Riskified revolutionizes Fraud Detection with AI. Stop chargebacks, approve more good orders, and boost revenue. Learn how to leverage Riskified today!

Riskified Is Built for Security and Moderation – Here’s Why

You’re trying to grow.

Selling stuff online.

But then the headaches start.

Fraud.

Chargebacks hitting your bottom line.

Reviewing orders manually?

Takes forever.

Slows everything down.

You’re blocking good customers sometimes.

Revenue dips.

Trust gets shaky.

AI is everywhere now.

Making things faster.

Smarter.

Especially in areas like Security and Moderation.

Specifically for Fraud Detection.

That’s where a tool like Riskified comes in.

It’s designed for this mess.

To clean it up.

To give you back time.

And money.

It changes the game for online businesses dealing with risk.

Let’s talk about it.

Why it matters.

How it works.

And if it’s the right move for you.

Table of Contents

- What is Riskified?

- Key Features of Riskified for Fraud Detection

- Benefits of Using Riskified for Security and Moderation

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Riskified?

- How to Make Money Using Riskified

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Riskified?

Okay, so what exactly IS Riskified?

Think of it as your bodyguard for online transactions.

It’s an AI-powered Fraud Detection platform.

Its main job?

Figuring out which online orders are legit.

And which ones are fraudulent.

Simple, right?

But the complexity is under the hood.

It uses machine learning.

It analyses tons of data points for every single order.

Things like customer behaviour.

Device fingerprinting.

Location data.

Past transaction history.

And a lot more stuff you wouldn’t even think of.

Its target audience?

Mainly large e-commerce businesses.

Companies that process a high volume of transactions.

Ones where manual review is just not feasible.

Where fraud losses can be huge.

Chargebacks kill profits.

And declining good customers pisses people off.

Riskified aims to solve these problems.

It automates the review process.

Makes faster decisions.

And here’s the kicker:

They offer a chargeback guarantee.

If they approve an order and it turns out to be fraudulent, leading to a chargeback…

They reimburse you for the loss.

That’s putting their money where their mouth is.

It shifts the risk.

From you to them.

That’s powerful.

Especially if fraud is eating your lunch.

It’s not just another filter.

It’s a decision-making engine.

Built specifically for the challenges of online transactions.

In the world of Security and Moderation, it’s a heavy hitter.

Focusing solely on the transactional side.

Protecting your revenue.

And letting you focus on selling.

Not chasing down dodgy orders.

Key Features of Riskified for Fraud Detection

Alright, let’s break down what this thing actually does.

What are the nuts and bolts?

The features that make it tick?

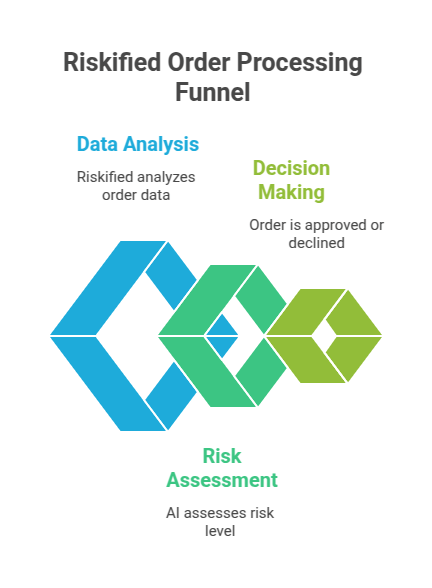

- Advanced AI and Machine Learning:

This is the core engine.

Riskified doesn’t use simple rules.

Like, “if the billing address is different from shipping, block it.”

That blocks good customers.

Bad move.

It uses complex algorithms.

It learns from billions of transactions across its network.

It looks for patterns.

Connections that humans would miss.

Or take forever to find.

This AI gets smarter over time.

Adapting to new fraud tactics.

That’s crucial because fraudsters don’t stand still.

They evolve.

Your defenses need to evolve too.

- Identity Verification:

How do you know if the person placing the order is actually who they say they are?

Riskified digs deep.

It verifies the customer’s identity.

It links digital identity signals.

Cross-references data points.

Is this device associated with this user before?

Is the email address linked to legitimate activity?

It builds a picture of the user.

Goes way beyond just checking if the card number matches the address.

This reduces false positives.

Approves more good orders.

Which is just as important as blocking bad ones.

Maybe more important.

- Chargeback Guarantee:

This is the big one.

Their confidence guarantee.

Riskified reviews the order.

Decides if it’s approved or declined.

