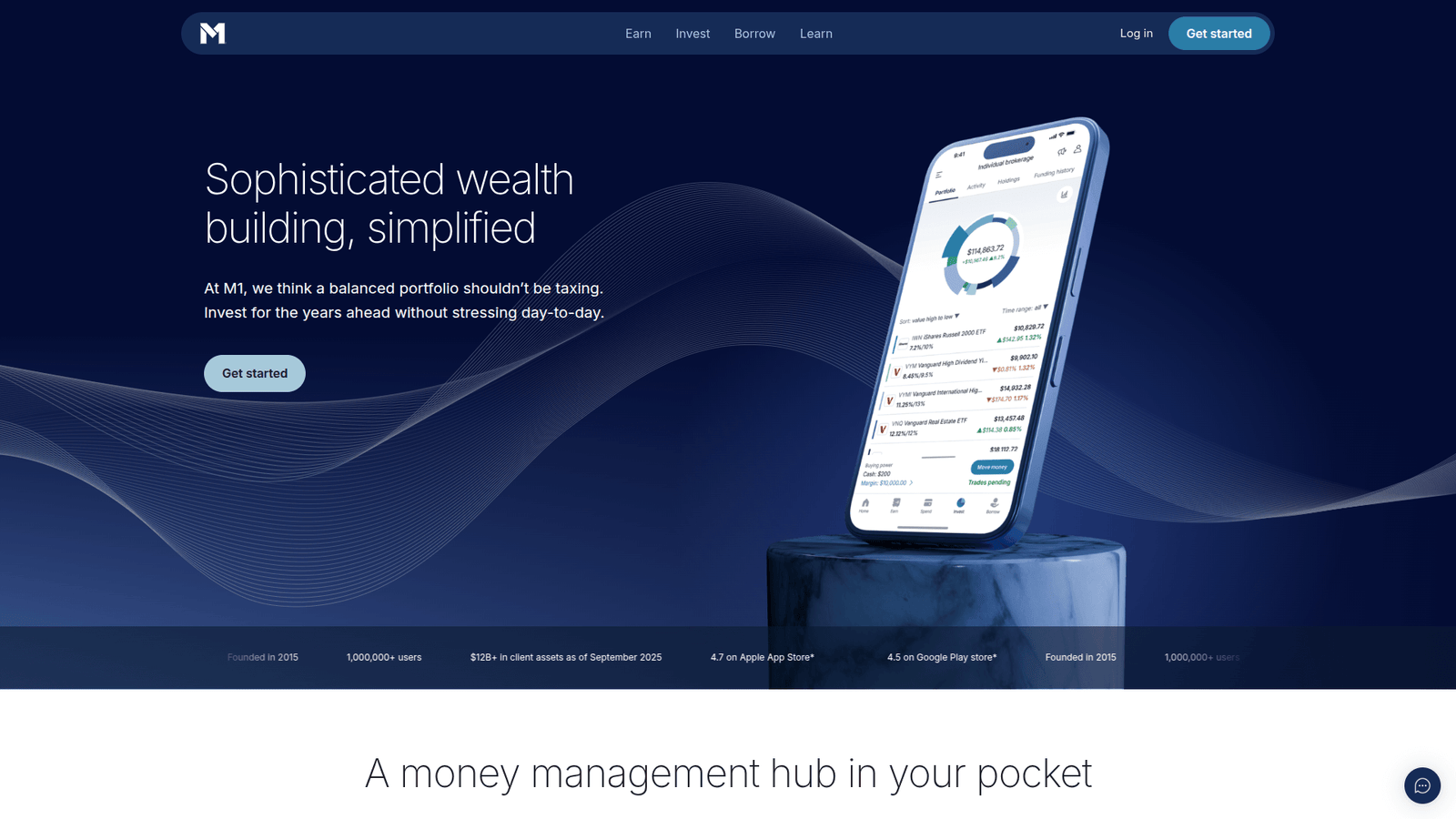

M1 Finance revolutionizes Portfolio Optimization and Robo-Advisors. Automate your investments, build custom portfolios, and boost returns. Start optimizing your wealth today!

