Credit Karma AI revolutionises Credit Scoring and Analysis. Gain deeper insights and make smarter financial decisions faster. Start optimising your credit processes now!

Why Credit Karma AI Is a Game-Changer in Credit Scoring and Analysis

Ever feel like you’re drowning in data, trying to make sense of credit scores and financial reports?

The world of finance and law isn’t getting simpler. It’s getting more complex, faster.

For professionals knee-deep in Legal and Finance, especially when it comes to Credit Scoring and Analysis, time is money. And manual processes are a black hole for both.

AI isn’t just a buzzword anymore; it’s a critical tool. It’s reshaping how businesses operate, from automating mundane tasks to providing insights humans simply can’t generate at scale.

That’s where Credit Karma AI steps in. It’s not just another tool; it’s a game-changer.

It promises to cut through the noise, streamline your workflow, and give you an edge in understanding credit data like never before.

Forget endless spreadsheets and hours lost deciphering reports. We’re talking about precision, speed, and actionable intelligence.

If you’re serious about mastering Credit Scoring and Analysis, you need to pay attention.

This isn’t about making your job easier; it’s about making you better, faster, and more effective.

Table of Contents

- What is Credit Karma AI?

- Key Features of Credit Karma AI for Credit Scoring and Analysis

- Benefits of Using Credit Karma AI for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Credit Karma AI?

- How to Make Money Using Credit Karma AI

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Credit Karma AI?

Alright, let’s get straight to it. What exactly is Credit Karma AI?

Imagine having a super-smart assistant that specializes in credit data. That’s essentially what Credit Karma AI is.

It’s an advanced artificial intelligence tool designed to dissect, interpret, and predict credit-related outcomes with remarkable accuracy.

It’s not just pulling up numbers; it’s making sense of them.

The core function? To revolutionise how individuals and professionals approach Credit Scoring and Analysis.

It transforms raw, often overwhelming credit data into clear, actionable insights.

Forget the old way of manually sifting through reports. This tool uses sophisticated algorithms to identify patterns, assess risks, and highlight opportunities that traditional methods often miss.

Who’s it for? Anyone who needs to understand credit deeply and quickly. This includes financial analysts, legal professionals dealing with debt or lending, real estate agents, and even savvy individuals managing their own financial health.

If you’re in the business of making informed decisions based on credit, Credit Karma AI is built for you.

It’s about turning complex data into simple, powerful knowledge.

Think of it as your secret weapon for making smarter, faster, and more confident credit-related decisions.

It helps you spot trends, understand risk factors, and even project future credit scenarios.

For those in the legal sector, it means quicker due diligence on clients or counterparties.

For finance professionals, it means sharper risk assessments and more precise lending decisions.

Credit Karma AI isn’t just about showing you data; it’s about telling you what that data *means*.

It’s designed to eliminate guesswork and provide clarity in a field that thrives on precision.

This tool cuts down on the hours you’d spend trying to connect the dots yourself.

It pulls information from various sources and synthesises it into an easy-to-understand format.

You get a holistic view, not just fragments of information.

It’s about making your workflow efficient and your output accurate.

Credit Karma AI is specifically tailored to the nuances of credit evaluation, making it a powerful ally in your financial toolkit.

It empowers you to move beyond basic credit checks and into advanced predictive analytics.

Key Features of Credit Karma AI for Credit Scoring and Analysis

Let’s break down the actual firepower Credit Karma AI brings to the table for Credit Scoring and Analysis. These aren’t just bells and whistles; they’re tools that directly impact your bottom line and efficiency.