If they approve it, they stand behind that decision.

If that approved order turns out to be fraudulent later…

And you get hit with a chargeback…

Riskified pays you back the money you lost.

The cost of the goods.

The chargeback fees.

Everything.

This completely changes your risk model.

You’re not carrying the fraud risk anymore.

They are.

This single feature is why many big players use Riskified.

- Policy Protect (Abuse Prevention):

Fraud isn’t just stolen cards.

It’s also policy abuse.

Things like fraudulent returns.

Promotion abuse.

Chargeback fraud (friendly fraud).

Riskified extends its capabilities to tackle these issues too.

It uses its data and AI to identify patterns of abuse.

Customers who always claim packages didn’t arrive.

People who return used items.

This protects your business from losses beyond traditional payment fraud.

It’s about Security and Moderation across the customer journey.

- Seamless Integration:

How easy is it to plug in?

Riskified integrates with major e-commerce platforms.

Payment gateways.

Order management systems.

The goal is minimal disruption.

Orders flow through Riskified in real-time.

Decisions come back fast.

Approving good orders quickly.

Declining bad ones instantly.

Without adding friction for legitimate customers.

These features combined create a powerful system.

It’s built to handle the scale and complexity of modern e-commerce fraud.

It’s not just a tool; it’s a strategic partner for Fraud Detection.

Letting you trust your checkout process.

And trust your customers.

Benefits of Using Riskified for Security and Moderation

Okay, so that’s what it does.

But what’s in it for you?

Why should you care?

The benefits are significant.

Especially if you’re serious about scaling your online business.

First, the big one: Reduced Fraud Losses.

This is the most obvious benefit.

Riskified’s core job is to stop fraud.

Their AI is good at it.

Identifying risky orders before they ship.

And with the chargeback guarantee, you’re protected even if one slips through their net.

This directly impacts your profitability.

Less money lost to fraudulent transactions.

Second: Increased Revenue (Approved Orders).

This is often overlooked.

When you’re scared of fraud, you tend to be overly cautious.

Declining orders that look slightly suspicious.

Maybe the shipping address is different.

Maybe it’s a new customer buying expensive items.

Manual review teams often play it safe.

Riskified’s AI is more accurate.

It can distinguish between a risky order and a good order that just looks a bit different.

This means fewer false positives.

More legitimate orders get approved.

More sales go through.

That’s pure revenue gain.

Third: Lower Operational Costs.

Manual fraud review is expensive.

You need staff.

Training.

Tools.

It takes time.

Especially during peak seasons.

Black Friday.

Christmas.

Fraud teams get swamped.

Orders pile up.

Riskified automates most of this.

Freeing up your team.

They can focus on other important things.

Like growth.

Or strategy.

Or maybe just go home on time.

You spend less on salaries and infrastructure for manual review.

Fourth: Improved Customer Experience.

Getting your order declined for no reason is frustrating.

It makes customers think twice about buying from you again.

Maybe they go to a competitor.

Riskified’s higher approval rates mean fewer good customers get rejected.

Legit orders are processed faster.

Customers get their stuff quicker.

Happy customers come back.

Simple.

It builds trust and loyalty.

Fifth: Scalability.

Your business is growing.

Great.

Can your manual fraud team handle double, triple, ten times the orders?

Probably not without massive hiring.

Riskified is built to scale.

Its AI can process millions of transactions.

Instantly.

As your volume increases, Riskified handles it.

Without you needing to massively ramp up staff.

This is key for sustainable growth.

Using Riskified isn’t just about stopping fraud.

It’s about optimizing your entire checkout and risk management process.

It’s a comprehensive approach to Security and Moderation in e-commerce.

Saving you money, making you more money, and making customers happier.

Pricing & Plans

Alright, the million-dollar question (or maybe just the thousand-dollar question).

How much does this thing cost?

And what do you get?

Riskified doesn’t publish standard pricing tiers on their website like many SaaS tools.

Why?

Because their pricing is typically customized.

It’s based on several factors:

Your transaction volume.

The average order value.

Your specific industry.

Your current fraud rate.

Which specific products or services you need (e.g., just order approval, or policy protect too).

So, there’s no simple “Basic,” “Pro,” “Enterprise” plan with fixed monthly fees.

You need to contact their sales team.

They’ll assess your business needs.

Analyze your data (often they run a trial period to see your real-world numbers).

Then they provide a quote.

How is it usually structured?

Often, it’s a percentage of approved transaction value.

Or a fixed fee per approved transaction.

