Experian AI Score transforms Credit Scoring and Analysis for Legal and Finance pros. Boost accuracy, save time, and make smarter decisions. Try it now!

Experian AI Score Is Built for Legal and Finance – Here’s Why

Alright, let’s talk about something huge.

AI is everywhere, right?

Especially if you’re in Legal and Finance.

It’s not just hype anymore.

It’s changing how we do things.

The old ways of handling complex tasks?

They’re getting a serious upgrade.

Think about Credit Scoring and Analysis.

It’s manual, it’s time-consuming, it’s prone to errors.

It’s a pain in the backside, frankly.

But what if there was a tool built specifically to make that easier?

A tool that understands the unique needs of your industry?

Enter Experian AI Score.

This isn’t just another generic AI assistant.

This is designed with you in mind.

It’s for the lawyers, the financial analysts, the credit officers.

It’s for anyone who deals with credit data day in, day out.

I’ve spent some time with it.

And let me tell you, it’s different.

It’s built for results.

It’s built to save you time, money, and headaches.

Ready to see why?

Table of Contents

- What is Experian AI Score?

- Key Features of Experian AI Score for Credit Scoring and Analysis

- Benefits of Using Experian AI Score for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use Experian AI Score?

- How to Make Money Using Experian AI Score

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is Experian AI Score?

Okay, let’s cut to the chase.

What exactly is Experian AI Score?

It’s an AI-powered platform from Experian, a name you likely already know and trust in the credit reporting world.

But this isn’t just about pulling a basic credit report.

Experian AI Score takes that data – often complex and sprawling – and applies advanced artificial intelligence and machine learning models to it.

Its core function?

To provide deeper, more nuanced Credit Scoring and Analysis.

Think beyond the standard FICO or VantageScore.

While those are crucial, Experian AI Score looks at the underlying data with a different lens.

It identifies patterns, predicts future behaviour, and flags risks or opportunities that manual analysis might miss.

Who’s it for?

If you’re in Legal and Finance, this is aimed squarely at you.

Lenders needing to assess risk accurately.

Law firms dealing with bankruptcy, debt recovery, or financial litigation.

Financial advisors helping clients understand their credit standing.

Risk managers in corporations.

Anyone whose job involves understanding someone’s creditworthiness in detail.

It’s designed to take the raw data and turn it into actionable intelligence.

It automates the grunt work of sifting through reports.

It provides insights faster and, often, more accurately than traditional methods alone.

Consider it your co-pilot for navigating the complex world of credit data.

It doesn’t replace your expertise.

It augments it.

It gives you a powerful new lens through which to view and interpret financial behaviour.

That’s the essence of Experian AI Score.

It’s intelligence applied to data, built for the demands of Legal and Finance.

It’s about getting a clearer picture, faster.

And making better decisions because of it.

That’s the game.

Key Features of Experian AI Score for Credit Scoring and Analysis

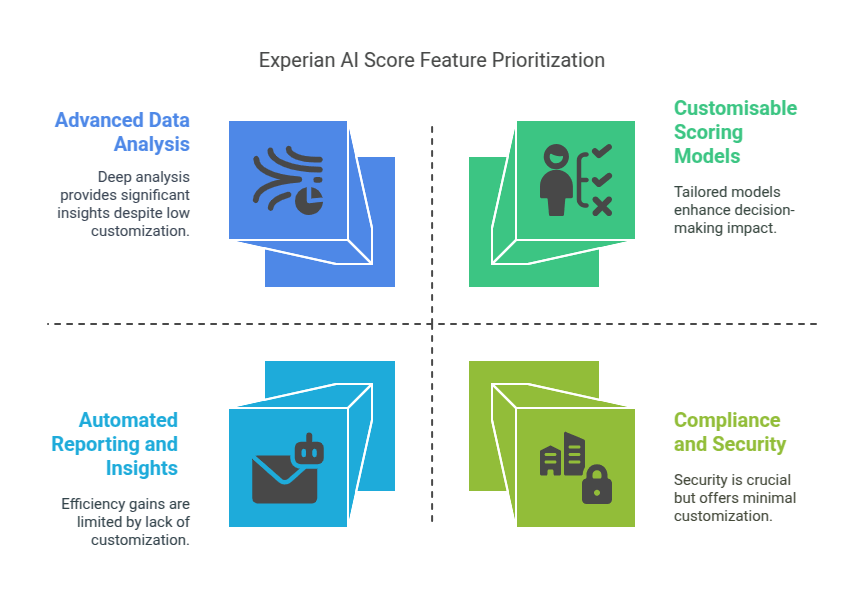

- Advanced Data Analysis:

This is where the “AI” really kicks in.