M1 Finance Simplifies Even Complex Portfolio Optimization and Robo-Advisors

Ever stare at your investment portfolio, feeling like you’re trying to herd cats?

You’re not alone.

The world of Finance and Trading is getting faster, more complex, and frankly, a bit overwhelming.

AI tools are popping up everywhere, promising to make things easier, smarter, and more profitable.

But which ones actually deliver?

That’s where M1 Finance enters the chat, especially if you’re wrestling with Portfolio Optimization and Robo-Advisors.

Forget the old way of doing things.

This isn’t just another platform; it’s a strategic partner designed to simplify your financial life and potentially boost your returns.

If you’re looking to automate, customise, and scale your investment strategy, stick around.

We’re about to break down how M1 Finance can be a game-changer for you.

Table of Contents

- What is M1 Finance?

- Key Features of M1 Finance for Portfolio Optimization and Robo-Advisors

- Benefits of Using M1 Finance for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use M1 Finance?

- How to Make Money Using M1 Finance

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is M1 Finance?

So, what exactly is M1 Finance?

Think of it as your personal investment architect, powered by automation.

It’s an automated investing platform that lets you build a custom portfolio of stocks and ETFs, then automates the rebalancing and investing process.

Unlike traditional robo-advisors that just give you pre-built portfolios, M1 Finance gives you control.

You choose the investments you want – individual stocks, ETFs, even other pre-made “Expert Pies.”

Then, you allocate percentages to each.

M1 Finance then automatically invests your money according to those percentages and keeps your portfolio balanced over time.

It targets individual investors, but its capabilities make it incredibly useful for professionals in Finance and Trading too, especially those focusing on wealth management and strategic asset allocation.

It’s not just about buying stocks; it’s about building a systematic approach to your money.

This means less emotional decision-making and more consistent execution of your investment strategy.

It’s about having a plan, setting it, and letting the system do the heavy lifting.

This frees up your mental energy to focus on what truly matters: refining your overall financial goals, not constantly monitoring every single trade.

It’s built for those who want smart automation without sacrificing control over their investment choices.

No more endless spreadsheets or manual rebalancing.

M1 Finance brings sophistication to your personal and client portfolios.

