finance and Trading, specifically with Financial NLP and Sentiment Analysis.

And whether it’s the tool you need to gain that edge.

Table of Contents

- What is AlphaSense?

- Key Features of AlphaSense for Financial NLP and Sentiment Analysis

- Benefits of Using AlphaSense for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use AlphaSense?

- How to Make Money Using AlphaSense

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is AlphaSense?

Alright, let’s get straight to it.

What is AlphaSense?

Think of it as a search engine, but built specifically for business and financial professionals.

It’s not like Google where you type something in and get a million random websites.

AlphaSense searches content that actually matters in Finance and Trading.

We’re talking company documents. SEC filings. Earnings calls transcripts. Research reports. News articles.

Expert calls. Industry journals. You name it.

Billions of documents.

And it does it fast.

But it’s more than just a search.

It uses AI, particularly Natural Language Processing (NLP).

This isn’t just keyword matching.

It understands the context.

It can find synonyms, concepts, and sentiment.

Even if the exact words aren’t there.

Its target audience?

People who need deep, reliable, and timely business information.

Financial analysts. Portfolio managers. Investment bankers. Corporate strategy teams. Market researchers.

Anyone whose decisions rely on understanding the market and specific companies inside and out.

It’s built for speed and accuracy in a high-stakes environment.

It helps you cut through the noise.

Find the signal.

And make a move before everyone else does.

That’s the promise.

An AI tool for Finance and Trading that gives you a real edge.

Key Features of AlphaSense for Financial NLP and Sentiment Analysis

- Smart Search Technology:

Okay, so this is the engine.

AlphaSense calls it “AI-powered Smart Search”.

What does that mean for Financial NLP and Sentiment Analysis?

It means you’re not just looking for a word like “revenue”.

You’re looking for the *concept* of revenue growth, decline, or commentary around it.

Even if they use different words like “top line”, “sales figures”, or “turnover”.

It understands financial jargon.

It understands related terms.

It cuts through the boilerplate language in financial documents.

It finds the juicy bits.

The parts that actually tell you something important about the business performance or outlook.

- Sentiment Analysis:

This is huge for trading.

It’s not just *what* is being said, but *how* it’s being said.

Is the CEO optimistic or cautious?

Are analysts positive or negative on the stock?

AlphaSense’s NLP engine analyzes text for sentiment.

It looks at words and phrases to determine the overall tone.

It can highlight positive, negative, and neutral language in documents.

You can see trends in sentiment over time for a company or sector.

This helps you gauge market mood.

Identify potential shifts before the price moves.

It’s like having a sentiment radar sweeping across millions of documents.

Spotting changes in attitude that manual reading would miss.

- Access to Premium Content:

Alright, you need the good stuff, right?

Not just public filings.

AlphaSense integrates with thousands of premium content sources.

Broker research reports from major banks.

Expert interview transcripts (the kind where people in the know spill the beans).

Industry publications.

This is content you’d normally pay a fortune for, or simply couldn’t access easily.

Having all of this searchable with powerful Financial NLP and Sentiment Analysis tools?

That’s a serious advantage.

It gives you a wider perspective.

Deeper insights.

Helps you see what the smart money is thinking.

- Monitoring and Alerts:

You can’t stare at the screen 24/7.

AlphaSense lets you set up alerts.

Track specific companies, keywords, or topics.

Get notified when new information drops.

When sentiment shifts on a company you’re watching.

When a competitor mentions a key trend.

This is automated intelligence gathering.

It keeps you informed without the constant manual checking.

Crucial for timely trading decisions.

Staying ahead of the curve.

Not missing that critical piece of news.

- Redlining and Comparison:

Financial documents change.

Comparing the latest 10-K to the previous one, line by line?

Painful. Slow. Prone to errors.

AlphaSense does redlining automatically.

It shows you exactly what changed between different versions of a document.

New risks added? Change in accounting policy? Updated management discussion?

You see it instantly.

This is vital for understanding subtle shifts in corporate communication.

Changes that might signal deeper issues or opportunities.

It saves hours of tedious work.

Lets you focus on analyzing the *implications* of the changes.

