Sift Science uses AI to boost your Fraud Detection efforts. Stop losses, save time, and improve Security and Moderation accuracy. See how it works!

Why Sift Science Is a Smart Choice for Fraud Detection

Okay, let’s talk fraud.

It’s a nightmare, right?

Costs businesses billions every year.

And honestly, the old ways of fighting it?

They’re just not cutting it anymore.

Manual reviews? Slow.

Rules-based systems? Too rigid.

The bad guys are getting smarter. Faster.

They’re using tech, so you need tech to fight back.

That’s where AI comes in.

Specifically, AI for Security and Moderation.

And even more specifically, tools like Sift Science.

It’s built for this fight.

Built to help you stop fraud dead in its tracks.

Without drowning in data or manual work.

Ready to see how?

Let’s get into it.

Table of Contents

- What is Sift Science?

- Key Features of Sift Science for Fraud Detection

- Benefits of Using Sift Science for Security and Moderation

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Sift Science?

- How to Make Money Using Sift Science

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Sift Science?

Okay, straight talk.

What exactly IS Sift Science?

Think of it as your digital detective.

But way, way faster and smarter than any human.

Sift Science is an AI-powered platform.

Its main job?

Fighting fraud.

But not just one type.

We’re talking payments fraud, account takeover, content abuse, promo abuse, and more.

It’s designed for businesses. Any business handling online transactions or user interactions.

E-commerce, marketplaces, fintech, travel, gaming – you name it.

If you’re dealing with users and potential bad actors, Sift is relevant.

It uses machine learning.

Big data analysis.

To spot risky behaviour.

In real-time.

It’s not just looking at one data point.

It’s looking at thousands.

Connections. Patterns. Anomalies.

Things a human eye would miss.

Or take ages to find.

It gives you a risk score.

For every transaction. Every user. Every event.

This lets you make quick decisions.

Approve. Decline. Or send for review.

Without slowing down the good customers.

That’s key.

You don’t want to stop legitimate business.

Just the fraudulent stuff.

Sift helps you do exactly that.

It’s built for teams in Security and Moderation.

Especially those focused on Fraud Detection.

It reduces chargebacks.

Stops account abuse.

Cleans up user-generated content.

Saves you money.

And saves your team time.

Big time.

It’s not just software.

It’s a fraud prevention network.

Learning from billions of events across its global customer base.

This shared intelligence makes it powerful.

New fraud tactics are spotted and patterns are shared (anonymously, of course).

So everyone on the network benefits.

Pretty smart, huh?

That’s the core idea behind Sift Science for Security and Moderation.

Key Features of Sift Science for Fraud Detection

Alright, what can this thing actually DO?

Let’s break down the features.

The ones that make Sift Science a serious player in Fraud Detection.