Experian AI Score doesn’t just read data points.

It analyses them using sophisticated algorithms.

It looks for correlations, anomalies, and trends that a human eye might miss.

For Credit Scoring and Analysis, this means a deeper dive into payment history, credit utilisation, credit mix, and more.

It can spot subtle patterns indicating future default risk or credit improvement potential.

It provides a more granular understanding than standard scores.

Think of it as getting an MRI instead of just an X-ray of a credit profile.

- Predictive Modelling:

This is huge for Legal and Finance professionals.

Experian AI Score can predict future credit behaviour with a higher degree of accuracy.

Will this applicant likely default?

Is this debt recoverable based on their current financial trajectory?

The AI models are trained on vast datasets, allowing them to forecast outcomes based on historical patterns.

This isn’t a crystal ball, but it’s the closest thing you’ll get in data analysis.

It allows for proactive decision-making.

You can assess risk more effectively before extending credit or pursuing legal action.

It’s about getting ahead of potential problems.

- Automated Reporting and Insights:

Manual reporting is a killer.

It’s boring, it’s time-consuming, and it’s where mistakes happen.

Experian AI Score automates the generation of detailed reports.

These reports aren’t just data dumps.

They include insights surfaced by the AI.

Key risk factors, opportunities for restructuring debt, flags for potential fraud – it highlights what’s most important.

This frees up your time for strategic work.

Instead of spending hours compiling data, you spend minutes reviewing insights and making decisions.

It makes the complex data digestible.

It puts the crucial information right in front of you.

This is where efficiency gets a serious boost.

- Customisable Scoring Models:

Not all situations are the same.

Experian AI Score allows for some degree of customisation.

You can tailor the scoring models to fit specific lending criteria or risk appetites.

Need to weigh certain factors more heavily for a particular type of loan or client?

You can often adjust parameters within the system.

This flexibility is crucial in Legal and Finance.

It means the tool adapts to your specific needs, not the other way around.

It ensures the analysis is relevant to your context.

This isn’t a one-size-fits-all solution.

It can be fine-tuned for your operations.

- Compliance and Security:

This is non-negotiable in Legal and Finance.

Experian understands this.

The platform is built with robust security measures.

It’s designed to handle sensitive financial data compliantly.

Dealing with credit information requires adhering to strict regulations.

Experian AI Score helps you stay within those boundaries.

It ensures data privacy and integrity are prioritised.

This gives you peace of mind.

You can focus on the analysis, knowing the underlying infrastructure is secure and compliant.

It’s a critical foundation for using AI in this field.

Benefits of Using Experian AI Score for Legal and Finance

Why bother with Experian AI Score?

Let’s talk benefits. Real-world benefits that hit your bottom line and save your sanity.

First up, massive time savings.

Manually reviewing credit reports, cross-referencing data, and generating detailed analyses takes forever.

AI automates much of this.

It can process mountains of data in minutes.

This frees you up.

You can handle more cases, review more applications, or spend more time on strategy.

Time is money, especially in Legal and Finance.

Next, improved accuracy and reduced risk.

Humans make mistakes. It’s a fact.

Especially when dealing with complex datasets under pressure.

AI isn’t perfect, but it eliminates human error in data processing and calculation.

Its predictive models offer a more objective assessment of risk.

This leads to better lending decisions, more effective debt recovery strategies, and reduced exposure to bad debt.

It takes the guesswork out of it.

You’re basing decisions on data-driven insights, not just intuition or partial analysis.

Then there’s deeper insights and strategic advantage.

Experian AI Score doesn’t just give you a score.

It explains *why* the score is what it is.

It highlights the key factors influencing creditworthiness.

This allows for more informed decisions.

You can structure deals better, negotiate from a position of strength, or advise clients with greater authority.

Understanding the nuances of a credit profile gives you an edge.

It allows for more tailored approaches.

It helps you spot opportunities your competitors might miss.

Finally, it leads to increased productivity and scalability.

With automated processes and faster analysis, your team can handle a higher volume of work.

Scaling your operations becomes much more feasible.

You’re not limited by the manual capacity of your analysts.

This means you can grow your business without necessarily proportional increases in staffing.

It makes your operations more efficient and resilient.

It’s about doing more with less, smartly.

These are tangible benefits.

They translate directly into better outcomes, lower costs, and a stronger competitive position.

That’s the power of applying AI to Credit Scoring and Analysis in Legal and Finance.

Pricing & Plans

Alright, the big question: how much does this thing cost?

