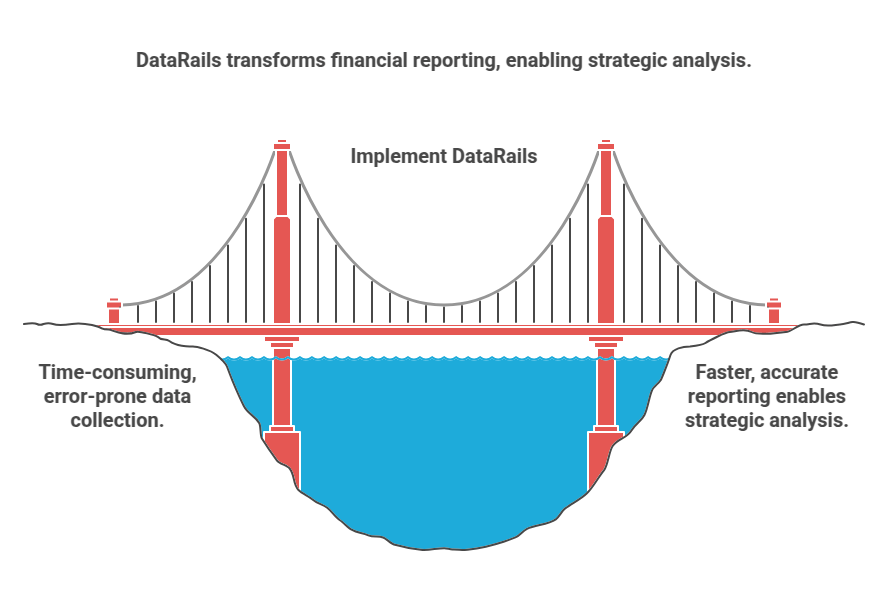

DataRails revolutionises Financial Reporting. Automate tasks, gain insights & save serious time in Legal and Finance. Ditch spreadsheets, get DataRails today!

Why More People in Legal and Finance Are Turning to DataRails

Okay, let’s talk about something real.

You’re in Legal and Finance.

Financial Reporting.

It’s a beast, right?

Hours and hours.

Gathering data.

Cleaning data.

Making charts.

Putting it all together.

Spreadsheets everywhere.

Versions flying around.

Someone changes a number.

Everything breaks.

You know the drill.

It’s painful.

It’s slow.

It’s risky.

But here’s the deal.

AI is changing things. Fast.

Not just for coding or writing blog posts.

For stuff that actually matters.

Like your numbers.

Like Financial Reporting.

And there’s this tool.

DataRails.

It’s built for this.

For finance pros.

For Legal and Finance departments drowning in data.

They say it makes Financial Reporting easy.

Like, *really* easy.

Less manual work.

More accuracy.

Faster insights.

Better decisions.

Big claims.

So, I checked it out.

I wanted to see if it lives up to the hype.

Especially for something as critical as Financial Reporting.

Something where mistakes cost money.

And time is everything.

Let’s break it down.

Table of Contents

- What is DataRails?

- Key Features of DataRails for Financial Reporting

- Benefits of Using DataRails for Legal and Finance

- Pricing & Plans

- Hands-On Experience / Use Cases

- Who Should Use DataRails?

- How to Make Money Using DataRails

- Limitations and Considerations

- Final Thoughts

- Frequently Asked Questions

What is DataRails?

Okay, straight up. What is DataRails?

Think of it as an AI platform.

Specifically designed for finance teams.

It’s not just another spreadsheet plugin.

It’s a system that sits on top of your existing financial data sources.

Stuff like your ERP, CRM, payroll system, even those scattered spreadsheets.

Its main job?

To centralise all that data.

Automate those painful, manual finance tasks.

Especially around things like Financial Reporting.

Budgeting.

Forecasting.

Consolidation.

It’s built for companies that have outgrown basic accounting software.

But aren’t ready for a massive, expensive enterprise system.

It targets the mid-market.

Companies with complex data structures.

But limited resources for huge IT projects.

So, it’s not for a one-man band.

It’s for finance departments with a few people.

Who are spending way too much time wrangling data.

Instead of analysing it.

It uses AI to understand your data.

Regardless of where it lives.

Or how it’s structured.

