Anaplan transforms Financial Reporting for Legal and Finance pros. Cut hours, boost accuracy, make better calls. Ready to level up?

Why Anaplan Is a Game-Changer in Financial Reporting

Alright, let’s talk numbers. Not just any numbers, the ones that matter. The ones that tell the story of your business.

Especially if you’re grinding it out in Legal and Finance.

You know the drill. Spreadsheets everywhere. Data silos. The late nights wrestling with complex models.

It feels like you’re constantly catching up, not getting ahead.

Now, the world’s changing. AI is popping up everywhere.

And yeah, it’s hitting Legal and Finance too.

For some, it’s scary. More tech to learn, right?

But for others, it’s opportunity.

A chance to ditch the busywork. To focus on what actually moves the needle.

This is where Anaplan steps in.

It’s not just another tool. It’s a different way to work.

Especially when it comes to something as critical as Financial Reporting.

Think less chaos, more clarity.

Less ‘hope this is right’, more ‘I know this is right’.

Ready to see how?

Table of Contents

- What is Anaplan?

- Key Features of Anaplan for Financial Reporting

- Benefits of Using Anaplan for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Anaplan?

- How to Make Money Using Anaplan

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Anaplan?

So, what exactly is this Anaplan thing?

Forget what you think you know about traditional planning software.

Anaplan is a cloud-based platform.

It’s built for connected planning.

Think connecting data, people, and plans across your entire business.

In the Legal and Finance space, this is huge.

You’re dealing with mountains of data.

Financials, operational metrics, legal data, compliance stuff.

Trying to bring all that together manually is a nightmare.

That’s Anaplan’s jam.

It pulls all that scattered info into one place.

Creates a single source of truth.

No more fighting over which version of the spreadsheet is the ‘right’ one.

Its core function? Making sense of complexity.

For Legal and Finance, this means better budgeting, forecasting, and yeah, you guessed it, Financial Reporting.

It’s designed for teams who need speed and accuracy.

For companies that are growing.

For anyone tired of the old way of doing things.

The target audience? Finance professionals, FP&A teams, operational planners, sales leaders, supply chain managers.

Basically, anyone involved in planning, budgeting, or performance management.

Including those handling the nitty-gritty of financial statements and reports.

It’s a powerful engine for dynamic planning.

And that directly impacts how you do Financial Reporting.

Making it faster, more accurate, and less painful.

Key Features of Anaplan for Financial Reporting

Alright, let’s zoom in on the features that make Anaplan a beast for Financial Reporting.

Because that’s what you care about, right?

Getting those reports done right, on time, every time.

- Connected Planning:

This is the big one. Anaplan isn’t just a reporting tool.

It connects your financial plans, operational plans, and any other relevant data points.

Imagine pulling sales data, expense forecasts, HR plans, and project budgets into one model.

This means your financial statements aren’t built in a vacuum.

They reflect the reality of the entire business.

No more surprises because one department’s plan didn’t match finance’s assumptions.

It gives you the full picture.

Which makes your financial numbers way more robust and defensible.

This connection drastically improves the accuracy and relevance of your Financial Reporting.

- Powerful Modeling Engine:

Spreadsheets have limits. Complex financial models break easily.

Anaplan’s modeling engine is built for this kind of complexity.

You can build driver-based models.

Scenario planning becomes easy – see the impact of different assumptions instantly.

What if sales drop by 10%? What if a new regulation hits?

Anaplan crunches the numbers fast.

This isn’t just about calculating numbers; it’s about understanding relationships.

How does a change in operational efficiency affect your profit margins?

How does a legal settlement impact cash flow?

This modeling power means your reports are based on dynamic, interconnected data, not static snapshots.

It handles large datasets without crashing.

It allows for granular detail.

Making your reports insightful, not just informative.

- Real-Time Collaboration:

How much time do you waste waiting for inputs from other teams?

Or consolidating feedback?

Anaplan is cloud-native and collaborative.

Multiple users can work in the same model simultaneously.

Changes are reflected in real-time.

Imagine your budget team updating expense forecasts while you’re building the P&L statement.

The numbers update instantly.

Comments and tasks can be assigned within the platform.

This eliminates email back-and-forth.

It speeds up the reporting cycle big time.

No more version control headaches.

Everyone is literally on the same page.

This collaborative environment is a game-changer for complex reports involving multiple stakeholders.

It ensures everyone is using the latest data.

- Advanced Reporting and Dashboarding:

Getting the data right is one thing.

Presenting it clearly is another.

Anaplan offers powerful reporting and dashboard capabilities.