With enterprise-level tools like Experian AI Score, pricing isn’t usually a simple “monthly subscription” on a website.

It’s typically tailored.

This means you’ll likely need to contact Experian directly for a custom quote.

Pricing often depends on factors like the size of your organisation, the volume of data you’ll be processing, the specific features you need, and how it integrates with your existing systems.

Is there a free plan? Highly unlikely for a sophisticated tool like this aimed at professionals handling sensitive data.

A free trial or a demo might be available, though.

This is usually the best way to get a feel for the platform before committing.

The premium version, which is likely the only version, includes the core AI analysis, predictive modelling, automated reporting, and customisation options we discussed.

It’s an investment. No doubt about it.

You’re paying for Experian’s data, their AI expertise, and the infrastructure to handle it securely.

How does it compare to alternatives?

Direct AI-powered credit scoring tools from major bureaus are rare competitors.

Most alternatives might be more basic credit reporting tools or general-purpose data analysis platforms that require significant in-house expertise to configure for credit data.

The value proposition of Experian AI Score is its specific focus and pre-built models for Credit Scoring and Analysis within the Legal and Finance context.

When considering the cost, don’t just look at the sticker price.

Calculate the return on investment.

How much time will it save?

How much risk will it reduce (and what’s the potential cost of that risk)?

How much can it increase your team’s capacity?

For many organisations dealing with high volumes of credit analysis, the efficiency gains and risk reduction alone could justify the investment.

Think of it as buying a high-performance machine for a critical task, not a cheap subscription.

It’s built for serious users with serious needs.

Getting a demo and a custom quote is the necessary first step to understanding the financial commitment.

Hands-On Experience / Use Cases

Let’s talk about what it’s like to actually use Experian AI Score, or at least imagine a typical use case based on its features.

Imagine you’re a commercial lender.

A business applies for a significant loan.

Traditionally, you’d pull their business credit report, personal credit reports of the principals, analyse financials, look at industry trends, and manually try to piece it all together to determine risk and set terms.

Hours, maybe days, of work.

With Experian AI Score, the process changes.

You input the relevant data points into the system.

The AI goes to work instantly.

It analyses the credit history, identifying repayment patterns that aren’t immediately obvious.

It looks at the relationship between different credit lines.

It cross-references against a vast database of historical business and consumer credit behaviour.

Within minutes, maybe less, it provides an AI-driven score.

But crucially, it also provides the *reasons* behind the score.

“Risk factor: high utilisation on Line of Credit X.”

“Positive indicator: consistent on-time payments on Term Loan Y for the past 36 months.”

“Predictive insight: based on current trends, likelihood of significant balance reduction on Revolving Account Z within 12 months is high.”

You get an automated report highlighting these insights.

This is the usability win.

Instead of sifting through pages of raw data, the AI serves up the critical information.

You can quickly see the strengths and weaknesses of the applicant’s credit profile.

You can then use your expertise to interpret these AI-generated insights in the context of the overall application, the market, and your institution’s specific policies.

Maybe the AI flags a high utilisation rate, but you know the business just secured a large contract that will improve cash flow.

The AI gives you the data point; you add the human context.

Results? Faster loan decisions.

More accurate risk assessment.

Better-structured loan terms.

Less time spent on manual analysis, more time spent on relationship building or reviewing edge cases.

Another use case: a law firm handling debt recovery.

They have a list of debtors.

Running these through Experian AI Score could provide insight into who is most likely to repay, who might require legal action, and who is essentially judgment-proof based on their current credit state.

This helps prioritise efforts.

Instead of chasing every debt equally, they focus resources where there’s the highest probability of recovery.

This isn’t just theoretical.

Applying advanced analytics to credit data is already happening.

Experian AI Score packages this capability specifically for professionals in Legal and Finance.

It makes the complex power of AI accessible for everyday (though critical) tasks like Credit Scoring and Analysis.

Who Should Use Experian AI Score?

Okay, so who is this tool really for?

If you’re operating in the Legal and Finance space and regularly deal with assessing creditworthiness, understanding financial risk, or analysing credit data, pay attention.

Here are some ideal user profiles:

Lending Institutions: Banks, credit unions, online lenders, mortgage companies. Anyone who extends credit needs accurate and efficient ways to assess applicant risk. Experian AI Score helps streamline underwriting and reduce bad debt.

Law Firms: Especially those specialising in bankruptcy, collections, debt recovery, financial litigation, or even divorce cases where understanding marital finances and credit is critical. Analysing a subject’s credit profile quickly and deeply can be invaluable.

