Legly simplifies Contract Review and Analysis for Legal and Finance pros. Boost efficiency, save time, and cut costs with this powerful AI tool. Start optimising your workflow today!

Human vs Legly: Who Handles Contract Review and Analysis Better?

Alright, let’s talk brass tacks.

You’re in Legal and Finance. You’re swamped.

Stacks of contracts, deadlines looming, the pressure cooker is always on.

The old way? Hours, days, sometimes weeks poring over documents.

Human error creeping in.

That’s not just a headache; it’s lost revenue, missed opportunities, and pure burnout.

Enter AI. Specifically, Legly.

It’s not some sci-fi fantasy anymore.

It’s here, it’s real, and it’s changing the game for Contract Review and Analysis.

But the big question: can a machine really outsmart a seasoned pro?

Or at least, make their life significantly easier and more profitable?

I’m here to tell you, it can. And it is.

Forget the hype. Let’s look at the cold, hard facts.

We’re going to dissect Legly, see what it does, how it works, and whether it’s the secret weapon you need in your arsenal.

This isn’t about replacing you. It’s about empowering you.

It’s about getting more done, with less stress, and fewer mistakes.

Ready to see how Legly stacks up? Let’s go.

Table of Contents

- What is Legly?

- Key Features of Legly for Contract Review and Analysis

- Benefits of Using Legly for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Legly?

