Kount empowers robust Fraud Detection, safeguarding your business from threats. Protect revenue, prevent chargebacks, and boost customer trust. Start optimising your security now!

Say Goodbye to Manual Fraud Detection – Hello Kount

You’re probably wrestling with fraud.

It’s a constant battle, isn’t it?

Manual reviews, missed red flags, chargebacks eating into your profits.

The digital landscape is a minefield for businesses.

Scammers are getting smarter, faster, and more sophisticated every single day.

Traditional methods? They just can’t keep up.

I get it. The pressure to protect your assets, maintain customer trust, and keep your bottom line healthy is immense.

But what if I told you there’s a smarter way?

A way to not just react to fraud, but to anticipate it, stop it dead in its tracks.

Welcome to Kount.

This isn’t just another tool; it’s a game-changer for anyone serious about Security and Moderation, especially when it comes to Fraud Detection.

AI isn’t some futuristic concept anymore; it’s here, and it’s revolutionising how we tackle these critical challenges.

It harnesses the power of AI to give you an unfair advantage against fraudsters.

Ready to ditch the spreadsheets and endless manual checks?

Let’s unpack how Kount can transform your operations.

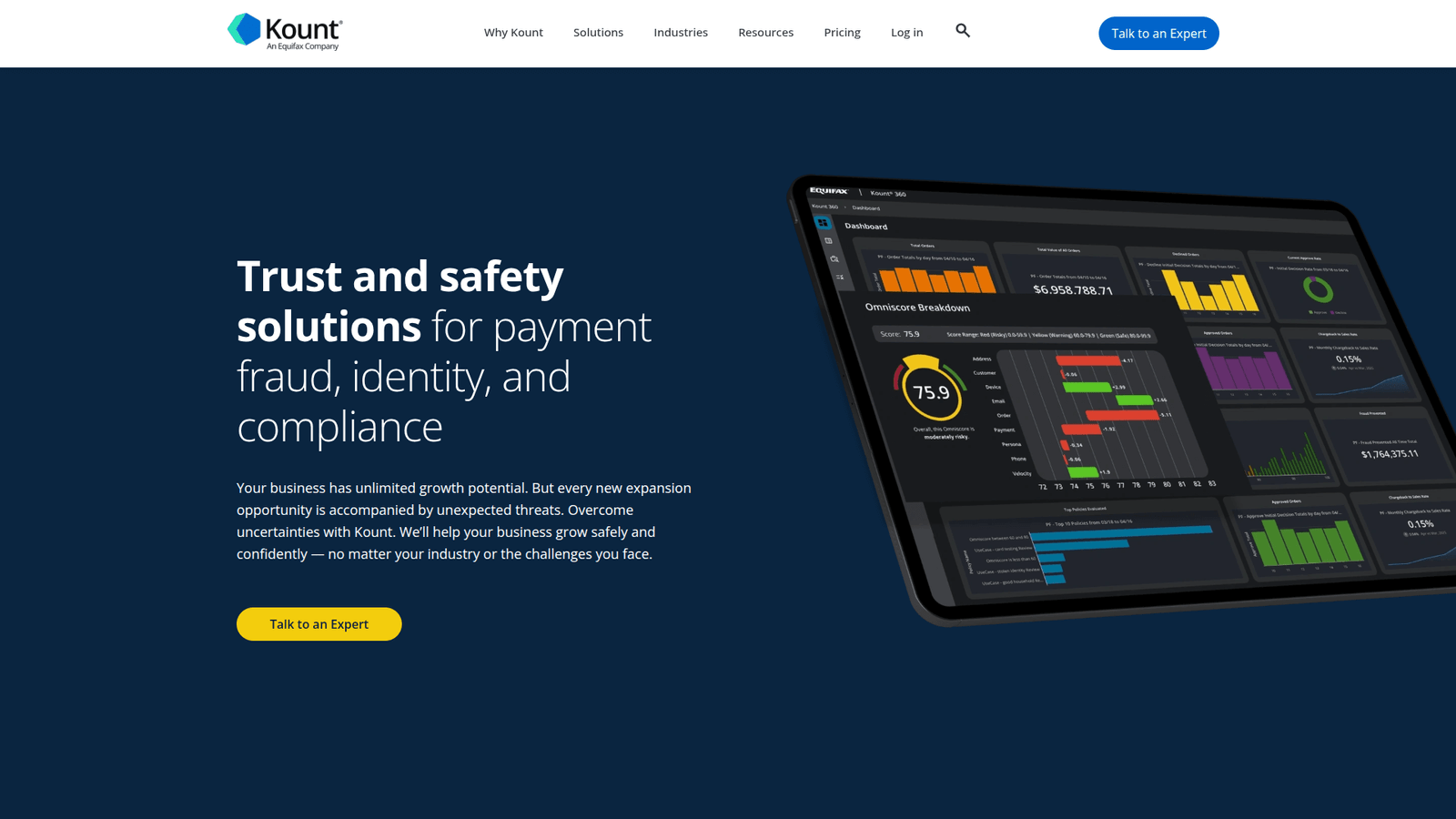

What is Kount?

Okay, let’s get straight to it. What exactly is Kount?

Kount is an AI-powered fraud prevention solution. It’s built to protect businesses from online fraud, chargebacks, and account takeovers.

Think of it as your digital bouncer, standing at the door of your online business, scrutinising every single transaction and interaction.