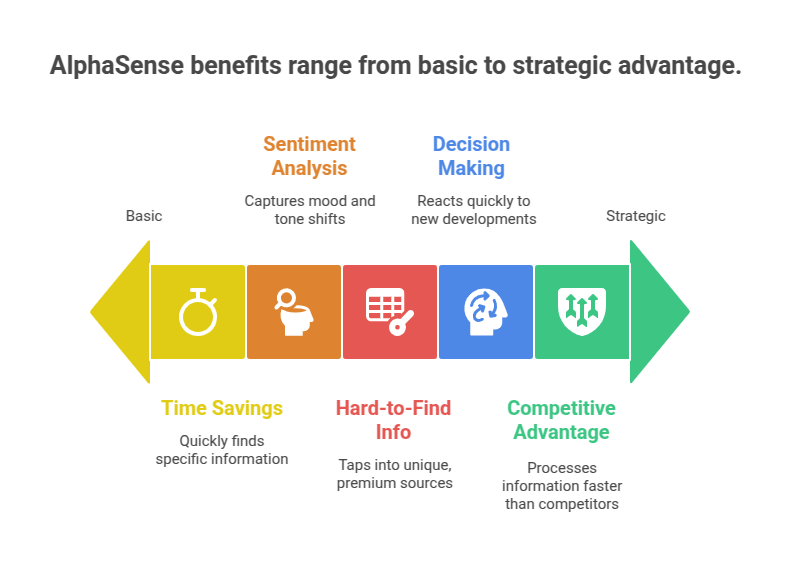

Benefits of Using AlphaSense for Finance and Trading

Okay, so you’ve got these features.

What’s the payoff?

Why would someone in Finance and Trading drop cash on this?

Simple: Edge and efficiency.

First, Time Savings. Massive time savings.

Trying to manually find specific points in a mountain of filings?

Hours. Days. Maybe weeks.

With AlphaSense, it’s minutes. Seconds.

Its AI sifts through the noise faster than any human possibly could.

You find what you need, when you need it.

This means you can cover more companies. Research more ideas.

Instead of spending your day searching, you’re spending it analyzing and deciding.

Second, Deeper Insights through Sentiment.

Financial NLP and Sentiment Analysis isn’t just about keywords.

It captures the mood. The tone.

You can see if management confidence is waning.

If analysts are turning bearish.

If news sentiment is shifting.

These subtle cues are often precursors to price movements.

Being able to track sentiment systematically across many sources?

That’s powerful.

Third, Access to Hard-to-Find Information.

That premium content? Broker research, expert calls?

That’s where unique insights live.

AlphaSense brings it all together, searchable with their powerful AI.

You’re tapping into sources your competitors might not easily access or effectively search.

Fourth, Improved Decision Making.

When you have better information, faster…

And you can gauge the sentiment surrounding that information…

Your decisions are simply better informed.

You can react quicker to new developments.

Spot trends earlier.

Validate or challenge your investment hypotheses with robust data.

It reduces uncertainty. Increases confidence.

Fifth, Competitive Advantage.

Look, this game is zero-sum.

Your gain is someone else’s loss.

Tools like AlphaSense aren’t just productivity enhancers.

They are competitive weapons.

They give you the ability to process information faster, understand market mood better, and access unique insights.

That translates directly into a potential edge in trading performance.

Simply put: It helps you work smarter, not harder.

Find the signal, avoid the noise.

Make more informed moves.

Pricing & Plans

Alright, the big question for any tool like this.

What does it cost?

Here’s the deal with AlphaSense.

It’s not a cheap monthly subscription you sign up for with a credit card on a website.

Think enterprise software.

It’s priced based on the size of your team, your specific needs, and the content packages you require.

They don’t publish standard pricing tiers on their website.

You have to contact them for a custom quote.

This tells you it’s aimed at serious players.

Institutions, funds, corporations.

Not typically the individual retail trader.

They might offer a free trial or demo.

This is the standard practice for high-value platforms like this.

It lets you kick the tires, see if it fits your workflow, and prove the ROI before you commit.

How does it compare to alternatives?