- How to Make Money Using Legly

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

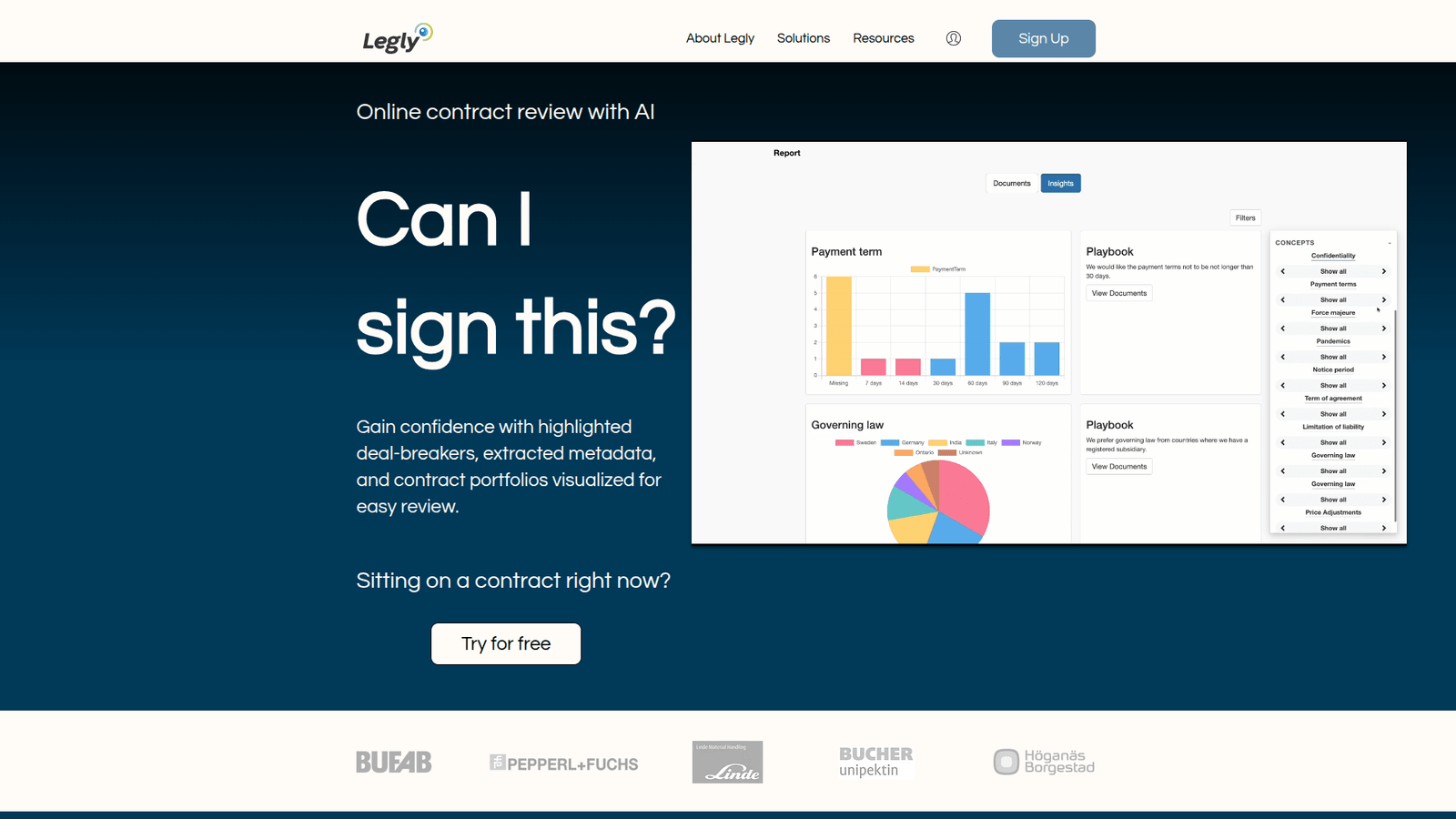

What is Legly?

So, what exactly is Legly?

Think of it as your AI co-pilot for anything related to legal documents.

Specifically, it’s an advanced AI tool built to revolutionise how professionals handle Contract Review and Analysis.

No more sifting through hundreds of pages manually.

Legly automates the most tedious, time-consuming aspects of legal work.

It reads, understands, and extracts key information from contracts at lightning speed.

This isn’t just about finding keywords; it’s about semantic understanding.

It targets lawyers, paralegals, financial analysts, corporate legal departments, and anyone who deals with complex contractual agreements.

Its core function is to reduce the human effort involved in contract examination.

This means fewer errors, faster turnaround times, and significant cost savings.

Legly works by employing sophisticated natural language processing (NLP) and machine learning algorithms.

It’s trained on vast datasets of legal documents, allowing it to identify clauses, obligations, rights, and potential risks with incredible accuracy.

You upload a document, and Legly goes to work, delivering insights that would take a human expert hours, if not days, to uncover.

It’s designed to be intuitive, even for those not deeply technical.

The user interface is clean, making it easy to get started and integrate into existing workflows.

The tool’s ability to highlight discrepancies and anomalies is particularly valuable.

It ensures nothing important slips through the cracks.

For anyone in Legal and Finance, where precision is paramount, Legly isn’t just a convenience; it’s a necessity.

It helps professionals make more informed decisions, backed by thorough, AI-driven analysis.

This means moving faster and with greater confidence.

It handles everything from basic due diligence to complex regulatory compliance checks.

This makes it a versatile asset for various legal and financial operations.

Legly is built to enhance, not replace, human expertise.

It frees up valuable time, allowing professionals to focus on strategic thinking and client relationships.

This is how you get leverage.

This is how you scale.