It uses a combination of machine learning, artificial intelligence, and a vast global network of data to detect and prevent fraudulent activities in real-time.

Kount’s core function is pretty simple: it helps you accept more good orders and reject more bad ones.

This means less revenue lost to scammers, fewer chargebacks hitting your bank account, and a much smoother experience for your legitimate customers.

It’s not just about stopping fraud; it’s about enabling growth.

By minimising fraud risk, Kount empowers businesses to expand into new markets and offer new payment methods with confidence.

Who is it for?

Anyone operating an online business, from small e-commerce shops to large enterprises.

If you handle online payments, subscriptions, or manage user accounts, you’re a target for fraudsters.

Kount helps you fight back effectively.

Its system works across multiple channels, too: web, mobile, and even call centres.

This unified approach ensures consistent protection, no matter how customers interact with your business.

The beauty of it lies in its ability to adapt.

Fraudsters are always evolving their tactics, and a static fraud detection system is a dead system.

Kount’s AI models constantly learn from new data, ensuring they remain effective against emerging threats.

It’s essentially giving you a fraud prevention team that never sleeps, never takes a holiday, and is always getting smarter.

This frees up your internal teams to focus on what they do best: growing your business, not chasing down suspicious transactions.

It’s about making your life easier, your business safer, and your profits higher.

That’s Kount in a nutshell.