Key Features of M1 Finance for Portfolio Optimization and Robo-Advisors

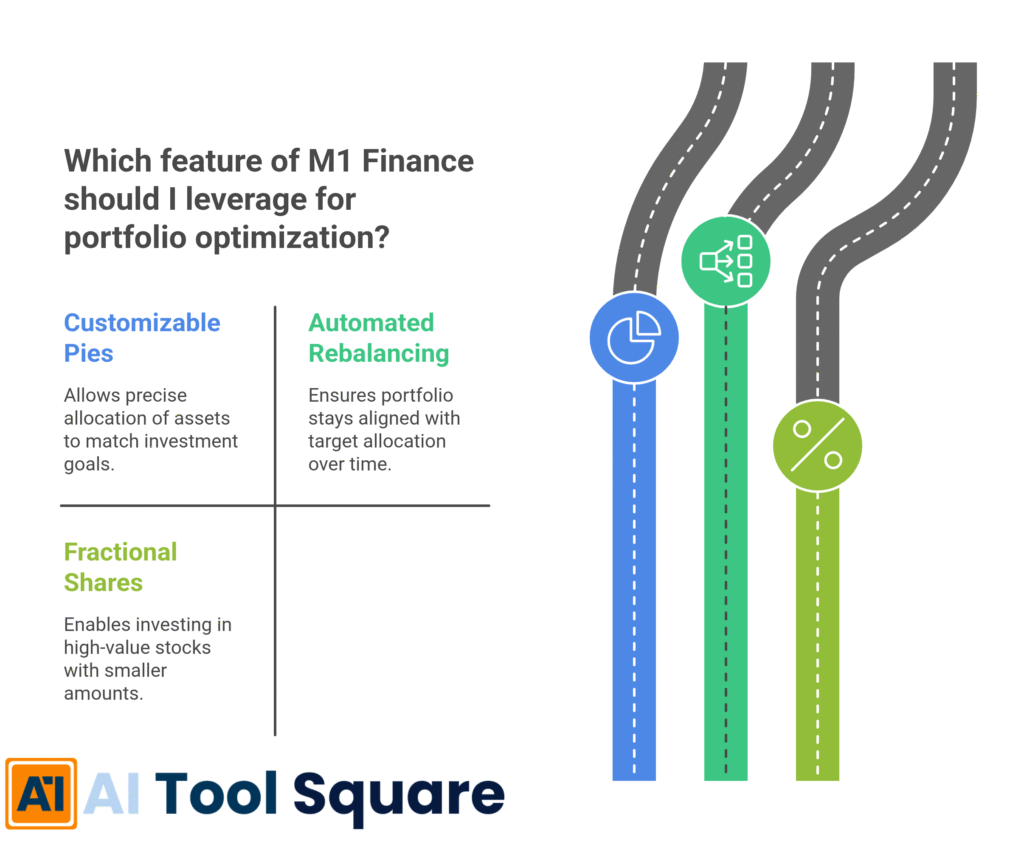

- Customizable “Pies” for Precision Investing: This is where M1 Finance truly shines for Portfolio Optimization and Robo-Advisors. You create investment “Pies” which are essentially custom portfolios. Each slice of the pie represents a specific stock or ETF, and you assign a percentage to it. M1 Finance then automatically invests new deposits and rebalances your portfolio to maintain your desired allocation. This means you can design highly specific strategies for growth, income, or a blend of both, all while automating the execution. Imagine building a pie for a client focused on sustainable investments, another for aggressive growth, and a third for dividend income – all managed with automated precision. This feature eliminates the need for manual calculations and constant monitoring, allowing for true set-and-forget portfolio management, or allowing you to easily adjust strategies with a few clicks.

- Automated Rebalancing and Dynamic Rebalancing: Manual rebalancing is a chore. It takes time, focus, and often leads to emotional decisions. M1 Finance handles this automatically. When you deposit new money, it automatically flows into the “underweight” slices of your pie, bringing your portfolio back to your target allocations. Even better, their “Dynamic Rebalancing” intelligently directs new money to correct any drift in your portfolio, without needing to sell existing holdings. This ensures your portfolio always reflects your chosen strategy without you needing to lift a finger. This is crucial for maintaining risk levels and capitalising on market movements without active intervention. It’s about letting your strategy work, consistently.

- Fractional Shares for Max Efficiency: Ever wanted to buy a tiny bit of a high-priced stock, but couldn’t afford a full share? M1 Finance uses fractional shares. This means every pound you invest gets put to work immediately, no matter the price of the individual stock or ETF. For Portfolio Optimization and Robo-Advisors, this is a game-changer because it allows for true diversification even with smaller investment amounts. You can allocate precise percentages across many different assets without being limited by share prices. This maximises capital efficiency and ensures your portfolio accurately reflects your desired asset allocation, right down to the penny. No wasted cash sitting on the sidelines.

These features combine to create a powerful platform for anyone serious about intelligent investing.

It’s not just about convenience; it’s about getting more from your money, more consistently.

The ability to customise, automate, and efficiently allocate capital makes M1 Finance a top contender in the AI tools for Finance and Trading space.

It’s designed to make complex investment strategies simple to implement and manage.

Benefits of Using M1 Finance for Finance and Trading

Alright, let’s talk real benefits.

Why should someone in Finance and Trading even look at M1 Finance?

First, time savings.

Seriously, how much time do you spend fiddling with trades, rebalancing, or just trying to keep track of a diversified portfolio?