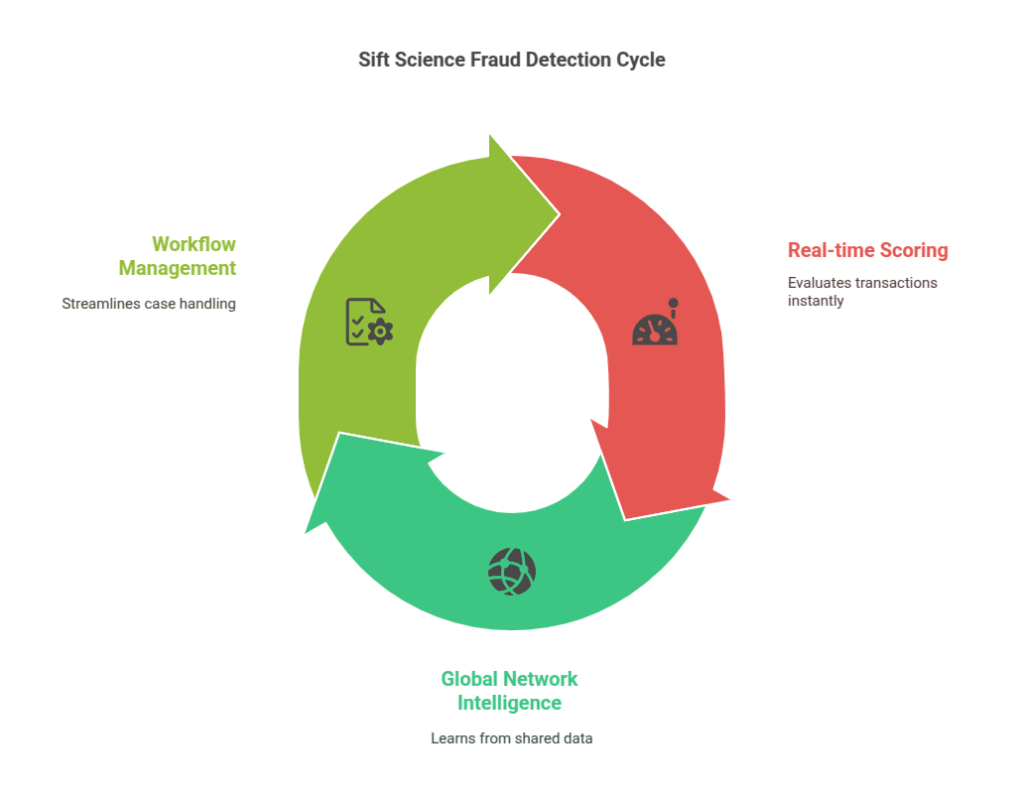

- Real-time Scoring and Decisioning:

This is huge.

Fraud moves fast.

Your defense needs to move faster.

Sift gives you a risk score.

For every transaction, every login, every new account.

Right as it happens.

Based on thousands of signals.

IP address, device ID, location, purchase history, user behaviour patterns… the list goes on.

This score tells you how risky the event is.

You can set up rules based on these scores.

Automatically approve low risk.

Automatically decline high risk.

Flag medium risk for review.

This isn’t just faster.

It’s more accurate than old-school methods.

Less manual grunt work.

More good customers sail through.

Fewer chargebacks from bad ones.

- Global Network Intelligence:

Remember I mentioned the network?

This is where it gets really interesting.

Sift processes data from its massive customer base.

Across different industries. Different parts of the world.

Think of it as a shared brain.

When a fraudster tries a new trick on one company, Sift learns.

That learning is anonymized and shared across the network.

So if that same fraudster, or group of fraudsters, tries the same trick on YOUR business…

Sift is already aware.

It spots the pattern instantly.

This collective intelligence is a massive advantage.

It helps Sift detect emerging fraud types.

Account takeover attacks, synthetic identities, promo abuse rings – these evolve constantly.

The network helps Sift stay ahead.

It’s like having thousands of fraud analysts working together, non-stop.

Pooling their knowledge.

To protect your business.

- Workflow and Case Management:

Stopping fraud isn’t just about spotting it.

It’s also about dealing with it efficiently.

Sift provides tools for your team.

A dashboard where you see everything.

Events flagged for review.

Risk scores.

All the data points that fed into that score.

Presented clearly.

Your analysts can review flagged cases quickly.

They can see related users, past activity, links between accounts.

Sift visualizes these connections.

Makes it easy to see if this transaction is linked to other suspicious activity.

Or if this user is linked to known fraudsters.

You can approve, decline, or escalate cases right there.

Automate responses.

Log decisions.

This streamlines the whole process.

Reduces the time spent on manual reviews.

Lets your team focus on the complex cases.

The ones that really need a human eye.

Instead of sifting through noise.

Pun intended.

These features combine to give you a powerful defense.

Against a constantly changing threat.

Benefits of Using Sift Science for Security and Moderation

Okay, features are nice.

But what’s the real payoff?

Why should someone fighting fraud in Security and Moderation even look at Sift Science?

Let’s talk benefits. The stuff that impacts your bottom line and your team’s sanity.

Major Reduction in Fraud Losses:

This is the big one.

Chargebacks cost money. Stolen goods or services cost money. Fines cost money.

Sift’s AI is designed to catch more fraud.

Before it hits you.

By accurately scoring transactions and identifying risky users in real-time, you stop the bad transactions.

Fewer chargebacks mean more revenue stays in your pocket.

Less merchandise shipped to fraudsters.

Less service abuse.

It directly impacts your profit margin.

Often, the money saved on fraud prevention far outweighs the cost of the tool.

