Equifax Ignite transforms Credit Scoring and Analysis for Legal and Finance pros. Unlock better insights and save time. Ready to see how?

Why Equifax Ignite Is a Game-Changer in Credit Scoring and Analysis

Let’s be real.

Work in Legal and Finance?

Credit scoring and analysis is likely eating your lunch.

It’s complex.

It’s time-consuming.

It’s… manual.

Or at least, it used to be.

AI is changing everything.

Fast.

And one tool is making serious waves, especially when you’re dealing with credit data.

Equifax Ignite.

Heard of it?

If you haven’t, listen up.

This isn’t just another piece of software.

It’s a fundamental shift in how you approach credit scoring and analysis.

It promises to cut through the noise.

Give you clarity.

And honestly?

Make your job a whole lot easier.

I’ve seen what it can do.

And you need to know about it.

Stick around.

I’ll show you why Equifax Ignite isn’t just another tool, it’s the tool for credit scoring and analysis right now.

Table of Contents

- What is Equifax Ignite?

- Key Features of Equifax Ignite for Credit Scoring and Analysis

- Benefits of Using Equifax Ignite for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Equifax Ignite?

- How to Make Money Using Equifax Ignite

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Equifax Ignite?

Alright, let’s break it down.

What exactly is Equifax Ignite?

Think of it as a powerful engine designed specifically for credit data.

It’s not some generic AI chatbot.

This is built to handle the complexities of credit scoring and analysis.

Equifax Ignite is essentially a cloud-based platform.

It gives businesses direct access to massive amounts of Equifax data.

But here’s the kicker: it wraps that data in powerful analytics tools.

And yep, it uses AI and machine learning to do the heavy lifting.

Its core function?

To let users explore, analyse, and score credit data faster and more effectively than ever before.

No more wrestling with clunky spreadsheets or outdated software.

It’s designed for organisations that need deep insights into credit risk.

This includes banks, lenders, fintech companies, and anyone else whose business depends on understanding creditworthiness.

Whether you’re a massive financial institution or a growing legal firm dealing with debt recovery or financial assessments, Equifax Ignite is built for scale and complexity.

It provides a single environment.

You bring your data, blend it with Equifax data, and run sophisticated models.

All in one place.

It cuts out the data silos.

Removes the bottlenecks.

And crucially, it speeds things up.

If you’re tired of waiting weeks for analysis that should take days, Equifax Ignite is the answer.

It’s about empowering analysts and decision-makers.

Giving them the tools to get actionable insights, not just raw numbers.

It’s designed to be intuitive, despite the complex stuff it does under the hood.

This means less time training staff and more time getting results.

In short?

Equifax Ignite is Equifax’s answer to the demand for faster, smarter, and more integrated credit data analysis.

It’s a serious piece of kit.

Built for serious players.

Who need serious results.

Especially in high-stakes Legal and Finance environments.

That’s what it is at its core.

A powerhouse for credit data.