This is key.

Because finance data is messy.

Different systems.

Different formats.

DataRails aims to make sense of that chaos.

And turn it into structured information.

Ready for reporting.

Ready for analysis.

Ready for action.

It promises to give you a single source of truth.

Which in finance?

That’s gold.

No more arguing about which version of the report is the right one.

No more tracking down formula errors.

It’s all supposed to be in one place.

Updated automatically.

Driven by AI.

That’s the promise.

A Finance Operations platform.

Specifically built to handle the grunt work.

So you can do the thinking.

For Financial Reporting, this could be huge.

Imagine cutting down the time spent just pulling data.

That’s what DataRails is aiming for.

Less admin, more insight.

Key Features of DataRails for Financial Reporting

Alright, let’s get specific.

What does DataRails actually *do* for Financial Reporting?

Because that’s the core problem we’re trying to solve here.

Manual, painful reporting.

- Data Consolidation and Integration:

This is foundational.

DataRails connects to all your systems.

ERP, accounting software, even Excel files.

It pulls data from anywhere.

And brings it into a single database.

Centralised.

Think of it as the ultimate data Hoover.

For Financial Reporting, this means no more manual data gathering.

No more copy-pasting between systems.

It automates that step.

Saves hours immediately.

- Automated Reporting and Report Generation:

This is where the magic happens.

Once the data is in DataRails, it automates the report creation.

You set up your report templates once.

Monthly reports.

Quarterly reports.

Board reports.

Whatever you need.

DataRails pulls the latest data.

And populates the reports automatically.

No more manual updates.

No more worrying if the numbers are fresh.

It updates in real-time or near real-time.

This feature alone cuts reporting time dramatically.

Freeing up finance teams for analysis.

- Data Mapping and Transformation:

Finance data is often inconsistent.

Different systems use different account codes.

Or names for things.

DataRails uses AI to map these differences.

It learns how your data is structured.

And how it should be unified.

This means data from different sources talks to each other.

Correctly.

Consistently.

For consolidated Financial Reporting, this is non-negotiable.

It ensures accuracy across the board.

Without hours of manual mapping work.

- Drill-Down Capabilities:

Okay, you see a number in a report.

But you need to know where it came from.

Why is revenue up/down?

With manual reporting, you’re digging through source files.

Clicking through tabs.

Looking up transactions.

DataRails lets you drill down.

From the summary report.

All the way back to the source transaction.

Instantly.

This makes validating numbers easy.

Auditing simple.

And answering questions about the report?

Fast.

- Version Control and Audit Trails:

Remember the spreadsheet nightmare?

Which version is the latest?

Who changed what?

DataRails solves this.

It keeps track of every change.

Who made it.

When they made it.

This is crucial for compliance.

For audits.

And for just having peace of mind.

You always know the history of your data.

And your reports.

- Integration with Excel:

Finance pros love Excel.

DataRails knows this.

It doesn’t try to replace it completely.

Instead, it enhances it.

You can still use your complex Excel models.

But they are connected to the centralised, clean data in DataRails.

Updates flow automatically.

No manual linking or copy-pasting.

It leverages the power of Excel.

While eliminating the spreadsheet chaos.

These features are specifically designed to tackle the pain points of Financial Reporting.

Automation.

Accuracy.

Speed.

Transparency.

That’s the goal.

Benefits of Using DataRails for Legal and Finance

So, features are one thing.

But what’s the payoff?

Why would someone in Legal and Finance actually switch to DataRails?

What are the tangible benefits?

Let’s talk results.

Massive Time Savings:

This is usually the first thing companies notice.

Think about the hours spent.

Gathering data.

Cleaning data.

Building reports manually.

Updating them.

It’s days of work.

Maybe even weeks.

DataRails automates much of this.

Companies report cutting reporting time by 50% or more.

That’s huge.

That’s time back.

Time you can use for analysis.

For strategy.

For actually driving the business forward.

Instead of being a data entry clerk.

Improved Accuracy and Reliability:

Manual processes?

Human error is inevitable.

Mistakes in formulas.

Copy-paste errors.

Using the wrong file version.

DataRails centralises data.

Automates updates.

And uses AI for mapping.

This drastically reduces errors.

Your reports are more reliable.

You trust the numbers.