There are other financial data terminals and research platforms out there.

Bloomberg and Refinitiv Eikon are the giants, obviously.

They are comprehensive but also incredibly expensive.

AlphaSense positions itself as a premium research and search tool.

Often used *alongside* or as a *more intuitive alternative* for research than the data terminals.

Its strength lies in its NLP and search capabilities across unstructured and qualitative data.

Something the traditional terminals aren’t as strong on.

Other AI-powered research tools are emerging.

But AlphaSense has a head start, a large content library, and a strong reputation.

Is it worth the cost?

For a team that needs to process vast amounts of financial information quickly and effectively, particularly leveraging Financial NLP and Sentiment Analysis?

The potential return on investment from better, faster insights can easily justify a significant annual cost.

If your decisions involve millions or billions of dollars, saving time and getting a slight edge is invaluable.

So, while there isn’t a simple “free plan” or $50/month option, the pricing reflects the value it delivers to professional users in Finance and Trading.

Hands-On Experience / Use Cases

Alright, let’s get practical.

How would you actually use this thing in the real world?

Imagine this scenario:

You’re tracking a specific tech company. Let’s call it “InnovateCorp”.

They just had their earnings call.

Instead of reading the entire 50-page transcript, you go to AlphaSense.

You search for “supply chain issues” or “component shortages”.

AlphaSense finds every mention. Not just the exact phrase, but related concepts.

It highlights the sentences where it’s discussed.

Then, you want to know the *tone* around it.

You use the sentiment analysis feature.

Is management downplaying it (neutral/slightly negative sentiment)?

Or are they expressing serious concern (clearly negative sentiment)?

AlphaSense quickly visually shows you the sentiment around those topics.

Maybe you also search for “new product launch” or “market opportunity”.

You check the sentiment there too.

Is the tone genuinely excited and confident (positive)? Or more cautious and vague (neutral/negative)?

Now, you want to see what analysts are saying.

You filter your search to include broker research reports.

You search for “InnovateCorp rating” or “price target”.

AlphaSense pulls up relevant snippets from dozens of analyst reports.

It might even aggregate sentiment across these reports.

Are they upgrading, downgrading, or staying put? What’s the overall mood?

You can then compare this to news articles sentiment using the news filter.

What’s the general media perception?

Another use case: Competitor analysis.

You track a rival company.

Set up alerts for any mention of “market share,” “new initiatives,” or “pricing strategy” in their filings or calls.

Use the sentiment analysis to see if they sound confident or struggling.

Redline their latest 10-K against the last one.

Instantly spot any changes in their risk factors or business description that might impact you.

The usability is generally reported as very good.

The interface is designed for speed and efficiency.

Finding specific information is fast, thanks to the smart search.

Visualizing sentiment trends is intuitive.

Compared to slogging through PDFs and using basic keyword searches, it’s night and day.

It’s about getting to the relevant information and understanding its context and tone, fast.

That’s the real-world benefit of AlphaSense for Financial NLP and Sentiment Analysis.

Who Should Use AlphaSense?

So, who is this tool actually built for?

Who gets the most bang for their buck with AlphaSense?

It’s not for everyone. Let’s be clear.

If you’re a casual investor trading a few stocks based on CNBC headlines, this is overkill.

AlphaSense is for professionals who need to conduct deep, timely research to inform critical business or investment decisions.

Think financial analysts at investment firms.

They need to quickly research companies, sectors, and macroeconomic trends.

Portfolio managers who need to stay on top of developments impacting their holdings or potential investments.

They use it to validate ideas, spot risks, and understand market narratives through sentiment.

Investment bankers working on deals (M&A, IPOs).

They need to quickly understand target companies, market sentiment, and regulatory environments.

Corporate strategy and development teams.

They use it to research competitors, understand market dynamics, and identify potential M&A targets.

Market researchers and consultants.

They need to gather comprehensive data and insights across various industries and companies for client projects.

Researchers focused on Financial NLP and Sentiment Analysis.

Academics or professionals specifically studying market language and mood.

Essentially, anyone whose job involves intensive reading and analysis of financial and business documents.