Key Features of Equifax Ignite for Credit Scoring and Analysis

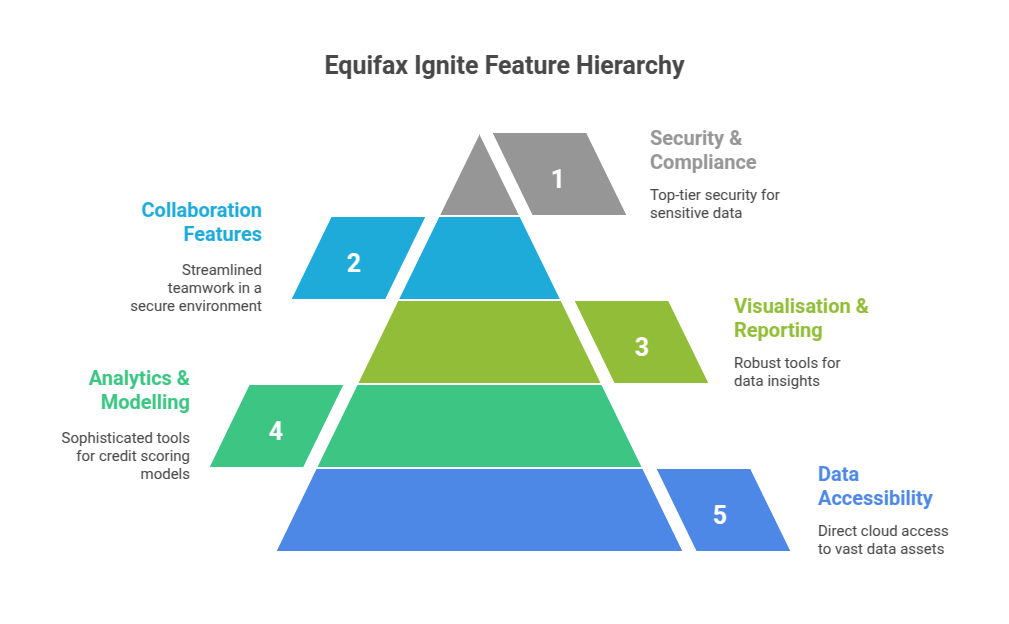

- Data Accessibility:

This is huge.

Equifax Ignite gives you direct, cloud-based access to Equifax’s vast data assets.

We’re talking credit reports, alternative data sources, commercial data – the lot.

You can blend this with your own internal data seamlessly.

No more exporting, importing, cleaning data manually across different systems.

It’s all there, ready to be used for credit scoring and analysis.

This accessibility drastically reduces the time it takes to get your hands on the information you need.

Getting fresh data points is instant.

This is critical for accurate and timely decisions.

Data silos are the enemy of good analysis.

Ignite breaks them down.

- Powerful Analytics & Modelling:

This is where the magic happens.

Equifax Ignite isn’t just a data dump.

It comes packed with sophisticated analytical tools.

You can build and deploy complex credit scoring models directly within the platform.

It supports various modelling techniques.

Machine learning algorithms are integrated.

This lets you build more predictive and accurate models than ever before.

Think less guesswork, more data-driven precision in your credit scoring and analysis.

You can test different scenarios.

Refine your models on the fly.

And deploy them quickly for real-world use.

This capability alone justifies the investment for serious players.

It gives you a competitive edge.

- Visualisation and Reporting:

Okay, raw data and complex models are great, but you need to understand them.

Equifax Ignite provides robust visualisation tools.

You can create dashboards and reports to make sense of the data.

Understand trends.

Spot outliers.

And communicate your findings effectively.

This is crucial for presenting insights to stakeholders who might not be data experts.

Visuals cut through complexity.

They help tell the story behind the numbers.

Whether you’re presenting a risk assessment or showing the impact of a new scoring model, clear visualisations are key.

This feature ensures that the complex analysis performed within Ignite isn’t locked away in tables and code.

It’s made accessible and actionable.

- Collaboration Features:

Credit scoring and analysis often involves teams.

Analysts, data scientists, risk managers, legal teams – they all need to work together.

Equifax Ignite is designed for collaboration.

Multiple users can work on the same projects.

Share models.

Review results.

And maintain version control.

This streamlines workflows and reduces the chances of errors.

No more emailing spreadsheets back and forth.

Everything happens in one secure, shared environment.

This is especially important in regulated industries like Legal and Finance, where transparency and auditability are critical.

Teamwork makes the dream work, right?

Ignite facilitates that for complex data tasks.

- Security and Compliance:

Dealing with sensitive credit data demands top-tier security.

Equifax Ignite is built with this in mind.

It’s a cloud platform from Equifax.

They know a thing or two about data security.

The platform is designed to meet stringent regulatory requirements.

Think GDPR, CCPA, and other data protection laws.

Compliance is built-in, not an afterthought.

This gives users peace of mind knowing they’re handling sensitive information responsibly.

Security breaches are nightmares.

Ignite helps you sleep better at night.

Especially when your work involves detailed Credit Scoring and Analysis on behalf of clients or your own institution.

Benefits of Using Equifax Ignite for Legal and Finance

Alright, why should you care about Equifax Ignite if you’re in Legal and Finance?

Beyond the cool features, what’s the real payoff?

It boils down to a few key things.