It’s an investment, yeah, but one with a clear ROI.

Increased Operational Efficiency:

Remember those manual reviews?

They eat time.

Your team is stuck sifting through orders, looking for red flags.

Sift automates a huge chunk of this.

The AI handles the low-risk and high-risk cases automatically.

Only the questionable ones land in the review queue.

And the case management tools make reviewing those cases faster.

All the relevant info is right there. Visualized.

This means your team needs less time to process more orders.

They can handle higher volumes without needing to hire more people.

Or they can focus their skills on more complex problems.

It frees up valuable resources.

Improved Customer Experience:

Fraud prevention isn’t just about stopping bad guys.

It’s also about keeping good customers happy.

Old fraud systems often decline legitimate transactions.

They block good customers by mistake.

That’s frustrating.

Customers bounce. They go elsewhere.

Sift’s AI is more accurate.

It uses machine learning to distinguish between good and bad behaviour patterns.

This means fewer false positives.

More legitimate transactions get approved instantly.

Customers have a smooth, fast checkout or sign-up experience.

They don’t even know Sift is there.

They just know it worked.

Happy customers mean repeat business.

Less customer support hassle dealing with frustrated users.

It’s a win-win.

Adaptability to New Fraud Tactics:

Fraudsters don’t stand still.

They constantly change their methods.

Old rule-based systems break when the rules change.

Sift’s AI, powered by the global network, is constantly learning.

It adapts to new patterns.

Emerging threats are spotted and factored into the risk scores.

This means your defense stays relevant.

Even as the fraud landscape shifts.

You’re not constantly playing catch-up.

Sift helps you stay one step ahead.

That’s a powerful benefit in the world of Fraud Detection.

Pricing & Plans

Alright, let’s talk money.

How much does this AI power cost?

Sift Science doesn’t just put their pricing on a simple page with three tiers.

It’s more complex than that.

Their pricing is typically tailored.

Based on your business’s specific needs.

The volume of transactions you process.

The types of fraud you’re facing.

Which specific Sift products you need (payments, account defense, content moderation, etc.).

Think of it less like buying a SaaS subscription off the shelf.

More like a custom solution.

This means you usually need to contact their sales team.

Have a conversation about your business.

Your challenges. Your transaction volume.

Then they’ll put together a proposal.

So, is there a free plan?

Generally, no.

Sift Science is an enterprise-grade solution.

It’s built for businesses with significant online activity.

Who are experiencing real fraud problems.

And need a serious, robust solution.

They might offer trials or demos.

Allowing you to see the platform in action with your own data.

This is crucial.

Seeing how well it performs with your specific fraud patterns is the real test.

Comparing Sift to alternatives?

Other players in the space include companies like Signifyd, Forter, Riskified.

Many also use AI and machine learning.

Some might focus heavily on payments fraud.

Others might have different strengths in areas like account protection or content moderation.

Pricing models also vary.

Some might charge per transaction.

Others might have tiered plans based on volume.

Sift’s competitive edge often lies in its global network intelligence.

The breadth of fraud types it covers within a single platform.

And its workflow tools for analysts.

When considering pricing, don’t just look at the sticker price.

Think about the ROI.

How much money will it save you in fraud losses?

How much time will it save your team?

What’s the value of a better customer experience?

For businesses losing significant amounts to fraud, Sift Science can quickly pay for itself.

It’s not the cheapest option out there.

But it’s a powerful one.

You’re paying for advanced AI, global threat intelligence, and a platform built for serious Fraud Detection.

Hands-On Experience / Use Cases

Okay, theory is cool.

But how does Sift Science actually play out in the real world?

Let’s talk about some common use cases.

And what using Sift feels like for teams on the ground.

Use Case 1: E-commerce Payments Fraud

Imagine you run an online store.

Orders pour in 24/7.

Fraudsters are constantly trying stolen credit cards.

Before Sift, you might be using basic rules.

Like, decline orders from country X. Or orders over Y amount.

This blocks legit orders. And fraudsters just tweak their methods.

Or maybe your team is manually reviewing every suspicious order.

Calling banks, checking IPs, Googling addresses. Slow, painful work.

With Sift integrated:

Every order gets a risk score instantly.