You can build custom reports.

Create interactive dashboards.

Visualise key metrics.

Drill down into the details.

Think board-ready presentations built directly from your live data.

No more manually updating charts in PowerPoint.

You can slice and dice data.

Look at performance by department, region, project, whatever makes sense for your business.

These reports stay connected to the underlying model.

So, if a number changes in the model, it updates in the report automatically.

This saves hours of manual work.

It means your reports are always accurate and up-to-date.

- Audit Trails and Security:

In Legal and Finance, compliance is everything.

Anaplan has robust audit trails.

You can see who changed what, when, and why.

This provides transparency and accountability.

Essential for internal controls and external audits.

Security is also a big deal.

Cloud platforms need to be secure.

Anaplan is built with enterprise-grade security.

Access controls are granular.

You can set permissions for different users and data segments.

This ensures sensitive financial data is protected.

It helps meet regulatory requirements.

Giving you peace of mind.

- Data Integration:

Your financial data lives in different systems.

ERP, CRM, HR systems, data warehouses.

Anaplan connects to these.

Using APIs and connectors.

This automated data flow eliminates manual data entry.

It reduces errors.

It ensures your models and reports are based on the latest data from your source systems.

No more painful data exports and imports.

This is crucial for building accurate, timely financial reports.

Benefits of Using Anaplan for Legal and Finance

Okay, so what does all that fancy tech actually mean for you?

For someone working day in, day out in Legal and Finance?

It means ditching the busywork.

And focusing on the stuff that matters.

Here are the real benefits:

Massive Time Savings:

Seriously, how much time do you spend on manual consolidation?

Updating spreadsheets?

Chasing down numbers?

Anaplan automates most of this.

Data integration, real-time updates, connected models.

All these things free up hours.

Hours you can use for analysis, strategizing, actually understanding the numbers.

Not just wrestling them into a report format.

Reporting cycles shrink.

Monthly closes get faster.

Board reports are generated in minutes, not days.

Improved Accuracy and Reliability:

Manual processes? They introduce errors.

Typo here, wrong formula there, missed update somewhere else.

Anaplan provides a single source of truth.

Data is integrated directly from sources.

Calculations are consistent across models.

Audit trails show you every change.

This dramatically improves the accuracy of your Financial Reporting.

Stakeholders trust the numbers more.

You can stand behind your reports with confidence.

No more nagging doubt in the back of your mind.

Better Decision Making:

This is the point of it all, right?

Financial Reporting isn’t just a compliance exercise.

It’s about giving leaders the information they need to make smart choices.

With Anaplan, you have real-time data.

Interactive dashboards.

Easy scenario planning.

You can quickly see the impact of decisions.

Identify trends faster.

Understand variances better.

This leads to more informed, strategic decisions.

Decisions based on solid data, not guesswork.

For both financial strategy and overall business strategy.

Enhanced Collaboration:

Legal and Finance often need to work together.

Or work with sales, operations, HR.

Anaplan breaks down these silos.

Everyone works in the same platform.

Using the same data.

Planning assumptions are visible to everyone.

Feedback is shared directly in the models.

This makes cross-functional collaboration seamless.

It improves alignment across the business.

Leading to more integrated and effective plans.

Which, surprise, makes your Financial Reporting better.

Because it reflects a unified view of the business.

Increased Agility:

The business world moves fast.

Regulations change. Market conditions shift. New opportunities pop up.

Traditional reporting is often too slow to keep up.

Anaplan’s dynamic modeling and real-time data allow you to react quickly.

Update forecasts on the fly.

Rerun scenarios in minutes.

Generate updated reports instantly.

This agility is critical.

It means your reports are always relevant.

They can support rapid decision-making.

Helping your business stay ahead of the curve.

Especially important for timely Financial Reporting under pressure.

Pricing & Plans

Okay, let’s talk brass tacks.

What’s this thing cost?

Anaplan isn’t cheap.

It’s not a ‘sign up with your email’ free tool.

It’s an enterprise-level platform.

Built for serious businesses with complex needs.

Think large companies, growing mid-market companies.

Their pricing is typically subscription-based.

It depends on factors like the number of users.

The complexity of your models.

The modules you need.

The data volume.

There’s no standard public price list you just click on.

You need to talk to their sales team.

Get a custom quote based on your specific requirements.

So, is there a free plan? No.

A free trial? Sometimes, maybe a demo or a proof-of-concept.

But not a standard ‘kick the tires for 30 days’ free trial like a consumer app.

What does the premium version include?