This model aligns their success with yours.

They get paid more when they approve more good orders.

And remember, if they approve a fraudulent one under the guarantee, they pay *you*.

Is there a free plan?

No.

Riskified is not a free tool.

It’s a premium enterprise-level solution.

It’s an investment.

It’s designed for businesses where fraud losses, manual review costs, and false declines are significant problems worth solving with a sophisticated system.

How does it compare to alternatives?

There are other Fraud Detection tools out there.

Some are simpler rule-based systems.

Some are more basic AI tools.

Some are network-based approaches.

Riskified’s key differentiators are often its scale of network data, the sophistication of its AI, and crucially, the chargeback guarantee.

Many competitors don’t offer that guarantee.

They just give you a score or a recommendation.

You still bear the risk.

Riskified takes on the risk for approved transactions.

That distinction is worth a premium for many businesses.

Expect the pricing discussion to be detailed.

They’ll want to understand your specific fraud challenges.

Your volume.

Your current costs.

They’ll build a business case showing the ROI.

How much you stand to save on fraud and manual review.

How much you’ll gain from higher approval rates.

The cost is substantial compared to basic tools.

But the potential return on investment can be massive for the right size business.

Think of it like hiring a top-tier security firm for your online store.

It costs more than a single security camera.

But they prevent bigger losses.

And give you peace of mind.

That’s the Riskified model.

Hands-On Experience / Use Cases

Alright, enough theory.

What does it look like in practice?

Imagine you run an online electronics store.

High-value items.

Phones, laptops, cameras.

Fraudsters love this stuff.

You’re currently using some basic fraud filters in your payment gateway.

And you have a small team manually reviewing orders.

Especially the big ones.

Or ones shipping to different addresses.

It takes hours every day.

Sometimes orders are delayed because the team can’t keep up.

You’re getting hit with chargebacks every month.

Painful.

Enter Riskified.

You integrate it into your workflow.

Could be through an API.

Or a pre-built connector for your platform.

Now, every order goes through Riskified.

An order comes in:

Customer buys a £1500 laptop.

Shipping address is different from billing.

Usually, this would flag for manual review.

Maybe even auto-decline.

Riskified gets the order data instantly.

It analyses hundreds of signals.

Is this customer’s device recognised?

Have they ordered from you before?

What about other stores in Riskified’s network?

Is the shipping address a known freight forwarder or high-risk location?

What’s the typical behaviour for a customer buying this product?

How does this customer’s digital footprint look?

Within seconds, Riskified gives a decision: Approve or Decline.

In this laptop example, maybe Riskified sees the customer is using a device they’ve used before for legitimate purchases on other sites.

The email address and phone number check out.

The shipping address, while different, isn’t high-risk and is a residential address.

Riskified’s AI determines the risk is low.

Decision: Approve.

The order is automatically processed for shipping.

No manual review needed.

Customer is happy, order ships fast.

You get paid.

Another order comes in:

High-value camera.

New customer.

Using a public VPN.

Email address looks suspicious (random letters/numbers).

Shipping address is a known commercial post box service linked to past fraud.

Riskified analyses.

Multiple high-risk signals stack up.

Low confidence in the user’s identity.

Decision: Decline.

The order is blocked instantly.

You avoid a potential chargeback.

No manual work.

The usability is designed for automation.

Once integrated, it largely works in the background.

Your team interacts with a dashboard to see overall stats.

Approval rates.

Declined orders.

Chargeback notifications.

They can dig into specific orders if needed, but the bulk of the decision making is automated.

The results for businesses using Riskified often show:

A significant drop in chargebacks.

An increase in approved orders (lower false decline rate).

A reduction in the time and cost spent on manual review.

Faster order processing.

It takes the heavy lifting out of Fraud Detection.

It lets you focus on running your business.

Instead of being bogged down in risk assessment.

That’s the real impact of using a tool like this.

Who Should Use Riskified?

Is Riskified for everyone?

Probably not.

As we touched on with pricing, it’s a premium solution.

So, who is it built for?

Large to Medium-Sized E-commerce Businesses: If you process a significant volume of online orders, especially with high average order values, Riskified is likely a good fit. Businesses doing tens of thousands or more orders per month often see the most ROI.

Businesses with High Fraud Rates: If you’re constantly battling chargebacks and fraudulent transactions, the cost of Riskified might be less than your current fraud losses. The guarantee model is particularly attractive here.