First, speed.

Time is money, right?

Traditional credit analysis can be slow.

Gathering data, cleaning it, running models, getting reports… it takes time.

Ignite drastically cuts down that cycle.

Accessing data is fast.

Running complex models is fast.

Generating insights? You guessed it, fast.

This means you can make decisions quicker.

Underwrite loans faster.

Assess risk in legal cases more rapidly.

Respond to market changes with agility.

Speed gives you an edge.

Next, accuracy.

AI and machine learning aren’t perfect, but they can spot patterns humans miss.

Equifax Ignite’s advanced analytics lead to more accurate credit scoring and analysis.

This means better risk assessments.

Fewer bad debts.

More profitable decisions.

In law, it means a clearer picture of a party’s financial standing or ability to pay.

Better accuracy leads to better outcomes.

Then there’s efficiency.

Manual processes are prone to errors.

They’re tedious.

Equifax Ignite automates much of the heavy lifting.

Data integration, model building, reporting – it streamlines the whole workflow.

This frees up your analysts and legal professionals.

They can focus on interpretation and strategy.

Not just data entry and cleanup.

Higher efficiency means lower costs and more productive staff.

What about insights?

Equifax Ignite helps you unlock deeper insights from your data.

You can explore different variables.

Segment populations in new ways.

Uncover hidden risks or opportunities.

The platform’s ability to blend diverse data sources gives you a 360-degree view.

This is powerful for strategic planning and targeted actions.

Deeper insights lead to smarter strategies.

Finally, compliance.

Navigating regulations in Credit Scoring and Analysis is tough.

Equifax Ignite is designed with regulatory requirements in mind.

It offers audit trails.

Version control.

Secure data handling.

This helps your organisation stay compliant.

Reduces the risk of costly fines or legal issues.

Built-in compliance provides peace of mind.

So, for Legal and Finance professionals, Equifax Ignite isn’t just a fancy tool.

It’s a strategic asset.

It makes you faster, more accurate, more efficient, more insightful, and more compliant.

That’s a winning combination.

Pricing & Plans

Okay, let’s talk money.

How much does Equifax Ignite cost?

This isn’t a tool you find on a typical SaaS pricing page with clear tiers like “Basic,” “Pro,” and “Enterprise.”

Equifax Ignite is built for large-scale, specific business needs.

It’s a platform primarily aimed at institutions, not individual users or small businesses in the traditional sense.

There isn’t a free plan.

And you won’t find a simple monthly subscription price online.

Pricing for Equifax Ignite is typically enterprise-level.

It’s customised based on several factors.

How much data do you need access to?

What specific Equifax data sets are required?

What level of analytics capability do you need?

How many users will be on the platform?

What are your integration requirements?

Are you using it for specific use cases like credit originations, portfolio management, or collections?

Because of this, you’ll need to contact Equifax directly for a custom quote.

They work with you to understand your specific Credit Scoring and Analysis needs.

Then they build a pricing package around that.

Think of it less like buying software off the shelf and more like getting a tailored business solution.

Compared to alternative AI tools?

Many AI tools focus on content generation or simple data analysis.

They have straightforward subscription models.

Equifax Ignite is in a different league.

It’s integrated with massive proprietary credit data.

It’s designed for complex, regulated financial and legal workflows.

Alternatives for this specific task might involve building in-house data warehouses and analytics platforms.

That’s incredibly expensive and time-consuming.

Or using a combination of separate data vendors, analytics software, and manual processes.

That’s inefficient and prone to errors.

While the upfront cost for Equifax Ignite might be significant, the value comes from the integrated data, powerful analytics, speed, and compliance features it provides.

For organisations where Legal and Finance hinges on accurate and fast credit insights, the ROI can be substantial.

It’s an investment in infrastructure and capability.

Not just a subscription for a tool.

If you’re serious about optimising your credit scoring and analysis at scale, talking to Equifax about Ignite is the next step.

Don’t expect consumer-level pricing.

But expect enterprise-level capability.

Hands-On Experience / Use Cases

How does Equifax Ignite actually get used?

Let’s look at some real-world scenarios, especially in Legal and Finance.