The core platform includes the modeling engine, data integration capabilities, collaboration tools, and reporting features.

They also have specific solutions or accelerators built on the platform.

Like solutions for financial planning, sales performance management, supply chain planning, and workforce planning.

For Legal and Finance, you’d be focused on the financial planning and analysis modules.

Comparing it to alternatives?

Alternatives in this space include tools like Workday Adaptive Planning, OneStream, Vena Solutions, and Oracle EPM.

Each has its strengths.

Anaplan often stands out for its flexibility in modeling.

And its true connected planning capabilities across different business functions.

It’s generally considered one of the top-tier platforms.

Expect pricing to reflect that.

It’s an investment.

But the ROI often comes from the efficiency gains, reduced errors, and better decision-making it enables.

Especially when you factor in the complexity of Financial Reporting for large entities.

So, budget accordingly.

Hands-On Experience / Use Cases

Let’s get real. What does using Anaplan actually *feel* like?

And how does it play out in real-world Legal and Finance scenarios?

It’s not like using a simple AI writing tool.

There’s a learning curve.

Building models requires understanding the platform’s logic.

But once you get it, the power is immense.

Imagine this scenario:

It’s month-end. You need to close the books and generate the monthly financial statements.

Normally, you’d pull data from your ERP.

Maybe grab expense reports from another system.

Get accrual data from accounting.

Chase down legal spend details from the legal team.

Consolidate all this into a massive spreadsheet.

Run macros that might or might not work.

Fix broken links.

Spend hours reconciling discrepancies.

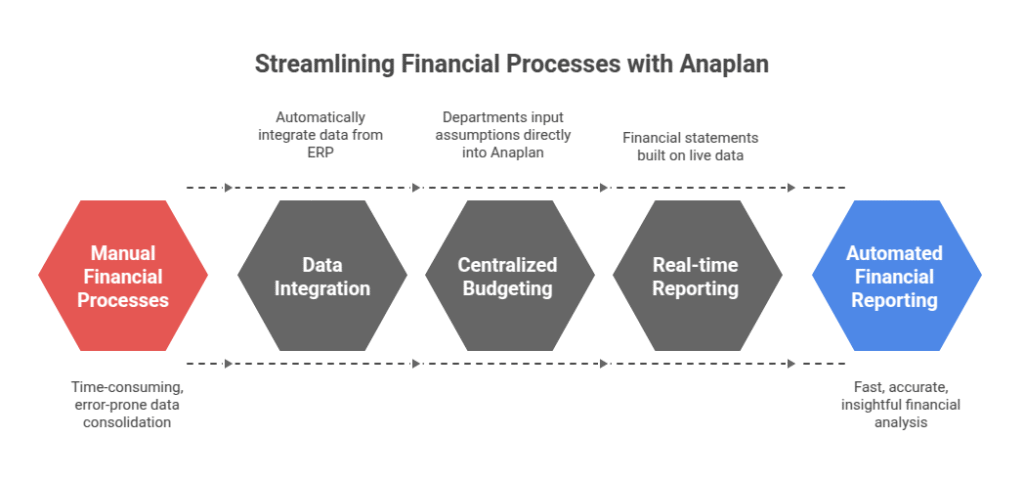

With Anaplan, this process changes.

Your ERP data is integrated automatically.

Legal spend can be captured and integrated directly if they’re using the platform or a connected system.

Accruals are managed within a connected model.

The financial statements are built directly on top of this live, integrated data.

You hit refresh.

The numbers are there.

Need to see the impact of a late-breaking invoice?

Enter it in the system (or source system that feeds Anaplan).

The reports update.

Usability? The interface is professional, designed for complex modeling.

It’s not always drag-and-drop simple for everything.

But for building serious financial models, it’s intuitive once you learn the ropes.

Results? Speed and accuracy go way up.

Instead of days, the core data aggregation and reporting might take hours.

Leaving you time to *analyse* the results.

To understand *why* numbers are different from forecast.

To provide actual insights to leadership.

Another use case: Budgeting.

Instead of sending out spreadsheet templates that come back in 50 different formats,

Departments enter their budget assumptions directly into Anaplan.

Finance can see the inputs in real-time.

Roll them up instantly.

Model different budget scenarios.

See the impact on projected revenue, expenses, and profit.

This connected, collaborative budgeting process directly feeds your future Financial Reporting.

Making forecasts based on solid, agreed-upon plans.

It simplifies even complex reporting requirements.

Like segment reporting or multi-currency consolidation.

Anaplan is built to handle these nuances.