Companies Selling High-Risk Goods: Electronics, luxury items, gift cards, digital goods – these are magnets for fraudsters. If your product catalogue includes such items, your fraud exposure is higher, making advanced protection more necessary.

Businesses Struggling with Manual Review Costs and Delays: If you’ve had to hire a team just to review orders, or if manual review is slowing down your shipping times, Riskified can automate and accelerate this process.

Businesses with Aggressive Growth Plans: If you plan to significantly increase your transaction volume, you need a fraud solution that can scale with you without proportional increases in operational cost. Riskified is built for scalability.

Companies Focused on Customer Experience: If reducing false declines and speeding up legitimate orders is a priority to keep customers happy, Riskified’s high approval rates are a key benefit.

Businesses Facing Policy Abuse Issues: Beyond just payment fraud, if you’re losing money to return fraud, promotion abuse, or friendly fraud, Riskified’s Policy Protect features can address these.

Who might NOT be the best fit?

Very small businesses with low transaction volume. The cost will likely outweigh the benefits.

Businesses with extremely low-value items where the cost per transaction for Riskified might be too high relative to the margin.

Companies selling goods or services where fraud is not a significant issue.

Riskified is an enterprise-grade tool for businesses that are serious about tackling complex Fraud Detection and operational efficiency at scale.

It’s an investment in protecting and growing your revenue, tailored for those facing the real-world challenges of online transaction risk.

How to Make Money Using Riskified

Okay, you’re running a business.

You use Riskified.

How does that actually translate into making *more* money?

It’s not a direct “service you sell” kind of tool, unless you’re an agency providing risk management.

For most businesses, making money with Riskified is about optimization and protection.

- Reduce Direct Losses:

The most straightforward way.

Riskified stops fraudulent orders.

Every fraudulent order stopped is money saved.

Money you would have lost to chargebacks, lost goods, shipping costs, and fees.

That saving goes straight to your bottom line.

With the chargeback guarantee, the risk of loss on approved orders is transferred.

This is pure profit protection.

- Increase Approved Order Rate:

This is huge.

Manual systems or less sophisticated tools decline good orders.

Orders from customers who were ready to buy.

Every false decline is lost revenue.

Riskified’s AI is better at identifying legitimate orders.

This means a higher percentage of orders get approved.

More sales completed.

More revenue generated from the same traffic.

That’s making money directly by improving your conversion funnel at the checkout stage.

- Decrease Operational Costs:

We talked about this.

Manual review teams are expensive.

By automating Fraud Detection, you need fewer people doing that specific task.

Or your existing team can be repurposed to more value-generating activities.

The money saved on salaries, training, and infrastructure is profit.

It’s like cutting expenses, which is just as good as increasing revenue.

Maybe better.

- Improve Customer Lifetime Value:

When good customers have a smooth buying experience…

Orders processed fast.

No false declines.

They are more likely to return.

Repeat customers are gold.

They cost less to acquire.

They buy more over time.

Riskified contributes to a positive experience that encourages repeat business.

This increases the total revenue you get from each customer over their lifetime.

- Enable Expansion into Riskier Markets/Products:

Maybe you avoided selling in certain geographies known for higher fraud rates.

Or maybe you held back on launching high-value product lines.

With Riskified’s protection, you can confidently expand into these areas.

Capturing new market share.

Selling higher-margin goods.

This unlocks new revenue streams previously deemed too risky.

Consider a real case study example (hypothetical, based on common outcomes):

An e-commerce site selling luxury goods was losing 2% of revenue to fraud chargebacks.

They also had a 5% false decline rate on manual reviews, losing potential sales.

And they had a team of 5 people doing manual review.

After implementing Riskified:

Fraud losses dropped to almost zero (thanks to the guarantee).

The approval rate increased by 4%.

The manual review team was reduced to 1 person focused on edge cases and reporting.

The savings on fraud losses and manual review alone paid for Riskified’s fees.

The 4% increase in approved orders on their volume added significant net new revenue.

Their operations became faster, leading to happier customers and more repeat business.

This isn’t just theoretical.

These are the kinds of results businesses report.

Using Riskified makes you money by plugging leaks in your funnel, cutting costs, and boosting successful transactions.

Limitations and Considerations

Nothing is perfect.

Riskified is powerful, but it has limitations and things you need to consider.

Cost: As discussed, it’s not cheap. It’s an enterprise solution with enterprise pricing. If you’re a small business, the cost might be prohibitive. You need significant transaction volume or high-value items to justify the investment.