Financial Services Firms: Financial planners, wealth managers, credit repair agencies. Helping clients understand and improve their credit is a core service. Advanced AI analysis can provide deeper insights than standard credit reports.

Corporate Finance Departments: Businesses extending trade credit to customers or assessing the financial health of partners and suppliers. Risk management is key, and AI-driven credit analysis provides a clearer picture.

Real Estate Professionals (Commercial): Assessing the creditworthiness of commercial lease applicants or buyers is crucial for managing risk in commercial property transactions.

Debt Collection Agencies: Prioritising collection efforts based on the likelihood of recovery, as indicated by AI-driven credit analysis, can dramatically improve efficiency and results.

Insurance Companies: Assessing risk can sometimes involve reviewing credit history, especially in commercial lines or certain personal policies.

Essentially, if your work involves making decisions based on someone’s or a business’s credit history, and you want to do it faster, more accurately, and with deeper insights, Experian AI Score is likely for you.

It’s not for the casual user checking their personal credit score once a year.

It’s built for professionals who need advanced tools to handle complex financial data at scale.

It’s for those who understand the value of data-driven decisions and want to leverage the latest technology to get an edge.

If you fit into one of these categories, exploring Experian AI Score could be a game-changer for your workflow and outcomes.

How to Make Money Using Experian AI Score

Alright, let’s talk brass tacks.

How do you turn a tool like Experian AI Score into actual revenue?

It’s about leveraging its capabilities to either offer new services, improve existing ones to charge more, or increase efficiency to handle higher volume.

Here are a few ways professionals in Legal and Finance can monetise using Experian AI Score:

- Offer Premium Credit Analysis Services:

Standard credit reports are basic.

With Experian AI Score, you can offer “Deep Dive” credit analysis.

Go beyond the score to provide detailed reports on risk factors, predictive insights, and tailored recommendations based on the AI’s findings.

Charge a premium for this advanced analysis, marketed as a service that offers superior insight compared to basic credit checks.

Example: A financial advisor could offer a service to high-net-worth clients or small business owners preparing for significant financing, providing them with a comprehensive AI-driven credit health report and strategic advice based on it.

- Improve Lending Efficiency and Reduce Losses:

For lenders, the money is made on the loans originated, but lost on defaults.

By using Experian AI Score to improve underwriting accuracy and speed, you originate more loans faster and reduce the percentage of bad loans.

The reduced losses and increased volume directly impact profitability.

It’s about making smarter lending decisions that protect your capital.

This efficiency gain is a direct path to increased revenue without necessarily increasing staff costs proportionally.

- Optimise Debt Recovery Strategies:

Law firms or collection agencies can use the predictive analysis to segment debtors.

Focus resources on those most likely to pay or where legal action has the highest chance of success.

Avoid wasting time and money pursuing debts with a low probability of recovery.

Increased recovery rates mean more commission or higher success fees.

Case Study Idea: Imagine a collections agency that historically recovers 15% of placed debt. By using AI to prioritise, they might increase that to 20% or 25% without increasing staff, significantly boosting their revenue.

- Enhance Consulting and Advisory Services:

Legal and finance consultants can use the tool to provide data-backed recommendations.

Advising a business on improving its credit profile before seeking investment or a loan.

Helping a client understand their financial standing in a legal dispute.

The AI insights provide credibility and depth to your advice, allowing you to charge higher consulting fees.

You’re not just giving opinions; you’re backing them with powerful data analysis.

Making money with Experian AI Score is about using its power to deliver superior results or operate more efficiently than you could manually or with less advanced tools.

It’s an investment in technology that should pay for itself through increased revenue, reduced costs, and improved outcomes for your clients or your own organisation.

It enables you to offer a higher-value service in the competitive Legal and Finance market.

Limitations and Considerations

Look, no tool is perfect. Experian AI Score is powerful, but it’s important to go into this with your eyes open.

Here are some limitations and things to consider:

It’s AI, Not Magic: The insights are based on data and algorithms. They are predictions and analyses, not absolute truths. They should inform your decisions, not replace your judgment and expertise. Human oversight is crucial, especially in complex or edge cases.

Data Quality is Key: The AI is only as good as the data it processes. If the underlying credit data is inaccurate or incomplete (which can happen), the AI’s analysis and scores will be affected. You still need processes to ensure the data input is clean and accurate.

Integration Challenges: Implementing a tool like this, especially in a large organisation, can involve integrating it with existing loan origination systems, case management software, or financial platforms. This can be complex, time-consuming, and require technical resources.