So, the hands-on experience is less about manual data manipulation and more about building intelligent models and analysing outputs.

It shifts your role from data processor to strategic advisor.

Who Should Use Anaplan?

Okay, who is Anaplan really for?

Is it for the solopreneur tracking expenses in a Google Sheet?

Probably not.

Anaplan is built for organisations with complexity.

Think companies that have outgrown spreadsheets.

Where planning and reporting involve multiple departments.

Different data sources.

And a need for speed and accuracy.

Ideal user profiles include:

Corporate Finance Teams: Especially Financial Planning & Analysis (FP&A) teams.

They live and breathe budgeting, forecasting, variance analysis, and obviously, Financial Reporting.

Anaplan is tailor-made for these tasks at scale.

Legal and Compliance Departments: While the financial side is key, Legal can also benefit.

Managing legal spend forecasts, tracking litigation impact on financials, ensuring compliance reporting feeds into financial disclosures.

A connected platform helps bridge these areas.

Large Businesses: Companies with significant revenue, multiple business units, or global operations.

Complexity scales with size.

Anaplan handles that scale.

Growing Mid-Market Companies: Businesses hitting a point where manual processes are breaking down.

They need a robust platform to support future growth without adding endless headcount just for data entry and reconciliation.

Companies Needing Integrated Planning: If your business performance depends on aligning sales, operations, HR, and finance plans.

Anaplan’s connected planning is a huge advantage.

Teams Focused on Strategic Planning: Leaders who want to move beyond static budgets and reports.

They want to model different futures, understand drivers, and make agile decisions.

Anaplan provides the engine for this.

If your Financial Reporting is a bottleneck.

If you’re spending too much time gathering and validating data.

If your forecasts are constantly inaccurate.

If collaboration on plans is a nightmare.

Then Anaplan is likely worth looking at.

It’s for organisations serious about modernising their planning and reporting processes.

And seeing the real financial benefits from doing so.

How to Make Money Using Anaplan

Okay, switching gears a bit.

If you become proficient in Anaplan, can you turn that into a revenue stream?

Absolutely.

This isn’t like a writing tool where you write articles for clients.

It’s about providing valuable services built on your Anaplan expertise.

Think consulting and implementation.

- Anaplan Implementation Consultant:

Companies buy Anaplan, but they need help setting it up.

Configuring models, integrating data sources, training users.

This requires specialised skills.

Implementation consultants are in high demand.

You can work for an Anaplan partner company.

Or become an independent consultant.

You’d guide companies through deploying Anaplan.

Designing their planning and reporting processes within the platform.

Focusing specifically on building their financial reporting models.

Rates for experienced consultants are significant.

- Anaplan Model Builder/Developer:

Once Anaplan is implemented, companies need ongoing model maintenance and development.

Building new models as business needs change.

Optimising existing ones.

Troubleshooting issues.

This is a highly technical role.

Requires deep understanding of the Anaplan platform and modeling best practices.

You can work internally for a company that uses Anaplan extensively.

Or offer freelance model building services.

Companies often need project-based help for specific model development tasks.

Especially around complex areas like consolidations or detailed financial statements.

- Anaplan Trainer:

Anaplan has a learning curve.

Companies need to train their finance teams, business users, and administrators.

If you’re good at explaining complex concepts clearly, training is an option.

You can develop and deliver training programmes.

Focusing on core Anaplan skills or specific use cases like Financial Reporting.

This can be done remotely or on-site.

Can you share a quick example?

Okay, imagine a small consulting firm.

They become Anaplan certified.

They specialise in helping businesses in Legal and Finance implement Anaplan specifically for their Financial Reporting needs.

They charge project fees based on the scope of the implementation.

This might involve:

Assessing the client’s current reporting process.

Designing the Anaplan model structure.

Configuring data integrations from their ERP or other systems.

Building the actual financial statement reports and dashboards in Anaplan.

Training the client’s finance team.

Providing ongoing support.

This firm could easily generate significant revenue by helping multiple clients achieve more accurate, efficient Financial Reporting with Anaplan.

It’s about leveraging your expertise on a powerful platform to solve real business problems.

The demand for skilled Anaplan professionals is high.

So, mastering it can definitely open up profitable opportunities.

Limitations and Considerations

Alright, let’s keep it real.

Anaplan isn’t a silver bullet.

Like any powerful tool, it has limitations and things you need to consider before jumping in.

Learning Curve:

It’s not plug-and-play.

Anaplan modeling is powerful but requires learning a new way of thinking about data and logic.

Especially if you’re coming from a spreadsheet-only world.

There’s training involved.