If you spend hours every week sifting through filings, reports, and news to find specific information or gauge market feeling, AlphaSense can likely save you significant time and give you better results.

It’s a tool for productivity AND insight generation in the high-stakes world of Finance and Trading.

If missing a key piece of information or misjudging market sentiment can cost your firm or clients serious money, AlphaSense is designed to help prevent that.

It’s an investment in better intelligence.

How to Make Money Using AlphaSense

Okay, how can you actually translate using AlphaSense into making money?

This isn’t about AlphaSense directly paying you.

It’s about how the tool empowers you to generate revenue or increase profitability in your existing work.

- Service 1: Enhanced Financial Research Services:

If you offer financial analysis, consulting, or research services to clients, AlphaSense makes you faster and better.

You can provide clients with more comprehensive reports, faster turnaround times, and deeper insights, particularly on sentiment analysis.

Imagine a client needs a deep dive into a sector or company.

Instead of weeks of manual work, you use AlphaSense to quickly pull relevant data points, understand management commentary contextually (NLP), and track sentiment shifts over time.

You deliver a higher-quality service, potentially justifying higher fees or allowing you to take on more clients.

- Service 2: Building and Selling Sentiment-Driven Trading Strategies:

AlphaSense provides robust sentiment data across various sources.

You could use this data to build systematic trading strategies based on sentiment signals.

For example, developing a strategy that buys stocks when sentiment turns positive based on analyst reports and sells when news sentiment becomes negative.

You can backtest these strategies using historical data available through AlphaSense or linked sources.

If successful, you could manage capital based on this strategy or potentially license the strategy or signals.

This leverages the unique data and analysis capabilities of AlphaSense directly into a revenue-generating product.

- Service 3: Competitive Intelligence & Market Monitoring for Corporations:

Many companies need to keep a close eye on their competitors and broader market trends.

You can offer a service providing curated competitive intelligence reports using AlphaSense.

Track competitor mentions of key initiatives, risk factors, or market conditions using AlphaSense’s search and alerting features.

Provide sentiment analysis on how competitors are discussing challenges or opportunities.

This is valuable for corporate strategy, sales, and marketing teams.

You become their eyes and ears in the market, powered by AlphaSense’s efficient data gathering.

Consider someone running a boutique investment research firm.

Before AlphaSense, they might spend 70% of their time searching for information.

With AlphaSense, that drops to 20%.

The remaining 50% is now spent on deeper analysis, creating more valuable research reports, or taking on additional client projects.

This increased capacity and enhanced service quality directly translates to more revenue and higher profitability.

It’s not about a passive income stream from AlphaSense itself.

It’s about leveraging a powerful tool to make your core business in Finance and Trading more effective and profitable.

By being faster, more insightful, and accessing better data with Financial NLP and Sentiment Analysis capabilities, you can charge more, win more business, or make better investment decisions.

Limitations and Considerations

No tool is perfect.

AlphaSense is powerful, especially for Financial NLP and Sentiment Analysis, but it has limitations and things to think about.

First, Cost.

As I mentioned, it’s an enterprise-level tool.

The price can be a barrier for smaller firms or individual users.

You need to have a clear use case and expect a significant ROI to justify the expense.

It’s not a casual purchase.

Second, It’s a Tool, Not a Brain.

AlphaSense provides information and highlights sentiment.

It doesn’t make the investment decision for you.

You still need your own expertise, judgment, and analytical skills to interpret the findings.

The sentiment analysis is powerful, but AI isn’t perfect at understanding nuance, sarcasm, or complex human language subtlety in every context.

You need to verify and cross-reference findings.

Third, Requires Training.

While the interface is generally user-friendly for its complexity, it’s a professional tool.

There’s a learning curve to master its full capabilities, especially the advanced search functions and filters.

You’ll need to invest time in learning how to use it effectively to get the most out of it.

Fourth, Content Coverage.

While AlphaSense has a massive content library, it’s not infinite.

There might be niche sources or private data you need that aren’t included.

You need to check if their content sources align with your specific research needs.

Fifth, Reliance on Data Feeds.

