NinjaTrader empowers Algorithmic Trading and Strategy Development, streamlining your workflow. Discover how this AI tool boosts efficiency and profitability. Get started now!

Here’s How NinjaTrader Solved My Biggest Algorithmic Trading and Strategy Development Issue

Alright, let’s be real.

The Finance and Trading game? It’s brutal.

Especially if you’re trying to stay ahead in Algorithmic Trading and Strategy Development.

It used to be a headache.

Manual processes, endless backtesting, hoping your logic holds up when the markets go wild.

Sound familiar?

I get it. I’ve been there.

But then I found NinjaTrader.

And let me tell you, it’s not just another piece of software.

It’s a game-changer.

This isn’t about some magic bullet, but it’s about a tool that lets you build, test, and deploy strategies faster and with more confidence than you ever thought possible.

If you’re serious about your trading, and you’re serious about making your algorithms work for you, then pay attention.

This is how it’s done.

This is about getting results, not just spinning your wheels.

Ready? Let’s jump in.

Table of Contents

- What is NinjaTrader?

- Key Features of NinjaTrader for Algorithmic Trading and Strategy Development

- Benefits of Using NinjaTrader for Finance and Trading

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use NinjaTrader?

- How to Make Money Using NinjaTrader

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

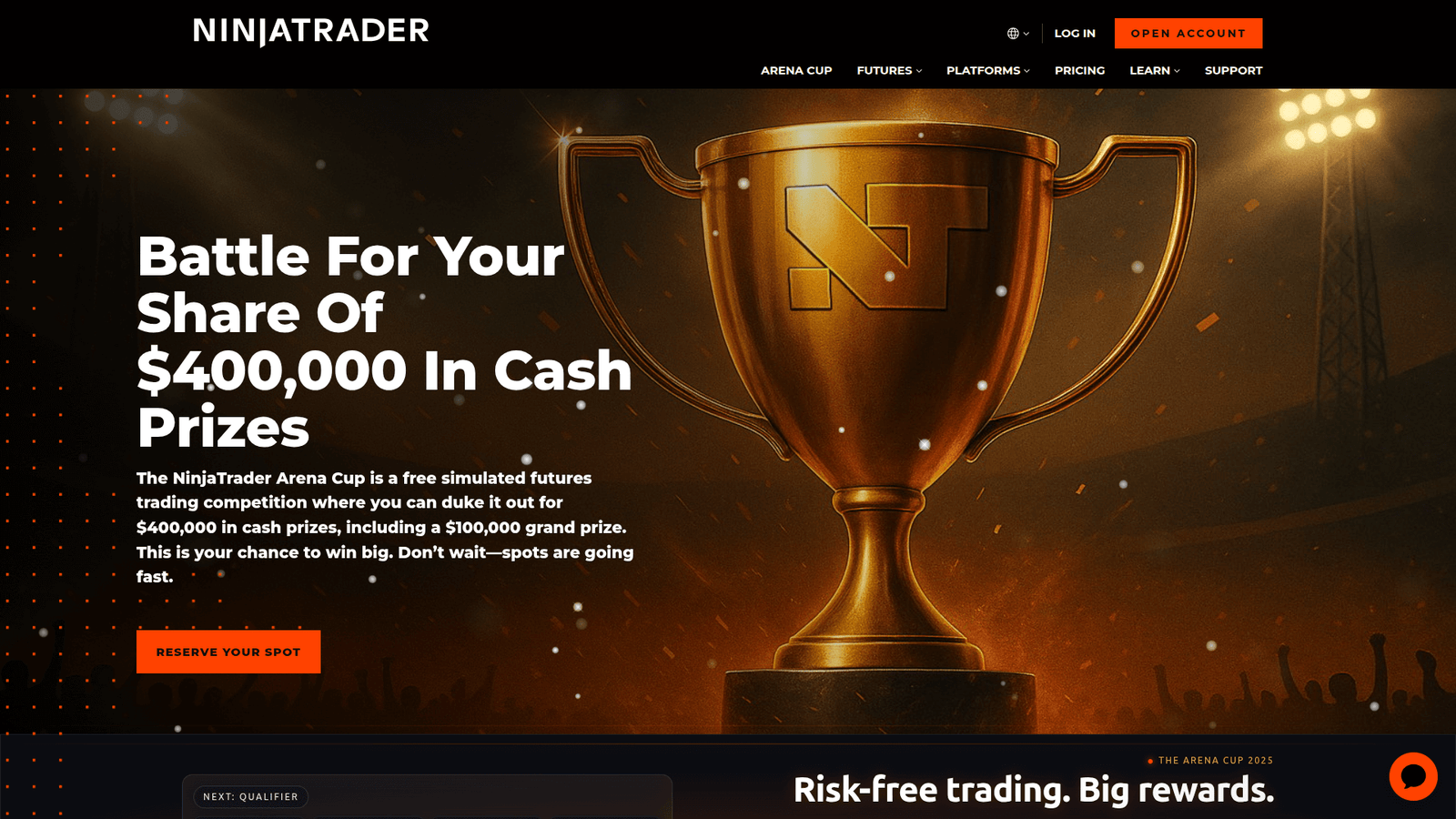

What is NinjaTrader?

Okay, so what exactly is NinjaTrader?

Forget the fancy jargon.

NinjaTrader is a powerful trading platform.

It’s built specifically for active traders.

Think futures, forex, and stocks.