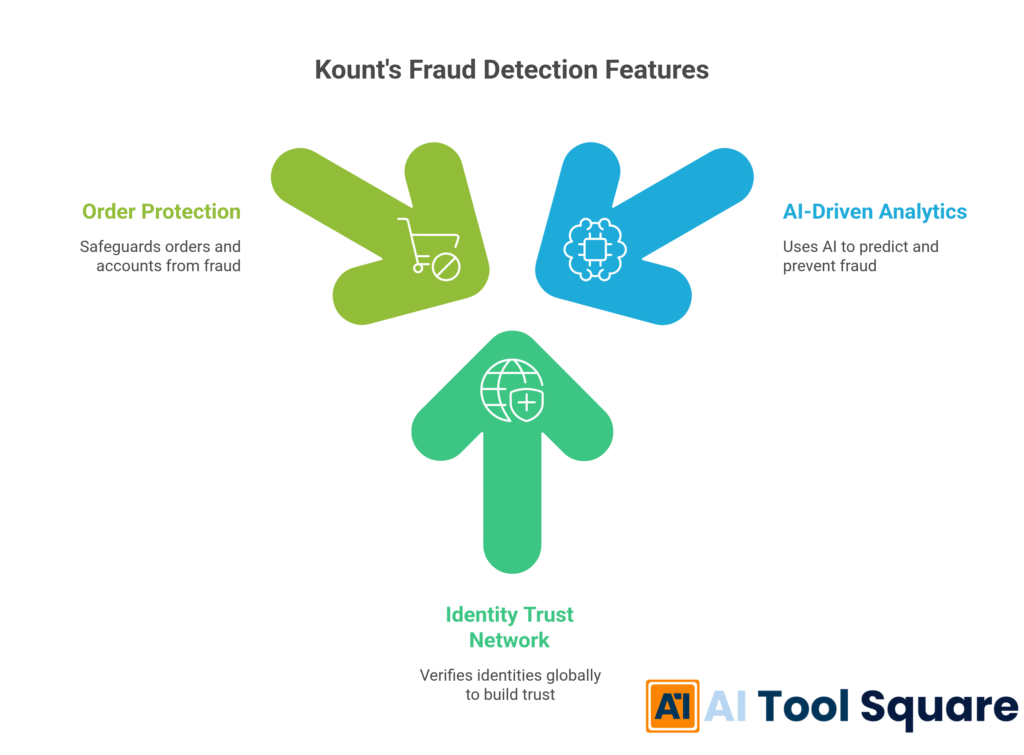

Key Features of Kount for Fraud Detection

Alright, let’s break down the mechanics. What specific features does Kount bring to the table for Fraud Detection? These aren’t just buzzwords; they’re critical components that deliver real results.

- AI-Driven Predictive Analytics:

This is where Kount truly shines. It doesn’t just look at individual data points; it analyses billions of data points in real-time.

Think about it: every transaction, every login attempt, every customer interaction generates data.

Kount’s AI engine processes this massive volume of information, looking for patterns, anomalies, and hidden connections that indicate fraud.

It uses predictive analytics to score each transaction for risk, giving you an immediate thumbs up or thumbs down.

This means you can automatically approve legitimate orders and decline fraudulent ones, all within milliseconds.

No more waiting, no more manual reviews bogging down your operations.

It’s about moving at the speed of the internet, not the speed of human review.

This precision reduces false positives, ensuring you don’t turn away good customers, which is just as important as stopping fraudsters.

- Identity Trust Global Network:

Imagine a network that shares fraud intelligence across thousands of businesses worldwide. That’s Kount’s Identity Trust Global Network.

It’s a massive, anonymised database of fraud signals and behaviours.

When a fraudster attempts an attack on one business using it, that information is used to protect all other businesses in the network.

It’s like having a collective immunity against fraud.

This network allows Kount to identify emerging fraud trends and notorious fraudsters much faster than any single business could on its own.

It helps to distinguish trusted customers from risky ones with incredible accuracy, by cross-referencing global data.

This shared intelligence is a huge advantage, especially against organised crime rings that target multiple merchants.

You’re not just protecting your business; you’re contributing to a larger defence system.

This collective power elevates the baseline of security for everyone involved.

- Order and Account Protection:

Fraud isn’t just about credit card transactions anymore. Account takeovers are a massive problem.

Kount addresses this with comprehensive order and account protection features.

It monitors everything from login attempts, password resets, and changes to account details, to identifying bot attacks trying to breach your customer accounts.

This multi-layered approach safeguards your customers’ identities and prevents fraudsters from using stolen credentials.

For orders, Kount scrutinises all transaction details – IP address, device used, billing and shipping addresses, payment method, and purchase history.

It flags suspicious elements that might indicate a fraudulent order, even if the payment method seems legitimate.

The result? Reduced chargebacks, fewer losses from stolen goods, and higher customer satisfaction because their accounts are secure.

It also helps in preventing friendly fraud, where legitimate customers dispute charges they made, by providing robust data to challenge chargebacks.

Ultimately, it’s about comprehensive protection that covers all angles of potential fraud, securing both your revenue and your reputation.

Benefits of Using Kount for Security and Moderation

So, why should you care about Kount? What’s the real payoff for your Security and Moderation efforts? It boils down to a few critical areas where it makes a huge difference.

First up: Massive Time Savings.

Think about how much time your team currently spends on manual fraud reviews.

Sifting through suspicious orders, cross-referencing details, making calls, sending emails – it’s a huge time sink.

Kount automates a significant portion of this.

Its AI makes real-time decisions, approving good orders instantly.

This frees up your security team to focus on truly complex cases or higher-value strategic initiatives.

They can stop being reactive fraud fighters and start being proactive risk managers.

It means less busywork, more impact.

Next: Improved Fraud Detection Accuracy.

Humans are good, but AI is better at pattern recognition on a massive scale.

Kount’s machine learning algorithms can spot subtle indicators of fraud that human eyes would easily miss.

This leads to a dramatic reduction in false positives (good customers blocked) and false negatives (fraudulent orders slipping through).

The result is fewer chargebacks, less revenue leakage, and a stronger bottom line.

You’re not just guessing; you’re making data-driven decisions with high confidence.

Then there’s Enhanced Customer Experience.

Nothing is more frustrating for a customer than a legitimate order being declined due to a false fraud alert.

It damages trust and can drive them straight to your competitors.