M1 Finance automates all that.

You set your allocation, and it handles the rest.

Imagine what you could do with those extra hours – finding new clients, researching deeper investment opportunities, or just, you know, having a life.

Next, enhanced precision and consistency.

Human error is real.

Emotional trading is even more real.

M1 Finance executes your strategy with unwavering discipline.

It doesn’t get scared during a dip or overly excited during a run-up.

It simply follows the rules you set, which leads to more consistent performance over the long term.

Then there’s the customisation at scale.

Traditional robo-advisors often give you a handful of pre-set options.

M1 Finance lets you build exactly what you want, asset by asset, percentage by percentage.

This means you can tailor portfolios to individual client needs or your own specific market views, and then apply that template across multiple accounts.

It’s powerful.

It also reduces the mental load.

Constantly monitoring markets and making adjustments is exhausting.

M1 Finance takes a huge chunk of that burden off your shoulders.

You define the strategy, the platform executes it.

This helps you overcome “analysis paralysis” or the fear of making the wrong move.

It allows you to focus on the big picture, the strategic thinking, rather than the transactional details.

Finally, it’s about leveraging advanced technology without complexity.

You don’t need to be a coding genius or an AI expert to use M1 Finance.

Its intuitive interface makes sophisticated investment strategies accessible.

This makes it one of the best Portfolio Optimization and Robo-Advisors tools available for those who want control and automation.

It’s like having a highly efficient, tireless assistant for your investment management.

More results, less burnout – that’s the M1 Finance promise.

Pricing & Plans

Alright, let’s talk brass tacks: what’s this going to cost you?

M1 Finance operates on a surprisingly straightforward pricing model, which is a breath of fresh air compared to many platforms that nickel and dime you.

For most core investing features, M1 Finance is actually free.

Yes, you read that right.

No management fees for their basic M1 Invest accounts.

This is a huge differentiator when you compare it to traditional robo-advisors or even human financial advisors who typically charge a percentage of assets under management (AUM).

With M1 Finance, you can build your custom “Pies,” automate your investments, and benefit from dynamic rebalancing without paying a penny in advisory fees.

However, they do offer an optional premium tier called M1 Plus.

This is where they generate revenue and offer additional perks for users who want more advanced features.

M1 Plus typically costs a flat annual fee, which can vary but is generally competitive.

What do you get with M1 Plus?

It usually includes a second trading window (allowing for more frequent rebalancing or adjustments), lower interest rates on M1 Borrow (their portfolio line of credit), higher APYs on M1 Spend (their checking account), and various other benefits like Smart Transfers and a premium debit card.

For someone seriously engaged in Portfolio Optimization and Robo-Advisors, the second trading window can be valuable for more precise execution or reacting to market changes within the day.

When you compare this to alternatives, M1 Finance stands out.

Many competing platforms charge advisory fees that eat into your returns, especially as your portfolio grows.

For example, a typical robo-advisor might charge 0.25% of AUM annually.

On a £100,000 portfolio, that’s £250 a year.

On a £1,000,000 portfolio, that’s £2,500.

M1 Finance’s free tier, or its flat fee for M1 Plus, can be significantly cheaper, especially for larger portfolios.

It’s designed to appeal to those who want robust tools without the ongoing percentage-based fees.

The value proposition is clear: control your investments with powerful automation, and keep more of your profits.

It’s a smart choice for anyone looking to minimise costs while maximising their investment efficiency in Finance and Trading.

Hands-On Experience / Use Cases

Let me tell you what it’s like to actually use M1 Finance.

I’ve seen platforms that promise the world and deliver a clunky interface.

M1 Finance isn’t one of them.

The usability is surprisingly good, especially for the power it packs.

Setting up your first “Pie” is intuitive.

You start by adding individual stocks or ETFs, searching by ticker or company name.

Let’s say I wanted a growth-oriented portfolio with a slight lean towards tech and some international diversification.

