IBM OpenPages revolutionises Risk Analysis and Management for Finance & Trading. Streamline compliance, mitigate threats, and boost your bottom line. Get started today!

IBM OpenPages Helps Me Improve My Risk Analysis and Management Approach

You’re in Finance and Trading.

You know the game.

High stakes.

Tight margins.

Risk everywhere you look.

It’s not just about making money; it’s about not losing it, right?

The traditional way of doing things?

It’s slow. It’s manual. It’s prone to error.

And frankly, it’s not cutting it anymore.

The market moves too fast. Regulations change on a dime.

That’s where AI comes in.

Not some futuristic, sci-fi concept.

Real, practical AI.

Like IBM OpenPages.

This isn’t just another tool.

It’s a strategic partner.

Especially when it comes to Risk Analysis and Management.

It’s what the pros are using.

It’s what’s giving them the edge.

I’ve seen it firsthand.

My approach to Risk Analysis and Management changed dramatically after using it.

And I’m going to tell you exactly how.

No BS, just the facts.

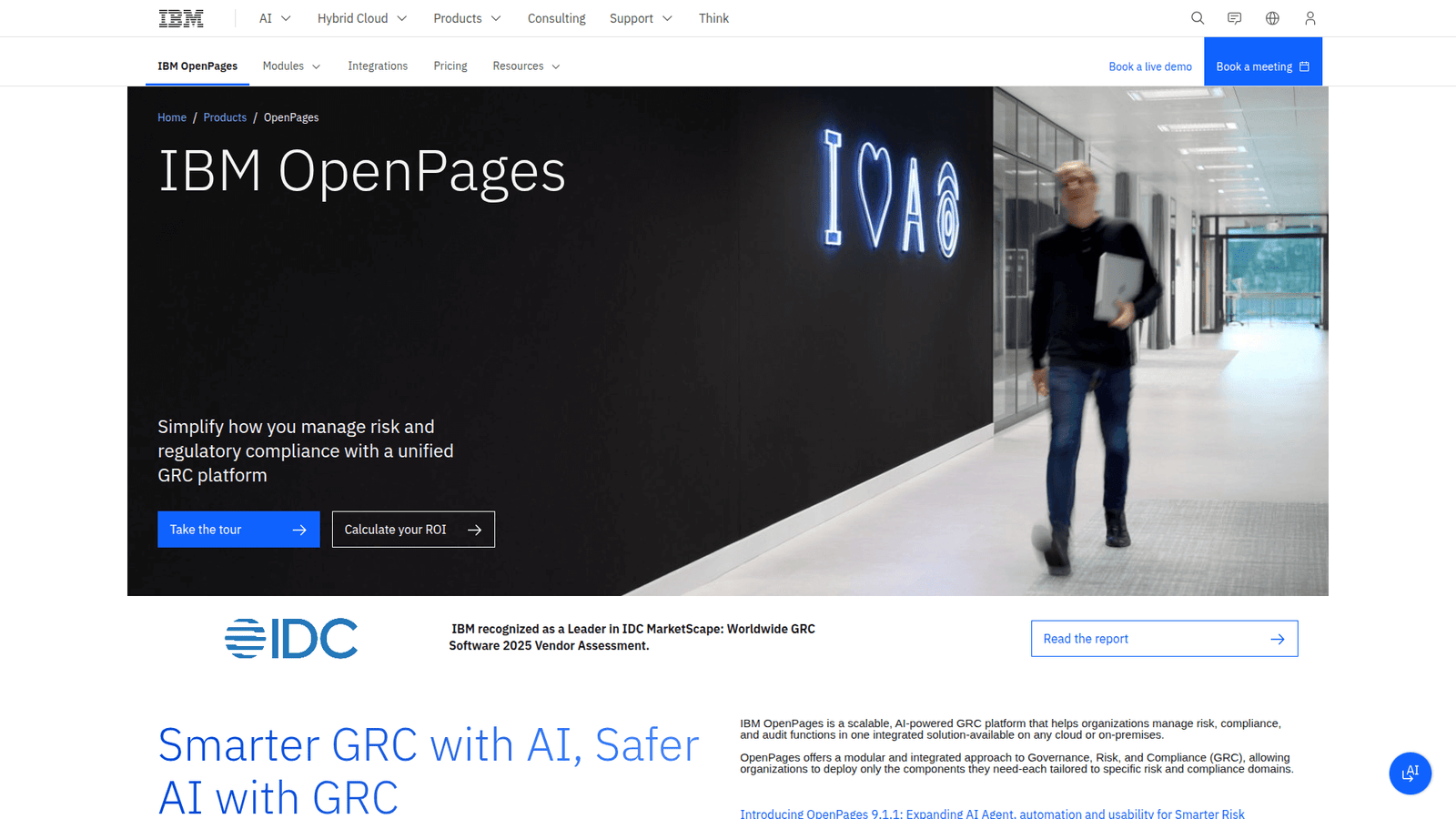

What is IBM OpenPages?

IBM OpenPages is an enterprise-grade AI solution.

It’s built for one thing: helping big companies handle their governance, risk, and compliance (GRC).

Think of it as your central command for everything risky.

It pulls data from everywhere.

Market trends, internal operations, regulatory updates.

It then gives you a single, unified view of your risk posture.

No more scattered spreadsheets. No more guessing games.