By accurately identifying good customers, Kount ensures their transactions go through smoothly and quickly.

This means happier customers, more repeat business, and a stronger brand reputation.

A seamless checkout process is a competitive advantage.

Also, Protection Against Emerging Threats.

Fraudsters don’t stand still. Their tactics are constantly evolving.

Traditional rule-based systems quickly become outdated.

Kount’s AI continuously learns and adapts to new fraud patterns, drawing insights from its vast global network.

This means you’re always protected against the latest threats, often before they even become widespread.

It’s like having an immune system that gets stronger with every new virus it encounters.

Finally: Significant Cost Reductions.

Fewer chargebacks mean fewer fees and less lost revenue.

Reduced manual review time means lower operational costs.

Preventing account takeovers saves you from costly customer service issues and reputational damage.

Kount directly impacts your profitability by cutting down these various fraud-related expenses.

It’s an investment that pays for itself, often many times over, by plugging the leaks in your revenue stream.

These are the tangible benefits. Kount isn’t just a fancy tech toy; it’s a strategic asset for any business serious about protecting itself and its customers.

Pricing & Plans

Alright, let’s talk money. This is where the rubber meets the road.

Is Kount going to break your budget? How does it stack up against other options?

It doesn’t typically publish a straightforward pricing table on their website.

This is common for enterprise-grade solutions in the fraud prevention space.

Why? Because pricing is usually tailored to the specific needs of each business.

Factors like your transaction volume, industry, specific fraud risks, and the features you need will all influence the final cost.

So, no “free plan” for Kount in the traditional sense.

You’re looking at a premium service designed for businesses with significant online operations.

However, they do offer demos and consultations.

This means you’ll need to contact their sales team directly.

During this consultation, you can discuss your business’s unique requirements, and they will then provide a customised quote.

What does a premium version typically include?

Everything we’ve talked about:

Real-time AI-driven risk scoring.

Access to the Identity Trust Global Network.

Comprehensive order and account protection.

Detailed reporting and analytics dashboards.

Integration capabilities with your existing e-commerce platforms and payment gateways.

Dedicated account management and support.

The value proposition isn’t about being the cheapest; it’s about delivering the most effective fraud prevention.

When you consider the potential losses from fraud – chargebacks, lost merchandise, operational costs of manual reviews, damaged customer trust – the investment in a robust solution like Kount often provides a significant return.

How does it compare to alternatives?

Many payment processors offer basic fraud tools, but these are often reactive and less sophisticated.

There are other dedicated fraud prevention vendors, too, each with their own strengths.

Kount distinguishes itself through its advanced AI, its vast global network, and its focus on holistic protection across the entire customer journey.

It’s not just about approving or declining a transaction; it’s about understanding the entire context of identity and trust.

Before committing, you’d want to:

1. Get a detailed understanding of your own fraud rates and losses.

2. Have a clear picture of how much manual effort your team spends on fraud.

3. Request a comprehensive proposal from Kount, outlining specific features and projected ROI.

4. Compare that proposal against other top-tier solutions in the market.

In essence, Kount is an enterprise-level investment for businesses serious about shutting down fraud and accelerating growth. It’s not a casual plug-in; it’s a strategic partnership.

Hands-On Experience / Use Cases

Okay, enough theory. How does Kount actually work when you’re in the trenches?

Let me paint a picture with a couple of use cases.

Imagine you run an e-commerce store selling high-value electronics.

High-value items? Magnets for fraudsters.

Before Kount, your team spent hours every day manually reviewing suspicious orders.

A customer places an order for two top-tier smartphones.

The billing address is in London, but the shipping address is a freight forwarder in Miami.

The payment method is a credit card, but the email address is a recently created free webmail account.

Red flags everywhere, right?

Manually, your team would:

1. Hold the order.

2. Try to call the customer – no answer.

3. Google the shipping address – confirms it’s a freight forwarder.

4. Check the IP address – might or might not match.

5. Ultimately, it’s a gut feeling, a coin toss, potentially hours of work for one order.

Now, with it.

That same order comes in.

Kount processes it in milliseconds.

Its AI looks at the device ID, the IP address, the email, the card details, the shipping address, the billing address, the order value, and cross-references all of this with its global network.

It sees that this specific device ID has been associated with chargebacks across five other merchants in the last week.

It flags the freight forwarder as a known fraud risk.

It identifies a pattern where this exact combination of factors almost always leads to a chargeback.