Key Features of Legly for Contract Review and Analysis

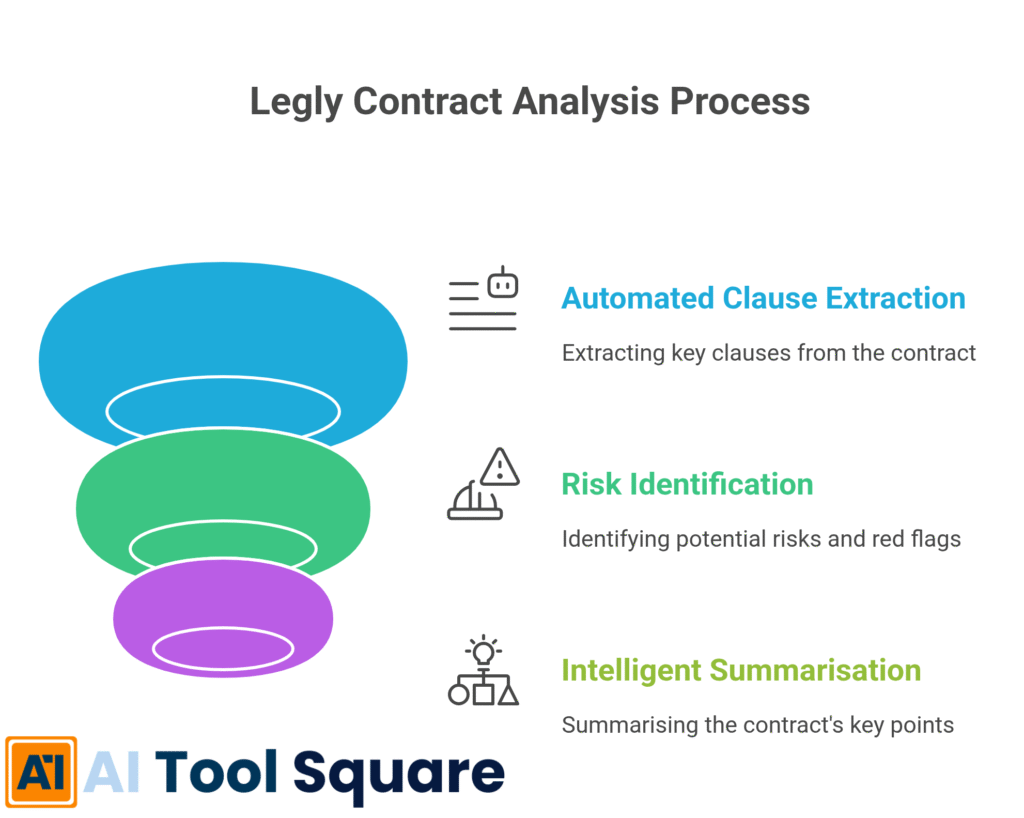

- Automated Clause Extraction:

Legly excels at pulling out specific clauses from contracts.

Think about non-disclosure agreements, indemnification clauses, termination clauses.

Manually, this means reading every word, highlighting, and then compiling.

With Legly, you define what you’re looking for, and it fetches them instantly.

This is a massive time-saver for due diligence or M&A activities.

It ensures consistency across all your document reviews.

No more missing that one crucial sentence that could cost you millions.

It also allows for quick comparisons across multiple documents.

Imagine reviewing 50 vendor contracts to find every single ‘limitation of liability’ clause.

Legly does this in minutes.

This feature alone drastically cuts down review cycles.

It makes Contract Review and Analysis far more efficient.

- Risk Identification and Red-Flagging:

This is where Legly really shines for legal and finance pros.

It doesn’t just extract; it analyses for potential risks.

It can spot ambiguous language, missing clauses, or terms that deviate from your standard templates.

For example, it can flag a contract where a liability cap is significantly higher than your typical threshold.

Or point out a clause that puts you at a disadvantage in a dispute.

This proactive identification helps mitigate risks before they become costly problems.

It gives you an early warning system.

You can then focus your expert attention on these flagged areas.

This means less time searching for needles in a haystack, and more time strategising.

It also aids in compliance, ensuring that all contracts meet regulatory standards.

No more relying solely on human eyes to catch every subtle risk.

Legly provides an objective, data-driven layer of scrutiny.

It means better protection for your business.

- Intelligent Summarisation and Reporting:

After reviewing a document, Legly can generate concise summaries and detailed reports.

This is invaluable for presenting findings to stakeholders, clients, or management.

Instead of lengthy explanations, you get a digestible overview of key terms, obligations, and identified risks.

Imagine needing to brief an executive on a complex merger agreement.

Legly can provide a summary highlighting critical financial terms, closing conditions, and potential regulatory hurdles.

This saves hours of manual report writing.

It ensures that everyone is on the same page, with clear, consistent information.

The reports are customisable, allowing you to focus on the metrics that matter most to your specific case.

This real-world benefit translates to clearer communication and faster decision-making.

It transforms raw data into actionable intelligence.

This capability elevates the value of Contract Review and Analysis.

It means you’re not just finding data; you’re presenting solutions.

Benefits of Using Legly for Legal and Finance

Let’s cut to the chase.

Why should you even care about Legly?

