Avalara simplifies Tax Calculations and Audit for Legal and Finance pros. Automate compliance, reduce risk, and save time. Ready to work smarter?

How Avalara Takes Your Results to the Next Level

Alright.

Let’s talk about something real.

The world is changing fast.

AI is everywhere.

And if you’re in Legal and Finance, you’ve seen it coming.

Specifically, when it comes to Tax Calculations and Audit.

Manual processes are soul-crushing.

Errors cost money. Big money.

Time is your most valuable asset.

Wasting it on spreadsheets and tracking down rates is just dumb business.

So, what’s the play?

How do you stop the bleeding?

How do you get back your time and sanity?

Enter Avalara.

This isn’t just another software.

This is a tool built to make your life easier.

Specifically, if you’re dealing with the complexities of taxes and audits.

It’s designed for professionals who want results.

Not headaches.

It promises to automate, streamline, and frankly, make you better at your job.

Less busywork.

More high-value work.

That’s the goal, right?

This article is going to break down exactly how Avalara does that.

No BS.

Just the facts.

What it is.

What it does.

Who it’s for.

And crucially, how it can make you more money or save you a ton of it.

Let’s get into it.

Table of Contents

- What is Avalara?

- Key Features of Avalara for Tax Calculations and Audit

- Benefits of Using Avalara for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Avalara?

- How to Make Money Using Avalara

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Avalara?

Okay, so what is this thing?

Avalara is a cloud-based software platform.

Think of it as your digital tax assistant.

But way smarter.

It automates tax compliance.

Sales tax, VAT, excise tax, you name it.

Across geographies, industries, transaction types.

This isn’t just a calculator.

It integrates with your existing systems.

Your ERP, e-commerce platform, accounting software.

It pulls in transaction data.

Applies the correct tax rules in real-time.

Based on ship-from and ship-to locations.

Product taxability rules.

Customer exemptions.

All of it.

It’s built for businesses of all sizes.

From small startups selling online.

To massive corporations with complex global tax obligations.

The core promise?

Accuracy and efficiency.

Reduce the risk of costly errors.

Free up your team from tedious manual work.

Focus on strategy.

Not data entry.

It’s particularly powerful for anyone knee-deep in Tax Calculations and Audit.

Accountants.

CFOs.

Tax managers.

Legal counsel dealing with tax compliance issues.

They built this tool specifically for these problems.

The ones that keep you up at night.

Worrying about audits.

Missing deadlines.

Getting hit with penalties.

Avalara aims to eliminate that worry.

By providing a system that’s always on.

Always updated.

And always calculating taxes correctly.

That’s the foundation.

Now, let’s see what it actually does.

Key Features of Avalara for Tax Calculations and Audit

Real-Time Tax Calculation:

This is the core function.

Avalara connects to your point-of-sale, e-commerce, or ERP system.

When a transaction happens, it sends the data to Avalara.

Avalara instantly figures out the correct tax amount.

Based on the latest rules for that specific location.

Down to the street address level.

It considers product taxability and customer exemption status.

No more guessing or using outdated spreadsheets.

This is crucial for accuracy in Tax Calculations and Audit.

Every single transaction is correct.

Tax Return Preparation and Filing:

Calculating tax is one thing.

Filing the returns is another headache.

Avalara automates this too.

It collects all the transaction data.

Sorts it by jurisdiction.

Fills out the necessary forms.

And can even file them electronically for you.

For hundreds or thousands of jurisdictions.

This saves days or weeks of work.

Especially for businesses with nexus in multiple states or countries.

It ensures deadlines are met.

And reduces the chance of errors on the returns themselves.

Exemption Certificate Management:

Dealing with tax-exempt customers?

Resellers, non-profits, government entities?

You need to collect and manage exemption certificates.

Missing or expired certificates are red flags in an audit.

Avalara provides a system to collect, validate, and store these certificates digitally.

It can even remind you when one is about to expire.

This makes audits much smoother.

You have all your documentation in one place.

Easily accessible.

Proving why you didn’t collect tax on a specific sale.

Audit Support and Reporting:

Nobody likes an audit.

But with Avalara, they become less terrifying.

The system keeps detailed records of every tax calculation.

The rules applied.

The data used.

This provides a clear audit trail.

You can generate reports quickly.

Showing exactly how tax was calculated for any transaction.

Or for any period.

This level of detail and organization is invaluable during an audit.

It shows tax authorities you have a robust, reliable system in place.

This builds confidence.

And often helps resolve audits faster and with fewer penalties.