Kount assigns a high-risk score, say 95 out of 100.

Based on your pre-set rules, it automatically declines the transaction.

The fraudster is stopped.

Your inventory is safe.

No chargeback fees.

No lost merchandise.

Your team never even saw it, because Kount handled it.

Another use case: protecting subscription services.

Imagine a SaaS company struggling with free trial abuse and account takeovers.

Fraudsters sign up for multiple free trials using stolen identities or payment details, then sell access to premium features on the black market.

Or, legitimate customer accounts get compromised, leading to unauthorised usage or even data breaches.

It steps in at the sign-up stage.

It analyses the user’s device, IP, email domain, and other registration data.

If someone is trying to create 20 accounts from the same device or IP with slightly different email addresses, Kount flags it.

It also monitors login attempts.

If an account that normally logs in from London suddenly attempts to log in from Beijing with a suspicious IP, it alerts you, or even blocks the login automatically.

This reduces trial abuse, secures customer accounts, and maintains the integrity of your service.

The usability of Kount’s platform is designed for clarity.

While the AI works behind the scenes, the dashboard provides clear insights.

You see risk scores, reasons for decisions, and detailed data points for any transaction that might require manual review (which are far fewer).

It’s powerful, yet accessible.

The results? Businesses report significant reductions in chargebacks (often 50% or more), substantial increases in auto-approval rates, and reclaim countless hours previously wasted on manual reviews.

It just works, letting you focus on growing your business, not constantly fighting fires.

Who Should Use Kount?

So, who really needs Kount? Is it for everyone, or just specific types of businesses?

Let’s cut through the noise.

Kount is for any business that processes online transactions or manages customer accounts and is serious about preventing fraud.

If you’re taking payments over the internet, you’re a target. Period.

Here are the ideal user profiles:

E-commerce Businesses (Small to Enterprise): This is the most obvious one. If you sell physical or digital goods online, you’re constantly at risk of credit card fraud, friendly fraud, and identity theft. Kount helps you approve more legitimate orders while blocking the bad ones, protecting your revenue and reputation.

Subscription Services & SaaS Companies: Dealing with free trial abuse, account takeovers, and payment fraud is a huge challenge here. Kount ensures account integrity, reduces churn from fraudulent sign-ups, and protects recurring revenue streams.

Online Marketplaces: If you facilitate transactions between multiple buyers and sellers, you have a complex fraud landscape. Kount can help protect both sides of the transaction, building trust in your platform.

Gaming & Gambling Platforms: These industries are particularly susceptible to bonus abuse, payment fraud, and account takeovers. Kount provides the robust real-time detection needed to maintain fair play and protect high-value accounts.

Travel & Ticketing Services: High-value transactions, international customers, and often non-refundable purchases make these businesses prime targets for fraud. Kount helps reduce chargebacks from stolen credit cards used for flights, hotels, and event tickets.

Financial Services & Fintech: While heavily regulated, these companies still face fraud at every touchpoint – from new account applications to online banking transactions. Kount offers an extra layer of real-time security to protect sensitive financial data and prevent illicit activities.

Any Business Experiencing High Chargeback Rates: If your chargeback-to-transaction ratio is eating into your profits and threatening your merchant accounts, Kount is a vital tool to bring that under control.

Businesses Looking to Expand Globally: Entering new markets with different fraud patterns is risky. Kount’s global network provides insights into regional fraud trends, allowing you to expand confidently without being blindsided.

Teams Overwhelmed by Manual Fraud Reviews: If your operations team spends more time fighting fraud than growing the business, Kount automates and streamlines processes, freeing up valuable resources.

Basically, if your business relies on online interactions and transactions for revenue, and you want to reduce fraud, protect your customers, and grow confidently, it is a serious contender. It’s an investment in your business’s future security and profitability.

How to Make Money Using Kount

Alright, so you get Kount helps stop losing money to fraud. But can it actually help you make more money?

Absolutely. It’s not just about cost savings; it’s about revenue generation and efficiency.

- Service 1: Offer Fraud Prevention Consulting & Implementation:

If you’re an agency or a consultant, learning Kount inside and out opens up a huge revenue stream.

Many businesses, especially small to medium-sized ones, know they have a fraud problem but lack the expertise to implement a robust solution.

You can position yourself as the expert.