Imagine a large bank’s lending division.

They receive thousands of loan applications daily.

Each needs a credit assessment.

Manually pulling individual reports and running them through an outdated system is slow.

With Equifax Ignite, they can automate much of this.

Applications flow in.

Ignite accesses the necessary Equifax data.

It runs the bank’s custom credit scoring model instantly.

Providing a risk score and recommendation almost in real-time.

This dramatically speeds up the loan origination process.

Improving the customer experience.

And allowing the bank to handle higher volumes without adding huge numbers of staff.

Consider a debt recovery law firm.

They need to assess the likelihood of recovering debt from individuals or businesses.

This involves deep Credit Scoring and Analysis.

Understanding financial health.

Payment history.

Asset indicators.

Using Ignite, the firm can quickly access comprehensive credit profiles.

Blend it with data from court records or their own systems.

Run analytics to predict recovery probability.

This helps them prioritise cases.

Allocate resources effectively.

And make informed decisions about pursuing legal action.

It shifts from guesswork to data-driven strategy.

Or think about a financial planning firm.

They advise high-net-worth clients.

Part of that involves understanding their clients’ overall financial picture.

Including complex credit situations or business credit.

Ignite allows them to analyse a client’s creditworthiness deeply and quickly.

Identify potential issues the client might not even be aware of.

Provide more comprehensive and accurate advice.

It enhances their service offering.

Builds client trust through robust analysis.

Another use case: portfolio risk management.

A large investment fund or a bank with a large loan book needs to constantly monitor the health of its portfolio.

Equifax Ignite lets them perform portfolio-level analysis.

Identify concentrations of risk.

Model the impact of economic changes on default rates.

Segment the portfolio based on new risk characteristics.

This proactive approach helps them manage risk effectively.

Take corrective actions before problems escalate.

Maintain a healthy financial position.

The usability of Ignite, from what I’ve seen and heard, focuses on providing a flexible environment.

It caters to users with different skill levels.

Analysts can use pre-built tools.

Data scientists can leverage more advanced modelling capabilities.

The interface is designed to be intuitive, reducing the learning curve compared to traditional data science platforms.

The results?

Faster insights.

More accurate models.

More efficient workflows.

Leading to better decisions and stronger financial performance or legal outcomes.

It’s about operationalising Credit Scoring and Analysis at scale.

And doing it right.

Who Should Use Equifax Ignite?

Okay, so who is Equifax Ignite actually for?

It’s not a tool for everyone.

This isn’t for your cousin starting a small online shop needing basic credit checks.

Equifax Ignite is built for organisations that have a significant volume and complexity of credit data to handle.

Think businesses where Credit Scoring and Analysis is a core function, not a side task.

Here’s who should be looking at it:

Large Banks and Lenders: This is their bread and butter. Underwriting loans, managing portfolios, collections – Ignite provides the speed and power they need to operate efficiently and manage risk at scale.

Fintech Companies: Often built on speed and data, fintechs need rapid access to comprehensive credit data and advanced analytics to build innovative products and services. Ignite fits perfectly.

Credit Card Companies: Issuing cards, managing risk, detecting fraud – all require sophisticated credit analysis. Ignite provides the platform.

Debt Buyers and Collection Agencies: Assessing the value and collectability of debt portfolios relies heavily on accurate credit data and predictive analysis. Ignite helps them make smarter purchasing and collection decisions.

Large Law Firms (especially those in finance-related areas): Firms dealing with bankruptcy, corporate finance, financial litigation, or debt recovery need deep insights into financial health and creditworthiness. Ignite offers the data and tools to support complex legal strategies involving financial assessments.

Major Corporations (for B2B credit): Companies extending credit to other businesses need robust commercial credit scoring. Ignite can integrate commercial data for comprehensive B2B risk assessment.

Government Agencies: Agencies involved in lending, guarantees, or financial oversight may require sophisticated tools for evaluating credit risk across populations or specific programmes.

It’s for teams of analysts, data scientists, risk managers, and legal professionals who are constantly working with credit data.