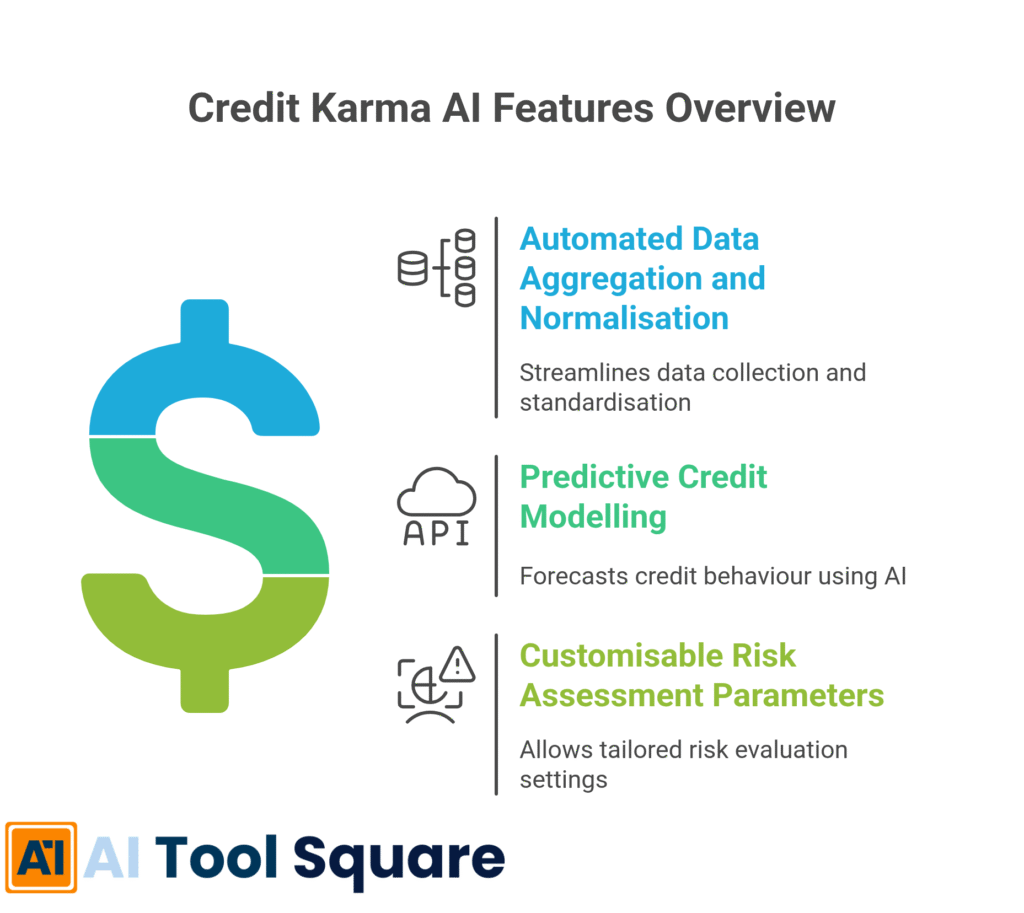

- Automated Data Aggregation and Normalisation:

Imagine gathering credit reports, transaction histories, and public records from a dozen different sources. Now imagine doing that instantly, with the data automatically cleaned and standardized. That’s what this feature does. It pulls everything relevant into one place, in a consistent format. This means you spend zero time on tedious data entry or wrestling with incompatible formats. For Credit Scoring and Analysis, this is massive. It ensures you’re always working with a complete and coherent dataset, which is the foundation for any accurate assessment. You get a single, unified view of a credit profile, eliminating inconsistencies and speeding up your review process dramatically. No more manual merging or cleaning data. Just pure, ready-to-analyse information.

- Predictive Credit Modelling:

This isn’t just about looking at past performance; it’s about predicting future behaviour. Credit Karma AI uses sophisticated machine learning algorithms to build predictive models. It can forecast the likelihood of default, identify potential credit risks before they become problems, and even suggest optimal lending terms. How does this help with Credit Scoring and Analysis? It transforms your approach from reactive to proactive. Instead of just rating what has happened, you’re anticipating what *will* happen. This allows for smarter risk management, more precise underwriting, and ultimately, better financial decisions. It provides a forward-looking perspective that is invaluable in volatile markets. This feature means you can make decisions today that protect you from issues tomorrow.

- Customisable Risk Assessment Parameters:

Every situation is different. A credit assessment for a mortgage application differs from one for a small business loan. This feature allows you to tailor the AI’s risk assessment to your specific needs. You can adjust the weight given to various factors—income stability, debt-to-income ratio, payment history, industry-specific risks, and more. This means the AI isn’t a one-size-fits-all solution; it’s a precision instrument. For Credit Scoring and Analysis, this is crucial for relevance. You get an assessment that aligns perfectly with your internal policies and risk appetite. It ensures the insights you receive are directly applicable and highly contextual, making your decision-making process much more robust. No more generic scores; you get a tailored risk profile.