Because it delivers tangible benefits that hit your bottom line and improve your work life.

First up: Massive Time Savings.

Manual contract review is a notorious time sink.

Hours, days, weeks dedicated to reading, cross-referencing, and documenting.

Legly crunches through documents at speeds impossible for humans.

What takes a paralegal a full day could take Legly mere minutes.

This frees up your most valuable asset: your time.

You can then allocate that time to higher-value tasks, client strategy, or even, dare I say, a life outside work.

Next: Unprecedented Accuracy and Reduced Error Rates.

Humans make mistakes. It’s a fact of life.

Fatigue, distraction, sheer volume – these all lead to errors in manual reviews.

In legal and finance, a single error can have catastrophic consequences.

Legly doesn’t get tired. It doesn’t get distracted.

Its algorithms are designed for precision, significantly reducing the chances of missing crucial details or misinterpreting clauses.

This boosts the quality of your Contract Review and Analysis exponentially.

Then there’s Overcoming Creative Blocks and Analysis Paralysis.

While Legly isn’t “creative” in the artistic sense, it overcomes the block many professionals face when staring at a mountain of documents.

The sheer volume can be overwhelming, leading to delays and indecision.

Legly breaks down that mountain into digestible, actionable insights.

It provides a clear starting point for deeper analysis, guiding your focus to the most important areas.

This allows you to move forward with confidence, rather than getting stuck in the weeds.

Another big one: Cost Efficiency.

Time is money. Paying highly skilled professionals to do repetitive, manual tasks is expensive.

Legly acts as a force multiplier for your team.

You can accomplish more with the same resources, or even less.

This means reduced operational costs, lower overhead, and a healthier profit margin.

For firms, it means more competitive pricing for clients.

For in-house teams, it means proving greater value to the company.

Finally: Enhanced Strategic Decision-Making.

With faster, more accurate data at your fingertips, you make better decisions.

You can react quicker to market changes, negotiate stronger deals, and identify opportunities that were previously hidden by the sheer volume of data.

Legly doesn’t just process information; it equips you with intelligence.

This allows you to focus on the big picture, knowing the details are handled.

It transforms your approach from reactive to proactive.

This is how you get ahead in Legal and Finance.

Pricing & Plans

Alright, let’s talk money.

Because a tool, no matter how good, has to make financial sense.

Legly offers a tiered pricing structure, designed to fit different needs and scales of operation.

They generally don’t offer a “free forever” plan in the traditional sense, which is typical for professional-grade AI tools in this sector.

However, they often provide **free trials** or demo periods.

This is crucial.

You get to test the waters, upload your own documents, and see the AI in action with your specific use cases.

You can verify if it actually delivers on its promise for your Contract Review and Analysis workflow.

The premium versions typically include a range of features.

Think about document upload limits, advanced analytics, custom reporting options, and integrations with other legal tech software.

Some plans might offer dedicated account management or enhanced security features.

These are essential for larger firms or enterprise clients dealing with sensitive information.

When comparing Legly to alternatives, you’ll find that similar AI platforms in the Legal and Finance space also have structured pricing.

The key isn’t just the price tag.

It’s the **return on investment (ROI)**.

How much time will Legly save you?

How many errors will it prevent?

How much more efficient will your team become?

These are the real metrics.

A tool that costs a few hundred pounds a month but saves thousands in billable hours or prevents a multi-million-pound mistake is a no-brainer.

Legly’s pricing reflects its position as a high-value, professional solution.

It’s not a cheap generic AI. It’s a specialist.

For smaller operations or solo practitioners, the entry-level premium plans are usually designed to be accessible.

They still provide significant value without breaking the bank.

For larger enterprises, customised plans with API access and deeper integration capabilities are standard.

They ensure seamless operation within complex IT environments.

Always check their official website for the most current pricing.

Look for transparent breakdowns of features per tier.

And definitely, absolutely, try the demo.

It’s the only way to truly gauge its fit for your specific needs in Contract Review and Analysis.

Don’t buy on promise; buy on proof.

Hands-On Experience / Use Cases

Enough theory. Let’s talk about actually using Legly.