I might add shares of Apple, Microsoft, Google, an S&P 500 ETF (like VOO), and an international market ETF (like VXUS).

Then, I assign percentages: 15% Apple, 15% Microsoft, 10% Google, 30% VOO, 30% VXUS.

Boom. Pie built.

From there, when I deposit money, M1 Finance automatically buys shares of these five holdings, ensuring my portfolio maintains those exact percentages.

If Apple goes up and now represents 17% of my portfolio, new deposits will preferentially buy into the other, now “underweight,” slices until the 15% target is met again.

This dynamic rebalancing is pure magic for long-term investors.

A powerful use case for professionals in Finance and Trading is client portfolio management.

Imagine you have a client who wants a “conservative income” portfolio.

You build a Pie with dividend-paying stocks, bond ETFs, and REITs, setting specific allocations.

You can then share this “Expert Pie” with other clients or replicate it across multiple accounts, saving immense time on setup and ongoing management.

Instead of manually buying individual stocks or rebalancing, the system does it all.

Another scenario: I used M1 Finance to create a “set it and forget it” portfolio for my daughter’s college fund.

It’s diversified with low-cost index funds, and I have a recurring deposit set up.

I check it maybe once a quarter, and it just… works.

The results? Consistent, automated growth aligned with my long-term strategy, without the constant need for intervention.

It feels like having a highly skilled, tireless portfolio manager working 24/7.

This level of automation and customisation is what makes M1 Finance a top contender for Portfolio Optimization and Robo-Advisors solutions.

It removes the busywork, allowing you to focus on strategic insights rather than operational overhead.

It’s effective, efficient, and surprisingly simple to use.

Who Should Use M1 Finance?

Alright, who’s this tool actually for?

M1 Finance isn’t a one-size-fits-all, but it hits a sweet spot for several types of users.

First, long-term investors who want to build wealth systematically without actively trading every day.

If you believe in dollar-cost averaging and maintaining a diversified portfolio, M1 Finance is your ally.

It automates these strategies, removing emotion from the equation.

Next, financial advisors and wealth managers looking to streamline their operations.

Imagine managing dozens, or even hundreds, of client portfolios.

Building custom Pies for each client, then letting M1 Finance handle the rebalancing and new investments, can free up massive amounts of your time.

It acts like a scalable platform for implementing your investment philosophy across your client base.

Also, DIY investors who want control but also automation.

Maybe you’re tired of traditional robo-advisors that force you into pre-selected portfolios.

M1 Finance gives you the reins to pick your own stocks and ETFs while still benefiting from automated management.

You get the best of both worlds.

Then there are those looking to save on fees.

If you’re tired of paying advisory fees that eat into your returns, M1 Finance’s free tier is a no-brainer.

It’s a robust platform without the recurring percentage-based charges of many competitors.

Lastly, people with specific investment philosophies.

Want to build an ESG portfolio?

Value investing?

Dividend growth?

M1 Finance allows you to explicitly construct a portfolio that reflects those values and strategies, then automates its maintenance.

It’s an ideal tool for anyone in Finance and Trading who wants to implement sophisticated Portfolio Optimization and Robo-Advisors strategies without the manual headache or exorbitant costs.

It brings institutional-level automation to individual and professional investors alike.

How to Make Money Using M1 Finance

“Okay, so M1 Finance saves me time, but how does it actually put more money in my pocket?”

That’s the real question, right?

It’s not a get-rich-quick scheme, but it absolutely creates significant opportunities for profit, both directly and indirectly.

- Service 1: Offer Automated Portfolio Management as a Service:

This is huge for financial professionals.

You can become a ‘financial coach’ or ‘investment strategist’ using M1 Finance as your backend.

Instead of charging AUM fees like traditional advisors (which M1 itself doesn’t charge on its core investing product), you can charge a flat monthly or annual fee for your expertise.