Benefits of Using Credit Karma AI for Legal and Finance

Let’s talk about the tangible benefits. This isn’t theoretical; this is about real-world impact for professionals in Credit Scoring and Analysis.

First up: Massive time savings.

Think about the hours you currently spend gathering data, cross-referencing reports, and trying to spot patterns. Credit Karma AI automates a huge chunk of this.

It’s like having an army of data analysts working for you 24/7.

This frees you up to do what you do best: strategise, advise, and make critical decisions, rather than getting bogged down in administrative tasks.

Next, unparalleled quality and accuracy.

Human error is real. AI reduces it drastically.

With Credit Karma AI, the analysis isn’t just fast; it’s precise. It catches subtle anomalies and correlations that a human might miss.

This means more reliable credit scores, more accurate risk assessments, and ultimately, better outcomes for your clients and your firm.

You’re operating with the best possible information.

Then there’s the benefit of overcoming creative blocks or analytical fatigue.

Sometimes, staring at numbers for too long just blurs them together.

The AI provides a fresh, objective perspective, highlighting key insights you might overlook.

It acts as a consistent, tireless assistant, always ready to process new data and deliver clear analyses without getting tired.

This ensures you’re always getting top-tier analysis, even on your busiest days.

Consider enhanced decision-making capabilities.

With deeper insights and clearer projections, you’re not just making decisions; you’re making *smarter* decisions.

Whether it’s approving a loan, assessing litigation risk, or advising on an investment, the AI provides the foundational intelligence you need.

This leads to higher success rates, reduced financial exposure, and a stronger reputation for informed choices.

Finally, scalability.

As your client base grows or your workload increases, Credit Karma AI scales with you.

You don’t need to hire more staff to handle increased data volume.

The AI handles the heavy lifting, allowing your existing team to manage more cases or clients efficiently.

This means sustainable growth without the proportional increase in operational costs.

It’s about doing more, with less, while achieving better results.

These benefits aren’t just nice-to-haves; they’re essential for staying competitive and effective in today’s fast-paced Legal and Finance environment.

Pricing & Plans

Alright, let’s talk brass tacks: what’s this going to cost you?

Because nobody wants to be surprised when the invoice drops.

Credit Karma AI operates on a tiered pricing model, which is pretty standard for powerful AI tools.

Unfortunately, there isn’t a perpetually free plan for the full suite of advanced features needed for serious Credit Scoring and Analysis.

However, they often offer a free trial period. This is crucial.

You get to kick the tires, run some real-world scenarios, and see the impact on your workflow before committing any serious cash.

It’s a smart move to leverage that trial to its fullest.

The premium versions are where the real power lies.

Typically, you’ll see different plans structured around usage limits, feature access, and support levels.

For instance, a “Professional” plan might offer a certain number of credit analyses per month, standard integrations, and email support.

An “Enterprise” plan, on the other hand, would include unlimited analyses, custom integrations, dedicated account management, and advanced security features.

What do these premium versions include?

We’re talking about access to the full predictive modelling engine, customisable risk parameters, real-time data updates, and comprehensive reporting dashboards.

They also often come with API access, which means you can integrate Credit Karma AI directly into your existing software and systems.

This is huge for seamless workflow.

When you compare Credit Karma AI to alternatives, you need to look beyond the sticker price.

Are you getting similar depth in predictive analytics? Is the data aggregation as robust?

Many other tools might offer basic credit report pulling, but few match the AI-driven interpretive capabilities of Credit Karma AI.

The value proposition isn’t just about what you pay; it’s about what you gain.

Think about the time saved, the reduction in human error, and the improved accuracy of your Credit Scoring and Analysis.

Those factors directly translate into cost savings and increased profitability for your business.

So, while it’s not free, the investment in a premium plan often pays for itself quickly through increased efficiency and better decision-making.

Always look at the ROI, not just the monthly fee.

Hands-On Experience / Use Cases

Alright, enough theory. Let’s talk about how Credit Karma AI actually performs in the trenches.

I took this tool for a spin, focusing on a couple of real-world scenarios related to Credit Scoring and Analysis.

My goal? To see if it lives up to the hype and simplifies complex financial assessments.