And the people reading the reports trust them too.

This builds confidence.

Leads to better decision-making.

Enhanced Financial Visibility:

With data scattered everywhere?

Getting a full picture is tough.

DataRails gives you that single source of truth.

You can see all your financial data.

Consolidated.

In one place.

This gives you deep insight.

You can see trends.

Spot issues early.

Understand performance drivers.

This isn’t just about reporting the past.

It’s about understanding the present.

And predicting the future.

Better Collaboration:

Teams working on different parts of the report?

Budget holders submitting their numbers?

DataRails provides a collaborative platform.

Everyone is working with the same, live data.

No more merging different versions of spreadsheets.

Updates are visible to everyone with access.

This streamlines the entire reporting and planning process.

Improves teamwork.

Reduces miscommunication.

Faster Decision Making:

If your reports take weeks to produce?

The data is old by the time you see it.

Decisions are based on stale information.

With DataRails, reports are generated quickly.

They use the latest data.

You can react faster.

Make timely adjustments.

Capitalise on opportunities.

Mitigate risks.

It accelerates the decision-making cycle.

Reduced Risk:

Manual processes are risky.

Errors.

Lack of audit trails.

Security issues with files everywhere.

DataRails centralises data securely.

Provides version control and audit trails.

Reduces the likelihood of errors.

This lowers the risk of financial misstatements.

Compliance issues.

It brings structure and control to chaos.

These benefits aren’t small wins.

They are fundamental improvements to the finance function.

Especially when it comes to something as recurring and vital as Financial Reporting.

It’s less about doing the job faster.

More about doing a fundamentally better job.

Pricing & Plans

Okay, so DataRails sounds good on paper.

But what does it cost?

This is a critical question for any business.

Especially for the mid-market companies DataRails targets.

DataRails doesn’t publish fixed pricing on their website.

This is common for B2B software of this type.

Why?

Because the price usually depends on several factors.

The size of your company.

The complexity of your needs.

How many data sources you need to connect.

The number of users who will access the platform.

The specific features you need (e.g., budgeting, consolidation, reporting).

So, there’s no simple “free plan” or “pro plan” listed with prices.

You need to contact their sales team.

Get a demo.

Talk about your specific situation.

Then they give you a custom quote.

This might seem annoying.

But it also means the solution should be tailored to you.

It’s an investment.

Not a monthly subscription you sign up for with a credit card.

How does it compare to alternatives?

Their main competition often includes:

Other dedicated FP&A (Financial Planning & Analysis) software vendors.

Large enterprise resource planning (ERP) systems with finance modules.

Or staying with enhanced Excel/spreadsheet methods.

Compared to full-blown enterprise ERP systems (like SAP or Oracle)?

DataRails is generally positioned as more affordable.

Easier to implement.

Less disruptive.

It’s built to integrate with your existing systems.

Not replace everything.

Compared to just using Excel?

Well, Excel is “free” (if you already have it).

But the *cost* of manual work is high.

The cost of errors is high.

The cost of lost time is high.

DataRails aims to provide significant ROI (Return on Investment).

By saving time and improving accuracy.

So the “cost” isn’t just the software license.

It’s the calculation of license cost versus the savings.

Savings in person-hours.

Savings from fewer errors.

Value from faster insights.

For companies where Financial Reporting is a significant burden?

The ROI from DataRails could be substantial.

But you need to do the calculation for your own business.

Their sales team should be able to help model this out.

They’ll likely show you case studies of similar companies.

And the results they achieved.

In short: No public pricing.

Contact them for a custom quote.

Expect it to be an investment.

Justified by significant operational benefits and ROI.

Hands-On Experience / Use Cases

Okay, let’s move from theory to practice.

How would using DataRails look in a real scenario?

Especially for Financial Reporting in a Legal and Finance context.

Imagine this:

It’s the end of the month.

Reporting time.

Normally, your finance team spends the first week (or more) on this.

Pulling data from the accounting system.

Getting sales data from the CRM.

Payroll costs from another system.

Expense data from yet another.

Gathering budget versus actuals spreadsheets from department heads.

Copy-pasting everything into a master report template in Excel.

Mapping different accounts.

Checking formulas.

Finding errors.

Sending out drafts.

Getting feedback.