Sift’s AI looks at purchase patterns, device data, location consistency, links to known bad accounts, and much more.

High score? Auto-decline.

Low score? Auto-approve.

Medium score? Goes to the review queue in the Sift console.

In the console, your analyst sees the score, the reasons for it, and a visual graph of related accounts.

They can quickly see if this new order is from a device linked to dozens of past chargebacks.

Or if the shipping address is associated with risky behaviour elsewhere on the network.

Review time per order drops dramatically.

False declines plummet.

Actual chargebacks go down.

The usability for the analyst is key here. It centralizes information and provides clear insights.

Use Case 2: Account Takeover (ATO) Prevention

This is huge for any platform with user accounts (marketplaces, fintech, gaming, etc.).

Fraudsters steal login credentials.

Then they take over legitimate accounts to steal stored value, personal data, or make fraudulent purchases.

Before Sift, you might rely on 2FA (Two-Factor Authentication) or basic anomaly detection (login from a new country).

But sophisticated attackers can bypass these.

Sift monitors login attempts and account activity.

It looks for subtle anomalies.

Login from a new device AND a new location AND impossible travel speed AND suspicious behaviour immediately after login?

Sift flags it.

It assigns a risk score to the login event itself.

You can set rules to challenge high-risk logins (e.g., force 2FA, require password reset) or block them entirely.

It learns what “normal” behaviour looks like for each user over time.

Making it harder for attackers to blend in.

This protects your users.

Prevents losses from compromised accounts.

And maintains trust in your platform.

The impact on Security and Moderation teams here is proactive defense. Stopping the takeover before damage is done.

Use Case 3: Content Moderation and Abuse Prevention

Beyond financial fraud, Sift tackles abuse on user-generated content platforms.

Fake reviews, spam, scams in listings, abusive profiles.

Moderating this manually is a nightmare of scale.

Sift uses AI to analyse user behaviour and content patterns.

It can identify users likely to post spam or abuse.

Score new listings or posts based on risk factors (e.g., language patterns, links, user history).

Flags suspicious content for review.

Automates the removal of obvious violations.

Helps Trust & Safety teams prioritize their work.

Leading to a cleaner, safer platform for legitimate users.

Reduces the burden on human moderators.

Allows the platform to scale without abuse getting out of control.

These examples show the breadth of Sift’s application beyond just payment screening.

It’s about understanding risky *behaviour*, no matter where it happens on your platform.

The usability is high for analysts. The results are tangible for the business.

Who Should Use Sift Science?

So, is Sift Science for everyone?

Probably not.

It’s a powerful tool, but it’s built for specific needs and specific types of businesses.

Here’s who typically gets the most value out of Sift Science:

E-commerce Businesses (especially high volume or high-ticket):

If you’re selling products online, you’re a target for payments fraud.

The more sales you have, the bigger the target you become.

High average order values also attract fraudsters.

Sift’s ability to accurately score transactions in real-time and reduce chargebacks is invaluable here.

It protects revenue and keeps operations smooth.

Marketplaces (like Etsy or Airbnb):

Marketplaces have complex fraud issues.

Payments fraud, yes.

But also seller fraud, buyer fraud, review abuse, content scams, account takeovers.

Sift’s ability to connect dots across users and events, and cover various types of fraud, makes it ideal for these platforms.

It helps them build trust and a safe environment for users.

Fintech Companies (payments, lending, wallets):

Fintech is inherently high-risk.

Money is involved.

Account takeovers, application fraud, payments fraud within the app, money laundering attempts.

Fintech companies need robust, real-time detection.

Sift’s precision in identifying risky behaviour at sign-up, login, and transaction is critical.

It helps them comply with regulations and prevent massive losses.

Online Gaming and Gambling Platforms:

These platforms deal with payments fraud, account takeovers, bonus abuse, chip dumping, and other forms of synthetic fraud.

Fraudsters try to cash out stolen funds or manipulate game outcomes.

Sift’s behaviour analysis and cross-account linking help detect these patterns that human reviewers would miss.

Ensuring fair play and preventing financial loss.

Any business experiencing significant fraud losses:

If you’re seeing chargebacks climb.

If you’re spending too much time on manual reviews.

If account takeovers are a constant problem.