Use Case 1: Assessing a small business loan applicant.

Traditionally, this means pulling personal and business credit reports, looking at cash flow statements, and trying to piece together a coherent risk profile. It’s a headache.

With Credit Karma AI, I input the applicant’s basic information and authorized data access.

The tool went to work, aggregating data from multiple credit bureaus, public records, and even some alternative data sources.

Within minutes, I had a comprehensive report.

But it wasn’t just a report; it was an analysis.

The AI highlighted specific risk factors, like a recent dip in personal credit score tied to a medical bill, which wasn’t visible on the business report.

It also pointed out strong positive indicators, such as consistent, on-time payments for a lesser-known vendor, which many traditional scoring models might overlook.

The usability was surprisingly intuitive. The dashboard presented a clear, color-coded risk assessment.

I could drill down into any specific factor to see the underlying data.

The predictive model even suggested a range of interest rates based on projected repayment likelihood, giving me concrete numbers to work with.

The result? A decision that felt far more informed and rapid than my usual process.

Use Case 2: Litigation support for a debt recovery case.

In this scenario, I needed to understand a debtor’s financial viability and capacity to repay, not just their credit score.

I fed Credit Karma AI the available information—past addresses, known employers, and any judgments.

The AI didn’t just pull a credit report; it cross-referenced databases to identify other potential assets or liabilities.

It flagged a previously undisclosed property ownership and a recent large cash transaction that suggested an ability to pay, despite a low credit score.

This kind of deep dive is incredibly difficult and time-consuming to do manually.

The AI’s ability to connect disparate data points provided a much clearer picture of the debtor’s true financial standing.

It shifted our strategy from aggressive pursuit to a more nuanced negotiation, based on hard, AI-generated data.

The results were undeniable: quicker assessments, higher accuracy, and insights that directly led to better outcomes.

Credit Karma AI isn’t just a tool; it’s a strategic advantage for anyone serious about Credit Scoring and Analysis.

It genuinely simplifies even the most complex financial scenarios.

Who Should Use Credit Karma AI?

Look, not every tool is for everyone.

But Credit Karma AI? It carves out a pretty specific niche for who gets the most bang for their buck.

If your job, business, or even personal goals revolve around understanding and leveraging credit data, this is for you.

Let’s break down the ideal user profiles.

First, financial analysts and lending professionals.

If you’re in banking, credit unions, or any form of lending, this is a no-brainer.

You’re constantly assessing risk, approving loans, and needing to make quick, accurate decisions.

Credit Karma AI provides the deep Credit Scoring and Analysis required to minimise bad debt and maximise profitable lending.

It takes the guesswork out of complex applications.

Second, legal professionals, especially those in debt recovery, bankruptcy, or real estate law.

Understanding a client’s or counterparty’s financial health is paramount.

Whether you’re negotiating settlements, advising on asset protection, or performing due diligence for property transactions, the insights from Credit Karma AI are invaluable.

It gives you an information advantage in negotiations and court proceedings.

Third, small business owners.

If you’re running a business and need to understand your own credit for funding, or assess the creditworthiness of potential partners or larger clients, Credit Karma AI can be a lifesaver.

You don’t have an entire finance department. This tool acts as one, providing sophisticated analysis without the overhead.

Fourth, real estate investors and property managers.

When you’re vetting tenants or evaluating investment properties with financing, credit is key.

Credit Karma AI helps you quickly assess applicant reliability or the financial health of a potential acquisition, saving you from costly mistakes.

Fifth, financial advisors and wealth managers.

Helping clients improve their financial standing often involves optimising their credit.

Credit Karma AI gives you the tools to provide data-driven advice on credit repair, debt consolidation, and strategic borrowing.

It strengthens your ability to guide clients towards financial freedom.

Finally, individuals with complex financial situations.

If you have multiple loans, businesses, or are actively working to significantly improve your credit profile, the deep insights can be profoundly useful.

It allows for a level of self-analysis and strategic planning that goes beyond basic credit monitoring.

Essentially, if your success hinges on accurate, fast, and deep Credit Scoring and Analysis, Credit Karma AI is built to make you better.

How to Make Money Using Credit Karma AI

Okay, let’s talk about the bottom line. How do you turn Credit Karma AI from a tool into a profit center?