Its core function is to bring structure to chaos.

It helps you identify, assess, monitor, and report on risks.

It’s designed for organisations that can’t afford to miss a beat.

Financial institutions, for example, are its bread and butter.

They face complex regulatory environments.

They deal with constant market volatility.

IBM OpenPages gives them the tools to stay ahead.

It’s not just about ticking boxes.

It’s about making smarter decisions.

Faster decisions.

Decisions that protect your assets and grow your business.

It’s for the serious players.

Those who want to turn risk into a competitive advantage.

It’s an AI tool built for managing the complexities of modern business risk.

Key Features of IBM OpenPages for Risk Analysis and Management

Let’s get real about what this thing actually does.

It’s packed with features, but some are absolutely critical for Risk Analysis and Management in Finance and Trading.

These are the ones that move the needle.

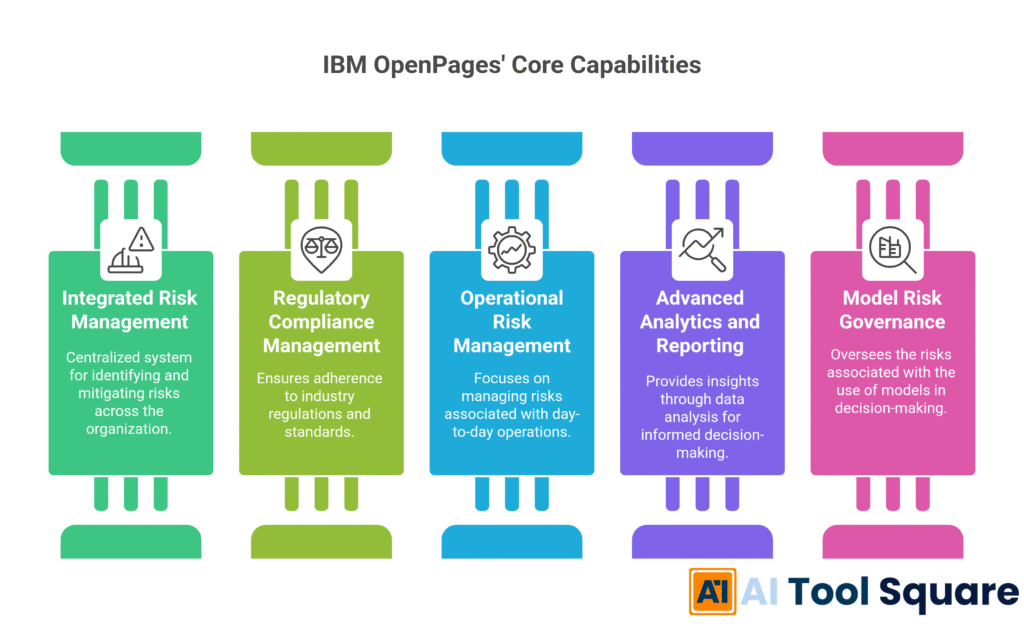

- Integrated Risk Management: This is huge. Instead of having separate systems for different types of risk – market risk, credit risk, operational risk – OpenPages brings it all together. You get a holistic view. Imagine seeing how a new trading strategy impacts your compliance obligations and your credit exposure all at once. No more silos. No more blind spots. This means you can spot interconnected risks before they blow up. It streamlines the whole process of identifying potential threats and opportunities across your business.