Making manual adjustments.

Generating P&L, Balance Sheet, Cash Flow.

Creating variance analysis reports.

Building decks for the board.

It’s a manual, repetitive marathon.

Now, with DataRails:

Your data sources (accounting, CRM, payroll, etc.) are already connected.

Data is pulled in automatically.

Mapped correctly by the system’s AI.

Your report templates (set up once in DataRails, maybe initially built from your existing Excel reports) are linked to the live data.

When you need the report?

You click generate.

DataRails pulls the latest data.

Populates the report.

Instantly.

Need to see the details behind a number?

You drill down directly in the report view.

See the underlying transactions.

Need to update a budget figure from a department head?

They enter it into a dedicated input sheet connected to DataRails.

The report updates automatically.

No more collecting spreadsheets via email.

The finance team spends less time on data collection and manipulation.

More time on *analysing* the report.

Understanding the variances.

Providing insights to management.

Instead of taking a week?

The core report might be ready in a day.

Or even hours.

Leaving the rest of the time for value-add analysis.

Use Case Example: Variance Analysis

Normally, comparing Actuals vs. Budget requires pulling two datasets.

Making sure they align.

Calculating variances line by line.

Then trying to figure out *why* there’s a variance.

With DataRails, the Actuals data is live.

The Budget data is stored and accessible.

You run a Variance Report template.

It shows the comparison instantly.

You see a significant variance in Marketing spend.

You drill down on that line.

See the breakdown of marketing expenses.

Maybe even see specific campaigns or invoices linked from the source system.

You understand the *why* much faster.

This isn’t just theoretical.

Companies using DataRails report these kinds of improvements.

Reduced reporting cycles.

Increased accuracy.

Finance teams shifting focus from data processing to strategic analysis.

The usability?

It’s designed for finance professionals.

Not IT experts.

While there’s a learning curve, it’s generally considered less steep than implementing a massive ERP module.

Especially since it integrates with Excel.

Leveraging existing skills.

Who Should Use DataRails?

Alright, who is this tool actually for?

Who gets the most bang for their buck with DataRails?

It’s pretty specific.

Finance Teams in Growing Businesses:

Companies that are past the startup phase.

They have multiple data sources now.

More complex reporting needs.

Maybe they have a few entities or subsidiaries to consolidate.

They have a finance team of usually 3-10 people.

Or more.

These teams are often buried in spreadsheets.

Struggling with manual processes.

DataRails is built specifically for this segment.

They’ve outgrown QuickBooks or Xero capabilities for Financial Reporting.

But can’t afford or aren’t ready for a huge SAP or Oracle implementation.

Companies Relying Heavily on Spreadsheets:

If your finance operations are heavily dependent on Excel models?

For budgeting.

For forecasting.

For consolidation.

For Financial Reporting.

And those spreadsheets are becoming unmanageable.

Prone to errors.

Difficult to update.

DataRails is designed to solve exactly this problem.

It keeps the Excel interface you’re used to.

But puts a robust, automated, centralised engine behind it.

Finance Leaders (CFOs, VPs of Finance, Controllers):

These are the people feeling the pain most directly.

They need accurate, timely reports to make decisions.

They are frustrated by the time and effort spent on reporting.

They are worried about the risk of errors.

They see their team spending time on manual tasks instead of analysis.

DataRails gives them the visibility and control they need.

It enables them to be more strategic.

Legal and Finance Departments:

While DataRails is primarily a finance tool?

The benefits extend to Legal and Finance as a whole.

Accurate financial data is crucial for legal compliance.

For due diligence.

For understanding financial risks.

For preparing financial statements for regulatory filings.

Legal teams relying on finance data will benefit from its accuracy and reliability.

The consolidation and audit trail features are particularly relevant for legal requirements.

Companies Needing Better Financial Planning and Analysis (FP&A):

Financial Reporting is backward-looking.

But DataRails also supports budgeting and forecasting.

If your company needs to improve its FP&A processes?

Create more dynamic budgets.

Run scenario analysis.

DataRails provides the platform for this.

Built on the same centralised data.

In short, DataRails is for companies that are:

Growing.

Struggling with manual financial processes.

Spending too much time on data work.

Need better visibility and accuracy.