Jurisdiction and Rate Management:

Tax rates and rules change constantly.

New jurisdictions create new taxes.

Keeping up manually is impossible.

Avalara continuously updates its database of tax rules.

Thousands of rules across thousands of jurisdictions.

Sales tax holidays.

Specific product taxability changes.

Boundary changes that affect rates.

You don’t have to track any of this.

Avalara does it automatically.

Ensuring you’re always using the most current and accurate information.

This is a massive time saver.

And a major accuracy booster.

Product Taxability Rules:

Not every product is taxed the same way.

Groceries versus clothing.

Digital goods versus physical products.

Avalara helps you classify your products.

Then applies the correct tax treatment based on location.

This is more complex than it sounds.

A food item might be taxable in one state but not another.

Avalara handles this complexity behind the scenes.

Ensuring your product catalogue is mapped to the correct tax rules.

Another layer of accuracy built-in.

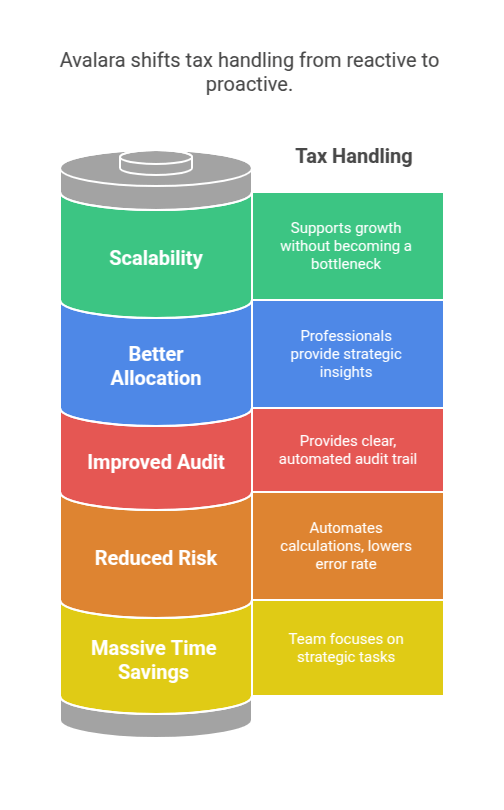

Benefits of Using Avalara for Legal and Finance

Why bother with Avalara?

What’s the real payoff?

For anyone in Legal and Finance, the benefits are clear and significant.

First off, massive time savings.

Hours spent on manual calculations disappear.

Weeks spent preparing and filing returns vanish.

Your team can focus on strategic tasks.

Analyzing data, planning, advising the business.

Not data entry and form filling.

Secondly, reduced risk of errors and penalties.

Manual processes are prone to human error.

Missed rate changes.

Incorrect jurisdiction lookups.

These errors lead to under or over-collecting tax.

Which leads to interest and penalties during an audit.

Avalara automates calculations using up-to-date data.

Drastically lowering the error rate.

Protecting your business from unnecessary costs.

Third, improved audit performance.

Audits are stressful and time-consuming.

But having a clear, automated audit trail changes the game.

Avalara logs every calculation.

Provides easy access to transaction data, tax rules applied, and exemption certificates.

This makes responding to auditor requests much faster.

It demonstrates a commitment to compliance.

Often resulting in quicker, less painful audits.

Fourth, better resource allocation.

Think about what your high-skilled finance and legal professionals are doing.

Are they managing spreadsheets?

Or are they providing strategic insights?

Avalara frees them up.

Allowing them to work on things that actually move the needle for the business.

That’s a smart use of expensive talent.

Finally, scalability.

As your business grows, so does the tax complexity.

Selling into new states?

New countries?

Introducing new product lines?

Handling this manually becomes exponentially harder.

Avalara scales with you.

Adding a new jurisdiction is just a configuration setting.

Not a manual research project and spreadsheet update marathon.

It supports your growth without becoming a bottleneck.

These aren’t minor improvements.

These are fundamental shifts in how Tax Calculations and Audit are handled.

From reactive, manual, and risky.

To proactive, automated, and compliant.

Pricing & Plans

Alright, what’s the damage?

Pricing for Avalara isn’t a simple one-size-fits-all.

It’s typically based on the complexity of your business.

Factors include:

The number of transactions you process.

The number of jurisdictions where you have tax obligations.

Which specific Avalara products you need (e.g., Sales Tax, VAT, Returns, Exemption Certificate Management).

The integrations required.

They don’t usually publish fixed pricing tiers online like a simple SaaS tool.