- Regulatory Compliance Management: Regulations are a moving target in Finance and Trading. MIFID II, Basel III, Dodd-Frank – it’s a constant battle to stay compliant. OpenPages has built-in capabilities to track regulatory changes, map them to your internal controls, and automate compliance tasks. This doesn’t just save you from fines; it frees up your team from mountains of paperwork. You can demonstrate compliance to auditors with ease, making those stressful reviews a breeze. It’s about not just meeting the rules, but proving you meet them consistently.

- Operational Risk Management: This covers everything from IT outages to human error, fraud, and process failures. These are the risks that can quietly erode your profits or suddenly cause massive losses. OpenPages helps you identify operational risks, assess their potential impact, and implement controls. It uses AI to spot patterns in your data that human analysts might miss. This proactive approach saves you headaches and millions. It ensures your day-to-day operations are robust and resilient against unforeseen disruptions.

- Advanced Analytics and Reporting: You need to see the data, clearly and quickly. OpenPages offers powerful dashboards and reporting tools. You can visualise your risk landscape, drill down into specific areas, and generate custom reports for different stakeholders – from the board to individual traders. This isn’t just pretty charts; it’s actionable intelligence. It helps you understand where your biggest risks lie and measure the effectiveness of your risk mitigation strategies. This data-driven insight is crucial for making informed strategic decisions.

- Model Risk Governance: In Finance and Trading, models drive everything – pricing, valuations, trading algorithms. If a model is wrong, you’re in deep trouble. OpenPages helps you manage the entire lifecycle of your quantitative models. This means tracking their development, validation, usage, and performance. It ensures your models are sound, compliant, and performing as expected. This feature is a game-changer for institutions reliant on complex algorithms. It provides confidence in the analytical tools underpinning your trading and investment decisions.

These features aren’t just bullet points on a sales page. They’re what gives you control. They’re what gives you confidence.

Benefits of Using IBM OpenPages for Finance and Trading

Let’s cut to the chase. Why should you care about IBM OpenPages?

It boils down to three things: time, money, and peace of mind.

First, time savings. You’re no longer sifting through spreadsheets. You’re not chasing down different departments for risk reports. OpenPages centralises everything. This means your risk team spends less time on manual aggregation and more time on actual analysis. That translates directly to faster responses to market changes or regulatory demands. It frees up your best people to focus on strategy, not administration.

Second, quality improvement. The AI capabilities in OpenPages are a game-changer. It spots anomalies and correlations that a human might miss. This means your risk assessments are more accurate, more comprehensive. You get a clearer picture of your exposure. Better data leads to better decisions, which means fewer mistakes and more consistent profits. It’s about moving from reactive to proactive risk management.

Third, overcoming creative blocks (or, in this case, analytical paralysis). When you’re faced with overwhelming data and complex regulations, it’s easy to get stuck. OpenPages simplifies this. It provides structured frameworks and automated workflows. This structure helps you identify new risks, develop innovative mitigation strategies, and explore different scenarios without getting bogged down. It allows your team to think strategically rather than just reactively.

Think about the sheer volume of data in Finance and Trading. Market data, transaction data, client data, regulatory filings. Trying to manually process that for risk analysis is like trying to empty the ocean with a teacup. OpenPages gives you the industrial-grade pump. It streamlines compliance audits. It reduces the likelihood of costly regulatory fines. It protects your reputation by preventing major risk events.

Ultimately, it helps you make more confident decisions. When you know your risks are properly managed, you can pursue growth opportunities with less hesitation. It’s not just about avoiding losses; it’s about enabling strategic gains. This tool provides a competitive edge in a demanding sector.

Pricing & Plans

Alright, let’s talk brass tacks: what’s this going to cost you?

IBM OpenPages isn’t your typical off-the-shelf SaaS product with a “Basic,” “Pro,” and “Enterprise” tier prominently displayed on a website.

This is a serious enterprise solution.

You won’t find a free plan. Not even a trial, usually.

It’s designed for large organisations, financial institutions, and complex trading firms.

The pricing model is almost always customised.