You help clients define their financial goals, create customised M1 “Pies” for them, and then provide ongoing strategic advice.

M1 handles the execution and rebalancing, making your job scalable.

You could offer tiered services: basic portfolio setup for one fee, and premium service with quarterly reviews and custom pie adjustments for another.

Your value is in the strategy and guidance, not the transactional busywork.

This allows you to serve more clients efficiently and potentially earn more than traditional percentage-based models.

- Service 2: Capitalise on Efficiency Gains for Your Own Investments:

Let’s talk about your personal wealth.

By automating your own Portfolio Optimization and Robo-Advisors, you’re not just saving time; you’re also likely improving your investment performance.

Manual investing often leads to emotional decisions – panic selling, chasing trends, forgetting to rebalance.

M1 Finance removes that.

It forces discipline.

Consistently investing according to a well-defined strategy, especially one focused on diversification and long-term growth, historically leads to better returns.

The savings on management fees, compared to a traditional advisor, directly translate into higher net returns in your pocket.

Over years, even small differences in fees and performance compound into significant wealth accumulation.

It’s about working smarter with your own money, making it grow more effectively.

- Service 3: Create and Market “Expert Pies” or Investment Templates:

M1 Finance has a feature called “Expert Pies,” which are essentially pre-made portfolios designed by M1 or other users.

You can create your own unique investment strategies (Pies) that align with specific goals – say, a “High-Growth Tech Pie,” a “Global Dividend Income Pie,” or a “Sustainable Energy Pie.”

While M1 doesn’t directly pay for these, you can market yourself as an expert who designs these.

You could build an audience around your investment philosophy, offer your “Pies” as templates (perhaps through a newsletter or paid community), and then guide people on how to implement them on M1 Finance.

This builds your brand and can lead to clients for your automated portfolio management services (as mentioned in Service 1).

It’s about monetising your investment knowledge and strategic insights, using M1 Finance as the vehicle for implementation.

Let’s consider an example: How Sarah, a freelance financial planner, makes £3,000/month using M1 Finance.

Sarah targets busy professionals who don’t have time to manage their investments.

She charges a flat £150/month for her “Guided Growth Portfolio” service.

For each client, she sets up a custom M1 Finance Pie based on their risk tolerance and goals.

She explains the strategy, and M1 Finance handles the daily investing and rebalancing.

Sarah provides quarterly reviews and makes strategic adjustments as needed.

With just 20 clients, she generates £3,000 a month.

M1 Finance’s automation means she can easily manage these 20 clients (and more) without getting bogged down in manual trades, making it a highly profitable model.

It’s a clear path to leveraging AI tools for Finance and Trading to build a real business.

Limitations and Considerations

No tool is perfect, and M1 Finance is no exception.

While it’s a stellar platform for Portfolio Optimization and Robo-Advisors, there are a few things to keep in mind.

First, limited trading windows.

For standard users, M1 Finance only executes trades once a day, in the morning.

If you’re an M1 Plus member, you get a second trading window in the afternoon.

This isn’t a platform for day trading or rapid-fire tactical adjustments.

It’s built for long-term, strategic investing, where daily fluctuations are less relevant.

If you need instant execution or intraday trading, M1 Finance isn’t for you.

Next, no manual trade control.

You can’t just jump in and buy 10 shares of Apple right now.

All buys and sells are integrated into the automated “Pie” system and occur during the trading window.

This is by design – it enforces discipline and automation – but it can be a learning curve for those used to traditional brokerage accounts.

You control the allocations, not the individual transactions.

Then there’s the lack of advanced research tools.

While M1 Finance provides basic data on stocks and ETFs, it’s not a full-fledged research platform like some dedicated brokerage accounts.

You’ll likely need to do your deeper fundamental or technical analysis on other platforms before deciding what to include in your M1 Pies.

It’s an execution and automation platform, not a research powerhouse.

Also, the learning curve for “Pies” and rebalancing logic.