You generally need to contact their sales team for a custom quote.

This makes sense because tax situations are unique to each business.

They need to understand your specific needs to give you an accurate price.

Is there a free plan?

No, Avalara is a premium enterprise-level solution.

There isn’t a free version or a free trial in the typical sense.

They might offer demos or limited pilot programs.

But it’s a significant investment.

What does the premium version include?

As discussed in the features section, the premium offering includes the core tax calculation engine.

Access to their vast database of tax rates and rules.

Integrations with hundreds of business systems.

Depending on the package you choose, it includes modules for:

- Automated tax return filing.

- Exemption certificate management.

- Cross-border duty and tax calculations.

- Lodging tax.

- Excise tax.

And much more.

It’s a comprehensive suite covering many aspects of transactional tax.

How does it compare to alternatives?

Alternatives range from manual processes (spreadsheets, in-house research) to less sophisticated software.

Manual is cheap upfront but incredibly expensive in time, risk, and penalties.

Other software might handle basic calculations for a few jurisdictions.

But they often lack the depth of rule content, the breadth of integrations, or the automation for filing and certificate management that Avalara offers.

Avalara is often seen as a leader in this space.

It’s a premium product designed for businesses where tax compliance is complex and critical.

The cost reflects the power and comprehensiveness of the platform.

It’s an investment in compliance, efficiency, and de-risking your business.

Hands-On Experience / Use Cases

Talking about features is one thing.

Seeing it in action is another.

Imagine a medium-sized e-commerce business.

Selling products across all US states and several countries.

They have physical nexus in a few states (offices, warehouses).

And economic nexus in many more due to sales volume.

Before Avalara, their process was a nightmare.

Their e-commerce platform had basic tax tables.

Updated quarterly, maybe.

Rates were often wrong.

They missed local taxes.

Determining taxability for specific products in different states was manual research.

Exemption certificates were collected via email and stored in a shared folder.

Someone had to manually check expiration dates.

At the end of each month, they pulled sales data.

Used spreadsheets to summarize taxes owed by jurisdiction.

Then manually logged into state websites to file returns.

It took two full-time accountants weeks each quarter.

And they still worried about getting it wrong.

They integrated Avalara.

Connecting it directly to their e-commerce platform and accounting software.

Now, when a customer checks out, Avalara calculates the exact tax in real-time.

Based on the customer’s address, the product, and the latest rules.

If a customer is tax-exempt, they can upload their certificate directly during checkout.

Avalara validates it and stores it digitally.

Expiration reminders are automatic.

At the end of the filing period, all the data is already in Avalara.

The system automatically prepares the returns.

The accountants review them.

And Avalara files them electronically.

The difference?

Time saved is immense.

Those two accountants now spend maybe a couple of days reviewing and submitting returns.

Not weeks.

Accuracy is way up.

Tax rates are always current.

Calculations are precise.

Audit preparation is simplified.

All the data and certificates are in one searchable place.

This isn’t just a convenience.

It’s a fundamental improvement in how the business handles a critical compliance function.

It allows them to focus on selling and growing.

Not getting buried in tax paperwork.

This is a typical use case for businesses dealing with distributed sales and complex tax obligations.

Avalara removes a huge operational burden.

Who Should Use Avalara?

Okay, so who actually needs this?

Avalara isn’t for everyone.

If you run a local corner shop selling only to people in your town.

Your tax situation is probably simple.

You likely don’t need Avalara.

But if your business starts crossing borders – state lines or international boundaries – things get complicated fast.

So, who is the ideal user?

E-commerce businesses: Especially those selling nationally or globally. Nexus rules are complex and constantly changing. Avalara handles the thousands of potential tax rates and rules.

Retailers with multiple locations: Managing local tax rates for numerous stores requires precise location-based calculations.

Software and SaaS companies: Taxability of digital products varies significantly by jurisdiction. Avalara helps classify and tax these services correctly.

Manufacturers and Wholesale Distributors: Dealing with complex product taxability and managing exemption certificates from resellers is a major headache Avalara solves.

Businesses with high transaction volume: Manually calculating and tracking tax on thousands or millions of transactions is impossible and error-prone. Automation is essential.

Companies operating in multiple tax jurisdictions: The more states or countries you sell into, the more complex your tax compliance becomes. Avalara is built for this complexity.

Businesses frequently audited: If you’ve faced audits or anticipate them due to growth or complexity, Avalara’s audit trail and reporting are invaluable.

Finance and Legal professionals responsible for Tax Calculations and Audit: Accountants, tax managers, legal counsel, CFOs who need reliable, automated compliance.