Cost: As mentioned, this isn’t a cheap tool. The initial investment and ongoing costs need to be justified by the expected returns in efficiency and risk reduction. It might not be cost-effective for very small operations with limited credit analysis needs.

Learning Curve: While designed to be user-friendly, understanding how to best interpret the AI’s insights, customise models (if that feature is available to you), and integrate the tool into your workflow will take time and training. It’s a new way of working for many.

Dependence on Experian Data: The tool relies on Experian’s extensive credit data. While comprehensive, it represents one source of information. Depending on your specific needs, you might still need to consider data from other bureaus or alternative data sources for a complete picture.

Regulatory Scrutiny of AI in Lending/Finance: The use of AI in credit decisions is an area of increasing regulatory focus. While Experian is a reputable provider and likely designs its tools with compliance in mind, users must remain aware of evolving regulations and ensure their use of the AI Score is fair, transparent, and non-discriminatory.

These aren’t necessarily dealbreakers, but they are factors to weigh up.

Using Experian AI Score is a step up in technology.

It requires careful planning, proper implementation, and a commitment to using the AI’s outputs intelligently alongside your own expertise.

It’s a powerful tool, but like any powerful tool, it needs to be used correctly and with an understanding of its inherent limitations.

Final Thoughts

Okay, wrapping this up.

Experian AI Score is a serious piece of technology for serious players in Legal and Finance.

It’s not a gimmick.

It’s designed to tackle a core, often painful, part of your job: Credit Scoring and Analysis.

The value proposition is clear:

Save time.

Reduce risk.

Get deeper insights.

Make smarter decisions.

These are the things that move the needle in your line of work.

It automates the manual grind, giving you back precious hours.

Its predictive capabilities help you see around corners, potentially saving you from bad debt or highlighting lucrative opportunities.

It’s built by a trusted name in the credit industry, which matters when dealing with sensitive data and compliance.

Yes, there’s an investment required.

Yes, you need to understand its limitations and use it wisely, always applying your professional judgment.

But for organisations and professionals who rely heavily on accurate and efficient credit analysis, the potential upside is significant.

It’s a tool that can genuinely reshape workflows.

It can make your team more productive.

It can lead to better financial outcomes.

If you’re serious about leveraging technology to improve your Credit Scoring and Analysis processes in Legal and Finance, Experian AI Score deserves a hard look.

It’s built for this exact challenge.

Don’t get left behind doing things the old way.

Explore how AI, specifically designed for your field, can give you an edge.

Visit the official Experian AI Score website

Frequently Asked Questions

1. What is Experian AI Score used for?

Experian AI Score is used for advanced Credit Scoring and Analysis, primarily in the Legal and Finance industries.

It uses artificial intelligence to analyse credit data, provide deeper insights, and predict future credit behaviour.

It helps professionals make faster, more accurate decisions related to lending, risk assessment, and debt recovery.

2. Is Experian AI Score free?

No, Experian AI Score is an enterprise-level tool for professionals.

It does not offer a free plan.

Pricing is typically custom and depends on the user’s specific needs and volume.

Contacting Experian directly for a demo and quote is necessary to understand the cost.

3. How does Experian AI Score compare to other AI tools?

Experian AI Score is specifically built for Credit Scoring and Analysis using Experian’s data infrastructure.

While there are general-purpose AI data analysis tools, Experian AI Score’s strength lies in its pre-built models and focus on the nuances of credit reporting and financial risk within Legal and Finance.

It’s less about general AI capabilities and more about applying AI effectively to a specific, complex domain.

4. Can beginners use Experian AI Score?

Experian AI Score is designed for professionals already working with credit data and financial analysis.

While the interface aims for usability, interpreting the AI’s insights and applying them requires existing knowledge in Legal and Finance and Credit Scoring and Analysis principles.

There will likely be a learning curve to fully leverage its capabilities.

5. Does the content created by Experian AI Score meet quality and optimization standards?

Experian AI Score doesn’t create content in the traditional sense like text or articles.

It generates scores, reports, and insights based on credit data analysis.

The “quality” refers to the accuracy and depth of its analysis and predictions for Credit Scoring and Analysis purposes.

Its output is optimised for informing financial and legal decisions, not for content marketing or SEO.

6. Can I make money with Experian AI Score?

Yes, professionals in Legal and Finance can make money using Experian AI Score by improving efficiency in their operations (saving costs), reducing financial risk (avoiding losses), and offering enhanced or premium credit analysis services based on the AI’s advanced capabilities.

It’s a tool for generating revenue through improved processes and service offerings.

It helps you work smarter and deliver more value.