It depends on several factors: the modules you need (Operational Risk, Regulatory Compliance, IT Risk, etc.), the number of users, the scale of your data, and whether you want it on-premises or cloud-based (IBM Cloud or other providers).

You’re looking at a solution that requires direct engagement with IBM sales teams.

They’ll assess your specific requirements, your existing GRC setup, and your integration needs.

Then they’ll give you a bespoke quote.

What does the premium version include?

Well, essentially, every deployment of OpenPages *is* a premium version, tailored to your needs.

It includes comprehensive suites for various risk disciplines.

Think advanced analytics, AI-driven insights, extensive reporting capabilities, and deep integration options with your existing IT ecosystem.

It’s built for scalability and performance.

Comparing it with alternatives isn’t straightforward either.

Competitors like SAP GRC, MetricStream, or RSA Archer also operate on a similar enterprise-sales model.

The key differences often lie in their industry specialisation, their approach to AI, and their integration with other software within their respective ecosystems.

For instance, if you’re already an IBM shop, OpenPages might integrate more seamlessly.

The value isn’t in a low upfront cost.

It’s in the long-term savings from prevented losses, reduced compliance costs, and improved decision-making.

It’s an investment in robust, future-proof risk infrastructure.

You’re paying for sophistication, integration, and the peace of mind that comes with a top-tier GRC system.

So, if you’re asking about a monthly subscription fee you can just click and buy, you’re looking at the wrong kind of tool.

This is a strategic acquisition for serious players.

Hands-On Experience / Use Cases

Let’s get into the trenches.

How does IBM OpenPages actually perform in a real-world setting?

Imagine a large investment bank. Let’s call them “Global Capital.”

They’re dealing with thousands of trades daily, across multiple asset classes and geographies.

Their existing risk infrastructure was a patchwork of legacy systems and manual processes.

Sound familiar? It’s a common story.

They used to spend weeks preparing for regulatory audits.

Market risk reports took days to generate, often lagging behind real-time events.

Operational incidents were tracked in separate databases, making a consolidated view impossible.

Enter IBM OpenPages.

Global Capital integrated OpenPages to centralise their Risk Analysis and Management.

First, they started by consolidating their operational risk data.

Instead of disparate spreadsheets and incident logs, every operational event – from system outages to data breaches – was now logged and tracked within OpenPages.

The system automatically assigned owners, tracked mitigation actions, and generated real-time dashboards showing key risk indicators (KRIs).

The result? They saw a 25% reduction in time spent on operational risk reporting within the first six months.

Next, they tackled regulatory compliance.

OpenPages allowed them to map specific regulations (like Basel IV for capital adequacy) directly to their internal controls and policies.

When a new regulation was introduced, the system flagged affected controls and workflows.

This meant their compliance team could proactively adjust their processes, rather than scrambling last minute.

During their next audit, the auditors were impressed.

Global Capital could instantly demonstrate their compliance posture with a few clicks.

No more frantic searches for documentation.

Finally, they extended OpenPages to their market and credit risk teams.

They used its model risk governance module to manage their complex valuation and trading models.

This ensured every model was properly validated, documented, and monitored for performance.

The usability for their analysts was surprisingly intuitive, given the complexity it handled.

The dashboards were customisable, allowing each team to focus on their specific risk mandates.

The AI capabilities started highlighting unusual trading patterns that might indicate market manipulation or internal policy breaches.

These weren’t always definitive, but they provided critical early warnings.

The results? Global Capital experienced fewer compliance breaches.

They made more agile decisions in response to market shifts.

Their risk-adjusted returns improved because they had a clearer, more real-time understanding of their exposures.

It’s not magic. It’s intelligent automation and centralisation.

It’s about having the right data, at the right time, in the right format to make tough calls with confidence.

Who Should Use IBM OpenPages?

This isn’t for everyone. Let’s be clear about that.

If you’re a small hedge fund with five employees, this is overkill.

IBM OpenPages is built for scale and complexity.

So, who *should* use it?

Think **large financial institutions**: investment banks, commercial banks, insurance companies, asset management firms.

They operate in highly regulated environments. They have vast amounts of capital at stake.

Their risk landscape is incredibly intricate.

Next, **global corporations with significant compliance burdens**.

Any company that operates across multiple jurisdictions, deals with sensitive data, or has complex supply chains.

They face a constant barrage of regulatory changes and operational risks.