It’s not just about placing trades.

It’s about having a full suite of tools at your fingertips.

Charting, market analysis, strategy development, and automated trading – it’s all here.

For anyone serious about Algorithmic Trading and Strategy Development, this tool is your workbench.

It gives you the framework to design, test, and deploy your trading ideas.

No more messing around with clunky, separate systems.

NinjaTrader brings everything together.

Its core function?

To empower traders to make data-driven decisions.

It offers robust charting capabilities.

You can customize indicators and analyze market movements with precision.

But where it really shines is in its algorithmic trading capabilities.

You can build sophisticated strategies without needing to be a coding guru.

It democratizes access to advanced trading methods.

This means more people can tap into the power of automated trading.

Its target audience?

Individual traders, proprietary firms, and fund managers.

Anyone who wants to take their trading seriously.

And by seriously, I mean systematically.

It’s for those who understand that consistent profits come from disciplined, tested strategies.

Not from gut feelings.

It supports multiple asset classes.

This makes it versatile for different trading styles.

From day traders to swing traders, there’s something here for everyone.

It truly makes high-level trading accessible.

That’s NinjaTrader. Simple as that.

Key Features of NinjaTrader for Algorithmic Trading and Strategy Development

Let’s break down what NinjaTrader actually brings to the table.

This isn’t just about making things look pretty.

It’s about functionality that directly impacts your bottom line.