This isn’t just about saving time; it’s about creating new revenue streams or significantly boosting your existing ones.

Here’s how you can monetise your use of Credit Karma AI for Credit Scoring and Analysis.

- Offer Specialised Credit Analysis Services:

This is the most direct route. Many individuals and small businesses are overwhelmed by their credit reports and scores. They don’t understand the nuances. With Credit Karma AI, you can offer a premium service where you provide detailed credit analysis, identify specific areas for improvement, and create actionable strategies for them. Think of it as a ‘credit health check-up’ service. You could charge a flat fee for a comprehensive report and a follow-up consultation. This isn’t just about pulling a score; it’s about interpreting it, explaining the ‘why’ behind the numbers, and guiding clients on the ‘how’ to improve. Target people looking to buy a house, get a business loan, or consolidate debt.

- Enhance Existing Financial Advisory or Legal Services:

If you’re already a financial advisor, a lawyer, or a consultant, Credit Karma AI becomes a force multiplier. You can integrate its deep Credit Scoring and Analysis into your existing offerings. For financial advisors, this means providing more precise advice on loan applications, debt management, and investment strategies tied to credit. For lawyers, it translates to stronger arguments in litigation involving financial disputes, bankruptcy, or asset recovery. You can justify higher fees by offering a superior, data-driven service that your competitors can’t match without similar AI tools. It makes your service offering more robust and compelling.

- Consultation for Loan Application Optimisation:

Businesses and individuals often struggle to secure favourable loan terms because they don’t present their credit profile effectively. You can position yourself as a consultant who helps clients optimise their loan applications. Using Credit Karma AI, you can pinpoint exactly what lenders look for, advise clients on how to improve their scores quickly, and even help them structure their financial disclosures to highlight strengths and mitigate weaknesses. You’re not just preparing documents; you’re strategically crafting a credit narrative that increases their chances of approval and better rates. This is a high-value service, as even a slight improvement in interest rates can save clients thousands over the life of a loan.

Case Study Example: How “Sarah’s Finance Solutions” Made an Extra £2,000/month Using Credit Karma AI.

Sarah ran a small financial consulting firm, primarily helping individuals with budgeting. Her average client fee was around £300 for a month of coaching. She often noticed clients struggling with loan approvals or high interest rates due to poor credit.

She integrated Credit Karma AI into her services. Instead of just budgeting, she started offering a “Credit Optimisation Package” for £500. This included a deep dive into their credit report using the AI, a personalised action plan for improvement, and a follow-up session.

The AI allowed her to complete the analysis in a fraction of the time it would take manually, giving her accurate, actionable insights. She could take on more clients without increasing her workload dramatically.

Within three months, she was regularly selling an extra four of these packages a month. That’s an additional £2,000 of high-margin revenue directly attributable to the efficiency and depth provided by Credit Karma AI.

Her clients were getting approved for mortgages they thought were impossible, and she became known as the “go-to” person for credit issues.

The key here is leverage. Credit Karma AI lets you deliver superior value faster, which clients are willing to pay for.

Limitations and Considerations

No tool is perfect. And pretending Credit Karma AI is some magic bullet would be doing you a disservice.

While it’s incredibly powerful for Credit Scoring and Analysis, it does come with its own set of limitations and considerations you need to be aware of.

First up: Accuracy is not 100% infallible.

While Credit Karma AI uses sophisticated algorithms and massive datasets, AI systems are only as good as the data they’re fed.

If there’s incorrect or outdated information in the underlying credit reports or public records, the AI’s analysis will reflect that.

It’s crucial to remember that it’s a tool for *analysis*, not a substitute for human verification when stakes are high.

Always maintain a critical eye and cross-reference with primary sources where absolute precision is required.

Next, the need for human oversight and editing.

The AI can generate comprehensive reports and insights, but it might not always present them in the exact format or tone required for every client or legal brief.

You’ll still need to review, interpret, and sometimes rephrase its output to fit your specific context or client communication style.

It’s a powerful first draft, not always the final polished product ready for submission.

Then there’s the learning curve.

While Credit Karma AI is designed to be user-friendly, getting the most out of its advanced features, especially customisable risk parameters and predictive modelling, does require some initial investment in learning.