The accuracy and timeliness depend on the underlying data feeds.

While AlphaSense aggregates from reputable sources, any delay or error in the source material will be reflected in the platform.

You are relying on external data providers.

Finally, Can Lead to Information Overload.

Because it finds *so much* information so quickly, you can sometimes get overwhelmed.

Filtering and focusing your searches becomes a skill in itself.

You need a clear research question to avoid drowning in data.

So, while AlphaSense is a game-changer for many, understand it’s a serious investment requiring training and critical thinking. It enhances your capabilities but doesn’t replace your expertise in Finance and Trading.

Final Thoughts

Alright, let’s wrap this up.

AlphaSense. Is it the real deal for Financial NLP and Sentiment Analysis in Finance and Trading?

Yeah. It is.

For professionals who live and breathe financial data, this tool provides a serious edge.

The AI-powered search cuts through the noise like a hot knife through butter.

The sentiment analysis gives you a crucial layer of insight that manual methods just can’t match at scale.

Access to premium content is a game-changer.

The efficiency gains are massive.

You’re not just searching faster.

You’re *understanding* better.

You’re spotting nuances.

You’re gauging market mood systematically.

These capabilities translate directly into the potential for making more informed, timely, and ultimately, more profitable decisions.

It’s not a magic bullet. It won’t make you a trading guru overnight if you don’t understand the fundamentals.

But if you’re already skilled in Finance and Trading, AlphaSense gives you superpowers.

It frees up your time to focus on strategy and analysis, not tedious data gathering.

It provides insights you wouldn’t get otherwise.

The cost is significant.

It’s built for institutions and professional teams where the ROI is clear based on the value of the decisions being made.

If you’re in a professional setting in Finance and Trading and deep research is critical to your success, you need to look at AlphaSense.

It’s one of the Best Financial NLP and Sentiment Analysis tools out there for pros.

My recommendation?

If your work involves significant financial research and analysis, particularly leveraging qualitative data and market sentiment, explore AlphaSense.

Get a demo. See how it handles your specific workflows.

Calculate the potential time savings and the value of better insights.

See if it fits your operation.

For many in the trenches of Finance and Trading, tools like AlphaSense are becoming less of a luxury and more of a necessity.

It’s about staying competitive in a market that’s only getting faster and more complex.

Don’t get left behind doing things the old way.

Visit the official AlphaSense website

Frequently Asked Questions

1. What is AlphaSense used for?

AlphaSense is primarily used by finance and business professionals.

It’s for searching, analyzing, and monitoring a vast library of financial documents, news, and research reports.

It uses AI, including Financial NLP and Sentiment Analysis, to find key information and gauge market sentiment quickly.

2. Is AlphaSense free?

No, AlphaSense is not free.

It is an enterprise-level platform with custom pricing based on user needs and team size.

It’s designed for professional use in firms and corporations, not individual users.

3. How does AlphaSense compare to other AI tools?

AlphaSense is specifically tailored for financial and business research.

Unlike general AI writing tools or search engines, it focuses on proprietary financial data and uses sophisticated NLP to understand industry-specific language and sentiment.

It competes more directly with financial data terminals and specialized research platforms.

4. Can beginners use AlphaSense?

AlphaSense is a professional tool.

While the interface is designed to be intuitive for its complexity, it requires understanding financial concepts and research workflows.

Beginners in finance might face a steeper learning curve compared to experienced professionals.

5. Does the content created by AlphaSense meet quality and optimization standards?

AlphaSense doesn’t “create” content like a generative AI tool.

It finds, analyzes, and presents existing content (filings, reports, news).

The quality is based on the source material, and AlphaSense helps you find the *most relevant* high-quality information quickly. It helps *you* create quality analysis and reports.

6. Can I make money with AlphaSense?

Yes, indirectly.

AlphaSense is a tool that enhances your ability to perform financial research and analysis.

By using it, you can save time, gain deeper insights (especially through Financial NLP and Sentiment Analysis), and access better information.

This can lead to making more profitable trading or investment decisions, offering more valuable research services to clients, or gaining a competitive edge in your professional role in Finance and Trading.