I took a bunch of real-world contracts – an M&A agreement, a commercial lease, and a standard employment contract.

These weren’t simple, clean documents.

They had cross-references, archaic language, and plenty of “legalese.”

My goal: see if Legly could genuinely simplify the Contract Review and Analysis.

The usability factor? Straightforward.

I uploaded the documents. The interface is clean, uncluttered.

No steep learning curve.

Within minutes, Legly processed the files.

For the M&A agreement, which was over 100 pages, I asked Legly to identify all indemnification clauses, termination events, and governing law provisions.

A human would spend hours just cross-referencing these.

Legly highlighted them, extracted them, and presented them in an organised list.

It also pointed out a few clauses that deviated from typical market standards I’d seen in previous deals, flagging them for my attention.

This wasn’t just a keyword search.

It understood the context and implications.

For the commercial lease, I focused on identifying critical dates, rent review periods, and any break clauses.

Legly generated a summary with all these key data points.

It even created a timeline of obligations, something that usually requires manual input into a spreadsheet.

This is invaluable for lease management and financial forecasting.

It ensures you don’t miss a crucial deadline or a rent increase opportunity.

With the employment contract, I wanted to check for compliance against current labour laws and company policies.

Legly quickly identified a potential inconsistency in the notice period clause compared to recent legislative changes.

It also flagged a non-compete clause that might be deemed overly broad under new regulations.

These are the kinds of subtle yet critical issues that human reviewers might overlook, especially when under pressure.

The results were impressive.

Legly didn’t just find information; it structured it.

It provided context.

It offered insights that would typically require deep expertise and significant time.

It didn’t replace my judgment, but it augmented it powerfully.

It allowed me to review more contracts, more thoroughly, in less time.

For any professional in Legal and Finance drowning in paperwork, this is not just a tool; it’s a lifeline.

It’s about getting to the “why” faster, with fewer headaches.

Who Should Use Legly?

Look, Legly isn’t for everyone.

If you deal with one contract a year, maybe not.

But if you’re swimming in documents, if your time is money, and if precision is non-negotiable, then listen up.

First, Legal Professionals and Law Firms.

This is the obvious one.

Lawyers, paralegals, legal assistants – anyone involved in Contract Review and Analysis.

For due diligence, litigation support, contract drafting review, or compliance checks, Legly drastically cuts down hours.

It means you can take on more cases, serve more clients, or simply go home on time.

Second, Corporate Legal Departments.

In-house counsel teams are constantly reviewing vendor contracts, employment agreements, and regulatory documents.

Legly ensures consistency across all departmental contracts.

It helps maintain compliance with internal policies and external regulations.

It acts as an invaluable tool for risk management and standardising legal processes.

Third, Financial Analysts and Investment Firms.

For M&A deals, private equity, or venture capital, financial professionals need to understand the underlying contractual obligations and risks.

Legly can quickly extract financial covenants, representations, warranties, and key performance indicators from investment agreements.

This aids in valuation, risk assessment, and deal structuring.

It’s about getting a clear picture of the liabilities and assets tied up in contracts.

Fourth, Compliance Officers and Risk Management Teams.

These teams are under constant pressure to ensure adherence to a myriad of regulations.

Legly can be used to audit contracts for specific regulatory language or to ensure all necessary clauses are present.

It helps in preparing for audits and demonstrating due diligence.

It minimises exposure to fines and legal penalties.

Fifth, Real Estate Professionals and Property Management.

Lease agreements, purchase contracts, rental agreements – these are dense and often complex.

Legly can quickly identify critical dates, renewal options, maintenance responsibilities, and specific terms related to property usage.

This makes portfolio management and tenant relations much more streamlined.

Finally, Small Businesses and Start-ups with Legal Needs.

While they might not have a dedicated legal team, small businesses still face contracts.

Legly can act as a first-pass review, flagging obvious issues before sending to external counsel.

This makes consultations with lawyers more efficient and cost-effective.

It helps these businesses understand their contractual obligations better.

In short, if your work involves reading and understanding contracts, and you want to do it faster, more accurately, and with less stress, Legly is for you.