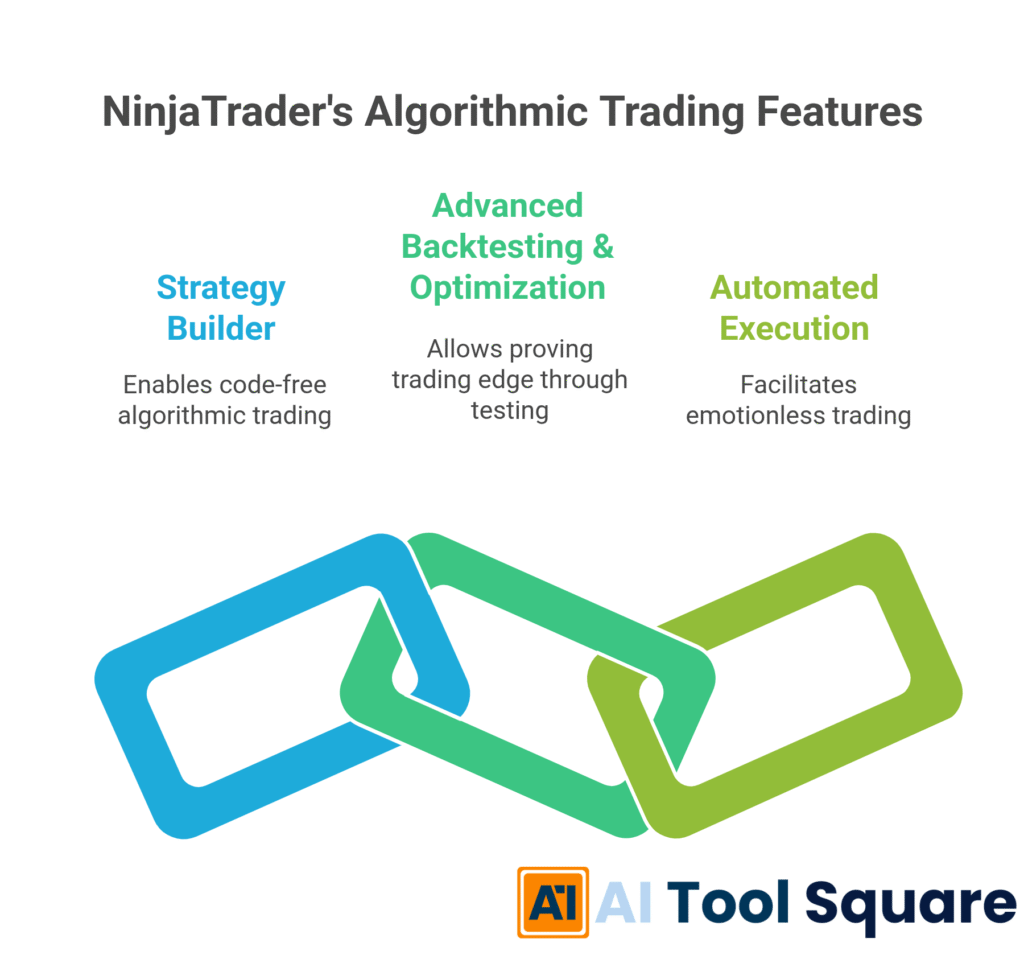

- Strategy Builder: Code-Free Algorithmic Trading and Strategy Development

This is a big one.

You don’t need to be a Python whiz to build sophisticated algorithms.

NinjaTrader’s Strategy Builder lets you create automated trading strategies visually.

Drag and drop conditions, actions, and indicators.

It’s intuitive.

This means you can rapid-prototype your ideas.

Test a hypothesis, build the logic, and see if it works.

No wasted time on coding syntax errors.

It’s about getting your strategy from idea to execution faster.

This dramatically reduces the barrier to entry for Algorithmic Trading and Strategy Development.

More ideas tested means more potential winning strategies found.

- Advanced Backtesting & Optimization: Prove Your Edge

What’s a strategy without proof?

Worthless, that’s what.

NinjaTrader offers incredibly powerful backtesting tools.

You can run your strategies against historical data.

And I’m talking about deep, tick-level data.

This gives you a realistic view of how your strategy would have performed.

But it doesn’t stop there.

The optimization engine allows you to tweak parameters.

Find the sweet spot for your entry and exit points.

Minimize drawdowns, maximize profits.

It’s about refining your edge.

This feature turns guesswork into calculated risk.

It’s essential for anyone serious about consistent performance.

- Automated Execution: Trade Without Emotion

Once your strategy is built and backtested, what’s next?

Automated execution.

This is where NinjaTrader truly delivers.

Your strategy can automatically place, manage, and close trades.

No more hesitation.

No more emotional decisions derailing your plan.

The market doesn’t care about your feelings.

Your algorithm does exactly what it’s programmed to do.

This leads to disciplined trading.

It ensures your strategy is followed precisely, every single time.

Even when you’re asleep or busy doing something else.

This is how you scale your trading operations.