In short, if your business has sales tax, VAT, or other transactional tax obligations in multiple places.

Or if your volume makes manual processing impractical.

Or if you want to significantly reduce your audit risk and compliance workload.

Then Avalara is likely a tool you should look at closely.

It’s designed for businesses that have outgrown simple tax solutions.

And need a professional, scalable platform.

How to Make Money Using Avalara

This might sound weird.

How do you *make* money with tax software?

You’re paying for it, right?

Well, it’s not about direct revenue from the tool itself.

It’s about the leverage it provides.

Here’s how Avalara translates into financial gain:

Reduce Costly Errors and Penalties: This is the most direct way. Getting tax calculations wrong leads to underpayment, which leads to penalties and interest during audits. Overpaying tax means you tie up capital unnecessarily. Avalara’s accuracy minimises these expensive mistakes. Think of every avoided penalty as money saved, which goes straight to your bottom line.

Increase Operational Efficiency: Time is money. If your finance team spends days or weeks on manual tax tasks, that’s a significant cost. Avalara automates these tasks. Those employees can now work on higher-value activities. This increases productivity and effectively reduces your operational costs for compliance.

Support Business Expansion: Tax compliance is often a barrier to growth. Entering a new state or country means dealing with new tax rules. Without automation, this can be slow and risky. Avalara makes it significantly easier and faster to become compliant in new markets. This allows you to pursue growth opportunities more aggressively, leading to increased sales and revenue.

Improve Audit Outcomes: While not direct “making money,” having a smooth audit process saves money. Auditors’ time costs money. Providing clear, accurate data quickly reduces the duration of the audit. And proving compliant practices helps avoid or reduce proposed assessments, penalties, and interest. A good audit outcome is money saved.

Enable Focus on Core Business: This is intangible but real. When you’re not stressed about tax compliance, you can focus on what you do best – running and growing your business. Leadership and teams can direct their energy towards product development, sales, marketing, and customer service. Things that directly generate revenue.

For Legal and Finance professionals offering services:

Offer Automated Tax Compliance Services: If you’re an accounting firm or tax consultant, you can use Avalara to provide automated tax calculation, filing, and exemption management services to your clients. This allows you to serve more clients efficiently, offer a premium service, and potentially charge a higher rate for streamlined, accurate tax compliance.

Provide Audit Support Services: Leverage Avalara’s robust reporting to assist clients during audits. Your ability to quickly pull detailed transaction data and demonstrate compliant processes is a valuable service.

Consult on Tax Technology Implementation: Many businesses need help implementing and configuring tax automation software. You can offer consulting services to help them select, set up, and integrate Avalara into their existing systems.

Look at it this way:

Manual tax work is a cost centre and a risk centre.

Avalara turns it into an efficient, reliable function.

That efficiency and reduced risk frees up resources and prevents losses.

Those saved resources and avoided costs are effectively “money made” or “money saved.”

Case study example: A growing SaaS company was spending tens of thousands per year on external consultants just to file sales tax returns across states. After implementing Avalara, they brought most of it in-house. The annual cost of Avalara was significantly less than the consultant fees. They saved $X amount per year, straight to profit. Plus, they reduced the risk of errors the consultants might have missed.

Avalara is an investment that pays dividends through efficiency, risk reduction, and enabling faster, safer growth.

Limitations and Considerations

No tool is perfect.

Avalara is powerful, but there are things to keep in mind.

First, Cost: It’s a premium solution. For very small businesses with simple tax needs, the cost might be prohibitive compared to the complexity they face. You need to have a certain level of transaction volume or jurisdictional complexity to justify the investment.

Second, Implementation Time and Effort: While Avalara integrates with many systems, getting it fully set up and configured takes time and effort. You need to map your products correctly, configure your integrations, and train your staff. It’s not an instant plug-and-play for complex setups.

Third, Dependence on Integration: Avalara is most powerful when integrated with your core business systems (ERP, e-commerce). If those integrations break or aren’t stable, it affects the tax calculation accuracy and automation.

Fourth, Requires Ongoing Management: While automation reduces manual work, it doesn’t eliminate the need for human oversight. You still need someone to review returns, manage exemption certificates (even if stored digitally), and stay informed about major tax law changes that might affect your setup.

Fifth, Specific Tax Types: While Avalara covers a broad range of transactional taxes, businesses with highly specialised tax needs (e.g., fuel tax, communications tax) might need specific modules or potentially other solutions in addition to Avalara.