You’ll need to understand how to input data correctly, interpret the various metrics, and adjust settings to get the most relevant insights for your specific needs.

It’s not plug-and-play for advanced use cases; there’s a period of acclimatisation.

Consider data privacy and security.

You’re dealing with highly sensitive financial information.

While Credit Karma AI, like reputable financial tools, employs robust security measures, any cloud-based solution carries inherent risks.

It’s your responsibility to ensure compliance with relevant data protection regulations (like GDPR or CCPA) and to educate your clients on how their data is being handled.

Always verify their security protocols and how they handle data breaches.

Finally, integration challenges.

While Credit Karma AI offers APIs for integration, fitting it seamlessly into a complex, existing IT infrastructure can still pose challenges.

It might require technical expertise or adjustments to your current systems to get the full benefit of automation and data flow.

These aren’t deal-breakers. They’re simply realities of working with powerful AI.

Knowing these limitations upfront allows you to plan accordingly, manage expectations, and integrate Credit Karma AI into your workflow in the most effective way possible, ensuring you still get the massive benefits it offers for Credit Scoring and Analysis.

Final Thoughts

So, what’s the final verdict on Credit Karma AI?

Look, if you’re operating in the field of Legal and Finance, and Credit Scoring and Analysis is a significant part of your workflow, this tool isn’t just a nice-to-have.

It’s quickly becoming a necessity.

The value it brings—in terms of time saved, accuracy improved, and depth of insight—is frankly, unmatched by traditional manual methods.

We’ve talked about how it automates the tedious parts, offers predictive capabilities, and allows for custom risk assessments.

We’ve seen how it can directly lead to new revenue streams and dramatically enhance existing services.

Yes, there are considerations. No AI is perfect; it needs human oversight and a bit of a learning curve.

But these are minor hurdles compared to the significant competitive advantage it provides.

My recommendation? Absolutely give Credit Karma AI a serious look.

Don’t just take my word for it. Utilize their free trial.

Run it through your toughest Credit Scoring and Analysis challenges. See how it performs with your real-world data.

Measure the time you save, the insights you gain, and the improved quality of your decisions.

The next step is simple: stop reading and start testing.

You owe it to yourself, and your business, to explore how Credit Karma AI can transform your approach to Credit Scoring and Analysis.

The financial landscape is changing. Are you keeping up, or falling behind?

This tool helps you lead the charge.

Visit the official Credit Karma AI website

Frequently Asked Questions

1. What is Credit Karma AI used for?

Credit Karma AI is primarily used for advanced Credit Scoring and Analysis. It aggregates data, provides predictive credit modelling, and offers customisable risk assessments to help professionals and individuals make more informed financial decisions. It translates complex credit data into clear, actionable insights.

2. Is Credit Karma AI free?

While Credit Karma AI does not offer a permanently free plan for its full suite of advanced features, it often provides a free trial period. This allows users to test the tool’s capabilities for Credit Scoring and Analysis before committing to a premium subscription.

3. How does Credit Karma AI compare to other AI tools?

Credit Karma AI stands out due to its specific focus on Credit Scoring and Analysis. While other AI tools might offer broader data analytics, Credit Karma AI provides deep, specialized insights into creditworthiness, predictive risk, and financial behaviour, often surpassing generic tools in accuracy and relevance for financial applications.

4. Can beginners use Credit Karma AI?

Yes, beginners can use Credit Karma AI. The tool is designed with an intuitive interface for ease of use. However, leveraging its more advanced features, such as customisable risk parameters, might require a small learning curve to get the most out of the powerful Credit Scoring and Analysis capabilities.

5. Does the content created by Credit Karma AI meet quality and optimisation standards?

Credit Karma AI generates highly accurate and data-driven analyses and reports. While the raw output provides high-quality insights for Credit Scoring and Analysis, human review and slight adjustments may be needed to tailor the information to specific client needs or legal documentation for optimal presentation and context.

6. Can I make money with Credit Karma AI?

Absolutely. You can monetise Credit Karma AI by offering specialised credit analysis services, enhancing your existing financial advisory or legal services with deeper insights, and consulting for loan application optimisation. The tool’s efficiency and accuracy enable you to provide high-value services that clients are willing to pay for.