It’s how you achieve true leverage in the markets.

Because your time is freed up.

You can focus on developing new strategies, not babysitting open positions.

Benefits of Using NinjaTrader for Finance and Trading

Alright, so we’ve covered the features.

But what does this actually mean for you?

What are the real-world benefits when you’re in the trenches of Finance and Trading?

Let’s talk impact.

First, Massive Time Savings.

Think about how long it takes to manually analyze charts.

Or to backtest a strategy by hand.

It’s an eternity.

NinjaTrader automates a huge chunk of this.

You can build, test, and optimize strategies in a fraction of the time.

This isn’t just about convenience.

It’s about opportunity cost.

More time saved means more strategies developed.

More strategies developed means more potential revenue streams.

Time is money, especially in this business.

Second, Improved Strategy Quality and Robustness.

Manual trading is prone to human error.

Emotions, fatigue, distractions – they all mess with your judgment.

NinjaTrader forces discipline.

Your strategies are based on logic and data, not impulse.

The rigorous backtesting and optimization features allow you to iron out flaws.

You can identify weaknesses before they cost you real money.

This leads to strategies that are more resilient.

Strategies that perform consistently, even in volatile markets.

It’s about building a solid foundation, not a house of cards.

Third, Overcoming Creative Blocks and Analysis Paralysis.

Ever stare at a chart for hours, completely stuck?

Trying to find an edge, but drawing a blank?

NinjaTrader’s visual strategy builder acts as a creative partner.

You can quickly experiment with different ideas.

Combine indicators, tweak parameters, and see the results instantly.

This iterative process sparks new ideas.

It helps you break through those mental barriers.

Instead of overthinking, you’re doing.

Instead of paralyzing yourself with options, you’re testing them.

It turns abstract concepts into concrete, testable strategies.

Finally, Reduced Emotional Trading and Increased Discipline.

This is huge.

The biggest killer of trading accounts isn’t bad strategies.

It’s emotional trading.

Fear, greed, hope – they lead to impulsive decisions.

NinjaTrader eliminates this.

Once your strategy is automated, it executes without emotion.

It adheres to its predefined rules, no matter what your gut is telling you.

This instills a level of discipline that’s almost impossible to maintain manually.

It’s about letting the data drive your decisions, not your feelings.

And that’s how you build a long-term, profitable trading career.

Pricing & Plans

Alright, let’s talk money.

Because nobody wants to invest in something that breaks the bank or doesn’t deliver value.

NinjaTrader has a pretty straightforward approach to pricing.

Is there a free plan? Yes, sort of.

You can get started with NinjaTrader for free.

This free version gives you access to a lot of the platform’s core features.

You can use their advanced charting, market analysis tools, and even practice trading with simulated accounts.

This is awesome for learning the ropes.

It’s perfect for building and backtesting strategies without risking a single penny.

You can get a solid feel for the platform’s capabilities before committing.

But here’s the kicker: the free version doesn’t allow live trading with real money.

For that, you need to upgrade.

The premium version, or rather, the version that unlocks live trading, comes in a few flavors.

You can either lease the software or buy it outright.

Leasing is typically a monthly or quarterly subscription.

It gives you full access to all features, including live trading and advanced order types.

The “lifetime” license is a one-time payment.

This means you own the software forever.

No recurring fees.

This can be a significant cost saving in the long run.

Especially if you plan on using NinjaTrader for years to come.

What does the premium version include?

Everything.

Live trading capabilities, access to all brokers supported by NinjaTrader.

Full access to all add-ons and third-party integrations.

Priority support, often.

It unlocks the full potential of Algorithmic Trading and Strategy Development.

Compared to alternatives?

Many other platforms charge hefty monthly fees for similar features.

Some even charge per trade or have high data feed costs.

NinjaTrader’s lifetime license option is a big differentiator.

It’s a serious investment, yes.

But for active traders, it can be significantly more cost-effective.

No lock-ins, no endless subscriptions.