Are finance-led, not IT-led, in their tool choices.

If that sounds like your situation?

Especially concerning Financial Reporting?

DataRails is probably worth looking into.

How to Make Money Using DataRails

This might sound a bit outside the box for a finance tool.

It’s not like DataRails generates content you can sell directly.

But yes, you absolutely can make money, or rather, significantly improve your profitability and revenue opportunities, by using DataRails.

It’s about efficiency and insight.

Offer Faster, More Accurate Financial Reporting as a Service:

- Service 1: Outsourced Financial Reporting.

If you’re an accounting firm or fractional CFO service?

You can use DataRails to offer superior reporting services to clients.

Instead of taking days to produce monthly reports for a client?

You connect their systems to DataRails.

Automate the process.

Deliver reports in hours, not days.

This lets you take on more clients without increasing headcount proportionally.

You can charge a premium for speed and accuracy.

Because your service is better and faster.

- Service 2: Financial Reporting Setup and Automation Consulting.

Many companies struggle with setting up proper Financial Reporting processes.

Or implementing tools like DataRails.

If you become an expert in DataRails?

You can offer consulting services.

Help companies connect their data.

Configure their reporting templates.

Train their team on the platform.

This is a high-value service.

Helping a company save potentially weeks of work every month is worth a lot.

- Service 3: Enhanced Financial Analysis and Advisory.

Because DataRails frees up time from manual reporting?

Your internal finance team (or external service) can spend more time on analysis.

Identifying profitability drivers.

Spotting cost savings.

Analysing customer or product segment performance.

This deeper insight leads to better strategic decisions for the business.

Better decisions mean increased revenue or reduced costs.

Directly impacting the bottom line.

You’re not just reporting numbers; you’re driving financial performance.

You can potentially structure compensation (internal or external) based on the value delivered from these insights.

Increase Internal Efficiency and Capacity:

If you’re using DataRails internally?

The finance team becomes much more efficient.

They can handle more volume (more reports, more complex analysis) without needing more staff.

This is a direct cost saving.

Or it allows them to take on other projects.

Maybe they can now handle forecasting, budgeting, or M&A analysis they didn’t have time for before.

This increased capacity is revenue-enabling.

They support growth initiatives that directly lead to more money.

Reduce Costs Through Better Visibility:

With accurate, timely reports?

You can identify areas of excessive spending faster.

Understand where money is going.

Make data-driven decisions to cut costs.

Prevent losses due to errors.

This is saving money, which is just as good as making money.

Example Case Study (Simulated based on reported benefits):

Let’s say ‘Acme Corp’, a medium-sized tech firm, implements DataRails for their Legal and Finance department.

Before DataRails, their finance team of 5 spent 10 days each month on manual consolidation and Financial Reporting.

That’s 50 person-days.

After DataRails, this drops to 2 days.

10 person-days.

They save 40 person-days a month.

If the blended cost of that finance team is, say, £400/day?

That’s £16,000 saved on reporting *each month*.

Annually? £192,000.

Plus, the reports are more accurate, reducing the risk of costly errors or poor decisions based on bad data.

They can now produce board reports weekly instead of monthly, reacting faster to market changes.

This allows them to be more agile.

Potentially capturing opportunities their slower competitors miss.

While not a direct “make money with AI” like selling articles, the financial return from implementing DataRails is substantial.

It’s about operational excellence that drives profitability.

Limitations and Considerations

Okay, no tool is perfect.

DataRails has limitations too.

Things you need to think about before diving in.

Implementation Effort:

While DataRails is positioned as easier than a full ERP replacement?

It’s still an implementation project.

You need to connect your data sources.

Map your charts of accounts.

Set up your report templates.

Train your team.

This takes time and resources.

There will be a period of setup and transition.

It’s not instant plug-and-play like some simpler AI tools.

Cost:

As discussed, there’s no public pricing.

You know it’s an investment.

It’s not cheap like a monthly SaaS subscription for a small tool.

You need to build a business case.

Calculate the ROI based on your specific situation.

Make sure the benefits justify the cost for *your* company size and complexity.

Reliance on Data Quality:

DataRails can automate processes.

But it can’t fix fundamentally bad data at the source.

If your underlying systems have incorrect entries?

Or inconsistent data?