If abuse is rampant on your platform.

Sift Science is designed to tackle these exact problems.

It’s for companies who have moved beyond basic fraud tools and need a more sophisticated, AI-driven approach.

It’s not typically for tiny startups with minimal transaction volume.

The investment and complexity are higher than a simple plugin.

But for businesses where Fraud Detection is a critical challenge impacting growth and profitability, Sift is a strong contender.

It’s built for scale. It’s built for complexity. It’s built for the modern fraud Security and Moderation needs.

How to Make Money Using Sift Science

Okay, how does using Sift Science translate into making more money?

It’s not a direct “generate content and sell it” kind of tool like some AI writers.

Sift makes you money indirectly.

By protecting the money you already make. And enabling you to make more.

Here’s how:

- Reduce Fraud Losses Directly:

This is the most obvious one.

Every fraudulent transaction Sift stops is money saved.

Money you don’t lose to chargebacks, stolen goods, or service abuse.

Think of the cost of a single chargeback: the lost revenue, the product/service cost, the chargeback fee, the operational cost of handling it.

Stopping even a few of these a day or week adds up fast.

Sift’s AI is better at catching fraud than manual review or basic rules.

So it stops more fraud.

That’s a direct boost to your profitability.

It’s like finding money you were about to lose.

- Increase Approval Rates for Legitimate Customers:

This is often overlooked.

Old, rigid fraud systems block good customers.

This is called a “false positive.”

Those blocked customers often leave and never come back.

That’s lost revenue. Future lifetime value gone.

Sift’s accurate AI means fewer false positives.

More legitimate transactions are approved instantly.

This leads to higher conversion rates.

More completed sales. More happy customers.

This directly increases your revenue.

It’s not just protecting existing revenue, it’s enabling growth by reducing unnecessary friction for good customers.

- Free Up Team Resources for Growth:

Manual fraud review is a drain.

Your team is stuck doing repetitive, time-consuming tasks.

With Sift automating much of the process, your team spends less time on reviews.

What can they do with that saved time?

They can focus on higher-value activities.

Like analyzing trends. Improving your fraud strategy. Working on other Security and Moderation initiatives.

Or maybe they can handle a higher volume of business without needing to hire more people.

This reduces operational costs as you scale.

Saved labour cost is money earned (or at least, not spent).

Example: Imagine a marketplace dealing with listing scams. Manually reviewing thousands of listings daily is impossible. With Sift flagging suspicious listings and users based on behavioural patterns, the moderation team focuses only on the highest-risk items. They catch scams faster, improving user trust and keeping legitimate sellers active. This healthier platform attracts more users and transactions, boosting revenue.

Another example: A subscription box service facing promo abuse. Users creating fake accounts for free trials. Sift identifies the links between these accounts (same device, slightly different emails, similar patterns). They automatically block these sign-ups. They save the cost of sending free boxes to fraudsters. Direct cost saving.

Sift Science isn’t a “side hustle” tool.

It’s a core business investment.

Its value is in making your existing business operations more secure, more efficient, and ultimately, more profitable by tackling the problem of Fraud Detection head-on.

Limitations and Considerations

No tool is perfect.

Sift Science is powerful, but it has limitations or things you need to consider before jumping in.

Integration Effort:

Sift isn’t a browser extension you install in two clicks.

Integrating Sift into your platform requires technical work.

You need to send Sift data. Lots of data.

User sign-ups, logins, payment attempts, order details, shipping info, content posts, messages… everything relevant to user behaviour.

This requires developer resources.

It’s a project.

The complexity depends on your existing systems, but don’t expect it to be instant.

Plan for the integration time and resources needed.

Not a Silver Bullet:

Sift uses AI, and AI is incredibly good at spotting patterns.

But it’s not magic.

It reduces fraud significantly, yes.

Does it eliminate it entirely? No system does that.

Fraudsters are persistent. They will always try to find new ways around defenses.

Sift is your strongest weapon, but you still need a strategy.

You still need a team (even if smaller) to manage the system, review complex cases, and adapt.

Reliance on Data Quality:

Sift’s AI is only as good as the data you feed it.

If you’re not sending comprehensive, accurate data…

…the AI’s ability to score risk is impacted.