Just own it, use it, and profit from it.

It’s a value proposition that’s hard to beat for long-term users.

Hands-On Experience / Use Cases

Let’s talk about a real scenario.

Because theory is one thing, but actually putting this tool to work is another.

Imagine I’m trying to develop a simple mean-reversion strategy for E-mini S&P 500 futures.

My old way involved hours of manually pulling data, plotting moving averages, and squinting at charts.

Then trying to code something up in Python, only to get stuck on API integrations.

It was a mess.

With NinjaTrader, the process changed entirely.

First, I fired up the Strategy Builder.

I wanted my strategy to enter a long position when the price crosses below a certain moving average.

And exit when it crosses back above, or hits a specific profit target/stop loss.

In the Strategy Builder, I could simply drag and drop the “Close price” indicator.

Then I added a “Simple Moving Average” indicator.

I set the conditions: “Close price crosses below SMA(20)”.

For the action, I chose “Enter Long”.

Then I added exit conditions for profit target and stop loss, all with clicks, not code.

It was surprisingly straightforward.

Next, I moved to backtesting.

I loaded up years of historical E-mini data within NinjaTrader.

I ran my newly built strategy.

The platform gave me detailed performance metrics: net profit, drawdowns, win rate, profit factor.

Instantly, I saw that my initial parameters weren’t great.

The strategy was losing money.

But instead of starting from scratch, I used the optimizer.

I told NinjaTrader to test different lengths for the moving average (e.g., 10 to 30) and various profit targets/stop losses.

Within minutes, it crunched through hundreds of combinations.

It presented me with the optimal parameters that yielded the best historical performance.

Suddenly, my losing strategy became profitable.

This iterative process, from idea to optimized strategy, took hours, not days or weeks.

The usability is outstanding.

The interface is clean, even with all its power.

Everything is logically laid out.

The learning curve, while present for advanced features, is surprisingly gentle for core functions.

For Algorithmic Trading and Strategy Development, this means less time wrestling with the tool and more time refining your actual trading ideas.

The results?

A fully tested, optimized strategy that I can confidently deploy.

And the best part?

Once deployed, NinjaTrader handles the execution.

No more sitting in front of the screen, hand-holding trades.

It just works.

This wasn’t just an improvement; it was a revolution in my workflow.

Who Should Use NinjaTrader?

Alright, so who is this beast actually for?

Because not every tool is for everyone.

NinjaTrader shines brightest for a specific type of user.

First up: Active Futures and Forex Traders.

If you’re trading futures contracts or currency pairs, NinjaTrader is practically tailor-made for you.

Its data feeds, charting, and execution capabilities are top-tier for these markets.

It’s built to handle the speed and precision required.

Next, Aspiring and Experienced Algorithmic Traders.

Whether you’re just dipping your toes into automated strategies or you’ve been doing it for years, NinjaTrader has tools for you.

The visual Strategy Builder makes it accessible for beginners.

The powerful C# API (NinjaScript) allows advanced users to write complex, custom indicators and strategies.

It bridges the gap between no-code and deep-code algorithmic trading.

Then there are Strategy Developers and Backtesters.

If your main game is designing and validating trading strategies, even if you don’t plan to live trade them yourself, NinjaTrader is a phenomenal lab.

The historical data access, robust backtesting engine, and optimization tools are critical.

You can rapidly iterate and test concepts.

This helps you prove an edge before deploying it elsewhere.

Also, Proprietary Trading Firms and Fund Managers.

Larger organizations can leverage NinjaTrader for its robust infrastructure.

Managing multiple strategies, monitoring diverse portfolios, and ensuring high-speed execution are all possible.

Its reliability and extensive customization options make it suitable for professional environments.

Finally, Anyone Serious About Disciplined Trading.

If you’re tired of emotional decisions derailing your profits, this tool is your answer.

It forces a systematic approach.

It helps you remove yourself from the trade execution, focusing instead on strategy development.