Time investment to become proficient.

It’s not something you master in an afternoon.

Cost:

We touched on this. It’s an enterprise platform with enterprise pricing.

It’s a significant investment for a company.

You need to build a solid business case to justify the cost.

Ensure the expected ROI from efficiency and better decision-making is there.

Implementation Effort:

Implementing Anaplan isn’t just installing software.

It involves designing and building your specific planning models.

Integrating your data sources.

This takes time and resources.

Often requires external consultants, especially for complex setups.

Project timelines can be several months, depending on scope.

Complexity of Modeling:

While the modeling engine is flexible, building very complex or highly specific models can be challenging.

It requires skilled model builders.

Maintaining complex models also requires ongoing expertise.

You can build almost anything, but building it *well* takes skill.

Data Integration Can Be Tricky:

Anaplan has good integration capabilities.

But connecting to legacy systems or poorly structured data sources can still be a project.

The quality of your outputs depends heavily on the quality and flow of your input data.

Getting data into Anaplan reliably and cleanly is critical.

Potential for Over-Engineering:

Because the platform is so flexible, there’s a risk of over-complicating models.

Building processes that are more complex than necessary.

This can make models hard to maintain and understand.

Requires discipline and good design principles.

Not a Replacement for Everything:

Anaplan is focused on planning, budgeting, forecasting, and performance management.

Including the reporting that comes from that.

It doesn’t replace your core accounting system (ERP).

Or dedicated legal practice management software.

It sits on top, connecting data for planning and reporting purposes.

For Financial Reporting, it excels at generating forward-looking reports, variance analysis, and integrated financial statements derived from plans.

But the core ledger is still in your accounting system.

These are considerations, not necessarily dealbreakers.

Every powerful tool has its nuances.

It’s about going in with eyes wide open.

And understanding what it takes to get value out of it.

Final Thoughts

Look, if you’re in Legal and Finance, and you’re still drowning in spreadsheets for Financial Reporting, you’re leaving a ton of time and accuracy on the table.

The old ways are slow, prone to errors, and frankly, painful.

Anaplan is one of the tools built to solve this exact problem.

It’s not just an AI tool in the sense of generating text or images.

It uses sophisticated algorithms and a connected platform to handle complex modeling, data integration, and real-time updates that AI principles underpin.

It’s more about augmented intelligence – empowering humans with better data and calculation power.

Is it right for everyone? No.

If you’re a small business with simple needs, it’s likely overkill.

But if you’re a growing or large organisation.

If your Financial Reporting is a bottleneck.

If you need connected planning across departments.

If you crave accuracy, speed, and better decision-making.

Then Anaplan is a serious contender.

It delivers on the promise of transforming planning and reporting.

Especially in complex areas like consolidated financials, budgeting, and forecasting.

It helps you spend less time gathering data and more time understanding what it means.

For Financial Reporting, it means getting those reports done faster, with fewer errors, and with deeper insights.

It’s a smart choice for organisations serious about their numbers.

My recommendation? If the challenges I described sound familiar, investigate Anaplan.

Talk to their team. See a demo tailored to your specific Legal and Finance needs.

Understand the implementation process and costs.

It might just be the game-changer your team needs.

Visit the official Anaplan website

Frequently Asked Questions

1. What is Anaplan used for?

Anaplan is used for connected planning across business functions.

This includes budgeting, forecasting, sales performance management, supply chain planning, workforce planning, and particularly, enhanced Financial Reporting.

2. Is Anaplan free?

No, Anaplan is an enterprise-level platform and requires a paid subscription.

Pricing is custom based on user count, modules, and complexity.

3. How does Anaplan compare to other AI tools?

Anaplan is different from typical AI content generation tools.

It’s a planning and performance management platform that uses advanced modeling and data connectivity principles.

While it incorporates intelligent features, its primary function isn’t generating content but processing, modeling, and reporting on complex business data.

4. Can beginners use Anaplan?

Using Anaplan requires training and involves a learning curve, especially for model building.

It’s designed for business professionals, but proficiency takes time and practice.

5. Does the content created by Anaplan meet quality and optimization standards?

Anaplan doesn’t ‘create’ content like articles or marketing copy.

It generates reports, dashboards, and financial statements based on your business data and models.

The quality and optimization of these reports depend on how well the models are built and the accuracy of the data fed into the system.

6. Can I make money with Anaplan?

Yes, you can make money by becoming an Anaplan expert.

Offering services like implementation consulting, model building, or training to companies that use or want to use the platform.

There is high demand for skilled Anaplan professionals.