Ensuring you are sending all the relevant user and event data is crucial for performance.

This goes back to the integration point – you need to set it up right.

Cost:

As discussed, Sift is an enterprise-level tool.

It’s a significant investment.

It’s priced for businesses losing substantial amounts to fraud.

For a small business with low volume and minimal fraud issues, it’s likely overkill and too expensive.

You need to weigh the cost against the potential savings and increased revenue.

Do the ROI calculation. Is the fraud you’re preventing (or the efficiency you’re gaining) worth the monthly or annual cost?

Requires Management and Tuning:

While Sift automates a lot, it’s not “set it and forget it.”

You need people to manage the system.

Monitor performance.

Adjust rules based on your business needs and observed fraud patterns.

Review the cases Sift flags.

It’s a partnership between the AI and your Security and Moderation team.

These are points to consider. They don’t negate Sift’s value.

But they mean you need to approach Sift as a serious business solution.

Not a simple plug-and-play app.

Especially when tackling something as critical as Fraud Detection.

Final Thoughts

Let’s wrap this up.

Fraud is a problem. A big one.

It’s not going away. It’s getting more complex.

Fighting it with outdated tools is a losing battle.

Manual reviews are slow, expensive, and prone to error.

Basic rules are easily bypassed.

This is where Sift Science comes in.

It’s an AI-powered platform designed specifically for this fight.

Using machine learning and a massive global network to identify risky behaviour in real-time.

It gives you a powerful defense against payment fraud, account takeovers, content abuse, and more.

The key benefits are clear:

You stop more fraud, directly reducing losses.

You increase approval rates for good customers, boosting revenue and improving experience.

You make your team way more efficient, saving operational costs.

You gain an adaptive defense that learns from new threats.

It’s not cheap, and it requires integration work.

It’s a serious business tool for serious problems.

But if you’re running an online business experiencing significant fraud.

If you’re in charge of Security and Moderation for a growing platform.

And Fraud Detection is a bottleneck or a major source of loss.

Then Sift Science is absolutely worth investigating.

It’s a smart choice for building a robust, scalable fraud prevention strategy.

It lets you focus on growing your business.

Instead of constantly battling bad actors with one hand tied behind your back.

My recommendation?

If you fit the profile of a business that could benefit, get a demo.

See how it performs on your data.

Talk to their team about your specific challenges.

Don’t let fraud eat away at your business.

Arm yourself with the right tools.

Sift Science is one of the best out there for fighting fraud.

Consider it for your defense.

Visit the official Sift Science website

Frequently Asked Questions

1. What is Sift Science used for?

Sift Science is primarily used for digital trust and safety, with a strong focus on Fraud Detection. It helps businesses identify and prevent various types of online fraud and abuse, including payments fraud, account takeover, content moderation issues, and promo abuse.

2. Is Sift Science free?

No, Sift Science is not a free tool. It is an enterprise-level platform with pricing typically tailored to the specific needs and transaction volume of a business. You generally need to contact their sales team for pricing details.

3. How does Sift Science compare to other AI tools?

Sift Science is specifically designed for fraud prevention and digital trust, unlike general AI tools. Its key differentiators often include its global network intelligence, which provides a broad view of fraud trends, and its comprehensive platform covering multiple types of online abuse beyond just payments.

4. Can beginners use Sift Science?

Sift Science is designed for businesses with dedicated teams in Security and Moderation. While the user interface for analysts is intuitive for reviewing cases, implementing and managing the system effectively requires technical integration and a solid understanding of fraud prevention principles. It’s not a tool for casual users.

5. Does the content created by Sift Science meet quality and optimization standards?

Sift Science doesn’t “create content” like an AI writer. It analyzes user behaviour and data to identify fraud and abuse patterns. Its “output” is risk scores, alerts, and case data for your team to act on. The quality and effectiveness of its fraud detection capabilities are generally considered high, particularly due to its AI and network effect.

6. Can I make money with Sift Science?

You make money with Sift Science indirectly. It prevents financial losses from fraud, which directly impacts your bottom line. It also increases operational efficiency and allows for higher approval rates of legitimate customers, boosting revenue and profitability. Its value is in protecting and enabling your existing business revenue.