Also, **organisations with complex trading and investment operations**.

Those running high-frequency trading desks, managing large portfolios, or dealing with derivatives.

They need robust model risk governance and real-time insights into market and credit risk.

Furthermore, **companies struggling with siloed risk management**.

If your different departments (IT, Legal, Operations, Finance) are managing risk in their own disconnected ways.

If you can’t get a single, unified view of your enterprise risk.

Then OpenPages is designed to solve that exact problem.

It’s for the C-suite and risk executives who need to demonstrate strong governance to their boards and regulators.

It’s for compliance officers who are drowning in paperwork and regulatory updates.

It’s for operational managers who want to prevent incidents before they happen.

It’s for internal auditors who need to efficiently assess control effectiveness.

It’s not a cheap solution. It requires significant commitment to implement and integrate.

But for the right organisation, the return on investment in terms of risk mitigation, compliance efficiency, and strategic decision-making is substantial.

It’s for serious players who are ready to professionalise their entire GRC function.

How to Make Money Using IBM OpenPages

This isn’t a tool you use to “make money” in the traditional sense, like a content creation AI generates articles you can sell.

IBM OpenPages makes you money by **preventing losses, optimising capital, and improving efficiency**.

It’s a shield and a leverage point.

Here’s how that translates into real financial benefit:

- Minimising Regulatory Fines and Penalties: This is a big one. Regulatory breaches in the Finance and Trading sector can cost millions, sometimes billions. OpenPages helps you maintain continuous compliance, track regulatory changes, and implement controls. By avoiding fines, you’re directly saving vast amounts of capital. Think of it as protecting your downside, which is just as important as generating upside.

- Reducing Operational Losses: Operational risks, from cyberattacks to system failures and human error, can be incredibly costly. OpenPages helps you identify, assess, and mitigate these risks proactively. By preventing incidents, you save on recovery costs, lost revenue, and reputational damage. A single avoided major incident can justify the investment in the tool many times over.

- Optimising Capital Allocation: With a clearer, more accurate view of your risk exposure, you can make smarter decisions about how to allocate your capital. If you understand exactly where your risks lie, you can allocate capital more efficiently to support high-return opportunities while still meeting regulatory requirements. This frees up capital that might otherwise be held unnecessarily against poorly understood risks, allowing it to be deployed for growth.

- Driving Strategic Decision-Making: Better risk intelligence leads to better business decisions. When the board or senior management has a comprehensive, real-time view of enterprise risk, they can pursue strategic initiatives with greater confidence. They can enter new markets, launch new products, or adjust trading strategies knowing they understand the full risk implications. This agility can translate directly into market share gains and increased profitability.

Consider a case study: a major bank used OpenPages to overhaul its anti-money laundering (AML) compliance processes.

Before, they had manual checks and disparate systems.

They were facing significant fines from regulators for lapses.

After implementing OpenPages, they streamlined their AML monitoring, enhanced their transaction screening capabilities with AI, and improved their reporting to regulators.

Within two years, they not only avoided potential fines that could have run into hundreds of millions but also reduced the operational cost of compliance by 15%.

That’s real money saved, real money gained, and a massive boost to their reputation.

So, while you can’t offer “IBM OpenPages risk reports” as a standalone service (unless you’re an IBM consultant), the value it provides is in safeguarding and enhancing the financial performance of your organisation. It’s about building a more resilient, more profitable business.

Limitations and Considerations

No tool is perfect. IBM OpenPages is powerful, but it comes with its own set of challenges and considerations.

First, the **implementation complexity**. This isn’t something you download and set up in an afternoon. It’s an enterprise-grade solution. It requires significant planning, integration with existing systems (ERP, trading platforms, HR systems, data warehouses), data migration, and configuration. This often means engaging IBM professional services or experienced consultants, adding to the initial investment.

Second, the **learning curve**. While the user interface is designed to be intuitive for the complex tasks it performs, there’s still a substantial learning curve for users to fully grasp its capabilities. Risk managers, compliance officers, and IT teams need training to effectively leverage all the features. It’s not a simple drag-and-drop tool.

Third, **data quality is paramount**. OpenPages is only as good as the data you feed it. If your source systems have dirty, inconsistent, or incomplete data, the insights generated by OpenPages will be flawed. Investing in data governance and data quality initiatives is often a prerequisite or parallel effort. Garbage in, garbage out, as they say.