It’s for those who understand that long-term success in Finance and Trading comes from a disciplined, data-driven approach.

Not from gut feelings or chasing hot tips.

If you fit into any of these categories, you owe it to yourself to check out NinjaTrader.

How to Make Money Using NinjaTrader

Okay, the big question.

How do you actually turn this powerful software into cold, hard cash?

It’s not just about trading your own account, although that’s certainly one way.

NinjaTrader opens up several revenue streams.

- Service 1: Selling Custom Indicators and Strategies

Think about this. Many traders are looking for an edge.

They might not have the time or skill to code their own indicators or strategies.

If you’re good at Algorithmic Trading and Strategy Development with NinjaTrader, you can build custom tools.

These could be unique indicators that identify specific market conditions.

Or fully automated strategies that execute trades based on your logic.

You can package these up and sell them.

There’s a marketplace specifically for NinjaTrader add-ons.

Or you can build your own website and market them there.

This creates a recurring revenue stream if you offer subscriptions or ongoing support.

It’s about leveraging your expertise to help other traders.

- Service 2: Providing Strategy Development and Backtesting Services

Not everyone wants to learn how to build or code strategies.

But many have trading ideas they want to test.

You can offer your services as a “quant-for-hire” using NinjaTrader.

Clients come to you with their trading hypotheses.

You then use NinjaTrader’s Strategy Builder and backtesting engine to build and validate their ideas.

You provide them with detailed performance reports.

Show them if their idea has a statistical edge or not.

This is invaluable for traders who are time-constrained or lack the technical skills.

You charge a fee per project or per hour.

It’s a clear value proposition.

- Service 3: Managing Prop Firm Accounts or Client Funds

Once you’ve proven your strategies work on NinjaTrader, you can seek out opportunities to manage capital.

Many proprietary trading firms will fund traders who demonstrate consistent profitability with automated systems.

You pass their evaluation, and they give you capital to trade.

You keep a percentage of the profits.

Alternatively, with proper licensing and regulation, you could manage funds for individual clients.

Your automated strategies, running on NinjaTrader, provide the engine for growth.

This is the ultimate leverage.

Turning your tested strategies into a profit-generating machine with external capital.

Case Study: How John makes $X/month using NinjaTrader for Algorithmic Trading and Strategy Development

Let’s talk about John.

John used to be a discretionary day trader.

He was stressed, inconsistent, and often overtraded.

He knew he needed a systematic approach.

John started with NinjaTrader’s free version, learning the Strategy Builder.

He built an idea based on simple trend following and backtested it rigorously.

After months of testing and optimization, he found a profitable setup.

He then invested in the lifetime license.

Now, John has two main income streams.

First, his automated strategy trades his personal account, generating consistent profits.

Second, he noticed a demand for simple, robust indicators in the NinjaTrader community.

He developed a unique momentum indicator using NinjaScript.

He started selling it on the NinjaTrader ecosystem for a small monthly fee.

With about 50 subscribers, he’s pulling in an additional consistent income.

He’s working smarter, not harder.

And his trading is less stressful than ever before.

That’s the power of NinjaTrader.

Limitations and Considerations

Look, no tool is perfect.

And NinjaTrader, while powerful, has its nuances.

You need to be aware of these before you jump in headfirst.

First, Accuracy and Over-Optimization Risk.

NinjaTrader’s backtesting is fantastic, but it’s only as good as the data you feed it.

And there’s a real danger of “over-optimization.”

This is where you tweak your strategy parameters so much that it looks amazing on historical data.

But it utterly fails in live trading because it’s fitted too perfectly to past market noise.

You need to understand basic statistical concepts.

Know how to conduct out-of-sample testing.

And accept that past performance is not indicative of future results.

The tool is powerful, but it won’t make you profitable if you abuse its capabilities.

Second, Learning Curve and Technical Acumen.

While the Strategy Builder is code-free, getting the most out of NinjaTrader requires some effort.

It’s not a “set it and forget it” system right out of the box.