Offer services to help businesses:

1. Evaluate their current fraud landscape.

2. Customise and configure it to their specific needs (rules, policies, integrations).

3. Train their teams on how to use the Kount dashboard effectively.

4. Provide ongoing monitoring and optimisation of their Kount setup.

Think about it: you’re not just selling a tool; you’re selling peace of mind and tangible savings.

You could charge a setup fee, a monthly retainer for management, or even a percentage of the fraud reduction achieved.

This is a high-value service because the ROI for businesses is direct and measurable.

- Service 2: Enhance Your Own Business’s Profitability:

This is for those using Kount for their own operations.

The most obvious way it helps you make money is by **reducing chargebacks.**

Every chargeback prevented is money saved and revenue retained.

But it goes beyond that.

Kount’s accuracy allows you to **increase your auto-approval rates.**

Think about how many good orders you might be declining or manually reviewing just to be safe.

By approving more legitimate transactions instantly, you convert more sales that might otherwise be abandoned or delayed.

This directly boosts your top-line revenue.

You also **save on operational costs.**

Less time spent on manual fraud reviews means your staff can focus on growth-oriented tasks: marketing, product development, customer service.

This translates into more efficient operations and higher productivity.

Furthermore, a strong fraud prevention system builds customer trust.

Customers feel safer shopping with you, leading to **increased loyalty and repeat business.**

A reputation for security is a powerful differentiator.

- Service 3: Provide Data-Driven Risk Assessment for Other Businesses:

Leverage Kount’s analytical capabilities to offer specialised risk assessment services.

For instance, a new startup might want to assess the fraud risk of expanding into a specific geographic region or launching a new payment method.

Using Kount’s insights, you could provide detailed reports on:

1. Expected fraud rates for different customer segments.

2. Recommended fraud rules and thresholds.

3. Insights into common fraud tactics in specific markets.

This is a niche, high-value service.

You’re selling actionable intelligence derived from a powerful AI tool.

Another angle: if you work with multiple clients in a specific industry, you can become the go-to expert for fraud trends within that sector, drawing insights from Kount’s aggregated data.

This transforms you from a general service provider into a specialised risk management partner.

Case Study Example: How “SecureCart Solutions” Makes $10K/month Using Kount for Fraud Detection

“SecureCart Solutions,” a small consulting firm run by John and Sarah, previously offered general e-commerce consultancy.

They saw many of their clients losing significant amounts to fraud and struggling with chargebacks.

They decided to specialise.

John and Sarah invested heavily in understanding it.

They became certified Kount partners (if such a program exists, or simply deep experts).

Their service involved:

1. Conducting a “Fraud Audit” for clients, using Kount’s reporting features to highlight vulnerabilities.

2. Implementing Kount from scratch, integrating it with the client’s existing e-commerce platform.

3. Customising Kount’s rule sets to precisely match the client’s risk appetite and customer base.

4. Training the client’s internal team on how to monitor dashboards and handle flagged transactions.

5. Offering ongoing “Fraud Optimisation” as a monthly retainer, where they would fine-tune rules, review performance, and adapt to new threats.

One client, an online apparel retailer, was losing $15,000 a month to chargebacks.

After SecureCart Solutions implemented and optimised Kount, the client saw chargebacks drop by 70% within three months.

SecureCart charged the retailer a $3,000 setup fee and a $1,000 monthly retainer for ongoing management.

With 10 such retainer clients, plus new setup fees, SecureCart Solutions now generates over $10,000 per month.

They make money by helping other businesses stop losing money. It’s a clear value exchange.

Limitations and Considerations

No tool is a magic bullet. Kount is powerful, but it’s important to go in with your eyes open.

Here are some limitations and considerations you need to keep in mind:

1. Cost Can Be a Barrier for Smaller Businesses:

As discussed, Kount is a premium, enterprise-grade solution.

It’s typically priced based on transaction volume and feature set.

For very small businesses with low transaction volumes, the cost might be prohibitive.

They might find more basic, cheaper fraud tools offered by their payment processors more accessible, even if less effective.

It’s an investment, and like any investment, you need the scale to see the return.

2. Integration Requires Technical Know-How:

Kount isn’t a simple plug-and-play browser extension.

Integrating it properly with your e-commerce platform, payment gateways, and other systems requires technical expertise.

This might involve developer resources, API integrations, and careful configuration.

If you don’t have an internal tech team, you might need to hire external consultants for the setup, adding to the initial cost and time.