Integration Effort: While they offer integrations, implementing a system like Riskified isn’t always plug-and-play, especially for complex or custom e-commerce setups. It requires technical resources to integrate properly and test thoroughly.

Reliance on AI Decisions: You’re trusting an AI to make critical decisions about approving or declining orders. While Riskified has a guarantee, relying solely on AI means you need to be comfortable with giving up some direct control over this process. You need to trust their model.

Complexity of Fraud: Fraudsters constantly adapt. While Riskified’s AI learns, there can be periods where new fraud vectors emerge that the AI needs time to fully understand and mitigate. No system catches everything instantly.

Not a Full Security and Moderation Suite: Riskified focuses heavily on transaction and policy abuse risk. It’s not a web application firewall, a content moderation tool, or a general cybersecurity platform. It solves a specific set of problems within the broader Security and Moderation category. You’ll still need other tools for different security needs.

Data Dependency: The AI’s effectiveness relies on data – both from your business and its network. The more data, the smarter it gets. New businesses or those with very unique models might require a learning period.

Contract Lock-in: Enterprise solutions often come with contracts, typically for a year or more. This means you’re committing to the platform for a period, regardless of short-term fluctuations in your business.

Before committing, do your research.

Understand your current fraud costs and false decline rates accurately.

Get a clear understanding of Riskified’s pricing based on your specific volume and needs.

Talk to other businesses in your industry that use it.

Consider a pilot program if possible to see real-world results with your data.

It’s a significant tool for Fraud Detection, but it’s not a magic bullet, and it comes with its own set of considerations.

Final Thoughts

So, wrapping this up.

Riskified is a serious player in the Security and Moderation space.

Specifically for Fraud Detection in e-commerce.

Its core value proposition is clear:

Use advanced AI to accurately approve more good orders and decline fraudulent ones.

And back that up with a chargeback guarantee.

This is a game-changer for businesses drowning in fraud losses or bogged down by manual review.

It allows them to scale confidently.

Reduce costs.

Increase revenue.

And improve the customer experience.

It’s not cheap, and it requires integration.

It’s not for every business, especially smaller ones.

But for the right business, the ROI can be substantial.

If you’re running a high-volume online store, selling high-risk goods, or suffering from significant fraud and operational inefficiencies…

You should definitely look at Riskified.

Don’t just think about the cost of the tool.

Think about the cost of NOT using it.

Lost revenue from false declines.

Money lost to chargebacks.

The expense of a large manual review team.

The opportunity cost of delayed orders and unhappy customers.

Riskified aims to turn your fraud department from a cost center into a revenue enabler.

By approving more good orders, faster.

My recommendation?

If you fit the profile of a medium to large e-commerce business with significant fraud exposure, evaluate Riskified seriously.

Reach out to them.

Understand their pricing for your specific case.

Explore a trial run if possible.

See how their AI performs with your actual transaction data.

It could be the tool that finally lets you sleep at night.

Knowing your revenue is protected.

And your good customers are getting their orders fast.

Visit the official Riskified website

Frequently Asked Questions

1. What is Riskified used for?

Riskified is primarily used by e-commerce businesses for online Fraud Detection and prevention. It uses AI and machine learning to review online orders and determine if they are legitimate or fraudulent. It aims to reduce chargebacks and increase approval rates of good orders.

2. Is Riskified free?

No, Riskified is not a free service. It is a premium, enterprise-level solution designed for medium to large-sized businesses with significant online transaction volume. Pricing is typically custom and based on factors like transaction volume and average order value.

3. How does Riskified compare to other AI tools?

Compared to simpler AI or rule-based fraud tools, Riskified often stands out due to its extensive network data, sophisticated AI model, and unique chargeback guarantee. While other tools might provide risk scores, Riskified takes on the financial risk for approved transactions that turn out to be fraudulent.

4. Can beginners use Riskified?

Riskified is designed for businesses with existing transaction volume and potentially a team managing e-commerce operations. While the end-user interface for monitoring is user-friendly, integrating and configuring Riskified typically requires technical expertise. It’s not aimed at individuals or very small startup businesses.

5. Does the content created by Riskified meet quality and optimization standards?

Riskified doesn’t create content in the way AI writing tools do. Its function is analysing transaction data for Fraud Detection. Therefore, this question isn’t applicable to Riskified.

6. Can I make money with Riskified?

Yes, businesses make money with Riskified indirectly. By preventing fraud losses, reducing operational costs associated with manual review, increasing the approval rate of legitimate orders, and improving customer experience leading to repeat business, Riskified helps businesses increase profitability and revenue.