You’ll need to learn the interface, understand how indicators work, and grasp the nuances of order types.

If you want to create highly custom indicators or complex strategies, you’ll need to learn NinjaScript (C#).

This isn’t for the faint of heart.

It demands a certain level of technical acumen.

But the reward for that effort is significant.

Third, Data Feed Costs and Connectivity.

To get reliable historical data and real-time quotes, you’ll need a data feed.

While NinjaTrader has integrated brokers that provide data, these often come with their own costs.

Especially for futures data, which can be expensive.

You need a stable internet connection for live trading.

Any disruptions can cause issues with order execution.

These are external considerations, but they are crucial for optimal performance.

Finally, No Magic Bullet Syndrome.

NinjaTrader is an amazing tool.

But it’s just a tool.

It doesn’t guarantee profits.

It won’t turn a bad trading idea into a good one.

It requires sound trading principles, market understanding, and risk management from you.

It amplifies your abilities.

But it doesn’t replace the need for skill and knowledge.

Approach it with realistic expectations, and you’ll be fine.

Use it to validate and execute your edge, not to find a shortcut to riches.

Final Thoughts

Alright, let’s wrap this up.

NinjaTrader is not just another piece of software.

It’s a powerhouse.

Especially if you’re serious about Algorithmic Trading and Strategy Development.

It’s designed to streamline your entire workflow.

From ideation to execution.

It empowers you to build, test, and automate your trading strategies with precision.

It removes emotional bias, improves discipline, and gives you back your time.

Is it perfect? No.

Does it require effort to learn and master? Absolutely.

But the return on that investment of time and energy?

Potentially massive.

For anyone in Finance and Trading, especially those eyeing automated systems, this tool is a game-changer.

It’s about working smarter, not harder.

It’s about building a robust, data-driven approach to the markets.

My recommendation?

If you’re still on the fence, download the free version.

Play around with the Strategy Builder.

Backtest some ideas.

See for yourself how much more efficient and effective your trading process can become.

Don’t just take my word for it.

Test it. Build with it.

And then make your decision.

Because in this game, inaction is often the biggest risk.

Take the next step.

Visit the official NinjaTrader website

Frequently Asked Questions

1. What is NinjaTrader used for?

NinjaTrader is primarily used by active traders for charting, market analysis, and developing automated trading strategies. It supports trading in futures, forex, and stocks, allowing users to backtest and execute their algorithmic strategies.

2. Is NinjaTrader free?

NinjaTrader offers a free version that includes advanced charting, market analysis, and simulated trading. However, to unlock live trading capabilities and full features, you need to purchase a license, either through a lease (subscription) or a one-time lifetime payment.

3. How does NinjaTrader compare to other AI tools?

NinjaTrader excels in providing a comprehensive platform specifically for algorithmic trading and strategy development in futures and forex. While other AI tools might focus on broader market analysis or specific asset classes, NinjaTrader offers a robust environment for building, testing, and deploying automated systems with both visual (code-free) and programming (C#) options.

4. Can beginners use NinjaTrader?

Yes, beginners can definitely use NinjaTrader. The platform offers a visual Strategy Builder that allows users to create automated strategies without coding. While some advanced features require a learning curve, the free version and extensive educational resources make it accessible for newcomers to algorithmic trading.

5. Does the content created by NinjaTrader meet quality and optimization standards?

NinjaTrader itself doesn’t “create content” in the traditional sense like an AI writing tool. Instead, it creates highly optimized and validated trading strategies through its backtesting and optimization engines. The quality and performance of these strategies depend on the user’s input, market understanding, and risk management principles. When properly used, it helps develop high-quality, data-driven trading systems.

6. Can I make money with NinjaTrader?

Absolutely. Beyond trading your own account with automated strategies, you can make money by selling custom indicators and strategies you develop on the platform. You can also offer strategy development and backtesting services to other traders or aim to manage capital for proprietary trading firms using your proven algorithmic systems.