If your current processes for Legal and Finance related to credit are slow, manual, or limited by technology…

If you need to build and test complex credit models…

If you need fast access to vast amounts of comprehensive credit data directly from a bureau…

And if compliance and security are non-negotiable priorities…

Then Equifax Ignite is likely a tool you should seriously consider.

It’s an enterprise-grade solution for enterprise-level problems in the credit space.

It’s an investment for organisations looking to lead in their respective fields by leveraging data and AI effectively.

It’s not cheap, and it’s not simple.

But for the right user, it’s incredibly powerful.

How to Make Money Using Equifax Ignite

Okay, let’s talk brass tacks.

How do organisations using Equifax Ignite actually make money with it?

It’s not about selling AI-generated articles, obviously.

It’s about leveraging the power of the platform to drive revenue, reduce costs, and manage risk more effectively.

Here’s how it translates into making money, especially in Legal and Finance:

- Service 1: Improved Lending Decisions:

This is the most direct path.

By using Equifax Ignite for faster, more accurate Credit Scoring and Analysis, lenders can:

Approve more good applicants, increasing loan volume.

Approve them faster, improving customer satisfaction and conversion rates.

Avoid approving risky applicants, reducing default rates and associated losses.

Optimise interest rates and terms based on a more granular understanding of risk, increasing profitability on each loan.

Each better decision, faster process, or avoided loss directly impacts the bottom line.

- Service 2: Enhanced Debt Recovery:

For debt buyers or law firms specialising in collections:

Using Ignite to analyse debt portfolios helps identify accounts with the highest probability of recovery.

This allows them to focus resources where they’re most likely to succeed.

They can predict which collection strategies are most likely to be effective for different segments.

This increases collection rates.

And reduces wasted effort on low-probability accounts.

Higher recovery rates mean more revenue from purchased debt or higher success fees for legal services.

- Service 3: Reduced Operational Costs:

Efficiency gains translate directly to cost savings.

Automating data tasks and analysis reduces the need for manual labour.

Faster processing means less time spent on each application or case.

Streamlined workflows reduce errors and rework.

Better risk models mean fewer resources spent on managing problem accounts later on.

Lower operating costs boost profitability without necessarily increasing revenue volume.

- Service 4: Developing and Selling Custom Models/Insights:

Some advanced users or consultancy firms might use Equifax Ignite’s capabilities to:

Develop highly specific credit scoring models tailored for niche markets or unique risks.

Offer sophisticated credit risk consulting services, powered by Ignite’s data access and analytics.

Provide deep-dive market analysis or industry benchmarking based on granular credit data.

These services can be sold to other businesses, creating a direct revenue stream based on expertise and the power of the platform.

Think of a case study: “How ‘Premier Finance Group’ Increased Loan Approvals by 15% Using Equifax Ignite”.

They were bottlenecked by slow manual credit review.

Implemented Ignite.

Automated data pulls and scoring.

Reduced review time from 48 hours to 4 hours.

This allowed them to process more applications.

Faster approvals meant fewer applicants dropped out.

More accurate scoring meant they could confidently approve more marginal cases that their old system flagged cautiously.

Result? A 15% increase in approved loans, directly boosting their revenue from interest and fees.

Making money with Equifax Ignite isn’t about a simple transaction.

It’s about transforming core business processes in Legal and Finance to be faster, smarter, and more profitable.

It’s about leveraging data and AI to make superior decisions related to credit risk.

Limitations and Considerations

Nothing is perfect, right?

Equifax Ignite is powerful, but it has limitations and things you need to consider before jumping in.

First, cost.

As discussed, this is an enterprise-level tool.

The investment is significant.

It’s not for startups or small businesses with limited budgets.

You need to have a clear business case and expected ROI to justify the expense.

Second, complexity.

While the interface is designed to be user-friendly for an enterprise platform, it’s still handling sophisticated Credit Scoring and Analysis.

There is a learning curve.

Your team will need training.

You’ll need staff with the right analytical skills to build and interpret the models.

It’s not plug-and-play for someone with no background in data or finance.

Third, data dependency.

The power of Ignite comes from its integration with Equifax data.