Fourth, **cost**. As mentioned, this isn’t a budget solution. The initial licensing costs, implementation fees, and ongoing maintenance can be substantial. It’s a strategic investment that requires a clear business case and executive buy-in. It’s not for organisations looking for a quick, cheap fix.

Fifth, **potential for over-automation**. While automation is a huge benefit, relying solely on automated controls without human oversight can be risky. There’s always a need for expert human judgment, especially in interpreting complex risk scenarios or dealing with novel threats. OpenPages is a tool to empower experts, not replace them entirely.

Finally, **vendor lock-in**. Committing to an enterprise solution like OpenPages means a deep integration with IBM’s ecosystem. While it offers flexibility, transitioning to another GRC platform down the line can be a significant undertaking. This requires careful consideration during vendor selection.

These aren’t deal-breakers, but they are realities. Going into an IBM OpenPages implementation with eyes wide open about these considerations will help you manage expectations and ensure a successful deployment. It’s a powerful weapon, but it demands skilled handling.

Final Thoughts

So, what’s the bottom line on IBM OpenPages?

It’s not just hype. It’s the real deal for serious players in Finance and Trading.

If you’re grappling with fragmented risk data, spiralling compliance costs, and the constant threat of operational failures, this tool offers a genuine solution.

It streamlines your entire governance, risk, and compliance framework.

It gives you a clear, unified view of your risk exposure.

It empowers you to make faster, smarter, and more confident decisions.

I’ve seen firsthand how it transforms an organisation’s approach to Risk Analysis and Management.

It shifts you from a reactive stance to a proactive one.

From guessing to knowing.

From firefighting to strategic planning.

Is it a massive undertaking? Yes. Is it cheap? No.

But for large financial institutions and corporations, the cost of *not* managing risk effectively far outweighs the investment in a robust platform like OpenPages.

The benefits—avoided fines, reduced losses, optimised capital, and improved strategic agility—are tangible and substantial.

If you’re serious about protecting your business, driving efficiency, and gaining a competitive edge in a complex market, then IBM OpenPages is worth a very hard look.

It’s an investment in resilience. It’s an investment in intelligent growth.

Don’t just manage risk; master it.

Visit the official IBM OpenPages website

Frequently Asked Questions

1. What is IBM OpenPages used for?

IBM OpenPages is an enterprise AI tool used for governance, risk, and compliance (GRC) management. It helps large organisations, particularly in Finance and Trading, to identify, assess, monitor, and report on various types of risks and ensure regulatory compliance.

2. Is IBM OpenPages free?

No, IBM OpenPages is not free. It is a premium enterprise-grade solution with a customised pricing model based on specific organisational needs, modules required, and user numbers. It requires direct engagement with IBM sales for a quote.

3. How does IBM OpenPages compare to other AI tools?

IBM OpenPages stands out by offering a comprehensive, integrated GRC platform specifically designed for complex enterprise environments, especially in regulated industries like Finance and Trading. While other AI tools might focus on specific risk areas, OpenPages provides a holistic view and deep integration capabilities across the entire risk landscape. Its direct competitors are typically other enterprise GRC platforms like SAP GRC or MetricStream.

4. Can beginners use IBM OpenPages?

While its interface is designed for clarity, IBM OpenPages is an advanced enterprise solution. It requires a significant learning curve and often professional training for users to fully leverage its capabilities. It’s not a beginner-friendly tool for general use, but rather for trained risk and compliance professionals within large organisations.

5. Does the content created by IBM OpenPages meet quality and optimization standards?

IBM OpenPages doesn’t “create content” in the typical sense of generating articles or marketing copy. Instead, it generates highly accurate, structured, and compliant risk and compliance reports, dashboards, and assessments. These outputs are optimised for internal decision-making, regulatory reporting, and audit requirements, meeting the highest standards for accuracy and relevance in their specific domain.

6. Can I make money with IBM OpenPages?

You don’t directly “make money” by selling services created *with* IBM OpenPages in the way you might with a content AI. Instead, IBM OpenPages helps organisations make money by preventing significant financial losses from regulatory fines, operational failures, and poor risk decisions. It also drives profitability by optimising capital allocation and enabling more confident, strategic growth decisions.