While the interface is user-friendly, understanding how the Pies work, how rebalancing occurs with new deposits, and when M1 chooses to sell (e.g., for rebalancing or withdrawals) takes a bit of time.

It’s not overly complex, but it’s different from what many investors are used to.

Finally, customer support can sometimes be slower than what you might find with larger, full-service brokers.

While they are responsive, it might not be instantaneous, which is a consideration if you frequently need immediate assistance.

Despite these points, for its core purpose of automated Portfolio Optimization and Robo-Advisors, M1 Finance excels.

It’s about understanding its strengths and making sure they align with your investment style in Finance and Trading.

Final Thoughts

So, what’s the verdict on M1 Finance?

If you’re in Finance and Trading, or even just a serious individual investor, and you’re tired of the manual grind of portfolio management, this tool is a serious contender.

It’s not just hype; it’s the real deal.

M1 Finance delivers on its promise of simplifying even complex Portfolio Optimization and Robo-Advisors strategies through elegant automation.

The ability to build highly customisable portfolios (“Pies”), automate investing with fractional shares, and ensure constant rebalancing without lifting a finger is incredibly powerful.

It frees up your time, removes emotional trading mistakes, and helps you maintain investment discipline, all while keeping costs remarkably low.

This means more time for strategic thinking, client acquisition, or simply enjoying your life.

For professionals, it’s a scalable solution for managing multiple client portfolios with consistency and precision.

For individual investors, it provides institutional-grade automation without the hefty fees.

Yes, it has its quirks, like the limited trading windows, but those are deliberate design choices that reinforce its long-term, strategic investment philosophy.

If you’re looking for an AI tool that actually delivers on efficiency and returns in the investment space, M1 Finance should be at the top of your list.

It’s a smart choice for anyone serious about growing their wealth systematically.

My recommendation?

Give it a try.

Set up a small portfolio, experiment with a few Pies, and see how the automation simplifies your financial life.

You might just find yourself wondering how you ever managed without it.

It’s time to work smarter, not harder, with your investments.

Visit the official M1 Finance website

Frequently Asked Questions

1. What is M1 Finance used for?

M1 Finance is primarily used for automated investing, portfolio customisation, and wealth management. It allows users to build custom portfolios of stocks and ETFs, then automates investing new money and rebalancing the portfolio according to set allocations. It’s a powerful tool for Portfolio Optimization and Robo-Advisors strategies.

2. Is M1 Finance free?

Yes, the core M1 Invest platform, including custom portfolios, automated investing, and dynamic rebalancing, is free with no management fees. M1 Finance offers an optional premium service called M1 Plus, which provides additional benefits for an annual fee.

3. How does M1 Finance compare to other AI tools?

M1 Finance stands out by offering a unique blend of customisation and automation. Unlike many traditional robo-advisors that offer pre-set portfolios, M1 allows users to pick individual stocks and ETFs while still benefiting from automated management and rebalancing. It’s ideal for those who want control but also efficiency.

4. Can beginners use M1 Finance?

Yes, beginners can definitely use M1 Finance. While the concept of “Pies” and custom allocations might seem a bit advanced initially, the interface is intuitive. M1 also offers pre-built “Expert Pies” that beginners can use as a starting point, learning how automated investing works without needing to pick individual stocks themselves.

5. Does the content created by M1 Finance meet quality and optimization standards?

M1 Finance doesn’t “create content” in the traditional sense like an AI writing tool. Instead, it creates highly optimised investment portfolios based on your chosen strategy. This automation ensures the “content” (your portfolio’s structure) adheres to your specific financial goals and risk tolerance, leading to disciplined and optimised investment execution.

6. Can I make money with M1 Finance?

Absolutely. You can make money directly through automated investing and portfolio growth. Additionally, financial professionals can leverage M1 Finance to offer scalable automated portfolio management services to clients, charging fees for their expertise in setting up and advising on these custom portfolios. It enables both direct wealth accumulation and service-based income generation.