While you can blend your own data, you are relying heavily on the quality, accuracy, and availability of Equifax’s information.

Any issues with the source data will impact your analysis.

You’re tied into the Equifax ecosystem to some extent.

Fourth, integration challenges.

While Ignite is designed for integration, bringing it into your existing tech stack might still require significant IT work.

Connecting it to your loan origination system, your legal case management software, or your internal data warehouses isn’t always a flip of a switch.

Planning and technical expertise are needed.

Fifth, needing ongoing management.

Credit models built in Ignite aren’t set-it-and-forget-it.

They need to be monitored.

Retested.

Updated as market conditions change or new data becomes available.

This requires ongoing effort and expertise from your team.

Sixth, explainability.

AI models, especially complex machine learning ones, can be black boxes.

Understanding *why* a model produced a specific score can be challenging.

In regulated industries like Legal and Finance, being able to explain a decision (e.g., why a loan was denied) is often legally required.

While Equifax is aware of this and provides tools to help, it’s a fundamental challenge with advanced AI that users must navigate.

So, before investing, you need to weigh these factors.

Is your organisation large enough?

Do you have the necessary technical and analytical talent?

Is the cost justifiable for the problems you need to solve?

Are you prepared for the integration and ongoing management effort?

Ignite is powerful, yes.

But it requires significant commitment and capability to use effectively.

Final Thoughts

Look, the world of Legal and Finance is changing.

Specifically, how we handle credit data is being revolutionised by AI.

Manual processes? They’re quickly becoming dinosaurs.

Equifax Ignite is at the forefront of this shift, particularly for complex Credit Scoring and Analysis.

It’s not a simple tool.

It’s a robust, enterprise-grade platform.

Designed to handle massive data volumes.

Build sophisticated models.

And integrate seamlessly into serious business workflows.

For organisations that live and breathe credit risk – banks, major lenders, fintechs, and large law firms – Ignite offers a level of speed, accuracy, and efficiency that’s hard to match with traditional methods.

It promises faster decisions, better risk management, and streamlined operations.

All wrapped up in a secure and compliant environment.

Yes, the investment is substantial.

Yes, it requires expertise to wield effectively.

But for those operating at scale, the benefits can be immense.

It’s about staying competitive.

Making smarter choices with data.

And ultimately, driving better financial outcomes.

If you’re in a position where credit scoring and analysis is a bottleneck or a point of risk, Equifax Ignite is more than just an AI tool.

It’s a potential game-changer for your operation.

It’s worth exploring if you fit the profile.

It could be the difference between leading your market and falling behind.

Visit the official Equifax Ignite website

Frequently Asked Questions

1. What is Equifax Ignite used for?

Equifax Ignite is primarily used by large organisations in finance and legal sectors for advanced Credit Scoring and Analysis. It allows access to Equifax data, building credit risk models, and performing detailed portfolio analysis.

2. Is Equifax Ignite free?

No, Equifax Ignite is an enterprise-level platform. It does not offer a free plan and pricing is customised based on the specific needs and scale of the client organisation.

3. How does Equifax Ignite compare to other AI tools?

Equifax Ignite is highly specialised compared to general AI tools. Its focus is specifically on integrating vast credit data with advanced analytics and machine learning for Credit Scoring and Analysis in regulated industries, unlike AI tools for content generation or broad data analysis.

4. Can beginners use Equifax Ignite?

Equifax Ignite is designed for professional analysts and data scientists. While it aims for usability within that context, it requires expertise in data analysis, financial modelling, and understanding credit data. It is not suitable for complete beginners.

5. Does the content created by Equifax Ignite meet quality and optimization standards?

Equifax Ignite doesn’t “create content” in the sense of articles or marketing copy. It generates data analysis, scores, reports, and visualisations based on credit data and models. The quality and relevance of its output are high for its specific purpose (credit analysis) but depend on the user’s input, model design, and the quality of the data used.

6. Can I make money with Equifax Ignite?

Yes, organisations use Equifax Ignite to make money indirectly by improving key business processes. This includes making more profitable lending decisions, increasing debt recovery rates, reducing operational costs through efficiency, and potentially offering advanced data analysis services to others.