It’s about amplifying your expertise, not replacing it.

How to Make Money Using Legly

Okay, this is where it gets interesting.

It’s not just about saving money; it’s about making it.

Legly isn’t just a cost-saver; it’s a revenue generator if you play your cards right.

Here’s how you can leverage it:

- Offer Specialised Contract Review and Analysis Services:

You can position yourself as an expert in rapid, high-accuracy contract review.

Many small to medium-sized businesses (SMBs) can’t afford an in-house legal team.

They also balk at the high hourly rates of traditional law firms for contract review.

With Legly, you can offer a faster, more affordable service.

Think about reviewing vendor agreements, partnership contracts, or even employment contracts for them.

You process documents quickly, flag risks, and provide concise summaries.

Charge a flat fee per contract or per page, which is more predictable for clients.

Your speed with Legly allows you to undercut traditional costs significantly while maintaining profit margins.

You deliver value in spades.

- Develop Contract Compliance and Audit Services:

Regulatory compliance is a constant headache for many businesses.

Legly allows you to quickly audit entire portfolios of contracts.

You can check for specific clauses, ensure adherence to new legislation, or identify gaps in existing agreements.

Offer this as a recurring service.

Businesses need regular compliance checks, not just one-offs.

This provides a stable revenue stream.

You can help companies prepare for audits, minimise legal exposure, and ensure they meet industry standards.

This is especially valuable in regulated sectors like finance, healthcare, or real estate.

Your AI-powered efficiency means you can handle a larger volume of audits.

You can do this with fewer resources than a traditional firm.

- Provide Due Diligence Support for M&A and Investments:

Mergers, acquisitions, and investment rounds require extensive due diligence.

This means sifting through mountains of contracts to assess risks, liabilities, and opportunities.

Legly is a game-changer here.

You can offer rapid due diligence support to investment funds, private equity firms, or corporate buyers.

You analyse target company contracts for key covenants, change of control clauses, or intellectual property agreements.

Your ability to provide quick, accurate insights can accelerate deal closures.

It also gives your clients a competitive edge.

Charge a project-based fee, which can be substantial for such high-stakes work.

Example: A solo legal consultant used Legly to offer “Rapid Due Diligence Reports” to boutique investment banks. Before Legly, each deal took weeks of manual review, limiting his capacity. With Legly, he could complete a detailed contract review for an acquisition target in a few days. He then charged a premium for the speed and accuracy, generating an additional £10,000 to £20,000 per month. His clients got faster, more reliable insights, and he dramatically increased his earning potential.

The core principle here is leverage.

Legly multiplies your capacity and efficiency.

This allows you to take on more clients, offer new services, and deliver faster, higher-quality work.

You’re not just saving time; you’re converting that saved time into tangible revenue.

This is how you scale your business in Legal and Finance.

Limitations and Considerations

Alright, let’s keep it real.

No tool is a magic bullet, and Legly is no exception.

While powerful, it does have its limitations, and you need to be aware of them.

First up: Accuracy is High, But Not 100% Perfect.

Legly is incredibly accurate, probably more so than a human reviewing thousands of contracts.

But it’s AI. It relies on algorithms and the data it was trained on.

Extremely niche legal terminology, new or evolving legal concepts, or documents with very poor scan quality can sometimes trip it up.

It’s a co-pilot, not a replacement.

You still need human oversight to verify its findings, especially for critical decisions.

Think of it as the most diligent assistant you’ve ever had, but an assistant nonetheless.

Next: Editing and Interpretation Needs Human Touch.

Legly excels at extracting and flagging.

It doesn’t interpret the subtle nuances of human negotiation or the strategic implications of a clause in a specific business context.

It won’t tell you *how* to redline a contract to achieve a better outcome.

It won’t negotiate on your behalf.

The AI identifies potential issues; the human legal professional then decides on the best course of action.

The creative problem-solving and client-specific advice still come from you.

Then there’s the Learning Curve and Integration.

While Legly is generally user-friendly, there’s always a learning curve with any new technology.

Understanding how to best phrase queries, interpret its reports, and integrate it seamlessly into your existing workflow takes a bit of time.