DataRails will pull it in.

Garbage in, garbage out still applies.

While it helps with mapping and consistency?

You still need good data hygiene in your source systems.

Learning Curve for Advanced Features:

The basics of report generation might be straightforward.

But mastering more advanced features?

Complex scenario modelling.

Setting up intricate budget workflows.

Building highly customised dashboards.

This will require training.

And time for your team to get comfortable.

It’s powerful, but power tools need training.

Not a Replacement for Financial Expertise:

DataRails automates tasks.

It provides data and reports.

But it doesn’t replace the need for skilled finance professionals.

You still need people to interpret the reports.

Provide analysis.

Make strategic recommendations.

Design the financial models.

It’s a tool to augment, not replace, the finance team.

Integration Limits:

While DataRails integrates with many systems?

Check if it connects seamlessly with *your specific* versions of *all* your necessary data sources.

Sometimes custom integrations are needed.

Which adds cost and complexity.

Ask specific questions about your tech stack during the demo.

These aren’t dealbreakers for everyone.

But they are important considerations.

Especially for a tool that represents a significant investment and process change.

Understand what you’re getting into.

Plan for the implementation.

Ensure your team is ready for the change.

Final Thoughts

So, after looking under the hood?

DataRails isn’t just another AI gimmick.

It’s a serious tool.

Built to solve a real, painful problem.

Manual, spreadsheet-driven Financial Reporting.

For finance teams in growing companies?

Drowning in data but lacking powerful, integrated tools?

DataRails looks like a game-changer.

It promises significant time savings.

Improved accuracy.

Better insights.

Reduced risk.

These aren’t minor benefits.

They free up the finance function to be more strategic.

To actually help the business grow.

Instead of just reporting on the past.

It leverages AI effectively.

Not for flashy outputs.

But for practical things.

Like data mapping.

Automation.

Making sense of complex financial data.

It’s an investment, no doubt.

Requires implementation.

It’s not for every business.

If you’re a very small company with simple finances?

It’s probably overkill.

But if your finance team is spending days (or weeks) on manual reporting each month?

If you’re worried about errors in your key financial statements?

If you need better visibility and faster insights to make decisions?

Especially in a complex environment like Legal and Finance?

DataRails should be on your shortlist.

It directly addresses the pain points of traditional Financial Reporting.

It enables the finance team to move up the value chain.

From data crunchers to strategic partners.

My recommendation?

If you fit the profile (growing company, manual finance pain, need better reporting), don’t just read about it.

Get a demo.

Talk through your specific challenges with their team.

See how it handles *your* data.

Evaluate the potential ROI for *your* business.

It could be the tool that finally gets your finance team out of spreadsheet hell.

Visit the official DataRails website

Frequently Asked Questions

1. What is DataRails used for?

DataRails is a finance operations platform.

It helps finance teams automate manual work.

Like data consolidation, Financial Reporting, budgeting, and forecasting.

It integrates data from various systems into one place.

2. Is DataRails free?

No, DataRails is not free.

It’s a paid B2B software solution.

Pricing is custom based on company size and needs.

You need to contact their sales team for a quote.

3. How does DataRails compare to other AI tools?

DataRails is an AI tool focused specifically on finance operations.

It’s different from general AI tools (like ChatGPT for text) or tools for other departments (like marketing AI).

It competes more directly with other FP&A software or enhanced Excel/spreadsheet solutions.

4. Can beginners use DataRails?

DataRails is designed for finance professionals.

While it has a learning curve during implementation and for advanced features?

It leverages existing Excel skills.

Making it accessible to finance teams without deep IT backgrounds.

Beginners to finance processes might find it complex, but finance beginners to *tech* should be able to learn it.

5. Does the content created by DataRails meet quality and optimization standards?

DataRails doesn’t “create content” in the marketing sense.

It generates financial reports and analysis.

The quality is based on the accuracy of your data and the setup of your reports.

It aims for high accuracy and provides the data needed for optimised financial analysis and decision-making.

6. Can I make money with DataRails?

Yes, indirectly.

Using DataRails can save significant time and improve efficiency.

This reduces costs and increases capacity to take on more work or focus on revenue-generating activities.

Accounting firms or consultants can also use it to offer faster, more accurate financial reporting services to clients.