3. Learning Curve for Optimisation:

While Kount’s AI does a lot of heavy lifting, effective fraud prevention isn’t entirely set-and-forget.

You’ll need to understand how to interpret the data, configure custom rules, and monitor performance.

Optimising it to your specific business model, customer base, and fraud patterns requires a learning curve.

It’s not just about turning it on; it’s about fine-tuning it to achieve the best balance between fraud prevention and customer experience.

4. Not 100% Fraud Proof:

No fraud prevention system, Kount included, can guarantee 100% fraud elimination.

Fraudsters are constantly innovating.

While Kount is incredibly effective at detecting known patterns and adapting to new ones, there will always be novel attack vectors.

The goal is to reduce fraud to an acceptable, manageable level, not eradicate it entirely.

Expect to still encounter a small percentage of fraud, but significantly less than before.

5. False Positives Can Still Happen:

While Kount dramatically reduces false positives, they can still occur.

Occasionally, a legitimate transaction might get flagged as high risk.

This often happens with unusual customer behaviour (e.g., a first-time high-value purchase, international travel patterns).

You need a process in place for manual review of these borderline cases to ensure you don’t turn away good customers.

It’s about finding that sweet spot.

6. Data Privacy and Compliance:

Kount handles sensitive transaction and customer data.

You need to ensure that its use aligns with your data privacy policies and complies with regulations like GDPR, CCPA, and PCI DSS.

It is built with these considerations in mind, but ultimately, the responsibility for compliance rests with your business.

You need to understand how data is collected, processed, and stored.

These aren’t deal-breakers, but they are important considerations. Kount is a powerful tool for serious businesses, and like any powerful tool, it requires some commitment and understanding to wield effectively.

Final Thoughts

Look, the world of online business isn’t getting any less risky.

Fraudsters are always sharpening their knives, and if you’re not keeping up, you’re losing money, reputation, and customer trust.

Kount isn’t just another piece of software; it’s a strategic defence mechanism.

It’s an investment that pays dividends by safeguarding your revenue, slashing chargebacks, and freeing your team from the endless grind of manual fraud reviews.

We’ve covered its powerful AI, its global network, and how it protects everything from individual transactions to entire customer accounts.

We’ve seen how it can be a profit center, not just a cost, enabling you to expand, serve more customers, and even offer consulting services.

Yes, it requires an investment, both financially and in terms of integration, but the alternative is far more costly.

The question isn’t whether you can afford Kount.

It’s whether you can afford *not* to have robust fraud protection in place.

If you’re serious about scaling your business, protecting your assets, and providing a seamless experience for your customers, Kount deserves a very close look.

It’s about making confident decisions in a complex, high-stakes environment.

So, what’s your next move?

If you’re battling fraud, losing sleep over chargebacks, or just know your current setup isn’t cutting it, then it’s time to take action.

Visit the official Kount website

Frequently Asked Questions

1. What is Kount used for?

Kount is primarily used for real-time online fraud detection and prevention. It helps businesses identify and block fraudulent transactions, prevent account takeovers, and reduce chargebacks by leveraging AI, machine learning, and a global data network.

2. Is Kount free?

No, Kount is not a free service. It is an enterprise-grade solution with customised pricing based on a business’s specific needs, transaction volume, and chosen features. You need to contact their sales team for a personalised quote.

3. How does Kount compare to other AI tools?

It stands out due to its advanced AI-driven predictive analytics, its extensive Identity Trust Global Network for shared fraud intelligence, and its comprehensive approach to protecting both orders and user accounts. While many tools offer basic fraud rules, Kount’s adaptive machine learning provides a more sophisticated, real-time defence against evolving threats.

4. Can beginners use Kount?

While Kount’s core AI works automatically, optimising its rules and interpreting its analytics dashboards does require some learning. It’s designed for businesses with dedicated security or operations teams, or those willing to invest in training or consulting for proper implementation and ongoing management.

5. Does the content created by Kount meet quality and optimization standards?

Kount doesn’t “create content” in the typical sense. It processes and analyses data to make fraud decisions. The quality of its output lies in its accuracy in identifying fraud and legitimate transactions, which is generally considered very high due to its advanced AI and global data insights.

6. Can I make money with Kount?

Yes, absolutely. By significantly reducing fraud losses and chargebacks, it directly helps businesses retain revenue and increase profitability. Additionally, you can make money by offering Kount implementation and optimisation services as a consultant, helping other businesses protect their assets.