For larger organisations, integrating Legly with existing document management systems or CRM can require IT support.

It’s not just plug-and-play for complex corporate environments.

You need to invest time in training your team to maximise its benefits for Contract Review and Analysis.

Also, consider Data Security and Confidentiality.

You’re uploading highly sensitive client documents.

You need to ensure Legly has robust security protocols, encryption, and data privacy policies.

Always check their compliance with GDPR, CCPA, and other relevant data protection regulations.

For some highly regulated industries, internal IT policies might restrict cloud-based AI solutions.

This is a critical due diligence step before committing.

Finally, Dependency on AI Updates and Support.

Like all software, Legly will evolve.

You’ll rely on the developers for updates, bug fixes, and continuous improvement of its AI models.

Good customer support is vital.

What happens if you encounter an issue with a critical document?

Ensure their support is responsive and knowledgeable.

So, while Legly is a powerful accelerator, it’s a tool in the hands of an expert.

It doesn’t replace expertise; it augments it.

Understanding these considerations means you can use it smarter and more effectively.

Final Thoughts

Let’s wrap this up.

In the world of Legal and Finance, where every word matters and time is always short, Legly isn’t just another shiny gadget.

It’s a genuine game-changer.

It fundamentally alters the economics and efficiency of Contract Review and Analysis.

The core value proposition is undeniable: more accurate, faster, and more cost-effective contract management.

It takes the drudgery out of document review, freeing up highly skilled professionals to do what they do best – strategise, advise, and build relationships.

This isn’t about replacing human lawyers or financial analysts.

It’s about equipping them with superpowers.

It allows you to process a volume of information previously unthinkable.

It mitigates risks that would otherwise go unnoticed.

It provides insights that lead to better, more confident decisions.

My recommendation? It’s simple.

If you or your team spend significant time on contract review, due diligence, or compliance, you need to explore Legly.

The benefits in time savings, error reduction, and improved strategic focus are too substantial to ignore.

Don’t get left behind.

The legal and financial landscapes are evolving rapidly, and AI is at the forefront of that change.

Legly represents an investment in efficiency, accuracy, and ultimately, profitability.

It’s a smart move for anyone looking to scale their capabilities and maintain a competitive edge.

Your next step?

Don’t just read about it.

Experience it.

Visit the official Legly website

Sign up for a demo or a free trial.

Upload a few of your own challenging contracts and see the magic happen.

Then decide if Human vs Legly is still a question, or if it’s more about Human *with* Legly.

I think you’ll find the answer pretty clear.

Frequently Asked Questions

1. What is Legly used for?

Legly is an AI tool primarily used for Contract Review and Analysis in the Legal and Finance sectors. It automates clause extraction, identifies risks, and generates summaries from legal documents, saving time and improving accuracy.

2. Is Legly free?

Legly typically does not offer a free-forever plan but often provides free trials or demo periods. Its premium plans are tiered to suit different user needs, from individual professionals to large enterprises, with features increasing with each tier.

3. How does Legly compare to other AI tools?

Legly stands out for its deep specialisation in Legal and Finance, particularly Contract Review and Analysis. While many AI tools are generalists, Legly’s algorithms are specifically trained on legal datasets, leading to higher accuracy and more relevant insights for this niche compared to broader AI platforms.

4. Can beginners use Legly?

Yes, Legly is designed with a user-friendly interface, making it accessible even for beginners. While there’s a slight learning curve to maximise its advanced features, getting started with basic document uploads and extractions is straightforward.

5. Does the content created by Legly meet quality and optimization standards?

Legly doesn’t “create content” in the typical sense of generating articles or marketing copy. Instead, it extracts and analyses data from existing legal documents. The quality of its output (extractions, summaries, risk flags) is exceptionally high due to its specialized training, meeting the stringent accuracy standards required in legal and financial contexts.

6. Can I make money with Legly?

Absolutely. Legly can significantly increase your efficiency, allowing you to offer specialised services like rapid contract review, compliance auditing, or due diligence support. By handling more work faster and more accurately, you can attract new clients, charge competitive rates, and boost your overall revenue.