Sixth, International Complexity: While Avalara handles VAT and other international taxes, global tax compliance is incredibly complex. Businesses with extensive international operations might still require significant in-house expertise or local tax advisors in addition to using Avalara. The tool helps, but doesn’t replace the need for understanding local nuances.

Seventh, Accuracy is Dependent on Input Data: Avalara calculates tax based on the data it receives from your integrated systems (e.g., customer address, product code). If your input data is inaccurate or incomplete, the tax calculation might still be wrong. Garbage in, garbage out.

These aren’t necessarily flaws in the tool itself.

They are considerations for deployment and ongoing use.

You need to go into it with realistic expectations.

It’s a powerful engine, but it needs to be properly fuelled and maintained.

Final Thoughts

So, where do we land with Avalara?

If you’re in Legal and Finance, specifically dealing with Tax Calculations and Audit.

And your business has grown beyond simple tax scenarios.

Avalara is definitely worth serious consideration.

It addresses real pain points:

The soul-crushing manual work.

The constant fear of errors and penalties.

The drain on valuable finance and legal resources.

It automates the complex, repetitive parts of tax compliance.

Provides accuracy you can trust.

Makes audits significantly less painful.

And allows your business to grow without tax compliance becoming an insurmountable obstacle.

It’s not a cheap fix.

It’s an investment in infrastructure.

Like upgrading your accounting software or your ERP system.

But for businesses facing the challenges of multi-jurisdictional tax.

The ROI is often clear.

Through time saved, errors avoided, and penalties sidestepped.

If you’re spending significant time on manual tax tasks.

Worrying about compliance.

Or limiting your business growth because tax is too complicated.

Then it’s time to look at automation.

And Avalara is a leader in that space.

The next step?

Don’t just read about it.

Evaluate your current tax process.

Quantify the time and cost involved.

Assess your risk exposure.

Then talk to Avalara.

See a demo tailored to your business.

Get a specific quote.

Compare that cost to the cost of doing nothing.

Or the cost of manual processes plus potential penalties.

For many growing businesses, especially in e-commerce, SaaS, or multi-location retail.

The numbers will likely speak for themselves.

Avalara is the smarter way to handle tax in the modern world.

Stop doing it the hard way.

Visit the official Avalara website

Frequently Asked Questions

1. What is Avalara used for?

Avalara is primarily used for automating tax compliance. This includes calculating sales tax, VAT, and other transactional taxes in real-time. It also helps with tax return preparation and filing, and managing exemption certificates. It’s designed to simplify complex tax obligations for businesses.

2. Is Avalara free?

No, Avalara is not free. It is a premium cloud-based tax compliance software. Pricing is typically based on factors like transaction volume, number of jurisdictions, and the specific services required. You usually need to contact their sales team for a custom quote tailored to your business needs.

3. How does Avalara compare to other AI tools?

Avalara is less of a general AI tool and more of a specialised automation platform using sophisticated rule engines and data sets. While it uses advanced technology to automate complex tasks, it’s different from generative AI tools for content creation or AI used in broader finance analysis. Its focus is narrow and deep: transactional tax compliance. Compared to other tax-specific software, it generally offers a wider range of integrations, a more comprehensive database of tax rules, and robust automation features for filing and certificate management.

4. Can beginners use Avalara?

Implementing and configuring Avalara, especially with multiple integrations, can be complex and often requires expertise. While the day-to-day use for tax calculation might be automated, setting up the system, mapping products, and managing integrations requires a good understanding of both your business systems and tax concepts. It’s typically used by businesses with dedicated finance or tax teams, or with support from implementation partners. So, a “beginner” in terms of tax knowledge might find the setup challenging without help.

5. Does the content created by Avalara meet quality and optimization standards?

Avalara doesn’t create content like marketing copy or blog posts. It generates highly accurate tax calculations, reports, and filed tax returns. The quality of its output in its domain (tax compliance) is considered very high, as it uses continuously updated tax rules and complex logic. The “optimization” it provides is in terms of tax accuracy, compliance efficiency, and audit readiness, not SEO or content marketing metrics.

6. Can I make money with Avalara?

Yes, indirectly. Using Avalara can help you make money by significantly reducing costs associated with manual tax work, errors, and penalties. It increases efficiency, freeing up valuable resources for strategic, revenue-generating activities. For accounting or consulting firms, using Avalara allows you to offer automated tax compliance services to clients, creating new revenue streams and increasing the efficiency of existing services. It’s an investment that pays off through cost savings, risk reduction, and enabling business growth.